Department: Invest Hong Kong

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Hong Kong in the Global Economy: How the Special Administrative Region Rises to the Challenges Posed by China

Asia Programme Paper: ASP PP 2010/05 Programme Paper Hong Kong in the Global Economy: How the Special Administrative Region Rises to the Challenges Posed by China Kerry Brown Senior Research Fellow, Asia Programme, Chatham House Sophie Steel Research Assistant October 2010 The views expressed in this document are the sole responsibility of the author(s) and do not necessarily reflect the view of Chatham House, its staff, associates or Council. Chatham House is independent and owes no allegiance to any government or to any political body. It does not take institutional positions on policy issues. This document is issued on the understanding that if any extract is used, the authors and Chatham House should be credited, preferably with the date of the publication. Programme Paper: Hong Kong in the Global Economy SUMMARY • The Hong Kong Special Administrative Region (SAR) has quickly bounced back from the effects of the global economic recession in 2008/09. Economic indicators for the first half of 2010 are strong and attention is turning to the medium- to long-term outlook and Hong Kong’s position in the region. • The SAR’s links with the Mainland economy are still special, though they are evolving and changing. While previously Hong Kong has been seen as the gateway into China, in the future it is also increasingly likely to be the gateway out of the People’s Republic of China (PRC). It now needs to focus on how it can best exploit this for its international positioning as others become interested in directly attracting PRC funds and investment. -

The Chief Executive's 2020 Policy Address

The Chief Executive’s 2020 Policy Address Striving Ahead with Renewed Perseverance Contents Paragraph I. Foreword: Striving Ahead 1–3 II. Full Support of the Central Government 4–8 III. Upholding “One Country, Two Systems” 9–29 Staying True to Our Original Aspiration 9–10 Improving the Implementation of “One Country, Two Systems” 11–20 The Chief Executive’s Mission 11–13 Hong Kong National Security Law 14–17 National Flag, National Emblem and National Anthem 18 Oath-taking by Public Officers 19–20 Safeguarding the Rule of Law 21–24 Electoral Arrangements 25 Public Finance 26 Public Sector Reform 27–29 IV. Navigating through the Epidemic 30–35 Staying Vigilant in the Prolonged Fight against the Epidemic 30 Together, We Fight the Virus 31 Support of the Central Government 32 Adopting a Multi-pronged Approach 33–34 Sparing No Effort in Achieving “Zero Infection” 35 Paragraph V. New Impetus to the Economy 36–82 Economic Outlook 36 Development Strategy 37 The Mainland as Our Hinterland 38–40 Consolidating Hong Kong’s Status as an International Financial Centre 41–46 Maintaining Financial Stability and Striving for Development 41–42 Deepening Mutual Access between the Mainland and Hong Kong Financial Markets 43 Promoting Real Estate Investment Trusts in Hong Kong 44 Further Promoting the Development of Private Equity Funds 45 Family Office Business 46 Consolidating Hong Kong’s Status as an International Aviation Hub 47–49 Three-Runway System Development 47 Hong Kong-Zhuhai Airport Co-operation 48 Airport City 49 Developing Hong Kong into -

New HKETO Director to Promote Hong Kong in ASEAN Countries

HONG KONG ECONOMIC & TRADE OFFICE • SINGAPORE FilesFiles FEBRUARY 2002 ISSUE • MITA (P) 297/09/2001 New HKETO Director to promote Hong Kong in ASEAN countries THE Hong Kong Economic and Trade rule of law, a clean and accountable Office (HKETO) would strive to its administration, the free flow of captial, uttermost to maintain and foster the close information and ideas, a level playing tie between Hong Kong and ASEAN field would continue to provide the countries in trade, business and culture, basis of Hong Kong’s success in the Mr Rex Chang, Director of HKETO in future. While Hong Kong’s strategic Singapore, said at a welcoming reception location with China as its hinterland, in January. low and simple taxes, world- class Mr Chang said, “ ASEAN, taken as a transport and communication group, is Hong Kong’s third largest infrastructure, concentration of top market for domestic exports, re-exports flight financial and business service and source of imports. It is also the Mr Rex Chang, Director of Hong Kong Economic providers had all worked out to make fourth largest trading partner of Hong and Trade Office, addressing at the reception. Hong Kong the Asia’s World City. Kong. Five of the ASEAN countries, Over 200 guests including diplomats, namely Singapore, Malaysia, Thailand, enhance the understanding of Hong government officials, senior business the Philippines and Indonesia, are Kong in the region. Mr Chang added that executives and representatives from the among the top 20 trading partners of Hong Kong welcomed more investment media and community organisations Hong Kong.” from the region. -

