List Store Ibox

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Daftar Optik Rekanan Astra Life - Optik Melawai Bulan Juli 2021

DAFTAR OPTIK REKANAN ASTRA LIFE - OPTIK MELAWAI BULAN JULI 2021 Daftar dapat berubah sewaktu-waktu tanpa pemberitahuan terlebih dahulu, oleh karena itu sebelum melakukan pembelian kacamata, silahkan menghubungi nomor telepon 24 jam Astra Life - Admedika (021) 2960 3282 Diperbaharui 15-Jul-21 NO KODE ADMEDIKA CABANG OPTIK MELAWAI ALAMAT NO TELEPON NANGGROE ACEH DARUSSALAM 1 7158 BANDA ACEH OPTIK MELAWAI HERMES PALACE MALL GF ZONA B UNIT 12 & 15 0651-7557555| 2 7448 BANDA ACEH OPTIK MELAWAI RUKO PANGLIMA POLEM ACEH JL. T . PANGLIMA POLEM NO.139, PEUNAYONG, BANDA ACEH 0651 - 635063| SUMATERA UTARA 3 7249 MEDAN OPTIK MELAWAI CENTRE POINT MEDAN UG NO.15 061-80501752| 4 7362 MEDAN OPTIK MELAWAI RING ROAD MEDAN RINGROAD CITY WALKS GF NO.10 061-80026645| 5 7372 MEDAN OPTIK MELAWAI SUN PLAZA MEDAN GF BLOK A NO. 21 - 23 061-4501043| 6 7248 MEDAN OPTIK MELAWAI THAMRIN PLAZA LT. 2 NO. 42-43 061-7362278| 7 A873 MEDAN OPTIK MELAWAI MANHATTAN Jl. Gatot Subroto No. 217, Sei Sikambing, Kota Medan, Sumatera utara 20123, GF – 18 061 - 80867000 8 A874 MEDAN OPTIK MELAWAI DELI PARK Jl. Guru Patimpus No. 1 Medan, Sumatera Utara, L2 – 03 & 05 061 - 62000 190 SUMATERA BARAT 9 7252 PADANG OPTIK MELAWAI ANDALAS PADANG LT. 1 NO.1 0751-7530030| 10 7315 PADANG OPTIK MELAWAI SKO GRANDMALL LT.2 NO.18F 0751 - 4488912| 11 7439 PADANG OPTIK MELAWAI TRANSMART PADANG TRANSMART PADANG GF.12,15 0751-8971131| BANGKA BELITUNG 12 7257 PANGKAL PINANG OPTIK MELAWAI PANGKAL PINANG BANGKA LT. DASAR PINTU UTAMA 0717-421515| 13 A876 PANGKAL PINANG OPTIK MELAWAI PANGKAL PINANG Jl. -

Supply RETAIL SECTOR

Research & Forecast Report Jakarta I Retail Accelerating success. “Limited new retail supply in DKI Jakarta brought the After the start of operations of Baywalk Mall, which is located occupancy rate up 2% to 89.3%. In contrast, the greater within the Green Bay Pluit Complex, Jakarta saw little new retail Jakarta area outside DKI Jakarta registered a slight decline space provided from the extension projects at Mall Puri Indah in occupancy to 82% due to the opening of two new retail (around 3,000 sq m) and Mall Kelapa Gading (around 6,000 sq centers. In the meantime, the average asking base rental m). These extended spaces are designed as F&B areas. With rate in Jakarta climbed by 3.3% q-o-q to IDR491,675 / sq m the small addition, the Jakarta retail cumulative supply moved / month. Similarly in the greater Jakarta area, the average upward to 4.32 million sq m as of 1Q 2014. Of this, 2.86 million sq asking base rent moved to IDR302,618 / sq m / month, m or 66.3% was marketed for lease. representing a 9.2% increase compared to last quarter.” Historically, after growing by 10% and bringing huge supply to - Ferry Salanto, Associate Director | Research the market in 2009, the annual growth of supply of retail space in Jakarta began weakening. From 2010 to 2013, the average growth was only 3.6% per year. In 2014, the growth of supply for shopping centres in Jakarta will continue declining. Although St RETAIL SECTOR Moritz is a huge mall expected to enter the market, overall, the total additional supply is only 138,200 sq m. -

