Annual Report 2008 3 Corporate Social Responsibility Towards Achieving Our Corporate Vision

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Large Firm Dynamics and Secular Stagnation: Evidence from Japan and the U.S

Bank of Japan Working Paper Series Large Firm Dynamics and Secular Stagnation: Evidence from Japan and the U.S. Yoshihiko Hogen* [email protected] Ko Miura** [email protected] Koji Takahashi*** [email protected] No.17-E-8 Bank of Japan June 2017 2-1-1 Nihonbashi-Hongokucho, Chuo-ku, Tokyo 103-0021, Japan ***Research and Statistics Department (currently at the Monetary Affairs Department) *** Research and Statistics Department *** Research and Statistics Department (currently at the Financial System and Bank Examination Department) Papers in the Bank of Japan Working Paper Series are circulated in order to stimulate discussion and comments. Views expressed are those of authors and do not necessarily reflect those of the Bank. If you have any comment or question on the working paper series, please contact each author. When making a copy or reproduction of the content for commercial purposes, please contact the Public Relations Department ([email protected]) at the Bank in advance to request permission. When making a copy or reproduction, the source, Bank of Japan Working Paper Series, should explicitly be credited. Large Firm Dynamics and Secular Stagnation: Evidence from Japan and the U.S. Yoshihiko Hogeny Ko Miuraz Koji Takahashix June 2017 Abstract Focusing on the recent secular stagnation debate, this paper examines the role of large …rm dynamics as determinants of productivity ‡uctuations. We …rst show that idiosyncratic shocks to large …rms as well as entry, exit, and reallocation e¤ects account for 30 to 40 percent of productivity ‡uctuations in Japan and the U.S. -

The Honorable Jarrett Keohokalole, Vice Chair; and Members of the Senate Committee on Judiciary

DAVID Y. IGE ISAAC W. CHOY GOVERNOR DIRECTOR OF TAXATION JOSH GREEN M.D. LT. GOVERNOR STATE OF HAWAII DEPARTMENT OF TAXATION P.O. BOX 259 HONOLULU, HAWAII 96809 PHONE NO: (808) 587-1540 FAX NO: (808) 587-1560 To: The Honorable Karl Rhoads, Chair; The Honorable Jarrett Keohokalole, Vice Chair; and Members of the Senate Committee on Judiciary The Honorable Donovan M. Dela Cruz, Chair; The Honorable Gilbert S.C. Keith-Agaran, Vice Chair; and Members of the Senate Committee on Ways and Means From: Isaac W. Choy, Director Department of Taxation Date: March 3, 2021 Time: 9:45 A.M. Place: Via Videoconference, Hawaii State Capitol Re: S.B. 1147, S.D. 1, Relating to Tobacco Products The Department of Taxation (Department) supports S.B. 1147, S.D. 1, an Administration measure, and offers the following comments for your consideration. S.B. 1147, S.D. 1, makes multiple amendments to chapter 245, Hawaii Revised Statutes (HRS). These amendments will enable improved regulation of the sale of electronic smoking products. S.D. 1 has a defective effective date of January 1, 2050. The Department appreciates the increased wholesaler/dealer license fees and retail permit fees in sections 245-2 and 245-2.5, HRS, respectively. In most cases, the current fee amount does not cover the cost to the State to issue the license or permit. The Department prefers this measure over the other measures proposing to impose the tobacco tax on electronic smoking products because the new imposition can be administered as part of the existing tax. The Department is able to administer this bill as currently written, provided a functional effective date of January 1, 2022 or later is inserted. -

