Web Fraud Prevention, Identity Verification & Authentication Guide 2018 -2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

PREPAID CARD by MAIL with Any Purchase of $750 Or More Made with the Synchrony Bank Music Credit Card.1

GET A $ PREPAID CARD BY MAIL with any purchase of $750 or more made with the Synchrony Bank Music credit card.1 Offer valid December 1 – December 31, 2017. Rebate form must be postmarked by January 31, 2018. Step 1: Make a single-receipt purchase with your Synchrony Bank Music credit card. Step 2: Complete this form, including mailing information and last 4 digits of the Synchrony credit card used. Name __________________________________________________________________________________________ Address ____________________________________________________________________________________ Last 4 digits of Synchrony credit card _________________________________________ City __________________________________________________________________________________________ Invoice # _____________________________________________________________________________________ State _______________________ Zip _______________________________________________________ Phone __________________________________________________________________________________________ Email (optional) _________________________________________________________________________ Step 3: Send a copy of your receipt, along with this completed form, to the address below. Music Credit Rebate Offer #5604 P.O. Box 7210 Mesa, AZ 85216 Please keep a copy of this rebate form and your original invoice for your records. Visit myrebatemanager.com or call 1-855-333-2820 to inquire about status. 1To be eligible to receive a rebate under this offer you must: (1) make a purchase of $750 or more on a single receipt from 12/01/2017 – 12/31/2017 with your Synchrony Bank Music credit card; (2) complete and submit a rebate form, together with a copy of the original receipt, that is postmarked by 1/31/2018. Cardholders who use their Synchrony Bank Music credit card for their qualifying purchase will be eligible to receive a $100 Visa Prepaid Card. Purchases with a Synchrony Bank Music credit card are subject to credit approval. One rebate per qualifying purchase valid at participating U.S. locations. See store for details. -

Synchrony: a Growing Credit-Card Powerhouse As It Outpaces Its Competitors, the Private-Label Giant Is Poised to See Its Shares Spike Later This Year

WSJ WSJ LIVE MARKETWATCH BARRON'S PORTFOLIO DJX MORE News, Quotes, Companies, Videos SEARCH ASIA EDITION U.S. EDITION Log In Subscribe HOME MAGAZINE DAILY INVESTING IDEAS TOP ADVISORS MARKET DATA PAID ADVISOR DIRECTORY FEATURE Synchrony: A Growing Credit-Card Powerhouse As it outpaces its competitors, the private-label giant is poised to see its shares spike later this year. Email Print 3 Comments Order Reprints By LAWRENCE C. STRAUSS February 20, 2016 Synchrony partners with 22 major retailers, including the names below, to issue private-label cards. The credit-card industry is facing head winds as major players duke it out for customers. But one part of the market isn’t getting enough credit: private-label cards, which typically are branded with one retailer and offer consumers perks that include discounts, loyalty rewards, and promotional financing. Private cards are gaining market share, growing at a 7% annual clip, compared with 5% for traditional offerings, says Bill Carcache, an analyst at Nomura Securities. The industry leader is Synchrony Financial (ticker: SYF), which was spun off from General Electric (GE) in 2014. The company has gained 12 points of market share since 2004, to an estimated 43%, according to the Nilson Report and Nomura, and its loan portfolio should grow by some 8% this year, thanks to continued market-share gains and a healthy U.S. consumer. Synchrony’s retail-card division partners with 22 merchants, including Amazon.com (AMZN) and Chevron (CVX). Synchrony “sits in the sweet spot of the [retail] payments Most Popular ecosystem, where we expect it will continue to outperform,” Carcache noted after it What Recession? GDP Set to Grow 3% announced solid fourth-quarter results on Jan. -

Fraud, Authentication, and Orchestration Hubs: a Path to Greater Agility

Fraud, Authentication, and Orchestration Hubs: A Path to Greater Agility DECEMBER 2019 Julie Conroy © 2019 Aite Group LLC. All rights reserved. Reproduction of this report by any means is strictly prohibited. Photocopying or electronic distribution of this document or any of its contents without prior written consent of the publisher violates U.S. copyright law, and is punishable by statutory damages of up to US$150,000 per infringement, plus attorneys’ fees (17 USC 504 et seq.). Without advance permission, illegal copying includes regular photocopying, faxing, excerpting, forwarding electronically, and sharing of online access. Fraud, Authentication, and Orchestration Hubs: A Path to Greater Agility DECEMBER 2019 TABLE OF CONTENTS IMPACT POINTS .............................................................................................................................................. 4 INTRODUCTION .............................................................................................................................................. 5 METHODOLOGY ........................................................................................................................................ 5 THE MARKET ................................................................................................................................................... 7 VENDOR SOLUTIONS .................................................................................................................................... 14 ACI WORLDWIDE .................................................................................................................................... -