Visitors׳ Perceptions on the Important Factors of Atrium Design in Shopping

Frontiers of Architectural Research (]]]]) ], ]]]–]]] HOSTED BY Available online at www.sciencedirect.com www.elsevier.com/locate/foar RESEARCH ARTICLE Visitors' perceptions on the important factors of atrium design in shopping centers: A study of Gandaria City Mall and Ciputra World in Indonesia Astrid Kusumowidagdoa,n, Agus Sacharib, Pribadi Widodob aInterior Architecture, Universitas Ciputra, Surabaya, East Java, Indonesia bFaculty of Art and Design, Bandung Institute of Technology, Bandung, Indonesia Received 21 July 2014; received in revised form 18 November 2015; accepted 23 November 2015 KEYWORDS Abstract Atrium; Atriums as quasi-internal public spaces in shopping centers play an essential role as an identity Shopping center; provider and offer spatial orientation in shopping center architecture. This study aims to Sense of place examine the significant factors of atrium design, which can provide a sense of place for shopping center visitors. The research was conducted with the sequential exploratory method, which involved a qualitative study, followed by a quantitative study. The objects of this research were two shopping centers located in the two largest cities in Indonesia, namely, Gandaria City Mall in Jakarta and Ciputra World in Surabaya. A total of 43 informants were a part of the qualitative data collection, and 350 respondents served as survey participants. The survey research shows that the design factors considered by visitors at the Gandaria City Mall are atrium legibility, atrium decoration, event decoration, social image and interaction, and event ambience, whereas the visitors at Ciputra World considered atrium legibility, social image and interaction, atrium ambience, and atrium decoration. & 2015 The Authors. Production and hosting by Elsevier B.V. -

PT Agung Podomoro Land Tbk

PT Agung Podomoro Land Tbk Public Expose 2 Desember 2019 0 Disclaimer Presentasi ini dipersiapkan semata-mata dan secara eksklusif untuk para pihak terundang untuk tujuan diskusi. Baik presentasi maupun isinya tidak boleh diperbanyak, atau digunakan tanpa izin tertulis dari PT Agung Podomoro Land Tbk. Presentasi ini dapat berisi pernyataan yang menyampaikan harapan berorientasi masa depan yang mewakili pandangan Perusahaan saat ini untuk perkiraan kejadian dan keuangan masa depan. Pandangan tersebut disajikan berdasarkan asumsi saat ini, yang mungkin memiliki berbagai risiko dan potensi perubahan. Disajikan berdasarkan asumsi yang dianggap benar pada saat ini, dan berdasarkan data yang tersedia pada saat presentasi ini dibuat. Perusahaan tidak dapat menjaminan bahwa pandangan tersebut akan, sebagian atau secara keseluruhan, akhirnya terwujud. Hasil yang sebenarnya dapat berbeda secara signifikan dari yang diproyeksikan. 1 Agenda 1. Tentang Perusahaan 2. Kinerja Operasional 3. Kinerja Keuangan 2 PT Agung Podomoro Land Tbk (APLN) Pendapatan Berulang .Malls .Hotels .Lainnya .Pengembang terkemuka dan terdiversifikasi .Pionir pengembangan superblock .Model pengembangan property terintegrasi . IPO di tahun 2010 Penjualan .Pengembangan Superblock .Rumah tapak/apartemen .Lainnya 3 Project Locations 4 Lahan untuk pengembangan* (Hektar) Medan; Balikpapan; 4,9 5,2 Greater Jakarta; Batam; 58,2 40,8 Bandung; 1,8 Karawang ; 5,7 Bogor; 91,2 Dalam Pengembangan Pengembangan; 209 Mendatang; 554 Bali; 7,4 Makassar; 15,0 Jakarta; 36,3 Bandung; 120,5 * Tidak termasuk reklamasi Karawang; 374,9 5 Agenda 1. Tentang Perusahaan 2. Kinerja Operasional 3. Kinerja Keuangan 6 Sekilas 2019 . Penjualan Sofitel senilai Rp 1,6 triliun pada Maret 2019. Pelunasan Obligasi Berkelanjutan I APLN Tahap II Tahun 2014 sebesar Rp750 miliar Juni 2019 . -

