WWE TRENDING SCHEDULES STATEMENT of OPERATIONS ($ in Millions; Unaudited)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Wwe 2016 Trending Schedules - Basis of Presentation

WWE 2016 TRENDING SCHEDULES - BASIS OF PRESENTATION WWE's operations are organized around four principal activities in ten reportable segments: The ten reportable segments of the Company now include the following: Network, Television, Home Entertainment and Digital Media are individual segments that comprise the Media Division; Live Events; Licensing, Venue Merchandise and WWEShop are individual segments that comprise the Consumer Products Division; WWE Studios and Corporate and Other. Media Division Network Segment revenues consist principally of subscriptions to WWE Network, fees for viewing our pay-per-view programming, and advertising fees. Television Segment revenues consist principally of television rights fees and advertising. Home Entertainment revenues consist principally of sales of WWE produced content via home entertainment platforms, including DVD, Blu-Ray, and subscription outlets. Digital Media revenues consist principally of advertising sales on our websites and third party websites, including YouTube, and sales of various broadband and mobile content. Live Events Revenues consist principally of ticket sales and travel packages for live events. Consumer Products Division Licensing Segment revenues consist principally of royalties or license fees related to various WWE themed products such as video games, toys and apparel. Venue Merchandise revenues consist of sales of merchandise at our live events. WWE Shop revenues consist of sales of merchandise on our websites, including through our WWEShop Internet storefront. WWE Studios Revenues consist of amounts earned from investing in, producing and/or distributing filmed entertainment. Corporate and Other Revenues consist of amounts earned from talent appearances. Expenses include corporate overhead and certain expenses related to sales and marketing, including our international offices, and talent development functions. -

ALLISA SWANSON Costume Designer

ALLISA SWANSON Costume Designer https://www.allisaswanson.com/ Selected Television: FIREFLY LANE (Pilot, S1&2) – Netflix / Brightlight Pictures – Maggie Friedman, creator TURNER & HOOCH (Pilot, S1) – 20th Century Fox / Disney+ – Matt Nix, writer – McG, pilot dir. ALIVE (Pilot) – CBS Studios – Uta Briesewitz, director ANOTHER LIFE (Pilot, S1) – Netflix / Halfire Entertainment – Aaron Martin, creator ONCE UPON A TIME (S7 eps. 716-722) – Disney/ABC TV – Edward Kitsis & Adam Horowitz, creators *NOMINATED, Excellence in Costume Design in TV – Sci-Fi/Fantasy - CAFTCAD Awards THE 100 (S3 + S4) – Alloy Entertainment / Warner Bros. / The CW – Jason Rothenberg, creator DEAD OF SUMMER (Pilot, S1) Disney / ABC / Freeform – Ian Goldberg, Adam Horowitz & Eddy Kitsis, creators MORTAL KOMBAT: LEGACY (Mini Series) – Warner Bros. – Kevin Tancharoen, director BEYOND SHERWOOD (TV Movie) – SyFy / Starz – Peter DeLuise, director KNIGHTS OF BLOODSTEEL (Mini-Series) – SyFy / Reunion Pictures – Phillip Spink, director SEA BEAST (TV Movie) – SyFy / NBC Universal TV – Paul Ziller, director EDGEMONT (S1 - S5) – CBC / Water Street Pictures / Fox Family Channel – Ian Weir, creator Selected Features: COFFEE & KAREEM – Netflix / Pacific Electric Picture Company – Michael Dowse, director GOOD BOYS (Addt’l Photo. )– Universal / Good Universe / Point Grey Pictures – Gene Stupnitsky, dir. DARC – Netflix / JRN Productions – Nick Powell, director THE UNSPOKEN – Lighthouse Pictures / Paladin – Sheldon Wilson, director THE MARINE: HOMEFRONT – WWE Studios – Scott Wiper, director ICARUS/THE KILLING MACHINE – Cinetel Films – Dolph Lundgren, director SPACE BUDDIES – Walt Disney Home Entertainment – Robert Vince, director DANCING TREES – NGN Productions – Anne Wheeler, director THE BETRAYED – MGM – Amanda Gusack, director SNOW BUDDIES – Walt Disney Home Entertainment – Robert Vince, director BLONDE & BLONDER – Rigel Entertainment – Bob Clark, director CHESTNUT: HERO OF CENTRAL PARK – Miramax / Keystone Entertainment – Robert Vince, dir. -

