Latin American Equity Indices Scorecard

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Creating Emerging Markets – Oral History Collection Ricardo Salinas

Creating Emerging Markets – Oral History Collection Ricardo Salinas Pliego, CEO, Grupo Salinas and Grupo Elektra Interviewed by Regina García Cuéllar, Researcher, Harvard Business School May 31, 2013 in Mexico City, Mexico Audio interview conducted in Spanish The Creating Emerging Markets Oral History Collection is part of the collections of Baker Library, Harvard Business School. The transcripts are made available for academic research and teaching. Any other use - including commercial reuse, mounting on other systems, or other forms of redistribution - requires permission of Harvard Business School. When use is made of these texts, it is the responsibility of the user to obtain the additional permissions for requests to cite and to observe the laws of copyright and the educational fair use guidelines. Research Inquiries & Requests to Cite Oral History Collection: Please contact Rachel Wise, HBS Archivist, [email protected] or Laura Linard, Director of Special Collections, [email protected] Preferred Citation: Interview with Ricardo Salinas Pliego, interviewed by Regina García Cuéllar, Mexico City, Mexico, May 31, 2013, Creating Emerging Markets Oral History Collection, Baker Library Historical Collections, Harvard Business School. Baker Library Historical Collections Baker Library | Bloomberg Center Harvard Business School Boston, MA 02163 617.495.6411 [email protected] http://www.library.hbs.edu/hc © 2013 Copyright Notice The Creating Emerging Markets Oral History Collection is owned by the President and Fellows of Harvard College. Interview with Ricardo Salinas Pliego Interviewed by Regina García Cuellar May 31, 2013 Mexico City, Mexico Audio interview conducted in Spanish RG: Desde pequeño ¿cuáles fueron los valores en su casa que han permeado a ser quién es? RS: ¿Por dónde comenzaremos? En mi infancia. -

Catching the Wave

Mexico: Catching the wave Economic reform, strong demographics and investment- focused corporates mean that Mexico is a market on the move. But how should you deal in a country that also brings complexity? Corbis/Ivan Vdovin Key insights razil might be a darling of investors, The short-term outlook is also generally • The Mexican economy is set to become but Mexico may soon eclipse it. The positive. Although the International Monetary the largest Latin American economy country is on course to overtake Fund recently cut Mexico’s growth forecast to within a decade, overtaking Brazil. Brazil and become the region’s 1.8% for this year, it expects growth to return • This growth is partly down to Mexico’s Blargest economy within a decade, according to 3% in 2014 as ongoing structural reforms strong fundamentals, such as demographics and political reform. to research by investment bank Nomura. bear fruit. Additionally, capital market • Mexico’s consumer sector has seen “Mexico is now in the moment, as a result activity is thriving. Dealogic figures show that more deals this year than any other of macro and micro factors and industrial Mexico’s equity capital market is having a industry in the country, in part thanks policies,” says Roberto Cuarón, Partner, record year — raising US$10.4b in 2013. to developing consumer credit firing Valuation and Business Modelling, EY, Mexico. the sector’s growth. “Other countries haven’t yet driven away the Economic reform • The country has also garnered a effects of the 2008 crisis.” A big factor behind the investment drive reputation as being a key position in A swelling middle class has made is the progress of reforms, introduced by corporates’ global supply chains. -

