SCOTLAND's ECONOMIC FUTURE POST-2014 SUBMISSION FROM

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Contract Leads Powered by EARLY PLANNING Projects in Planning up to Detailed Plans Submitted

Contract Leads Powered by EARLY PLANNING Projects in planning up to detailed plans submitted. PLANS APPROVED Projects where the detailed plans have been approved but are still at pre-tender stage. TENDERS Projects that are at the tender stage CONTRACTS Approved projects at main contract awarded stage. Reserved Matters for 86 residential units Planning authority: Huntingdon Job: Outline Off Scholars Drive Cawston Market Place, London, W1W 8AJ Tel: 020 Detail Plans Granted for school (extension) Agent: For Ward Planning Consultancy Ltd, Planning authority: Newcastle-Upon-Tyne Client: Morris Homes (North) Ltd Agent: Plans Submitted for football clubhouse Planning authority: Rugby Job: Detail Plans 7307 9200 Client: Northamptonshire County Council 13D Cornmarket, Louth, Lincolnshire, LN11 9PY Job: Detailed Plans Submitted for 90 student MIDLANDS/ Morris Homes (North) Ltd, Morland House, Client: St Ives Town Football Club Agent: Granted for community hall Client: Cawston LINCOLN £2.1M Education Services Agent: GSS Architecture, Tel: 07872919007 flats (conversion/extension) Client: JLP Altrincham Road, Wilmslow, Cheshire, SK9 Partners In Planning, 10 Manor Mews, Bridge Parish Council Developer: H B Architects, 17 Land Opposite, 55 - 77 Waterford Lane 35 Headlands, Kettering, Northamptonshire, HARROGATE £0.52M Development Consultancy Agent: CAG EAST ANGLIA 5NW Tel: 01625 544444 Street, St. Ives, Cambridgeshire, PE27 5UW Warwick Street, Rugby, Warwickshire, CV21 Cherry Willingham NN15 7ES Contractor: Jeakins Weir Ltd, Kingsley Nursing & Residential, 36 - 40 Architects, Garrowood Studio, Grange, Keith, LINCOLN £3.9M Tel: 01480494969 3DH Tel: 01788 576137 Planning authority: West Lindsey Job: Detail Uppingham House, 5 Saxon Way West, Corby, Ripon Road Grampian, AB55 6SE Tel: Not Available Early Planning Land Rear Of, 49 Dogdyke Road STRATFORD-ON-AVON £0.6M STOKE-ON-TRENT £2.7M Plans Granted for 23 houses/8 flats & luxury Northamptonshire, NN18 9EZ Tel: 01536 Planning authority: Harrogate Job: Detailed Former O’Donnell Construction, St. -

ROBERT BURNS and FRIENDS Essays by W. Ormiston Roy Fellows Presented to G

University of South Carolina Scholar Commons Robert Burns and Friends Robert Burns Collections 1-1-2012 ROBERT BURNS AND FRIENDS essays by W. Ormiston Roy Fellows presented to G. Ross Roy Patrick G. Scott University of South Carolina - Columbia, [email protected] Kenneth Simpson See next page for additional authors Publication Info 2012, pages 1-192. © The onC tributors, 2012 All rights reserved Printed and distributed by CreateSpace https://www.createspace.com/900002089 Editorial contact address: Patrick Scott, c/o Irvin Department of Rare Books & Special Collections, University of South Carolina Libraries, 1322 Greene Street, Columbia, SC 29208, U.S.A. ISBN 978-1-4392-7097-4 Scott, P., Simpson, K., eds. (2012). Robert Burns & Friends essays by W. Ormiston Roy Fellows presented to G. Ross Roy. P. Scott & K. Simpson (Eds.). Columbia, SC: Scottish Literature Series, 2012. This Book - Full Text is brought to you by the Robert Burns Collections at Scholar Commons. It has been accepted for inclusion in Robert Burns and Friends by an authorized administrator of Scholar Commons. For more information, please contact [email protected]. Author(s) Patrick G. Scott, Kenneth Simpson, Carol Mcguirk, Corey E. Andrews, R. D. S. Jack, Gerard Carruthers, Kirsteen McCue, Fred Freeman, Valentina Bold, David Robb, Douglas S. Mack, Edward J. Cowan, Marco Fazzini, Thomas Keith, and Justin Mellette This book - full text is available at Scholar Commons: https://scholarcommons.sc.edu/burns_friends/1 ROBERT BURNS AND FRIENDS essays by W. Ormiston Roy Fellows presented to G. Ross Roy G. Ross Roy as Doctor of Letters, honoris causa June 17, 2009 “The rank is but the guinea’s stamp, The Man’s the gowd for a’ that._” ROBERT BURNS AND FRIENDS essays by W. -