Trevor Morris

TREVOR MORRIS COMPOSER Trevor Morris is one of the most prolific and versatile composers in Hollywood. He has scored music for numerous feature films and won two EMMY awards for outstanding composition for his work in Television. Internationally renowned for his music on The Tudors, The Borgias, Vikings and the hit NBC television series Taken, Trevor is a stylistically and musically inventive soundtrack creator. Trevor’s unique musical voice can be heard on his recent film scores which include The Delicacy, Hunter Killer, Asura, Olympus Has Fallen, London Has Fallen, and Immortals. And further Television compositions including Another Life, Condor, Castlevania, The Pillars oF the Earth for Tony and Ridley Scott, Emerald City and Iron Fist for Marvel Television. Trevor has also worked as a co-producer/ conductor/ orchestrator on films including Black Hawk Down, The Last Samurai, The Ring Two, Pirates of the Caribbean, and Batman Begins and collaborated with Tony and Ridley Scott, Neil Jordan, Luc Besson, Jerry Bruckheimer, Antoine Fuqua, Tarsem Singh Dandwar, as well as composers James Newton Howard and Hans Zimmer. Trevor is also a Concert Conductor, conducting his music in live concert performances around the globe, including Film Music Festivals in Cordoba Spain, Tenerife Spain, Los Angeles, and Krakow Poland where he conducted a 100-piece orchestra and choir for over 12,000 fans. Trevor has been nominated 5 times for the prestigious EMMY awards, and won twice. As well as being nominated at the World Soundtrack Awards in Ghent for the ‘Discovery of the Year ‘composer award for the film Immortals. Trevor is a British/Canadian dual citizen, based in Los Angeles. -

Starter Pack Helping New* Film Societies and Community Film Groups Find the Right Film for Their Audiences

STARTER PACK HELPING NEW* FILM SOCIETIES AND COMMUNITY FILM GROUPS FIND THE RIGHT FILM FOR THEIR AUDIENCES CALLING NEW* FILM SOCIETIES AND COMMUNITY FILM GROUPS... CHOOSE THREE SCREEN EACH USE YOUR FILMS FROM OUR OF THE FILMS FINDINGS TO LIBRARY OF OVER AND SURVEY PLAN A 13,000 TITLES YOUR TAILORED FILM FOR AN AUDIENCE PROGRAMME INTRODUCTORY1 FOR THEIR 2 FOR YOUR 3 PRICE* PREFERENCES COMMUNITY * Please refer to the ‘Legal Stuff’ section on page 2 for further information and full terms DIGITAL E NTERTAINMENTTE CHNOLOGY INTRODUCING THE STARTER PACK We understand that establishing the right film schedule for a new film society or community film group can be challenging, as well as a big financial commitment. That’s why we’ve launched our Starter Pack - to help new organisations find their feet and discover whether a film screening is the right one for them and their audience. Available to film societies and community film groups who have set up a Filmbankmedia account within the last 12 months, the Starter Pack provides an exciting introduction to our diverse range of content on offer and available for film screenings. After creating an account at Filmbankmedia.com/setup, organisations have the opportunity to select 3 films from our film library for their first 3 screenings, at a special introductory price. PRICING The Starter Pack is available on a Commercial or Non-Commercial basis: NON - COMMERCIAL SCREENINGS COMMERCIAL SCREENINGS • Select 3 films from our film library for non-commercial • Select 3 films from our film library for commercial screenings. screenings. • Commercial pricing will fall under a reduced minimum • Invoicing will take place on the day of the screening of each guarantee of £50+VAT or 35% of the total Box Offfice returns title (£50+VAT per title). -