Elektra (ELEKTRA) Marcela Martínez Suárez [email protected] (52-55) 5169-9384

Second Quarter 2004 Grupo Elektra (ELEKTRA) Marcela Martínez Suárez [email protected] (52-55) 5169-9384 August 5, 2004 SELL ELEKTRA * / EKT Grupo Elektra Prepays 2008 Senior Notes – Strong Price: Mx / ADR Ps 68.25 US$ 22.98 Performance at All Divisions Price Target Ps 71.00 Risk Level High • Elektra is now consolidating the Bank's results. Our comments are based on figures presented by Grupo 52 Week Range: Ps 77.20 to Ps 31.65 Elektra. During 2Q04, sales were up 20.5%, as a result of Shares Outstanding: 236.7 million strong performance at the Bank and the retail division. Market Capitalization: US$ 1.41 billion New personnel hired resulted in an 0.8-pp contraction in Enterprise Value: US$ 2.04 billion operating margin. Operating profit and EBITDA, Avg. Daily Trading Value US$ 1.4 million however, were up 12.5% and 11%, respectively. Retail Ps/share US$/ADR store formats are posting strong results, and the "Nobody 2Q EPS 1.39 0.49 Undersells Elektra" slogan has attracted more consumers. T12 EPS 6.19 2.16 The group's valuation, as measured by the EV/EBITDA T12 EBITDA 15.55 5.42 multiple, is at 6.35x, and should drop to 5.8x by year-end T12 Net Cash Earnings 11.93 4.16 2004. Our price target of Ps 71 represents a 5.54% Book Value 28.86 10.06 nominal yield, including a Ps 1.033 dividend. The above, T12 2004e coupled with the fact that Elektra is a high-risk stock, P/E 11.02x leads us to recommend Elektra as a SELL. -

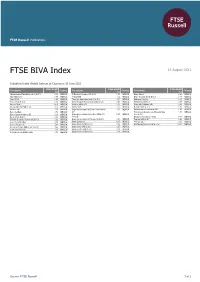

FTSE BIVA Index

2 FTSE Russell Publications 19 August 2021 FTSE BIVA Index Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) Administradora Fibra Danhos S.A. de C.V. 0.15 MEXICO El Puerto de Liverpool SA de CV 0.53 MEXICO Grupo Mexico 8.89 MEXICO Alfa SAB de CV 0.89 MEXICO Femsa UBD 9.2 MEXICO Grupo Rotoplas S.A.B. de C.V. 0.17 MEXICO Alpek S.A.B. 0.28 MEXICO Fibra Uno Administracion S.A. de C.V. 1.91 MEXICO Industrias Penoles 1.02 MEXICO Alsea S.A.B. de C.V. 0.56 MEXICO Genomma Lab Internacional S.A.B. de C.V. 0.46 MEXICO Kimberly Clark Mex A 0.88 MEXICO America Movil L 13.59 MEXICO Gentera SAB de CV 0.35 MEXICO Megacable Holdings SAB 0.64 MEXICO Arca Continental SAB de CV 1.53 MEXICO Gruma SA B 1.37 MEXICO Nemak S.A.B. de C.V. 0.16 MEXICO Bachoco Ubl 0.36 MEXICO Grupo Aeroportuario del Centro Norte Sab de 1.31 MEXICO Orbia Advance Corporation SAB 1.59 MEXICO Banco del Bajio 0.76 MEXICO CV Promotora y Operadora de Infraestructura 1.05 MEXICO Banco Santander Mexico (B) 0.43 MEXICO Grupo Aeroportuario del Pacifico SAB de CV 2.27 MEXICO S.A. de C.V. Becle S.A.B. de C.V. 0.86 MEXICO Series B Qualitas Controladora y Vesta 0.48 MEXICO Bolsa Mexicana de Valores SAB de CV 0.62 MEXICO Grupo Aeroportuario del Sureste SA de CV 2.21 MEXICO Regional SAB de CV 0.83 MEXICO Cementos Chihuahua 0.79 MEXICO Grupo Banorte O 11.15 MEXICO Televisa 'Cpo' 4.38 MEXICO Cemex Sa Cpo Line 7.43 MEXICO Grupo Bimbo S.A.B. -

Striving to Overcome the Economic Crisis: Progress and Diversification of Mexican Multinationals’ Export of Capital

