Income Tax Fact Sheet 4, Reciprocity

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Mason's Minnesota Statutes 1927

1940 Supplement To Mason's Minnesota Statutes 1927 (1927 to 1940) (Superseding Mason s 1931, 1934, 1936 and 1938 Supplements) Containing the text of the acts of the 1929, 1931, 1933, 1935, 1937 and 1939 General Sessions, and the 1933-34,1935-36, 1936 and 1937 Special Sessions of the Legislature, both new and amendatory, and notes showing repeals, together with annotations from the various courts, state and federal, and the opinions of the Attorney General, construing the constitution, statutes, charters and court rules of Minnesota together with digest of all common law decisions. Edited by William H. Mason Assisted by The Publisher's Editorial Staff MASON PUBLISHING CO. SAINT PAUL, MINNESOTA 1940 CH. 56C—NEWSPAPERS §7392 7352-14. Violation a gross misdemeanor.—In the with the ownership, printing or publishing of any such event of any newspaper failing to file and register as publication or of any article published therein either provided for in Section 1 of this act, the party printing in a criminal action for libel by reason of such publica- or publishing the same shall be guilty of a gross mis- tion or in any civil action based thereon. (Act Apr. demeanor. (Act Apr. 21, 1931, c. 293, §4.) 21, 1931, c. 293, §5.) 7352-15. Court to determine ownership.—In the 7353-10. Definition.—By the term "newspaper" aa event of the publication of any newspaper within the expressed herein, shall be included any newspaper, State of Minnesota without the names of-the owners circular or any other publication whether issued regu- and publishers thereof fully set forth in said news- larly or intermittently by the same parties or by paper, circular or publication, the court or the jury may determine such ownership and publisher on evi- parties, one of whom has been associated with one or dence of the general or local reputation of that fact more publication of such newspaper or circular, and opinion evidence may be offered and considered whether the name of the publication be the same or by the court or Jury in any case arising in connection different. -

Indiana Michigan Power Company State of Indiana

I.U.R.C. NO. 18 ORIGINAL SHEET NO. 1 INDIANA MICHIGAN POWER COMPANY STATE OF INDIANA INDIANA MICHIGAN POWER COMPANY SCHEDULE OF TARIFFS AND TERMS AND CONDITIONS OF SERVICE GOVERNING SALE OF ELECTRICITY IN THE STATE OF INDIANA ISSUED BY EFFECTIVE FOR ELECTRIC SERVICE RENDERED TOBY L. THOMAS ON AND AFTER MARCH 11, 2020 PRESIDENT FORT WAYNE, INDIANA ISSUED UNDER AUTHORITY OF THE INDIANA UTILITY REGULATORY COMMISSION DATED MARCH 11, 2020 IN CAUSE NO. 45235 I.U.R.C. NO. 18 ORIGINAL SHEET NO. 2 INDIANA MICHIGAN POWER COMPANY STATE OF INDIANA LOCALITIES WHERE ELECTRIC SERVICE IS AVAILABLE LOCALITY COUNTY LOCALITY COUNTY Aboite Township Allen Decatur Adams Adams Township Allen Delaware Township Delaware Albany Randolph Dunkirk Jay Albion Noble Blackford Albion Township Noble Duck Creek Township Madison Alexandria Madison Allen Township Noble Eaton Delaware Anderson Township LaPorte Eel River Township Allen Elkhart Elkhart Baugo Township Elkhart Elwood Madison Bear Creek Township Jay Bear Creek Township Adams Fall Creek Township Henry Benton Township Elkhart Fairfield Township DeKalb Berne Adams Fairmount Grant Blountsville Henry Farmland Randolph Blue Creek Township Adams Fort Wayne Allen Boone Township Madison Fowlerton Grant Bryant Jay Franklin Township DeKalb Bryant Township Wells Franklin Township Grant Butler DeKalb Franklin Township Randolph Butler Township DeKalb French Township Adams Cedar Creek Township Allen Galena Township LaPorte Center Township Delaware Gas City Grant Center Township Grant Gaston Delaware Center Township LaPorte Geneva Adams Center Township Marshall German Township St. Joseph Centre Township St. Joseph Grabill Allen Chester Township Wells Grant Township DeKalb Chesterfield Madison Green Township Noble Churubusco Whitley Green Township Randolph Clay Township St. -