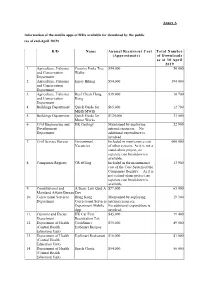

Information of the Mobile Apps of B/Ds Available for Download by the Public (As of End-April 2019)

Annex A Information of the mobile apps of B/Ds available for download by the public (as of end-April 2019) B/D Name Annual Recurrent Cost Total Number (Approximate) of Downloads as at 30 April 2019 1. Agriculture, Fisheries Country Parks Tree $54,000 50 000 and Conservation Walks Department 2. Agriculture, Fisheries Enjoy Hiking $54,000 394 000 and Conservation Department 3. Agriculture, Fisheries Reef Check Hong $39,000 10 700 and Conservation Kong Department 4. Buildings Department Quick Guide for $65,000 12 700 MBIS/MWIS 5. Buildings Department Quick Guide for $120,000 33 000 Minor Works 6. Civil Engineering and HK Geology Maintained by deploying 22 900 Development internal resources. No Department additional expenditure is involved. 7. Civil Service Bureau Government Included in maintenance cost 600 000 Vacancies of other systems. As it is not a stand-alone project, no separate cost breakdown is available. 8. Companies Registry CR eFiling Included in the maintenance 13 900 cost of the Core System of the Companies Registry. As it is not a stand-alone project, no separate cost breakdown is available. 9. Constitutional and A Basic Law Quiz A $77,000 65 000 Mainland Affairs Bureau Day 10. Correctional Services Hong Kong Maintained by deploying 19 300 Department Correctional Services internal resources. Department Mobile No additional expenditure is App involved. 11. Customs and Excise HK Car First $45,000 19 400 Department Registration Tax 12. Department of Health CookSmart: $35,000 49 000 (Central Health EatSmart Recipes Education Unit) 13. Department of Health EatSmart Restaurant $16,000 41 000 (Central Health Education Unit) 14. -

Financial Services Industry News

Apr-Jun 2019 FINANCIAL SERVICES INDUSTRY NEWS ASSET MANAGEMENT Mutual Recognition of Funds between the Netherlands and Hong Kong The Securities and Futures Commission (SFC) and the Dutch Authority for the Financial Markets (AFM) have entered into a Memorandum of Understanding on Mutual Recognition of Funds (MoU) on 15 May 2019. The MoU will allow eligible Hong Kong Collective Investment Schemes (CIS) and Dutch Undertakings for Collective Investment in Transferable Securities (UCITS) to be distributed in each other’s market through a streamlined process. The MoU establishes a framework for exchange of information, regular dialogue as well as regulatory cooperation in relation to the cross- border offering of eligible Hong Kong CIS and Dutch UCITS. In addition, a streamlined approach to the authorisation of funds also applies where Dutch fund managers have been appointed as managers of other European Union UCITS that qualify under the SFC recognised jurisdiction schemes regime. “This new framework with the AFM will open up opportunities for the asset management industries in both markets and provide investors in Hong Kong and the Netherlands with more investment choices. We will continue to expand the mutual recognition of funds arrangements with other jurisdictions as part of the SFC’s commitment to develop Hong Kong into an international asset management centre,” said Mr Ashley Alder, the SFC’s Chief Executive Officer. “This newly established bridge between the Netherlands and Hong Kong constitutes an important stepping stone for the Dutch asset management industry seeking to develop activities in Asia. It leads to offering investors greater choice and diversification in their investments. -

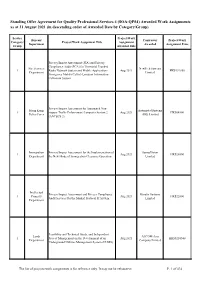

SOA-QPS4) Awarded Work Assignments As at 31 August 2021 (In Descending Order of Awarded Date by Category/Group)

