Travis County

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Vetoes of Legislation 85Th Legislature

HOUSE RESEARCH ORGANIZATION October 5, 2017 Texas House of Representatives Vetoes of Legislation 85th Legislature Gov. Greg Abbott vetoed 50 bills approved by the 85th Legislature during the 2017 regular legislative session. The vetoed bills include 36 House bills and 14 Senate bills. This report includes a digest of each vetoed measure, the governor’s stated reason for the veto, and a response to the veto by the author or the sponsor of the bill. If the House Research Organization analyzed a vetoed bill, the Daily Floor Report in which the analysis appeared is cited. A summary of the governor’s line-item vetoes to SB 1 by Nelson, the general appropriations act for fiscal 2018-19, will appear in an upcoming House Research Organization state finance report, Texas Budget Highlights, Fiscal 2018-19. Focus Report: Number 85-7 Page 2 House Research Organization Contents Recognizing academic success by former special education students HB 61 by Guillen (Uresti) ............................................................................................................. 7 Entitling a parent to view a deceased child’s body before an autopsy HB 298 by Larson (Campbell) ..................................................................................................... 8 Requiring state agencies to cite legislation authorizing rules HB 462 by Dale (Zaffirini) ............................................................................................................ 9 Coordinating statewide pesticide disposal activities HB 572 by Stephenson (Kolkhorst) -

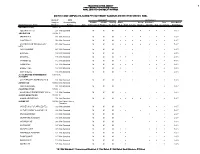

Postsecondary Readiness Distinction by District Name

TEXAS EDUCATION AGENCY 1 PERFORMANCE REPORTING DIVISION FINAL 2018 ACCOUNTABILITY RATINGS DISTRICTS AND CAMPUSES RECEIVING POSTSECONDARY READINESS DISTINCTION BY DISTRICT NAME District/ 2018 Domains* Distinctions Campus Accountability Student School Closing Read/ Social Academic Post Num Met of District/Campus Name Number Rating Note Achievement Progress the Gaps ELA Math Science Studies Growth Gap Secondary Num Eval ABERNATHY ISD 095901 B ABERNATHY H S 001 Met Standard M M M ○ ● ● ● ● ● ● 6 of 7 ABILENE ISD 221901 B ABILENE H S 001 Met Standard M M M ○ ● ○ ● ○ ● ● 4 of 7 COOPER H S 002 Met Standard M M M ● ● ● ● ○ ● ● 6 of 7 ACADEMY FOR TECHNOLOGY 010 Met Standard M M M ● ● ● ● ● ● ● 7 of 7 ENG CLACK MIDDLE 047 Met Standard M M M ○ ○ ● ○ ○ ○ ● 2 of 7 BOWIE EL 104 Met Standard M M M ○ ○ ● ○ ○ ● 2 of 6 DYESS EL 108 Met Standard M M M ● ● ○ ○ ● ● 4 of 6 JACKSON EL 112 Met Standard M M M ● ○ ● ○ ● ● 4 of 6 THOMAS EL 151 Met Standard M M M ● ● ● ● ● ● 6 of 6 BASSETTI EL 153 Met Standard M M M ● ○ ○ ○ ● ● 3 of 6 MARTINEZ EL 155 Met Standard M M M ○ ● ○ ○ ○ ● 2 of 6 ACCELERATED INTERMEDIATE 101849 A ACADEMY ACCELERATED INTERDISCIPLIN 101 Met Standard M M M ● ○ ○ ○ ● ● 3 of 6 ADRIAN ISD 180903 Met Standard ADRIAN SCHOOL 001 Met Standard M M M ○ ○ ○ ○ ○ ○ ● 1 of 7 AGUA DULCE ISD 178901 C AGUA DULCE ELEMENTARY SCHO 101 Met Standard M M M ● ● ○ ○ ● ● 4 of 6 ALAMO HEIGHTS ISD 015901 B ALAMO HEIGHTS H S 001 Met Standard M M M ● ● ● ● ○ ○ ● 5 of 7 ALDINE ISD 101902 Not Rated: Harvey Provision CARVER H S FOR APPLIED TEC 002 Met Standard M M M ● ○ ○ -

