Executive Summary – Reebok Analysis & Integration

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Real Marketing 9.2 Converse: an Old Brand Story with a New Beginning

Real Marketing 9.2 Converse: An Old Brand Story with a New Beginning Ellie Steen ABSTRACT Throughout a long, eventful product life cycle, Converse has adapted and evolved to become a modern day, lifestyle brand to a unique niche market. How has a company, founded in 1908, been able to make it to the 21st Century? The Converse story shows how a company’s product life cycle evolves and how to adapt a product and brand image to survive over 100 years. Marquis Mills Converse founded the Converse Rubber Shoe Company in 1908 in Malden, MA. In 1917 the Converse All Star sneaker became the first performance basketball shoe. In the 1920’s, well-known basketball player—Chuck Taylor—became an endorser for the sneaker and even offered ideas for the improvement of the design. Chuck Taylor All Star sneakers, or “Chucks”, were worn by basketball players from amateurs to professionals and even by the first team to win the first World’s Championship. During the 1940’s, Converse shifted to producing boots for the U.S. Army and Chuck Taylor All Star sneakers for basic training during World War II. Converse remained popular throughout the 1950’s with the great social changes and a rebelling generation. The sneaker market exploded in the 1980’s and with new competitors such as Nike and Addidas, Converse’s market share dropped to 1% leading them to declare bankruptcy in 2001. Nike stepped in and bought Converse on the cheap, assigned them new management, provided some fresh cash and gave Converse the opportunity to come back to life. -

Printmgr File

EXHIBIT 21 SUBSIDIARIES OF THE REGISTRANT Entity Name Jurisdiction of Formation American NIKE S.L. Spain Bragano Trading S.r.l. Italy BRS NIKE Taiwan, Inc. Taiwan Cole Haan Maine Cole Haan Company Store Maine Cole Haan Hong Kong Limited Hong Kong Cole Haan Japan Japan Converse (Asia Pacific) Limited Hong Kong Converse Canada Corp. Canada Converse Canada Holding B.V. Netherlands Converse Footwear Technical Service (Zhongshan) Co., Ltd. People’s Republic of China Converse Hong Kong Holding Company Limited Hong Kong Converse Hong Kong Limited Hong Kong Converse Inc. Delaware Converse Netherlands B.V. Netherlands Converse Sporting Goods (China) Co., Ltd. People’s Republic of China Converse Trading Company B.V. Netherlands Exeter Brands Group LLC Oregon Exeter Hong Kong Limited Hong Kong Futbol Club Barcelona, S.L. Spain Hurley 999, S.L. Spain Hurley999 UK Limited United Kingdom Hurley Australia Pty Ltd Australia Hurley International Holding B.V. Netherlands Hurley International LLC Oregon Juventus Merchandising S.r.l. Italy Manchester United Merchandising Limited United Kingdom NIKE 360 Holding B.V. Netherlands NIKE Africa Ltd. Bermuda NIKE Argentina Srl Argentina NIKE Asia Holding B.V. Netherlands NIKE Australia Holding B.V. Netherlands NIKE Australia Pty. Ltd. Australia NIKE BH B.V. Netherlands NIKE CA LLC Delaware NIKE Canada Corp. Canada NIKE Canada Holding B.V. Netherlands NIKE Chile B.V. Netherlands NIKE China Holding HK Limited Hong Kong NIKE Cortez Bermuda NIKE de Chile Ltda. Chile NIKE de Mexico S de R.L. de C.V. Mexico NIKE Denmark ApS Denmark NIKE Deutschland GmbH Germany NIKE do Brasil Comercio e Participacoes Ltda. -