Download a PDF Version of the 2017 Annual Review

Front Back Cover for Avisan.qxp_Layout 1 11/15/17 1:27 PM Page 1 Secure Technology Alliance 191 Clarksville Road Princeton Junction, New Jersey 08550 Annual Review 2017 Alliance A Secure Publication Technology 7 Volume www.securetechalliance.org Annual Review 2017 SCA-ad 2017 resized.indd 1 10/30/2017 10:40:22 AM EXECUTIVE DIRECTOR’S LETTER: A MESSAGE FROM RANDY VANDERHOOF Delivering Value to a Diverse Market Thank you for taking the time to read the 2017 Annual Review. This publication captures the best aspects of the membership experience for 2017 that hundreds of individual members and their organizations helped to provide. This year was especially sig- nificant, as the organization expanded its mission beyond smart cards and was re-branded as the Secure Technology Alliance. The new name and scope allows the Alliance to include embedded chip technology, hardware and software, and the future of digital security in all forms. The vast number of deliverables and member-driven activities recorded in the publication illustrates the diversity of the markets we serve and the commitment of all the industry professionals who contribute their knowledge and leadership toward expanding the market for smart card and related secure chip technologies. CHANGE COMES WITH NEW OPPORTUNITIES The decision to expand the mission and rebrand the organization was driven THE DECISION TO EXPAND by the changes in the secure chip industry, mostly from mobile technol- ogy and the growth of Internet-connected devices. This does not mean the THE MISSION AND REBRAND market for smart cards has disappeared. In fact, over the last few years, the THE ORGANIZATION WAS U.S. -

Regulation of Dietary Supplements Hearing

S. HRG. 108–997 REGULATION OF DIETARY SUPPLEMENTS HEARING BEFORE THE COMMITTEE ON COMMERCE, SCIENCE, AND TRANSPORTATION UNITED STATES SENATE ONE HUNDRED EIGHTH CONGRESS FIRST SESSION OCTOBER 28, 2003 Printed for the use of the Committee on Commerce, Science, and Transportation ( U.S. GOVERNMENT PUBLISHING OFFICE 20–196 PDF WASHINGTON : 2016 For sale by the Superintendent of Documents, U.S. Government Publishing Office Internet: bookstore.gpo.gov Phone: toll free (866) 512–1800; DC area (202) 512–1800 Fax: (202) 512–2104 Mail: Stop IDCC, Washington, DC 20402–0001 VerDate Nov 24 2008 11:04 May 24, 2016 Jkt 075679 PO 00000 Frm 00001 Fmt 5011 Sfmt 5011 S:\GPO\DOCS\20196.TXT JACKIE SENATE COMMITTEE ON COMMERCE, SCIENCE, AND TRANSPORTATION ONE HUNDRED EIGHTH CONGRESS FIRST SESSION JOHN MCCAIN, Arizona, Chairman TED STEVENS, Alaska ERNEST F. HOLLINGS, South Carolina, CONRAD BURNS, Montana Ranking TRENT LOTT, Mississippi DANIEL K. INOUYE, Hawaii KAY BAILEY HUTCHISON, Texas JOHN D. ROCKEFELLER IV, West Virginia OLYMPIA J. SNOWE, Maine JOHN F. KERRY, Massachusetts SAM BROWNBACK, Kansas JOHN B. BREAUX, Louisiana GORDON SMITH, Oregon BYRON L. DORGAN, North Dakota PETER G. FITZGERALD, Illinois RON WYDEN, Oregon JOHN ENSIGN, Nevada BARBARA BOXER, California GEORGE ALLEN, Virginia BILL NELSON, Florida JOHN E. SUNUNU, New Hampshire MARIA CANTWELL, Washington FRANK R. LAUTENBERG, New Jersey JEANNE BUMPUS, Republican Staff Director and General Counsel ROBERT W. CHAMBERLIN, Republican Chief Counsel KEVIN D. KAYES, Democratic Staff Director and Chief Counsel GREGG ELIAS, Democratic General Counsel (II) VerDate Nov 24 2008 11:04 May 24, 2016 Jkt 075679 PO 00000 Frm 00002 Fmt 5904 Sfmt 5904 S:\GPO\DOCS\20196.TXT JACKIE C O N T E N T S Page Hearing held on October 28, 2003 ......................................................................... -