2017 Statewide Elementary School Rankings CAMPUS DISTRICT COUNTY STATE RANK GRADE

2017 Statewide Elementary School Rankings CAMPUS DISTRICT COUNTY STATE RANK GRADE PRAIRIE CREEK EL RICHARDSON ISD DALLAS COUNTY 1 A+ CANYON CREEK EL ROUND ROCK ISD WILLIAMSON COUNTY 2 A+ BEVERLY EL PLANO ISD COLLIN COUNTY 3 A+ KERR EL ALLEN ISD COLLIN COUNTY 4 A+ JACK D JOHNSON EL CARROLL ISD TARRANT COUNTY 5 A+ SPICEWOOD EL ROUND ROCK ISD WILLIAMSON COUNTY 6 A+ BUCKALEW EL CONROE ISD MONTGOMERY COUNTY 7 A+ COMMONWEALTH EL FORT BEND ISD FORT BEND COUNTY 8 A+ TANGLEWOOD EL FORT WORTH ISD TARRANT COUNTY 9 A+ CREEKSIDE FOREST EL TOMBALL ISD HARRIS COUNTY 10 A+ MARTHA & JOSH MORRISS TEXARKANA ISD BOWIE COUNTY 11 A+ MATH & ENGINEERING EL RIVER OAKS EL HOUSTON ISD HARRIS COUNTY 12 A+ CORNERSTONE EL FORT BEND ISD FORT BEND COUNTY 13 A+ WILLIAM B TRAVIS DALLAS ISD DALLAS COUNTY 14 A+ ACDMY/VNGRD FOR SILVERCREST EL PEARLAND ISD BRAZORIA COUNTY 15 A+ HORN EL HOUSTON ISD HARRIS COUNTY 16 A+ MARY EVANS EL ALLEN ISD COLLIN COUNTY 17 A+ SKAGGS EL PLANO ISD COLLIN COUNTY 18 A+ CARVER CENTER MIDLAND ISD MIDLAND COUNTY 19 A+ LAUREL MOUNTAIN EL ROUND ROCK ISD WILLIAMSON COUNTY 20 A+ 1 CAMPUS DISTRICT COUNTY STATE RANK GRADE MATHEWS EL PLANO ISD COLLIN COUNTY 21 A+ MCSPEDDEN EL FRISCO ISD COLLIN COUNTY 22 A+ BESS CAMPBELL EL LAMAR CISD FORT BEND COUNTY 23 A+ POPE EL CYPRESS-FAIRBANKS ISD HARRIS COUNTY 24 A+ BRENTFIELD EL RICHARDSON ISD DALLAS COUNTY 25 A+ CASTLE HILLS EL LEWISVILLE ISD DENTON COUNTY 26 A+ WINDSOR PARK G/T CORPUS CHRISTI ISD NUECES COUNTY 27 A+ DERETCHIN EL CONROE ISD MONTGOMERY COUNTY 28 A+ BUSH EL HOUSTON ISD HARRIS COUNTY 29 A+ ANDREWS -

IDEOLOGY and PARTISANSHIP in the 87Th (2021) REGULAR SESSION of the TEXAS LEGISLATURE

IDEOLOGY AND PARTISANSHIP IN THE 87th (2021) REGULAR SESSION OF THE TEXAS LEGISLATURE Mark P. Jones, Ph.D. Fellow in Political Science, Rice University’s Baker Institute for Public Policy July 2021 © 2021 Rice University’s Baker Institute for Public Policy This material may be quoted or reproduced without prior permission, provided appropriate credit is given to the author and the Baker Institute for Public Policy. Wherever feasible, papers are reviewed by outside experts before they are released. However, the research and views expressed in this paper are those of the individual researcher(s) and do not necessarily represent the views of the Baker Institute. Mark P. Jones, Ph.D. “Ideology and Partisanship in the 87th (2021) Regular Session of the Texas Legislature” https://doi.org/10.25613/HP57-BF70 Ideology and Partisanship in the 87th (2021) Regular Session of the Texas Legislature Executive Summary This report utilizes roll call vote data to improve our understanding of the ideological and partisan dynamics of the Texas Legislature’s 87th regular session. The first section examines the location of the members of the Texas Senate and of the Texas House on the liberal-conservative dimension along which legislative politics takes place in Austin. In both chambers, every Republican is more conservative than every Democrat and every Democrat is more liberal than every Republican. There does, however, exist substantial ideological diversity within the respective Democratic and Republican delegations in each chamber. The second section explores the extent to which each senator and each representative was on the winning side of the non-lopsided final passage votes (FPVs) on which they voted. -