Striving to overcome the economic crisis: Progress and diversification of Mexican multinationals’ export of capital Report dated December 28, 2011 EMBARGO: The contents of this report cannot be quoted or summarized in any print or electronic media before December 28, 2011, 7:00 a.m. Mexico City; 8:00 a.m. NewYork; and 1 p.m. GMT. Mexico City and New York, December 28, 2011: The Institute for Economic Research (IIEc) of the National Autonomous University of Mexico (UNAM) and the Vale Columbia Center on Sustainable International Investment (VCC), a joint initiative of the Columbia Law School and the Earth Institute at Columbia University in New York, are releasing the results of their third survey of Mexican multinationals today. 1 The survey is part of a long-term study of the rapid global expansion of multinational enterprises 2 (MNEs) from emerging markets. The present report focuses on data for the year 2010. Highlights In 2010, the top 20 Mexican MNEs had foreign assets of USDD 123 billion (table 1 below), foreign sales of USDD 71 billion, and employed 255,340 people abroad (see annex table 1 in annex I). The top two firms, America Movil and CEMEX, together controlled USDD 85 billion in foreign assets, accounting for nearly 70% of the assets on the list. The top four firms (including FEMSA and Grupo Mexico) jointly held USDD 104 billion, which represents almost 85% of the list’s foreign assets. Leading industries in this ranking, by numbers of MNEs, are non-metallic minerals (four companies) and food and beverages (another four companies). -

460 NYSE Non-U.S. Listed Issuers from 47 Countries (December 28, 2004)

460 NYSE Non-U.S. Listed Issuers from 47 Countries (December 28, 2004) Share Country Issuer (based on jurisdiction of incorporation) † Symbol Industry Listed Type IPO ARGENTINA (10 DR Issuers ) BBVA Banco Francés S.A. BFR Banking 11/24/93 A IPO IRSA-Inversiones y Representaciones, S.A. IRS Real Estate Development 12/20/94 G IPO MetroGas, S.A. MGS Gas Distribution 11/17/94 A IPO Nortel Inversora S.A. NTL Telecommunications 6/17/97 A IPO Petrobras Energía Participaciones S.A. PZE Holding Co./Oil/Gas Refining 1/26/00 A Quilmes Industrial (QUINSA) S.A. LQU Holding Co./Beer Production 3/28/96 A IPO Telecom Argentina S.A. TEO Telecommunications 12/9/94 A Telefónica de Argentina, S.A. TAR Telecommunications 3/8/94 A Transportadora de Gas del Sur, S.A. TGS Gas Transportation 11/17/94 A YPF Sociedad Anónima YPF Oil/Gas Exploration 6/29/93 A IPO AUSTRALIA (10 ADR Issuers ) Alumina Limited AWC Diversified Minerals 1/2/90 A Australia and New Zealand Banking Group Limited ANZ Banking/Financial Services 12/6/94 A BHP Billiton Limited BHP Mining/Exploration/Production 5/28/87 A IPO Coles Myer Ltd. CM Retail Operations 10/31/88 A James Hardie Industries N.V. JHX International Bldg. Materials 10/22/01 A National Australia Bank Limited NAB Banking 6/24/88 A Rinker Group Limited (Rinker) RIN Heavy Building Materials Mfg. 10/28/03 A Telstra Corporation Limited TLS Telecommunications 11/17/97 A IPO Westpac Banking Corporation WBK Banking 3/17/89 A IPO WMC Resources Ltd WMC Minerals Development/Prod. -

