ERISA Subrogation After Montanile Colleen E

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Doctrine of Clean Hands

LITIGATION - CANADA AUTHORS "Clean up, clean up, everybody clean up": the Norm Emblem doctrine of clean hands December 06 2016 | Contributed by Dentons Introduction Origins Bethany McKoy Recent cases Comment Introduction On occasion, in response to a motion or claim by an adverse party seeking equitable relief, a party will argue that the relief sought should be denied on the basis that the moving party has not come to court with 'clean hands'. This update traces the origin of what is often referred to as the 'doctrine of clean hands' and examines recent cases where: l a moving party has been denied equitable relief on the basis that it came to court with unclean hands; and l such arguments did not defeat the moving party's claim. Origins The doctrine of clean hands originated in the English courts of chancery as a limit to a party's right to equitable relief, where the party had acted inequitably in respect of the matter. In the seminal case Toronto (City) v Polai,(1) the Ontario Court of Appeal provided some insight into the origins and purpose of the doctrine: "The maxim 'he who comes into equity must come with clean hands' which has been invoked mostly in cases between private litigants, requires a plaintiff seeking equitable relief to show that his past record in the transaction is clean: Overton v. Banister (1844), 3 Hare 503, 67 E.R. 479; Nail v. Punter (1832), 5 Sim. 555, 58 E.R. 447; Re Lush's Trust (1869), L.R. 4 Ch. App. 591. These cases present instances of the Court's refusal to grant relief to the plaintiff because of his wrongful conduct in the very matter which was the subject of the suit in equity."(2) Although the court declined to use the doctrine to dismiss the appellant's action for an injunction in that case, it did set the stage for the maxim's future use in Canadian courts. -

The Restitution Revival and the Ghosts of Equity

The Restitution Revival and the Ghosts of Equity Caprice L. Roberts∗ Abstract A restitution revival is underway. Restitution and unjust enrichment theory, born in the United States, fell out of favor here while surging in Commonwealth countries and beyond. The American Law Institute’s (ALI) Restatement (Third) of Restitution & Unjust Enrichment streamlines the law of unjust enrichment in a language the modern American lawyer can understand, but it may encounter unintended problems from the law-equity distinction. Restitution is often misinterpreted as always equitable given its focus on fairness. This blurs decision making on the constitutional right to a jury trial, which "preserves" the right to a jury in federal and state cases for "suits at common law" satisfying specified dollar amounts. Restitution originated in law, equity, and sometimes both. The Restatement notably attempts to untangle restitution from the law-equity labels, as well as natural justice roots. It explicitly eschews equity’s irreparable injury prerequisite, which historically commanded that no equitable remedy would lie if an adequate legal remedy existed. Can restitution law resist hearing equity’s call from the grave? Will it avoid the pitfalls of the Supreme Court’s recent injunction cases that return to historical, equitable principles and reanimate equity’s irreparable injury rule? Losing anachronistic, procedural remedy barriers is welcome, but ∗ Professor of Law, West Virginia University College of Law; Visiting Professor of Law, The Catholic University of America Columbus School of Law. Washington & Lee University School of Law, J.D.; Rhodes College, B.A. Sincere thanks to Catholic University for supporting this research and to the following conferences for opportunities to present this work: the American Association of Law Schools, the Sixth Annual International Conference on Contracts at Stetson University College of Law, and the Restitution Rollout Symposium at Washington and Lee University School of Law. -

