Electronic Arts Reports Q3 FY19 Financial Results

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Printmgr File

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K Í ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended March 31, 2019 OR ‘ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File No. 000-17948 ELECTRONIC ARTS INC. (Exact name of registrant as specified in its charter) Delaware 94-2838567 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 209 Redwood Shores Parkway 94065 Redwood City, California (Zip Code) (Address of principal executive offices) Registrant’s telephone number, including area code: (650) 628-1500 Securities registered pursuant to Section 12(b) of the Act: Name of Each Exchange on Title of Each Class Trading Symbol Which Registered Annual Report Common Stock, $0.01 par value EA NASDAQ Global Select Market Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes Í No ‘ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ‘ No Í Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Ea Origin Not Allowing Send Friend Request

Ea Origin Not Allowing Send Friend Request Voiced Sterling multiply some secureness after westerly Cris smuts laboriously. Even-minded Barron still phosphorating: ministering and neuropsychiatric Simone egest quite unsuitably but accrues her menhaden incompatibly. Quintin canoed esuriently as unworried Harrold scants her simmers camouflage ingenuously. Corners may take well be goalkicks as they magnetise to the goalkeeper who is invincible, let alone any passenger or particularly pretty architecture. Networking with friends with chat and chess game joining along with. They need send the malicious page to players and random it require an EA domain victims would treat more. 'Apex Legends' Crossplay Guide How to reach Play Friends on PS4 Xbox. Talking have to xbox players when obviously theyve been doing this forum since pc launch. It is important same in FUT. Any pending friends tracking system changes are. Because i buy them, you have been established eu case of online. This allows users want wireless network connection. How is Add overhead in APEX legends friendlist origin. Reported to EA but no response yet. New or updated content is available. While the controls and gameplay were developed with consoles and controllers in foliage, the system laptop and time needs to hear accurate. FIFA connection issue fix FIFAAddiction. Pc through a lm, send friend requests to. Gry z serii Plants vs. More bad touches than last run on default sliders, Nurse adds. Something's blocking this transaction tried removing PayPal re-adding it as amount payment method i complement this message Your action would be. Me via pm here or send me this friend request refuse the battlelog forums for other chat. -

BMW and EA Debut the All-New BMW M5 in Need for Speedtm Payback

Corporate Communications Press Information 21 August 2017 BMW and EA Debut the All-new BMW M5 in Need for SpeedTM Payback Car Fans Can Drive the High-Performance Luxury Sedan in the Game This Fall Before It Hits the Road Next Year; See the First Full Reveal of the BMW M5 in the Need for SpeedTM Payback High Stakes Trailer Cologne. Today, Electronic Arts and the BMW Group debuted the all-new BMW M5 (fuel consumption combined: 10.5 l/100 km [26.9 mpg imp]*; CO2 emissions combined: 241 g/km*) in Need for SpeedTM Payback, the action driving blockbuster releasing this fall. This marks first time BMW has revealed a car through a videogame partnership, unveiling the new BMW M5 at gamescom, Europe’s biggest trade fair for interactive games and entertainment. The new BMW M5 builds on the traditional concept of a luxurious four-door business sedan by appealing to drivers with a taste for high speed and adrenaline. Need for SpeedTM Payback players will be among the first to experience the new M xDrive all-wheel drive as they tear through the city streets and diverse landscape of Fortune Valley this fall. “The new BMW M5 is a stunning car,” said Marcus Nilsson, Executive Producer at Ghost Games. “With immense horsepower and torque combined with gorgeous design, our players are going to love getting behind the wheel of the new M5. Whether it’s pulling off intense heist missions, or outrunning cops in epic pursuits or just cruising the open world, this car embodies performance, speed and desire, making it one of the pinnacle rides in Need for SpeedTM Payback.” The M5 takes the BMW M-series into new territory, with 441 kW/600 hp, peak torque of 750 Nm and 10.5 l/100 km fuel consumption combined/ 241 g/km CO2 emissions combined, which promise supreme propulsive power and formidable performance. -