Debtwire Political Risk Research: Argentina's Macri Balances Fiscal

Political Risk: Mexico’s AMLO strives for prudent populism, but markets need convincing 18 April 2019 Andrés Manuel López Obrador alarmed markets by cancelling a ma- FIGURE 1: Quarterly GDP Growth (YoY) jor airport project and suspending auctions of oil rights to private companies, but has kept to his promise of no nationalizations or ex- 6% propriations. Total Agribusiness A priority for the new government is the rehabilitation of struggling Services Industrial Pemex, which has suffered from mismanagement and corruption. 4% For an overview of policy effects on issuers covered by Debtwire, see pages 2 and 3. 2% Mexican President Andrés Manuel López Obrador (commonly referred 0% to as AMLO) was elected in July 2018 with over half the popular vote, and took office on 1 December. With strong public support and his Na- tional Regeneration Movement (MORENA) holding a majority in both houses of Congress and two-thirds of state legislatures, he has the po- -2% 1Q16 3Q16 1Q17 3Q17 1Q18 3Q18 litical capital to pass economic and social reforms promised during his campaign. Elected on a populist platform promising to fight corruption, Source: Debtwire, Ministry of Finance and Public Credit (SHCP) violence and inequality, his first initiatives have included efforts to stop Industrial sector includes mining, energy, construction and manufacturing fuel theft at state-owned Pemex, cap public-sector salaries, and create a new national guard to fight organized crime. FIGURE 2: Pemex 2028 and Mexico 2027 Z-spread While AMLO has pledged to avoid nationalizations and expropriations, investors fear what his leftist populism could mean for Mexican busi- 550 ness, especially since he took office amid slowing economic growth 5 Dec: Oil auctions suspended 29 Jan: Pemex (Figure 1). -

Mexican Multinational Enterprises: Navigating Uncertainty from NAFTA to the USMCA March 2020

1 Mexican Multinational Enterprises: Navigating Uncertainty from NAFTA to the USMCA March 2020 Mexico City and New York, The Institute for Economic Research (IIEc) of the National Autonomous University of Mexico (UNAM) and the Columbia Center on Sustainable Investment (CCSI), a joint center of Columbia Law School and the Earth Institute at Columbia University in New York, are releasing the results of their ninth survey of Mexican multinationals.1 The survey, conducted in 2019, is part of a long-term study of the rapid global expansion of multinational enterprises (MNEs) from emerging markets. The present report focuses on data for the year 2017. Highlights In 2017, the 20 largest Mexican MNEs had foreign assets of US$ 153 billion (Table 1), foreign revenue of US$ 100 billion, and 408,231 foreign employees (Annex I, Table 1). The two largest companies (América Móvil and CEMEX) together controlled US$ 74 billion, equivalent to 48% of the total foreign assets of the companies on the list. The four largest MNEs (also including FEMSA and Grupo Mexico) together controlled US$ 104 billion, equivalent to 68% of the total. Companies in the food and beverage sectors (seven) dominate the list, followed by companies in the non-metallic minerals (three) and diversified (three) sectors. Only two companies are 1 The authors of this report, Dr. Jorge Basave Kunhardt and Dra. Maria Teresa Gutiérrez Haces are senior researchers at the Economics Research Institute of National University of Mexico (UNAM). The authors kindly ask that this work be cited properly. Technical support was provided by Vanessa Mora and Iris Velasco. -

FACTSHEET - AS of 23-Sep-2021 Solactive GBS Mexico Large & Mid Cap USD Index TR

FACTSHEET - AS OF 23-Sep-2021 Solactive GBS Mexico Large & Mid Cap USD Index TR DESCRIPTION The Solactive GBS Mexico Large & Mid Cap USD Index TR is part of the Solactive Global Benchmark Series which includes benchmark indices for developed and emerging market countries. The index intends to track the performance of the large and mid cap segment covering approximately the largest 85% of the free-float market capitalization in the Mexican market. It is calculated as a totalreturn index in USD and weighted by free-float market capitalization. HISTORICAL PERFORMANCE 1,400 1,200 1,000 800 600 400 Jan-2008 Jan-2010 Jan-2012 Jan-2014 Jan-2016 Jan-2018 Jan-2020 Jan-2022 Solactive GBS Mexico Large & Mid Cap USD Index TR CHARACTERISTICS ISIN / WKN DE000SLA85R9 / SLA85R Base Value / Base Date 754.81 Points / 08.05.2006 Bloomberg / Reuters / .SMXLMCUT Last Price 1137.66 Index Calculator Solactive AG Dividends Reinvested Index Type Total Return Calculation 8:00 am to 10:30 pm (CET), every 15 seconds Index Currency USD History Available daily back to 08.05.2006 Index Members 25 FACTSHEET - AS OF 23-Sep-2021 Solactive GBS Mexico Large & Mid Cap USD Index TR STATISTICS 30D 90D 180D 360D YTD Since Inception Performance 0.74% 2.09% 14.70% 60.83% 19.19% 50.72% Performance (p.a.) - - - - - 2.70% Volatility (p.a.) 17.42% 17.32% 17.54% 20.61% 18.97% 26.60% High 1178.78 1178.78 1178.78 1178.78 1178.78 1375.98 Low 1109.13 1074.52 992.52 707.38 904.79 407.30 Sharpe Ratio 0.54 0.50 1.82 2.99 1.42 0.09 Max. -

