SUCCEEDING THROUGH PERFORMANCE

A N N UA L R E P O R T 2 013

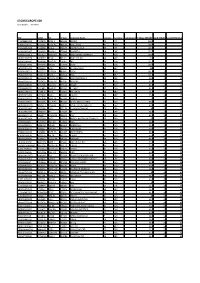

_Key figures of Jenoptik

in million euros

Sales

2013

600.3

228.4 371.9

74.8

2012

585.0

208.1 376.9

77.7

Change in %

2.6

Oct.–Dec. 2013

167.8

71.1

Oct.–Dec. 2012

161.9

58.0

Change in %

3.6

Domestic Foreign

- 9.7

- 22.6

- −1.3

- 96.7

- 103.9

- −7.0

EBITDA EBIT

−3.6 −3.9

- 21.1

- 18.9

- 11.6

- 52.7

- 54.8

- 15.2

- 12.7

- 19.6

EBIT margin

- (EBIT in % of sales)

- 8.8

47.2 47.2

9.4

46.1 50.2

9.1

13.6 18.1

7.9

- 9.7

- Earnings before tax

Earnings after tax

- 2.4

- 40.7

- −6.1

- 20.2

- −10.6

Free cash flow

- (before income taxes)

- 47.0

- 43.7

- 7.6

- 41.8

- 17.0

- 145.6

Investments in property, plant and equipment and

- intangible assets

- 24.4

- 31.2

- −22.0

−2.0

- 6.0

- 14.0

- −56.8

- 6.6

- Order intake

- 575.3

- 587.2

- 160.0

- 150.1

in million euros

Order backlog Employees

31/12/2013

411.4

31/12/2012

446.8

Change in %

−7.9

- 3,433

- 3,272

- 4,9

Please note that there may be rounding differences as compared to the mathematically exact amounts (monetary units, percentagees) in this report.

_Key figures of Jenoptik by segment

- in million euros

- 2013

- 2012

- Change in %

- Oct.–Dec. 2013

- Oct.–Dec. 2012

- Change in %

- Sales

- 600.3

224.7 187.4 185.1

3.1

585.0

212.3 182.7 186.4

3.6

2.6

5.8

167.8

64.3 46.6 56.4

0.4

161.9

50.6 57.7 53.4

0.3

3.6

- 27.1

- Lasers & Optical Systems

- Metrology

- 2.6

- −19.2

- 5.7

- Defense & Civil Systems

Others1)

−0.7

−15.0

−3.6

−6.7 −12.1

25.0

−61.8

−3.9

−9.2

−11.6 48.5 −5.4

68.4

- EBITDA

- 74.8

34.0 25.2 16.7 −1.0

77.7

36.4 28.6 13.3 −0.6

54.8

27.1

21.1

10.2

6.1

18.9

5.2

11.6

- 94.8

- Lasers & Optical Systems

- Metrology

- 12.7

2.2

−51.9 183.2 −25.6

19.6

164.8 −56.0

2.926.1

−14.7

Defense & Civil Systems Others1)

6.3

−1.4

15.2

7.8

−1.2

12.7

2.9

- EBIT

- 52.7

24.6 22.6 11.6

Lasers & Optical Systems

- Metrology

- 25.6

7.8

- 5.3

- 12.1

- 0.2

- Defense & Civil Systems

Others1)

5.0

- −6.0

- −5.7

- −2.9

- −2.5

EBIT margin

- (EBIT in % of sales)

- 8.8

10.9 12.0

6.2

9.4

12.8 14.1

9.1

12.1 11.5

8.8

7.8

- 5.8

- Lasers & Optical Systems

- Metrology

- 21.1

- 0.4

- Defense & Civil Systems

R+D output

4.2

51.1

19.4 19.4 12.2

0.0

49.1

19.0 16.9 13.1

4.0

2.0

13.1

4.1

13.3

4.7

−1.4

−12.0

19.0 −8.0

−211.1

6.6

Lasers & Optical Systems

- Metrology

- 15.0

−6.9

−71.0

−2.0

0.7

- 5.6

- 4.7

Defense & Civil Systems Others1)

- 3.5

- 3.8

- 0.1

- −0.1

160.0

56.3 47.4 55.0

1.3

0.1

- Order intake

- 575.3

221.4 172.5 179.2

2.2

587.2

219.9 198.7 165.0

3.6

150.1

52.7 40.7 56.0

0.7

Lasers & Optical Systems Metrology

6.8

−13.2

8.6

16.3 −1.8 83.6

Defense & Civil Systems

- Others1)

- −39.6

- in million euros

- 31/12/2013

411.4

94.3

31/12/2012

446.8

105.2

87.4

Change in %

−7.9

−10.4 −16.8

−3.5

Order backlog

Lasers & Optical Systems

- Metrology

- 72.8

Defense & Civil Systems Others1)

246.9

−2.6

255.8

- −1.6

- −57.7

- 4.9

- Employees

- 3.433

1.391

907

3.272

1.349

814

Lasers & Optical Systems Metrology

3.1

11.4

Defense & Civil Systems Others1)

- 907

- 913

- −0.7

- 228

- 196

- 16.3

1) including consolidation

_A portrait of Jenoptik

We are a globally operating, integrated optoelectronics Group. Optical technologies are the very basis of our business. Our customers primarily include companies in the semiconductor equipment industry, the automotive and automotive supplier industries, the medical technology, security and defense technology industries and the aviation industry. In 2013, our 3,433 employees at around 80 locations around the world generated revenue of approximately 600 million euros.