Judith Zaffirini Work Together Constructively

2016-2017 • Austin, Texas Dear Friends: State Affairs and Health and Human Services committees. What’s more, I The Pulitzer Prize-winning writer, am delighted to serve as Senate Chair Katherine Anne Porter, whose child- of the Eagle Ford Shale Legislative hood home is in Hays County, wrote that Caucus and as a member of the Texas we can overcome society’s challenges, if Judicial Council. Count on me to con- only all of us who want a change for the tinue to cast every vote by balancing the better just get up and work for it, all the needs and priorities of our district with time, with as much knowledge and intel- those of our great State. ligence as we can muster. Katherine Anne Porter also wrote, Porter’s stirring words reflect my the habit which distinguishes civilized purpose in the Texas Senate: I work ev- people from others is that of discus- ery day to bring about a better future sion, exchange of opinion and ideas, for our children, our families, our com- the ability to differ without quarrelling, munities and our great state. to say what you have to say civilly and These communities are home to then to listen civilly to another speaker. more than 800,000 constituents living Civility, communication, collabora- in 18 counties, namely, Bee, Caldwell, tion and preparation are the cor- Duval, Jim Hogg, Karnes, La nerstones of effective public Salle, Live Oak, McMullen, Civility, communication, service. To prompt meaningful San Patricio, Starr, Webb, Wil- discussion of key issues, this son and Zapata; and parts of collaboration and preparation are the annual newsletter is not only a Atascosa, Bexar, Guadalupe, cornerstones of effective public service. -

Prism Fall 08.Pdf

We are here in South Texas and we are here for “Life” The Company You Keep® Peace of mind comes from having financial protection. Let us show you how New York Life’s values and financial strength may help you achieve it. Schedule a FREEno-obligation consultation with one of our highly trainedAgents to review your financial protection needs. For more than 160 years, New York Life has been helpingpeople protect what’s most important to them- the future of their loved ones. In this time of turmoil in the financial markets, we’re pleased to be able to tell you that New York Life Insurance Company remains tremendously healthy. NewYork Life has been in the business of making - and Eddie L. Garcia, MBA, CLU® keeping - long-term promises for more than 160 years. Andbecause we are a mutual company, not shareholder Agent, owned, we never have the incentive to make overly New York Life Located in Texas A&M International University’s aggressiveinvestments to boost our earnings in the short Insurance Company term. Every decision and every investment we make Sue and Radcliffe Killam Library is guided by our commitment to keep our promises decadesinto the future. Find out what solutions we can 4133 Gollihar Rd. offer and why we remain Corpus Christi, Texas 78412 The Company You Keep® (361) 854-4500 2 CONTENTS PRIDE. PASSION. PERFORMANCE. President’s Message ..............................................................................3 Pride TAMIU Pre-Engineering Program ..................................................4 More Students Attend University While in High School ............................................................................5 Passion School of Business Gets New Name ...........................................6 Salinas Trust Responds to Sanchez Challenge .....................7 Performance TAMIU’s Quiet Revolution ..................................................................8 Texas Legislature to focus on Higher Education .................9 ABOUT PRISM Donors Dr. -