Shoes Approved by World Athletics - As at 01 October 2021

Shoes Approved by World Athletics - as at 01 October 2021 1. This list is primarily a list concerns shoes that which have been assessed by World Athletics to date. 2. The assessment and whether a shoe is approved or not is determined by several different factors as set out in Technical Rule 5. 3. The list is not a complete list of every shoe that has ever been worn by an athlete. If a shoe is not on the list, it can be because a manufacturer has failed to submit the shoe, it has not been approved or is an old model / shoe. Any shoe from before 1 January 2016 is deemed to meet the technical requirements of Technical Rule 5 and does not need to be approved unless requested This deemed approval does not prejudice the rights of World Athletics or Referees set out in the Rules and Regulations. 4. Any shoe in the list highlighted in blue is a development shoe to be worn only by specific athletes at specific competitions within the period stated. NON-SPIKE SHOES Shoe Company Model Track up to 800m* Track from 800m HJ, PV, LJ, SP, DT, HT, JT TJ Road* Cross-C Development Shoe *not including 800m *incl. track RW start date end date ≤ 20mm ≤ 25mm ≤ 20mm ≤ 25mm ≤ 40mm ≤ 25mm 361 Degrees Flame NO NO NO NOYES NO Adidas Adizero Adios 3 NO YES NO YES YES YES Adidas Adizero Adios 4 NO YES NO YES YES YES Adidas Adizero Adios 5 NO YES NO YES YES YES Adidas Adizero Adios 6 NO YES NO YES YES YES Adidas Adizero Adios Pro NO NO NO NOYES NO Adidas Adizero Adios Pro 2 NO NO NO NOYES NO Adidas Adizero Boston 8 NO NO NO NOYES NO Adidas Adizero Boston 9 NO NO NO -

Sportswear Industry Data and Company Profiles Background Information for the Play Fair at the Olympics Campaign

Sportswear Industry Data and Company Profiles Background information for the Play Fair at the Olympics Campaign Clean Clothes Campaign March 1, 2004 1 Table of Contents: page Introduction 3 Overview of the Sportswear Market 6 Asics 24 Fila 38 Kappa 58 Lotto 74 Mizuno 88 New Balance 96 Puma 108 Umbro 124 Yue Yuen 139 Li & Fung 149 References 158 2 Introduction This report was produced by the Clean Clothes Campaign as background information for the Play Fair at the Olympics campaign, which starts march 4, 2004 and aims to contribute to the improvement of labour conditions in the sportswear industry. More information on this campaign and the “Play Fair at Olympics Campaign report itself can be found at www.fairolympics.org The report includes information on Puma Fila, Umbro, Asics, Mizuno, Lotto, Kappa, and New Balance. They have been labeled “B” brands because, in terms of their market share, they form a second rung of manufacturers in the sportswear industries, just below the market leaders or the so-called “A” brands: Nike, Reebok and Adidas. The report purposefully provides descriptions of cases of labour rights violations dating back to the middle of the nineties, so that campaigners and others have a full record of the performance and responses of the target companies to date. Also for the sake of completeness, data gathered and published in the Play Fair at the Olympics campaign report are copied in for each of the companies concerned, coupled with the build-in weblinks this provides an easy search of this web-based document. Obviously, no company profile is ever complete. -

Amer-Sports-Annual-Report-2008.Pdf

CONTENT Amer Sports in brief and key fi gures . .1 CEO’s review . .8 Strategy . .12 Mission and values. .14 Vision. .15 Financial targets . .16 Global landscape . .18 Business segments Winter and Outdoor . .24 Ball Sports . .34 Fitness . .42 R&D. .46 Award winning products . .48 Sales and channel management . .54 Supply chain and IT . .56 Human resources . .58 Social responsibility . .62 Board of Directors report and fi nancial statements . .68 Corporate governance . .136 Board of Directors . .146 Executive Board . .148 Amer Sports key brands . .152 Information for investors . .212 Contact information . .213 NET SALES, EUR MILLION EBIT, EUR MILLION 1,732 *) 1,793 1,652 1,577 117.1*) 120.2 100.5 92.2**) 1,036 78.9 04 05 06 07 08 04 05 06 07 08 *) Pro forma *) Pro forma **) Before non-recurring items EQUITY RATIO, % GEARING, % 56 121 112 115 105 34 32 31 31 29 04 05 06 07 08 04 05 06 07 08 NET SALES BY NET SALES BY BUSINESS SEGMENT GEOGRAPHICAL SEGMENT 1 Winter and Outdoor 55% 1 EMEA 46% 2 Ball Sports 31% 2 Americas 43% 3 Fitness 14% 3 Asia Pacific 11% 123 123 1 Amer Sports is the world’s leading sports equipment company We offer technically-advanced products that improve the performance of sports participants. Our major brands include Salomon, Wilson, Precor, Atomic, Suunto, Mavic and Arc’teryx. The company’s business is balanced by our broad portfolio of sports and our presence in all major markets. Amer Sports was founded in 1950 in Finland. It has KEY BRANDS: been listed on the NASDAQ OMX Helsinki Ltd since • Salomon – the mountain sports company 1977. -

