Bradford Reclamation District 2059

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

0 5 10 15 20 Miles Μ and Statewide Resources Office

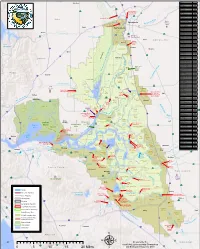

Woodland RD Name RD Number Atlas Tract 2126 5 !"#$ Bacon Island 2028 !"#$80 Bethel Island BIMID Bishop Tract 2042 16 ·|}þ Bixler Tract 2121 Lovdal Boggs Tract 0404 ·|}þ113 District Sacramento River at I Street Bridge Bouldin Island 0756 80 Gaging Station )*+,- Brack Tract 2033 Bradford Island 2059 ·|}þ160 Brannan-Andrus BALMD Lovdal 50 Byron Tract 0800 Sacramento Weir District ¤£ r Cache Haas Area 2098 Y o l o ive Canal Ranch 2086 R Mather Can-Can/Greenhead 2139 Sacramento ican mer Air Force Chadbourne 2034 A Base Coney Island 2117 Port of Dead Horse Island 2111 Sacramento ¤£50 Davis !"#$80 Denverton Slough 2134 West Sacramento Drexler Tract Drexler Dutch Slough 2137 West Egbert Tract 0536 Winters Sacramento Ehrheardt Club 0813 Putah Creek ·|}þ160 ·|}þ16 Empire Tract 2029 ·|}þ84 Fabian Tract 0773 Sacramento Fay Island 2113 ·|}þ128 South Fork Putah Creek Executive Airport Frost Lake 2129 haven s Lake Green d n Glanville 1002 a l r Florin e h Glide District 0765 t S a c r a m e n t o e N Glide EBMUD Grand Island 0003 District Pocket Freeport Grizzly West 2136 Lake Intake Hastings Tract 2060 l Holland Tract 2025 Berryessa e n Holt Station 2116 n Freeport 505 h Honker Bay 2130 %&'( a g strict Elk Grove u Lisbon Di Hotchkiss Tract 0799 h lo S C Jersey Island 0830 Babe l Dixon p s i Kasson District 2085 s h a King Island 2044 S p Libby Mcneil 0369 y r !"#$5 ·|}þ99 B e !"#$80 t Liberty Island 2093 o l a Lisbon District 0307 o Clarksburg Y W l a Little Egbert Tract 2084 S o l a n o n p a r C Little Holland Tract 2120 e in e a e M Little Mandeville -

Countywide Reclamation Services

Countywide Reclamation Services Municipal Service Review/Sphere of Influence Update (2nd Round) Contra Costa Local Agency Formation Commission DRAFT Countywide Reclamation Services MSR/SOI (2nd Round) Contra Costa LAFCO PREPARED FOR: CONTRA COSTA LOCAL AGENCY FORMATION COMMISSION _____________________________________________________________________________________ COMMISSIONERS Don Tatzin, City Member Rob Schroder, City Member Federal Glover, County Member Mary Piepho, County Member Donald Blubaugh, Public Member Michael McGill, Special District Member Igor Skaredoff, Special District Member ALTERNATE COMMISSIONERS Tom Butt, City Member Candace Andersen, County Member Sharon Burke, Public Member Stan Caldwell, Special District Member STAFF Lou Ann Texeira, Executive Officer Kate Sibley, Executive Assistant/LAFCO Clerk 1 Countywide Reclamation Services MSR/SOI (2nd Round) Contra Costa LAFCO Table of Contents I. EXECUTIVE SUMMARY ........................................................................................................................... 10 II. INTRODUCTION ..................................................................................................................................... 16 Local Agency Formation Commissions (LAFCOs) .................................................................................... 16 Municipal Service Reviews ...................................................................................................................... 16 Spheres of Influence .............................................................................................................................. -