REPORT of INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM to the Board of Directors and Stockholders of World Wrestling Entertainment, Inc

TO OUR SHAREHOLDERS few years ago, we began executing a bold strategy to transform WWE’s business and provide a foundation for significant long-term growth. Our financial and operational performance in 2015 proves that this strategy is not only working; it is delivering impressive results. We achieved record revenue of $659 million, an increase of 21%, reflecting record contributions from our key businesses: WWE Network, Television, Live Events, and Consumer Products. Our focus on global growth is also paying off – international revenue hit an all-time high, increasing 46% to $170 million, or 26% of overall sales. WWE’s strong, top-line growth translated into significantly improved bottom-line performance, with our Adjusted OIBDA increasing to $69 million, representing a 10% Adjusted operating margin. WWE’s total shareholder return of 48% (including $36 million dividend payout) outpaced the majority of our entertainment peers and key market benchmarks, such as the S&P 500 and the Russell 2000. Recognizing WWE’s industry leadership, earnings growth, and the long-term potential of our global business, WWE was added to the S&P SmallCap 600 Index. We are proud that we accomplished what we set out to do – increasing the monetization of our content by leveraging our position as a global media enterprise uniquely engaged with our fans across traditional television, direct-to- consumer (WWE Network), and digital and social platforms. We enter 2016 with significant opportunities ahead and strong operating momentum. global brand strength: record engagement across platforms The consumption of WWE content reached unprecedented levels across television, direct-to- consumer (WWE Network), and digital and social platforms, which serve as the pillars of our future growth. -

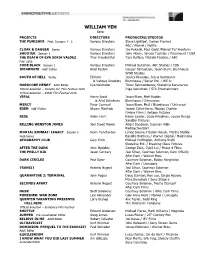

WILLIAM YEH Editor

WILLIAM YEH Editor PROJECTS DIRECTORS PRODUCERS/STUDIOS THE PUNISHER Pilot, Seasons 1 - 2 Various Directors Steve Lightfoot, Darren Frankel ABC / Marvel / Netflix CLOAK & DAGGER Series Various Directors Joe Pokaski, Paul Gadd /Marvel TV/ Freeform SHOOTER Season 1 Various Directors John Hlavin, Janace Tashjian / Paramount / USA THE DEATH OF EVA SOFIA VALDEZ Thor Freudenthal Tara Butters, Michele Fazekas / ABC Pilot 2016 CODE BLACK Season 1 Various Directors Michael Seitzman, ABC Studios / CBS INCARNATE Add’l Editor Brad Peyton Couper Samuelson, Jason Blum, Blumhouse WWE Studios SOUTH OF HELL Series Eli Roth Jessica Rhoades, Jenna Santoianni & Various Directors Blumhouse / Sonar Ent. / WE tv HARDCORE HENRY Add’l Editor Ilya Naishuller Timur Bekmambetov, Ekaterina Kononenko Official Selection – Toronto Int. Film Festival 2016 Inga Vainshtein / STX Entertainment Official Selection – SXSW Film Festival 2016 VIRAL Henry Joost Jason Blum, Matt Kaplan & Ariel Schulman Blumhouse / Dimension MERCY Peter Cornwell Jason Blum, McG / Blumhouse / Universal EDEN Add’l Editor Shyam Madiraju Jaume Collet-Serra, Nicolas Chartier Ombra Films / Voltage Pictures RIDE Helen Hunt Karen Lauder, Lizzie Friedman, Louise Runge Sandbar Pictures KILLING WINSTON JONES Joel David Moore Albert Sandoval, Daemon Hillin RadioactiveGiant MORTAL KOMBAT: LEGACY Season 2 Kevin Tancharoen Lance Sloane, Hayden Roush, Marina Stabile Web Series Bandito Brothers / Warner Digital / Machinima GEOGRAPHY CLUB Gary Entin Michael Huffington, Anthony Bretti Shoreline Ent. / Breaking Glass Pictures AFTER THE DARK John Huddles George Zakk, Cybill Lui / Phase 4 Films THE PHILLY KID Jason Connery Joel Silver, Courtney Solomon, Karri O’Reilly After Dark / Warner Bros. DARK CIRCLES Paul Soter Courtney Solomon, Bobby Ranghelov After Dark / Lionsgate TRANSIT Antonio Negret Joel Silver, Courtney Solomon After Dark / Warner Bros. -

