2020 Highlight Its Significantly Improved Balance Sheet and Strong Cash Flow, Along with Continuing Or Growing Demand for SCA’S Core Audio Products

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

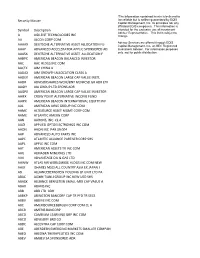

Security Master Symbol Description a AGILENT TECHNOLOGIES INC AA

*The information contained herein is believed to Security Master be reliable but is neither guaranteed by EQIS Capital Management, Inc. its principles nor any affiliated EQIS companies. This information is Symbol Description intended for the exclusive use of investment Adviser Representative. This list is subject to A AGILENT TECHNOLOGIES INC change. AA ALCOA CORP COM Advisor Services are offered through EQIS AAAAX DEUTSCHE ALTERNATIVE ASSET ALLOCATION FU Capital Management, Inc. an SEC Registered AAAP ADVANCED ACCELERATOR APPLIC SPONSORED AD Investment Adviser. For information purposes AAASX DEUTSCHE ALTERNATIVE ASSET ALLOCATION F only, not for public distribution. AABPX AMERICAN BEACON BALANCED INVESTOR AAC AAC HLDGS INC COM AACFX AIM CHINA A AADAX AIM GROWTH ALLOCATION CLASS A AADEX AMERICAN BEACON LARGE CAP VALUE INSTL AADR ADVISORSHARES WCM/BNY MLNFCSD GR ADR ETF AAGIY AIA GROUP LTD SPONS ADR AAGPX AMERICAN BEACON LARGE CAP VALUE INVESTOR AAIFX CROW POINT ALTERNATIVE INCOME FUND AAIPX AMERICAN BEACON INTERNATIONAL EQUITY INV AAL AMERICAN AIRLS GROUP INC COM AAMC ALTISOURCE ASSET MGMT CORP COM AAME ATLANTIC AMERN CORP AAN AARONS, INC. CL A AAOI APPLIED OPTOELECTRONICS INC COM AAON AAON INC PAR $0.004 AAP ADVANCED AUTO PARTS INC AAPC ATLANTIC ALLIANCE PARTNER CORP SHS AAPL APPLE INC COM AAT AMERICAN ASSETS TR INC COM AAU ALMADEN MINERALS LTD AAV ADVANTAGE OIL & GAS LTD AAWW ATLAS AIR WORLDWIDE HLDGS INC COM NEW AAXJ ISHARES MSCI ALL COUNTRY ASIA EX JAPAN I AB ALLIANCEBERNSTEIN HOLDING LP UNIT LTD PA ABAC AOXIN TIANLI GROUP INC NEW -

Commercial Radio Awards (Acras), Announced This Evening at the Royal International Convention Centre in Brisbane

MEDIA RELEASE 19 October 2019 Jonesy & Amanda win Best On-Air Team FM at Radio Awards Successful WSFM breakfast hosts Jonesy and Amanda (Brendan Jones and Amanda Keller), have been crowned Best On- Air Team (Metro FM category) at the 31st Australian Commercial Radio Awards (ACRAs), announced this evening at the Royal International Convention Centre in Brisbane. The win caps off a great year for the much-loved duo, who have notched up 14 years on air together and previously won the coveted award in 2012 and 2014. 2GB’s drive time host Ben Fordham won Best Talk Presenter for the fifth time and 2GB morning presenter Ray Hadley was awarded Best Current Affairs Presenter, bringing his career tally of ACRAs to 33 across all categories. The Best On-Air Team (Metro AM) was won by Afternoons with Erin Molan & Natalie Peters, the first female duo to host a news/talk show on 2GB and the first all-female team to win this award in ACRAs history. NOVA’s popular drive show Kate, Tim & Marty won Best Networked Program and Best Syndicated Australian Program. Best Entertainment Presenter went to Triple M funny man Lawrence Mooney, while Rebecca Morse, half of Hit107 Adelaide’s new breakfast duo Bec & Cosi, won Best Newcomer On-Air. Winners of other major awards included: Best Sports Presenter – Peter Sterling (Triple M, Sydney) Best Music Presenter – Kent “Smallzy” Small, Nova Network Best Community Service Project – Kennedy Molloy’s trip to Yuendumu for Red Dust, Triple M. Best News Presenter (Metro AM) – Mel Usher, FIVEaa, Adelaide Best News Presenter (Metro FM) – Ange Anderson, Nova 106.9 Brisbane Brian White Award for Radio Journalism - Matthew Pantelis, FIVEaa, Adelaide Best Music Special - Carrie Bickmore & Tommy Little, Southern Cross Austereo Best Original Podcast (Unbranded) – Hamish & Andy, PodcastOne Australia. -