IGA News No. 92

IGA NEWS Newsletter of the International Geothermal Association Quarterly No. 109 1 IGA ACTIVITIES CONTENTS IGA ACTIVITIES Message from the Executive Message from the Executive Director... 1 Director 41st GRC Annual Meeting… 2 Greetings to all members of the IGA and to those that 2nd Annual General Assembly of GEMex Project… 3 are reading this newsletter. As mentioned in our MEXIREC 2017 and REN21 SC Meeting… 5 previous writing, the IGA Board has developed a new strategy which will help us to strengthen the role of our AFRICA members and the wider geothermal energy community Djibouti: Kuwaiti Grant for Geothermal Program… 7 not only for our sector, but also in the wider context of Ethiopia: Japanese Grant, and Geothermal Projects … 7 the ongoing renewable energy and climate change Kenya: Several Geothermal Notes… 9 debate. Tanzania: CIF to Fund the Ngozi Project: … 11 The IGA has been very busy over the past months to AMERICAS initiate strategic activities aligned with our four Pillars: Chile: Two Notes… 12 &13 Visibility, Authority, Independence and Costa Rica: Miravalles Renamed, Loan at Risk… 14 Membership. In this newsletter I focus on Pillar Ecuador: Exploration at the Chachimbiro Project … 15 Visibility: it is with great pride that I can show you our Honduras: First Geothermal Plant in Operation… 15 new logo and visual identity for the IGA (see the right Latin America: 8 Projects to Be Granted by GDF… 16 upper part of this page). We thank Team Visibility Mexico: Old Well Flows & Portable Plant… 17 (Andy Blair, Jane Brotheridge, Kristin Vala United States: Several Notes… 18 Matthiasdottir, and Bjarni Bjarnasson) for their great ASIA / PACIFIC RIM work and support. -

Alteration to East Ayrshire Local Plan 2

EAST AYRSHIRE COUNCIL ALTERATION TO EAST AYRSHIRE LOCAL PLAN FINALISED DRAFT SUSTAINABILITY APPRAISAL BACKGROUND INFORMATION PAPERS VOLUME 2 APPENDIX 13A: DETAILED SEA OF CORE AREA DEVELOPMENT SITES APPENDIX 13B: DETAILED SEA OF IRVINE VALLEY CORRIDOR DEVELOPMENT SITES BACKGROUND INFORMATION: APPENDIX 13A: SEA OF CORE AREA SETTLEMENT SITES CROOKEDHOLM Ref. No. Site Location Site Suggested By 004(b) Land to West of Grougar Road Hope Homes Scotland, Watson Terrace, Drongan KA6 7AB 026 Land to West of Grougar Road James Barr, 226 West George Street, Glasgow G2 2LN 061 Land to West of Grougar Road James Barr, 226 West George Street, Glasgow G2 2LN 090(a) Land to West of Crookedholm Mr D.S.A Rennie, Ralstonhill Farm, Kilmarnock KA3 6HL 090(c) Land to East and West of Grougar Road Mr D.S.A Rennie, Ralstonhill Farm, Kilmarnock KA3 6HL 095(a) Land to West of Grougar Road Mr. Andrew Walters, Atkins, Clifton House, Clifton Place, Glasgow G3 7YY 155 Land at Ralstonyards Farm Mr Wilson Barclay, Ralstonyards Farm, Kilmarnock KA3 6HW CD044(a) Land to East of Grougar Road Duan Developments, per Carricks Darley Hay, 7 Alloway Place, Ayr KA7 2AE CD069 Land at Main Road Mr D Ferguson, per Architecture Designs and Development Solutions, 14A Beresford Terrace, Ayr KA7 2EG CD083 Land to West of Grougar Road James Barr, 226 West George Street, Glasgow G2 2LN CD141 Land to West of Grougar Road Mr D Malcolmson, per Bryce Associates Ltd., 6 Newton Place, Glasgow G3 7PR Site Ref No Environmental Criteria 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 004(b), 026, +/- - o o + o o + o o ? - o - - - - + 061 and CD083 Nature of Impact General neutral or negative environmental impacts. -

