Report of the Subcommittee to Study Issues Arising from Lehman Brothers-Related Minibonds and Structured Financial Products

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Section 1256 and Foreign Currency Derivatives

Section 1256 and Foreign Currency Derivatives Viva Hammer1 Mark-to-market taxation was considered “a fundamental departure from the concept of income realization in the U.S. tax law”2 when it was introduced in 1981. Congress was only game to propose the concept because of rampant “straddle” shelters that were undermining the U.S. tax system and commodities derivatives markets. Early in tax history, the Supreme Court articulated the realization principle as a Constitutional limitation on Congress’ taxing power. But in 1981, lawmakers makers felt confident imposing mark-to-market on exchange traded futures contracts because of the exchanges’ system of variation margin. However, when in 1982 non-exchange foreign currency traders asked to come within the ambit of mark-to-market taxation, Congress acceded to their demands even though this market had no equivalent to variation margin. This opportunistic rather than policy-driven history has spawned a great debate amongst tax practitioners as to the scope of the mark-to-market rule governing foreign currency contracts. Several recent cases have added fuel to the debate. The Straddle Shelters of the 1970s Straddle shelters were developed to exploit several structural flaws in the U.S. tax system: (1) the vast gulf between ordinary income tax rate (maximum 70%) and long term capital gain rate (28%), (2) the arbitrary distinction between capital gain and ordinary income, making it relatively easy to convert one to the other, and (3) the non- economic tax treatment of derivative contracts. Straddle shelters were so pervasive that in 1978 it was estimated that more than 75% of the open interest in silver futures were entered into to accommodate tax straddles and demand for U.S. -

Faqs on Straddle Contracts – Currency Derivatives

FAQs on Straddle Contracts FAQs on Straddle Contracts – Currency Derivatives 1. What is meant by a Straddle Contract? Straddle contracts are specialised two-legged option contracts that allow a trader to take positions on two different option contracts belonging to the same product, at the same strike price and having the same expiry. 2. What are the components of a Straddle contract? A straddle contract comprises of two individual legs, the first being the call option leg and the second being the put option leg, having same strike price and expiry. 3. In which segment will Straddle contracts be offered? To start with, straddle contracts will be offered in the Currency Derivatives segment. 4. What will be the market lot of the straddle contract? Market lot of a straddle contract will be the same as that of its corresponding individual legs i.e. the market lot of the call option leg and the put option leg. 5. What will be the tick size of the straddle contract? Tick size of a straddle contract will be the same as that of its corresponding individual legs i.e. the tick size of the call option leg and the put option leg. 6. For which expiries will straddle contracts be made available? Straddle contracts will be made available on all existing individual option contracts - current, near, & far monthly as well as quarterly and half yearly option contracts. 7. How many in-the-money, at-the-money and out-of-the-money contracts will be available? Minimum two In-the-Money, two Out-of-the-Money and one At-the-Money straddle contracts will be made available. -

Beauty Is Not in the Eye of the Beholder

Insight Consumer and Wealth Management Digital Assets: Beauty Is Not in the Eye of the Beholder Parsing the Beauty from the Beast. Investment Strategy Group | June 2021 Sharmin Mossavar-Rahmani Chief Investment Officer Investment Strategy Group Goldman Sachs The co-authors give special thanks to: Farshid Asl Managing Director Matheus Dibo Shahz Khatri Vice President Vice President Brett Nelson Managing Director Michael Murdoch Vice President Jakub Duda Shep Moore-Berg Harm Zebregs Vice President Vice President Vice President Shivani Gupta Analyst Oussama Fatri Yousra Zerouali Vice President Analyst ISG material represents the views of ISG in Consumer and Wealth Management (“CWM”) of GS. It is not financial research or a product of GS Global Investment Research (“GIR”) and may vary significantly from those expressed by individual portfolio management teams within CWM, or other groups at Goldman Sachs. 2021 INSIGHT Dear Clients, There has been enormous change in the world of cryptocurrencies and blockchain technology since we first wrote about it in 2017. The number of cryptocurrencies has increased from about 2,000, with a market capitalization of over $200 billion in late 2017, to over 8,000, with a market capitalization of about $1.6 trillion. For context, the market capitalization of global equities is about $110 trillion, that of the S&P 500 stocks is $35 trillion and that of US Treasuries is $22 trillion. Reported trading volume in cryptocurrencies, as represented by the two largest cryptocurrencies by market capitalization, has increased sixfold, from an estimated $6.8 billion per day in late 2017 to $48.6 billion per day in May 2021.1 This data is based on what is called “clean data” from Coin Metrics; the total reported trading volume is significantly higher, but much of it is artificially inflated.2,3 For context, trading volume on US equity exchanges doubled over the same period. -