MARSHALLING SECURITIES and WORDS of RELEASE

MARSHALLING SECURITIES and WORDS OF RELEASE Note on Hill v Love (2018) 53 V.R. 459 and Burness v Hill [2019] VSCA 94 © D.G. Robertson, Q.C., B.A., LL.M., M.C.I.Arb. Queen’s Counsel Victorian Bar 205 William Street, Melbourne Ph: 9225 7666 | Fax: 9225 8450 www.howellslistbarristers.com.au [email protected] -2- Table of Contents 1. The Doctrine of Marshalling 3 2. The Facts in Hill v Love 5 2.1 Facts Relevant to Marshalling 5 2.2 Facts Relevant to the Words of Release Issue 6 3. The Right to Marshal 7 4. Limitations on and Justification of Marshalling 9 4.1 Principle 9 4.2 Arrangement as to Order of Realization of Securities 10 5. What is Secured by Marshalling? 11 5.1 Value of the Security Property 11 5.2 Liabilities at Time of Realization of Prior Security 12 5.3 Interest and Costs 14 6. Uncertainties in Marshalling 15 6.1 Nature of Marshalling Right 15 6.2 Caveatable Interest? 17 6.3 Proprietary Obligations 18 7. Construction of Words of Release 19 7.1 General Approach to the Construction of Contracts 19 7.2 Special Rules for the Construction of Releases 20 7.3 Grant v John Grant & Sons Pty. Ltd. 22 8. Other Points 24 8.1 Reasonable Security 24 8.2 Fiduciary Duty 24 8.3 Anshun Estoppel 25 This paper was presented on 18 September 2019 at the Law Institute of Victoria to the Commercial Litigation Specialist Study Group. Revised 4 December 2019. -3- MARSHALLING SECURITIES and WORDS OF RELEASE The decisions of the Supreme Court of Victoria in Hill v Love1 and, on appeal, Burness v Hill2 address the doctrine of marshalling securities and also the construction of words of release in terms of settlement. -

Order of Permanent Injunction

~ I() / ClOSFri IN TH UNTED STATES DISTRICT COURT FOR THE DISTRICT OF NEW JERSEY ~ :-~:~~rx:: FI'l'. ,.¡lÕ '-- . ...'íF=~ ,::,.~-'--'f;~."' ._---, ,,~.-,.' UNTED STATES ) H ii ii,; l' C( r ) ~t'rA~~ c" C\ f Plaintiff ) ) v. Civil No. 02-5340 (JAti O:30_,_~~~!'~ ) \:ViUJMfi T. 'vLt::Rh ) RICHA HA a/a ) RICK BRYAN, d//a TAXGATE, ) ENTERED ON ) THE DOCKET ) Defendant. ) MAR 3 1 2003 ORDER OF PERMNENT INJUNCTION 8~!AM T....WALSH,Y .--CLERK " (Deputy Cierk) Plaintiff the United States, has filed a Complaint for Permanent Injunction against the defendant, Richard Haraka, aIa Rick Bryan d//a Taxgate. Haraka does not admit the allegations of the complaint, except that he admits that the Court has jurisdiction over him and over the subject matter of this action. By his Consent, which has been previously filed, Haraka law, and consents to the entry of waives the entry of findings offact and conclusions of this Permanent Injunction. A. The Court has jurisdiction over this action under 28 U.S.c. Sections 1340 and 1345, and under 26 U.S.C. Sections 7402 and 7408. B. The Court finds that Haraka has neither admitted nor denied the United States' allegations that Haraka is subject to penalty under 26 U.S.C. Sections 6700 and 6701. C. It is hereby ORDERED that Richard Haraka, a/a Rick Bryan d//a Taxgate, and, in addition, his associates, senior members, purported "tax experts," representatives and other affliates, and all others in active concert or participation with him who receive actual notice of i 1 .~ this Order, are permanently restrained and enjoined from directly or indirectly: 1. -