Agpasa, Brendon

29 January 2021 The Hon Paul Fletcher MP PO Box 6022 House of Representatives Parliament House Canberra ACT 2600 CHRIS (BRENDON) AGPASA SUBMISSION TO THE 2021-22 PRE-BUDGET SUBMISSIONS Dear Minister Fletcher, I write to request assistance had appropriate for media diversity to support digital radio and TV rollouts will continue in the federal funding, Brendon Agpasa was a student, radio listener and TV viewer. Paul Fletcher MP and the Morrison Government is supporting the media diversity including digital radio rollout, transition of community television to an online operating model, digital TV rollout, radio and TV services through regional media and subscription TV rollout we’re rolled out for new media landscape and it’s yours to towards a digital future of radio and TV broadcasting. We looking up for an expansion of digital radio rollout has been given consideration, the new digital spectrum to test a trial DRM30 and DRM+ with existing analogue (AM/FM) radio services, shortwave radio and end of spectrum (VHF NAS licences) will be adopted Digital Radio Mondiale services in Australia for the future plans. The radio stations Sydney’s 2GB, Melbourne’s 3AW, Brisbane’s Nova 106.9, Adelaide’s Mix 102.3, Perth’s Nova 93.7, Hit FM and Triple M ranks number 1 at ratings survey 8 in December 2020. Recently in December 2020, Nova Entertainment had launched it’s new DAB+ stations in each market, such as Nova Throwbacks, Nova 90s, Nova Noughties, Nova 10s, Smooth 80s and Smooth 90s to bring you the freshest hits, throwbacks and old classics all day everyday at Nova and Smooth FM. -

Media Tracking List Edition January 2021

AN ISENTIA COMPANY Australia Media Tracking List Edition January 2021 The coverage listed in this document is correct at the time of printing. Slice Media reserves the right to change coverage monitored at any time without notification. National National AFR Weekend Australian Financial Review The Australian The Saturday Paper Weekend Australian SLICE MEDIA Media Tracking List January PAGE 2/89 2021 Capital City Daily ACT Canberra Times Sunday Canberra Times NSW Daily Telegraph Sun-Herald(Sydney) Sunday Telegraph (Sydney) Sydney Morning Herald NT Northern Territory News Sunday Territorian (Darwin) QLD Courier Mail Sunday Mail (Brisbane) SA Advertiser (Adelaide) Sunday Mail (Adel) 1st ed. TAS Mercury (Hobart) Sunday Tasmanian VIC Age Herald Sun (Melbourne) Sunday Age Sunday Herald Sun (Melbourne) The Saturday Age WA Sunday Times (Perth) The Weekend West West Australian SLICE MEDIA Media Tracking List January PAGE 3/89 2021 Suburban National Messenger ACT Canberra City News Northside Chronicle (Canberra) NSW Auburn Review Pictorial Bankstown - Canterbury Torch Blacktown Advocate Camden Advertiser Campbelltown-Macarthur Advertiser Canterbury-Bankstown Express CENTRAL Central Coast Express - Gosford City Hub District Reporter Camden Eastern Suburbs Spectator Emu & Leonay Gazette Fairfield Advance Fairfield City Champion Galston & District Community News Glenmore Gazette Hills District Independent Hills Shire Times Hills to Hawkesbury Hornsby Advocate Inner West Courier Inner West Independent Inner West Times Jordan Springs Gazette Liverpool -

Melbourne Program Guide

http://prtten04.networkten.com.au:7778/pls/DWHPROD/Program_Repo... MELBOURNE PROGRAM GUIDE Sunday 29th April 2012 06:00 am Mass For You At Home G Religious Program 06:30 am Hillsong G Religious Program 07:00 am Natural Connections (Rpt) G Natural Connections From Sydney Harbour to the Australian desert and Northern rainforests, iconic Australian landscapes are infused with Aboriginal history and culture. Representatives from these regions tell us of their connection with the past and approach to the future. 08:00 am Saving Seals (Rpt) G Saving Seals 09:00 am Good Chef Bad Chef (Rpt) CC G WS Chef Adrian Richardson and nutritionist Janella Purcell go head to head in a food showdown! 09:30 am Good Chef Bad Chef (Rpt) CC G WS Chef Adrian Richardson and nutritionist Janella Purcell go head to head in a food showdown! 10:00 am The Bolt Report CC Join Andrew Bolt, one of Australia's most read, most topical newspaper columnist, as he addresses today's political and social issues through opinion commentary, panel discussion and interviews. 10:30 am Meet The Press CC Join Paul Bongiorno and Hugh Riminton as they interview the main players on the Australian public affairs stage, and cover the issues making news in Federal politics. 11:00 am The Circle Highlights Show CC PG The best bits from The Circle, Yumi Stynes along with Gorgi Coghlan and a stunning line up of local and international talent will help kick start your weekend! 12:00 pm Netball: ANZ Championship 2012 Round 5: West Coast Fever V Adelaide Thunderbirds The ANZ Championships Netball is the pre-eminent netball league in the world. -

