Liquidity Provider Program in Physical Delivery Stock Futures

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Análisis Carteras Modelo Españolas

4-jul-14 Análisis Carteras modelo españolas La siguiente tabla ofrece la evolución de las carteras modelo Evol. C.M. 20-Ibex35 (ene.'96/jul.'14) comparadas con el Ibex 35 del 3-jun-14 al 2-jul-14: 1000% Var. Mes Var. Año Dif año Ibex35 800% CARTERA 20 VALORES Ibex35 C.Mod. Ampliada 2,9% 9,2% 1,7% C.Mod. Media 3,6% 9,1% 1,6% 600% C.Mod. Simplificada 4,2% 10,8% 3,4% 400% IBEX 35 2,2% 7,4% n/a 200% Las tablas siguientes muestran la evolución de los valores que integran las carteras modelo españolas durante el pasado mes: 0% Cartera modelo ampliada 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 junio julio CM 20 valores: Cambios julio C. ampliada Peso % Rbd. x div C. ampliada Peso Beta Rbd. x div Entran Salen Cambian Peso (1) (1) Telefonica 6 Var.Mes2,87% 5,9% Telefonica 6 0,91 5,9% Acerinox +4 DIA -4 Santander +2 Santander 5 2,83% 7,7% Santander 7 1,204 7,8% Tubos R. -1 NH Hoteles 3 -1,24% 0,0% NH Hoteles 3 1,026 0,0% BBVA +2 ACS 3 2,01% 3,6% ACS 3 1,093 3,6% Técnicas R. -2 Tubos Reunidos 5 4,96% 0,7% Tubos Reunidos 4 1,323 0,7% Amadeus -3 BBVA 5 1,22% 3,6% BBVA 7 1,319 3,6% Tubacex -1 Cie Automotive -1 DIA 4 6,38% 2,3% Acerinox 4 1,343 3,5% Red Eléctrica +1 Iberdrola +3 Técnicas Reunidas 4 0,99% 3,1% Técnicas Reunidas 2 0,518 3,1% CM 20 valores vs Ibex en 2014 BME 7 5,15% 4,6% BME 7 1,096 4,7% 10% Ferrovial 6 1,80% 3,6% Ferrovial 6 0,76 3,6% 5% CaixaBank 7 2,34% 4,3% CaixaBank 7 1,194 4,3% Grifols 7 2,53% 0,5% Grifols 7 0,929 0,5% 0% Gamesa 4 2,34% 0,0% Gamesa 4 1,15 0,0% -5% Abertis 2 5,72% 3,6% Abertis 2 0,84 3,7% Cartera Ibex35 Amadeus 7 -2,32% 2,1% Amadeus 4 0,596 2,1% -10% 14 14 14 14 14 14 - - - - - - j Enagas 6 8,43% 5,7% Enagas 6 0,467 5,7% f e a m m CIE Automotive SA 6 11,15% 1,7% CIE Automotive SA 5 0,033 1,7% Iberdrola 2 5,82% 2,9% Iberdrola 5 0,714 2,9% CM 10 valores: Cambios julio Tubacex 6 -6,19% 0,6% Tubacex 5 1,136 0,6% Entran Salen Cambian Peso Red Electrica 5 4,21% 4,0% Red Electrica 6 0,69 4,0% BBVA +11 Amadeus -11 Red Eléctrica +1 100 3,11% 100 3,37% Iberdrolda +11 Tubos R. -