307439 Ferdig Master Thesis

Master's Thesis Using Derivatives And Structured Products To Enhance Investment Performance In A Low-Yielding Environment - COPENHAGEN BUSINESS SCHOOL - MSc Finance And Investments Maria Gjelsvik Berg P˚al-AndreasIversen Supervisor: Søren Plesner Date Of Submission: 28.04.2017 Characters (Ink. Space): 189.349 Pages: 114 ABSTRACT This paper provides an investigation of retail investors' possibility to enhance their investment performance in a low-yielding environment by using derivatives. The current low-yielding financial market makes safe investments in traditional vehicles, such as money market funds and safe bonds, close to zero- or even negative-yielding. Some retail investors are therefore in need of alternative investment vehicles that can enhance their performance. By conducting Monte Carlo simulations and difference in mean testing, we test for enhancement in performance for investors using option strategies, relative to investors investing in the S&P 500 index. This paper contributes to previous papers by emphasizing the downside risk and asymmetry in return distributions to a larger extent. We find several option strategies to outperform the benchmark, implying that performance enhancement is achievable by trading derivatives. The result is however strongly dependent on the investors' ability to choose the right option strategy, both in terms of correctly anticipated market movements and the net premium received or paid to enter the strategy. 1 Contents Chapter 1 - Introduction4 Problem Statement................................6 Methodology...................................7 Limitations....................................7 Literature Review.................................8 Structure..................................... 12 Chapter 2 - Theory 14 Low-Yielding Environment............................ 14 How Are People Affected By A Low-Yield Environment?........ 16 Low-Yield Environment's Impact On The Stock Market........ -

Tax Treatment of Derivatives

United States Viva Hammer* Tax Treatment of Derivatives 1. Introduction instruments, as well as principles of general applicability. Often, the nature of the derivative instrument will dictate The US federal income taxation of derivative instruments whether it is taxed as a capital asset or an ordinary asset is determined under numerous tax rules set forth in the US (see discussion of section 1256 contracts, below). In other tax code, the regulations thereunder (and supplemented instances, the nature of the taxpayer will dictate whether it by various forms of published and unpublished guidance is taxed as a capital asset or an ordinary asset (see discus- from the US tax authorities and by the case law).1 These tax sion of dealers versus traders, below). rules dictate the US federal income taxation of derivative instruments without regard to applicable accounting rules. Generally, the starting point will be to determine whether the instrument is a “capital asset” or an “ordinary asset” The tax rules applicable to derivative instruments have in the hands of the taxpayer. Section 1221 defines “capital developed over time in piecemeal fashion. There are no assets” by exclusion – unless an asset falls within one of general principles governing the taxation of derivatives eight enumerated exceptions, it is viewed as a capital asset. in the United States. Every transaction must be examined Exceptions to capital asset treatment relevant to taxpayers in light of these piecemeal rules. Key considerations for transacting in derivative instruments include the excep- issuers and holders of derivative instruments under US tions for (1) hedging transactions3 and (2) “commodities tax principles will include the character of income, gain, derivative financial instruments” held by a “commodities loss and deduction related to the instrument (ordinary derivatives dealer”.4 vs. -