Changing Stations

1 CHANGING STATIONS FULL INDEX 100 Top Tunes 190 2GZ Junior Country Service Club 128 1029 Hot Tomato 170, 432 2HD 30, 81, 120–1, 162, 178, 182, 190, 192, 106.9 Hill FM 92, 428 247, 258, 295, 352, 364, 370, 378, 423 2HD Radio Players 213 2AD 163, 259, 425, 568 2KM 251, 323, 426, 431 2AY 127, 205, 423 2KO 30, 81, 90, 120, 132, 176, 227, 255, 264, 2BE 9, 169, 423 266, 342, 366, 424 2BH 92, 146, 177, 201, 425 2KY 18, 37, 54, 133, 135, 140, 154, 168, 189, 2BL 6, 203, 323, 345, 385 198–9, 216, 221, 224, 232, 238, 247, 250–1, 2BS 6, 302–3, 364, 426 267, 274, 291, 295, 297–8, 302, 311, 316, 345, 2CA 25, 29, 60, 87, 89, 129, 146, 197, 245, 277, 354–7, 359–65, 370, 378, 385, 390, 399, 401– 295, 358, 370, 377, 424 2, 406, 412, 423 2CA Night Owls’ Club 2KY Swing Club 250 2CBA FM 197, 198 2LM 257, 423 2CC 74, 87, 98, 197, 205, 237, 403, 427 2LT 302, 427 2CH 16, 19, 21, 24, 29, 59, 110, 122, 124, 130, 2MBS-FM 75 136, 141, 144, 150, 156–7, 163, 168, 176–7, 2MG 268, 317, 403, 426 182, 184–7, 189, 192, 195–8, 200, 236, 238, 2MO 259, 318, 424 247, 253, 260, 263–4, 270, 274, 277, 286, 288, 2MW 121, 239, 426 319, 327, 358, 389, 411, 424 2NM 170, 426 2CHY 96 2NZ 68, 425 2Day-FM 84, 85, 89, 94, 113, 193, 240–1, 243– 2NZ Dramatic Club 217 4, 278, 281, 403, 412–13, 428, 433–6 2OO 74, 428 2DU 136, 179, 403, 425 2PK 403, 426 2FC 291–2, 355, 385 2QN 76–7, 256, 425 2GB 9–10, 14, 18, 29, 30–2, 49–50, 55–7, 59, 2RE 259, 427 61, 68–9, 84, 87, 95, 102–3, 107–8, 110–12, 2RG 142, 158, 262, 425 114–15, 120–2, 124–7, 129, 133, 136, 139–41, 2SM 54, 79, 84–5, 103, 119, 124, -

O Verviewof a Ustralia

Overview of A ustralia's M edia O w nership Law s Commercial Free-to-Air TV Broadcasting 1975 (FATA), which applies to all media. All Control direct proposals for foreign investment of Licences A person who has company interests in a more than 5% are subject to case-by-case company which exceed 15% is regarded as A person must not control (see control below): examination, as are proposals for portfolio being in a position to exercise control of the shareholdings of more than 5%. Up to 25% • licences whose combined licence area company (the '15% rule’) (cl. 6, Sch. 1, BSA). foreign investment by a single shareholder populations exceed 75°/o of the population Company interests include shareholding, in a mass circulation newspaper is permitted, of Australia; voting, dividend or winding-up interests (s. 6 with a maximum of 30% for all foreign BSA). Importantly, the 15% rule does not only • more than one licence in the same licence interests. Aggregate investment in provincial apply to direct interests held in a company, it area (though see exception below) (s. 53 and suburban newspapers is limited to 50%. A also applies to an interest of more than 15% Broadcasting Services Act 1992 (BSA)). separate policy relates to foreign ownership of which is carried through a chain of companies ethnic newspapers in Australia. Similar limits apply to directors of companies (cl. 7, Sch. 1, BSA). Minor company interests can that control licences; a director of two or more also be traced through a chain of companies companies that between them control licences; Cross-Media Controls *• (fractional tracing method) and combined to a person who controls a licence and who is a A person must not control: determine a person's relevant interest in a director of a company that controls another company (cl. -