Published on July 21, 2021 1. Changes in Constituents 2

Results of the Periodic Review and Component Stocks of Tokyo Stock Exchange Dividend Focus 100 Index (Effective July 30, 2021) Published on July 21, 2021 1. Changes in Constituents Addition(18) Deletion(18) CodeName Code Name 1414SHO-BOND Holdings Co.,Ltd. 1801 TAISEI CORPORATION 2154BeNext-Yumeshin Group Co. 1802 OBAYASHI CORPORATION 3191JOYFUL HONDA CO.,LTD. 1812 KAJIMA CORPORATION 4452Kao Corporation 2502 Asahi Group Holdings,Ltd. 5401NIPPON STEEL CORPORATION 4004 Showa Denko K.K. 5713Sumitomo Metal Mining Co.,Ltd. 4183 Mitsui Chemicals,Inc. 5802Sumitomo Electric Industries,Ltd. 4204 Sekisui Chemical Co.,Ltd. 5851RYOBI LIMITED 4324 DENTSU GROUP INC. 6028TechnoPro Holdings,Inc. 4768 OTSUKA CORPORATION 6502TOSHIBA CORPORATION 4927 POLA ORBIS HOLDINGS INC. 6503Mitsubishi Electric Corporation 5105 Toyo Tire Corporation 6988NITTO DENKO CORPORATION 5301 TOKAI CARBON CO.,LTD. 7011Mitsubishi Heavy Industries,Ltd. 6269 MODEC,INC. 7202ISUZU MOTORS LIMITED 6448 BROTHER INDUSTRIES,LTD. 7267HONDA MOTOR CO.,LTD. 6501 Hitachi,Ltd. 7956PIGEON CORPORATION 7270 SUBARU CORPORATION 9062NIPPON EXPRESS CO.,LTD. 8015 TOYOTA TSUSHO CORPORATION 9101Nippon Yusen Kabushiki Kaisha 8473 SBI Holdings,Inc. 2.Dividend yield (estimated) 3.50% 3. Constituent Issues (sort by local code) No. local code name 1 1414 SHO-BOND Holdings Co.,Ltd. 2 1605 INPEX CORPORATION 3 1878 DAITO TRUST CONSTRUCTION CO.,LTD. 4 1911 Sumitomo Forestry Co.,Ltd. 5 1925 DAIWA HOUSE INDUSTRY CO.,LTD. 6 1954 Nippon Koei Co.,Ltd. 7 2154 BeNext-Yumeshin Group Co. 8 2503 Kirin Holdings Company,Limited 9 2579 Coca-Cola Bottlers Japan Holdings Inc. 10 2914 JAPAN TOBACCO INC. 11 3003 Hulic Co.,Ltd. 12 3105 Nisshinbo Holdings Inc. 13 3191 JOYFUL HONDA CO.,LTD. -

Itraxx Japan Series 35 Final Membership List March 2021

iTraxx Japan Series 35 Final Membership List March 2021 Copyright © 2021 IHS Markit Ltd T180614 iTraxx Japan Series 35 Final Membership List 1 iTraxx Japan Series 35 Final Membership List...........................................3 2 iTraxx Japan Series 35 Final vs. Series 34................................................ 5 3 Further information .....................................................................................6 Copyright © 2021 IHS Markit Ltd | 2 T180614 iTraxx Japan Series 35 Final Membership List 1 iTraxx Japan Series 35 Final Membership List IHS Markit Ticker IHS Markit Long Name ACOM ACOM CO., LTD. JUSCO AEON CO., LTD. ANAHOL ANA HOLDINGS INC. FUJITS FUJITSU LIMITED HITACH HITACHI, LTD. HNDA HONDA MOTOR CO., LTD. CITOH ITOCHU CORPORATION JAPTOB JAPAN TOBACCO INC. JFEHLD JFE HOLDINGS, INC. KAWHI KAWASAKI HEAVY INDUSTRIES, LTD. KAWKIS KAWASAKI KISEN KAISHA, LTD. KINTGRO KINTETSU GROUP HOLDINGS CO., LTD. KOBSTL KOBE STEEL, LTD. KOMATS KOMATSU LTD. MARUB MARUBENI CORPORATION MITCO MITSUBISHI CORPORATION MITHI MITSUBISHI HEAVY INDUSTRIES, LTD. MITSCO MITSUI & CO., LTD. MITTOA MITSUI CHEMICALS, INC. MITSOL MITSUI O.S.K. LINES, LTD. NECORP NEC CORPORATION NPG-NPI NIPPON PAPER INDUSTRIES CO.,LTD. NIPPSTAA NIPPON STEEL CORPORATION NIPYU NIPPON YUSEN KABUSHIKI KAISHA NSANY NISSAN MOTOR CO., LTD. OJIHOL OJI HOLDINGS CORPORATION ORIX ORIX CORPORATION PC PANASONIC CORPORATION RAKUTE RAKUTEN, INC. RICOH RICOH COMPANY, LTD. SHIMIZ SHIMIZU CORPORATION SOFTGRO SOFTBANK GROUP CORP. SNE SONY CORPORATION Copyright © 2021 IHS Markit Ltd | 3 T180614 iTraxx Japan Series 35 Final Membership List SUMICH SUMITOMO CHEMICAL COMPANY, LIMITED SUMI SUMITOMO CORPORATION SUMIRD SUMITOMO REALTY & DEVELOPMENT CO., LTD. TFARMA TAKEDA PHARMACEUTICAL COMPANY LIMITED TOKYOEL TOKYO ELECTRIC POWER COMPANY HOLDINGS, INCORPORATED TOSH TOSHIBA CORPORATION TOYOTA TOYOTA MOTOR CORPORATION Copyright © 2021 IHS Markit Ltd | 4 T180614 iTraxx Japan Series 35 Final Membership List 2 iTraxx Japan Series 35 Final vs. -