Eurex Circular 097/17

eurex circular 097/17 Date: 13 September 2017 Recipients: All Trading Participants of Eurex Deutschland and Eurex Zürich and Vendors Authorized by: Mehtap Dinc Foreign exchange (FX) derivatives: Introduction of FX Rolling Spot Futures Contact: Jenny Ivleva, Product R&D Fixed Income, T +44-207-862-70-98, [email protected]; Joachim Heinz, Product R&D Fixed Income, T +49-69-211-1 59 55, [email protected] Content may be most important for: Attachments: Ü All departments 1. New and updated sections of the Contract Specifications for Futures Contracts and Options Contracts at Eurex Deutschland and Eurex Zürich 2. Eurex Clearing circular 086/17 Summary: The Management Board of Eurex Deutschland and the Executive Board of Eurex Zürich AG decided to introduce FX Rolling Spot Futures on the following currency pairs with effect from 6 October 2017: EUR/USD, EUR/CHF, EUR/GBP, GBP/USD, GBP/CHF, USD/CHF, AUD/USD, AUD/JPY, EUR/AUD, EUR/JPY, USD/JPY, NZD/USD. FX Rolling Spot Futures are perpetual futures contracts which are rolled daily if an open position exists at the end of the trading day. FX Rolling Spot Futures mimic trading OTC FX spot contracts combined with the daily usage of a tom-next (T/N) swap in order to roll over the value date of the spot position. This circular contains all information on the introduction of the new products and the new and updated sections of the relevant Rules and Regulations of Eurex Deutschland and Eurex Zürich AG. Information on clearing of FX products at Eurex Clearing AG (Eurex Clearing) products as well as the new and updated sections of the relevant Rules and Regulations of Eurex Clearing AG are contained in Eurex Clearing circular 086/17, which is available as attachment 2 to this circular. -

C1 Trading and Hedging Bitcoin Volatility Santander Financial

1. Options 2. Implied Vol 3. Trading Volatility 4. Bitcoin VIX 5. Hedging with Perpetuals 6. Speculation with Perpetuals 1. Options 2. Implied Vol 3. Trading Volatility 4. Bitcoin VIX 5. Hedging with Perpetuals 6. Speculation with Perpetuals 1. Options Fundamentals Trading and Hedging Bitcoin Volatility • A standard European option is like a `ticket' that gives the holder the right to buy (call option) or sell (put option) an `underlying' financial Santander Financial Engineering School instrument with market price St at time t • at a fixed price called the strike price, K • on the maturity date, T years after its issue Carol Alexander • Running time from issue of the option (time 0) until the option expires Professor of Finance, University of Sussex is denoted t, so T − t denotes the time to expiry in years Visiting Professor, HSBC Business School, Peking University • If the option is held to expiry (but few are), the pay-off is • 18 March 2021 max fST − K; 0g for a standard call option • max fK − ST ; 0g for a standard put option Carol Alexander 1 / 66 Carol Alexander 2 / 66 1. Options 2. Implied Vol 3. Trading Volatility 4. Bitcoin VIX 5. Hedging with Perpetuals 6. Speculation with Perpetuals 1. Options 2. Implied Vol 3. Trading Volatility 4. Bitcoin VIX 5. Hedging with Perpetuals 6. Speculation with Perpetuals Call Option Prices Option Price vs Underlying Price Maturity (days) Strike 40 50 60 70 80 90 100 110 120 130 140 150 80 20.372 20.495 20.611 20.690 20.800 20.916 20.972 21.063 21.166 21.220 21.329 21.408 82 18.383 18.510 18.632 -