Commercial Radio

FINALISTS FOR 2019 AUSTRALIAN COMMERCIAL RADIO AWARDS (ACRAs) Please note: Category Finalists are denoted with the following letters: Country>Provincial>Non-Metropolitan>Metropolitan>Syndication/Production Company BEST ON-AIR TEAM – METRO FM The Kyle & Jackie O Show; Kyle Sandilands & Jackie Henderson, KIIS 106.5, Sydney NSW, Australian Radio Network M Kate, Tim & Marty; Kate Ritchie, Tim Blackwell & Marty Sheargold Nova Network, NOVA Entertainment M Chrissie, Sam & Browny Chrissie Swan, Sam Pang, Jonathan Brown & Dean Thomas, Nova 100, Melbourne VIC, NOVA Entertainment M Jonesy & Amanda; Brendan Jones & Amanda Keller, WSFM, Sydney NSW, Australian Radio Network M Fifi, Fev & Byron; Fifi Box, Brendan Fevola & Byron Cooke, 101.9 The Fox, Melbourne VIC, Southern Cross Austereo M Kennedy Molloy; Jane Kennedy & Mick Molloy, Triple M Network, Southern Cross Austereo M BEST ON-AIR TEAM – METRO AM Afternoons with Erin Molan & Natalie Peters; Erin Molan & Natalie Peters, 2GB, Sydney NSW, Macquarie Media Limited M Breakfast with David Penberthy & Will Goodings; David Penberthy & Will Goodings, 5AA, Adelaide SA, NOVA Entertainment M Drive with Mark Allen & David Schwartz; Mark Allen & David Schwartz, Macquarie Sports Radio, Melbourne VIC, Macquarie Media Limited M Ray Hadley's Continuous Call Team; 2GB, Sydney NSW, Macquarie Media Limited M Laurel, Gary & Mark; Laurel Edwards, Gary Clare & Mark Hine, 4KQ, Brisbane QLD, Australian Radio Network M BEST ON-AIR TEAM COUNTRY AND PROVINCIAL Monkey in the Morning; Matt Monk, Lachi Rooke & Danielle Keilar, -

Autoradio MD 42540 AUS.Fm Seite 2 Mittwoch, 30

Autoradio MD 42540_AUS.fm Seite 2 Mittwoch, 30. November 2005 9:01 09 OVERVIEW 1. OPEN : Open control panel 2. SEL: Press repeatedly to call up the following audio settings: volume, bass, treble, balance, fader; SEL: Press repeatedly for a little longer to call up the various traffic announcement settings SEL: When carrying out an MP3 search using letters, confirm every entry 3. PWR: turn device on/off (the device can also be turned on with any other key except OPEN) DIM (tap): dim display Turn knob: adjust selected audio setting (see Item 2) 4. Display 5. REC: record on device connected via USB TA (Traffic Announcement): activate the TA function 6. EQ (Equaliser): press repeatedly to change sound settings 7. USB connection (behind protective cover) 8. AS/PS: save stations automatically 9. 0 / DSP: number key 0 / switch display mode 10. 1/ PAU: number and station key 1 / pause play in CD/MP3 mode 11. 2 / SCN: number and station key 2 / scan function in CD/MP3 mode 12. 3 / RPT: number and station key 3 / repeat function in CD/MP3 mode 13. 4 / SHF: number and station key 4 / shuffle function in CD/MP3 mode 14. 5 / DIR : number and station key 5 / MP3 search downwards 15. 6 / DIR : number and station key 6 / MP3 search upwards 16. 7 / MOD: number key 7 / select operating mode Radio CD/MP3 USB card reader 17. 8 / TUN/TRK : number key 8 / station search backwards 18. 9 / TUN/TRK : number key 9 / station search forwards 19. LOU: loudness/BND: band selector/enter: confirm selection. -

What Does Health Reform Mean for North Carolina?