"After the Guarantor Pays: the Uncertain Equitable Doctrines Of

AFTER THE GUARANTOR PAYS: THE UNCERTAIN EQUITABLE DOCTRINES OF REIMBURSEMENT, CONTRIBUTION, AND SUBROGATION Brian D. Hulse Author’s Synopsis: This Article addresses the equitable doctrines of reimbursement, contribution, and subrogation as they apply to guarantors and other secondary obligors. Specifically, it explores in detail guarantors’ and other secondary obligors’ rights after they make payment under the guaranty or other secondary obligation and then seek to recover some or all of the amount paid from the borrower, other guarantors, or the collateral for the primary obligation. This article discusses the inconsistencies in the case law on these subjects, which can create unpredictable results. It concludes that, when multiple parties are liable on a common debt, in whatever capacity, they should enter into appropriate reimbursement and contribution agreements at the outset of the transaction to avoid litigation and unpredictable outcomes. I. INTRODUCTION ....................................................................... 42 II. PRELIMINARY ISSUE: WHO IS A SURETY? .......................... 45 A. Examples of Types of Sureties ............................................ 45 B. Honey v. Davis: A Case Study ............................................ 46 III. REIMBURSEMENT ................................................................... 50 A. When Does the Right to Reimbursement Arise? ................. 50 B. How Much is the Guarantor Entitled to be Reimbursed? .... 50 C. Effect of Release of the Borrower by the Creditor ............. -

In the Supreme Court of India Civil Appelalte Jurisdiction

Reportable IN THE SUPREME COURT OF INDIA CIVIL APPELALTE JURISDICTION CIVIL APPEAL Nos. 9949-9950 OF 2014 (Arising out of SLP (C) Nos.35800-35801 of 2011) Rathnavathi & Another Appellant(s) VERSUS Kavita Ganashamdas Respondent(s) J U D G M E N T Abhay Manohar Sapre, J. 1. Leave granted. 2. The plaintiff filed two suits, one for specific performance of agreement and other for grant of permanent injunction in relation to the suit house. The trial court vide common judgment and decree dated 16.10.2001 dismissed both the Page 1 suits. The first appellate court, i.e., the High Court, in appeal, by impugned judgment and decree dated 08.09.2011 reversed the judgment and decree of the trial court and decreed both the suits in appeal, against the defendants. Being aggrieved by the judgment and decree of the High Court, Defendants 1 and 3 have approached this Court in the instant civil appeals. 3. The question arises for consideration in these appeals is whether the High Court was justified in allowing the first appeals preferred by the plaintiff, resulting in decreeing the two civil suits against defendants in relation to suit house? 4. In order to appreciate the controversy involved in the civil suits, and now in these appeals, it is necessary to state the relevant facts. 5. For the sake of convenience, description of parties herein is taken from Original Suit No.223/2000. 6. Defendant no.2 is the original owner of the suit house and defendant no.1 is the subsequent purchaser of the suit house from defendant no.2. -

In Re Billman: Disposition of Substitute Assets Possessed by Third Party and Subject to Rico Forfeiture May Be Enjoined Charles Szczesny

University of Baltimore Law Forum Volume 21 Article 14 Number 2 Spring, 1991 1991 Recent Developments: In re Billman: Disposition of Substitute Assets Possessed by Third Party and Subject to Rico Forfeiture May Be Enjoined Charles Szczesny Follow this and additional works at: http://scholarworks.law.ubalt.edu/lf Part of the Law Commons Recommended Citation Szczesny, Charles (1991) "Recent Developments: In re Billman: Disposition of Substitute Assets Possessed by Third Party and Subject to Rico Forfeiture May Be Enjoined," University of Baltimore Law Forum: Vol. 21 : No. 2 , Article 14. Available at: http://scholarworks.law.ubalt.edu/lf/vol21/iss2/14 This Article is brought to you for free and open access by ScholarWorks@University of Baltimore School of Law. It has been accepted for inclusion in University of Baltimore Law Forum by an authorized editor of ScholarWorks@University of Baltimore School of Law. For more information, please contact [email protected]. the bringing of an action." Id. at 257, medical malpractice. Where a physician rary restraining order (TRO) prohibit 577 A.2d at 68. The court explained that repeatedly misdiagnoses his patient's ing McKinney from disposing of the the Joneses could only succeed in their condition due to negligence, each visit $550,000. McKinnEry, 915 F.2d at 919. suit if they could prove that Dr. Speed with the doctor may constitute a separ The court subsequently held a hearing had been negligent within the five years ate cause of action and thus, begin a new to determine the validity of the TRO, prior to filing the complaint. -