Dpci National Illicit Cigarettes in South Africa

SOUTH AFRICAN POLICE SERVICE SOUTH AFRICAN POLICE SERVICE DPCI NATIONAL ILLICIT CIGARETTES IN SOUTH AFRICA Priority Crime Management Centre Analytical Approach: To Focus on or/and Affect the Business System of Crime PERIOD: 1 APRIL 2017 – 31 MARCH 2018 1 BACKGROUND It will be seen that the name or reference in our view is rather a misnomer in that it does not amount to any illicit trade in tobacco but rather CRIMINAL ACTS Fraud or Tax Evasion in terms of the tax laws. The illicit cigarettes trade is defined as “the production, import, export, purchase, sale, or possession of tobacco goods which fail to comply with legislation” (FATF 2012). Illicit cigarettes trade activities fall under 3 categories: § Contrabrand: cigarettes smuggled from abroad without domestic duty paid. • Counterfeit: cigarettes manufactured without authorization of the rightful owners, with intent to deceive consumers and to avoid paying duty. • Illicit whites: brands manufactured legitimately in one country, but smuggled and sold in another without duties being paid. • Cigarette smuggling, also informally referred to as “bootlegging,” is the illicit transportation of cigarettes or cigars from an administrative division with low taxation to a division with high taxation for sale and consumption. The practice, commonly used by organized crime syndicates and rebel groups, is a form of tax evasion. • BACKGROUND Modus operandi as followed by perpetrators regarding the illicit trade in tobacco • Smuggling genuine, counterfeit and illicit branded cigarettes; • Diversion of cigarettes intended for export; • Trading in illicit tobacco; • Non-reporting of income from trade in illicit tobacco to evade income and sales taxes; • Operating legitimate businesses as using the business as a front to facilitate illicit trade (from Zimbabwe to SA). -

Ranking of Stocks by Market Capitalization(As of End of Jan.2018)

Ranking of Stocks by Market Capitalization(As of End of Jan.2018) 1st Section Rank Code Issue Market Capitalization \100mil. 1 7203 TOYOTA MOTOR CORPORATION 244,072 2 8306 Mitsubishi UFJ Financial Group,Inc. 115,139 3 9437 NTT DOCOMO,INC. 105,463 4 9984 SoftBank Group Corp. 98,839 5 6861 KEYENCE CORPORATION 80,781 6 9432 NIPPON TELEGRAPH AND TELEPHONE CORPORATION 73,587 7 9433 KDDI CORPORATION 71,225 8 7267 HONDA MOTOR CO.,LTD. 69,305 9 8316 Sumitomo Mitsui Financial Group,Inc. 68,996 10 7974 Nintendo Co.,Ltd. 67,958 11 7182 JAPAN POST BANK Co.,Ltd. 66,285 12 6758 SONY CORPORATION 65,927 13 6954 FANUC CORPORATION 60,146 14 7751 CANON INC. 58,005 15 6902 DENSO CORPORATION 54,179 16 4063 Shin-Etsu Chemical Co.,Ltd. 53,624 17 8411 Mizuho Financial Group,Inc. 52,124 18 6594 NIDEC CORPORATION 52,025 19 9983 FAST RETAILING CO.,LTD. 51,647 20 4502 Takeda Pharmaceutical Company Limited 50,743 21 7201 NISSAN MOTOR CO.,LTD. 49,108 22 8058 Mitsubishi Corporation 48,497 23 2914 JAPAN TOBACCO INC. 48,159 24 6098 Recruit Holdings Co.,Ltd. 45,095 25 5108 BRIDGESTONE CORPORATION 43,143 26 6503 Mitsubishi Electric Corporation 42,782 27 9022 Central Japan Railway Company 42,539 28 6501 Hitachi,Ltd. 41,877 29 9020 East Japan Railway Company 41,824 30 6301 KOMATSU LTD. 41,162 31 3382 Seven & I Holdings Co.,Ltd. 39,765 32 6752 Panasonic Corporation 39,714 33 4661 ORIENTAL LAND CO.,LTD. 38,769 34 8766 Tokio Marine Holdings,Inc. -