Bethel Island Area of Benefit

Julia R. Bueren, Director Deputy Directors R. Mitch Avalon Brian M. Balbas Stephen Kowalewski Stephen Silveira ADOPTED BY BOARD OF SUPERVISORS ON ___________________ Development Program Report for the Bethel Island Area of Benefit August, 2016 Prepared Pursuant to Section 913 of the County Ordinance Code Prepared by and for: Contra Costa County Public Works Department, Transportation Engineering Division and Department of Conservation and Development, Community Development Division "Accredited by the American Public Works Association" 255 Glacier Drive Martinez, CA 94553-4825 TEL: (925) 313-2000 FAX: (925) 313-2333 www.cccpublicworks.org Development Program Report for the Bethel Island Area of Benefit Table of Contents CHAPTER 1: INTRODUCTION AND PURPOSE ............................................................... 1 CHAPTER 2: BACKGROUND ........................................................................................... 2 CHAPTER 3: LOCATION AND BOUNDARY .................................................................... 3 CHAPTER 4: GENERAL PLAN RELATIONSHIP ............................................................... 3 CHAPTER 5: PROJECT LIST ........................................................................................... 4 CHAPTER 6: DEVELOPMENT POTENTIAL ..................................................................... 5 CHAPTER 7: ESTIMATED COST OF ROAD IMPROVEMENTS .......................................... 6 CHAPTER 8: METHOD OF COST APPORTIONMENT ...................................................... -

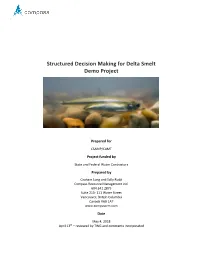

Structured Decision Making for Delta Smelt Demo Project

Structured Decision Making for Delta Smelt Demo Project Prepared for CSAMP/CAMT Project funded by State and Federal Water Contractors Prepared by Graham Long and Sally Rudd Compass Resource Management Ltd. 604.641.2875 Suite 210- 111 Water Street Vancouver, British Columbia Canada V6B 1A7 www.compassrm.com Date May 4, 2018 April 13th – reviewed by TWG and comments incorporated Table of Contents Table of Contents ............................................................................................................... i Executive Summary .......................................................................................................... iii Introduction ...................................................................................................................... 1 Approach .......................................................................................................................... 1 Problem Definition ........................................................................................................... 4 Objectives ......................................................................................................................... 5 Alternatives ...................................................................................................................... 9 Evaluation of Trade-offs ................................................................................................. 17 Discussion and Recommendations ................................................................................ -

Initial Study/Mitigated Negative Declaration Bacon Island Levee Rehabilitation Project State Clearinghouse No. 2017012062

FINAL ◦ MAY 2017 Initial Study/Mitigated Negative Declaration Bacon Island Levee Rehabilitation Project State Clearinghouse No. 2017012062 PREPARED FOR PREPARED BY Reclamation District No. 2028 Stillwater Sciences (Bacon Island) 279 Cousteau Place, Suite 400 343 East Main Street, Suite 815 Davis, CA 95618 Stockton, CA 95202 Stillwater Sciences FINAL Initial Study/Mitigated Negative Declaration Bacon Island Levee Rehabilitation Project Suggested citation: Reclamation District No. 2028. 2016. Public Review Draft Initial Study/Mitigated Negative Declaration: Bacon Island Levee Rehabilitation Project. Prepared by Stillwater Sciences, Davis, California for Reclamation District No. 2028 (Bacon Island), Stockton, California. Cover photo: View of Bacon Island’s northwestern levee corner and surrounding interior lands. May 2017 Stillwater Sciences i FINAL Initial Study/Mitigated Negative Declaration Bacon Island Levee Rehabilitation Project PROJECT SUMMARY Project title Bacon Island Levee Rehabilitation Project Reclamation District No. 2028 CEQA lead agency name (Bacon Island) and address 343 East Main Street, Suite 815 Stockton, California 95202 Department of Water Resources (DWR) Andrea Lobato, Manager CEQA responsible agencies The Metropolitan Water District of Southern California (Metropolitan) Deirdre West, Environmental Planning Manager David A. Forkel Chairman, Board of Trustees Reclamation District No. 2028 343 East Main Street, Suite 815 Stockton, California 95202 Cell: (510) 693-9977 Nate Hershey, P.E. Contact person and phone District -