The Casting Director Guide from Now Casting, Inc

The Casting Director Guide From Now Casting, Inc. This printable Casting Director Guide includes CD listings exported from the CD Connection in NowCasting.com’s Contacts NOW area. The Guide is an easy way to get familiar with all the CD’s. Or, you might want to print a copy that lives in your car. Keep in mind that the printable CD Guide is created approximately once a month while the CD Connection is updated constantly. There will be info in the printable “Guide” that is out of date almost immediately… that’s the nature of casting. If you need a more comprehensive, timely and searchable research and marketing tool then you should consider using Contacts NOW in NowCasting.com. In Contacts NOW, you can search the CD database directly, make personal notes, create mailing lists, search Agents, make your own Custom Contacts and print labels. You can even export lists into Postcards NOW – a service that lets you create and mail postcards all from your desktop! You will find Contacts NOW in your main NowCasting menu under Get it NOW or Guides and Labels. Questions? Contact the NowCasting Staff @ 818-841-7165 Now Casting.com We’re Back! Many post hiatus updates! October ‘09 $13.00 Casting Director Guide Run BY Actors FOR Actors More UP- TO-THE-MINUTE information than ANY OTHER GUIDE Compare to the others with over 100 pages of information Got Casting Notices? We do! www.nowcasting.com WHY BUY THIS BOOK? Okay, there are other books on the market, so why should you buy this one? Simple. -

PRESS Graphic Designer

© 2021 MARVEL CAST Natasha Romanoff /Black Widow . SCARLETT JOHANSSON Yelena Belova . .FLORENCE PUGH Melina . RACHEL WEISZ Alexei . .DAVID HARBOUR Dreykov . .RAY WINSTONE Young Natasha . .EVER ANDERSON MARVEL STUDIOS Young Yelena . .VIOLET MCGRAW presents Mason . O-T FAGBENLE Secretary Ross . .WILLIAM HURT Antonia/Taskmaster . OLGA KURYLENKO Young Antonia . RYAN KIERA ARMSTRONG Lerato . .LIANI SAMUEL Oksana . .MICHELLE LEE Scientist Morocco 1 . .LEWIS YOUNG Scientist Morocco 2 . CC SMIFF Ingrid . NANNA BLONDELL Widows . SIMONA ZIVKOVSKA ERIN JAMESON SHAINA WEST YOLANDA LYNES Directed by . .CATE SHORTLAND CLAUDIA HEINZ Screenplay by . ERIC PEARSON FATOU BAH Story by . JAC SCHAEFFER JADE MA and NED BENSON JADE XU Produced by . KEVIN FEIGE, p.g.a. LUCY JAYNE MURRAY Executive Producer . LOUIS D’ESPOSITO LUCY CORK Executive Producer . VICTORIA ALONSO ENIKO FULOP Executive Producer . BRAD WINDERBAUM LAUREN OKADIGBO Executive Producer . .NIGEL GOSTELOW AURELIA AGEL Executive Producer . SCARLETT JOHANSSON ZHANE SAMUELS Co-Producer . BRIAN CHAPEK SHAWARAH BATTLES Co-Producer . MITCH BELL TABBY BOND Based on the MADELEINE NICHOLLS MARVEL COMICS YASMIN RILEY Director of Photography . .GABRIEL BERISTAIN, ASC FIONA GRIFFITHS Production Designer . CHARLES WOOD GEORGIA CURTIS Edited by . LEIGH FOLSOM BOYD, ACE SVETLANA CONSTANTINE MATTHEW SCHMIDT IONE BUTLER Costume Designer . JANY TEMIME AUBREY CLELAND Visual Eff ects Supervisor . GEOFFREY BAUMANN Ross Lieutenant . KURT YUE Music by . LORNE BALFE Ohio Agent . DOUG ROBSON Music Supervisor . DAVE JORDAN Budapest Clerk . .ZOLTAN NAGY Casting by . SARAH HALLEY FINN, CSA Man In BMW . .MARCEL DORIAN Second Unit Director . DARRIN PRESCOTT Mechanic . .LIRAN NATHAN Unit Production Manager . SIOBHAN LYONS Mechanic’s Wife . JUDIT VARGA-SZATHMARY First Assistant Director/ Mechanic’s Child . .NOEL KRISZTIAN KOZAK Associate Producer . -