Tobacco Advertising in Maputo, Mozambique: How Will They Keep Pressing? (Publicidad Del Tabaco En Maputo, Mozambique: ¿Cómo Aguantarán La Presión?)

13 CARTAS 189-157 (251-252).qxd 19/5/06 10:05 Página 251 CARTAS AL DIRECTOR Tobacco advertising in Maputo, Mozambique: how will they keep pressing? (Publicidad del tabaco en Maputo, Mozambique: ¿cómo aguantarán la presión?) Dear Editor: To describe the current condition of tobacco advertising in a developing country with low prevalence of cigarette smok- ing, we decided to quantify the proportion of billboard and news- 251 Gac Sanit. 2006;20(3):251-2 13 CARTAS 189-157 (251-252).qxd 19/5/06 10:05 Página 252 Cartas al Director paper advertising devoted to tobacco and to analyze its con- Figure 1. Tobacco billboard-advertising in Maputo, tents. Mozambique (April, 2005). Maputo outdoor advertising was surveyed by 3 observers (in loco and after visualizing the images recorded in video), both in downtown largest and busier avenues (24th of July, 25th of September, Eduardo Mondlane, Guerra Popular, Julius Nyerere, Karl Marx, Kenneth Kaunda, Mao Tse Tung, Vladimir Lenine) and in the suburbs (Acordos de Lusaka, Angola, Joaquim Chissano, FPLM, Julius Nyerere, Malhangalene, Moçambique, OUA, Vladimir Lenine). The total length of the streets surveyed was approximately 120 kilometres. The main daily (Expresso, Mediafax, Notícias) and weekly (Demos, Domingo, Embondeiro, País, Savana, Zambeze) newspapers published in Maputo were checked to identify advertising items. In April 2005, we identified 707 billboards (79.9% down- town; 45.0% larger than 1 m2 as estimated by the observers and 8.4% blank). Only 2 tobacco advertisements were observed (0.3% of the non-blank billboards). Both were large panels, one with the typical image of a group of people smoking, and the other displaying a tobacco plantation (fig. -

FCTC Reporting Instrument New Zealand

FCTC Reporting Instrument New Zealand Supporting Information and Explanatory Notes Much of the information below relates to the Smoke-free Environments Act (1990), a full version of which is available online at www.legislation.govt.nz/browse_vw.asp?content-set=pal_statutes and the Smoke-free Environments Regulations (1999) http://www.legislation.govt.nz/browse_vw.asp?content-set=pal_regs Section Brief Summary Information 2 Demographics 2 (b) This data is from the 2006 New Zealand census. People can choose to identify with more one than one ethnicity so the figures do not add to 100%. See www.stats.govt.nz/census/2006-census- data/national-highlights/2006-census-quickstats-national- highlights.htm?page=para006Master 3 Tobacco Use Footnotes: The definition of daily smoker is someone who smokes one or more cigarettes per day The definition of occasional smoker is someone who smokes less than one cigarette per day The definition of a (male or female) smoker is 3 (b) Very little snus or chewing tobacco is used in New Zealand. It can be imported for personal use but it is an offence to import for sale, pack or distribute any tobacco products labelled as suitable for chewing or any other oral use (other than smoking). 3 ii) Supply There were three significant individual cases whereby cigarettes were imported [smuggled] undeclared into New Zealand totalling around 400,000 cigarettes. There were nil records in respect of cut smoking tobacco. 4 Taxation Excise duty Cigars, cheroots, and cigarillos $361.45 per kilo of tobacco 1 content Cigarettes -