Straddles and Strangles to Help Manage Stock Events

Webinar Presentation Using Straddles and Strangles to Help Manage Stock Events Presented by Trading Strategy Desk 1 Fidelity Brokerage Services LLC ("FBS"), Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917 690099.3.0 Disclosures Options’ trading entails significant risk and is not appropriate for all investors. Certain complex options strategies carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Options, and call 800-544- 5115 to be approved for options trading. Supporting documentation for any claims, if applicable, will be furnished upon request. Examples in this presentation do not include transaction costs (commissions, margin interest, fees) or tax implications, but they should be considered prior to entering into any transactions. The information in this presentation, including examples using actual securities and price data, is strictly for illustrative and educational purposes only and is not to be construed as an endorsement, or recommendation. 2 Disclosures (cont.) Greeks are mathematical calculations used to determine the effect of various factors on options. Active Trader Pro PlatformsSM is available to customers trading 36 times or more in a rolling 12-month period; customers who trade 120 times or more have access to Recognia anticipated events and Elliott Wave analysis. Technical analysis focuses on market action — specifically, volume and price. Technical analysis is only one approach to analyzing stocks. When considering which stocks to buy or sell, you should use the approach that you're most comfortable with. As with all your investments, you must make your own determination as to whether an investment in any particular security or securities is right for you based on your investment objectives, risk tolerance, and financial situation. -

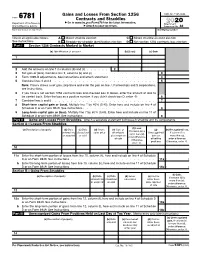

Form 6781 Contracts and Straddles ▶ Go to for the Latest Information

Gains and Losses From Section 1256 OMB No. 1545-0644 Form 6781 Contracts and Straddles ▶ Go to www.irs.gov/Form6781 for the latest information. 2020 Department of the Treasury Attachment Internal Revenue Service ▶ Attach to your tax return. Sequence No. 82 Name(s) shown on tax return Identifying number Check all applicable boxes. A Mixed straddle election C Mixed straddle account election See instructions. B Straddle-by-straddle identification election D Net section 1256 contracts loss election Part I Section 1256 Contracts Marked to Market (a) Identification of account (b) (Loss) (c) Gain 1 2 Add the amounts on line 1 in columns (b) and (c) . 2 ( ) 3 Net gain or (loss). Combine line 2, columns (b) and (c) . 3 4 Form 1099-B adjustments. See instructions and attach statement . 4 5 Combine lines 3 and 4 . 5 Note: If line 5 shows a net gain, skip line 6 and enter the gain on line 7. Partnerships and S corporations, see instructions. 6 If you have a net section 1256 contracts loss and checked box D above, enter the amount of loss to be carried back. Enter the loss as a positive number. If you didn’t check box D, enter -0- . 6 7 Combine lines 5 and 6 . 7 8 Short-term capital gain or (loss). Multiply line 7 by 40% (0.40). Enter here and include on line 4 of Schedule D or on Form 8949. See instructions . 8 9 Long-term capital gain or (loss). Multiply line 7 by 60% (0.60). Enter here and include on line 11 of Schedule D or on Form 8949. -

Long Straddle Strategy to Hedge Uncertainty

International Journal of Research in Finance and Marketing (IJRFM) Available online at : http://euroasiapub.org/current.php?title=IJRFM Vol. 7 Issue 1, January - 2017, pp. 136~148 ISSN(o): 2231-5985 | Impact Factor: 6.397 | Thomson Reuters Researcher ID: L-5236-2015 LONG STRADDLE STRATEGY TO HEDGE UNCERTAINTY Dr. Thangjam Ravichandra Assistant Professor & Coordinator Department of Professional Studies Christ University, Bangalore, India ABSTRACT This paper examines the use of Long Straddle as a strategy to hedge risk and yield maximum return as opposed to trading in pure options and trading in equity stocks. Our analysis is based on the Long Straddle created for three different well established companies which are Mindtree, TCS and Infosys. The purpose of the paper is to bring out the benefits of using the strategy and comparing it with pure options trading and equity stock trading. The long straddle is a way to profit from increased volatility or sharp move in the underlying stock’s price so as to maximize the return of the investor. The research paper is done solely for the purpose of investments in options. Key words: Hedge, Risk & Return, Long Straddle, Options, Equity Stocks, Volatility . International Journal of Research in Finance & Marketing Email:- [email protected], http://www.euroasiapub.org 136 An open access scholarly, peer-reviewed, interdisciplinary, monthly, and fully refereed journal International Journal of Research in Finance and Marketing (IJRFM) Vol. 7 Issue 1, January - 2017 ISSN(o): 2231-5985 | Impact Factor: 6.397 | 1. INTRODUCTION Options allow investors and traders to make money in ways that are not possible simply by buying or selling the underlying security. -