Daftar Optik Rekanan Astra Life - Optik Melawai Bulan Agustus 2021

DAFTAR OPTIK REKANAN ASTRA LIFE - OPTIK MELAWAI BULAN AGUSTUS 2021 Daftar dapat berubah sewaktu-waktu tanpa pemberitahuan terlebih dahulu, oleh karena itu sebelum melakukan pembelian kacamata, silahkan menghubungi nomor telepon 24 jam Astra Life - Admedika (021) 2960 3282 Diperbaharui 18-Aug-21 NO KODE ADMEDIKA STATUS e-CARD CABANG OPTIK MELAWAI ALAMAT NO TELEPON NANGGROE ACEH DARUSSALAM 1 7158 N/A BANDA ACEH OPTIK MELAWAI HERMES PALACE MALL GF ZONA B UNIT 12 & 15 0651-7557555| 2 7448 N/A BANDA ACEH OPTIK MELAWAI RUKO PANGLIMA POLEM ACEH JL. T . PANGLIMA POLEM NO.139, PEUNAYONG, BANDA ACEH 0651 - 635063| SUMATERA UTARA 3 7249 N/A MEDAN OPTIK MELAWAI CENTRE POINT MEDAN UG NO.15 061-80501752| 4 7362 N/A MEDAN OPTIK MELAWAI RING ROAD MEDAN RINGROAD CITY WALKS GF NO.10 061-80026645| 5 7372 N/A MEDAN OPTIK MELAWAI SUN PLAZA MEDAN GF BLOK A NO. 21 - 23 061-4501043| 6 7248 N/A MEDAN OPTIK MELAWAI THAMRIN PLAZA LT. 2 NO. 42-43 061-7362278| 7 A873 N/A MEDAN OPTIK MELAWAI MANHATTAN Jl. Gatot Subroto No. 217, Sei Sikambing, Kota Medan, Sumatera utara 20123, GF – 18 061 - 80867000 8 A874 N/A MEDAN OPTIK MELAWAI DELI PARK Jl. Guru Patimpus No. 1 Medan, Sumatera Utara, L2 – 03 & 05 061 - 62000 190 SUMATERA BARAT 9 7252 N/A PADANG OPTIK MELAWAI ANDALAS PADANG LT. 1 NO.1 0751-7530030| 10 7315 N/A PADANG OPTIK MELAWAI SKO GRANDMALL LT.2 NO.18F 0751 - 4488912| 11 7439 N/A PADANG OPTIK MELAWAI TRANSMART PADANG TRANSMART PADANG GF.12,15 0751-8971131| BANGKA BELITUNG 12 7257 N/A PANGKAL PINANG OPTIK MELAWAI PANGKAL PINANG BANGKA LT. -

Only Yesterday in Jakarta: Property Boom and Consumptive Trends in the Late New Order Metropolitan City

Southeast Asian Studies, Vol. 38, No.4, March 2001 Only Yesterday in Jakarta: Property Boom and Consumptive Trends in the Late New Order Metropolitan City ARAI Kenichiro* Abstract The development of the property industry in and around Jakarta during the last decade was really conspicuous. Various skyscrapers, shopping malls, luxurious housing estates, condominiums, hotels and golf courses have significantly changed both the outlook and the spatial order of the metropolitan area. Behind the development was the government's policy of deregulation, which encouraged the active involvement of the private sector in urban development. The change was accompanied by various consumptive trends such as the golf and cafe boom, shopping in gor geous shopping centers, and so on. The dominant values of ruling elites became extremely con sumptive, and this had a pervasive influence on general society. In line with this change, the emergence of a middle class attracted the attention of many observers. The salient feature of this new "middle class" was their consumptive lifestyle that parallels that of middle class as in developed countries. Thus it was the various new consumer goods and services mentioned above, and the new places of consumption that made their presence visible. After widespread land speculation and enormous oversupply of property products, the property boom turned to bust, leaving massive non-performing loans. Although the boom was not sustainable and it largely alienated urban lower strata, the boom and resulting bust represented one of the most dynamic aspect of the late New Order Indonesian society. I Introduction In 1998, Indonesia's "New Order" ended. -

