Equinet Analyser 20.01.2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Jenoptik Annual Report 2013

SUCCEEDING THROUGH PERFORMANCE ANNUAL REPORT 2013 _ Key figures of Jenoptik in million euros 2013 2012 Change in % Oct.–Dec. 2013 Oct.–Dec. 2012 Change in % Sales 600.3 585.0 2.6 167.8 161.9 3.6 Domestic 228.4 208.1 9.7 71.1 58.0 22.6 Foreign 371.9 376.9 −1.3 96.7 103.9 −7.0 EBITDA 74.8 77.7 −3.6 21.1 18.9 11.6 EBIT 52.7 54.8 −3.9 15.2 12.7 19.6 EBIT margin (EBIT in % of sales) 8.8 9.4 9.1 7.9 Earnings before tax 47.2 46.1 2.4 13.6 9.7 40.7 Earnings after tax 47.2 50.2 −6.1 18.1 20.2 −10.6 Free cash flow (before income taxes) 47.0 43.7 7.6 41.8 17.0 145.6 Investments in property, plant and equipment and intangible assets 24.4 31.2 −22.0 6.0 14.0 −56.8 Order intake 575.3 587.2 −2.0 160.0 150.1 6.6 in million euros 31/12/2013 31/12/2012 Change in % Order backlog 411.4 446.8 −7.9 Employees 3,433 3,272 4,9 Please note that there may be rounding differences as compared to the mathematically exact amounts (monetary units, percentagees) in this report. _ Key figures of Jenoptik by segment in million euros 2013 2012 Change in % Oct.–Dec. 2013 Oct.–Dec. 2012 Change in % Sales 600.3 585.0 2.6 167.8 161.9 3.6 Lasers & Optical Systems 224.7 212.3 5.8 64.3 50.6 27.1 Metrology 187.4 182.7 2.6 46.6 57.7 −19.2 Defense & Civil Systems 185.1 186.4 −0.7 56.4 53.4 5.7 Others1) 3.1 3.6 −15.0 0.4 0.3 68.4 EBITDA 74.8 77.7 −3.6 21.1 18.9 11.6 Lasers & Optical Systems 34.0 36.4 −6.7 10.2 5.2 94.8 Metrology 25.2 28.6 −12.1 6.1 12.7 −51.9 Defense & Civil Systems 16.7 13.3 25.0 6.3 2.2 183.2 Others1) −1.0 −0.6 −61.8 −1.4 −1.2 −25.6 EBIT 52.7 54.8 −3.9 15.2 12.7 -

DXE Liquidity Provider Registered Firms

DXE Liquidity Provider Program Registered Securities European Equities TheCboe following Europe Limited list of symbols specifies which firms are registered to supply liquidity for each symbol in 2021-09-28: 1COVd - Covestro AG Citadel Securities GCS (Ireland) Limited (Program Three) DRW Europe B.V. (Program Three) HRTEU Limited (Program Two) Jane Street Financial Limited (Program Three) Jump Trading Europe B.V. (Program Three) Qube Master Fund Limited (Program One) Societe Generale SA (Program Three) 1U1d - 1&1 AG Citadel Securities GCS (Ireland) Limited (Program Three) HRTEU Limited (Program Two) Jane Street Financial Limited (Program Three) 2GBd - 2G Energy AG Citadel Securities GCS (Ireland) Limited (Program Three) Jane Street Financial Limited (Program Three) 3BALm - WisdomTree EURO STOXX Banks 3x Daily Leveraged HRTEU Limited (Program One) 3DELm - WisdomTree DAX 30 3x Daily Leveraged HRTEU Limited (Program One) 3ITLm - WisdomTree FTSE MIB 3x Daily Leveraged HRTEU Limited (Program One) 3ITSm - WisdomTree FTSE MIB 3x Daily Short HRTEU Limited (Program One) 8TRAd - Traton SE Jane Street Financial Limited (Program Three) 8TRAs - Traton SE Jane Street Financial Limited (Program Three) Cboe Europe Limited is a Recognised Investment Exchange regulated by the Financial Conduct Authority. Cboe Europe Limited is an indirect wholly-owned subsidiary of Cboe Global Markets, Inc. and is a company registered in England and Wales with Company Number 6547680 and registered office at 11 Monument Street, London EC3R 8AF. This document has been established for information purposes only. The data contained herein is believed to be reliable but is not guaranteed. None of the information concerning the services or products described in this document constitutes advice or a recommendation of any product or service. -

