Latin America Equity Indices SCORECARD

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Creating Emerging Markets – Oral History Collection Ricardo Salinas

Creating Emerging Markets – Oral History Collection Ricardo Salinas Pliego, CEO, Grupo Salinas and Grupo Elektra Interviewed by Regina García Cuéllar, Researcher, Harvard Business School May 31, 2013 in Mexico City, Mexico Audio interview conducted in Spanish The Creating Emerging Markets Oral History Collection is part of the collections of Baker Library, Harvard Business School. The transcripts are made available for academic research and teaching. Any other use - including commercial reuse, mounting on other systems, or other forms of redistribution - requires permission of Harvard Business School. When use is made of these texts, it is the responsibility of the user to obtain the additional permissions for requests to cite and to observe the laws of copyright and the educational fair use guidelines. Research Inquiries & Requests to Cite Oral History Collection: Please contact Rachel Wise, HBS Archivist, [email protected] or Laura Linard, Director of Special Collections, [email protected] Preferred Citation: Interview with Ricardo Salinas Pliego, interviewed by Regina García Cuéllar, Mexico City, Mexico, May 31, 2013, Creating Emerging Markets Oral History Collection, Baker Library Historical Collections, Harvard Business School. Baker Library Historical Collections Baker Library | Bloomberg Center Harvard Business School Boston, MA 02163 617.495.6411 [email protected] http://www.library.hbs.edu/hc © 2013 Copyright Notice The Creating Emerging Markets Oral History Collection is owned by the President and Fellows of Harvard College. Interview with Ricardo Salinas Pliego Interviewed by Regina García Cuellar May 31, 2013 Mexico City, Mexico Audio interview conducted in Spanish RG: Desde pequeño ¿cuáles fueron los valores en su casa que han permeado a ser quién es? RS: ¿Por dónde comenzaremos? En mi infancia. -

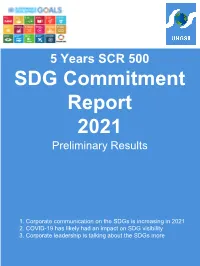

SDG Commitment Report 2021 Preliminary Results

Powered by: 5 Years SCR 500 SDG Commitment Report 2021 Preliminary Results 1. Corporate communication on the SDGs is increasing in 2021 2. COVID-19 has likely had an impact on SDG visibility 3. Corporate leadership is talking about the SDGs more Over 95% of companies now discussing SDGs in annual report Share of comapnies mentioning SDGs 100% 98% 96% 94% 92% 90% 88% 86% 84% 82% 80% 2017 2018 2019 2020 2021 Huge increase in share of chairmen discussing the SDGs Share of chairmen discussing SDGs 35% 30% 25% 20% 15% 10% 5% 0% 2017 2018 2019 2020 2021 Slight increase in share of CEOs discussing the SDGs Share of CEOs discussing SDGs 60% 50% 40% 30% 20% 10% 0% 2017 2018 2019 2020 2021 Most companies are discussing the SDGs more than last year ASML HSBC Holdings BMW Banpu Vonovia Increase in Andritz AG Iceland Air number of ABB Abbott Laboratories SDG Allianz Accenture statements in Barloworld BASF 2021 vs. 2020 Facebook Apple Remgro ABN Amro Tesco Air Canada Adidas Best Buy Fannie Mae Swatch Group Intel Bank of Montreal Whirlpool Adobe Tyson Foods Disney Freddie Mac Coach Aviva Deere JM Smucker Costco Live Nation Shoprite Haseko George Weston Carnival Comcast Hormel FedEx Conagra Walmart Sysco Boeing Medtronic Starbucks Decrease in Distell Hershey number of Citigroup Fifth Third SDG Telefonica IBM statements in Humana Astral Foods 2021 vs. 2020 Visa British American Tobacco Eskom -1500 -1000 -500 0 500 1000 1500 2000 2500 3000 5 Increase in visibility of almost all SDGs in 2021; decreases not statistically significant SDG8 Decent Work SDG16 Peace & Justice Increase in SDG9 Industry & Innovation number of SDG SDG12 Responsible Consumption statements in SDG3 Good Health 2021 vs. -

ANNUAL REPORT 2018 to Generate Economic and Social Value Through Our Companies and Institutions

