ZMCL Venturing Into Radio Broadcasting Business

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

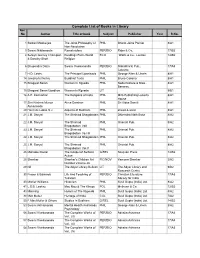

Complete List of Books in Library Acc No Author Title of Book Subject Publisher Year R.No

Complete List of Books in Library Acc No Author Title of book Subject Publisher Year R.No. 1 Satkari Mookerjee The Jaina Philosophy of PHIL Bharat Jaina Parisat 8/A1 Non-Absolutism 3 Swami Nikilananda Ramakrishna PER/BIO Rider & Co. 17/B2 4 Selwyn Gurney Champion Readings From World ECO `Watts & Co., London 14/B2 & Dorothy Short Religion 6 Bhupendra Datta Swami Vivekananda PER/BIO Nababharat Pub., 17/A3 Calcutta 7 H.D. Lewis The Principal Upanisads PHIL George Allen & Unwin 8/A1 14 Jawaherlal Nehru Buddhist Texts PHIL Bruno Cassirer 8/A1 15 Bhagwat Saran Women In Rgveda PHIL Nada Kishore & Bros., 8/A1 Benares. 15 Bhagwat Saran Upadhya Women in Rgveda LIT 9/B1 16 A.P. Karmarkar The Religions of India PHIL Mira Publishing Lonavla 8/A1 House 17 Shri Krishna Menon Atma-Darshan PHIL Sri Vidya Samiti 8/A1 Atmananda 20 Henri de Lubac S.J. Aspects of Budhism PHIL sheed & ward 8/A1 21 J.M. Sanyal The Shrimad Bhagabatam PHIL Dhirendra Nath Bose 8/A2 22 J.M. Sanyal The Shrimad PHIL Oriental Pub. 8/A2 Bhagabatam VolI 23 J.M. Sanyal The Shrimad PHIL Oriental Pub. 8/A2 Bhagabatam Vo.l III 24 J.M. Sanyal The Shrimad Bhagabatam PHIL Oriental Pub. 8/A2 25 J.M. Sanyal The Shrimad PHIL Oriental Pub. 8/A2 Bhagabatam Vol.V 26 Mahadev Desai The Gospel of Selfless G/REL Navijvan Press 14/B2 Action 28 Shankar Shankar's Children Art FIC/NOV Yamuna Shankar 2/A2 Number Volume 28 29 Nil The Adyar Library Bulletin LIT The Adyar Library and 9/B2 Research Centre 30 Fraser & Edwards Life And Teaching of PER/BIO Christian Literature 17/A3 Tukaram Society for India 40 Monier Williams Hinduism PHIL Susil Gupta (India) Ltd. -

Tiger Zinda Hai Movie 1 Eng Sub Download

Tiger Zinda Hai Movie 1 Eng Sub Download Tiger Zinda Hai Movie 1 Eng Sub Download 1 / 3 2 / 3 Tiger Zinda Hai | 'F'u'l'l'HD'M.o.V.i.E'2017'online'free'Stream'English'Subtitle' ... Morocco .... Tiger Zinda Hai Movie. ... English (US) · Español · Português (Brasil) · Français (France) · Deutsch ... Image may contain: 1 person ... movie online free, Vodka Diaries full movie download, Vodka Diaries full movie 123movies, Vodka ... free online streaming, Vodka Diaries full movie english, Vodka Diaries full movie eng sub,.. Download The Tiger Zinda Hai (2017) English Subtitle - SUBDL. ... Popular movies · Register · Advertise · Disable adsNew. Language. film ... Tiger, 8 years after he fled with former Pakistani intelligence (ISI) agent, Zoya. ... Web-DLArabic (1).. Tiger Zinda Hai ... Hon3y; Number of CD's: 1; Frame (fps): 25 ... Report Bad Movie Subtitle: Author. Thanks (23). Download. This page has been viewed 5167 .... Tiger Zinda Hai Movie 1 Eng Sub Download > DOWNLOAD 09419bd2f6 Subtitles Tiger Zinda Hai - subtitles english. Tiger Zinda Hai 2017 .... Check out this video on Streamable using your phone, tablet or desktop.. Favorite Katrina Kaif Movie ... Tiger Zinda Hai (2017) Katrina Kaif in Tiger Zinda Hai (2017) Salman Khan and Katrina Kaif ... The song 'Swag Se Swagat' clocked 1 MILLION Streams in 24 hrs & a massive 10 Million streams in 10 days. ... dubbed in Hindi, while in the DVD version, the original English dialogues are retained.. Tiger Zinda Hai, watch Tiger Zinda Hai, watch Tiger Zinda Hai eng sub, Tiger Zinda Hai online ep 1, ep 2, ep 3, ep 4, watch Tiger Zinda Hai episode 5, episode 6 ... -