How HALO Is Leading Innovation In

CONSTRUCTION JOURNAL HALO: innovation in regeneration An initiative to regenerate a vacant site in Kilmarnock has created a beacon for innovation in sustainability, community engagement and collaboration Author: Dr Marie Macklin CBE and Drew Macklin 24 March 2021 In 2009, multinational beverage producer Diageo closed its packaging plant in Kilmarnock, meaning the end of Johnnie Walker whisky’s 189-year association with its hometown. The closure left a 28-acre site vacant at the heart of the town. Having identified an opportunity to revitalise our hometown and support the growth and resilience of the Ayrshire economy, we have spent the decade since then negotiating with the government and Diageo to come up with a masterplan for the area. The result is HALO – so-called as the halo effect is a rise from the ashes – a regeneration initiative to create a place where people can live, work, learn and play. HALO Kilmarnock, Scotland is the first of four such town centre net zero carbon energy projects, a community urban village setting the standard for low carbon energy sites across the UK. Work on projects in the north of England, Wales and Northern Ireland is due to begin soon. The project – which focuses on minimising energy use, promoting health and encouraging enterprise – will cost £65m and will generate £200m GDP for Scotland’s economy, as well as creating up to 1,300 jobs. The focal point of the project is the 49,500sq ft HALO Enterprise and Innovation Hub, designed to stimulate digital learning, inspire innovative thinking and support new and upcoming businesses. -

UK Government Announces £100 Million for Ayrshire Growth Deal

31 January 2019 UK Government announces £100 million for Ayrshire Growth Deal The UK Government is to invest £100 million in the Ayrshire Growth Deal. This investment will drive growth across the region, boosting jobs and opportunity across Ayrshire. This takes the total of UKG investment in the Growth Deals Programme to more than £1.2 billion across Scotland. The UK Government will invest £100 million in the Ayrshire Growth Deal, the Scottish Secretary David Mundell has announced today as he visited HALO Kilmarnock and Ayrshire College. The multi-million pound investment will help drive economic development across the region, boosting jobs, creating opportunity and encouraging further inward investment. The funding levels for specific projects will be confirmed within the coming weeks and is expected to focus on employability and skills programmes, innovation, aerospace and energy projects at Hunterston and Cumnock as well as vital improvements to digital connectivity and regeneration. Scottish Secretary David Mundell said: “The UK Government’s £100 million investment in the Ayrshire Growth Deal will be transformative for the region, boosting jobs and prosperity right across Ayrshire. This brings UK Government investment in Growth Deals in Scotland to £1.2 billion, a huge commitment to growing Scotland’s economy. “We look forward to working with the Ayrshire Councils, the Scottish Government and the private sector to finalise the details of the innovative projects to be funded through the Growth Deal.” To date the UK Government has committed to more than £1.2 billion of Growth Deals Programme investment across Scotland helping to drive growth across the country. -

Please Note That the Minute Requires to Be Approved As a Correct Record at the Next Council Meeting and May Be Amended

PLEASE NOTE THAT THE MINUTE REQUIRES TO BE APPROVED AS A CORRECT RECORD AT THE NEXT COUNCIL MEETING AND MAY BE AMENDED EAST AYRSHIRE COUNCIL MINUTES OF MEETING HELD ON THURSDAY 27 JUNE 2013 AT 1000 HOURS IN THE COUNCIL CHAMBERS, COUNCIL HEADQUARTERS, LONDON ROAD, KILMARNOCK PRESENT: Provost Jim Todd and Councillors Eòghann MacColl, Helen Coffey, Andrew Hershaw, Maureen McKay, Tom Cook, Lillian Jones, Iain Linton, Douglas Reid, Jim Buchanan, Depute Provost John Campbell, Councillors Gordon Cree, John Knapp, Hugh Ross, Alan Brown, George Mair, Bobby McDill, John McFadzean, Neil McGhee, Stephanie Primrose, Jim Roberts, David Shaw, Billy Crawford, Barney Menzies, Kathy Morrice, John Bell, Elaine Dinwoodie and Moira Pirie. ATTENDING: Fiona Lees, Chief Executive; Elizabeth Morton, Depute Chief Executive/Executive Director of Neighbourhood Services; Graham Short, Executive Director of Educational and Social Services; Alex McPhee, Executive Director of Finance and Corporate Support; Chris McAleavey, Acting Executive Director of Neighbourhood Services; Bill Walkinshaw, Head of Democratic Services; Craig McArthur, Head of Finance; Alan Neish, Head of Planning and Economic Development; David Mitchell, Head of Legal, Procurement and Regulatory Services; Eddie Fraser, Head of Service: Community Care; Kevan Aitken, Acting Head of Roads and Transportation; Joe McLachlan, Corporate Accounting Manager; Julie Jamieson, Group Finance Manager - Central; Craig Iles, Principal Planning Officer; Jim Farrell, Shared Services Project Manager; and Stuart Nelson, Administrative Officer. APOLOGIES: Councillors Ellen Freel, John McGhee, Drew McIntyre and Eric Ross. CHAIR: Provost Jim Todd, Chair. ADDITIONAL BUSINESS: COUNCIL APPOINTMENTS 1. On the matter having been raised, it was agreed that a request from the SNP Group to alter their representation on certain Council Committees and external organisations be dealt with under Item 7 on the Agenda. -