![[411000-AR] Datos Generales - Reporte Anual](https://docslib.b-cdn.net/cover/2518/411000-ar-datos-generales-reporte-anual-3892518.webp)

[411000-AR] Datos Generales - Reporte Anual

Clave de Cotización: ELEKTRA Fecha: 2020-12-31 [411000-AR] Datos generales - Reporte Anual Reporte Anual: Anexo N Oferta pública restringida: No Tipo de instrumento: Acciones,Deuda LP,Deuda CP Emisora extranjera: No Mencionar si cuenta o no con aval u otra garantía, No especificar la Razón o Denominación Social: En su caso, detallar la dependencia parcial o total: No 1 de 113 Clave de Cotización: ELEKTRA Fecha: 2020-12-31 [412000-N] Portada reporte anual GRUPO ELEKTRA, S.A.B. de C.V. ESTADOS UNIDOS MEXICANOS Av. FFCC de Río Frío N° 419 CJ, Col. Fraccionamiento Industrial del Moral, Iztapalapa, C.P. 09010, Ciudad de México 2 de 113 Clave de Cotización: ELEKTRA Fecha: 2020-12-31 Serie [Eje] serie serie2 Especificación de las características de los títulos en circulación [Sinopsis] Clase No pertenece a clase alguna No pertenece a clase alguna Serie No pertenece a serie alguna No pertenece a serie alguna Tipo Ordinarias Ordinarias Número de acciones 284,291,164 284,291,164 Bolsas donde están registrados Bolsa Mexicana de Valores, Bolsa Institucional de Valores Mercado de Valores de Latinoamérica Clave de pizarra de mercado origen ELEKTRA* XEKT Tipo de operación - - Observaciones Acciones comunes ordinarias, sin expresión de valor nominal, Acciones comunes ordinarias, sin expresión de valor nominal, que no pertenecen a serie alguna. que no pertenecen a serie alguna. Clave de cotización: ELEKTRA La mención de que los valores de la emisora se encuentran inscritos en el Registro: Los títulos se encuentran inscritos en el Registro Nacional de Valores Leyenda artículo 86 de la LMV: La inscripción en el Registro Nacional de Valores no implica certificación sobre la bondad de los valores, solvencia de la emisora o sobre la exactitud o veracidad de la información contenida en este Reporte anual, ni convalida los actos que, en su caso, hubieren sido realizados en contravención de las leyes. -

