The Bank of Kyoto, Ltd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Hitachi and Omron Announce Joint Venture Details for Hitachi-Omron Terminal Solutions, Corp

FOR IMMEDIATE RELEASE Hitachi and Omron Announce Joint Venture Details For Hitachi-Omron Terminal Solutions, Corp. Tokyo, May 11, 2004 --- Hitachi, Ltd. (NYSE:HIT / TSE: 6501) and Omron Corporation (TSE / OSE: 6645) today decided the outline of a joint venture for combining their ATM and other information equipment businesses. Today’s decision is based on an agreement between the two companies that was reached on January 26, 2004. The new company, to start operations on October 1, 2004, will be called Hitachi-Omron Terminal Solutions, Corp. and will be responsible for the planning, development, manufacture and sales of ATMs and other self-service machines, terminal systems and other information equipment as well as for the modules and solutions businesses. Aiming for a globally competitive position, in an information equipment market expected to see growth during the ubiquitous era, the new company will fulfill broad customer needs by providing optimal solutions based on recognition and handling technologies for cash, cards, passbooks, forms, etc. and other human interface technologies that enable simple operation for customers and end-users. Reorganization Overview 1. Company Name: Hitachi-Omron Terminal Solutions, Corp. 2. Overview of Corporate Separation: (1) Schedule for the corporate separation May 11, 2004 Approval by executive officers of corporate separation agreement (Hitachi) Approval by directors of corporate separation agreement (Omron) Conclusion of corporate separation agreement June 24, 2004 Approval of corporate separation agreement by shareholders (Omron, planned) October 1, 2004 Date of corporate separation (tentative) Registration of corporate separation (tentative) - more - 2 (2) Method used for corporate separation a) Method used for corporate separation Hitachi and Omron will transfer their business units to a new company jointly established by them through a joint corporate separation. -

History of the Bank of Kyoto (Showa to Heisei Eras)

History of The Bank of Kyoto (Showa to Heisei Eras) The Bank of Kyoto was established in 1941 as Tanwa Bank (Head Office: Fukuchiyama City) through the merger of four banks in northern Kyoto: Ryotan Bank, Miyazu Bank, Tango Commercial Bank, and Tango Industrial Bank. In 1951 the Bank changed its name to the Bank of Emergence of venture companies and subsequent rapid growth Collapse of Japan’s bubble economy Post-war recovery High and stable growth Japanese financial Big Bang Kyoto’s leading bank Kinki’s leading bank 1941 1951 1966 1984 1989 1999 Established Changed name to the Bank of Completed construction of current Listed on the second sections of the Tokyo Opened representative office in Opened the Direct Banking Tanwa Bank Kyoto Head Office Stock Exchange and the Osaka Securities Hong Kong Center Tanwa Bank Head Office Established current emblem Exchange The Bank recorded its sole loss 1950 1953 1973 1986 1998 Commissioned to provide main Relocated Head Office to Kyoto City Listed on the Kyoto Changed designation to the first Started over-the-counter depository service for Kyoto Prefecture Stock Exchange sections of both exchanges sales of investment trusts 1985 Established symbol mark Former Head Office 1. Growth as a Locally Headquartered Bank Dividend Income from Securities Held for Strategic Equity ● Birth of the Bank of Kyoto ● Accompanying the Creation of New Industries (¥ billion) The Bank of Kyoto was established in October 1941 as Tanwa As Japan’s ancient capital, Kyoto has long nurtured 20.0 Bank in Fukuchiyama City, Kyoto Prefecture through the merger culture and industry with a climate rich in entrepreneurial 15.0 of four banks in northern Kyoto: Ryotan Bank, Miyazu Bank, spirit responsible for creating many new things. -