RSAOI WEEKLY PGME : 29 JUN to 05 JUL 18 HINDI MOVIE – PADMAAVAT on 29 JUN 18 @ 1830HRS (2H 44Min)

RSAOI WEEKLY PGME : 29 JUN TO 05 JUL 18 HINDI MOVIE – PADMAAVAT on 29 JUN 18 @ 1830HRS (2h 44min) Film synopsis - Set in medieval Rajasthan, Queen Padmavati is married to a noble king and they live in a prosperous fortress with their subjects until an ambitious Sultan hears of Padmavati's beauty and forms an obsessive love for the Queen of Mewar. Director: Sanjay Leela Bhansali Writers: Prakash Kapadia (screenplay), Sanjay Leela Bhansali (screenplay) Stars: Deepika Padukone, Aditi Rao Hydari, Anupriya Goenka HINDI MOVIE – TIGER ZINDA HAI on 30 JUN 18 @ 1830HRS (2h 41min) Film synopsis - When a group of Indian and Pakistani nurses are held hostage in Iraq by a terrorist organization, a secret agent is drawn out of hiding to rescue them. Director: Ali Abbas Zafar Writers: Neelesh Misra (story), Ali Abbas Zafar (story) Stars: Salman Khan, Katrina Kaif, Anupriya Goenka Contd ……2 -2- HINDI MOVIE – BAHUBALI – 2 on 01 JULY 18 @ 1500HRS (2h 47min) Film synopsis - When Shiva, the son of Bahubali, learns about his heritage, he begins to look for answers. His story is juxtaposed with past events that unfolded in the Mahishmati Kingdom. Director: S.S. Rajamouli Writers: Vijayendra Prasad (story by), S.S. Rajamouli (screenplay by) Stars: Prabhas, Rana Daggubati, Anushka Shetty HINDI MOVIE – DANGAL on 01 JULY 18 @ 1830HRS (2h 41min) Film synopsis - Former wrestler Mahavir Singh Phogat and his two wrestler daughters struggle towards glory at the Commonwealth Games in the face of societal oppression. Director: Nitesh Tiwari Writers: Piyush Gupta, Shreyas Jain Stars: Aamir Khan, Sakshi Tanwar, Fatima Sana Shaikh Contd ……3 -3- HINDI MOVIE – SULTAN on 02 JULY 18 @ 1830HRS (2h 50min) Film synopsis - Sultan is a classic underdog tale about a wrestler's journey, looking for a comeback by defeating all odds. -