Illinois Lake Michigan Implementation Plan

Illinois Lake Michigan Implementation Plan Creating a Vision for the Illinois Coast Photo credits: Lloyd DeGrane, Alliance for the Great Lakes and Duane Ambroz, IDNR Final December 2013 The Illinois Lake Michigan Implementation Plan (ILMIP) was developed by the Illinois Department of Natural Resources in partnership with the Alliance for the Great Lakes, Bluestem Communications (formerly Biodiversity Project), Chicago Wilderness, and Environmental Consulting & Technology, Inc. Developed by the Illinois Coastal Management Program, a unit of the Illinois Department of Natural Resources and supported in part through the National Oceanic and Atmospheric Administration This project was funded through the U.S. EPA Great Lakes Restoration Initiative. Equal opportunity to participate in programs of the Illinois Department of Natural Resources (IDNR) and those funded by the U.S. Fish and Wildlife Service and other agencies is available to all individuals regardless of race, sex, national origin, disability, age, religion, or other non-merit factors. If you believe you have been discriminated against, contact the funding source’s civil rights office and/or the Equal Employment Opportunity Officer, IDNR, One Natural Resources Way, Springfield, IL 62702-1271; 217/785-0067, TTY 217/782-9175. Table of Contents I. Introduction ......................................................................................................................... 1 II. Illinois Lake Michigan Watersheds .................................................................................... -

State Abbreviations

State Abbreviations Postal Abbreviations for States/Territories On July 1, 1963, the Post Office Department introduced the five-digit ZIP Code. At the time, 10/1963– 1831 1874 1943 6/1963 present most addressing equipment could accommodate only 23 characters (including spaces) in the Alabama Al. Ala. Ala. ALA AL Alaska -- Alaska Alaska ALSK AK bottom line of the address. To make room for Arizona -- Ariz. Ariz. ARIZ AZ the ZIP Code, state names needed to be Arkansas Ar. T. Ark. Ark. ARK AR abbreviated. The Department provided an initial California -- Cal. Calif. CALIF CA list of abbreviations in June 1963, but many had Colorado -- Colo. Colo. COL CO three or four letters, which was still too long. In Connecticut Ct. Conn. Conn. CONN CT Delaware De. Del. Del. DEL DE October 1963, the Department settled on the District of D. C. D. C. D. C. DC DC current two-letter abbreviations. Since that time, Columbia only one change has been made: in 1969, at the Florida Fl. T. Fla. Fla. FLA FL request of the Canadian postal administration, Georgia Ga. Ga. Ga. GA GA Hawaii -- -- Hawaii HAW HI the abbreviation for Nebraska, originally NB, Idaho -- Idaho Idaho IDA ID was changed to NE, to avoid confusion with Illinois Il. Ill. Ill. ILL IL New Brunswick in Canada. Indiana Ia. Ind. Ind. IND IN Iowa -- Iowa Iowa IOWA IA Kansas -- Kans. Kans. KANS KS A list of state abbreviations since 1831 is Kentucky Ky. Ky. Ky. KY KY provided at right. A more complete list of current Louisiana La. La. -

South Dakota Department of Corrections 3200 East Highway 34, C/O 500 East Capitol Avenue Pierre, SD 57501 (605) 773-3478

PRISON INFORMATION PROJECT [email protected] c/o Prof. Margo Schlanger 910 Legal Research Building 625 South State Street Ann Arbor, Michigan 48109-1215 February 13, 2014 FOIA Coordinator South Dakota Department of Corrections 3200 East Highway 34, c/o 500 East Capitol Avenue Pierre, SD 57501 (605) 773-3478 Re: Request Related to Prisoner Grievances and Prisoner Correspondence Dear FOIA Coordinator: We are University of Michigan Law School students conducting a research project (the Prison Information Project) on prisoner grievance and correspondence/publication procedures throughout state prison systems. As part of our project, we are requesting public records from various state departments of corrections. Our request is made under the South Dakota Sunshine Law, S.D.C.L. 1-27-1 et seq. The goal of our project is to increase public awareness and enhance the public interest through the collection, analysis, and dissemination of information regarding prisoner grievance procedures and correspondence/publication guidelines. To that end, the Prison Information Project requests the following documents: Records Requested 1. Any current prisoner handbook or manual (including any inmate orientation handbook or manual), system-wide or institution-specific. 2. All current prisoner grievance regulations, policies, guidelines, manuals, directives, rules, etc., including general grievance policies/guidelines/etc. and specific grievance policies/guidelines/etc. relating to, for example, health care or sexual assault. • If the attached document is the only and most current and complete policy, please indicate as such. If this is the case, there is no need to send a duplicate policy. • By "grievance," we mean any grievance or complaint, whether formal or informal, whatever the subject matter. -

