Punjab State Agricultural Marketing Board

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Initial Environment Examination IND: Infrastructure Development Investment Program for Tourism

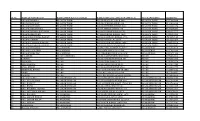

Initial Environment Examination Project Number: 40648-034 January 2017 IND: Infrastructure Development Investment Program for Tourism - Tranche 3 Sub Project : Imperial Highway Heritage C onservation and Visitor Facility Development: (L ot-3) Adaptive Reuse of Aam Khas Bagh and Interpretation Centre/Art and Craft C entre at Maulsari, Fatehgarh Sahib Submitted by Program Management Unit, Punjab Heritage and Tourism Board, Chandigarh This Initial Environment Examination report has been prepared by the Program Management Unit, Punjab Heritage and Tourism Board, Chandigarh for the Asian Development Bank and is made publicly available in accordance with ADB’s public communications policy (2011). It does not necessarily reflect the views of ADB. This report is a document of the borrower. The views expressed herein do not necessarily represent those of ADB's Board of Directors, Management, or staff, and may be preliminary in nature. In preparing any country program or strategy, financing any project, or by making any designation of or reference to a particular territory or geographic area in this document, the Asian Development Bank does not intend to make any judgments as to the legal or other status of any territory or area. Compliance matrix to the Queries from ADB Package no.: PB/IDIPT/T3-03/12/18 (Lot-3): Imperial Highway Heritage Conservation and Visitor Facility Development: Adaptive Reuse of Aam Khas Bagh and Interpretation Centre/Art and Craft Centre at Maulsari, Fatehgarh Sahib Sl.no Query from ADB Response from PMU 1. We note that there are two components Noted, the para has been revised for better i.e. Aam Khas Bagh and Maulsari (para 3, understanding. -

Service Area Plan-District Ludhiana

Service Area Plan of District Ludhiana: Name of block Place of Village Name of Villages under the Population Population Post of 2000(2001 Gram Panchayat of the of Revenue office/Sub cences BR/BC/AT Name Of Name of Gram Village Code mentioned Name of Vill (2001 Post Office population) M Name of Bank Branch Panchayat Name of Village as per census at col. No. 5 Revenue Village census) YES/NO Block : 1. Dehlon Rurka BC PSB Dehlon Rurka Rurka 826000 2604 Rurka 2604 Yes Gopalpur BC PSB Dehlon Gopalpur Gopalpur 827600 2219 Gopalpur 2219 Yes Dharour BC PSB Jaspal Bangar Dharour Dharour 824000 2670 Dharour 2670 Yes Sihan Daud BC BOI Maloud Sihan Daud Sihan Daud 801500 2085 Sihan Daud 2085 Yes Ram Garh BC BOI Ram Garh Ram Garh 3917 Ram Garh 3917 Yes Sardaran Maloud Sardaran Sardaran 802100 Sardaran Ber Kalan BC BOI Maloud Ber Kalan Ber Kalan 803900 2523 Ber Kalan 2523 Yes Nanak Pura BC BOI Nanak Pura Nanak Pura 2085 Nanak Pura 2085 Yes Jagera Qila Raipur Jagera Jagera 804500 Jagera Jhammat BC BOI Khatra ChuharmJhammat Jhammat 804700 2001 Jhammat 2001 Yes Kulhar BC IOB Sihar Kulhar Kulhar 804600 2142 Kulhar 2142 Yes Umed Pur BC Union Bank Ghawadi Umed Pur Umed Pur 824100 2020 Umed Pur 2020 Yes Bhutta BC Union Bank Ghawadi Bhutta Bhutta 824900 2370 Bhutta 2370 Yes Shankar BC Union Bank Ghawadi Shankar Shankar 825200 2437 Shankar 2437 Yes Khanpur BC Union Bank Ghawadi Khanpur Khanpur 831200 3341 Khanpur 3341 Yes Butari BC BOI Khatra ChuharmButari Butari 825800 3313 Butari 3313 Yes Block : 2 Doraha Rampur BC PSB Doraha Rampur Rampur 809400 6111 Rampur -