Annual-Report-2014-2015-Ministry-Of-Information-And-Broadcasting-Of-India.Pdf

Annual Report 2014-15 ANNUAL PB REPORT An Overview 1 Published by the Publications Division Ministry of Information and Broadcasting, Government of India Printed at Niyogi offset Pvt. Ltd., New Delhi 20 ANNUAL 2 REPORT An Overview 3 Ministry of Information and Broadcasting Annual Report 2014-15 ANNUAL 2 REPORT An Overview 3 45th International Film Festival of India 2014 ANNUAL 4 REPORT An Overview 5 Contents Page No. Highlights of the Year 07 1 An Overview 15 2 Role and Functions of the Ministry 19 3 New Initiatives 23 4 Activities under Information Sector 27 5 Activities under Broadcasting Sector 85 6 Activities under Films Sector 207 7 International Co-operation 255 8 Reservation for Scheduled Castes, Scheduled Tribes and other Backward Classes 259 9 Representation of Physically Disabled Persons in Service 263 10 Use of Hindi as Official Language 267 11 Women Welfare Activities 269 12 Vigilance Related Matters 271 13 Citizens’ Charter & Grievance Redressal Mechanism 273 14 Right to Information Act, 2005 Related Matters 277 15 Accounting & Internal Audit 281 16 CAG Paras (Received From 01.01.2014 To 31.02.2015) 285 17 Implementation of the Judgements/Orders of CATs 287 18 Plan Outlay 289 19 Media Unit-wise Budget 301 20 Organizational Chart of Ministry of I&B 307 21 Results-Framework Document (RFD) for Ministry of Information and Broadcasting 315 2013-2014 ANNUAL 4 REPORT An Overview 5 ANNUAL 6 REPORT Highlights of the Year 7 Highlights of the Year INFORMATION WING advertisements. Consistent efforts are being made to ● In order to facilitate Ministries/Departments in promote and propagate Swachh Bharat Mission through registering their presence on Social media by utilizing Public and Private Broadcasters extensively. -

92.7 BIG FM Launches 'U.P. Ki Kahaniyan with Neelesh Misra'

92.7 BIG FM launches ‘U.P. ki Kahaniyan with Neelesh Misra’ By : INVC Team Published On : 25 May, 2015 10:04 PM IST INVC NEWS New Delhi, India’s No. 1 radio network, 92.7 BIG FM has always strived to create campaigns and shows that aim to bring about change in the society by large. Taking forward the role of a crusader, the FM network is set to introduce a fifteen minute segment ‘U.P. ki Kahaniyan with Neelesh Misra’ that is aimed at bringing out positive and inspiring stories from the state of Uttar Pradesh. Using the powerful medium of storytelling as an inspirational tool, 92.7 BIG FM has roped in master story-teller Neelesh Misra, known for his popular award-winning show ‘Yaadon Ka Idiot Box’. Known as the pioneer of championing social issues and environmental awareness, 92.7 BIG FM will also bring on-board their own team of field researchers and NGO associations to enable peopleto take advantage of various government schemes, bring about changes and make their lives meaningful. Mr. Ashwin Padmanabhan, Executive Vice President and Business Head, Reliance Broadcast Network Limited, spoke on the occasion of the new show launch, “I am delighted to announce the launch of our all-new segment ‘U.P. ki Kahaniyan with Neelesh Misra’. At 92.7 BIG FM, our objective is not just providing wholesome entertainment to our listeners but also engaging with them on grassroots level. Our many campaigns and shows are devised keeping that factor in mind. Through our new segment, we aim to reach out to the Hindi Speaking Market (HSM) inspire the listeners on enriching their lives and creating a better future.” Hailing from Uttar Pradesh, story teller Neelesh Misra will exclusively anchor the segment and give insights into the diversity of the state, its culture and languages. -