Corporate Profile

Corporate Profile The Bank’s Organization (As of July 1, 2018) General Meeting of Shareholders Audit & Supervisory Board Audit & Supervisory Board Members Audit & Supervisory Board Secretariat Corporate Planning Division Board of Directors Risk Management Division Business Headquarters Business departments: Public & Regional Affairs Division Head Office Business Department, Osaka Business Department, Executive Committee Tokyo Business Department, Credit Examination Division Domestic branches and Treasury & Investment Division Sub-branches International Division Hong Kong Representative Office Shanghai Representative Office Dalian Representative Office Bangkok Representative Office General Secretariat Human Resources and General Affairs Division Kyoto Banking College Business Administration Division Business Operations Center Systems Division Productivity Innovation Headquarters Secretariat Internal Audit Division Board of Directors and Audit & Supervisory Board Members (As of June 28, 2018) Chairman Director & Counselor Standing Audit & Supervisory Board Executive Officers Hideo Takasaki Yasuo Kashihara Member Masao Okuda Takayuki Matsumura Yoshihiro Yamanaka President Directors Hiroyuki Ando Nobuhiro Doi Hiroyuki Hata Audit & Supervisory Board Members Kazuhiro Waki Norikazu Koishihara (external) Yoshihiko Hamagishi Hiroshi Nishimura Senior Managing Directors Junko Otagiri (external) Nobuaki Sato (external) Minoru Wada Masahiko Naka Masaki Ishibashi (external) Kenji Hashi Hiroshi Hitomi Masaya Anami Managing Executive Officers Hideya Naka -

34 Executives, Stock Information, Major Shareholders : PDF(545KB)

Executives, Stock information and Major shareholders Executives As of July 1, 2016 Stock information As of March 31, 2016 Board of Directors Number of shares outstanding at the end of current term 225,263 thousands of shares President Tsuneo Murata Number of shareholders at the end of current term Executive Deputy President, 55,589 Representative Director Yoshitaka Fujita Number of shares outstanding( unit: one thousand) Directors Toru Inoue ■ Financial Institutions ■ Foreign Companies ■ Domestic Companies Norio Nakajima ■ Own Shares ■ Individual Investors & Others Hiroshi Iwatsubo Own Shares Individual Investors & Others 13,560(6.0%) 21,333(9.5%) Yoshito Takemura Satoshi Ishino Domestic Companies 9,134(4.0%) Takashi Shigematsu No. of Shares Outstanding (Outside Director) Foreign Companies 94,114(41.8%) 225,263 (unit: one thousand) Audit and Supervisory Committee Member, Board Members Junichi Tanaka Financial Institutions 87,121(38.7%) Hiroaki Yoshihara (Outside Director) Stock exchange listing Masakazu Toyoda [Domestic] Tokyo Stock Exchange First Section (Outside Director) [Overseas] Singapore Exchange Hiroshi Ueno (Outside Director) Major shareholders As of March 31, 2016 Vice Presidents Number of shares Name Ownership( %) (unit: one thousand) Executive Vice Presidents JP MORGAN CHASE BANK Toru Inoue 15,526 7.3 380055 Norio Nakajima Japan Trustee Services Bank, Ltd. 12,082 5.7 Yuichi Kojima (Trust Account) Nippon Life Insurance Company 7,361 3.5 Satoshi Sonoda The Master Trust Bank of Japan, Ltd. 6,801 3.2 Hiroshi Iwatsubo (Trust Account) Senior Vice Presidents STATE STREET BANK AND 6,710 3.2 Yoshito Takemura TRUST COMPANY Satoshi Ishino The Bank of Kyoto, Ltd. 5,260 2.5 Meiji Yasuda Life Insurance Company 5,240 2.5 Masahiro Ishitani The Shiga Bank, Ltd. -

Notice Relating to Disposal of Treasury Stock Through Third-Party Allotment to Employees Shareholding Association