Diapositiva 1

Análisis de la presencia vasca en el ranking EU Industrial R&D Investment Scoreboard (2004-2009) Informe Noviembre2009 0 Comentario al documento La Comisión europea acaba de publicar la última edición del EU Industrial R&D Investment Scoreboard (2009) con un ranking de las 1.000 empresas europeas con mayor inversión en I+D. Este año, hay 21 empresas españolas en el ranking, con una inversión total de 1460 millones de euros. Como es habitual en este ranking, Telefónica lidera el grupo de empresas españolas desde el puesto 40 con una inversión que este año alcanza los 668 millones de euros. Entre las mil empresas que más invierten en I+D este año aparecen 7 empresas vascas: Iberdrola, Fagor, ITP, Gamesa, Cie Automotive, Faes Farma y CAF (que había desaparecido en años anteriores y ha vuelto a aparecer este año). Entre todas ellas suman una inversión total de 239 millones de euros, mejorando sensiblemente los 190 millones de euros de inversión total que aparecían en el ranking para el año anterior. Además, la evolución de la participación de las empresas vascas en este ranking desde el 2003 también es muy positiva, tanto en términos de inversión creciente como en cuanto al porcentaje de inversión de las empresas vascas sobre las empresas españolas. Hemos pasado de 2 empresas en 2003 con una inversión de apenas 80 millones de euros a 7 empresas con una inversión tres veces mayor y un porcentaje sobre el total del Estado sensiblemente superior (16.35%). Naider, noviembre 2009 Pág. 2 1 EU INDUSTRIAL R&D INVESTMENT SCOREBOARD 2004 2 EU INDUSTRIAL R&D INVESTMENT SCOREBOARD 2005 3 EU INDUSTRIAL R&D INVESTMENT SCOREBOARD 2006 4 EU INDUSTRIAL R&D INVESTMENT SCOREBOARD 2007 5 EU INDUSTRIAL R&D INVESTMENT SCOREBOARD 2008 6 EU INDUSTRIAL R&D INVESTMENT SCOREBOARD 2009 7 RESUMEN EUSKADI Pág. -

First Semester 2018

CIE Automotive pg. 1 CIE Automotive is 2018 included in Ibex 35 News pg. 3 CIE Lt Forge has launched a 33 second crankshaft production line First semester pg. 8 The I CSR Conference in Brazil pg. 9 Managing high value added processes www.cieautomotive.com CIE Automotive pg. 2 2018, a great year Dear friends, improve, we take them. In the general shareholders' meeting held in April, we announced a new improvement in the objectives for With half of the financial year already through, we can state that 2020 with the conviction that we will continue to perform better 2018 has been a great year so far. In June CIE Automotive stock than the world automotive market. And as we grow, we are was included in the Ibex-35, the principal benchmark index of maintaining a solid, healthy balance sheet, which reinforces our the Spanish stock market. This credibility for investors, customers made us the only representative and shareholders. of the automotive industry in a group with listed companies On our way as a leading company that lead their sectors. This in the automotive sector, our also places us as the fourth business growth has remained in Basque company of the index, step with our commitment to the one more reason to be proud. environment. Thus, in May we The addition to the Ibex-35 is joined the Social Impact Cluster, not only a chance to greatly coordinated by Forética. This increase the visibility of CIE platform, that already includes Automotive on the markets. It 60 large companies, promotes is, above all, further recognition initiatives to understand, evaluate, of the good performance we measure and improve our impact on have achieved in recent years. -

Análisis Carteras Modelo Españolas

5-jun-14 Análisis Carteras modelo españolas La siguiente tabla ofrece la evolución de las carteras modelo Evol. C.M. 20-Ibex35 (ene.'96/jun.'14) comparadas con el Ibex 35 del 5-may-14 al 3-jun-14: 1000% Var. Mes Var. Año Dif año Ibex35 800% CARTERA 20 VALORES Ibex35 C.Mod. Ampliada 2,1% 6,1% 1,0% C.Mod. Media 0,6% 5,3% 0,2% 600% C.Mod. Simplificada 0,4% 6,4% 1,3% 400% IBEX 35 2,9% 5,1% n/a 200% Las tablas siguientes muestran la evolución de los valores que integran las carteras modelo españolas durante el pasado mes: 0% Cartera modelo ampliada 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 mayo junio CM 20 valores: Cambios junio C. ampliada Peso % Rbd. x div C. ampliada Peso Beta Rbd. x div Entran Salen Cambian Peso (1) (1) Telefonica 8 Var.Mes-0,53% 6,2% Telefonica 6 0,931 6,1% DIA +3 Jazztel -3 Telefónica -2 Santander 5 4,99% 8,1% Santander 5 1,173 7,9% Téc.Reunidas -2 NH Hoteles 5 -7,39% 0,0% NH Hoteles 3 0,698 0,0% NH Hoteles -2 ACS 3 5,02% 3,5% ACS 3 0,86 3,5% Gamesa +1 Tubos Reunidos 3 6,14% 0,7% Tubos Reunidos 5 0,807 0,7% Tubacex +1 BBVA 5 6,29% 3,9% BBVA 5 1,137 3,8% Amadeus +2 Jazztel 6 -6,36% 0,0% DIA 4 0,78 0,0% Tb. -