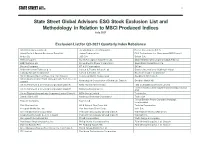

State Street Global Advisors ESG Stock Exclusion List and Methodology in Relation to MSCI Produced Indices July 2021

1 State Street Global Advisors ESG Stock Exclusion List and Methodology in Relation to MSCI Produced Indices July 2021 Exclusion List for Q3-2021 Quarterly Index Rebalance Adani Enterprises Limited Jacobs Engineering Group Inc. Reinet Investments S.C.A. Adani Ports & Special Economic Zone Ltd. Japan Tobacco Inc. RLX Technology, Inc. Sponsored ADR Class A Airbus SE JBS S.A. Safran S.A. Altria Group Inc Korea Aerospace Industries, Ltd. Saudi Arabian Oil Company (Saudi Aramco) BAE Systems plc Korea Electric Power Corporation Saudi Basic Industries Corp. Boeing Company KT & G Corporation SK Inc. British American Tobacco p.l.c. Larsen & Toubro Infotech Ltd Smoore International Holdings Limited Canopy Growth Corporation Larsen & Toubro Ltd. Southern Copper Corporation China National Nuclear Power Co. Ltd. Class A Lockheed Martin Corporation Swedbank AB Class A China Northern Rare Earth (Group) High-Tech Co., Ltd. Metallurgical Corporation of China Ltd. Class A Swedish Match AB Class A China Petroleum & Chemical Corporation Class A MMC Norilsk Nickel PJSC Tata Consultancy Services Limited Teva Pharmaceutical Industries Limited Sponsored China Petroleum & Chemical Corporation Class H Motorola Solutions, Inc. ADR China Shipbuilding Industry Company Limited Class A MTN Group Limited Textron Inc. Danske Bank A/S Northrop Grumman Corporation Thales SA Tokyo Electric Power Company Holdings, Eastern Company Nutrien Ltd. Incorporated Elbit Systems Ltd Oil & Natural Gas Corp. Ltd. Toshiba Corporation Freeport-McMoRan, Inc. Pan American Silver Corp. Vale S.A. General Dynamics Corporation PetroChina Company Limited Class A Wal-Mart de Mexico SAB de CV Grupo Mexico S.A.B. de C.V. Class B PetroChina Company Limited Class H Walmart Inc. -

Annual Report FY2017

Corporate Information 048 Corporate Governance 058 History of the JT Group Japan Tobacco Inc. Annual Report FY2017 062 Regulation and Other Relevant Laws Year ended December 31, 2017 065 Litigation 066 Members of the Board, Audit Investment Operations & Analysis and Supervisory Board Members, leading and Executive Officers to sustainable 018 Industry Overview 067 Members of the JTI growth. 018 Tobacco Business Executive Committee 021 Pharmaceutical Business 067 Corporate Data 021 Processed Food Business 068 Investor Relations Activity 022 Review of Operations 069 Shareholder Information 022 International Tobacco Business 028 Japanese Domestic Tobacco Business 032 Global Tobacco Strategy 034 Pharmaceutical Business 038 Processed Food Business 040 Risk Factors Management 044 JT Group and Sustainability 046 Environmental, Social and 001 Performance Indicators Governance Initiatives 002 At a Glance 004 Consolidated Five-Year Financial Summary 006 Message from the Chairman and CEO Financial Information 008 CEO Business Review 010 Highlights (JT Group’s 2017) 071 Message from CFO 012 Management Principle, Strategic 072 Financial Review Framework and Resource Allocation 080 Consolidated Financial Statements 014 Business Plan 2018 086 Notes to Consolidated 015 Role and Target of Each Business Financial Statements 016 Performance Measures 139 Independent Auditor’s report 140 Glossary of Terms Management Performance Indicators Adjusted Operating Profit Dividend per Share 585.3 14 0 (JPY BN) (JPY) - 0.3% +7. 7 % Year-on-Year Change Year-on-Year Change - 0.6% Factsheets available at: Year-on-Year Change at Constant Exchange Rates https://www.jt.com/investors/results/annual_report/ Unless the context indicates otherwise, references in this Annual Report to ‘we’, ‘us’, In addition, these forward-looking statements are necessarily dependent upon ‘our’, ‘Japan Tobacco’, ‘JT Group’ or ‘JT’ are to Japan Tobacco Inc. -