East Ayrshire Council Council 27 June 2013

EAST AYRSHIRE COUNCIL COUNCIL 27 JUNE 2013 SCOTTISH GOVERNMENT REGENERATION CAPITAL GRANT FUND Report by Acting Executive Director of Neighbourhood Services PURPOSE OF REPORT 1. The purpose of this report is (i) to provide Council with details of the recently launched Scottish Government Regeneration Capital Grant Fund (RCGF); (ii) to seek agreement on the projects for which the Council should submit grant applications under the fund; (iii) to seek agreement in principle as to the level of financial support from the Council for each project to be submitted and (iv) to seek agreement as to the priority that should be given to each grant application. BACKGROUND 2. The Scottish Governments (SG) Achieving a Sustainable Future: Regeneration Strategy was launched in January 2012. It sets out as its vision:- “A Scotland where our most disadvantaged communities are supported and where all places are sustainable and promote well-being.” 3. Achievement of the vision relies on a wide range of supporting outcomes being delivered. The supporting outcomes are not unique to regeneration and many cross over into wider government policy, including economic development, policy and place making, education and skills etc. It is where there is a persistent and concentrated absence of these outcomes being delivered that additional intervention is required. 4. The vision points to a need for a coordinated approach across the public, private and third sectors, alongside community led action. The Regeneration Capital Grant Fund (RCGF), has subsequently been developed in partnership with local authorities‟, and will provide financial support to projects that will deliver large scale positive improvements to deprived areas. -

New Series, Volume 18, 2017

NEW SERIES, VOLUME 18, 2017 DISCOVERY AND EXCAVATION IN SCOTLAND A’ LORG AGUS A’ CLADHACH AN ALBAINN NEW SERIES, VOLUME 18 2017 Editor Paula Milburn Archaeology Scotland Archaeology Scotland is a voluntary membership organisation, which works to secure the archaeological heritage of Scotland for its people through education, promotion and support: • education, both formal and informal, concerning Scotland’s archaeological heritage • promotion of the conservation, management, understanding and enjoyment of, and access to, Scotland’s archaeological heritage • support through the provision of advice, guidance, resources and information related to archaeology in Scotland Our vision Archaeology Scotland is the leading independent charity working to inspire people to discover, explore, care for and enjoy Scotland’s archaeological heritage. Our mission …to inspire the discovery, exploration, stewardship and enjoyment of Scotland’s past. Membership of Archaeology Scotland Membership is open to all individuals, local societies and organisations with an interest in Scottish archaeology. Membership benefits and services include access to a network of archaeological information on Scotland and the UK, three newsletters a year, the annual edition of the journal Discovery and excavation in Scotland, and the opportunity to attend Archaeology Scotland’s annual Summer School and the Archaeological Research in Progress conference. Further information and an application form may be obtained from Archaeology Scotland Email [email protected] Website www.archaeologyscotland.org.uk A’ lorg agus a’ cladhach an Albainn The Gaelic translation of Discovery and excavation in Scotland was supplied by Margaret MacIver, Lecturer in Gaelic and Education, and Professor Colm O’Boyle, Emeritus Professor, both at the Celtic, School of Language and Literature, University of Aberdeen. -