January 21, 2016 PC Agenda Packet

Solano County 675 Texas Street Fairfield, California 94533 www.solanocounty.com Agenda - Final Thursday, January 21, 2016 7:00 PM Board of Supervisors Chambers Planning Commission Planning Commission Agenda - Final January 21, 2016 Any person wishing to address any item listed on the Agenda may do so by submitting a Speaker Card to the Clerk before the Commission considers the specific item. Cards are available at the entrance to the meeting chambers. Please limit your comments to five (5) minutes. For items not listed on the Agenda, please see “Items From the Public”. All actions of the Solano County Planning Commission can be appealed to the Board of Supervisors in writing within 10 days of the decision to be appealed. The fee for appeal is $150. Any person wishing to review the application(s) and accompanying information may do so at the Solano County Department of Resource Management, Planning Division, 675 Texas Street, Suite 5500, Fairfield, CA. Non-confidential materials related to an item on this Agenda submitted to the Commission after distribution of the agenda packet are available for public inspection during normal business hours and on our website at www.solanocounty.com under Departments, Resource Management, Boards and Commissions. The County of Solano does not discriminate against persons with disabilities and is an accessible facility. If you wish to attend this meeting and you will require assistance in order to participate, please contact Kristine Letterman, Department of Resource Management at (707) 784-6765 at least 24 hours in advance of the event to make reasonable arrangements to ensure accessibility to this meeting. -

Restoring the Sacramento- San Joaquin Delta Ecosystem

APRIL 2015 RESTORING THE SACRAMENTO- SAN JOAQUIN DELTA ECOSYSTEM California EcoRestore (EcoRestore) will accelerate and implement a comprehensive suite of habitat restoration actions to support the long-term health of the Sacramento-San Joaquin Delta’s (Delta) native fish and wildlife species. 3,500 ACRES ACRES MANAGED WETLANDS CREATED 9,000 for subsidence reversal and MORE THAN TIDAL & SUB-TIDAL HABITAT RESTORATION carbon management 30,000 ACRES OF DELTA HABITAT 1,000+ ACRES ACRES RESTORATION 17,500+ PROPOSITION 1 & 1E FUNDED FLOODPLAIN RESTORATION & PROTECTION RESTORATION PROJECTS 500+ acres restored; planning, Aquatic, riparian and upland permitting and financing secured habitat projects; multi-benefit for an additional 17,000 acres flood management projects Coordinate with Through the Delta Stewardship Council’s Delta Implement multiple fish existing local Habitat Science Plan, leverage collaborative Delta science passage improvement Conservation Plans and efforts such as the Interagency Ecological Program projects in the Yolo Natural Community and Interim Science Action Agenda, and undertake Bypass and other key Conservation Plans investigations that support adaptive management locations (HCP/NCCP) and long-term understanding of Delta systems. Over the next 5 years, California will pursue more than 30,000 acres of critical Delta restoration under the EcoRestore program, and pursuant to pre-existing regulatory requirements and various enhancements to improve the overall health of the Delta. Proposition 1 funds and other state public dollars will be directed exclusively for public benefits unassociated with any regulatory compliance responsibilities. Additional priority restoration projects will be identified through regional and locally-led planning processes facilitated by the Delta Conservancy. Plans will be completed for the Cache Slough, West Delta, Cosumnes, and South Delta. -

San Joaquin Delta Recreational Boating

1 2 3 4 5 6 7 8 9 10 h g u Bascule lo Br. S S n o Marinas AND r AND d L e g t L t r u a IS 84 h IS s AND S g Marinas Actively Distributing and Collecting s L 4 u 5 o l ugh Absorbents for Free IS S A o A CITIES 35 Sl TWIN RD S l h o Certified Used Oil Collection Centers, Free Drop Off C g u u g a g t c o h h a l a h o e S b S R Y Swing Marinas with Sewage Pumpouts m E a Br. e T CT t E13 S T S l h 99 o g U u BERT u S Marinas with Fuel Dock Open to the Public g SPE r lo h LI e h S O ug in lo M S PR D s Bridges R w do ea RD M ELM SIMMERHORN RD Y R A t E L 34 5 Interstate Highway L c e G A L T in HARVEY RD BOESSOW RD d p Bascule s s C ST ay o LOCKE r Br. AVE LINE Sl. P 16 CARO 84 RYER NEW HOPE RD 6 17 State Highway GRAND 10 RIV 15 Fixed 220 ER RD W A L N U T RD Br. KOST RD J9 Howard Landing B ISLAND G R O V E IL B Ferry County Roads Cable VA Swing RD LAUFFER RD EE Ferries V E Br. L LD H 31 O 41 v RT NO R D RD C W WALNUT GROVE 0 5 Miles R a E D ISLAND c h R h g J11 e u V N lo I O 75 S T 71 E R 0 L 5 Kilometers W S I NE HOPE A LANDING RD W RD L KER J8 ND S 56 160 l ISLA o TRACT u RD ANDRUS Slough g IS J10 L. -