Village & Townwise Primary Census Abstract, Ludhiana, Part XIII-A & B

PARTS XIII A &, B SERIES-11 PUNJAB VILLAGE & TOWN DIRECtORY VILLAGE & TOWNWISB PRIMARY CENSUS ABSTRACT DIS1'RICT CENSUS IANDBOOK LUDHIANA DISTRICT D. N. :OlUR t:>F 'tHE INDIAN ADMiNISTRATIVE SBIWlcB blrector 01 census Operations PUNJAB '"0z it ;: 0 2! ~l ! ::I: :;. ~~(~'J-'"\.'-I E ~ .> % R~U P N ~ .. J I , 0 ,. -4 , ~ ~ ~ < . 8 '" f ...... '* ( J-,~ . ",2 r \- ~ ~ ) .. fj D ..s.. '" i ,.."\.... -' .')... " ~ U , ~~ s::: 0 : .> ii: \ ti~· !~ ... \ . .. .. ! !!!. I 0 I, ., .s.. ; , :~ ,<t i i ~5 I ,- z ) Ir:) .... @ %.. .... 0 L,~,~,_,-·" ...... ~. .i 1- I U\ .... ::> .s.. ...J I). W ., z > 0 0 ..'" 0 0 '" II! 0 '"gf .,; Z '"<t ;- ~ ~ ~;> 0 Q. 0 0 Z Q. ~ .. :r Q. 0 '"0 c 0 c 3: "I !:: Q. 0 g 0 0 g 3: ~. C\ c 0 0 ~ ~ i In"' eo"' "' '" zll> w'" 1:1 El i!: ::- > u~ '" ZU :\'" {J 0:~~ _. ~'" _e ••• · ~I ~I __ ~ __________ ~======.. ~ __ = ___~J~ CENSUS OF INDIA, 1981 A-CENTRAL GOVERNMENT PUBLICATIONS Part-I-A Administration Report-Enumeration (for offidal use only) (Printed) Part-I-B Administration Report-Tabulation (for offic~al use only) Part-II-A General Population Tables 1 ~ Combined Volum~ (Printed) Part-II-B Primary Census Abstract J Part-III General Economic Tables Part-IV Social and Cultural Tables Part-V Migration Tables, Part-VI Fertility Tables Part-VII Tables on Houses and Disabled Population (Printed) Part-VJII Household Tables Part-IX Special Tables on Scheduled Castes and Scheduled Tribes Part-X-A Town Directory (Printed) Part-X-B Survey Reports on Selected Towns Part-X-C Survey Reports on Selected Villages Part-XI Ethnographic notes and special studies on Scheduled Castes and Scheduled Tribes Part-XII Census Atlas . -