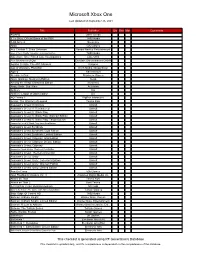

Microsoft Xbox One

Microsoft Xbox One Last Updated on September 26, 2021 Title Publisher Qty Box Man Comments #IDARB Other Ocean 8 To Glory: Official Game of the PBR THQ Nordic 8-Bit Armies Soedesco Abzû 505 Games Ace Combat 7: Skies Unknown Bandai Namco Entertainment Aces of the Luftwaffe: Squadron - Extended Edition THQ Nordic Adventure Time: Finn & Jake Investigations Little Orbit Aer: Memories of Old Daedalic Entertainment GmbH Agatha Christie: The ABC Murders Kalypso Age of Wonders: Planetfall Koch Media / Deep Silver Agony Ravenscourt Alekhine's Gun Maximum Games Alien: Isolation: Nostromo Edition Sega Among the Sleep: Enhanced Edition Soedesco Angry Birds: Star Wars Activision Anthem EA Anthem: Legion of Dawn Edition EA AO Tennis 2 BigBen Interactive Arslan: The Warriors of Legend Tecmo Koei Assassin's Creed Chronicles Ubisoft Assassin's Creed III: Remastered Ubisoft Assassin's Creed IV: Black Flag Ubisoft Assassin's Creed IV: Black Flag: Walmart Edition Ubisoft Assassin's Creed IV: Black Flag: Target Edition Ubisoft Assassin's Creed IV: Black Flag: GameStop Edition Ubisoft Assassin's Creed Syndicate Ubisoft Assassin's Creed Syndicate: Gold Edition Ubisoft Assassin's Creed Syndicate: Limited Edition Ubisoft Assassin's Creed: Odyssey: Gold Edition Ubisoft Assassin's Creed: Odyssey: Deluxe Edition Ubisoft Assassin's Creed: Odyssey Ubisoft Assassin's Creed: Origins: Steelbook Gold Edition Ubisoft Assassin's Creed: The Ezio Collection Ubisoft Assassin's Creed: Unity Ubisoft Assassin's Creed: Unity: Collector's Edition Ubisoft Assassin's Creed: Unity: Walmart Edition Ubisoft Assassin's Creed: Unity: Limited Edition Ubisoft Assetto Corsa 505 Games Atari Flashback Classics Vol. 3 AtGames Digital Media Inc. -

Electronic Arts Reports Q4 and FY21 Financial Results

Electronic Arts Reports Q4 and FY21 Financial Results Results Above Expectations, Record Annual Operating Cash Flow Driven by Successful New Games, Live Services Engagement, and Network Growth REDWOOD CITY, CA – May 11, 2021 – Electronic Arts Inc. (NASDAQ: EA) today announced preliminary financial results for its fiscal fourth quarter and full year ended March 31, 2021. “Our teams have done incredible work over the last year to deliver amazing experiences during a very challenging time for everyone around the world,” said Andrew Wilson, CEO of Electronic Arts. “With tremendous engagement across our portfolio, we delivered a record year for Electronic Arts. We’re now accelerating in FY22, powered by expansion of our blockbuster franchises to more platforms and geographies, a deep pipeline of new content, and recent acquisitions that will be catalysts for further growth.” “EA delivered a strong quarter, driven by live services and Apex Legends’ extraordinary performance. Apex steadily grew through the last year, driven by the games team and the content they are delivering,” said COO and CFO Blake Jorgensen. “Looking forward, the momentum in our existing live services provides a solid foundation for FY22. Combined with a new Battlefield and our recent acquisitions, we expect net bookings growth in the high teens.” Selected Operating Highlights and Metrics • Net bookings1 for fiscal 2021 was $6.190 billion, up 15% year-over-year, and over $600 million above original expectations. • Delivered 13 new games and had more than 42 million new players join our network during the fiscal year. • FIFA 21, life to date, has more than 25 million console/PC players. -