OECD Handbook on Economic Globalisation Indicators OECD Handbook on Economic Globalisation Indicators Globalisation Economic on Handbook OECD

2005 « STATISTICS STATISTICS M Measuring Globalisation easuring Globalisation OECD Handbook on Economic Globalisation Although globalisation’s impact on national economies is well recognised, little quantitative information is available to shed light on the issues involved in debates on the subject. The purpose of this manual is not to evaluate the many consequences of globalisation, but rather to measure its extent and intensity. The manual defines the concepts and puts forward guidelines for data collection and the fine-tuning of globalisation indicators. Measuring Globalisation The proposed indicators apply by and large to multinational firms – the major players in the process of globalisation – particularly in the areas of trade, international investment and technology transfer. OECD Handbook on Economic Globalisation Indicators OECD Handbook on Economic Globalisation Indicators OECD Handbook on Economic Globalisation Indicators OECD’s books, periodicals and statistical databases are now available via www.SourceOECD.org, our online library. This book is available to subscribers to the following SourceOECD themes: Statistics: Sources and Methods Industry, Services and Trade General Economics and Future Studies Science and Information Technology Ask your librarian for more details of how to access OECD books on line, or write to us at [email protected] www.oecd.org ISBN 92-64-10808-4 2005 92 2005 06 1 P -:HSTCQE=VU]U]U: 2005 Measuring Globalisation OECD Handbook on Economic Globalisation Indicators ORGANISATION FOR ECONOMIC CO-OPERATION AND DEVELOPMENT ORGANISATION FOR ECONOMIC CO-OPERATION AND DEVELOPMENT The OECD is a unique forum where the governments of 30 democracies work together to address the economic, social and environmental challenges of globalisation. -

Empirical Properties of Straddle Returns

EDHEC RISK AND ASSET MANAGEMENT RESEARCH CENTRE 393-400 promenade des Anglais 06202 Nice Cedex 3 Tel.: +33 (0)4 93 18 32 53 E-mail: [email protected] Web: www.edhec-risk.com Empirical Properties of Straddle Returns December 2008 Felix Goltz Head of applied research, EDHEC Risk and Asset Management Research Centre Wan Ni Lai IAE, University of Aix Marseille III Abstract Recent studies find that a position in at-the-money (ATM) straddles consistently yields losses. This is interpreted as evidence for the non-redundancy of options and as a risk premium for volatility risk. This paper analyses this risk premium in more detail by i) assessing the statistical properties of ATM straddle returns, ii) linking these returns to exogenous factors and iii) analysing the role of straddles in a portfolio context. Our findings show that ATM straddle returns seem to follow a random walk and only a small percentage of their variation can be explained by exogenous factors. In addition, when we include the straddle in a portfolio of the underlying asset and a risk-free asset, the resulting optimal portfolio attributes substantial weight to the straddle position. However, the certainty equivalent gains with respect to the presence of a straddle in a portfolio are small and probably do not compensate for transaction costs. We also find that a high rebalancing frequency is crucial for generating significant negative returns and portfolio benefits. Therefore, from an investor's perspective, straddle trading does not seem to be an attractive way to capture the volatility risk premium. JEL Classification: G11 - Portfolio Choice; Investment Decisions, G12 - Asset Pricing, G13 - Contingent Pricing EDHEC is one of the top five business schools in France.