ANNUAL REPORT 2018 To generate economic and social value through our companies and institutions. We have established a mission, a vision and values that are both our beacons and guidelines to plan strategies and projects in the pursuit of success. Fomento Económico Mexicano, S.A.B. de C.V., or FEMSA, is a leader in the beverage industry through Coca-Cola FEMSA, the largest franchise bottler of Coca-Cola products in the world by volume; and in the beer industry, through ownership of the second largest equity stake in Heineken, one of the world’s leading brewers with operations in over 70 countries. We participate in the retail industry through FEMSA Comercio, comprising a Proximity Division, operating OXXO, a small-format store chain; a Health Division, which includes all drugstores and related operations; and a Fuel Division, which operates the OXXO GAS chain of retail service stations. Through FEMSA Negocios Estratégicos (FEMSA Strategic Businesses) we provide logistics, point-of-sale refrigeration solutions and plastics solutions to FEMSA’s business units and third-party clients. FEMSA’s 2018 integrated Annual Report reflects our commitment to strong corporate governance and transparency, as exemplified by our mission, vision and values. Our financial and sustainability results are for the twelve months ended December 31, 2018, compared to the twelve months ended December 31, 2017. This report was prepared in accordance with the Global Reporting Initiative (GRI) Standards and the United Nations Global Compact, this represents our Communication on Progress for 2018. Contents Discover Our Corporate Identity 1 FEMSA at a Glance 2 Value Creation Highlights 4 Social and Environmental Value 6 Dear Shareholders 8 FEMSA Comercio 10 Coca-Cola FEMSA 18 FEMSA Strategic Businesses 28 FEMSA Foundation 32 Corporate Governance 40 Financial Summary 44 Management’s Discussion & Analysis 46 Contact 52 Over the past several decades, FEMSA has evolved from an integrated beverage platform to a multifaceted business with a broad set of capabilities and opportunities. -

Empresas Copec S.A. Consolidated Financial

EMPRESAS COPEC S.A. CONSOLIDATED FINANCIAL STATEMENTS AS OF DECEMBER 31, 2018 IFRS - International Financial Reporting Standards IAS - International Accounting Standards NIFCH - Chilean Financial Reporting Standards IFRIC - International Financial Reporting Interpretations Committee US$ - United States dollars ThUS$ - Thousands of US dollars MUS$ - Millions of US dollars MCh$ - Millions of Chilean Pesos COP$ - Colombian pesos S./ - Peruvian nuevo sol WorldReginfo - d6a34cd4-9970-4f3e-9bfb-af0f71482286 INDEPENDENT AUDITORS' REPORT Santiago, March 8, 2019 Dear Shareholders and Directors Empresas Copec S.A. We have audited the accompanying consolidated financial statements of Empresas Copec S.A. and affiliates, which comprise a consolidated statement of financial position as of December 31, 2018 and 2017, the corresponding consolidated statements of income by function, consolidated comprehensive income, consolidated changes in equity and consolidated cash flow for the years ending on these dates, and the corresponding notes to the consolidated financial statements. Management's responsibility for the consolidated financial statements Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with International Financial Reporting Standards (IFRS). This responsibility includes the design, implementation and maintenance of relevant internal controls for the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether -

Annual Report Enel Chile 2016 Annual Report Enel Chile 2016 Annual Report Santiago Stock Exchange ENELCHILE

2016 Annual Report Enel Chile 2016 Annual Report Enel Chile Annual Report Santiago Stock Exchange ENELCHILE Nueva York Stock Exchange ENIC Enel Chile S.A. was initially incorporated as Enersis Chile S.A. on March 1st, 2016 and changed to Enel Chile S.A. on October 18th, 2016. As of December 31st, 2016, the total share capital of the Company was Th$ 2,229,108,975 represented by 49,092,772,762 shares. Its shares trade on the Santiago Stock Exchange and the New York Stock Exchange as American Depositary Receipts (ADR). The main business of the Company is the development, operation, generation, distribution, transformation, or sale of energy in any form, directly or through other companies. Total assets of the Company amount to Th$ 5,398,711,012 as of December 31st, 2016. Enel Chile controls and manages a group of companies that operate in the Chilean electricity market. Net profit attributable to the controlling shareholder in 2016 reached Th$ 317,561,121 and operating income reached Th$ 457,202,938. At year-end 2016 the Company directly employed 2,010 people through its subsidiaries in Chile. Annual Report Enel Chile 2016 Summary > Letter from the Chairman 4 > Open Power 10 > Highlights 2016 12 > Main Financial and Operating Data 16 > Identification of the Company and Documents of Incorporation 20 > Ownership and Control 26 > Management 32 > Human Resources 54 > Stock Markets Transactions 64 > Dividends 70 > Investment and Financing Policy 76 > History of the Company 80 > Investments and Financial Activity 84 > Risk Factors 92 > Corporate -