San Joaquin River Delta, California, Flow-Station Network

Innovation in Monitoring: The U.S. Geological Survey Sacramento–San Joaquin River Delta, California, Flow-Station Network The U.S. Geological Survey (USGS) 121˚45' 121˚30' 121˚15' installed the first gage to measure the flow 38˚ of water into California’s Sacramento–San 30' Sacramento Channel Joaquin River Delta (figs. 1, 2) from the River FPT Freeport Sacramento Sacramento- Sacramento River in the late 1800s. Today, r San Joaquin ve San Yolo Bypass i Delta s R a network of 35 hydro-acoustic meters Francisco ne m u s measure flow throughout the delta. This San o Francisco Sutter/ C region is a critical part of California’s Bay Hood Steamboat freshwater supply and conveyance system. San Elk Slough corridor Joaquin Sacramento Deep Water Ship With the data provided by this flow-station River SUT Delta network—sampled every 15 minutes and Sutter transfer Slough HWB flow updated to the web every hour—state Slough SSS SDC and federal water managers make daily 38˚ Creek DWS DLC Mokelumne 15' GES decisions about how much freshwater LIB Walnut Dry can be pumped for human use, at which RYI GSS Grove Steamboat NMR locations, and when. Fish and wildlife Yolo Bypass flow SMR River R scientists, working with water managers, ive r Mokelumne Rio Vista SRV River system also use this information to protect fish exchange Threemile Slough Lodi species affected by pumping and loss of MOK SDI TSL habitat. The data are also used to help LPS to en determine the success or failure of efforts Sacram OSJ SJJ FAL PRI to restore ecosystem processes in what has MAL San Joaquin been called the “most managed and highly Pittsburg ORO River/central delta exchanges altered” watershed in the country. -

Agricultural Land Use in the Delta

CHAPTER 5 Protect and Enhance the Unique Cultural, Recreational, Natural Resource, and Agricultural Values of the California Delta as an Evolving Place CHAPTER 5 PROTECT AND ENHANCE THE UNIQUE CULTURAL, RECREATIONAL, NATURAL RESOURCE, AND AGRICULTURAL VALUES OF THE CALIFORNIA DELTA AS AN EVOLVING PLACE ABOUT THIS CHAPTER This chapter describes the unique values that distinguish the Sacramento- San Joaquin Delta (Delta) and make it a special region. It also outlines the Delta Stewardship Council’s (Council) five core strategies for protecting and enhancing these values: ■ Designate the Delta as a special place worthy of national and state attention ■ Plan to protect the Delta’s lands and communities ■ Maintain Delta agriculture as a primary land use, a food source, a key economic sector, and a way of life ■ Encourage recreation and tourism that allow visitors to enjoy and appreciate the Delta, and that contribute to its economy ■ Sustain a vital Delta economy that includes a mix of agriculture, tourism, recreation, commercial and other industries, and vital components of state and regional infrastructure The 2 policies and 19 recommendations to carry out these strategies are found at the end of the chapter. Protecting the Delta as a place also depends on the strategies to reduce flood and other risks to the Delta that are described in Chapter 7. 164 DELTA PLAN, 2013 CHAPTER 5 PROTECT AND ENHANCE THE UNIQUE CULTURAL, RECREATIONAL, NATURAL RESOURCE, AND AGRICULTURAL VALUES OF THE CALIFORNIA DELTA AS AN EVOLVING PLACE RELEVANT LEGISLATION The Sacramento-San Joaquin Delta Reform Act of 2009 (3) Maximize public access to Delta resources and declared State policy for the resources and values of the maximize public recreational opportunities in the Delta (Water Code section 85054): Delta consistent with sound resources conservation principles and constitutionally protected rights of “Coequal goals” means the two goals of providing a private property owners. -