Growth of Financial Service Sector in India

IOSR Journal of Business and Management (IOSR-JBM) e-ISSN: 2278-487X, p-ISSN: 2319-7668 PP 24-26 www.iosrjournals.org Growth of Financial Service Sector in India Nivedhita.J Ph.D., (Part time) Research Scholar in Management, P.K.R Arts College for Women, Gobichettipalayam. I. Introduction India has a diversified financial sector undergoing rapid expansion, both in terms of strong growth of existing financial services firms and new entities entering the market. The sector comprises commercial banks, insurance companies, non-banking financial companies, co-operatives, pension funds, mutual funds and other smaller financial entities. The banking regulator has allowed new entities such as payments banks to be created recently thereby adding to the types of entities operating in the sector. However, the financial sector in India is predominantly a banking sector with commercial banks accounting for more than 64 per cent of the total assets held by the financial system. The Government of India has introduced several reforms to liberalise, regulate and enhance this industry. The Government and Reserve Bank of India (RBI) have taken various measures to facilitate easy access to finance for Micro, Small and Medium Enterprises (MSMEs). These measures include launching Credit Guarantee Fund Scheme for Micro and Small Enterprises, issuing guideline to banks regarding collateral requirements and setting up a Micro Units Development and Refinance Agency (MUDRA). With a combined push by both government and private sector, India is undoubtedly one of the world's most vibrant capital markets. II. Market Size Total outstanding credit by scheduled commercial banks of India stood at Rs 72,606.11 billion (US$ 1.08 trillion)!. -

Proposed Community Reinvestment Act Strategic Plan of American

Community Reinvestment Act Strategic Plan of American Challenger Bank, N.A. (proposed) Stamford, Connecticut November 10, 2020 CRA STRATEGIC PLAN Table of Contents SECTION 1: INTRODUCTION .................................................................................................................. 1 A. General Information .......................................................................................................................... 1 B. Bank’s Specialized Business Model ................................................................................................. 1 C. Financial Information ........................................................................................................................ 3 SECTION 2: COMMUNITY REINVESTMENT ACT ............................................................................... 4 A. CRA Requirements ........................................................................................................................... 4 B. Strategic Plan - Overall Focus, Effective Date, and Term ................................................................ 6 C. Bank’s Commitment to CRA ............................................................................................................ 6 D. Program Oversight and Resources .................................................................................................... 7 E. Development of Bank’s CRA Strategic Plan .................................................................................... 7 SECTION 3: BANK’S ASSESSMENT -

A Handbook of Vendors to the North American Payments Market

2021 BUYERS’ GUIDE A handbook of vendors to the North American payments market Volume Eighteen, Number Eight • DigitalTransactions.net • August 2021 DigitalTransactions.net brings you the most important payments market news, in one place, updated the moment it happens Breaking news from the payments market, posted daily Concise, clean interface is easy to navigate Calendar of industry events Complete current and past issues of Digital Transactions magazine Detailed listings of payments market suppliers 13 years of payments news and analysis DIGITALTRANSACTIONS.NET CONTENTS August 2021 ■ Volume 18, Number 8 The Gimlet Eye 4 A Remarkable Industry BUYERS’ GUIDE 2021 ACH Information . Fraud Prevention . Payment Processing . ACH Processing . Gift Cards . Payment Software . Acquiring Bank . Global Acquirers . Payments Education . Age Verification . Healthcare Payments . PCI Compliance . Agent & ISO Program . High Risk Processing . PCI Security . Alcoholic Beverage POS Software . Identity Verification . Portfolio Assessment . Alternative Payments . Imaging Services . Portfolio Purchases . Associations. Imprinter Equipment & Supplies . Portfolio Sales . ATM Equipment & Services . Incident Response & Forensics . POS Cloud . Auto ID/RFID Technologies . Independent Software Vendors . POS Software . Automated Sales Tax Solutions . Independent Sales Organizations (ISOs) . POS Stands . Back Office Automation . Instant Card Issuance . POS Supplies . Bar Code Technology . Insurance . POS Systems . Bill Payment and Presentment -