Unit City Level 1 Unit 183C, 185C, 187C, Jl. Asia Afrika No.8 GF Unit G

Address No Shop Name Phone Unit City 1 Plaza Senayan Level 1 unit 183C, 185C, 187C, Jl. Asia Afrika No.8 South Jakarta 021-572 5126 2 Pondok Indah Mall 2 GF unit G55, Jl. Metro Pondok Indah, Kebayoran Lama, South Jakarta 021-7592 0871 3 Grand Indonesia Shopping Town West Mall, 3A Floor unit ED 1-12A, Jl. M.H. Thamrin No. 1, Kebon Kacang Central Jakarta 021- 2358 0341 4 Central Park GF unit G 217 A, Jl. Let. Jendral S. Parman kav.28 West Jakarta 021-5698 5350 5 Senayan City 5th Floor unit 5-30 , Jl. Asia Afrika Lot. 19 South Jakarta 021-7278 1165 6 Puri Indah Mall unit G E003, Jl. Puri Agung, Puri Indah, Kembangan Selatan West Jakarta 021-582 2774 7 Super Pakuwon Mall Indah Pakuwon Mall 2nd Mezzanine no 41 Jl Puncak Indah Lontar no 2 Surabaya 031-991 47564 8 Tunjungan Plaza 3 Plaza Central Lantai PC-01. No.90. Jalan Basuki Rachmad No 8A,10A,12A. Surabaya 60261 Surabaya 031-992 50528 9 Kota Kasablanka GF Food Society unit FSG M26, Jalan Casablanca Raya Kav. 88 South Jakarta 021-2948 8494 10 Gandaria City Main Street GF, MG12, JL. Sultan Iskandar Muda, Kebayoran Lama South Jakarta 021-2900 7932 11 Emporium Pluit Mall 4th unit IC-07, Jl. Pluit Selatan Raya, Penjaringan North Jakarta 021-6667 6738 12 Plaza Indonesia Level Basement Unit #088,089, Jl. MH Thamrin, Jakarta Pusat - 10350 Central Jakarta 021-29921928 13 Cilandak Town Square GF unit B 040, Jl. T.B. Simatupang Kav. 17 South Jakarta 021-766 3054 14 Mal Kelapa Gading 1 GF-183, Jl. -

BOI LABS BOI – Research Services BRAND AWARENESS JABODETABEK

MALLS BOI LABS BOI – Research Services BRAND AWARENESS JABODETABEK Brand awareness - Jabodetabek n=150, base = customers in Jabodetabek area 80% 73% 62% 60% 55% 50% 50% 46% 48% 48% 46% 40% 35% 29% Aided 23% 24% 20% 20% 20% 16% Unaided 8% TOM 4% 2% 3% 4% 0% No malls scores above 80% aided awareness most likely due to the large number of malls in Jabodetabek area. Overall, Mall Kelapa Gading is the most well-known mall in Jabodetabek with 73% aided awareness. In addition it also leads in top of mind (20%) followed closely by Plaza Senayan (16%). 2 PT BOI Raja Sedjahtera | www.boi-rs.com | +62 21 7202 136 BRAND AWARENESS SURABAYA Brand awareness - Surabaya n=25, base = customers in Surabaya 100% 100% 100% 100% 100% 92% 92% 88% 80% 60% Aided Unaided 40% TOM 20% 8% 4% 0% Tunjungan Plaza Galaxy Mall Grand City Everybody in Surabaya knows all the big malls. Although Tunjungan Plaza, one of the most iconic malls in Surabaya is far ahead in top of mind (88%). 3 PT BOI Raja Sedjahtera | www.boi-rs.com | +62 21 7202 136 BRAND AWARENESS DENPASAR Brand awareness - Denpasar n=50, base = customers in Denpasar 98% 98% 100% 96% 87% 85% 80% 67% 60% Aided 40% Unaided 40% 33% TOM 20% 17% 0% Beachwalk Discovery Shopping Mall Mal Bali Galeria Beachwalk and Discovery Shopping Mall are the most popular malls in Denpasar. The 2 malls are toe-to-toe in termas of awareness, with Beachwalk scoring slightly higher in aided, unaided and top of mind. -