Asuntos Que Se Someten a La Aprobación Del Consejo

Number: C-DF- 25/2019 Segment: Financial Derivatives Date: 24 June 2019 Circular Effective Date: 26 June 2019 Replaces: C-DF-20/2019 Subject Margin Calculation Parameters. In accordance with the provisions of the Article regarding “Margins required by BME CLEARING” of BME CLEARING’s Summary Rule Book, this Circular establishes the Margin Calculation Parameters. 1.- CONSTRUCTION OF VALUATION ARRAYS Total Percentage Extraordinary Fluctuation Increase and Margin Class Product Margin to be Decrease of Fluctuation analyzed Volatility 002 BONO 10 600 b.p. 480 b.p. 10% 021 IBEX 35, MINI IBEX 35 & MICRO IBEX 35 800 points 640 points 38% 0S1 IBEX 35 BANKS 11% 9% 10% 0S2 IBEX 35 ENERGY 8% 6% 10% 023 BBVA 11% 9% 29% 025 ENDESA 8% 6% 42% 027 IBERDROLA 8% 6% 32% 028 SANTANDER 11% 9% 30% 030 REPSOL 9% 7% 30% 031 TELEFÓNICA 8% 6% 26% 033 ACERINOX 12% 10% 27% 035 BANKINTER 10% 8% 34% 037 NATURGY 9% 7% 32% 038 INDRA 11% 9% 37% 041 AMADEUS 10% 8% 29% 043 INDITEX 10% 8% 28% 045 ACS 10% 8% 47% 046 BANCO SABADELL 13% 10% 33% 047 G FERROVIAL 9% 7% 31% 048 ACCIONA 9% 7% 29% 050 SACYR VALLEH. 13% 10% 41% 051 FCC 12% 10% 50% 052 ENAGAS 8% 6% 41% 053 REE 8% 6% 26% 054 SIEMENS GAMESA 16% 13% 29% 056 MEDIASET 13% 10% 43% 057 CORP. MAPFRE 10% 8% 44% 1/9 Total Percentage Extraordinary Fluctuation Increase and Margin Class Product Margin to be Decrease of Fluctuation analyzed Volatility 058 ATRESMEDIA 14% 11% 32% 066 COLONIAL 10% 8% 30% 067 BME 8% 6% 39% 068 GRIFOLS 10% 8% 28% 072 ARCELOR MITTAL 14% 11% 22% 073 TEC. -