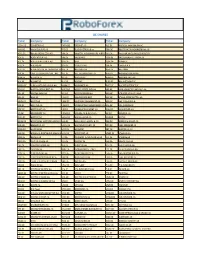

R Trader Instruments Cfds and Stocks

DE SHARES Ticker Company Ticker Company Ticker Company 1COV.DE COVESTRO AG FNTN.DE FREENET AG P1Z.DE PATRIZIA IMMOBILIEN AG AAD.DE AMADEUS FIRE AG FPE.DE FUCHS PETROLUB vz PBB.DE DEUTSCHE PFANDBRIEFBANK AG ACX1.DE BET-AT-HOME.COM AG FRA.DE FRAPORT AG FRANKFURT AIRPORTPFV.DE PFEIFFER VACUUM TECHNOLOGY ADJ.DE ADO PROPERTIES FRE.DE FRESENIUS PSM.DE PROSIEBENSAT.1 MEDIA SE ADL.DE ADLER REAL ESTATE AG G1A.DE GEA PUM.DE PUMA SE ADS.DE ADIDAS AG G24.DE SCOUT24 AG QIA.DE QIAGEN N.V. ADV.DE ADVA OPTICAL NETWORKING SE GBF.DE BILFINGER SE RAA.DE RATIONAL AFX.DE CARL ZEISS MEDITEC AG - BR GFT.DE GFT TECHNOLOGIES SE RHK.DE RHOEN-KLINIKUM AG AIXA.DE AIXTRON SE GIL.DE DMG MORI RHM.DE RHEINMETALL AG ALV.DE ALLIANZ SE GLJ.DE GRENKE RIB1.DE RIB SOFTWARE SE AM3D.DE SLM SOLUTIONS GROUP AG GMM.DE GRAMMER AG RKET.DE ROCKET INTERNET SE AOX.DE ALSTRIA OFFICE REIT-AG GWI1.DE GERRY WEBER INTL AG S92.DE SMA SOLAR TECHNOLOGY AG ARL.DE AAREAL BANK AG GXI.DE GERRESHEIMER AG SAX.DE STROEER SE & CO KGAA BAS.DE BASF SE HAB.DE HAMBORNER REIT SAZ.DE STADA ARZNEIMITTEL AG BAYN.DE BAYER AG HBM.DE HORNBACH BAUMARKT AG SFQ.DE SAF HOLLAND S.A. BC8.DE BECHTLE AG HDD.DE HEIDELBERGER DRUCKMASCHINENSGL.DE SGL CARBON SE BDT.DE BERTRANDT AG HEI.DE HEIDELBERGCEMENT AG SHA.DE SCHAEFFLER AG BEI.DE BEIERSDORF AG HEN3.DE HENKEL AG & CO KGAA SIE.DE SIEMENS AG BIO4.DE BIOTEST AG HLAG.DE HAPAG-LLOYD AG SIX2.DE SIXT SE BMW.DE BAYERISCHE MOTOREN WERKE AGHLE.DE HELLA KGAA HUECK & CO SKB.DE KOENIG & BAUER AG BNR.DE BRENNTAG AG HNR1.DE HANNOVER RUECK SE SPR.DE AXEL SPRINGER SE BOSS.DE HUGO BOSS -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Corporate Non-Financial Reporting in Germany

Copyright © Development International e.V., 2019 ISBN: 978-3-9820398-1-7 Authors: Chris N. Bayer, PhD Gisella Vogel Sarah Kaltenhäuser Katherine Storrs Jiahua (Java) Xu, PhD Juan Ignacio Ibañez, LL.M. Title: A New Responsibility for Sustainability: Corporate Non-Financial Reporting in Germany Date published: May 6, 2019 Funded by: iPoint-systems gmbh www.ipoint-systems.com Executive Summary Germany's economy is the fourth-largest in the world (by nominal GDP), and with 28% of the euro area market, it represents the largest economy in Europe.1 Considering the supply chains leading to its economy, Germany's cumulative environmental, social and governance performance reverberates globally. The EU Non-Financial Reporting Directive (NFRD) is the impetus behind this study – a new regulation that seeks to “increase the relevance, consistency and comparability of information disclosed by certain large undertakings and groups across the Union.”2 Large undertakings in EU member states are not only required to report on their financial basics, now they are also required by Article 1 of the Directive to account for their non- financial footprint, including adverse impacts they have on the environment and supply chains. In accordance with the Directive, the German transposition stipulates that the non-financial declaration must state which reporting framework was used to create it (or explain why no framework was applied), as well as apply non-financial key performance indicators relevant to the particular business. These requirements are our point of departure: We systematically assess the degree of non-financial transparency and performance reporting for 2017 applying an ex-post assessment framework premised on the Global Reporting Initiative (GRI), the German Sustainability Code (Deutscher Nachhaltigkeitskodex, DNK) and the United Nations Global Compact (UNGC). -