Sr No. Name of the Village Name of the Police Station Rank Name & No

SR NO. NAME OF THE VILLAGE NAME OF THE POLICE STATION RANK NAME & NO. OF POLICE OFFICILAS PLACE OF POSTING MOBILE NO. 1 VILLAGE BHOURA PS SALEM TABRI ASI/LR PRABHJIT SINGH 169 PS SALEM TABRI 9855103369 2 VILL BAHADUR KE PS SALEM TABRI ASI/LR GURMAIL SINGH 618 PS SALEM TABRI 8146300619 3 VILLAGE KASABAD PS SALEM TABRI ASI/LR JATINDER KUMAR 944 PS SALEM TABRI 9815091073 4 VILLAGE HUSAINPURA PS SALEM TABRI HC/PR SWARN SINGH 1443 PS SALEM TABRI 8437209284 5 VILLAGE MANJH PHAGUWAL PS SALEM TABRI ASI/LR SATNAM MASIH 1632 PS SALEM TABRI 9592127575 6 VILLAGE BHATTIAN PS SALEM TABRI HC BALWINDER KUMAR 1698 PS SALEM TABRI 9888051802 7 VILLAGE KUTBEWAL RAIEAN PS SALEM TABRI ASI/LR SURINDER KUMAR 1794 PS SALEM TABRI 9501172940 8 VILLAGE QADIAN PS SALEM TABRI ASI/LR JINDER LAL 2103 PS SALEM TABRI 9501256100 9 VILLAGE TALWANDI KALAN PS SALEM TABRI ASI/LR SURINDER SINGH 2485 PS SALEM TABRI 9256376274 10 VILLAGE FATHEPUR GUJRAN PS SALEM TABRI ASI/LR PRIT PAL SINGH 2631 PS SALEM TABRI 9878000631 11 VILLAGE PHAMBRA PS JODHEWAL SI AMRITPAL SHARMA 07/LPCT PS JODHEWAL 9815114973 12 VILLAGE GAHLEWAL PS JODHEWAL ASI JASBIR SINGH 2222/LDH PS JODHEWAL 9815800233 13 VILLAGE KAKOWAL PS JODHEWAL ASI GURMUKH SINGH 2650/LDH PS JODHEWAL 9855271113 14 MALAKPUR PS PAU LUDHIANA ASI/LR LAKHWINDER SINGH 188 PS PAU 9779362500 15 JAINPUR PS PAU ASI/LR LOVLEESH KUMAR 334 PS PAU 9872750788 16 TALWARA PS PAU ASI/LR GIAN SINGH 473 PS PAU 9780003579 17 BARANHARRA PS PAU ASI/LR AMRIK SINGH 2342 PS PAU 9815410333 18 AYALI KHURD PS PAU ASI/LR SATNAM SINGH 2412 PS PAU 9914200779 19 HAIBOWAL KHURD PS PAU ASI/CR KULWINDER SINGH 2583 PS PAU 9915500212 20 BIRMI PS PAU SI/LR AJIT SINGH 1037/LDH PS PAU 9417355637 21 BAISEMI PS PAU SI/LR BALWINDER SINGH 674/LDH PS PAU 9815800674 22 VILLAGE SUNET PS SARABHA NAGAR ASI/LR KULWANT SINGH 405 PS SARABHA NAGAR 7508040230 23 VILL. -

Sn Village Name Hadbast No. Patvar Area Kanungo Area Population 2001 1991

Distt LUDHIANA BET AREA POPULATION SN VILLAGE NAME HADBAST NO. PATVAR AREA KANUNGO AREA POPULATION 2001 1991 1234567 BLOCK SIDHWAN BET 1 ABUPURA 30 ABUPURA LODHIWALA 1377 1545 2 AHINGRAN 39 MANNAWARPURA LODHIWALA 85 91 3 AKKUWAL 186 TALWARA SIDHWAN BET 321 364 4 ALIWAL 11 ALIWAL BHUNDRI 890 974 5 SHEIKH QUTAB 22 BHAINI ARRIAN SIDHWAN BET 350 450 6 SIDHWAN BET 28 SIDHWAN BET-I & II SIDHWAN BET 3082 3183 7 SALEMPURA 26 SALEMPURA SIDHWAN BET 1977 2631 8 SAFFIPURA 29 ABBUPURA LODHIWALA 276 257 9 SHEREWAL 178 PATTIMULTANI LODHIWALA 350 743 10 SAHBAJ PURA 36 PATTI MULTANI LODHIWALA 64 78 11 HUJRA 184 SIDHWAN BET-II SIDHWAN BET 424 475 12 HYTEWALA 179 BAGHIAN LODHIWALA 193 52 13 KHURSAIDPURA 183 SIDHWANBET-II SIDHWAN BET 601 741 14 GORSIAN QADAR BAKSH 20 GORSIAN QADAR BAKSH SIDHWAN BET 456 538 15 KOTMAN 18 KOTMAN BHUNDRI 832 1042 16 GAG KALAN 185 TALWARA SIDHWAN BET 310 450 17 KAKAR(TIHARA) 34 KAKAR LODHIWALA 1300 1460 BET-LDH.xls Ludhiana 1 POPULATION SN VILLAGE NAME HADBAST NO. PATVAR AREA KANUNGO AREA POPULATION 2001 1991 1234567 18 KOT UMRA 17 KOTMAN BHUNDRI 331 352 19 KATWAL 41 MANWAR PURA LODHIWALA 41 31 20 KANIAN HUSSAINI 180 KANIAN HUSSAINI LODHIWALA 689 1183 21 GORSIAN KHAN MOHAMMAD 19 GORSIAN KHAN BAKSH SIDHWAN BET 517 716 22 GIDDAR PINDI 32 LODHIWALA LODHIWALA 1927 2242 23 GHUNNEWAL 187 TALWARA SIDHWAN BET 272 342 24 GHAMNEWAL 6 BHATHA DHUA BHUNDRI 614 757 25 TALWARA 21 TALWARA SIDHWAN BET 1045 1428 26 TARAF KOTLI 38 MUNNABER PURA LODHIWALA 449 516 27 PARJIAN BIHARIPUR 181 PARJIAN BIHARIPUR LODHIWALA 893 1137 28 TALWANDI NAUABAD 8 ALIWAL BHUNDRI 363 499 29 PATI MULTANI 37 PATI MULTANI LODHIWALA 735 770 30 BAGHIAN 177 BAGHIAN LODHIWALA 684 933 31 BAHADERKE 176 BHAGIAN LUDHIWALA 576 674 32 ANNIAWAL 7 RANKE BHUNDRI 197 240 33 BHUMAL 25 BHUMAL SIDHWAN BET 702 959 34 BHUNDRI 16 BHUNDRI BHUNDRI 3287 3822 35 BANIAWAL 5 BHATHA DHUAN BHUNDRI 162 198 36 MANWARPURA 40 MANWARPURA LODHIWALA 327 262 BET-LDH.xls Ludhiana 2 POPULATION SN VILLAGE NAME HADBAST NO. -