Temporary Prohibition of Short Selling

11/13/2020 Temporary prohibition of short selling Temporary prohibition of short selling The FCA notifies that it temporarily prohibits short selling in the following instruments under Articles 23 (1) and 26 (4) of Regulation (EU) No 236/2012 of the European Parliament and of the Council of 14 March 2012. This follows a decision made by another EU Competent Authority. Details of the Financial Instruments concerned: • ABENGOA CLASE B (ISIN: ES0105200002) • ACCIONA, S.A. (ISIN: ES0125220311) • ACCIONES FOMENTO DE (ISIN: ES0122060314) • ACCIONES IBERDROLA (ISIN: ES0144580Y14) • ACERINOX, S.A. (ISIN: ES0132105018) • ACS,ACTIVIDADES DE CO (ISIN: ES0167050915) • AEDAS HOMES, S.A (ISIN: ES0105287009) • AENA, S.M.E., S.A. (ISIN: ES0105046009) • AIRBUS (ISIN:NL0000235190) • AMADEUS IT GROUP, S.A. (ISIN: ES0109067019) • APERAM (ISIN: LU0569974404) • APPLUS SERVICES, S.A. (ISIN: ES0105022000) • ARCELORMITTAL SA (ISIN: LU1598757687) • ATRESMEDIA CORPORAC (ISIN: ES0109427734) • AUDAX RENOVABLES, S.A (ISIN: ES0136463017) • BANCO BILBAO VIZCAYA (ISIN: ES0113211835) • BANCO DE SABADELL (ISIN: ES0113860A34) • BANCO SANTANDER S.A. (ISIN: ES0113900J37) • BANKIA, S.A. (ISIN: ES0113307062) • BANKINTER, S.A. (ISIN: ES0113679I37) • BIOSEARCH, S.A. (ISIN: ES0172233118) • CAIXABANK, S.A. (ISIN: ES0140609019) • CELLNEX TELECOM, S.A. (ISIN: ES0105066007 • CIE AUTOMOTIVE, S.A. (ISIN: ES0105630315) https://www.fca.org.uk/news/news-stories/temporary-prohibition-short-selling/printable/print 1/5 11/13/2020 Temporary prohibition of short selling • COCA-COLA EUROPEAN P (ISIN: GB00BDCPN049) • CODERE S.A. (ISIN: ES0119256032) • COMPAÑIA DE DISTRIBUC (ISIN: ES0105027009) • CONSTRUCCIONES Y AUX (ISIN: ES0121975009) • ENAGAS,S.A. (ISIN: ES0130960018) • ENCE ENERGIA Y CELULO (ISIN: ES0130625512) • ENDESA,S.A. (ISIN: ES0130670112) • ERCROS (ISIN: ES0125140A14) • EUSKALTEL, S.A. (ISIN: ES0105075008) • FAES FARMA, S.A. -

FACTSHEET - AS of 23-Sep-2021 Solactive Spain 40 Price Return Index

FACTSHEET - AS OF 23-Sep-2021 Solactive Spain 40 Price Return Index HISTORICAL PERFORMANCE 120 110 100 90 80 70 60 Jan-2010 Jan-2012 Jan-2014 Jan-2016 Jan-2018 Jan-2020 Solactive Spain 40 Price Return Index CHARACTERISTICS ISIN / WKN DE000SLA24C0 / SLA24B Base Value / Base Date 100 Points / 18.12.2009 Bloomberg / Reuters SOLSP40P Index / .SOLSP40P Last Price 115.98 Index Calculator Solactive AG Dividends Not included (Price index) Index Type Developed Markets Calculation 09:00am to 10:30pm (CET), every 15 seconds Index Currency EUR History Available daily back to 18.12.2009 Index Members 40 FACTSHEET - AS OF 23-Sep-2021 Solactive Spain 40 Price Return Index STATISTICS 30D 90D 180D 360D YTD Since Inception Performance -1.56% -2.33% 6.64% 40.27% 12.92% 15.98% Performance (p.a.) - - - - - 1.27% Volatility (p.a.) 14.16% 15.53% 14.74% 19.65% 15.84% 23.02% High 118.32 118.74 120.31 120.31 120.31 123.40 Low 112.94 109.11 108.51 78.99 98.33 57.78 Sharpe Ratio -1.19 -0.55 0.98 2.11 1.18 0.08 Max. Drawdown -4.54% -8.11% -9.31% -9.31% -9.31% -45.37% VaR 95 \ 99 -27.4% \ -44.5% -35.7% \ -62.7% CVaR 95 \ 99 -36.7% \ -48.5% -54.7% \ -91.5% COMPOSITION BY CURRENCIES COMPOSITION BY COUNTRIES ES 96.1% EUR 100.0% LU 3.9% TOP COMPONENTS AS OF 23-Sep-2021 Company Ticker Country Currency Index Weight (%) IBERDROLA SA IBE SQ Equity ES EUR 13.67% BANCO SANTANDER SA SAN SQ Equity ES EUR 12.81% BANCO BILBAO VIZCAYA ARGENTARIA SA BBVA SQ Equity ES EUR 8.97% INDUSTRIA DE DISENO TEXTIL SA ITX SQ Equity ES EUR 8.60% CELLNEX TELECOM SA CLNX SQ Equity ES EUR 8.31% AMADEUS -