Stoxx® Latin America Total Market Index

STOXX® LATIN AMERICA TOTAL MARKET INDEX Components1 Company Supersector Country Weight (%) ITAU UNIBANCO HOLDING SA -PREF Banks BR 4.60 AMBEV Food & Beverage BR 4.34 BANCO BRADESCO SA - PREF Banks BR 3.52 Fomento Economico Mexicano Food & Beverage MX 3.27 SAN MIGUEL Food & Beverage AR 2.92 America Movil SAB de CV Telecommunications MX 2.66 Grupo Financiero Banorte SAB d Banks MX 2.23 Petroleo Brasileiro SA Oil & Gas BR 2.21 Wal-Mart de Mexico SAB de CV Retail MX 2.17 PETROLEO BRASILEIRO S.A. -PREF Oil & Gas BR 2.00 Credicorp Banks PE 1.82 ITAUSA - PREF Financial Services BR 1.71 Cielo SA Financial Services BR 1.68 ULTRAPAR PARTICIPACOES SA Utilities BR 1.62 BRF SA Food & Beverage BR 1.60 BM&FBovespa SA Financial Services BR 1.53 Grupo Mexico SAB de CV Basic Resources MX 1.44 SACI Falabella Retail CL 1.42 VALE S.A. - PREF Basic Resources BR 1.30 Banco do Brasil SA Banks BR 1.18 Fibra Uno Administracion Real Estate MX 1.05 Vale SA Basic Resources BR 1.04 KROTON ON Retail BR 1.03 GRUPO LALA Food & Beverage MX 0.99 EMPRESA DE ENERG Utilities CO 0.98 BANCO BRADESCO SA Banks BR 0.97 BBSEGURIDADE ON NM Insurance BR 0.96 TELEFONICA BRASIL PREF. Telecommunications BR 0.96 ARCA CONTINENTAL Food & Beverage MX 0.95 Grupo Financiero Inbursa SA Banks MX 0.84 RAIA DROGASIL Retail BR 0.82 Empresas COPEC SA Oil & Gas CL 0.77 LOJAS RENNER Retail BR 0.77 CCR - CIA DE CONCESSOES ROD. -

Geographic Listing by Country of Incorporation: FOREIGN

FOREIGN COMPANIES REGISTERED AND REPORTING WITH THE U.S. SECURITIES AND EXCHANGE COMMISSION December 31, 2005 Geographic Listing by Country of Incorporation COMPANY COUNTRY MARKET Antigua Sinovac Biotech Ltd. Antigua AMEX Argentina Alto Palermo S.A. Argentina NMS BBVA Banco Frances S.A. Argentina NYSE Cresud Sacif Argentina NMS Grupo Financiero Galicia S.A. Argentina NMS IRSA Inversiones y Representacions, S.A. Argentina NYSE Mastellone Hermanos S.A. Argentina OTC - Debt MetroGas S.A. Argentina NYSE Multicanal S.A. Argentina OTC Nortel Inversora S.A. Argentina NYSE Petrobras Energia Participaciones S.A. Argentina NYSE Telecom Argentina S.A. Argentina NYSE Telefonica de Argentina S.A. Argentina NYSE Telefonica Holding of Argentina, Inc. Argentina OTC - Debt Transportadora de Gas del Sur S.A. Argentina NYSE YPF S.A. Argentina NYSE Australia Alumina Ltd. Australia NYSE Amcor Ltd. Australia NMS Ansell Ltd. Australia NMS Atlas Pacific Ltd. Australia CAP MKT Australia & New Zealand Banking Group Ltd. Australia NYSE BHP Billiton Ltd. Australia NYSE Burns, Philip & Co. Ltd. Australia OTC - Debt Chemgenex Pharmaceuticals Ltd. Australia NMS CityView Corp Ltd. Australia OTC Coles Myer Ltd. Australia NYSE Commonwealth Bank of Australia Australia OTC Genetic Technologies Ltd. Australia NMS Metal Storm Ltd. Australia CAP MKT National Australia Bank Ltd. Australia NYSE Novogen Ltd. Australia NMS Orbital Corp Ltd. Australia OTC Petsec Energy Ltd. Australia OTC Phamaxis Ltd. Australia NMS Prana Biotechnology Ltd. Australia CAP MKT Progen Industries Ltd. Australia CAP MKT pSivida Ltd. Australia NMS Rinker Group Ltd. Australia NYSE Page 1 Rio Tinto Ltd. Australia OTC Telstra Corp Ltd. Australia NYSE Westpac Banking Corp.