List of Surrounding States *For Those Chapters That Are Made up of More Than One State We Will Submit Education to the States and Surround States of the Chapter

List of Surrounding States *For those Chapters that are made up of more than one state we will submit education to the states and surround states of the Chapter. Hawaii accepts credit for education if approved in state in which class is being held Accepts credit for education if approved in state in which class is being held Virginia will accept Continuing Education hours without prior approval. All Qualifying Education must be approved by them. Offering In Will submit to Alaska Alabama Florida Georgia Mississippi South Carolina Texas Arkansas Kansas Louisiana Missouri Mississippi Oklahoma Tennessee Texas Arizona California Colorado New Mexico Nevada Utah California Arizona Nevada Oregon Colorado Arizona Kansas Nebraska New Mexico Oklahoma Texas Utah Wyoming Connecticut Massachusetts New Jersey New York Rhode Island District of Columbia Delaware Maryland Pennsylvania Virginia West Virginia Delaware District of Columbia Maryland New Jersey Pennsylvania Florida Alabama Georgia Georgia Alabama Florida North Carolina South Carolina Tennessee Hawaii Iowa Illinois Missouri Minnesota Nebraska South Dakota Wisconsin Idaho Montana Nevada Oregon Utah Washington Wyoming Illinois Illinois Indiana Kentucky Michigan Missouri Tennessee Wisconsin Indiana Illinois Kentucky Michigan Ohio Wisconsin Kansas Colorado Missouri Nebraska Oklahoma Kentucky Illinois Indiana Missouri Ohio Tennessee Virginia West Virginia Louisiana Arkansas Mississippi Texas Massachusetts Connecticut Maine New Hampshire New York Rhode Island Vermont Maryland Delaware District of Columbia -

Texas Iowa Kansas Ohio Illinois Nebraska Missouri Oklahoma

Sully Codington Chippewa Wright Anoka Presque Isle Meade Spink Lac qui Parle Kandiyohi Meeker Lincoln Cheboygan Taylor Langlade Menominee Charlevoix Clark Ramsey Hennepin St. Croix Marinette Hughes Hamlin Deuel Leelanau Stanley Chippewa Campbell Haakon Hyde Yellow Medicine McLeod Pennington Hand Carver Alpena Weston Renville Washington Dunn Menominee Otsego Montmorency Antrim Beadle Marathon Oconto Door Kingsbury Scott Dakota Pierce Leelanau Sibley Eau Claire Custer Brookings Lincoln Clark Shawano Jones Lyon Pepin Buffalo Redwood Oscoda Alcona Grand Traverse Kalkaska Crawford Jerauld Benzie Jackson Lyman Nicollet Le Sueur Goodhue Sanborn Rice Miner Brown Wood Kewaunee Portage Waupaca Converse Lake Buffalo Brown Moody Wabasha Outagamie Fall River South Dakota Pipestone Trempealeau Jackson Shannon Mellette Brule Murray Minnesota Iosco Niobrara Manistee Wexford Missaukee Roscommon Ogemaw Aurora Cottonwood Watonwan Blue Earth Davison Waseca Steele Hanson Dodge McCook Olmsted Waushara Bennett Manitowoc Minnehaha Winona Winnebago Calumet Tripp Rock Arenac Todd Nobles Monroe Jackson La Crosse Juneau Mason Lake Osceola Clare Gladwin Douglas Wisconsin Martin Adams Faribault Wyoming Freeborn Hutchinson Marquette Huron Dawes Gregory Mower Green Lake Charles Mix Fillmore Turner Lyon Houston Fond du Lac Sheboygan Lincoln Osceola Bay Sioux Dickinson Emmet Vernon Oceana Mecosta Isabella Midland Winnebago Keya Paha Worth Newaygo Platte Sheridan Bon Homme Mitchell Boyd Yankton Howard Columbia Sioux Sauk Tuscola Kossuth Richland Dodge Sanilac Cherry O'Brien -