Mansa District Punjab

MANSA DISTRICT PUNJAB Government of India Ministry of Water Resources CENTRAL GROUND WATER BOARD North Western Region Chandigarh 2013 Contributors S.C. Behera Scientist - ‘D’ Prepared under supervision of A.K Bhatia Regional Director Our Vision “Water Security through Ground water Management” GROUND WATER INFORMATION BOOKLET MANSA DISTRICT, PUNJAB CONTENTS MANSA DISTRICT AT A GLANCE 1.0 INTRODUCTION 2.0 RAINFALL & CLIMATE 3.0 GEOMORPHOLOGY AND SOILS 4.0 GROUND WATER SCENARIO 4.1 HYDROGEOLOGY 4.2 GROUND WATER RESOURCE 4.3 GROUND WATER QUALITY 4.4. SCOPE OF GROUND WATER DEVELOPMENT 5.0 GROUND WATER MANAGEMENT 5.1 WATER CONSERVATION & ARTIFICIAL RECHARGE 6.0 GROUND WATER RELATED ISSUES & PROBLEMS 7.0 RECOMMENDATIONS 3 MANSA DISTRICT AT A GLANCE Sl.No Contents Statistics 1. GENERAL INFORMATION i. Geographical Area (Sq.Km) 2171 ii. Location N290 32`: 300 12` E750 10`: 750 46` iii. District Head Quarters Mansa Administrative Divisions iv. Sub Divisions 3 v. Number of Tehsils 3 (Mansa, Budhlada, Sardulgarh) vi. Number of Blocks 5 (Mansa, Budhlada, Sardulgarh, Bhiki, Jhunir) vii. Number of Towns 5 viii. Number of Villages 244 ix. Population (As per Census 2011) 7,68,808 x. Average Annual Rainfall (mm) 378 mm 2. GEOMORPHOLOGY i. Major Physiographic Units Quaternary Alluvium comprising clays, sands and kankar ii. Major Drainage Ghaggar River and Sirhind Drain 3. LANDUSE (Sq.Km) i. Forest Area 27 ii. Net area sown 1900 iii. Cultivable Area 4. MAJOR SOIL TYPES Clayey Loam Sandy Loam 5. AREA UNDER PRINCIPAL CROPS 337000 ha Wheat(170000ha) , Rice (74000), Cotton (92000 ha) , Bajra (1000 ha) 6. -