The Colorful P.E.O. Woman by Judy R

MAY—JUNE The Colorful 0908 8 P.E.O. Woman 18 A LOOK at THE U.K. P.E.O. GROUP 32 THE ROLE OF RELIGION IN P.E.O. Philanthropic Educational Organization OFFICERS OF INTERNATIONAL CHAPTER President Barbara Andes STUDY AND RESEARCH COMMITTEE 1243 Miramar Dr., Fullerton, CA 92831-2038 Chairman, Barbara James, 708 E Anchor Way, Post Falls, ID 83854 First Vice President Elizabeth E. Garrels Vice Chairman, Carol M. Thomason, 4320 N 28th Way, Phoenix, AZ 85016 2257 235th St., Mount Pleasant, IA 52641-8582 Kay Duffield, 1919 Syringa Dr., Missoula, MT 59803 Mary Stroh, 4721 Woodwind Way, Virginia Beach, VA 23455-4770 Second Vice President Susan Reese Sellers Barbara Rosi, 39W600 Oak Shadows Ln., Saint Charles, IL 60175-6983 12014 Flintstone Dr., Houston, TX 77070-2715 Elizabeth McFarland, 3924 Los Robles Dr., Plano, TX 75074-3831 Organizer Maria T. Baseggio HISTORY COMMITTEE OF ONE 173 Canterbury Ln., Blue Bell, PA 19422-1278 Wilma Leonard Turner, 1308 Highland Dr., Rolla, MO 65401 Recording Secretary Beth Ledbetter NOMINATING COMMITTEE 910 Tucker Hollow Rd. W, Fall Branch, TN 37656-3622 Chairman, Mary S. Hanley, 471 Middlesex Ave., Metuchen, NJ 08840 Administrative Staff Judy French, 7059 W Christian Dr., New Palestine, IN 46163-9114 Chief Executive Officer Anne Pettygrove Sue Gates, 1305 S Main, Aberdeen, SD 57401 [email protected] Elise Weed, 1317 NW 150th Ter., Edmond, OK 73013 Director of Finance/Treasurer Kathy A. Soppe Nancy Yamamoto, 2687 Norwood Pl., Carson City, NV 89703 [email protected] Director of Communications/Historian Joyce C. Perkins Special Committee for Membership Advancement [email protected] Elizabeth E. -

Delta Narratives-Saving the Historical and Cultural Heritage of The

Delta Narratives: Saving the Historical and Cultural Heritage of The Sacramento-San Joaquin Delta Delta Narratives: Saving the Historical and Cultural Heritage of The Sacramento-San Joaquin Delta A Report to the Delta Protection Commission Prepared by the Center for California Studies California State University, Sacramento August 1, 2015 Project Team Steve Boilard, CSU Sacramento, Project Director Robert Benedetti, CSU Sacramento, Co-Director Margit Aramburu, University of the Pacific, Co-Director Gregg Camfield, UC Merced Philip Garone, CSU Stanislaus Jennifer Helzer, CSU Stanislaus Reuben Smith, University of the Pacific William Swagerty, University of the Pacific Marcia Eymann, Center for Sacramento History Tod Ruhstaller, The Haggin Museum David Stuart, San Joaquin County Historical Museum Leigh Johnsen, San Joaquin County Historical Museum Dylan McDonald, Center for Sacramento History Michael Wurtz, University of the Pacific Blake Roberts, Delta Protection Commission Margo Lentz-Meyer, Capitol Campus Public History Program, CSU Sacramento Those wishing to cite this report should use the following format: Delta Protection Commission, Delta Narratives: Saving the Historical and Cultural Heritage of the Sacramento-San Joaquin Delta, prepared by the Center for California Studies, California State University, Sacramento (West Sacramento: Delta Protection Commission, 2015). Those wishing to cite the scholarly essays in the appendix should adopt the following format: Author, "Title of Essay", in Delta Protection Commission, Delta Narratives: Saving the Historical and Cultural Heritage of the Sacramento-San Joaquin Delta, prepared by the Center for California Studies, California State University, Sacramento (West Sacramento: Delta Protection Commission, 2015), appropriate page or pages. Cover Photo: Sign installed by Discover the Delta; art by Marty Stanley; Photo taken by Philip Garone.