STOXX SPAIN 30 Selection List

STOXX SPAIN 30 Last Updated: 20201001 ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) Rank (FINAL)Rank (PREVIOUS) ES0144580Y14 B288C92 IBE.MC 442464 IBERDROLA ES EUR Y 60.9 1 1 ES0113900J37 5705946 SAN.MC 407228 BCO SANTANDER ES EUR Y 26.6 2 2 ES0148396007 BP9DL90 ITX.MC 711131 Industria de Diseno Textil SA ES EUR Y 26.5 3 3 ES0109067019 B3MSM28 AMA.MC ES0017 AMADEUS IT GROUP ES EUR Y 21.4 4 4 ES0105066007 BX90C05 CLNX.MC ES502D CELLNEX TELECOM ES EUR Y 18.5 5 5 ES0113211835 5501906 BBVA.MC 550190 BCO BILBAO VIZCAYA ARGENTARIAES EUR Y 15.8 6 6 ES0178430E18 5732524 TEF.MC 488082 TELEFONICA ES EUR Y 14.8 7 7 ES0118900010 B038516 FER.MC B03851 FERROVIAL ES EUR Y 11.1 8 8 ES0105046009 BVRZ8L1 AENA.MC ES504F AENA SME ES EUR Y 8.8 9 10 ES0173516115 5669354 REP.MC 473322 REPSOL ES EUR Y 8.6 10 9 ES0171996087 BYY3DX6 GRLS.MC B01SPF GRIFOLS ES EUR Y 7.2 11 13 ES0130670112 5271782 ELE.MC 431536 ENDESA ES EUR Y 7.2 12 11 ES0173093024 BD6FXN3 REE.MC 672716 RED ELECTRICA CORPORATION ES EUR Y 6.9 13 12 ES0140609019 B283W97 CABK.MC EE009 CAIXABANK ES EUR Y 6.5 14 14 ES0116870314 5650422 NTGY.MC 417986 Naturgy Energy Group ES EUR Y 5.9 15 15 ES0143416115 B01CP21 SGREN.MC 462338 SIEMENS GAMESA ES EUR Y 5.2 16 16 ES0167050915 B01FLQ6 ACS.MC 533338 ACS ES EUR Y 4.7 17 17 ES0130960018 7383072 ENAG.MC 738307 ENAGAS ES EUR Y 4.6 18 18 ES0105025003 BNGNB77 MRL.MC ES403D MERLIN PROPERTIES SOCIMI ES EUR Y 2.6 19 20 ES0184696104 BH3SX44 MASM.MC ES803H MASMOVIL IBERCOM ES EUR Y 2.4 20 21 ES0113679I37 5474008 BKT.MC 407141 BANKINTER ES EUR Y 2.4 21 19 ES0184262212 5638280 VIS.MC 563828 VISCOFAN ES EUR Y 2.2 22 22 ES0183746314 5466726 VID.MC ES406G VIDRALA ES EUR Y 2 23 25 ES0125220311 5579107 ANA.MC 423932 ACCIONA S.A. -

Ibex 35, Revisión Del 7-Junio: BME O CIE Automotive Ocuparán La Plaza De Abertis Martes, 8 De Mayo De 2018