District Survey Report

DISTRICT SURVEY REPORT FOR SAND MINING DISTRICT TARNTARAN MINING DIVISION, TARNTARAN DEPTT. OF MINES AND GEOLOGY, PUNJAB PREFACE In Compliance to the notification issued by the Ministry of Environment , Forest And Climate change dated 15.01.2016 , the preparation of District Survey Report of river bed mining and other minor minerals is in accordance with appendix 10 of the notification . It is also mentioned here that the procedure of preparation of District Survey Report is as per notification guidelines. Every efforts have been made to cover sand mining locations, areas & overview of Mining activity in the district with all its relevant features pertaining to geology & mineral wealth in replenishable and non-replenishable areas of rivers, streams and other sand sources. This report will be a model and guiding document which is a compendium of available mineral resources , geographical set up , environmental and ecological set up of the District and is based on data of various departments , published reports , and websites. The data may vary due to floods , heavy rains and other natural calamities. Therefore , it is recommended that Sub Divisional Level Committee may take into consideration all its relevant aspects / data while scrutinizing and recommending the application for EC to the concerned Authority. Overview of Mining Activity SURVEY REPORT OF DISTRICT TARNTARAN th As per Gazette notification of 15 January 2016 of Ministry of Environment, Forest and Climate Change a Survey shall be carried out by the District Environment Impact -

World Bank Document

Procurement Plan for Punjab RWSS (P150520) I. General 1. Bank’s approval Date of the procurement Plan 2012 Public Disclosure Authorized 2. Date of General Procurement Notice: [October 01, 2014 ] 3. Period covered by this procurement plan: January 2017 onwards II. Goods and Works and non-consulting services. 1. Prior Review Threshold: Procurement Decisions subject to Prior Review by the Bank as stated in Appendix 1 to the Guidelines for Procurement: 2. Procurement Method Prior Review Threshold US$ 1. ICB and LIB (Goods) Above US$ 500,000 2. NCB (Goods) Above US$ 100,000 3. ICB (Works) Above US$ 40 million Public Disclosure Authorized 4. NCB (Works) Above US$ 10 million 5. (Non-Consultant Services) Below US$ 100,000 2. Prequalification for Bidders _Not applicable_ 3. Proposed Procedures for CDD Components (as per paragraph. 3.17 of the Guidelines: NA 4. Reference to (if any) Project Operational/Procurement Manual: Project Implementation Manual for World Bank Loan Project P150520 Public Disclosure Authorized 5. Any Other Special Procurement Arrangements: In addition, the justification for all contracts to be issued on the basis of LIB, single-source or direct contracting (except for contracts less than US$50,000 in value) will be subject to prior review. Justification for all contracts to be issued on the basis of LIB, single-source or direct contracting (except for contracts less than US$50,000 in value) will be subject to prior review. III. Selection of Consultants 1. Prior Review Threshold: Selection decisions subject to Prior Review by Bank as stated in Appendix 1 to the Guidelines Selection and Employment of Consultants: Public Disclosure Authorized Selection Method Prior Review Threshold 1. -

Compendium of 50 Years of Achievements (1962-2012)

A Saga of Progress COMPENDIUM OF 50 YEARS OF ACHIEVEMENTS (1962-2012) PUNJAB AGRICULTURAL UNIVERSITY LUDHIANA-141004 Citation: A Saga of Progress: Compendium of 50 Years of Achievements, Punjab Agricultural University, Ludhiana, 2012, pp 230. Published by: Dr Satbir Singh Gosal, Director of Research, for and on behalf of Punjab Agricultural University, Ludhiana in November, 2012. Printed at: Foil Printers, Ludhiana Cover Design : Kulwant Singh Basra FOREWORD India has made tremendous progress in agriculture. Food grain production increased from 50 mt in 1950- 51 to 257 mt in 2011-12. A food-deficient nation during 1950s and 1960s, it has now not only exportable surplus of certain commodities but is among the top exporters of rice, one of three most important crops. Punjab state has played a leading role in this agricultural transformation. Food grain production in the state was 3.1 mt in 1960-61 and it increased to 29.2 mt during 2011-12. More importantly, productivity of wheat rose from 12 to 51 q/ha and that of paddy from 15 to about 60 q/ha. In fact, rice production increased by nearly 50 times. With 38- 75 and 25-45 % contribution of wheat and rice, respectively, to the central food grain pool for public distribution, the State became mainstay of national food security and came to be known as bread basket of India. The agricultural transformation was technology led. It started with the introduction/development of high yielding dwarf, input responsive varieties of wheat in mid 1960s followed by that of rice and the package of complementary production-protection technologies, the adoption of which ushered in an era of “Green Revolution”. -