March 29, 2019 To All Persons Concerned Name of Company Listed: Kyocera Corporation Name of Representative: Hideo Tanimoto, President and Director (Code number: 6971, The First Section of the Tokyo Stock Exchange) Person for Inquiry: Shoichi Aoki Director, Managing Executive Officer and General Manager of Corporate Management Control Group (Tel: +81-75-604-3500) Notice Relating to Disposal of Treasury Stock through Third-Party Allotment to Employees Shareholding Association This is to advise you that Kyocera Corporation (the “Company”) has resolved at a meeting of its Board of Directors held on March 29, 2019 to dispose of treasury stocks through the third-party allotment to Stock Purchase Plan for Kyocera Group Employees, which is the employees shareholding association of the Company (the “Subscriber” or “Shareholding Association”) (the “Third-Party Allotment”). For your information, the detail of the Third-Party Allotment will be decided by the Board of Directors to be held on June 25, 2019 and will be disclosed. 1. Overview of disposal of treasury stock (1) Disposal date* July 11, 2019 Common stock 723,200 (2) Class and number of shares Note: This is the currently prospective number and may be changed at a meeting to be disposed of of the Board of Directors to be held on June 25, 2019. The disposal price will be decided by the Board of Directors to be held on June 25, 2019, based on the closing price of the Company’s common stock on the Tokyo Stock Exchange on the business day preceding the date of the resolution (3) Disposal price* of the Board of Directors (if the Company’s shares are not traded on said date, the closing price of the most recent trading day preceding said date) to the extent that it will not be excessively advantageous for the Subscriber. -

Tokyo Stock Exchange Tokyo Stock Exchange

Tokyo Stock Exchange Annual Report 1998 Year Ended March 31, 1998 Profile or almost 120 years, the Tokyo Stock Exchange (TSE) has Fbeen recognized and functioned as Japan’s central stock market. Since its reestablishment in 1949, the TSE has responded positively to trading demands from both overseas and domestic investors, operating both cash and derivatives markets. Now, at the drawn of a new era in which the legal and system- atic framework created by the recent market reforms is taking shape, the TSE is endeavoring to construct and operate a highly efficient and competitive market that will allow it to play a major role in the economic life of Japan, Asia and the world. 3000 2500 2000 1500 CONTENTS Statistical Highlights.....................................3 1000 Message from the President..........................5 TSE Market System.......................................6 Special Feature............................................12 500 Financial Statements...................................14 Board of Governors and Auditors ..............17 List of Members and Special Participants ...20 1970 7172 73 74 75 Statistical Highlights At December 31 1997 1996 1995 (STOCK MARKET) Listed Companies : Domestic .................................................. 1,805 1,766 1,714 : Foreign ..................................................... 60 67 77 Newly Listed Companies : Domestic .................................................. 50 59 32 : Foreign ..................................................... 1 20 Market Value (¥ billions) : Domestic -

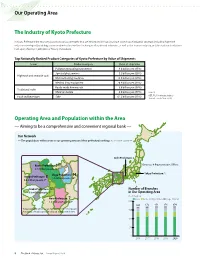

Operating Area and Population Within the Area the Industry of Kyoto

Our Operating Area The Industry of Kyoto Prefecture In Kyoto Prefecture, the economy possesses various strengths that are embedded in Kyoto’s unique added-value industrial structure, including high-tech industries developed by adding a new wisdom to the excellent techniques of traditional industries, as well as the tourism industry and the traditional industries built upon the city’s 1,200 years of history and culture. Top Nationally Ranked Product Categories of Kyoto Prefecture by Value of Shipments Sector Product category Value of shipments Pollution measuring instruments 9.6 billion yen (35%) Spectral photometers 5.2 billion yen (26%) High-tech and research tools Material testing machines 13.0 billion yen (39%) Medical X-ray equipment 20.4 billion yen (14%) Ready-made kimono, obi 6.8 billion yen (38%) Traditional crafts Chirimen textile 2.8 billion yen (79%) (Source) Food and beverages Sake 61.2 billion yen (13%) METI: FY2018 industry statistics (domestic market share in %) Operating Area and Population within the Area — Aiming to be a comprehensive and convenient regional bank — Our Network — The populations within areas in our operating area and their prefectural rankings (As of October 1, 2018) — Aichi Prefecture: 2 Kyoto Prefecture: 111 Overseas: 4 Representative Offices 2.5 million people, 13th Tokyo Prefecture: 1 Shiga Prefecture: 14 Hyogo Prefecture: 8 1.4 million people, 26th 5.4 million people, 7th Osaka Prefecture: 31 Number of Branches 8.8 million people, 3rd in Our Operating Area (As of March 31) Nara Prefecture: 7 Kyoto Osaka Shiga Nara Hyogo Other 1.3 million people, 30th 200 169 172 174 174 174 Total population within our operating area: 19.6 million people 150 Percentage of total population of Japan: approximately 15% 100 50 0 2016 2017 2018 2019 2020 8 The Bank of Kyoto, Ltd. -