Woman up How Diverse Companies Come out on Top

Woman Up How Diverse Companies Come Out on Top BCG Gender Diversity Index Germany 2020 Boston Consulting Group (BCG) partners with leaders in business and society to tackle their most important challenges and capture their greatest opportunities. BCG was the pioneer in business strategy when it was founded in 1963. Today, Boston Consulting Group helps clients with total transformation: inspiring complex change, enabling organizations to grow, building competitive advan- tage, improving customer and employee satisfaction, and driving bottom-line impact. Sustained success requires a combination of digital and human capabilities. BCG’s diverse, global teams bring deep industry and functional expertise and a range of perspectives to spark change. BCG delivers solutions through leading-edge management consul- ting along with technology and design, corporate and digital ventures—and business purpose. BCG works in a uniquely collaborative model across the firm and throughout all levels of the client organization, generating results that allow its clients to thrive. The company has offices in more than 90 cities in over 50 countries and generated revenue of $8.6 billion in 2020 with its 22,000 employees worldwide. More information: www.bcg.de The Technical University of Munich (TUM) is one of Europe’s top universities. It is committed to excellence in research and teaching, interdisciplinary education, and the active promotion of promising young scientists. The university also forges strong links with companies and scientific institutions across the world. TUM was one of the first three universities in Germany to be named a University of Excellence. Moreover, TUM regularly ranks among the best European universities in international rankings. -

Euro Stoxx® Total Market Index

EURO STOXX® TOTAL MARKET INDEX Components1 Company Supersector Country Weight (%) ASML HLDG Technology Netherlands 3.45 LVMH MOET HENNESSY Consumer Products & Services France 2.76 LINDE Chemicals Germany 2.40 SAP Technology Germany 2.38 TOTAL Energy France 1.99 SANOFI Health Care France 1.88 SIEMENS Industrial Goods & Services Germany 1.84 ALLIANZ Insurance Germany 1.74 L'OREAL Consumer Products & Services France 1.55 IBERDROLA Utilities Spain 1.38 SCHNEIDER ELECTRIC Industrial Goods & Services France 1.35 AIR LIQUIDE Chemicals France 1.33 ENEL Utilities Italy 1.32 BASF Chemicals Germany 1.23 ADYEN Industrial Goods & Services Netherlands 1.13 ADIDAS Consumer Products & Services Germany 1.13 AIRBUS Industrial Goods & Services France 1.08 BNP PARIBAS Banks France 1.05 DAIMLER Automobiles & Parts Germany 1.03 ANHEUSER-BUSCH INBEV Food, Beverage & Tobacco Belgium 1.02 DEUTSCHE TELEKOM Telecommunications Germany 1.02 BAYER Health Care Germany 1.00 VINCI Construction & Materials France 0.98 BCO SANTANDER Banks Spain 0.93 Kering Retail France 0.87 AXA Insurance France 0.86 PHILIPS Health Care Netherlands 0.85 SAFRAN Industrial Goods & Services France 0.85 DEUTSCHE POST Industrial Goods & Services Germany 0.84 INFINEON TECHNOLOGIES Technology Germany 0.84 Prosus Technology Netherlands 0.83 ESSILORLUXOTTICA Health Care France 0.80 DANONE Food, Beverage & Tobacco France 0.73 INTESA SANPAOLO Banks Italy 0.73 MUENCHENER RUECK Insurance Germany 0.72 PERNOD RICARD Food, Beverage & Tobacco France 0.66 ING GRP Banks Netherlands 0.64 HERMES INTERNATIONAL -