International Companies with U.S. Branches

INTERNATIONAL COMPANIES WITH U.S. BRANCHES ® CLEMSON UNIVERSITY MICHELIN CAREER CENTER Company: Home Country: Type of Business: Royal Dutch/Shell Group Netherlands oil & gas Royal Dutch/Shell Group United Kingdom oil & gas BP United Kingdom oil & gas DaimlerChrysler Germany automobile Toyota Motor Japan automobile Mitsubishi Japan trading & distribution Mitsui & Co Japan trading & distribution Allianz Worldwide Germany insurance ING Group Netherlands diversified finance Volkswagen Group Germany automobile Sumitomo Japan trading & distribution Marubeni Japan trading & distribution Hitachi Japan electronic equipment Honda Motor Japan automobile AXA Group France insurance Sony Japan household durables Ahold Netherlands food & drug retail Nestle Switzerland food products Nissan Motor Japan automobile Credit Suisse Group Switzerland diversified finance Deutsche Bank Group Germany diversified finance BNP Paribas France bank Deutsche Telekom Germany telecom services Aviva United Kingdom insurance Generali Group Italy insurance Samsung Electronics South Korea semiconductor equip & prods Vodafone United Kingdom wireless telecom svcs Toshiba Japan electronic equipment ENI Italy oil & gas Unilever Netherlands food products Unilever United Kingdom food products Fortis Netherlands diversified finance France Telecom France telecom services UBS Switzerland diversified finance HSBC Group United Kingdom bank BMW-Bayerische Motor Germany automobile NEC Japan computers & peripherals Fujitsu Japan computers & peripherals Bayer HypoVereinsbank Germany bank -

R&Co Risk-Based International Index – Weighting

Rothschild & Co Risk-Based International Index Indicative Index Weight Data as of June 30, 2021 on close Constituent Exchange Country Index Weight(%) Jardine Matheson Holdings Ltd Singapore 1.46 LEG Immobilien SE Germany 0.98 Ajinomoto Co Inc Japan 0.95 SoftBank Corp Japan 0.89 Shimano Inc Japan 0.85 FUJIFILM Holdings Corp Japan 0.73 Singapore Exchange Ltd Singapore 0.72 Japan Tobacco Inc Japan 0.72 Cellnex Telecom SA Spain 0.69 Nintendo Co Ltd Japan 0.69 Carrefour SA France 0.67 Nexon Co Ltd Japan 0.66 Deutsche Wohnen SE Germany 0.65 Bank of China Ltd Hong Kong 0.64 REN - Redes Energeticas Nacion Portugal 0.63 Pan Pacific International Hold Japan 0.63 Japan Post Holdings Co Ltd Japan 0.62 Nippon Telegraph & Telephone C Japan 0.61 Roche Holding AG Switzerland 0.61 Nestle SA Switzerland 0.61 Novo Nordisk A/S Denmark 0.59 ENEOS Holdings Inc Japan 0.59 Nomura Research Institute Ltd Japan 0.59 Koninklijke Ahold Delhaize NV Netherlands 0.59 Jeronimo Martins SGPS SA Portugal 0.58 HelloFresh SE Germany 0.58 Toshiba Corp Japan 0.58 Hoya Corp Japan 0.58 Siemens Healthineers AG Germany 0.58 MS&AD Insurance Group Holdings Japan 0.57 Coloplast A/S Denmark 0.57 Kerry Group PLC Ireland 0.57 Scout24 AG Germany 0.57 SG Holdings Co Ltd Japan 0.56 Symrise AG Germany 0.56 Nitori Holdings Co Ltd Japan 0.56 Beiersdorf AG Germany 0.55 Mitsubishi Corp Japan 0.55 KDDI Corp Japan 0.55 Sysmex Corp Japan 0.55 Chr Hansen Holding A/S Denmark 0.55 Ping An Insurance Group Co of Hong Kong 0.55 Eisai Co Ltd Japan 0.54 Chocoladefabriken Lindt & Spru Switzerland 0.54 Givaudan