Grand Rapids

16 Wright Twp. Alpine Twp. 131 Plainfield CANNONSBURG Coopersville 19 GARFIELD 96 Twp. 23 T LD I E Polkton O FI 48TH 40TH GRAND RAPIDS 88TH C N AI 68TH HAYES 60TH 25 L 4 MILE ALPINE WALKER 4 MILE P Twp. M-44 LEONARD 24 FRUIT RIDGE 37 CONN 33 G 28 R 26 30 W RIVER 16TH 96 31B GE A JOHNSON R 3 MILE N A EAST BELTLINE 3 MILE 96 L D D 3 MILE R R A I PETTIS F V REMEMBRANCE GUILD O KNAPP E R 12TH BASS Allendale LEONARD 131 Grand Rapids R D G LINCOLN LAKE DEAN F 24TH 2 MILE PLAINFIELD W FULLER r 88 KNAPP Twp. a Y Twp. TURNER n WARNER ANN d KENT COUNTY R 14TH OTTAWA COUNTY OTTAWA 8TH 37 BRISTOL 44 iv Ada Twp. e PETTIS BUCHANAN LEONARD ALPINE 87 GRAND RAPIDS36 r MONROE LEONARD 56TH B.R. Tallmadge Twp. 77 131 79 37 84TH HONEY CREEK VALLEY 78 196 CRAHEN RIVER HILL LAKE MICHIGAN 76 A 77C 38 45 45 45 MICHIGAN B AND R COLLINDALE GR IV E FULTON R LAND MARY- 39 FULTON Grand Valley Walker 75 21 L State University IN PIERCE D LOVERS LN O BRIEN E WEALTHYB N Reeds 11 T COLLEGE LUCE RKE 84A B TERWO MA FRANKLIN Lake ADA 60TH 64TH T R 96TH T TH L 44 U K AK FILLMORE B 83B A E 73 L 40A A 21 HILL FOREST M RIVERVIEW CASCADE FILLMORE A WILSON S AIRPORT D 83A Z UN O East 96 196 O MO PLYMOUTH TAYLOR TAYLOR BURTON INDIAN LEE G BURTON r Grand Rapids COTTONWOODa 72 BAUER n 82 SPAULDING d 196 PORTER ALGER 37 BURTON R iv Porter Lake B POLK PARIS EAST er 70 28TH 81 Georgetown Twp. -

The Need for Action in Michigan

The Need for Action in Michigan For decades, infrastructure in Michigan has suffered from a systemic lack of investment. The need for action is clear: Michigan’s infrastructure received a D+ grade on its Infrastructure Report Card. The American Jobs Plan will make a historic investment in our nation’s infrastructure. • ROADS AND BRIDGES: In Michigan there are 1,219 bridges and over 7,300 miles of highway in poor condition. Since 2011, commute times have increased by 4.6% in Michigan and on average, each driver pays $644 per year in costs due to driving on roads in need of repair. The American Jobs Plan will devote more than $600 billion to transform our nations' transportation infrastructure and make it more resilient, including $115 billion repairing roads and bridges. • PUBLIC TRANSPORTATION: Michiganders who take public transportation spend an extra 67.7% of their time commuting and non-White households are 5.6 times more likely to commute via public transportation. 17% of trains and other transit vehicles in the state are past useful life. The American Jobs Plan will modernize public transit with an $85 billion investment. • RESILIENT INFRASTRUCTURE: From 2010 to 2020, Michigan has experienced 19 extreme weather events, costing the state up to $5 billion in damages. The President is calling for $50 billion to improve the resiliency of our infrastructure and support communities’ recovery from disaster. • DRINKING WATER: Over the next 20 years, Michigan’s drinking water infrastructure will require $13 billion in additional funding. The American Jobs Plan includes a $111 billion investment to ensure clean, safe drinking water is a right in all communities. -

Geology of Michigan and the Great Lakes

35133_Geo_Michigan_Cover.qxd 11/13/07 10:26 AM Page 1 “The Geology of Michigan and the Great Lakes” is written to augment any introductory earth science, environmental geology, geologic, or geographic course offering, and is designed to introduce students in Michigan and the Great Lakes to important regional geologic concepts and events. Although Michigan’s geologic past spans the Precambrian through the Holocene, much of the rock record, Pennsylvanian through Pliocene, is miss- ing. Glacial events during the Pleistocene removed these rocks. However, these same glacial events left behind a rich legacy of surficial deposits, various landscape features, lakes, and rivers. Michigan is one of the most scenic states in the nation, providing numerous recre- ational opportunities to inhabitants and visitors alike. Geology of the region has also played an important, and often controlling, role in the pattern of settlement and ongoing economic development of the state. Vital resources such as iron ore, copper, gypsum, salt, oil, and gas have greatly contributed to Michigan’s growth and industrial might. Ample supplies of high-quality water support a vibrant population and strong industrial base throughout the Great Lakes region. These water supplies are now becoming increasingly important in light of modern economic growth and population demands. This text introduces the student to the geology of Michigan and the Great Lakes region. It begins with the Precambrian basement terrains as they relate to plate tectonic events. It describes Paleozoic clastic and carbonate rocks, restricted basin salts, and Niagaran pinnacle reefs. Quaternary glacial events and the development of today’s modern landscapes are also discussed. -