Texas Elementary School Rankings - 2019 UPDATED

Texas Elementary School Rankings - 2019 UPDATED STATE RANK CAMPUS DISTRICT COUNTY C@R GRADE 1 WINDSOR PARK G/T CORPUS CHRISTI ISD NUECES A+ 2 WILLIAM B TRAVIS VANGUARD ACAD OF DALLAS ISD DALLAS A+ 3 SCHOOL FOR THE TALENTED & GIFTED I DALLAS ISD NA A+ 4 OLD UNION EL CARROLL ISD TARRANT A+ 5 HUDSON EL LONGVIEW ISD GREGG A+ 6 SUDIE L WILLIAMS TALENTED AND GIFT DALLAS ISD NA A+ 7 SCHOOL FOR THE HIGHLY GIFTED GRAND PRAIRIE ISD DALLAS A+ 8 CARROLL EL CARROLL ISD TARRANT A+ 9 EMMA VERA EL ROMA ISD STARR A+ 10 J KAWAS EL LAREDO ISD WEBB A+ 11 EL MAGNET AT REAGAN EL ECTOR COUNTY ISD ECTOR A+ 12 SPRING BRANCH ACADEMIC INSTITUTE SPRING BRANCH ISD HARRIS A+ 13 GEORGE B DEALEY MONTESSORI ACADEMY DALLAS ISD DALLAS A+ 14 T H ROGERS SCHOOL HOUSTON ISD HARRIS A+ 15 MARTHA & JOSH MORRISS MATH & ENGIN TEXARKANA ISD BOWIE A+ 16 DEVERS EL DEVERS ISD LIBERTY A+ 17 FLORENCE J SCOTT EL ROMA ISD STARR A+ 18 VALLEY VIEW NORTH EL VALLEY VIEW ISD HIDALGO A+ 19 CACTUS RANCH EL ROUND ROCK ISD WILLIAMSON A+ Texas Elementary School Rankings - 2019 UPDATED STATE RANK CAMPUS DISTRICT COUNTY C@R GRADE 20 CANYON CREEK EL ROUND ROCK ISD WILLIAMSON A+ 21 CARVER CENTER MIDLAND ISD MIDLAND A+ 22 SKAGGS EL PLANO ISD COLLIN A+ 23 KIMBERLIN ACAD FOR EXCEL GARLAND ISD DALLAS A+ 24 WALNUT GLEN ACAD FOR EXCEL GARLAND ISD DALLAS A+ 25 TALLEY EL FRISCO ISD NA A+ 26 CREEKSIDE FOREST EL TOMBALL ISD HARRIS A+ 27 TANGLEWOOD EL FORT WORTH ISD TARRANT A+ 28 RUMMEL CREEK EL SPRING BRANCH ISD HARRIS A+ 29 LAUREL MOUNTAIN EL ROUND ROCK ISD WILLIAMSON A+ 30 BEVERLY EL PLANO ISD COLLIN A+ 31 PATSY -

In the United States Court of Appeals for the Fifth Circuit ______

Case: 14-41127 Document: 00512849851 Page: 1 Date Filed: 11/26/2014 IN THE UNITED STATES COURT OF APPEALS FOR THE FIFTH CIRCUIT ____________ No. 14-41127 USDC No. 2:13-cv-00193 ____________ MARC VEASEY, et al., Appellees, v. RICK PERRY, et al., Appellants. ____________ APPEAL FROM THE UNITED STATES DISTRICT COURT FOR THE SOUTHERN DISTRICT OF TEXAS, CORPUS CHRISTI DIVISION ____________ Veasey-LULAC Appellees’ Motion to Expedite Appeal ____________ CHAD W. DUNN J. GERALD HEBERT K. SCOTT BRAZIL JOSHUA J. BONE Brazil & Dunn Campaign Legal Center 4201 Cypress Creek Pkwy 215 E Street NE Suite 530 Washington, DC 20002 Houston, Texas 77068 (Additional counsel listed on next page) Case: 14-41127 Document: 00512849851 Page: 2 Date Filed: 11/26/2014 ARMAND G. DERFNER Derfner, Altman & Wilborn, LLC P.O. Box 600 Charleston, S.C. 29402 NEIL G. BARON Law Office of Neil G. Barron 914 FM 517 W, Suite 242 Dickinson, Texas 77539 DAVID RICHARDS Richards, Rodriguez & Skeith, LLP 816 Congress Avenue, Suite 1200 Austin, Texas 78701 LUIS ROBERTO VERA, JR. LULAC National General Counsel 1325 Riverview Towers, 111 Soledad San Antonio, Texas 78205-2260 Counsel for the Veasey-LULAC Appellees-Movants 1 Case: 14-41127 Document: 00512849851 Page: 3 Date Filed: 11/26/2014 CERTIFICATE OF INTERESTED PERSONS The undersigned counsel of record certifies that the following listed persons and entities as described in the fourth sentence of Rule 28.2.1 have an interest in the outcome of this case. These representations are made in order that the judges of this court may evaluate possible disqualification or recusal. -