Ayrshire Growth Deal – Strategic Business Case

Agenda Item No. 9 South Ayrshire Council Report by Executive Director, Economy, Neighbourhood and Environment to South Ayrshire Council of 6 October 2016 Subject: Ayrshire Growth Deal – Strategic Business Case 1. Purpose 1.1 The purpose of this report is to seek approval for the submission of the Ayrshire Growth Deal Strategic Business Case (SBC) and for continuation of funding to support the next stages of the work. North Ayrshire Council and East Ayrshire Council are considering the SBC at their Cabinet Meetings on 27 and 28 September respectively and a verbal update regarding their decisions will be given at the Council meeting. 2. Recommendation 2.1 It is recommended that the Council: 2.1.1 Approves the submission of the Ayrshire Growth Deal Strategic Business Case (SBC) contained in Apppendix 1; and 2.1.2 Approves funding of £70,000 from uncommitted reserves to support the next stages of the work until end September 2017. 3. Background 3.1 Leadership Panel approved the preparation of an Ayrshire Growth Deal in collaboration with East Ayrshire Council and North Ayrshire Council at its meeting on 25 August 2015 (link here) and provided funding to end of March 2016 to allow development of the bid. Leadership Panel on 19 January 2016 subsequently approved the approach being taken to the development of the deal and the proposals for assessing projects for inclusion in the deal (link here). Council approved the submission of the Ayrshire Growth Deal Prospectus to Scottish and UK Governments at its meeting of 3 March 2016 (link here). 3.2 There have been positive responses from both Scottish and UK Governments to the Prospectus. -

Marie's out to Put Heart Back Into Kilmarnock

14 24.05.2013 Kilmarnock Standard Kilmarnock Standard 24.05.2013 15 SPECIAL REPORT Starting Klin has positive vision You’d be mistaken if you Marie is very open fire was thought Marie Macklin about much of the plans was all talk. and will share them in a Marie’s out to put heart Behind the positive “conversation” event being a ‘cry thinking hashtags on twitter held on Wednesday, June 5, at and the “go-do” attitude there Centrestage in Kilmarnock. is a woman with a clear vision And there’s more going on for help’ for Kilmarnock. behind the scenes, which, And she’s got the brains and if pulled off, could be like backing to make it happen. nothing ever seen before in A 42-year-old man started the town. a fire at Kilmarnock police The girl from Kilmarnock’s back into Kilmarnock Onthank estate is on the verge Speaking at her offices station as “a cry for help”, a i n K i l m a r n o c k , t h e court heard this week. of pulling off a major plan that doing an 8000 seater multi- would transform the town businesswoman told the Francis Stebbings, of David Standard: “I think we’ve got The Klin Group is Kilmarnock. out more about her use arena so it can do all types and reinvent its ambition holding a consultation The event, at plans. of sport. It will also be for Dale Avenue, Stewarton, and pride. a good heart and decent folk earlier pleaded guilty to in the town and for us to drive session next month for Centrestage in the Any business or sporting, conferencing and Her multi-million pound entertainment events. -

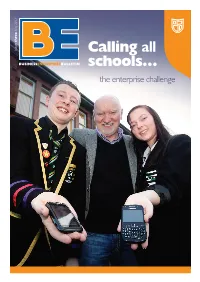

BUSINESS ENTERPRISE BULLETIN Schools… the Enterprise Challenge BUSINESS ENTERPRISE BULLETIN Issue Three 2

2 1 0 2 y a M e e r h t e u s s i Calling all BUSINESS ENTERPRISE BULLETIN schools… the enterprise challenge BUSINESS ENTERPRISE BULLETIN issue three 2 nterprise and business education in East Ayrshire Around the schools … Eschools is moving on apace – and the BE bulletin showcases this achievement. Auchinleck and Cumnock Doon The Council’s Business Enterprise Fund has Future plans include a new learning centre Courses are being delivered in Higher sparked not only the launch of Business for students at Hope Homes’ Knockroon Leadership currently to 25 pupils. SfW in Enterprise and Skills Centres in our nine housing development . Engineering will be delivered in partnership secondary schools - but also a burst of with Ayr College. ideas, creativity and individuality. Seventy-five pupils have participated in Each school has selected initiatives and masterclasses linked to the school’s BESC programmes tailored to suit the requirements and 21 have completed Intermediate 1 and talents of students to help make them work experience. ready for a bright future in the world of work. Doon has business links with Craigengillan Programmes are backed by accredited Estate, Horizon Hotel and Goodrich. qualifications at a range of levels, right up to Higher. Such qualifications not only make Grange young people more desirable in the eyes of employers, but also develop their personal Intermediate 1 Enterprise and Employability Courses being delivered include Intermediate awareness and skills such as communication, courses are being delivered to S3 and SfW 1 Skills for Work (SfW) Construction at teamworking and leadership. Engineering at Access 3, in conjunction with Auchinleck and Int 1/2 Fashion Textile at Kilmarnock College.