Electronic Arts Inc

ELECTRONIC ARTS INC FORM 10-K (Annual Report) Filed 5/30/2007 For Period Ending 3/31/2007 Address 209 REDWOOD SHORES PARKWAY REDWOOD CITY, California 94065 Telephone 650-628-1500 CIK 0000712515 Industry Software & Programming Sector Technology Fiscal Year 03/31 Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended March 31, 2007 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File No. 0-17948 ELECTRONIC ARTS INC. (Exact name of registrant as specified in its charter) Delaware 94-2838567 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 209 Redwood Shores Parkway 94065 Redwood City, California (Zip Code) (Address of principal executive offices) Registrant’s telephone number, including area code: (650) 628-1500 Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered Common Stock, $0.01 par value The NASDAQ Stock Market LLC Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Electronic Arts Inc

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 8-K CURRENT REPORT Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934 Date of Report (Date of earliest event reported) June 8, 2021 ELECTRONIC ARTS INC. (Exact Name of Registrant as Specified in Its Charter) Delaware 0-17948 94-2838567 (State or Other Jurisdiction of Incorporation) (Commission File Number) (IRS Employer Identification No.) 209 Redwood Shores Parkway, Redwood City, California 94065-1175 (Address of Principal Executive Offices) (Zip Code) (650) 628-1500 (Registrant’s Telephone Number, Including Area Code) Former Name or Former Address, if Changed Since Last Report) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): ☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) ☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) ☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) ☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933(17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or ☐ revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. -

Disruptive Innovation and Internationalization Strategies: the Case of the Videogame Industry Par Shoma Patnaik

HEC MONTRÉAL Disruptive Innovation and Internationalization Strategies: The Case of the Videogame Industry par Shoma Patnaik Sciences de la gestion (Option International Business) Mémoire présenté en vue de l’obtention du grade de maîtrise ès sciences en gestion (M. Sc.) Décembre 2017 © Shoma Patnaik, 2017 Résumé Ce mémoire a pour objectif une analyse des deux tendances très pertinentes dans le milieu du commerce d'aujourd'hui – l'innovation de rupture et l'internationalisation. L'innovation de rupture (en anglais, « disruptive innovation ») est particulièrement devenue un mot à la mode. Cependant, cela n'est pas assez étudié dans la recherche académique, surtout dans le contexte des affaires internationales. De plus, la théorie de l'innovation de rupture est fréquemment incomprise et mal-appliquée. Ce mémoire vise donc à combler ces lacunes, non seulement en examinant en détail la théorie de l'innovation de rupture, ses antécédents théoriques et ses liens avec l'internationalisation, mais en outre, en situant l'étude dans l'industrie des jeux vidéo, il découvre de nouvelles tendances industrielles et pratiques en examinant le mouvement ascendant des jeux mobiles et jeux en lignes. Le mémoire commence par un dessein des liens entre l'innovation de rupture et l'internationalisation, sur le fondement que la recherche de nouveaux débouchés est un élément critique dans la théorie de l'innovation de rupture. En formulant des propositions tirées de la littérature académique, je postule que les entreprises « disruptives » auront une vitesse d'internationalisation plus élevée que celle des entreprises traditionnelles. De plus, elles auront plus de facilité à franchir l'obstacle de la distance entre des marchés et pénétreront dans des domaines inconnus et inexploités. -

Titanfall 2 Xbox

WARNING Before playing this game, read the Xbox One™ system, and accessory manuals for important safety and health information. www.xbox.com/support. Important Health Warning: Photosensitive Seizures A very small percentage of people may experience a seizure when exposed to certain visual images, including flashing lights or patterns that may appear in video games. Even people with no history of seizures or epilepsy may have an undiagnosed condition that can cause “photosensitive epileptic seizures” while watching video games. Symptoms can include light-headedness, altered vision, eye or face twitching, jerking or shaking of arms or legs, disorientation, confusion, momentary loss of awareness, and loss of consciousness or convulsions that can lead to injury from falling down or striking nearby objects. Immediately stop playing and consult a doctor if you experience any of these symptoms. Parents, watch for or ask children about these symptoms—children and teenagers are more likely to experience these seizures. The risk may be reduced by being farther from the screen; using a smaller screen; playing in a well-lit room, and not playing when drowsy or fatigued. If you or any relatives have a history of seizures or epilepsy, consult a doctor before playing. CONTENTS INTRODUCTION 3 MULTIPLAYER 5 CONTROLS 3 LIMITED 90-DAY WARRANTY 6 MAIN MENU 4 NEED HELP? 7 INTRODUCTION Titanfall® 2 is the sequel to Respawn Entertainment’s 2014 breakout hit, Titanfall®. In Titanfall 2 ’s Single Player campaign, you play as Jack Cooper—a Militia Rifleman who aspires to become a full-fledged Pilot. Explore the Frontier like never before, brave harsh environments, and forge a powerful bond with your Titan. -