LS Magazine 2018.Cdr

Vol. 7 June 2018 Youth on a Move... LUCKNOW society, aims to preserve, LUCKNOW Society has always been paying equal consideration to Lucknow Hai To Mahez Gumbad-o Minar Nahi, Lucknow Hum Par Fida Hai Hum Fida-e Lucknow, “ promote and resurrect the inimitable the contemporary botheration as well as decrepit complications. Sirf Ek Shaher Nahi Kucha-o Bazaar Nahi, “ “ Kya Hai Taaqat Aasmaan Ki Jo Churaae Lucknow culture and heritage of the city of “Iske Aanchal Mein Mohabbat Ke Phool Khilte Hai, nawabs, revive its past magnificence as it Be it the “Lucknow Literary Festival”, which has been adorned with affects a modern grace. ‘Let’s Unite for sundry of well – known names and faces that not only grace the Iski Galiyon Mein Farishto Ke Pate Milte Hai In spite of being a Non-Lucknowite Culture, Knowledge, Nationalism and Objective Welfare of Society’ – event with their presence but also share their experiences, their by birth, the love he carries in his fields of life. The initiates like “Lets’s Salute” and each character of the christening contains the fervor of insights with young and old alike, which not only solves the purpose heart for Lucknow as well as “Yaadein” take us back in the dates to events and commitment to the cause. Headed by a band of zealous of making the legendary writers shine among the youngsters but Literature is incomparable. The zeal personalities associated to them. Encouraging the lucknowites, the society came into force on 25th April 2011 also encouraging the young talent to come forward or be it bringing to carry forward the heritage and youth to come forward, the Society has been sanctioned under the Societies Registration Act (Act XXI of 1860). -

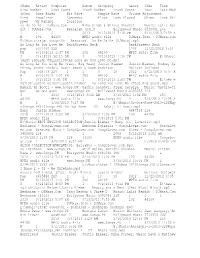

Name Artist Composer Album Grouping Genre Size Time Disc Number Disc Count Track Number Track Count Year Date Mod Ified Date

Name Artist Composer Album Grouping Genre Size Time Disc Number Disc Count Track Number Track Count Year Date Mod ified Date Added Bit Rate Sample Rate Volume Adjustment Kind Equalizer Comments Plays Last Played Skips Last Ski pped My Rating Location Aa Re Aa Re - DJMaza.Com Mika Singh & Shreya Ghoshal Music: Lalit Pan dit | DJMaza.Com Besharam (2013) Bollywood Music 6539001 266 1 1 6 2013 9/15/2013 5:10 PM 9/16/2013 7:59 A M 192 44100 MPEG audio file DJMaza.Info | DJMaza.com E:\Music\rajat songs\06 - Besharam - Aa Re Aa Re [DJMaza].mp3 As Long As You Love Me BackStreets Back BackStreets Back pop 5377910 222 1998 11/22/2012 4:14 PM 8/10/2013 1:37 PM 192 44100 MPEG audio file 3 9/6/2013 12:15 AM 4 9/13/2013 7:36 PM E:\Music \BEST ENGLISH COLLECTION\As Long As You Love Me.mp3 As Long As You Love Me (feat. Big Sean) Justin Bieber Justin Bieber, Rodney Je rkins, Andre Lindal, Nasri Atweh & Sean Anderson Believe (Deluxe) Pop 7568778 229 1 1 3 18 2012 5/12/2013 3:07 A M 8/10/2013 1:51 PM 256 44100 MPEG audio file 1 9/2/2013 9:31 PM 1 8/10/2013 2:09 PM E:\new e nglish\Justin Beiber\Justin Bieber - As Long You Love Me (feat Big Sean).mp3 Babaji Ki Booti - www.Songs.PK Sachin Sanghvi, Jigar Saraiya Music: Sachin-Ji gar Go Goa Gone www.Songs.PK Bollywood Music 4385035 226 3 2013 4/22/2013 3:02 AM 8/10/2013 1:02 PM 154 44100 MPEG audio file www.Songs.PK 2 9/6/2013 12:08 A M 2 8/28/2013 7:27 PM E:\Music\Go-Goa-Gone-2013-128Kbp s(Songs.PK)\[Songs.PK] Go Goa Gone - 03 - Babaji Ki Booti.mp3 Baby Justin Bieber 4447538 216 2010 5/12/2013 3:08 AM 8/10/2013 1:36 PM 160 44100 MPEG audio file 3 9/8/2013 5:01 PM E:\Music\BEST ENGLISH COLLECTION\Justin Bieber - Baby (ft. -