Integrated Report 2020 Index

INTEGRATED REPORT 2020 INDEX 4 28 70 92 320 PRESENTATION CORPORATE GOVERNANCE SECURITY METHODOLOGY SWORN STATEMENT 29 Policies and practices 71 Everyone’s commitment 93 Construction of the report 31 Governance structure 96 GRI content index 35 Ownership structure 102 Global Compact 5 38 Policies 103 External assurance 321 HIGHLIGHTS 74 104 Glossary CORPORATE STRUCTURE LATAM GROUP EMPLOYEES 42 75 Joint challenge OUR BUSINESS 78 Who makes up LATAM group 105 12 81 Team safety APPENDICES 322 LETTER FROM THE CEO 43 Industry context CREDITS 44 Financial results 47 Stock information 48 Risk management 83 50 Investment plan LATAM GROUP CUSTOMERS 179 14 FINANCIAL INFORMATION INT020 PROFILE 84 Connecting people This is a 86 More digital travel experience 180 Financial statements 2020 navigable PDF. 15 Who we are 51 270 Affiliates and subsidiaries Click on the 17 Value generation model SUSTAINABILITY 312 Rationale buttons. 18 Timeline 21 Fleet 52 Strategy and commitments 88 23 Passenger operation 57 Solidary Plane program LATAM GROUP SUPPLIERS 25 LATAM Cargo 62 Climate change 89 Partner network 27 Awards and recognition 67 Environmental management and eco-efficiency Presentation Highlights Letter from the CEO Profile Corporate governance Our business Sustainability Integrated Report 2020 3 Security Employees Customers Suppliers Methodology Appendices Financial information Credits translated at the exchange rate of each transaction date, • Unless the context otherwise requires, references to “TAM” although a monthly rate may also be used if exchange rates are to TAM S.A., and its consolidated affiliates, including do not vary widely. TAM Linhas Aereas S.A. (“TLA”), which operates under the name “LATAM Airlines Brazil”, Fidelidade Viagens e Turismo Conventions adopted Limited (“TAM Viagens”), and Transportes Aéreos Del * Unless the context otherwise requires, references to Mercosur S.A. -

Catching the Wave

Mexico: Catching the wave Economic reform, strong demographics and investment- focused corporates mean that Mexico is a market on the move. But how should you deal in a country that also brings complexity? Corbis/Ivan Vdovin Key insights razil might be a darling of investors, The short-term outlook is also generally • The Mexican economy is set to become but Mexico may soon eclipse it. The positive. Although the International Monetary the largest Latin American economy country is on course to overtake Fund recently cut Mexico’s growth forecast to within a decade, overtaking Brazil. Brazil and become the region’s 1.8% for this year, it expects growth to return • This growth is partly down to Mexico’s Blargest economy within a decade, according to 3% in 2014 as ongoing structural reforms strong fundamentals, such as demographics and political reform. to research by investment bank Nomura. bear fruit. Additionally, capital market • Mexico’s consumer sector has seen “Mexico is now in the moment, as a result activity is thriving. Dealogic figures show that more deals this year than any other of macro and micro factors and industrial Mexico’s equity capital market is having a industry in the country, in part thanks policies,” says Roberto Cuarón, Partner, record year — raising US$10.4b in 2013. to developing consumer credit firing Valuation and Business Modelling, EY, Mexico. the sector’s growth. “Other countries haven’t yet driven away the Economic reform • The country has also garnered a effects of the 2008 crisis.” A big factor behind the investment drive reputation as being a key position in A swelling middle class has made is the progress of reforms, introduced by corporates’ global supply chains. -