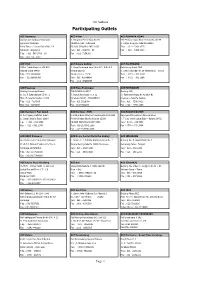

Participating Outlets

All Address Participating Outlets ACE Karawaci ACE Polim ACE PERMATA HIJAU Alamat Ace Hardware Karawaci Jl. Panglima Polim Raya No.73 ITC Permata Hijau Blok Emerald No.3639 Supermal Karawaci Jakarta 12160 Indonesia Jl. Letjen Soepono Jakarta Selatan Pintu Timur Lt Dasar Blok G No 23 PO BOX 3208/Plus JKB 11032 Telp : 021 – 5366 4555 Karawaci Tangerang Telp : 0217254359 60 Fax : 021 – 5366 4550 Telp : 021 547 3708 09 Fax : 021 7254361 Fax : 021 5473707 ACE Pluit ACE Kelapa Gading ACE PALEMBANG Jl.Pluit Indah Raya no.168 MS Jl. Raya Boulevard barat blok XC 9 No.36 Palembang Indah Mall Jakarta Utara 14450 Kelapa Gading Jl. Letkol Iskandar No.18 Palembang – 30129 Telp : 021 66698368 Jakarta Utara 14250 Telp : 0711 – 762 3107 Fax : 021 66698369 Telp : 021 45846664 Fax : 0711 – 762 3266 Fax : 021 45846657 ACE Pasaraya ACE Plaza Tunjungan ACE FATMAWATI Gedung Pasaraya Grande TUNJUNGAN PLAZA I Gedung ACE Lt. B2 Jl. Iskandarsyah II No. 2 Jl. Basuki Rachmad no.812 Jl. Fatmawati Raya No.42 Blok B1 Blok. M Jakarta Selatan 12160 Surabaya 60261 INDONESIA Cilandak – Jakarta Selatan Telp : 021 7227635 Telp : 0315326998 Telp : 021 – 7590 9922 FAX :021 7251009 Fax : 0315310286 Fax : 021 7590 1155 ACE Hardware Puri Indah ACE Hardware PIM ACE NAGOYA BATAM Jl. Puri Agung Mall Puri Indah Lt.II Blok BII Jl.Metro Pondok Indah blok IIIB Nagoya Hill Superblock Ground Floor Lt. Dasar Jakarta Barat 11610 Pondok Indah Jakarta Selatan 12310 Jl. Teuku Umar Lubuk Baja – Batam 29432 Tep : 021 582 2303 PO BOX 3208/PLUS/JKB/11032 Telp : 0778 – 749 3900 Fax : 021 – 582 2305 Telp : (6221)7591 2288 Fax : 0778 – 749 3990 Fax : (6221)7590 6633 ACE SRBY Pakuwon ACE Home Center Mal Artha Gading ACE SEMARANG Ace Home Center Supermal Pakuwon Lt Dasar Lt 1 Jl Artha Gading Selatan No. -

1 Hotel Duniatex Group, Pakuwon Tambah Portofolio Recurring Income

Beli 2 mal & 1 Hotel Duniatex Group, Pakuwon Tambah Portofolio Recurring Income PROPERTY INSIDE – PT Pakuwon Jati Tbk. melalui anak usahanya membeli 3 aset properti yang terdiri dari 2 pusat perbelanjaan atau mal dan 1 hotel di Yogyakarta dan Solo. Untuk transaksi tersebut, emiten properti dengan kode saham PWON ini merogoh kocek hingga Rp 1,359 triliun. Direktur dan Sekretaris Perusahaan Pakuwon Jati Minarto Basuki menjelaskan alasan transaksi tersebut untuk diversifikasi geografis bisnis perseroan di luar Surabaya dan Jakarta. Baca juga: Intiland Luncurkan DUO, Produk Inovatif Dengan Harga Rp700 Jutaan “Diversifikasi geografis untuk memperoleh potensi basis pertumbuhan baru di luar Surabaya dan Jakarta,” tulis Minarto dalam keterbukaan informasi, Senin (30/11). Minarto menjelaskan aset yang dibeli perseroan adalah Hartono Mall Yogyakarta, Hotel Marriott Yogyakarta, dan Hartono Solo Baru. Awalnya ketiga aset tersebut dimiliki oleh PT Delta Merlin Dunia Properti sebagai pemilik gedung dan Sumitro selaku pemilik tanah. Perusahaan properti tersebut merupakan entitas Duniatex Group. Baca juga: Pasokan Apartemen Q3 2020 Naik 114%, Meikarta Penyumbang Terbanyak Transaksi jual-beli tersebut dilakukan Pakuwon Jati melalui PT Pakuwon Permai yang merupakan anak usaha dengan kepemilikan saham sebesar 67,13 persen. Minarto menyampaikan nilai transaksi tersebut mencapai Rp 1,35 triliun dan sumber pendanaan diambil dari kas internal. Dengan tambahan aset properti tersebut, portofolio PWON yang menghasilkan tambahan berulang atau recurring income pun semakin -