Standing Offer Agreement for Quality Professional Services 4 (SOA-QPS4) Awarded Work Assignments as at 31 August 2021 (in descending order of Awarded Date by Category/Group) Service Project/Work Bureau/ Contractor Project/Work Category/ Project/Work Assignment Title Assignment Department Awarded Assignment Price Group Awarded Date Privacy Impact Assessment (PIA) and Privacy Compliance Audit (PCA) for Terrestrial Trunked Fire Services NewTrek Systems 1 Radio Network System and Mobile Application - Aug 2021 HK$192850 Department Limited Emergency Mobile Caller's Location Information Collection System Privacy Impact Assessment for Automated Non- Hong Kong Automated Systems 1 stopper Traffic Enforcement Computer System 2 Aug 2021 HK$64500 Police Force (HK) Limited (ANTECS 2) Immigration Privacy Impact Assessment for the Implementation of SunnyVision 1 Aug 2021 HK$28000 Department the New Mode of Immigration Clearance Operation Limited Intellectual Privacy Impact Assessment and Privacy Compliance Kinetix Systems 1 Property Aug 2021 HK$22800 Audit Services for the Madrid Protocol IT System Limited Department Feasibility and Technical Study, and Independent Lands AECOM Asia 1 Project Management on the Development of an Aug 2021 HK$5210540 Department Company Limited Underground Utilities Management System (UUMS) The list of projects/work assignments is for reference only. It may not be exhaustive. P. 1 of 434 Standing Offer Agreement for Quality Professional Services 4 (SOA-QPS4) Awarded Work Assignments as at 31 August 2021 (in descending order -

Hong Kong & Mainland China News – December-2018

V Hong Kong & Mainland China News – December-2018 China's import-export value passes 2017 level By www.news.rthk.hk Saturday, December 1, 2018 The total value of China’s imports and exports already exceeded the full-year figure for 2017 as of mid-November, China’s customs administration said Saturday. The General Administration of Customs said in a statement on its website that as of mid- November, the total value of imports and exports had risen nearly 15 percent, compared with the same period a year earlier. It did not give a specific figure. The value of China’s yuan-denominated imports and exports was 27.79 trillion yuan in 2017, according to previously released customs data. More foreign businesses set up HK offices By www.news.rthk.hk Wednesday, December 12, 2018 Sino-US trade tensions have so far failed to put foreign businesses off setting up in Hong Kong, according to a new survey by investment promotion body InvestHK. The latest survey by the group found that the number of overseas or mainland-headquartered businesses with operations in the SAR reached 8,754 this year, compared to 8,225 a year ago, an increase of 6.4 percent. And Stephen Phillips, director-general of investment promotion, saw reason for optimism about the year ahead. "I think if we look at the economic fundamentals for Hong Kong, China, Asia more widely, they remain strong," he said. "But that's not to dismiss the fact that the trade tensions are causing a degree of uncertainty." He said bigger investors were looking at how to respond to the tensions, but Hong Kong would continue to play an important role due to its location. -

Investhk-Client Profiles, April 2021

Client Profiles April 2021 Based in Macao, Australia and Hong offer (IPO) advisory, capital project Australia Kong with international engagement advisory and management, valuation, exposure, CWK Advisory Limited is financial due diligence, restructuring, established by partners equipped insolvency, merger and acquisition, and with extensive “Big-4” experience. The dispute resolutions. company is providing customised CWK’s future plan is to invest in different services to individuals, organisations, startups and lead them from startups to local and multinational corporates and Pre-IPO and IPO. listed companies. Support Services and Corporate Finance CWK service offering is a one-stop shop cwkglobal.com with substantial expertise, including but not limited to internal control review, AML compliance advisory, initial public LX International Advisory Limited is an an accurate decision and minimise advisory company providing services the onboarding time. The company for financial services companies in also offers one-stop shop services with the banking and finance sector. Its substantial expertise. technologically advanced solutions LX’s future plan is to make use of the cover the areas of regulatory reporting, latest financial technology to support risk management, compliance, and corporates and demonstrate the business transaction monitoring to meet the concept of a new generation of FinTech increasing demands of compliance and RegTech. within the financial industry. Financial Advisory – Corporate Service LX Screening System uses a risk-based lx-advisory.com approach coupled with the comprehensive watchlist data and latest technologies in search, AI, and natural language processing, ensures getting Populous is a global design practice National Speed Skating Oval. The specialising in creating environments company offers architecture, interior that draw people and communities design, wayfinding, event planning, together for unforgettable experiences. -