Capital Increase Presentation

Enel Américas Capital Increase February 27th, 2019 Table of Contents Our Track Record Transaction Rationale Transaction Structure Closing Remarks 2 Our Track Record 3 Proposed Equity Capital Increase Facilitates Pursuit of Proven Growth Strategy Formation of Successful Up to US$ 3.5 Bn Continued the Largest Delivery of Capital Increase Growth Private Utility Growth and Capital Structure Strategy & Company in Shareholder Optimization to Consolidation LatAm Value Unlock Growth Created Americas- Organic Facilitates execution of Minority investors buyout focused growth vehicle growth strategy with leading market Captured efficiencies Privatization and position Cash flow optimization consolidation Expanded Free Market Unlocked efficiencies and Enel X segments Credit enhancement Enel X expansion Simplified structure Inorganic Higher market capitalization, float and Reduced leakage Acquired Enel Dx São liquidity Paulo and Enel Dx Goiás evidencing strong value creation capabilities 4 Our Track Record Sustainability, Growth, Efficiencies and Value Creation 2016 2018 I&N(3) End users MM 14.1 24.5 EBITDA US$ Bn 2.4 3.4 Growth Net Income US$ Bn 1.0 1.7 CAPEX US$ Bn 1.2 1.7 Group simplification Number of companies 43 32(4) Opex reduction Cumulated efficiencies(1,5) US$ MM ~ 130 ~ 420 Shareholder return Total Dividends US$ Bn 0.3 0.5 Value creation People benefited(1) MM (cumulated) 1.4 2.7 Sustainability commitment Index Member Number of indexes 0 4(2) Notes: 3. Infrastructure & Networks 5 1. Base year 2015 4. Not including acquired -

Nómina De Acciones

NÓMINA DE ACCIONES NÓMINA DE ACIONES QUE CUMPLEN REQUISITOS PARA SER CONSIDERADAS EN CATEGORÍAS GENERALES DE INVERSIÓN REPORTE TRIMESTRAL NÓMINA DE ACCIONES QUE CUMPLEN REQUISITOS PARA SER CONSIDERADAS EN CATEGORÍAS GENERALES DE INVERSIÓN La Superintendencia de Pensiones emitió la Circular N° 2.026 que deroga la Circular N° 2.010, relativa a los Parámetros para el cálculo de los límites de inversión de los Fondos de Pensiones y Fondos de Cesantía, la que entrará en vigencia el 20 de marzo de 2018. En la Circular, se publica la nómina de las acciones de sociedades anónimas abiertas nacionales que cumplen con los requisitos definidos por el Régimen de Inversión de los Fondos de Pensiones, para ser consideradas en las categorías generales de inversión. Cabe señalar que aquellas acciones que no cumplan con los requisitos antes señalados, podrán ser adquiridas bajo las condiciones establecidas para la categoría restringida, definida en el citado Régimen. El detalle de esta información se encuentra a continuación: ACCIONES DE SOCIEDADES ANÓNIMAS ABIERTAS 1. De acuerdo a lo dispuesto en el inciso sexto del artículo 45 del D.L 3.500 de 1980 y en el Régimen de Inversión de los Fondos de Pensiones las acciones elegibles en categoría general, tanto por instrumento como por emisor, a partir del 20 de marzo de 2018, en virtud del cumplimiento del requisito de presencia ajustada mayor o igual a 25% o contar con un Market Maker en los términos y condiciones establecidos en la Normativa vigente, son las siguientes: RAZÓN SOCIAL NEMOTÉCNICO SERIE AES GENER S.A. AESGENER ÚNICA AGUAS ANDINAS S.A. -