DWS Equity Funds Semiannual Reports 2010/2011

DWS Investment GmbH DWS Equity Funds Semiannual Reports 2010/2011 ■ DWS Deutschland ■ DWS Investa ■ DWS Aktien Strategie Deutschland ■ DWS European Opportunities ■ DWS Intervest ■ DWS Akkumula : The DWS/DB Group is the largest German mutual fund company according to assets under management. Source: BVI. As of: March 31, 2011. 4/2011 DWS Deutschland DWS Investa DWS Aktien Strategie Deutschland DWS European Opportunities DWS Intervest DWS Akkumula Contents Semiannual reports 2010/2011 for the period from October 1, 2010, through March 31, 2011 (in accordance with article 44 (2) of the German Investment Act (InvG)) TOP 50 Europa 00 General information 2 Semiannual reports 2010 DWS Deutschland 4 DWS Investa 10 2011 DWS Aktien Strategie Deutschland 16 DWS European Opportunities 22 DWS Intervest 28 DWS Akkumula 36 1 General information Performance ing benchmarks – if available – are also b) any taxes that may arise in connec- The investment return, or performance, presented in the report. All financial tion with administrative and custodial of a mutual fund investment is meas - data in this publication is as of costs; ured by the change in value of the March 31, 2011. c) the costs of asserting and enforcing fund’s units. The net asset values per the legal claims of the investment unit (= redemption prices) with the addi- Sales prospectuses fund. tion of intervening distributions, which The sole binding basis for a purchase are, for example, reinvested free of are the current versions of the simpli- The details of the fee structure are set charge within the scope of investment fied and the detailed sales prospec - forth in the current detailed sales accounts at DWS, are used as the basis tuses, which are available from DWS, prospectus. -

Shifting Socioemotional Wealth Prioritization During a Crisis

Shifting socioemotional wealth prioritization during a crisis A content analysis of statements to shareholders of family businesses MASTER THESIS WITHIN: Business Administration NUMBER OF CREDITS: 30 ECTS PROGRAMME OF STUDY: Global Management AUTHORS: Stella Alice Gisela Heuer & Lajos Szabó TUTOR: Tommaso Minola JÖNKÖPING May 2021 Master Thesis in Business Administration Title: Shifting socioemotional wealth prioritization during a crisis: A content analysis of statements to shareholders of family businesses Authors: Stella Alice Gisela Heuer and Lajos Szabó Tutor: Tommaso Minola Date: 2021-05-24 Key terms: Family business, socioemotional wealth, FIBER, COVID-19, content analysis, Sweden, Germany Abstract Family businesses are generally considered to be the most prevalent form of business around the world. They have also been shown to differ from their non-family counterparts due the non- economic factors that influence their decision-making. One of the most widely used conceptualization of these factors concerns the controlling family’s socioemotional endowment or in other words, the family’s socioemotional wealth. Newer approaches have proposed that socioemotional wealth can not only be broken down into several component dimensions, but that these dimensions may shift in prioritization in response to different contingencies. The sudden spread of the COVID-19 pandemic and the global crisis that has followed in its wake is one such contingency, impacting economies and family firms virtually everywhere in the world. Studying the crisis’ effects on family firms has thus already been outlined as a major focus of research going forward. This paper aims to develop the concept of socioemotional wealth as a dynamic construct and study the crisis’ effects on family firms. -

Euro Stoxx® Total Market Index

EURO STOXX® TOTAL MARKET INDEX Components1 Company Supersector Country Weight (%) ASML HLDG Technology Netherlands 4.29 LVMH MOET HENNESSY Consumer Products & Services France 3.27 SAP Technology Germany 2.34 LINDE Chemicals Germany 2.26 TOTALENERGIES Energy France 1.89 SANOFI Health Care France 1.82 SIEMENS Industrial Goods & Services Germany 1.81 L'OREAL Consumer Products & Services France 1.73 ALLIANZ Insurance Germany 1.62 SCHNEIDER ELECTRIC Industrial Goods & Services France 1.35 AIR LIQUIDE Chemicals France 1.24 AIRBUS Industrial Goods & Services France 1.19 DAIMLER Automobiles & Parts Germany 1.17 IBERDROLA Utilities Spain 1.14 ENEL Utilities Italy 1.13 BNP PARIBAS Banks France 1.12 BASF Chemicals Germany 1.08 DEUTSCHE TELEKOM Telecommunications Germany 1.03 BCO SANTANDER Banks Spain 1.03 VINCI Construction & Materials France 1.01 DEUTSCHE POST Industrial Goods & Services Germany 1.01 Kering Retail France 1.00 ADYEN Industrial Goods & Services Netherlands 0.98 ANHEUSER-BUSCH INBEV Food, Beverage & Tobacco Belgium 0.97 ADIDAS Consumer Products & Services Germany 0.97 BAYER Health Care Germany 0.94 SAFRAN Industrial Goods & Services France 0.86 AXA Insurance France 0.83 ESSILORLUXOTTICA Health Care France 0.81 INTESA SANPAOLO Banks Italy 0.78 ING GRP Banks Netherlands 0.77 HERMES INTERNATIONAL Consumer Products & Services France 0.77 INFINEON TECHNOLOGIES Technology Germany 0.77 VOLKSWAGEN PREF Automobiles & Parts Germany 0.72 PHILIPS Health Care Netherlands 0.71 DANONE Food, Beverage & Tobacco France 0.69 Prosus Technology Netherlands -