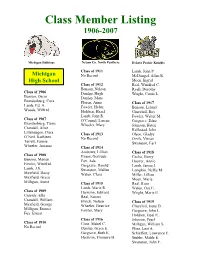

Class of 1906 Dunlap, Hugh Wright, Curtis L

Class Member Listing 1906-2007 Michigan Bulldogs Nelson Co. North Panthers Dakota Prairie Knights Class of 1911 Lamb, John P. Michigan No Record McDougal, Allan R. High School Moen, Ingrid Class of 1912 Real, Winifred C. Benson, Nelson Ryall, Dorothy Class of 1906 Dunlap, Hugh Wright, Curtis L. Benson, Oscar Dunlap, Mary Brandenburg, Cora Floren, Anna Class of 1917 Lamb, Ed. A. Fowler, Helen Benson, Leland Woods, Wilfred Holdren, Hazel Churchill, Roy Lamb, John R. Fowler, Walter M. Class of 1907 O’Connel, Lurene Gargrave, Edna Brandenburg, Tunis Wheeler, Mary Johnson, Hattie Crandall, Alice Kallestad, John Lillehaugen, Clara Class of 1913 Olson, Gladys O’Neil, Kathleen No Record Orvik, Vivian Terrett, Fannie Swanston, Earl Wheeler, Amassa Class of 1914 Andrews, Lillian Class of 1918 Class of 1908 Evans, Gertrude Cecka, Henry Benson, Marian Fox, Ada Hoover, Annie Fowler, Winifred Gargrave, Harold Lamb, James J. Lamb, J.S. Swanston, Mallan Lampkin, Nellie M. Maxfield, Dasiy Walen, Clara Miller, Lillian Maxfield, Grace Moen, Marie Milligan, Annie Class of 1915 Real, Rose Lamb, Marie R. Walen, Osa E. Class of 1909 Harrison, Edward Wright, Marie E. Cassidy, Ella Real, Naomi Crandall, William Elvick, Nelson Class of 1919 Maxfield, George Wheeler, Beatrice Churchill, Irene D. Milligan, Emmet Fowler, Mary Gargrave, John L. Fox, Ernest Holdren, Opal E. Class of 1916 Johnson, Pearl Class of 1910 Cone, Mabel C. Milligan, William S. No Record Dunlap, Grace E. Pline, Lest A. Gargrave, Ruth E. Schieffert, Lawrence E. Harrison, Florence H. Stubbs, Mable E. Swanston, John F. Class of 1920 Barney, Blanche Harrison, George Dunlap, Ray Christianson, Alma Lamb, Claire Fowler, Fern Dusbabek, John Lamb, Maurice Harrison, Clifford Greenlee, Gladys Lillehaugen, Hilma Hoover, Alma Heinen, Mary Smith, Wilbert Lamb, Mary Hoynes, Estella Studley, Matilda Orvik, Walter L. -

Remote Sales Tax Collection in Michigan As a Result of South Dakota V

Remote Sales Tax Collection in Michigan as a result of South Dakota v. Wayfair How does the U.S. For more than thirty years, Michigan has followed U.S. Supreme Court Supreme Court’s precedent and only required sellers with a physical presence in the state decision impact to collect, pay or remit sales tax. The June 2018 U.S. Supreme Court decision in South Dakota v Wayfair overturned its previous decision in Michigan? Quill that required only a physical presence. Michigan’s standards for when sales and use tax are required are provided in administrative guidance from the Michigan Department of Treasury and changes to this guidance have been issued as a result of the Supreme Court’s recent decision. Why is Michigan Treasury is committed to the fair and efficient administration of the tax making this change? system. This change allows Treasury to consistently and fairly collect sales tax from both in-state and out-of-state businesses. Individuals are already required to pay sales tax on out-of-state purchases. This allows for more efficient collection of the sales tax by collecting from businesses rather than individuals. Who will be impacted? Out-of-state (remote) sellers with sales exceeding $100,000 or 200 or more transactions in Michigan in the previous calendar year will be required to collect and remit sales tax. These thresholds are consistent with South Dakota’s thresholds that were upheld by the U.S. Supreme Court. What is the financial Based on the thresholds above, Treasury estimates $203 Million in impact for Michigan? additional FY 2019 sales tax collection, rising to $236 Million in 2020 and $248 Million in 2021.