Sailors of Stories by Ayesha Singh and Sunita Raghu | Published: 29Th July 2017 10:00 PM | Last Updated: 30Th July 2017 07:36 AM | A+ a A- | India Is a Sea of Stories

7/31/2017 Home Magazine Sailors of Stories By Ayesha Singh and Sunita Raghu | Published: 29th July 2017 10:00 PM | Last Updated: 30th July 2017 07:36 AM | A+ A A- | India is a sea of stories. On its tides are old ships piloted by new sailors. A talented group of men and women, who have plundered the treasures of Hindoostan’s folklore, grandmother’s tales and the vast canvas of the epics, are bringing its tales to the contemporary audience. Their inspiration is the soul of the story. Today, individuals such as Neelesh Misra who brought back storytelling to radio, Sanjoy Roy who was the pioneer of several festivals around the art form, Koitso Salil Mukhia who is bringing back shamanic stories of his community, Samatha Sharma who is telling tales for therapeutic purposes, Mohan Krishnan, the banker who trained freshers using the medium at the Reserve Bank of India and later traded his profession for storytelling, have made it their journey of exploration. The reintroduction has taken a leaf out of the ‘global storytelling’ revival surge of the late 60s. Here, we introduce raconteurs who are changing the way we live in the world of words. Healing Touch Laila Paladugu, 35, Hyderabad Founder-Director, Kathakalpa Laila Paladugu, founder-director of Kathakalpa, which promotes life skills through storytelling, left her corporate career as a trainer at S&P Global in Hyderabad to start this learning centre. It facilitates mental, social, and academic development in children. Through workshops she conducts on weekends, summer holidays and after school, the focus is to hone study, thinking and social skills. -

Media Ecosystems: the Walls Fall Down

Media ecosystems: The walls fall down KPMG in India’s Media and Entertainment report 2018 September 2018 kpmg.com/in Media ecosystems: The walls fall down KPMG in India’s Media and Entertainment report 2018 We would like to thank all those who have contributed and shared their valuable domain insights in helping us put this report together. Image courtesy Makuta VFX Prime Focus Ltd Reliance Animation Sony Pictures Network India Toonz Animation Viacom 18 Media Pvt Ltd Yash Raj Films Zee Entertainment Enterprises Ltd • The information contained in Media ecosystems: The walls fall down report is of a general nature and is not intended to address the circumstances of any particular individual or entity. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation. • Although we have attempted to provide correct and timely information, there can be no guarantee that such information is correct as of the date it is received or that it will continue to be correct in the future. • The report contains information obtained from the public domain or external sources which have not been verified for authenticity, accuracy or completeness. • Use of companies’ names in the report is only to exemplify the trends in the industry. We maintain our independence from such entities and no bias is intended towards any of them in the report. • Our report may make reference to ‘KPMG Analysis’; this merely indicates that we have (where specified) undertaken certain analytical activities on the underlying data to arrive at the information presented; we do not accept responsibility for the veracity of the underlying data. -

The Doon School WEEKLY Saturday, March 9 Z 2013 Z Issue No

Established in 1936 The Doon School WEEKLY Saturday, March 9 z 2013 z Issue No. 2337 AROUND THE REGULARS INTERVIEWS POETRY 2 WORLD 2 3 4 ToTo PayPay oror NotNot toto PayPay Madhav Dutt comments on the 2013 Budget which was presented recently. No matter what anyone says about the budget, one thing is for sure, it was a move well made. The Union Budget for the year 2013 cannot be broken down and explicated without providing a background of the current political scenario in our country. One final year separates us from the 2014 General Elections, and it is fair to say that the next residents of Race Course Road are still un-decided. The UPA’s second term has been marked with scandals, corruption and futile debates in Parliament. UPA President Sonia Gandhi has used the budget to pave the path towards her party’s re- election. One fact still remains: the party that wins the General Elections will enter a parliament with no decisive opinion or stand on key issues. There have been myriad reactions to this budget. After the budget speech, the Leader of the Opposition expressed her extreme opinions, calling it ‘unimaginative’ and bland. Many have said that the common man has been left out of this budget. After all, at the end of the day, the common man just worries about the bare necessities: food, electricity, water, fuel and a roof to sleep under. This was the Union Government’s 82nd Budget. Drafting and formulating a national budget for any country is a herculean task, and for a country as populous and large as ours, it is infinitely harder. -