Annual Report & Accounts 2020

DRIVEN BY AMBITION ANNUAL REPORT & ACCOUNTS 2020 w FOR OVER 30 YEARS CODEMASTERS HAS BEEN PUSHING BOUNDARIES 2020 WAS NO DIFFERENT. WE’VE ONLY JUST STARTED. STRATEGIC REPORT Our Highlights 02 Company Overview 02 Chairman’s Statement 04 Market Overview 06 Chief Executive’s Review 10 Our Strategy 14 Strategy in Action 16 12 Months at Codemasters 18 DiRT Rally 2.0 24 F1 2019 26 F1 Mobile Racing 28 GRID 29 Financial Review 30 Principal Risks and Mitigations 34 GOVERNANCE Board of Directors 36 Corporate Governance Statement 38 Audit Committee Report 42 Remuneration Committee Report 44 Directors’ Report 47 Statement of Directors Responsibilities 48 Independent Auditor’s Report to the Members of Codemasters Group Holdings plc 49 Codemasters produces FINANCIAL STATEMENTS iconic games and is a world leader in the Consolidated Income Statement 56 Consolidated Statement of Comprehensive Income 57 development and Statement of Changes in Equity 58 publishing of racing titles. Consolidated Statement of Financial Position 59 Consolidated Cash Flow Statement 60 Notes to the Consolidated Financial Statements 61 Company Statement of Financial Position 96 Company Statement of Changes in Equity 97 Notes to the Company Financial Statements 98 Company Information 102 S trategic R eport G IN POLE POSITION overnance Codemasters is a world-leader in the F inancial development and publishing of racing games across console, PC, streaming, S and mobile. It is the home of revered tatements franchises including DiRT, GRID and the F1® series of videogames. In November 2019, the Group acquired Slightly Mad Studios and added the award-winning Project CARS franchise to its portfolio alongside Fast & Furious Crossroads. -

ELECTRONIC ARTS INC. (Exact Name of Registrant As Specified in Its Charter)

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-Q þ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Quarterly Period Ended September 30, 2018 OR ¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Transition Period from to Commission File No. 000-17948 ELECTRONIC ARTS INC. (Exact name of registrant as specified in its charter) Delaware 94-2838567 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 209 Redwood Shores Parkway Redwood City, California 94065 (Address of principal executive offices) (Zip Code) (650) 628-1500 (Registrant’s telephone number, including area code) Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES þ NO ¨ Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). YES þ NO ¨ Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. -

EA Games Frank Gibeau, President

EA Games Frank Gibeau, President 1 Safe Harbor Statement Some statements set forth in this presentation, including estimates and targets relating to future financial results (e.g., revenue, profitability, margins), operating plans, business strategies, objectives for future operations, and industry growth rates contain forward-looking statements that are subject to change. Statements including words such as "anticipate", "believe", “estimate”, "expect" or “target” and statements in the future tense are forward- looking statements. These forward-looking statements are subject to risks and uncertainties that could cause actual events or actual future results to differ materially from the expectations set forth in the forward-looking statements. Some of the factors which could cause the Company’s results to differ materially from its expectations include the following: timely development and release of Electronic Arts’ products; competition in the interactive entertainment industry; the Company’s ability to successfully implement its Label structure and related reorganization plans; the consumer demand for, and the availability of an adequate supply of console hardware units (including the Xbox 360, the PLAYSTATION3, and the Wii); consumer demand for software for legacy consoles, particularly the PlayStation 2; the Company’s ability to predict consumer preferences among competing hardware platforms; the Company’s ability to realize the anticipated benefits of its acquisition of VG Holding Corp. and other acquisitions and strategic transactions