11Th Annual Conference

1 1th Annual Conference January 16–17, 2014 January 16, 2014 Dear Participants: Welcome to the 11th Annual Conference of The Academy of Medicine, Engineering & Science of Texas (TAMEST)! I am delighted that so many leaders from the fields of education, medicine, science, and business are attending this year’s event in Austin. In 2004, along with Nobel Laureates Michael Brown and the late Richard Smalley, I established TAMEST to strengthen the state’s research community and to secure Texas’ future as a leader in medicine, engineering and science. Membership in TAMEST consists of Texas’ 263 members of the Institute of Medicine, National Academy of Engineering, and National Academy of Sciences, including our 10 Nobel Laureates. As we celebrated our 10th year, we achieved a number of new milestones, including the highest number of members in the history of our organization. Since 2004 we have added 114 new TAMEST members, either through their election to one of the National Academies, or through the increasing numbers of leading researchers moving to Texas. Our Edith and Peter O’Donnell Awards program, established in 2006 to recognize the state’s most promising young investigators, has honored a total of 36 individuals for their scientific achievements.This year’s annual conference will be TAMEST’s 19th major event, continuing our tradition of providing forums for interaction to foster collaboration and accelerate innovation across the state. The program for this year’s conference focuses on the emergence of computational science and engineering and its pervasive impact on virtually every aspect of scientific inquiry and technological innovation central to the progress, security, and welfare of modern civilization. -

GO COOGS! 713-GO COOGS for More UH Events: 2009-10 Basketball Schedule

0073040572 NON-PROFIT ORG. U.S. POSTAGE PAID PERMIT NO. 5910 UNIVERSITY ADVANCEMENT HOUSTON, TEXAS 306 McELHINNEY HALL HOUSTON, TEXas 77204-5035 CHANGE SERVICE REQUESTED Get Your Tickets Today! GO COOGS! 713-GO COOGS www.uh.edu/athletics For more UH events: www.uh.edu/calendar 2009-10 BASKEtbALL SCHEDULE 12/06 vs. Texas A&M- 01/09 vs. Tulsa TV 02/16 @ UCF TV Corpus Christi 01/13 vs. UTEP 02/20 @ UAB 12/14 vs. Troy 01/16 @ East Carolina 02/24 vs. Memphis 12/19 vs. Mississippi State TV 01/20 vs. UCF 02/27 @ SMU 12/21 vs. The Citadel 01/23 @ Memphis TV 03/03 vs. Rice 12/23 vs. TCU 01/30 vs.Marshall TV 03/06 @ Tulane 12/29 @ Louisiana Tech 02/03 @ UTEP TV 01/01 @ UTSA 02/06 vs. Southern Miss TV 01/03 @ Iowa State 02/09 @ Western Kentucky 01/06 @ Rice TV 02/13 vs. SMU Tell us what you think: www.uh.edu/magazine At The University of Houston Magazine, our goal is to create a publication you’ll be proud to receive, read and share with others. Your involvement as an engaged reader is critical to our success. As we strive to continue to improve the magazine, we want to hear from you. Please help us by going online at www.uh.edu/survey to take a brief survey about your thoughts on The UH Magazine. We want to know whether you prefer the print or the online edition, what sections you most enjoy, what sections you don’t prefer and suggested improvements for our online edition. -