Zerohack Zer0pwn Youranonnews Yevgeniy Anikin Yes Men

Zerohack Zer0Pwn YourAnonNews Yevgeniy Anikin Yes Men YamaTough Xtreme x-Leader xenu xen0nymous www.oem.com.mx www.nytimes.com/pages/world/asia/index.html www.informador.com.mx www.futuregov.asia www.cronica.com.mx www.asiapacificsecuritymagazine.com Worm Wolfy Withdrawal* WillyFoReal Wikileaks IRC 88.80.16.13/9999 IRC Channel WikiLeaks WiiSpellWhy whitekidney Wells Fargo weed WallRoad w0rmware Vulnerability Vladislav Khorokhorin Visa Inc. Virus Virgin Islands "Viewpointe Archive Services, LLC" Versability Verizon Venezuela Vegas Vatican City USB US Trust US Bankcorp Uruguay Uran0n unusedcrayon United Kingdom UnicormCr3w unfittoprint unelected.org UndisclosedAnon Ukraine UGNazi ua_musti_1905 U.S. Bankcorp TYLER Turkey trosec113 Trojan Horse Trojan Trivette TriCk Tribalzer0 Transnistria transaction Traitor traffic court Tradecraft Trade Secrets "Total System Services, Inc." Topiary Top Secret Tom Stracener TibitXimer Thumb Drive Thomson Reuters TheWikiBoat thepeoplescause the_infecti0n The Unknowns The UnderTaker The Syrian electronic army The Jokerhack Thailand ThaCosmo th3j35t3r testeux1 TEST Telecomix TehWongZ Teddy Bigglesworth TeaMp0isoN TeamHav0k Team Ghost Shell Team Digi7al tdl4 taxes TARP tango down Tampa Tammy Shapiro Taiwan Tabu T0x1c t0wN T.A.R.P. Syrian Electronic Army syndiv Symantec Corporation Switzerland Swingers Club SWIFT Sweden Swan SwaggSec Swagg Security "SunGard Data Systems, Inc." Stuxnet Stringer Streamroller Stole* Sterlok SteelAnne st0rm SQLi Spyware Spying Spydevilz Spy Camera Sposed Spook Spoofing Splendide -

2017 Region IV Exhibitor/Sponsor Guide

2017 Region IV Exhibitor/Sponsor Guide 3M Booth 103 ABCorp Booth 200 P: 877‐777‐3571 www.3m.com/vehiclereg Rola Hamandi | [email protected] | 954‐ Armed with innovative technology and industry 993‐5476 experience, 3M provides ingenious solutions for a Jack Barnett | [email protected] | 615‐794‐ variety of transportation industries across the globe. 1575 Our complete spectrum of products, services and www.ABCorp.com solutions address the common challenges of the ABCorp™ is a trusted global provider of secure motor vehicle industry to enhance organizational products and solutions. ABCorp pioneered the performance and productivity. 3M offers license concept of secure transactions in 1795 when it plate materials and equipment, as well as on‐demand assisted the newly formed United States to produce services, to enhance DMV operations; world class counterfeit‐resistant currency. Over the past 220+ security for driver credentials and secure vehicle years ABCorp has produced products for countless identification solutions; automated license plate governments, corporations and not‐for‐profit readers and software; automated finger print organizations. Products and solutions include systems, and mobile ID solutions. passports, national IDs, driver licenses, mobile Identity, vital records, stock & bond certificates, AAA – American Automobile Association of checks, financial cards, processing systems, inventory Southern California management, document solutions, and payment Driver’s License Breakout Sponsor solutions among others. Tari Cody Cody.Tari@aaa‐calif.com P: 714‐885‐2051 AAA.com ACF Technologies, Inc. Booth 305 As North America’s largest motoring and leisure Josh Gravley [email protected] travel organization, AAA provides more than 57 P: 828‐398‐0040 www.customerflow.com million members with travel, insurance, financial and ACF Technologies offers customer experience automotive‐related services, including DMV in some solutions for the motor vehicle industry and regions. -