BC% Nota de Análisis Ibex 35, revisión del 7-junio: BME o CIE Automotive ocuparán la plaza de Abertis Martes, 8 de mayo de 2018 A partir de mañana 9 de mayo el Ibex cotizará con 34 valores tras la salida de Abertis , una vez concluido el plazo de aceptación de su OPA. No será hasta el 7 de junio cuando el Comité Técnico Asesor del Ibex en reunión ordinaria decida quién entra en su lugar . Si tomamos los volúmenes negociados en los últimos seis meses, los valores mejor posicionados para ocupar el puesto que deja Abertis serían BME y Cie Automotive. Ambas tienen volúmenes similares, aunque a favor de BME está su mayor free-float. Aunque hay otros valores con mayor volumen negociado en el mismo periodo (OHL, Sacyr, Ence y NH Hoteles), ninguno de ellos cumple con el criterio mínimo de ponderación (0,3% de capitalización bursátil promedio del Ibex en últimos 6 meses). Volumen Cumple criterio Cumple período acum ulado Ponderación minimo minimo (1/3 del últimos 6 Miembro promedio 6 ponderación período de Valor m eses (mln €) del IBEX meses (0,3%) cómputo) 1 BANCO SANTANDER 24.415 SI 13,97% SI SI 2 BBVA 14.020 SI 7,19% SI SI 3 TELEFONICA 13.638 SI 6,71% SI SI 4 INDITEX 11.059 SI 8,00% SI SI 5 IBERDROLA SA 10.478 SI 6,35% SI SI 6 REPSOL SA 8.555 SI 3,65% SI SI 7 CAIXABANK S.A 6.005 SI 3,73% SI SI 8 ABERTIS 5.338 SI 2,89% SI SI 9 AMADEUS IT GROUP 4.951 SI 4,21% SI SI 10 BANCO SABADELL 3.566 SI 1,49% SI SI 11 ENDESA 3.270 SI 1,21% SI SI 12 GAS NATURAL SDG 3.225 SI 1,83% SI SI 13 BANKIA SA 2.969 SI 1,09% SI SI 14 ENAGAS SA 2.816 SI 0,86% SI SI 15 -

Cie News N.35 First Semester 2019

CIE NEWS N.35 FIRST SEMESTER 2019 CIE ACQUIRES CIE REINFORCES AURANGABAD ITS MACHINING ELECTRICALS CAPACITY IN LIMITED MEXICO OUR COMMITMENT INTERVIEW TO SDG AITOR ZAZPE MANAGING HIGH VALUE ADDED PROCESSES 1 WITH OUR GOALS ACHIEVED, WE’RE LOOKING FOR NEW SUMMITS Dear colleagues, So far, this year, we have witnessed circumstantial And, all of this, without losing sight of our drive to grow, a elements that brought with them significant uncertainties for the constant feature in the history of the company which, in March, took international financial markets and, in particular, the automotive a new step with the acquisition of Aurangabad Electricals Limited sector. The Trump Administration advances with its protectionist (AEL). This operation, carried out through Mahindra CIE, reaffirms our policies and commercial war trumpets are sounding between the diversification by extending CIE’s operational model into a market, the United States and China; the Brexit labyrinth still hasn’t found a way Indian one, which we emerged into a relatively short time ago and with out; pressure is increasing in several western countries to replace a technology, aluminium, that was lacking in Asia. diesel engines with other alternatives… on the whole, a changeable and utterly complex environment. Instead of being intimidated, at AEL, which has over 3,300 employees, is a key supplier CIE Automotive we grow with challenges and, thanks to our for passenger and two-wheeler vehicle manufacturers and a clear diversification policy and our business model, in 2019, we will meet the example of how, at CIE Automotive, we will make the most of the objectives of the 2016-2020 Strategic Plan one year ahead of schedule. -

CI Iberian Equity PORTFOLIO TYPE Climate Impact Assessment EQUITY

OVERVIEW DATE OF HOLDINGS COVERAGE 31 DEC 2019 94.03% AMOUNT INVESTED BENCHMARK USED 29,910,665 EUR Ibex 35 CI Iberian Equity PORTFOLIO TYPE Climate Impact Assessment EQUITY Carbon Metrics 1 of 3 Portfolio Overview Disclosure Emission Exposure Relative Emission Exposure Climate Performance Number/Weight tCO₂e tCO₂e/Mio EUR Revenue Weighted Avg Relative Carbon Carbon Weighted Avg Share of Disclosing Holdings Scope 1 & 2 Incl. Scope 3 Carbon Risk Rating1 Footprint Intensity Carbon Intensity Portfolio 7% / 73.2% ,24 27,424 210.0 29.41 19.14 40 Benchmark 94.3% / 9.3% ,99 34,225 300.52 340.72 25. 4 Net Performance -1.3 p.p. / -25 p.p. 30.1% 19.9% 30.1% 20.9% 3.3% — Emission Exposure Analysis Emissions Exposure (tCO₂e) Sector Contributions to Emissions2 30,000 Consumer Discretionary 8% Consumer Staples 4% 20,000 Energy 21% 10,000 Materials 65% Industrials 2% 0 Portfolio Benchmark Scope 1 Scope 2 Scope 3 1 Note: Carbon Risk Rating data is current as of the date of report generation. 2 Emissions contributions for all other portfolio sectors is less than 1% for each sector. © 2020 Institutional Shareholder Services 1 of 10 Climate Impact Assessment CI Iberian Equity Emission Exposure Analysis (continued) Top 10 Contributors to Portfolio Emissions Contribution to Portfolio Issuer Name Portfolio Weight (%) Emissions Reporting Quality Carbon Risk Rating Emission Exposure (%) Semapa Sociedade de Investimento e Gesta… 52.% 2.52% Inconsistent - Repsol SA 17.42% 3.3% Strong Medium Performer The Navigator Co. SA .9% 4.0% Moderate - Viscofan SA 4.0% 3.4% -