Hong Kong: a Key Link for the Belt and Road

INVESTHK_BRIBooklet_EN_Jan19_Cover_OP.ai 1 2/1/2019 上午9:58 C M Y CM MY CY CMY K CONTENTS 3 ABOUT INVEST 4-5 HONG KONG BELT AND ROAD 6-7 OVERVIEW 8-11HONG KONG ADVANTAGES HONG KONG AND THE NATIONAL DEVELOPMENT 12-13 AND REFORM COMMISSION 14-17 INDUSTRY OPPORTUNITIES REGIONAL 18-21 OPPORTUNITIES 4 5 ABOUT INVEST HONG KONG Invest Hong Kong (InvestHK) is the Hong Kong Special Administrative Region Government’s department responsible for attracting foreign direct investment. Our goal is to help Mainland and overseas Introduction to business contacts: companies to set up and develop their - Lawyers, accountants, human resource businesses in Hong Kong. For those foreign specialists, consultancies, designers, companies that are already established interior specialists and real estate here, we extend our services to help them companies expand in our city. Arranging visit programmes: All of our services are free, confidential - Meetings with service providers, and tailored to clients’ needs. professional associations, and Our comprehensive range of government officials and departments services includes: Business support facilitation: Latest information on Hong Kong’s - Support and assistance with business business environment: licences, visa applications, trade mark - Sector-specific advice and registration, IP and trade regulations opportunities - Marketing and public relations services - Business incorporation procedures during the launch and expansion of - Tax and business regulations your company - Cost-of-business models - Advice on living and working in - Employment legislation Hong Kong — housing, healthcare, - Immigration requirements schooling and networking - Business networking opportunities InvestHK has offices in major cities around the world and industry experts across a range of business sectors. -

Investhk-Client Profiles, April 2019

Client Profiles April 2019 Hong Kong is a fast growing pioneer sales outside of Australia as it is an ideal Australia market for vegan (plant-based) foods. place to enter the wider Asian markets Many famous brands have chosen and Hong Kong consumers are getting Hong Kong first for the new product more eager for more non-dairy and plant launches, including Beyond Meat, based options. Impossible Foods and now Bite Society Food and Beverages with its vegan milky choc balls and bitesociety.com choc bloks. The company decided to make Hong Kong its first market for BLOSSOM is based in Australia, food products of the highest quality, combining upstream and downstream which are natural, pure and healthy. resource chains in the health industry. The company specialises in research BLOSSOM protects human health with and development, production and sales its powerful scientific research and of nutrition, health and natural products. development skills. The company is a Its mission is to bring everyone a healthy top-notch worldwide health product body and a happy life. development, production and sales Retail and Wholesale enterprise. Blossom series products are blossomhealth.com.au made in Australia, providing vitamin supplements and natural health Champ Partners is a human resources management — freeing up internal staff consultancy with deep human to focus on the core business activities. resources expertise in Hong Kong. The company is valued by its customers With local team members having more for fast turnaround time, professional than ten years of experience in the advice, and strict compliance to industry, Champ Partners can provide Hong Kong’s employment regulations. -

Hong Kong's Innovation and Technology Sector: Guide For

Schweizerisches Generalkonsulat in Hong Kong Ref. 652.0 – RAN/GBU Hong Kong, 27.10.2016 Hong Kong’s Innovation and Technology Sector: Guide for Entrepreneurs Table of Contents 1. Governmental Oragnizations ...........................................................................................................2 1.1. InvestHK, StartmeupHK and Hong Kong Fintech ....................................................................2 1.2. Hong Kong Science and Technology Park (HKSTP) ...............................................................3 1.3. HKSTP Innocentre....................................................................................................................5 1.4. Cyberport ..................................................................................................................................5 2. Incubators ........................................................................................................................................7 2.1. MakerBay .................................................................................................................................7 2.2. Dim Sum Labs ..........................................................................................................................7 2.3. Design Incubation Program (by the Hong Kong Design Centre) .............................................8 2.4. Incu-Lab ....................................................................................................................................8 3. Accelerators .....................................................................................................................................9 -

Investhk-Client Profiles, October 2018

Client Profiles October 2018 Established by an Australian investor industry knowledge. Its commercial Australia in March 2018, Golden Dragon Capital experience spans over a range of mineral Limited is an investment project commodities such as gold, copper, lead, advisory firm with a proven track record, zinc, etc. offering clients in the mining industry Hong Kong proves to be an excellent link access to a range of cross-border between Mainland China and overseas services. The company specifically investors who are interested in entering works with mining companies that the Mainland market. Its Hong Kong are looking to enter Mainland China office focuses on linking investment to sign off-take agreements or seek projects with investors especially in technical support with leading Chinese Australia and Mainland China. companies. Investment Project Advisory The company has been in the industry goldendragoncapital.com for more than seven years and has cultivated an extensive network of relationships and developed in-depth Founded in 2016 in Sydney, Hyper Anna and HR) to power high-impact use cases, Limited is an Artificial Intelligence including cross-sells/up-sells, expense powered data analysis company. management, revenue forecasting, Interacting with Anna is like talking to supply chain management and many a real person, she does all the tedious more. and technical works of writing code, Hyper Anna expanded to Hong Kong analysing data, producing charts & more in 2017 to embrace opportunities in the importantly insights - all things that area and enhance its presence in the come along with data analytics. Think Asia Pacific market. It now serves several Siri over the top of the organisation’s financial services clients in the region.