Sr. No Name & Address Company Name & Address 1 Kamaljit Singh S

.Sr. Name & Address Company Name & Address No 1 Kamaljit Singh S/o Rajinder Singh M/s Royal Consultants Ground Floor Madhook Complex Ferozepur Road Ludhiana 2 Ishwinder Singh S/o Harjinder Singh M/s Wisdom Migration & Immigration Services Private Limited Ludhiana , & M/s Wisdom Immigration Consultancy Services Inc S.C.O 12A,First Floor Wisdom Model Town Extn. Market, Near Krishna Mandir Ludhiana 3 Gurpreet Singh S/o Sher Singh M/s G.S Trade Test Centre Amloh Road Khanna 4 Kanwaljit singh S/o Harbhajan Singh Cheema M/s Cheema International M-12, Ground floor Dhian Complex near Bus stans Ludhiana 5 Manjit Singh S/o S. Amarjit Singh M/s The Visa Headquarters SCF 15 First Floor Main Market Sarbha Nagar Ludhiana 6 Raghbir Singh S/o Priti Singh M/s True International & Education Private Ltd 7 Kanwarpal Singh S Pritpal Singh M/s SSC Education Abroad and Study Circle 158-L Model Town Ludhiana 8 Sh. Kuldeep Singh S/o Satpal Singh M/s Wave Immigration & Education Consultany Service Grewal Janta Nagar Chout Gill Road Ludhiana 9 Nana Brar S/o Nazar V.P.O Akhara M/s Brar Travel Adviors Adda Raikot Back side Jagraon 10 Ranjodh Singh S/o Harjinder Singh M/s Mind Maker GTB Khanna 11 Prithipal Singh S/o S. Mohan Singh M/s Globes Immigration Services B-xx-2460 Krishan Nagar Ludhiana 12 Ajit Singh S/o Chain Singh M/s R.A Travel Services 3/1 jawhar Nagar Opp Bus Stand Ludhiana 13 Gaurav Chaudhary S/o Sh. Harish Chaudhary Chaudhary Consultanty b-1-387 Cinema Road Ludhiana 14 Amandeep Singh S/o Tirth Singh M/s Singh Travel 3rd Floor Nanakna Sahib Complex Near Bus stand 15 Rupinder Singh S/o Ujjar Singh Kanwal M/s Pro Star Immrigation Consultany Services office No.3 Upper Ground floor madhok complex ludhiiana 16 Seema Arora W/o Sh. -