PT Lippo Karawaci Tbk FY20 Results Presentation 11 May 2021 Shareholder Structure

PT Lippo Karawaci Tbk FY20 Results Presentation 11 May 2021 Shareholder Structure As of 30 December 2020 As of 31 December 2019 No. of No. of Change No. Description No. of Shares % No. of Shares % Investors Investors YTD (%) I. Domestic Insurance 24 1,049,803,440 1.5% 36 629,830,720 0.9% 66.7% Individual 20,166 2,885,379,262 4.1% 10,491 2,134,292,043 3.0% 35.2% Corporation 122 32,802,325,492 46.3% 155 33,642,920,062 47.5% -2.5% Foundation 2 332,500 0.0% 3 14,551,000 0.0% -97.7% Pension Fund 25 52,756,420 0.1% 30 115,585,460 0.2% -54.4% Others 53 219,789,584 0.3% 3 28,149,800 0.0% 680.8% Sub Total 20,392 37,010,386,698 52.2% 10,718 36,565,329,085 51.6% 1.2% II. International Retail 58 30,221,538 0.0% 57 58,961,538 0.1% -48.7% Institutional 253 33,857,410,133 47.8% 291 34,273,727,746 48.3% -1.2% Others - - 0.0% - - 0.0% Sub Total 311 33,887,631,671 47.8% 348 34,332,689,284 48.4% -1.3% Total 20,703 70,898,018,369 100.0% 11,066 70,898,018,369 100.0% 0.0% 2 Contents Business Model 04 - 06 Recent Developments 07 - 14 4Q20 Financial Data 16 - 36 Corporate Governance Initiatives 37 - 42 Subsidiaries 43 - 59 Meikarta 59 - 61 Corporate Data 62 - 65 Appendix 66 - 77 One of Indonesia’s largest integrated real estate developers One of the largest diversified publicly Market leader in property development, lifestyle listed property companies in Indonesia by total malls, and healthcare in Indonesia assets and revenue ◼ Ongoing development of 3 projects (1) with GFA of ◼ Total assets as of 4Q20: $3.71 billion approximately 175,000 sqm (1) ◼ 4Q20 revenue: $228 million ◼ Manage 56 malls with GFA of 3.5 million sqm ◼ 4Q20 Market capitalization: $956 million ◼ Network of 39 hospitals with 3,630 beds Large diversified land bank with 10 Nationwide platform with presence years + worth of development across 40 cities in the country ◼ 1,362 ha available across Indonesia, providing more than 10 years of development pipeline Growing through strategic Integrated business model with ability to partnership across integrated recycle capital. -

Agung Podomoro Land

Indonesia Company Guide Agung Podomoro Land Version 2 | Bloomberg : APLN IJ | Reuters: APLN.JK Refer to important disclosures at the end of this report DBS Group Research . Equity 7 Jun 2016 FULLY VALUED Laying low for now Last Traded Price: Rp244 (JCIJCIJCIJCI : 4,896.03) Price Target : Rp205 (-16% downside) (Prev Rp285) Maintain FULLY VALUED call. We adjusted our RNAV Potential Catalyst: More significant project acquisitions downwards to Rp502/sh to reflect latest revenue recognition Where we differdiffer:::: Having the most bearish estimates and earning estimates given the latest development of APLN’s Analyst existing and new projects. Subsequently, our TP is adjusted to Edward Ariadi Tanuwijaya +6221 3003 4932 Rp205 (implying c.19% downside from current level). [email protected] What’s New Reclamation project status remains uncleaunclearrrr.. The development of APLN’s major projects remain uncertain with all the swirling • New revenue stream from PGV Cimanggis project news on the 160-ha Pluit City reclamation project. APLN, • Reclamation project remains unclear given the known for its fast turnover business model, has to seek other latest development (and administrative court projects to maintain its earnings continuity and sustainability. order) • Balance sheet will continue to be highly geared New segment provides fresh revenue streamstream.. APLN recently groundbroke its new project Podomoro Golf View (PGV) • Maintain FULLY VALUED call Cimanggis in south Jakarta suburb area. The company, through its subsidiary PT. Graha Tunas Selaras, plans to build 25 apartment towers (i.e. 37,000 apartment units) on this 60- Price Relative ha project. This PGV project offers 20-30 sqm units with price Rp Relative Index per unit ranging between Rp198m and Rp470m.