1144 05/16 Issue One Thousand One Hundred Forty-Four Thursday, May Sixteen, Mmxix

#1144 05/16 issue one thousand one hundred forty-four thursday, may sixteen, mmxix “9-1-1: LONE STAR” Series / FOX TWENTIETH CENTURY FOX TELEVISION 10201 W. Pico Blvd, Bldg. 1, Los Angeles, CA 90064 [email protected] PHONE: 310-969-5511 FAX: 310-969-4886 STATUS: Summer 2019 PRODUCER: Ryan Murphy - Brad Falchuk - Tim Minear CAST: Rob Lowe RYAN MURPHY PRODUCTIONS 10201 W. Pico Blvd., Bldg. 12, The Loft, Los Angeles, CA 90035 310-369-3970 Follows a sophisticated New York cop (Lowe) who, along with his son, re-locates to Austin, and must try to balance saving those who are at their most vulnerable with solving the problems in his own life. “355” Feature Film 05-09-19 ê GENRE FILMS 10201 West Pico Boulevard Building 49, Los Angeles, CA 90035 PHONE: 310-369-2842 STATUS: July 8 LOCATION: Paris - London - Morocco PRODUCER: Kelly Carmichael WRITER: Theresa Rebeck DIRECTOR: Simon Kinberg LP: Richard Hewitt PM: Jennifer Wynne DP: Roger Deakins CAST: Jessica Chastain - Penelope Cruz - Lupita Nyong’o - Fan Bingbing - Sebastian Stan - Edgar Ramirez FRECKLE FILMS 205 West 57th St., New York, NY 10019 646-830-3365 [email protected] FILMNATION ENTERTAINMENT 150 W. 22nd Street, Suite 1025, New York, NY 10011 917-484-8900 [email protected] GOLDEN TITLE 29 Austin Road, 11/F, Tsim Sha Tsui, Kowloon, Hong Kong, China UNIVERSAL PICTURES 100 Universal City Plaza Universal City, CA 91608 818-777-1000 A large-scale espionage film about international agents in a grounded, edgy action thriller. The film involves these top agents from organizations around the world uniting to stop a global organization from acquiring a weapon that could plunge an already unstable world into total chaos. -

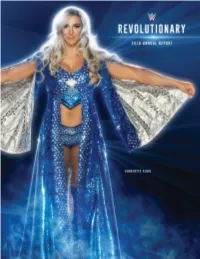

The 2016 Annual Report

TO OUR SHAREHOLDERS Several years ago, we began transforming WWE’s business to drive long-term growth by placing strategic emphasis on optimizing the value of our content, developing digital and technology platforms, and expanding our global presence. Our execution of these initiatives has been strong as we continue to leverage the three pillars of our content ecosystem: traditional television distribution, direct-to-consumer (WWE Network), and digital and social platforms. Our results in 2016, including record revenues and increased consumption of our content, demonstrate the successful ongoing transformation of our business model. Every day, as the media industry evolves, we become more digital and more global, with a greater emphasis on direct-to- consumer. We believe we are well positioned to drive long-term growth and create shareholder value. 2016 BREAKING RECORDS… BUILDING ON STRENGTH In 2016, WWE delivered the highest revenue in our Company’s history, $729 million – up 11% from 2015 and an impressive 44% from 2013, the year prior to the launch of WWE Network. These results included record revenue from our Network, Television, Live Events, Venue Merchandise and WWE Shop business segments. Growth from international markets continued to fuel our performance, reaching $189 million, up 11%. WWE’s strong, top-line growth translated into a 44% increase in operating income to $55.7 million. The market continued to reward this performance. Over the past twelve months, WWE stock provided shareholders with a 12% total return (including $37 million dividend payout).1 In addition, we issued $215 million of convertible note financing on favorable terms to support the execution of our long-term growth strategy.2 FORBES NAMED WRESTLEMANIA AS ONE OF THE TOP 5 MOST VALUABLE SPORTS EVENTS IN THE WORLD RECORD BRAND ENGAGEMENT We delivered these results because WWE is a one- of-a-kind brand with unmatched global engagement – a brand now able to directly reach any household with broadband access anywhere in the world. -