Corporate Profile

Corporate Profile The Bank’s Organization (As of June 29, 2016) Corporate Planning Division Corporate Communications Division Risk Management Division General Meeting of Shareholders Compliance Management Division Business Headquarters Audit & Supervisory Board Business Promotion Division Audit & Supervisory Board Members Area Business Headquarters Audit & Supervisory Board Secretariat Business Support Division Retail Banking Division Board of Directors Public & Regional Affairs Division Business departments: Credit Examination Division Head Office Business Department, Osaka Business Department, Executive Committee Tokyo Business Department, Treasury & Investment Division Domestic Branches and Securities & International Division Sub-branches Hong Kong Representative Office Shanghai Representative Office Dalian Representative Office Bangkok Representative Office General Secretariat Personnel Division Kyoto Banking College General Affairs Division Business Administration Division Business Operations Center Systems Division Tokyo Liaison Office Internal Audit Division Board of Directors and Audit & Supervisory Board Members (As of June 29, 2016) Chairman Director & Counselor Standing Audit & Supervisory Board Executive Officers Hideo Takasaki Yasuo Kashihara Members Hirokazu Tagano Tadahiko Nishiyama Hiroyuki Yamamoto President Directors Takayuki Matsumura Keizo Tokomoto Nobuhiro Doi Shinichi Nakama (external) Yoshihiko Norikazu Koishihara (external) Audit & Supervisory Board Members Hamagishi Senior Managing Directors Nobuaki Sato (external) -

The Bank of Kyoto, Ltd. 700, Yakushimae-Cho, Karasuma-Dori, Matsubara-Agaru, Shimogyo-Ku, Kyoto, Japan

Note: This document has been translated from a part of the Japanese original for reference purposes only. In the event of any discrepancy between this translated document and the Japanese original, the original shall prevail. Securities identification code: 8369 June 1, 2018 To our shareholders: Nobuhiro Doi President The Bank of Kyoto, Ltd. 700, Yakushimae-cho, Karasuma-dori, Matsubara-Agaru, Shimogyo-ku, Kyoto, Japan NOTICE OF THE 115TH ORDINARY GENERAL MEETING OF SHAREHOLDERS You are cordially invited to attend the 115th Ordinary General Meeting of Shareholders of The Bank of Kyoto, Ltd. (the “Bank”), which will be held as described below. If you are unable to attend the meeting in person, you may exercise your voting rights by postal mail or electronic means (the Internet). Please indicate your approval or disapproval of the proposals after reviewing the attached Reference Documents for the General Meeting of Shareholders, and return it by postal mail or the Internet to reach us no later than 5:00 p.m. on Wednesday, June 27, 2018 (Japan Standard Time). Meeting Details 1. Date and Time: Thursday, June 28, 2018 at 10:00 a.m. (Japan Standard Time) (Reception will open at 9:00 a.m.) 2. Venue: 7th floor Hall, Head office of the Bank 700, Yakushimae-cho, Karasuma-dori, Matsubara-Agaru, Shimogyo-ku, Kyoto, Japan 3. Purposes: Items to be reported: 1. Business Report and Non-Consolidated Financial Statements for the 115th Term (from April 1, 2017 to March 31, 2018) 2. Consolidated Financial Statements, as well as the results of audit of the -

Investment in Innovation Kyoto 2021 (KYOTO-Icap2 Fund)