Beyond Unconscionability: the Case for Using "Knowing Assent" As the Basis for Analyzing Unbargained-For Terms in Standard Form Contracts

Beyond Unconscionability: The Case for Using "Knowing Assent" as the Basis for Analyzing Unbargained-for Terms in Standard Form Contracts Edith R. Warkentinet I. INTRODUCTION People who sign standard form contracts' rarely read them.2 Coun- sel for one party (or one industry) generally prepare standard form con- tracts for repetitive use in consecutive transactions.3 The party who has t Professor of Law, Western State University College of Law, Fullerton, California. The author thanks Western State for its generous research support, Western State colleague Professor Phil Merkel for his willingness to read this on two different occasions and his terrifically helpful com- ments, Whittier Law School Professor Patricia Leary for her insightful comments, and Professor Andrea Funk for help with early drafts. 1. Friedrich Kessler, in a pioneering work on contracts of adhesion, described the origins of standard form contracts: "The development of large scale enterprise with its mass production and mass distribution made a new type of contract inevitable-the standardized mass contract. A stan- dardized contract, once its contents have been formulated by a business firm, is used in every bar- gain dealing with the same product or service .... " Friedrich Kessler, Contracts of Adhesion- Some Thoughts About Freedom of Contract, 43 COLUM. L. REV. 628, 631-32 (1943). 2. Professor Woodward offers an excellent explanation: Real assent to any given term in a form contract, including a merger clause, depends on how "rational" it is for the non-drafter (consumer and non-consumer alike) to attempt to understand what is in the form. This, in turn, is primarily a function of two observable facts: (1) the complexity and obscurity of the term in question and (2) the size of the un- derlying transaction. -

The Preliminary Injunction Standard: Understanding the Public Interest Factor

Michigan Law Review Volume 117 Issue 5 2019 The Preliminary Injunction Standard: Understanding the Public Interest Factor M Devon Moore University of Michigan Law School Follow this and additional works at: https://repository.law.umich.edu/mlr Part of the Civil Procedure Commons, Courts Commons, and the Jurisprudence Commons Recommended Citation M D. Moore, The Preliminary Injunction Standard: Understanding the Public Interest Factor, 117 MICH. L. REV. 939 (2019). Available at: https://repository.law.umich.edu/mlr/vol117/iss5/4 https://doi.org/10.36644/mlr.117.5.preliminary This Note is brought to you for free and open access by the Michigan Law Review at University of Michigan Law School Scholarship Repository. It has been accepted for inclusion in Michigan Law Review by an authorized editor of University of Michigan Law School Scholarship Repository. For more information, please contact [email protected]. NOTE THE PRELIMINARY INJUNCTION STANDARD: UNDERSTANDING THE PUBLIC INTEREST FACTOR M Devon Moore* Under Winter v. NRDC, federal courts considering a preliminary injunction motion look to four factors, including the public interest impact of the injunc- tion. But courts do not agree on what the public interest is and how much it should matter. This Note describes the confusion over the public interest fac- tor and characterizes the post-Winter circuit split as a result of this confu- sion. By analyzing the case law surrounding the public interest factor, this Note identifies three aspects of a case that consistently implicate the direction and magnitude of this factor: the identity of the parties, the underlying cause of action, and the scope of injunctive relief. -