Ioz826l I%RU LD1IS

4p iOZ826l I%RU LD1IS 2011 we tined misson to achieve dramatic and sustained increase our earnings through the production and distrbution of iew content While developing this transformative opportunity our fin ncial results for the year were impacted by both the weak performance of our movie releases and strategic decsions to witL hold several hours of previously licensed television content for distributon on our ootenrial new televison network In 2011 our cal igs declined 52% from our Jico cihor Vu Lerdar in to record 2010 resu and ot stock fell 35% ic ndost cc price resulting /n cant as to be one in otal shareholder me urn that was below other divcraihed of /1 Fs ni a/a/e ipe entertainmcnt peers and key market benchmarks such as the SP 500 and the Russell 2000 Although our financial resuks were below cur expectatons vie made important progress on key strategic inihatvs durng the year devloping our content and talent assets extending our brand prusence in new ledia and continuing our ernational expansion Many of our achievements in these areas derived at least in pait from our preparaLion for new WWE television network iV abed IV SLAP ti--uy Li Sn as ui and vood co nct ceow oc Creating new programs and distributing all of our content in way that ootirnizes ts value through traditional and emerging platforms is ir most important straegic mx perative Executng ths intiatve effectively including the potential auncn of WWE Net ork has Lhe power to transform our business while being natural extension of our core corn petencies And thats before -

Filmhighlights Im September

handel.uphe.de Ausgabe September 2019 FILMHIGHLIGHTS IM SEPTEMBER TOPTHEMA: GLAM GIRLS FILMHIGHLIGHTS GLAM GIRLS HINREISSEND VERDORBEN FIGHTING WITH MY FAMILY PAW PATROL: ULTIMATIVER EINSATZ © 2019 Universal Studios und Metro-Goldwyn-Mayer Pictures Inc. Alle Rechte vorbehalten. NEUHEITEN · AKTIONSTITEL · VORSCHAU INHALTE PICTURES | SEPTEMBER 2019 UNIVERSAL PICTURES PARAMOUNT HOME ENTERTAINMENT Fighting with my Family TV-Serie: South Park – Season 22 Eine wahre Wrestling-Geschichte produziert von Wrestling- 10 neue Episoden der preisgekrönten hemmungslos- Legende und Superstar Dwayne ‚The Rock‘ Johnson chaotischen Erfolgsserie. ................................................... ................................................... Glam Girls — Hinreißend verdorben Paw Patrol: Ultimativer Einsatz Neuinterpretation des Komödienklassikers „Zwei hinreißend 5 neue, spannende Rettungs-Abenteuer mit der Paw Patrol — verdorbene Schurken“ mit weiblichem Duo davon sogar 3 in Doppellänge ................................................... ................................................... TV-Serie: The Purge: Die Säuberung — Aufstieg der Teenage Mutant Ninja Staffel 1 Turtles Die TV-Neuinterpretation von „The Purge“ startet nun mit 10 7 Episoden mit jeder Menge Turtle-Power in der brandneuen spannungsgeladenen, tödlichen Episoden Turtle-Serie ................................................... ................................................... TV-Serie: New Amsterdam — Staffel 1 Neu auf Blu-ray: Stephen King‘s The Staffel 1 der neuen Medical-Serie