Mitsubishi UFJ Financial Group, Inc. (MUFG) Investment in Innovation Kyoto 2021 (KYOTO-iCAP2 Fund) Tokyo, January 12, 2021 --- MUFG today announced its decision to invest in the Innovation Kyoto 2021 Investment Limited Partnership (This Fund), with the main objectives of contributing to the development of the next generation of industries and enhancing the global competitiveness of Japan’s economy. This Fund is managed by Kyoto University Innovation Capital Co., Ltd., a 100%-owned subsidiary of Kyoto University, a national university corporation. It will support growth by investing primarily in venture companies that utilize the results of research conducted by Kyoto University. MUFG will utilize its domestic and overseas network to support the development of new seed and early-stage venture companies. Additionally, by supporting venture companies in the fields of biotechnology, life science and deep technologies such as materials and machinery, all of which Kyoto University specializes in, MUFG will contribute to the creation of innovative businesses that have the potential to revolutionize the world. By using its extensive network, customer base, and advanced financial services, MUFG will continue to provide stable support to venture companies—which will play a role in next-generation industries—to resolve medium- to long-term environmental and social issues and support customers’ sustainable growth. Details Registered name Innovation Kyoto 2021 Investment Limited Partnership Legal basis Act on Strengthening Industrial Competitiveness and laws related to limited partnership agreements for investment Investment targets Primarily venture businesses that utilize the results of research conducted by Kyoto University Investors General partner: Kyoto University Innovation Capital Co., Ltd. Limited partners: Kyoto University Mitsubishi UFJ Financial Group, Inc. -

Annual Report 2019

The Bank of Kyoto, Ltd. Annual Report 2019 Annual Report 2019 For the year ended March 31, 2019 The Bank of Kyoto, Ltd. Profile Since its founding on October 1, 1941, The Bank of Kyoto, Ltd. (hereinafter, “the Bank”) and its consolidated subsidiaries have consistently strived to live up to their management principle of “Serving the Prosperity of the Community.” Under this management principle, the Bank’s fundamental mission is to contribute to the greater prosperity of the local community and the development of local industries. As Kyoto Prefecture’s largest retail bank, the Bank provides customers in the local community with high-quality financial services, thereby striving to further deepen its relationships of trust. With the environment surrounding financial institutions growing increasingly harsh, the Bank will work to fulfill its social mission of being the bank most trusted by customers as well as the bank with the strongest presence in the region. Head Office (Kyoto Prefecture) Contents 1 Consolidated Financial Highlights Non-Consolidated Basis 2 History 4 Message from the President Total Assets: Total Deposits: 6 Our Operating Area 8 Management Plan ¥9,653.8 ¥8,057.6 9 Non-Financial Information billion billion 10 Community-Based Finance (8th among regional banks) (7th among regional banks) — Contributing to Development of the Regional Community by Solving Social Issues through Business — 12 Initiatives for Corporate Customers and Individual Business Owners Loans and Bills Discounted: Unrealized Gains on Securities: 14 Financial -

Operating Area and Population Within the Area the Industry of Kyoto

Our Operating Area The Industry of Kyoto Prefecture In Kyoto many cutting-edge, high-tech industries exist side by side with traditional industries and the tourism industry built upon the city’s 1,200 years of history and culture. Kyoto is also known as the town of students with a high concentration of universities and academic research institutions, so it has an ideal environment for developing venture businesses and new industries. The manufacturing industries of Kyoto Prefecture are supported by a high level of technical capability that is unique to Kyoto, and they have captured high shares of the national market in a diverse array of fields and product categories. Top-National Ranked Product Categories of Kyoto Prefecture by Value of Shipments Sector Product category Value of shipments Pollution measuring instruments 12.9 billion yen (51%) Spectral photometer 9.9 billion yen (47%) High-tech and research tools Other analyzing equipment 41.9 billion yen (47%) Physical, chemical machinery and appliances 17.3 billion yen (20%) Printmaking and printing Plate making machine 12.3 billion yen (76%) Ready-made kimono, obi 6.6 billion yen (39%) Traditional crafts Chirimen textiles 2.9 billion yen (75%) (Source) METI: FY2013 industry statistics Food and beverages Japanese confectionery 37.4 billion yen ( 7%) (domestic market share in %) Operating Area and Population within the Area — Aiming to be a comprehensive and convenient regional bank — Kyoto Bank’s Network — The populations within areas in our operating area and their prefectural rankings