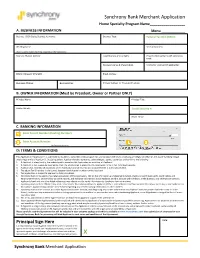

Synchrony Bank Merchant Application Home Specialty Program Name______A

Synchrony Bank Merchant Application Home Specialty Program Name__________________ A. BUSINESS INFORMATION Menu ____________ Business / DBA (Doing Business As) Name: Business Type: Federal Tax ID # (EIN #): IRS Filing Name: Years in Business: {Name used for federal tax filing; required per IRS Regulations) Business Physical Address: Total Business Annual Sales: Projected Annual Sales with Synchrony Bank: Business License # (if applicable): Contractor License # (if applicable): Billing Address (if different): Email Address: Business Phone: Business Fax: Primary Contact for Financing Program: B. OWNER INFORMATION (Must be President, Owner or Partner ONLY) Principal Name: Principal Title: Home Address: Social Security #: Home Phone: C. BANKING INFORMATION Bank Transit Number (Routing Number): Bank Account Number: No Personal Accounts D: TERMS & CONDITIONS This Application (“Application”) is submitted to establish a consumer credit program for, and to obtain merchant processing privileges on behalf of, the above-named principal and/or legal entity (“Applicant”). By signing below, Applicant hereby represents, acknowledges, agrees, authorizes and confirms the following: 1. If Applicant is a legal entity, the undersigned is executing this Application as an officer of Applicant. 2. If Applicant is not a separate legal entity, then the undersigned is executing this Application in his or her individual capacity. 3. Applicant has reviewed all provisions of this Application and all information provided herein is true and complete. 4. The above Tax ID number is the correct taxpayer identification number for the Applicant. 5. This application is subject to approval by Synchrony Bank. 6. Synchrony Bank or its agents, may retain possession of this Application, rely on the information and statements herein, check and verify Applicant’s credit history and employment history, secure follow up credit reports, and exchange information about Applicant and this account with creditors, credit bureaus, and other proper persons. -

To SBI Cards and Payment Services Ltd. Niche Product in the Consumer Oriented Business 27Th Feb

“SUBSCRIBE” to SBI Cards and Payment Services Ltd. Niche product in the consumer oriented business 27th Feb. 2020 Salient features of the IPO: Recommendation SUBSCRIBE • SBI Cards and Payment Services Ltd. (SBI Card), another PSU stock is Price Band Rs. 750 - 755 per Share about to enter equity market with its IPO, which opens on 2nd Mar. and close on 5th Mar. 2020. The price band is Rs. 750 - 755 per share. Face Value Rs. 10 • The issue comprises of 137.15 - 137.19mn shares (fresh issue: 6.62 - Shares for Fresh Issue 6.62 - 6.67mn Shares 6.67; OFS shares: 130.53mn shares) in offering. Total IPO size is Rs. Shares for OFS 130.53mn Shares 102,895.1 - 103,547.7mn. Fresh Issue Size Rs. 5,000mn • The company will not receive any proceeds from OFS. Majority of the OFS Issue Size Rs. 97,895.1 - 98,547.7mn fresh issue net proceeds, will be utilize by the company to augment 137.15 - 137.19mn Shares Total Issue Size the capital base so as to meet the future capital requirement. (Rs. 102,895.1 - 103,547.7mn) 02nd Mar. - 05th Mar. 2020 Key competitive strengths: Bidding Date (For QIB bidder, offer closes on • Second largest credit card issuer in India with deep industry expertise 04th Mar. 2020) and a demonstrated track record of growth and profitability Reserved for SBI Cards • Diversified customer acquisition capabilities 1.86mn Shares • Supported by a strong brand and pre-eminent promoter Employees (mn Shares) Reserved for SBI • Diversified portfolio of credit card offerings 13.05mn Shares • Advanced risk management and data analytics capabilities Shareholders (mn Shares) • Modern and scalable technology infrastructure Net Offer for Sales (mn 122.23 - 122.28mn Shares • Highly experienced and professional management team Shares) (Rs.