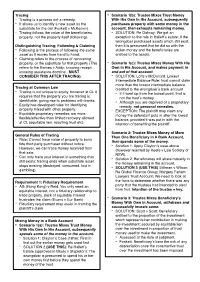

Tracing Is a Process Not a Remedy

Tracing - Scenario 1(b): Trustee Mixes Trust Money - Tracing is a process not a remedy. With His Own In His Account, subsequently - It allows us to identify a new asset as the purchases property with some money in the substitute for the old (Foskett v McKeown). account, then exhausts remaining money. - Tracing follows the value of the beneficiaries - SOLUTION: Re Oatway: We get an property, not the property itself (following). exception to the rule in Hallett’s estate: if the wrongdoer purchased assets which still exist, Distinguishing Tracing; Following & Claiming then it is presumed that he did so with the - Following is the process of following the same stolen money and the beneficiaries are asset as it moves from hand to hand. entitled to the assets. - Claiming refers to the process of recovering property, or the substitute for that property (This - Scenario 1(c): Trustee Mixes Money With His refers to the Barnes v Addy; knowing receipt, Own In His Account, and makes payment in knowing assistance doctrine - MUST and out of that account. CONSIDER THIS AFTER TRACING). - SOLUTION: Lofts v McDonald: Lowest Intermediate Balance Rule: trust cannot claim more than the lowest intermediate balance Tracing at Common Law - credited to the wrongdoer’s bank account Tracing is not unique to equity, however at CL it - If it went up from the lowest point, that is requires that the property you are tracing is not the trust’s money. identifiable, giving rise to problems with banks. - - Although you are deprived of a proprietary Equity has developed rules for identifying remedy, not personal remedies. -

Circuit Court for Frederick County Case No. C-10-CV-19-000066

Circuit Court for Frederick County Case No. C-10-CV-19-000066 UNREPORTED IN THE COURT OF SPECIAL APPEALS OF MARYLAND No. 1658 September Term, 2019 ______________________________________ JP MORGAN CHASE BANK, N.A. v. TRUIST BANK, ET AL. ______________________________________ Fader, C.J., Nazarian, Shaw Geter, JJ. ______________________________________ Opinion by Fader, C.J. ______________________________________ Filed: December 17, 2020 *This is an unreported opinion, and it may not be cited in any paper, brief, motion, or other document filed in this Court or any other Maryland Court as either precedent within the rule of stare decisis or as persuasive authority. Md. Rule 1-104. — Unreported Opinion — ______________________________________________________________________________ This appeal concerns the respective priority positions of (1) a lender who refinances a home mortgage loan secured by a first-priority deed of trust on the property, and (2) an intervening home equity lender whose line of credit is secured by a deed of trust on the same property.1 Specifically, we consider whether the refinancing lender is equitably subrogated to the original home mortgage lender’s senior priority position when, in a transaction contemporaneous with the refinancing, the intervening home equity lender’s line of credit is paid down to zero but, unbeknownst to the refinancing lender, the line is not closed and the deed of trust is never released. We hold that in such circumstances the refinancing lender is equitably subrogated to the position of the original, first-priority lender if the intervening lender maintains its original priority position, is not otherwise prejudiced, and would be unjustly enriched in the absence of subrogation. -

Asset Tracing in the British Virgin Islands

Article Asset Tracing in the British Virgin Islands In this article, we will discuss some of the tools available to a party in the British Virgin Islands to seek to recover property, or proceeds of property, which have been misappropriated. It is not surprising that in some cases, the identity of the wrongdoer or the whereabouts of the misappropriated property is unknown. Against that background, it is worth noting that while a BVI, and whether there has been any past judgment which company incorporated in the BVI is required to maintain may shed light on assets held by the company. In addition, certain records at the office of its registered agent (such as upon application the BVI Land Registry can provide certain its memorandum and articles of association, register of details regarding the owner of BVI land or real estate. directors, register of members, minutes of members’ and However, this requires the applicant to first be able to directors’ meetings and copies of resolutions), there is no identify the location or owner of the land. A party may also right for the public to inspect such records. Indeed, obtain certain information regarding vessels registered under confidentiality of corporate documents and information is a BVI flag from the BVI Ship Registry. one of the key attractions of incorporating a company in the BVI. BVI companies are not generally required to maintain or What is “tracing”? file statutory accounts, or meet any particular set of international accounting standards. Under section 98 of the Tracing consists of a series of rules developed by equity to BVI Business Companies Act 2004, all that a company is deal with situations where assets have been required to maintain are records “sufficient to show and misappropriated and the wrongdoer is not in a position to explain the company’s transactions” and which “will, at any compensate, or money compensation is not adequate.