Emerging Index - QSR

2 FTSE Russell Publications 19 August 2021 FTSE RAFI Emerging Index - QSR Indicative Index Weight Data as at Closing on 30 June 2021 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) Absa Group Limited 0.29 SOUTH BRF S.A. 0.21 BRAZIL China Taiping Insurance Holdings (Red 0.16 CHINA AFRICA BTG Pactual Participations UNT11 0.09 BRAZIL Chip) Acer 0.07 TAIWAN BYD (A) (SC SZ) 0.03 CHINA China Tower (H) 0.17 CHINA Adaro Energy PT 0.04 INDONESIA BYD (H) 0.12 CHINA China Vanke (A) (SC SZ) 0.09 CHINA ADVANCED INFO SERVICE 0.16 THAILAND Canadian Solar (N Shares) 0.08 CHINA China Vanke (H) 0.2 CHINA Aeroflot Russian Airlines 0.09 RUSSIA Capitec Bank Hldgs Ltd 0.05 SOUTH Chongqing Rural Commercial Bank (A) (SC 0.01 CHINA Agile Group Holdings (P Chip) 0.04 CHINA AFRICA SH) Agricultural Bank of China (A) (SC SH) 0.27 CHINA Catcher Technology 0.2 TAIWAN Chongqing Rural Commercial Bank (H) 0.04 CHINA Agricultural Bank of China (H) 0.66 CHINA Cathay Financial Holding 0.29 TAIWAN Chunghwa Telecom 0.32 TAIWAN Air China (A) (SC SH) 0.02 CHINA CCR SA 0.14 BRAZIL Cia Paranaense de Energia 0.01 BRAZIL Air China (H) 0.06 CHINA Cemex Sa Cpo Line 0.7 MEXICO Cia Paranaense de Energia (B) 0.07 BRAZIL Airports of Thailand 0.04 THAILAND Cemig ON 0.03 BRAZIL Cielo SA 0.13 BRAZIL Akbank 0.18 TURKEY Cemig PN 0.18 BRAZIL CIFI Holdings (Group) (P Chip) 0.03 CHINA Al Rajhi Banking & Investment Corp 0.52 SAUDI Cencosud 0.04 CHILE CIMB Group Holdings 0.11 MALAYSIA ARABIA Centrais Eletricas Brasileiras S.A. -

Elektra (ELEKTRA) Marcela Martínez Suárez [email protected] (52-55) 5169-9384

Second Quarter 2004 Grupo Elektra (ELEKTRA) Marcela Martínez Suárez [email protected] (52-55) 5169-9384 August 5, 2004 SELL ELEKTRA * / EKT Grupo Elektra Prepays 2008 Senior Notes – Strong Price: Mx / ADR Ps 68.25 US$ 22.98 Performance at All Divisions Price Target Ps 71.00 Risk Level High • Elektra is now consolidating the Bank's results. Our comments are based on figures presented by Grupo 52 Week Range: Ps 77.20 to Ps 31.65 Elektra. During 2Q04, sales were up 20.5%, as a result of Shares Outstanding: 236.7 million strong performance at the Bank and the retail division. Market Capitalization: US$ 1.41 billion New personnel hired resulted in an 0.8-pp contraction in Enterprise Value: US$ 2.04 billion operating margin. Operating profit and EBITDA, Avg. Daily Trading Value US$ 1.4 million however, were up 12.5% and 11%, respectively. Retail Ps/share US$/ADR store formats are posting strong results, and the "Nobody 2Q EPS 1.39 0.49 Undersells Elektra" slogan has attracted more consumers. T12 EPS 6.19 2.16 The group's valuation, as measured by the EV/EBITDA T12 EBITDA 15.55 5.42 multiple, is at 6.35x, and should drop to 5.8x by year-end T12 Net Cash Earnings 11.93 4.16 2004. Our price target of Ps 71 represents a 5.54% Book Value 28.86 10.06 nominal yield, including a Ps 1.033 dividend. The above, T12 2004e coupled with the fact that Elektra is a high-risk stock, P/E 11.02x leads us to recommend Elektra as a SELL. -

Annual Report 2017

Annual Report Enel Chile 2017 Santiago Stock Exchange ENELCHILE Nueva York Stock Exchange ENIC Enel Chile S.A. was initially incorporated as Enersis Chile S.A., on March 1, 2016. On October 18, of the same year, the company changed its name to Enel Chile S.A. As of December 31, 2017 the company´s total subscribed and paid capital amounted to Ch$ 4,120,836,253 represented by 49,092,772,762 shares. These shares are traded on the Santiago Stock Exchange and, as American Depository Receipts (ADR) on the New York Stock Exchange. The company’s business is to exploit, develop, operate, generate, distribute, transform and/or sell energy, in any form and nature, directly or through other companies. Total assets as of December 31, 2017, amounted to ThCh $5,694,773,008 . Enel Chile controls and manages a group of companies that operate in the Chilean electricity market. In 2017, net income attributable to the controlling shareholder reached ThCh$ 349,382,642 and operating income was ThCh $578,630,574 . At year end 2017, a total 1,948 people were directly employed by its subsidiaries in Chile. Annual Report Enel Chile 2017 2 Annual Report Enel Chile 2017 Contents > Letter from the Chairman ....................................................................4 > Open Power ........................................................................................8 > Highlights 2017 ................................................................................10 > Main financial and operating data .....................................................14