Television, Memory, and History: ‘Informal Knowledge’ of Doordarshan on the Internet1

. Volume 16, Issue 2 November 2019 Television, memory, and history: ‘Informal knowledge’ of Doordarshan on the Internet1 Sanjay Asthana, Middle Tennessee State University, USA Abstract: This article explores people’s memories of India’s state-run television, Doordarshan in the 1980s; a decade which witnessed rapid expansion of the television network and the emergence of a wide range of programs such as drama, classical and film-based music, historical, mythological, and fictional narratives, soap operas, sitcoms, serials, etc. Indeed, it is not unusual for people to have memories of their first encounters with television, the particular experiences of watching ‘favorite’ programs, remembering advertisements, jingles, parts of programs, television personalities, etc. The article foregrounds people’s memories of the everyday experiences, and knowledge of television paying heed to the argument of Darian-Smith and Turnbull (2012:1) that, ‘... the everyday ‘informal knowledge’ about television and its technology as experienced by those who are watching it has been displaced by the ‘formal knowledge’ of those equipped with the appropriate fashionable theory to analyze it.’ To this end, the article examines the ways in which people remember and reminisce about television, recuperate their familial, social, and cultural contexts of their viewing habits and practices, which although constructed around individual identity reveal a more collective intersection of culture and history. Keywords: television, history, memories, nostalgia, domestic, audience, viewing practices, publics, informal knowledge In a 2016 blogpost, psychologist Sadaf Vidha noted that nostalgia for India’s state-run television, Doordarshan has been on the increase on the internet.2 Sadaf ruminates on the role of nostalgia in activating memory networks, the generation of positive and negative associations and perturbation leading to a certain ‘stuckness’ in the past. -

Univerzita Karlova / Charles University Universidade Do Porto / University of Porto

Univerzita Karlova / Charles University Universidade do Porto / University of Porto Filozofická fakulta / Faculty of Arts (Prague) Faculdade de Letras / Faculty of Arts and Humanities (Porto) Ústav anglofonních literatur a kultur / Department of Anglophone Literatures and Cultures (Prague) Departamento de Estudos Anglo-Americanos / Department of Anglo-American Studies (Porto) Text and Event in Early Modern Europe (TEEME) An Erasmus Mundus Joint Doctorate Ph.D. dissertation The Shakespeare Salesman Saksham Sharda Supervisors: Professor Martin Procházka (Charles University) Professor Rui Carvalho Homem (University of Porto) 2018 English Abstract The Shakespeare Salesman The Shakespeare Salesman offers a comprehensive analysis of Vishal Bhardwaj’s Shakespeare trilogy that consists of the films: Maqbool (2003), Omkara (2006), and Haider (2014). The trilogy only recently being completed, previous attempts to study Bhardwaj’s work have been confined to chapters in books, with their analysis often relegated to the understanding of a greater theme about the industry as a whole, and hence this work intends to accord due space to Bhardwaj’s films by making them the centre of the discussion. The analyses of these films show that Bhardwaj’s work is torn between issues of authenticity, fidelity, and originality, often leading to what the thesis defines as “narrative crises” that are resolved with thought-provoking, at times problematic, but largely unique methods. Hence each of the three chapters, accorded to the respective film being discussed, focuses on the said crisis. By focusing specifically on these aspects the argument does not, by any means, intend to lessen or mis-portray the achievements, contribution and importance of Bhardwaj’s work.