THE JENOPTIK GROUP

Corporate Center

- Lasers &

- Defense &

Segments Divisions

- Optical Systems

- Metrology

- Civil Systems

Lasers & Material Processing

Industrial Metrology

Defense &

- Civil Systems

- Optical Systems

- Traffic solutions

We supply reliable, efficient and precise laser technology for industrial processing of various materials. Our customers benefit from our holistic approach, as we cover the entire value chain – from semiconductor material, laser sources, laser system and systems engineering for production facilities through to

We are one of very few manufacturers in the world to produce integrated optical systems and precision optics for the most stringent demands in terms of quality. We are a development and production partner for optoelectronic and optomechanical systems, modules and assemblies based on optical, micro-optical and layered optic components made from glass, infrared materials and plastics.

As global metrology specialists, we develop and produce highprecision production measuring technology. Our experience in

We develop and produce components and systems for better traffic safety on the world’s roads. This includes mobile and stationary systems such as speed and red light monitoring equipment and special solutions for detecting other traffic violations. In our function as a service provider, Jenoptik also covers all aspects of the associated process chain.

We focus on equipment for military and civil vehicles, trains and aircraft, drive and stabilization engineering, energy systems as well as laser and infrared sensor technology. Optoelectronic instruments and systems for the security industry as well as software, measurement and control technology complement our service range. tactile, optical and pneumatic measuring methods puts us in a position to devise custom solutions for the widest range of measuring tasks – at every stage of the production process and in the inspection room. industrial waste gas cleaning systems.

Shared Service Center

JENOPTIK ANNUAL REPORT 2013

_SUCCEEDING THROUGH PERFORMANCE

We are an outstanding hightech partner to our customers! On the principle of growing

„FROM GOOD TO GREAT“,

we want to do even better justice to this claim:

FROM GOOD TO GREAT –

2013 TO 2017

INTERNATIONALIZATION

INNOVATION

OPERATIONAL EXCELLENCE

~10

We energetically drive our operational development on, boost networks with our customers and increasingly gain access to new markets around the world. In this way we generate growth and raise our corporate value.

approx. 10 percent growth per year over the market cycles

800

approx. 800 million euros revenue in 2017

9/10

9 to 10 percent EBIT margin over the market cycles

_Contents

MANAGEMENT

2

Foreword of the Executive Board

6

Report of the Supervisory Board Status Report 2013

1 2 1 6 1 8 2 2

JENOPTIK 2013 – Selected events The Jenoptik Share SUCCEEDING THROUGH PERFORMANCE

CORPORATE GOVERNANCE

3 6 4 2 4 5

Corporate Governance Report Information and Notes relating to takeover law Remuneration Report

GROUP MANAGEMENT REPORT

5 2 7 6 9 1 9 5 9 6

General Group Information Business Report Segment Reporting Events after the reporting date Risk and Opportunity Report

1 0 8 Forecast Report

CONSOLIDATED FINANCIAL STATEMENTS

1 1 8 Consolidated Statement of Comprehensive Income

1 1 9 Consolidated Statement of Financial Position 1 2 0 Statement of Changes in Equity 1 2 2 Consolidated Statement of Cash Flows 1 2 3 Notes 1 7 8 Assurance by the Legal Representatives 1 7 9 Auditors´ Report

COVER PICTURE

INFORMATION

Expertise in optics – one example of this can be seen on the cover image of this year’s annual report. These micro-optics (a Shack-Hartmann microlens array), in real life no larger than a thumbnail, are an all-round powerhouse. Because of the outstanding properties of materials such as calcium fluoride, optics are suitable for universal use in light refraction and shaping. Used in medical systems for ophthalmology, for example, they allow measurement of eye parameters. In quality assurance for semiconductor and optical systems, or in microscopy, too, micro-optics are extremely versatile.

1 8 0 Executive Management Board 1 8 1 Scientific Advisory Council 1 8 2 Glossary 1 8 4 List of Grafics and Tables 1 8 6 Historical Summary of Financial Data 1 8 8 Dates / Contact / Imprint

Further information on the Internet

Further information in the Annual Report

2

JENOPTIK ANNUAL REPORT 2013

Dr. Michael Mertin, President & CEO, and Rüdiger Andreas Günther, Chief Financial Officer

3

MANAGEMENT

Foreword of the Executive Board

Foreword of the Executive Board

2013 has been a challenging year, but we still succeeded in achieving our targets and increasing revenue. This makes it the fourth successive year in which the Group generated organic growth.