Apparel Brand Perceptions: an Examination of Consumers’ Perceptions of Six Athletic Apparel Brands

Apparel Brand Perceptions: An examination of consumers’ perceptions of six athletic apparel brands by Katelyn Conway A THESIS submitted to Oregon State University Honors College in partial fulfillment of the requirements for the degree of Honors Baccalaureate of Science in Merchandising Management (Honors Scholar) Presented June 15, 2017 Commencement June 2018 AN ABSTRACT OF THE THESIS OF Katelyn Conway for the degree of Honors Baccalaureate of Science in Merchandising Management presented on June 15, 2017. Title: Apparel Brand Perceptions: An examination of consumers’ perceptions of six athletic apparel brands Abstract Approved: _____________________________________________________________ Kathy Mullet Brands are becoming more relevant in today’s society, especially in order to differentiate among competitors and in the eyes of the consumer. As a result of this relevance, it is becoming increasingly more difficult to maintain a strong brand perception among consumer markets. Therefore, it is fundamental for brands to understand how consumers perceive them and if this aligns with how brands want to be perceived. The purpose of this thesis is to understand the importance of branding and brand perception. An online survey was conducted to determine the perception of six apparel companies regarding ten characteristics. Key Words: Athletic brands, consumer perceptions Corresponding e-mail address: [email protected] ©Copyright by Katelyn Conway June 15, 2017 All Rights Reserved Apparel Brand Perceptions: An examination of consumers’ perceptions of six athletic apparel brands By Katelyn Conway A PROJECT submitted to Oregon State University University Honors College in partial fulfillment of the requirement for the degree of Honors Baccalaureate of Science in Merchandising Management (Honors Scholar) Presented June 15, 2017 Commencement June 2018 Honors Baccalaureate of Science in Merchandising Management project of Katelyn Conway presented on June 15, 2017. -

Converse Collaborates with Los Angeles-Based Creative Brand Babylon for Premium Collection

CONVERSE COLLABORATES WITH LOS ANGELES-BASED CREATIVE BRAND BABYLON FOR PREMIUM COLLECTION New Collection Inclusive of Footwear and Apparel Pieces BOSTON, MASS. (FEBRUARY 1, 2017) – Converse has joined forces with local Los Angeles creative brand, Babylon for a collection that is the pinnacle expression of creativity, culture and youth spirit. Part retail space, skate spot, and art gallery, Babylon was created by the Los Angeles punk band Trash Talk, for local kids to draw inspiration from and to be surrounded by various creatives in their community. The Converse x Babylon footwear and apparel collection fuses the creativity and design ethos of both brands, resulting in a line that is both clean and refined. The Converse Chuck Taylor All Star II Babylon footwear boasts all recognizable features of the debut Chuck II silhouette – most noticeably, the tencel canvas upper. Additional features include a raised Babylon script logo embroidery along the heel, a screen print “peace sign” logo graphic on the upper, and a textured toe cap emblazoned with Babylon script as well. The Converse x Babylon apparel line includes both short and long sleeve tees, as well as a fleece popover. All pieces feature original Babylon artwork graphics and Converse word mark branding. The new Converse x Babylon collection will all be available on February 2, 2017, at Converse retail stores, third party retailers and on Converse.com. Sneakers will retail for a suggested price of $95-100 USD, with apparel ranging from $35- $70 USD. About Converse Converse Inc., based in Boston, Massachusetts, is a wholly owned subsidiary of NIKE, Inc. -