Sr. No. Name of the Owner Address Area Mobile Number Home

Sr. Home Name of The Owner Address Area Mobile Number Vehicle Number Dirver Name No. Delivery DARSHAN KARYANA 1 MALI GANJ MALI GANJ 98551-21320 STORE ANANDPUR RATION PUNJAB MATA 2 PUNJAB MATA NAGAR 94631-42740 DEPOT NAGAR RAJU DEPARTMENTAL 3 AGAR NAGAR AGAR NAGAR 99156-51786 STORE RAM SARUP SUNIL 4 MALI GANJ MALI GANJ 94632-02719 KUMAR 5 RAJ KARYANA STORE FIELD GANJ FIELD GANJ 99145-22786 G T ROAD, G T ROAD, JALANDHAR 6 PALI KARYANA STORE JALANDHAR 98760-86365 BYPASS BYPASS 7 RAJU KARYANA NURWALA ROAD NURWALA ROAD 94634-07453 MALHOTRA KARYANA 8 DIVISION NO.3 DIVISION NO.3 98142-17417 STORE KRISHAN LAL VED 9 MALI GANJ MALI GANJ 94171-57911 PARKASH 10 MANJINDER KARYANA SALM TABRI SALM TABRI 98150-36299 OLD COURT 11 MANI BALWANT OLD COURT CHOWK 98726-34351 CHOWK HAIBOWAL 12 RIKHI RAM NAND LAL HAIBOWAL CHOWK 98724-59265 CHOWK 13 RIKHI RAM NAND LAL MOTI NAGAR MOTI NAGAR 94637-49332 JWAHAR NAGAR 14 KWALITY STORE JWAHAR NAGAR CAMP 98761-93490 CAMP JWAHAR NAGAR 15 GARG KARYANA STORE JWAHAR NAGAR CAMP 73555-78848 CAMP 16 JOLLY KARYANA MODEL TOWN MODEL TOWN 98729-56000 17 KOCHAR KARYANA MALI GANJ MALI GANJ 92167-02423 18 SATPAL KARYANA GIASPURA GIASPURA 79863-80804 19 GOLDY KARYANA GIASPURA GIASPURA 98150-64395 20 ARORA KARYNA FOCAL POINT FOCAL POINT 98788-24157 21 MOHIT KARYANA DHURI LINES DHURI LINES 81469-54677 22 VICKY KARYANA Store SHIMLAPURI SHIMLAPURI 98883-00450 YES PB 10 EF 9839 MAYANK 23 PAL KARYANA STORE SHIMLAPURI SHIMLAPURI 98885-57563 24 RAJINDER KARYANA SHIMLAPURI SHIMLAPURI 94658-64894 25 SAHIL KARYANA SHIMLAPURI SHIMLAPURI 97812-09709 -

List of Absconders U/S 299 Crpc As on 31.07.2021

GRP, Punjab List of Absconders u/s 299 CrPC As on 31.08.2021 SNo. Name Father’s Name Address Police Station Distt State FIR Date Under Section Police Station Date of P.O. No. 1 Vijay Giri Chokat Giri r/o Vill Sital Bardar Kulia Vantt Gopalganj Bihar 18 12.11.10 20/61/85 NDPS GRPS Abohar 22.08.2014 Act 2 Kundan Yadev Surat Yadev r/o Datiranan Katola Thane Gopal Ganj Bihar 61 29.07.09 25/54/59 Arms GRPS Amritsar 18.04.2013 Act 3 Mohd. Samsudeen Dil Mohd. r/o Haraeia Maszid H.No1/117 Dahia, Katihar Bihar 65 02.05.87 409 IPC GRPS Bathinda 26/11/1998 4 Anjani Shahi s/o Radha Shahi r/o Vill. Chomukh Bochara Mujaffarpur Bihar 100 09.10.16 20 NDPS Act GRPS Bathinda 20.02.2019 5 Dhani Shankar s/o Madan Mohan r/o Vill. Chandpur, PS. Bainpai Madhuwani Bihar 69 14.06.17 379-B IPC GRPS Bathinda 18-03-2020 Choudhary Choudhary 6 Punya Nand Raj Kumar r/o Vill. Devi Ganj Narpat Ganj, Aheria Bihar 34 14.03.11 61/1/14 Ex. Act GRPS Jalandhar 08.02.2014 Kumar 7 Sanjeev Rai Nawab Rai r/o Maitola Brar Pur Bakhtiar Pur Patna Bihar 149 28.11.201 279/427 IPC GRPS Jalandhar 03.09.2014 3 8 Randhir Kumar Jai Parkash r/o Vill. Surti Tolla Naon Gachian Bhawani pur Purnia Bihar 31 21.03.13 25 Arms Act GRPS Jalandhar 04.02.2015 9 Rakesh Kumar @ r/o Kham Khol Farwis Ganj Purnia Bihar 66 28.05.14 61/1/14 Ex.