We can be rightly proud of this! Despite a tough market environment, we pressed on with the development of the company and secured our future with appropriate capital expenditure. This shows that Jenoptik now has the strength to remain on course in dynamic economic environments, too. We continue to invest systematically in the long-term development of the company. Our sustainable strategy is bearing fruit and has been adopted by all units of the Group around the world.

“Succeeding through Performance”, the guiding principle of this Annual Report, highlights one key factor in the successful implementation of our strategy. It draws attention to our uncompromising determination to achieve the very best performance for our stakeholders, anytime and anywhere. This performance promise is our ticket to successful growth in the world’s markets.

And we made a further step in the right direction last year: for the first time in the company’s recent history, we succeeded in generating revenue of over 600 million euros. The Group operating result came to 52.7 million euros. As planned, we made extensive capital expenditure to expanding our international sales structures, developed new products and pushed on with our Group development projects. With an improved financial result, our earnings before tax were at a higher level than last year. The Group achieved a profitability level almost on a par with the record year of 2012.

We countered weak markets in other European countries and parts of Asia with revenue increases in America and Germany. Jenoptik generated 62 percent of its revenue abroad.

In 2013, Jenoptik again generated clearly positive cash flows, considerably reduced its net debt and increased its equity ratio to 53.0 percent. The Group also has a long-term and robust financing structure which provides it with sufficient room for maneuver to secure future growth and the continuing implementation of our strategy.

Due to their varying levels of internationalization and fluctuating demand patterns among customers, the segments developed at different rates in 2013. The Lasers & Optical Systems and Metrology segments set new revenue records despite a volatile economic environment, while revenue in the Defense & Civil Systems segment remained virtually unchanged. The development of business and earnings was essentially supported by optimizations of internal processes and successes in implementing the internationalization strategy. All three segments generated a positive operating result, also in 2013.

4

JENOPTIK ANNUAL REPORT 2013

We continued the Jenoptik Excellence Program (JEP), including the Group development projects such as Go-Lean and JOE (Jenoptik One ERP), as scheduled. The Group’s largest project, JOE, has three objectives: we want to support international growth with harmonized processes and standardized IT systems; we want to increase efficiency in the operating functions by establishing a standardized ERP system; and we want to optimize Group management through the further development of methods in controlling and accounting.

Our shareholders keep a very close eye on our development process and evidently rate it highly: in mid-June 2013, the Jenoptik share broke the ten-euro mark for the first time in nine years; at its intra-year peak of 13.84 euros in October, it rose to its highest level since 2002.

The steps we have taken lay the foundations for our further successful growth as an integrated and globally operating company. We will continue to build on these foundations in 2014 and beyond.

Our objective for the years ahead remains sustainable and profitable growth, which we want to secure with three strategic levers: further expansion into international markets, capital expenditure in research and development and an improvement in operating processes – to the benefit of shareholders, customers and employees.

Our internationalization process is transforming us from a markedly “regional” company with sales structures abroad into a genuine global corporation. We want to move away from being a “global seller” to become a “global player”, a high-tech company with value creation all around the world. This is a major challenge, but at the same time a major opportunity.

In terms of the company’s operational excellence, it means we want to make our internal processes more efficient and actively bring common values to life. Jenoptik is not just represented in Germany, but has locations around the world. The corporate cultures which have developed over decades are just as varied as the different sites and their histories. With a standard Jenoptik identity and common values which are upheld at all locations and across national boundaries we create the basis for lasting success. We would like to take this opportunity to thank our employees for their willingness to adopt this state of constant change and their great contribution to it.

5

MANAGEMENT

Foreword of the Executive Board

We look to the future with optimism: in 2014, we expect an increase in revenue of between 5 and 10 percent and Group operating results of 55 to 62 million euros. With respect to the development of our key sectors such as the semiconductor equipment and automotive industries, we currently expect a stable to slightly positive trend for the coming months.

Dear shareholders, dear customers and partners, dear employees, we are on the right track. “Succeeding through Performance” – this guiding principle through the Annual Report defines all our entrepreneurial activities. We want to and will prove that we are up to the challenges change brings with it. Together with and for our customers, we will continue to create products and solutions which set standards and inspire confidence.

We thank you for your continued trust in us.

- Michael Mertin

- Rüdiger Andreas Günther

Jena, March 2014

DR. MICHAEL MERTIN

President & CEO

RÜDIGER ANDREAS GÜNTHER

Chief Financial Officer

Dr. Michael Mertin joined the company as Chief Operating Officer in October 2006 and has been the President & CEO of JENOPTIK AG since July 1, 2007. He is responsible for the operational business as well as for the areas of legal affairs, strategy, business development and innovation management, communication and marketing, quality and processes, purchasing and supply chain management, auditing, supervision of official bodies, corporate governance, data protection, IT, Shared Service Center and, as Human Resources Director, for personnel. He has been appointed until July 30, 2017.

Rüdiger Andreas Günther has been Chief Financial Officer of JENOPTIK AG since April 1, 2012. He is responsible for the areas of accounting & controlling, treasury, taxes, risk & compliance management, mergers & acquisitions, investor relations and the strategic real estate portfolio. He has been appointed until March 31, 2015.