Published by the North Carolina Institute of Medicine and The Duke Endowment What Does www.ncmedicaljournal.com May/June 2010,Mean 71:3 for NorthHealth Carolina? Reform Also in this Issue: Projected Changes in NC Health Insurance Coverage “Why is this the best fit for my practice? They see things through my eyes.” ProAssurance understands your desire for more control, less uncertainty, and preservation of your hard-earned professional identity. It’s about fair treatment. You want reasonable rates with stable premiums, prompt service, easy access to valuable risk reduction information, and of course, unfettered defense of your good medicine. The qualities you value most in a protection partner are easily within reach. Just take a look. Professional Liability Insurance & Risk Management Services ProAssurance Group is rated A (Excellent) by A.M. Best. For individual company ratings, visit www.ProAssurance.com 800.292.1036 The Reveal Logo and TREATED FAIRLY are trademarks of ProAssurance Corporation. 2-8-24 NC Medical Journal.indd 1 8/27/09 8:36:01 AM www.chestpainnetwork.org Hadley Wilson, MD, FAAC | Sanger Heart & Vascular Institute Being well-connected can save your life. The region’s most comprehensive Chest Pain Network connects nine area hospitals and local EMS agencies through our exclusive Yellow Phone system. When the phone rings, a well- orchestrated series of events and protocols are begun for the swift transport of heart attack patients to a waiting catheterization lab. The result is an amazing 33 percent faster response time than the national average. And another example of how our integrated network brings together people and technology to save thousands of lives every year. -

12 September 2019

Official Visit to Switzerland 7 – 12 September 2019 The Honourable Annastacia Palaszczuk MP Premier of Queensland and Minister for Trade Page 1 TABLE OF CONTENTS PROGRAM.............................................................................................................................................. 3 SATURDAY 7 SEPTEMBER 2019 ................................................................................................................................. 3 SUNDAY 8 SEPTEMBER 2019 .................................................................................................................................... 3 MONDAY 9 SEPTEMBER 2019 ................................................................................................................................... 4 TUESDAY 10 SEPTEMBER 2019 ................................................................................................................................. 5 WEDNESDAY 11 SEPTEMBER 2019 ............................................................................................................................ 6 THURSDAY 12 SEPTEMBER 2019 ............................................................................................................................... 6 DELEGATES AND MEMBERS .............................................................................................................. 7 OFFICIAL PARTY MEMBERS ....................................................................................................................................... 7 AUSTRALIAN -

COMMERCIAL RADIO AWARDS (Acras) Please Note: Category Finalists Are Denoted with the Following Letters: Country>Provincial>Non-Metropolitan>Metropolitan

FINALISTS FOR 2016 AUSTRALIAN COMMERCIAL RADIO AWARDS (ACRAs) Please note: Category Finalists are denoted with the following letters: Country>Provincial>Non-Metropolitan>Metropolitan BEST ON-AIR TEAM – METRO FM Kate, Tim & Marty; Kate Ritchie, Tim Blackwell & Marty Sheargold, Nova Network, NOVA Entertainment M The Kyle & Jackie O Show; Kyle Sandilands & Jackie Henderson, KIIS 106.5, Sydney NSW, Australian Radio Network M The Hamish & Andy Show; Hamish Blake & Andy Lee, Hit Network, Southern Cross Austereo M Jonesy & Amanda; Brendan Jones & Amanda Keller, WSFM , Sydney NSW, Australian Radio Network M Fifi & Dave; Fifi Box & Dave Thornton, hit101.9 Fox FM, Melbourne VIC, Southern Cross Austereo M Chrissie, Sam & Browny; Chrissie Swan, Sam Pang & Jonathan Brown, Nova 100, Melbourne VIC, NOVA Entertainment M BEST ON-AIR TEAM – METRO AM FIVEaa Breakfast; David Penberthy & Will Goodings, FIVEaa, Adelaide SA, NOVA Entertainment M 3AW Breakfast; Ross Stevenson & John Burns, 3AW, Melbourne VIC, Macquarie Media Limited M 3AW Nightline/Remember When; Bruce Mansfield & Philip Brady, 3AW, Melbourne VIC, Macquarie Media Limited M The Big Sports Breakfast with Slats & TK; Michael Slater & Terry Kennedy, Sky Sports Radio, Sydney NSW, Tabcorp M Breakfast with Steve Mills & Basil Zempilas; Steve Mills & Basil Zempilas, 6PR, Perth WA, Macquarie Media Limited M Nights with Steve Price; Steve Price & Andrew Bolt, 2GB, Sydney NSW, Macquarie Media Limited M BEST ON-AIR TEAM COUNTRY & PROVINCIAL Bangers & Mash; Janeen Hosemans & Peter Harrison, 2BS Gold, Bathurst