2016 Platinum Sponsor

Agenda posted 9/21/16 2016 Platinum Sponsor PRE-CONFERENCE, WED, Sept. 28 12:30–6pm Bus Tour of SAWS desal plant and ASR facilities Hosted by Zachry Parsons (Must be registered for Texas Desal 2016 to register for the bus tour; nominal fee required) DAY ONE, THUR, Sept. 29 7:30– 8:15 am Continental & Coffee in Mezzanine Hosted by American Water Chemicals 8:15 am Conference Kickoff in the Ballroom 8:15–8:30 am Welcome: Texas Desal Association President, Paul Choules, Water Cycle Opening Remarks: Director Peter Lake, Texas Water Development Board 8:30–8:45 am Recap of 9/28 SAWS Bus Tour: Randy Palachek, Parsons and Rick Glover, Zachry 8:45–9:15 am Droughts and Water Policy in Texas: Innovative Water Supply Strategies and Funding Carlos Rubinstein, Poseidon Water 9:15–9:30 am Legislative Update from Texas Desalination Association Justin Sutherland, Carollo Engineers 9:30–9:45 am BOR-funded Research & Opportunities for Future Partnerships and Grants Yuliana E. Porras-Mendoza, Bureau of Reclamation 9:45–10:15 am Networking Break Hosted by IDE Americas 10:15-11:15 am Water from the Desert (The El Paso Session) Moderated by Ed Archuleta, University of Texas at El Paso Brackish Water Desal in El Paso, Nine Years In & Planning for the Future Jeremy Anderson, CDM Smith Changing the Game for Desal Water Solutions Paul Wallace, Enviro Water Minerals Desalination Membrane Selection for Direct Potable Reuse Daniel Olson, Arcadis-US Page 1 of 3 TexasDesal2016 AGENDA DAY ONE, THUR, Sept. 29 - CONTINUED 11:15 am Luncheon Buffet Service 11:30 –12:30pm Luncheon & Keynote Address by the Honorable Kay Bailey Hutchison Hosted by Ferrovial 12:30-12:45 pm Presentation of the Ed Archuleta Desalter Scholarship Award Sponsored by Carollo Engineers 12:45-1pm Other Presentations and Announcements by Texas Desal Assoc. -

Policy Report Texas Fact Book 2006

Te x a s F a c t Book 2006 LEGISLATIVE BUDGET BOARD LEGISLATIVE BUDGET BOARD SEVENTY-NINTH TEXAS LEGISLATURE 2005 – 2006 DAVID DEWHURST, CO-CHAIR Lieutenant Governor, Austin TOM CRADDICK, CO-CHAIR Representative District 82, Midland Speaker of the House of Representatives STEVE OGDEN Senatorial District 5, Bryan Chair, Senate Committee on Finance ROBERT DUNCAN Senatorial District 28, Lubbock JOHN WHITMIRE Senatorial District 15, Houston JUDITH ZAFFIRINI Senatorial District 21, Laredo JIM PITTS Representative District 10, Waxahachie Chair, House Committee on Appropriations JAMES KEFFER Representative District 60, Eastland Chair, House Committee on Ways and Means FRED HILL Representative District 112, Richardson VILMA LUNA Representative District 33, Corpus Christi JOHN O’BRIEN, Deputy Director CONTENTS STATE GOVERNMENT STATEWIDE ELECTED OFFICIALS . 1 MEMBERS OF THE SEVENTY-NINTH TEXAS LEGISLATURE . 3 The Senate . 3 The House of Representatives . 4 SENATE STANDING COMMITTEES . 8 HOUSE OF REPRESENTATIVES STANDING COMMITTEES . 10 BASIC STEPS IN THE TEXAS LEGISLATIVE PROCESS . 14 TEXAS AT A GLANCE GOVERNORS OF TEXAS . 15 HOW TEXAS RANKS Agriculture . 17 Crime and Law Enforcement . 17 Defense . 18 Economy . 18 Education . 18 Employment and Labor . 19 Environment and Energy . 19 Federal Government Finance . 20 Geography . 20 Health . 20 Housing. 21 Population . 21 Social Welfare . 22 State and Local Government Finance . 22 Technology . 23 Transportation . 23 Border Facts . 24 STATE HOLIDAYS, 2006 . 25 STATE SYMBOLS . 25 POPULATION Texas Population Compared with the U.S. 26 Texas and the U.S. Annual Population Growth Rates . 27 Resident Population, 15 Most Populous States . 28 Percentage Change in Population, 15 Most Populous States . 28 Texas Resident Population, by Age Group .