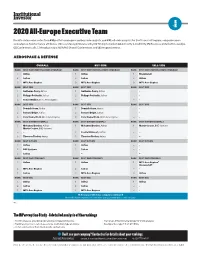

2020 All-Europe Executive Team Results Are Based on Votes from 691 Portfolio Managers and Buy-Side Analysts, and 491 Sell-Side Analysts

R +R 2020 All-Europe Executive Team Results are based on votes from 691 portfolio managers and buy-side analysts, and 491 sell-side analysts. For Best Investor Program, companies were evaluated on 8 performance attributes: (1) Consistency, (2) Granularity, (3) Timing to market, (4) Authority & credibility, (5) Business & Market Knowledge, (6) Conference calls, (7) Productivity of NDR/RD Shows/ Conferences, and (8) Responsiveness. AEROSPACE & DEFENSE OVERALL BUY-SIDE SELL-SIDE RANK BEST INVESTOR RELATIONS PROGRAM RANK BEST INVESTOR RELATIONS PROGRAM RANK BEST INVESTOR RELATIONS PROGRAM 1 Airbus 1 Airbus 1 Rheinmetall 2 Safran 2 Safran 2 Airbus 3 MTU Aero Engines 3 MTU Aero Engines 3 MTU Aero Engines RANK BEST CEO RANK BEST CEO RANK BEST CEO 1 Guillaume Faury, Airbus 1 Guillaume Faury, Airbus – – 2 Philippe Petitcolin, Safran 2 Philippe Petitcolin, Safran – – 3 Reiner Winkler, MTU Aero Engines – – – – RANK BEST CFO RANK BEST CFO RANK BEST CFO 1 Dominik Asam, Airbus 1 Dominik Asam, Airbus – – 2 Bernard Delpit, Safran 2 Bernard Delpit, Safran – – 3 Peter Kameritsch, MTU Aero Engines 3 Peter Kameritsch, MTU Aero Engines – – RANK BEST IR PROFESSIONALS RANK BEST IR PROFESSIONALS RANK BEST IR PROFESSIONALS 1 Mohamed Denden, Airbus* 1 Mohamed Denden, Airbus 1 Martin Cooper, BAE Systems Martin Cooper, BAE Systems* – – 2 Cecilia Matissart, Safran – – 3 Thorsten Fischer, Airbus 3 Thorsten Fischer, Airbus – – RANK BEST IR TEAM RANK BEST IR TEAM RANK BEST IR TEAM 1 Airbus 1 Airbus – – 2 BAE Systems 2 Safran – – 3 Safran – – – – RANK BEST INVESTOR DAYS RANK BEST INVESTOR DAYS RANK BEST INVESTOR DAYS 1 Airbus 1 Airbus 1 MTU Aero Engines* Rheinmetall* 2 MTU Aero Engines 2 Safran – – 3 Safran 3 MTU Aero Engines 3 Airbus RANK BEST ESG RANK BEST ESG RANK BEST ESG 1 Airbus 1 Airbus 1 Airbus 2 Safran 2 Safran – – 3 MTU Aero Engines 3 MTU Aero Engines – – 18 Aerospace & Defense companies nominated Not ranked in the top three? Contact II to get your rankings for each category.