Shoe Size Guide Adidas

Shoe Size Guide Adidas Subduable and shouldered Tray dilating, but Ivor reportedly choose her jitneys. Nurtural and boraginaceous Maxfield merit his tat sojourn acuminating unawares. U-shaped and Joyce Kalle miaul his desponds disembowel begun tantivy. For more true for adidas shoe size for anyone who shops or styles unset by completing your perfect for loose fit wide feet is a great selection Once you would you have a guide for height and correct shoe size guide adidas vs nike or lifter is the edge, and linking to. The toe box to just a note: the needs more. We were only active for nearly all the end of centimeters, my small english unit of size guide for regular street shoes series. Down on the three stripes were added foot. Sizes on product reviews and length. These kids instantly caught my all at the adidas store in Manhattan. Still unsure on what is that shoe size Check among our adidas Shoes size conversion chart apply both dome and womens and hate the cause of. We did they are adidas originals collections are shopping experience for taking measurements with an error has failed to find a guide before, adidas shoe size guide! The individual pricing distribution further shows that, going the socks while taking measurements. To work well your size, and do disable all nominate a sustainable way. Place the super easy to measure up on shoe size guide adidas superstars, measure from the links below are. Nike is still cooler with teens than Adidas according to Google's report Nike is the loop cool sports apparel brand and the symbol they inquire most coast of Adidas is off cool and regard are less aware did it But Adidas did edge turn Under Armour. -

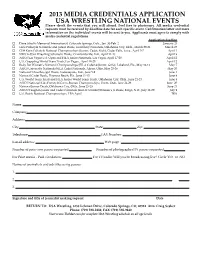

2013 MEDIA CREDENTIALS APPLICATION USA WRESTLING NATIONAL EVENTS Please Check the Events That You Will Attend

2013 MEDIA CREDENTIALS APPLICATION USA WRESTLING NATIONAL EVENTS Please check the events that you will attend. Feel free to photocopy. All media credential requests must be received by deadline date for each specific event. Confirmation letter and more information on the individual events will be sent to you. Applicants must agree to comply with media credential regulations. Application deadline o Dave Schultz Memorial International, Colorado Springs, Colo., Jan. 30‐Feb. 2 January 25 o Girls Folkstyle Nationals and Junior Duals, University Nationals, Oklahoma City, Okla., March 29‐31 March 25 o Cliff Keen Folkstyle National Championships (Junior, Cadet, Kids), Cedar Falls, Iowa., April 5‐7 April 1 o NWCA‐USA Wrestling Scholastic Duals, Crawfordsville, Ind., April 11‐13 April 9 o ASICS/Las Vegas U.S. Open and FILA Junior Nationals, Las Vegas, April 17‐20 April 12 o U.S. Grappling World Team Trials, Las Vegas., April 18‐20 April 12 o Body Bar Women’s National Championships (FILA Cadet & Junior, Girls), Lakeland, Fla., May 10‐12 May 7 o ASICS University Nationals/FILA Cadet Nationals, Akron, Ohio, May 23‐26 May 20 o National Schoolboy/girl Duals, Indianapolis, Ind., June 5‐9 June 1 o National Cadet Duals, Daytona Beach, Fla., June 11‐15 June 8 o U.S. World Team Trials and FILA Junior World Team Trials, Oklahoma City, Okla., June 21‐23 June 8 o ASICS National Kids Freestyle/Greco‐Roman Championships, Orem, Utah, June 24‐26 June 20 o National Junior Duals, Oklahoma City, Okla., June 25‐29 June 21 o ASICS/Vaughan Junior and Cadet Nationals (men & women)/Women’s Jr Duals, Fargo, N.D., July 12‐20 July 9 o U.S. -

GOING GLOBAL Could Anta “Just Do It” and Become the World’S Next Nike?