Women-On-Board-Index

WOMEN‐ON‐BOARD‐INDEX III Aufsichtsräte (Stand 30.06.2011) powered by FidAR Zahl Anteil WoB-Index Posit Zahl AR- Unternehmen Notierung Frauen Frauen nur ion Mitgl. AR AR Aufsichtsräte 1 Biotest AG SDAX 6 3 50% 50,00% 1 Douglas Holding AG MDAX 16 8 50% 50,00% 3 HAMBORNER REIT SDAX 10 4 40% 40,00% 4 Deutsche Bank AG DAX 20 7 35% 35,00% 5 Amadeus Fire AG SDAX 6 2 33% 33,33% 5 Bechtle AG TecDAX 12 4 33% 33,33% 5 Beiersdorf AG DAX 12 4 33% 33,33% 5 centrotherm photovoltaics AG TecDAX 3 1 33% 33,33% 5 TAG Immobilien AG SDAX 6 2 33% 33,33% 10 Deutsche Post AG DAX 20 6 30% 30,00% 10 GfK SE SDAX 10 3 30% 30,00% 12 Commerzbank AG DAX 20 5 25% 25,00% 12 Fielmann AG MDAX 16 4 25% 25,00% 12 Fraport AG MDAX 20 5 25% 25,00% 12 Henkel AG & Co. KGaA DAX 16 4 25% 25,00% 12 Kabel Deutschland Holding AG MDAX 12 3 25% 25,00% 12 Merck KGaA DAX 16 4 25% 25,00% 12 Software AG TecDAX 12 3 25% 25,00% 12 Symrise AG MDAX 12 3 25% 25,00% 20 Axel Springer AG MDAX 9 2 22% 22,22% 20 Q-CELLS SE TecDAX 9 2 22% 22,22% 20 Sky Deutschland AG MDAX 9 2 22% 22,22% 20 STADA Arzneimittel AG MDAX 9 2 22% 22,22% 24 comdirect bank AG SDAX 5 1 20% 20,00% 24 Deutsche Telekom AG DAX 20 4 20% 20,00% 24 Hawesko Holding AG SDAX 5 1 20% 20,00% 24 Münchener Rück AG DAX 20 4 20% 20,00% 24 RHÖN-KLINIKUM AG MDAX 20 4 20% 20,00% 24 Siemens AG DAX 20 4 20% 20,00% 30 Praktiker Bau- und Heimwerkermärkte MDAX 16 3 19% 18,75% 30 TUI AG MDAX 16 3 19% 18,75% 32 adidas AG DAX 12 2 17% 16,67% 32 ADVA AG Optical Networking TecDAX 6 1 17% 16,67% 32 AIXTRON SE TecDAX 6 1 17% 16,67% 32 BASF SE DAX 12 2 17% -

Determinants and Value of Enterprise Risk Management: Empirical Evidence from Germany

Determinants and Value of Enterprise Risk Management: Empirical Evidence from Germany Philipp Lechner, Nadine Gatzert Working Paper Department of Insurance Economics and Risk Management Friedrich-Alexander University Erlangen-Nürnberg (FAU) Version: February 2017 1 DETERMINANTS AND VALUE OF ENTERPRISE RISK MANAGEMENT: EMPIRICAL EVIDENCE FROM GERMANY Philipp Lechner, Nadine Gatzert* This version: February 21, 2017 ABSTRACT Enterprise risk management (ERM) has become increasingly relevant in recent years, espe- cially due to an increasing complexity of risks and the further development of regulatory frameworks. The aim of this paper is to empirically analyze firm characteristics that deter- mine the implementation of an ERM system and to study the impact of ERM on firm value. We focus on companies listed at the German stock exchange, which to the best of our knowledge is the first empirical study with a cross-sectional analysis for Germany and one of the first for a European country. Our findings show that size, international diversifica- tion, and the industry sector (banking, insurance, energy) positively impact the implementa- tion of an ERM system, and financial leverage is negatively related to ERM engagement. In addition, our results confirm a significant positive impact of ERM on shareholder value. Keywords: Enterprise risk management; firm characteristics; shareholder value JEL Classification: G20; G22; G32 1. INTRODUCTION In recent years, enterprise risk management (ERM) has become increasingly relevant, espe- cially against the background of an increasing complexity of risks, increasing dependencies between risk sources, more advanced methods of risk identification and quantification and information technologies, the consideration of ERM systems in rating processes, as well as stricter regulations in the aftermath of the financial crisis, among other drivers (see, e.g., Hoyt and Liebenberg, 2011; Pagach and Warr, 2011).