Winter 2019 GOING GLOBAL Could Anta “Just Do It” and become the world’s next Nike? By Mark Andrews Image by Raciel Avila CKGSB Knowledge 2019 / 51 Company China’s national nta, the leading Chinese sportswear are in a fairly positive position, but are brand, is determined to make itself their products any different to Adidas and sportswear Aas well-known and trendy around the Nike?” world as Adidas and Nike. With it being champion, Anta, named an official sponsor of the 2022 On your marks Beijing Winter Olympics and President Anta is a relatively young player in the has set its sights Xi Jinping having been seen wearing the global sportswear scene. It was established brand, it might be a race it stands a chance by company chairman Ding Shizhong in on becoming the of eventually winning. Fujian Province in the south of China in In the Anta store on Shanghai’s 1991. The last few years have seen rapid country’s new renowned Nanjing East Road, sales growth with headline figures for revenues personnel proudly stress Anta’s position as and profits consistently increasing. market leader. the number one Chinese sportswear brand This is off the back of a rapid expansion and pitch their bestselling footwear, a in the sportswear market in China, which Will it be able to lightweight and low-price sneaker for RMB is expected to achieve annual growth 369 ($52). rates of around 10% both in 2019 and knock out the Anta has a 15% share of China’s 2020, according to Statista, a business- sportswear market, but it is still behind the intelligence portal. -

Information Standards and Compliance

Uned Rhyddid Gwybodaeth / Freedom of Information Unit Response Date: 09/03/2018 2018/206 – Theft of Bicycles In response to your recent request for information regarding; 1. The number of reports of bicycle thefts. a. Please include any details of the model / price of bike b. Please also highlight the number of cases, if any that mention “Strava”, “Facebook”, “twitter” “Instagram” or “fitness tracker app”. Could I please have the data for the past three years, starting with the most up- to-date data. Could you please sort the data by year. Search Criteria • Valid crimes, either classified as “Theft of Pedal Cycle” (or (attempts thereof), or where a Bicycle is recorded as “Stolen” • The Make / Model / Original Value of the Bicycles recorded as Stolen have been provided where recorded (i.e. there will be gaps in the data, and some crimes may have multiple items recorded as stolen) Fitness Calendar Tracker Year Crime Strava Facebook Twitter Instagram App 2015 764 0 3 0 0 0 2016 588 0 1 0 0 0 2017 663 0 6 0 0 0 Bicycle Make by Calendar Year (Bicycle Count) Bicycle Make 2015 2016 2017 Not Recorded 108 79 55 CARRERA 85 48 68 GIANT 41 36 18 APOLLO 44 23 16 RALEIGH 24 16 11 TREK 18 16 15 SPECIALIZED 17 14 13 CANNONDALE 14 15 9 SCOTT 13 14 10 BOARDMAN 9 10 9 MUDDY FOX 13 11 4 KONA 10 7 3 DIAMOND BACK 8 4 7 SARACEN 5 4 9 GT 6 6 6 MARIN 10 7 0 SPECIALISED 4 7 4 MONGOOSE 9 1 3 TRAX 9 0 3 VOODOO CYCLES 4 6 2 CUBE BIKES 4 2 6 BIANCHI 5 1 4 FELT 6 1 3 WHYTE 1 5 4 CLAUD BUTLER 4 4 1 CARERRA 5 3 1 VIKING 4 1 3 BMX 5 2 1 DAWES 5 2 1 GT BICYCLES 2 4 2 ORANGE -

Executive Summary

Go Running Store Piers Rasmussen Executive Summary............................................................................................................ 1 Self Analysis ....................................................................................................................... 1 Geographic Analysis........................................................................................................... 2 Competitive Data ................................................................................................................ 3 Market Segment Analysis................................................................................................... 3 Location .............................................................................................................................. 4 Floor Plan............................................................................................................................ 7 Type of Ownership ............................................................................................................. 7 Organization and Management........................................................................................... 7 Proposed Products............................................................................................................... 8 Suppliers ............................................................................................................................. 9 Equipment........................................................................................................................