451Research- a Highly Attractive Location

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A Life Cycle Assessment Approach on Swedish and Irish Beef Production

Life Cycle Analysis – HT161 December 2016 A life cycle assessment approach on Swedish and Irish beef production Group 1 - Emma Lidell, Elvira Molin, Arash Sajadi & Emily Theokritoff 0 AG2800 Life cycle assessment Lidell, Molin, Sajadi, Theokritoff Summary This life CyCle assessment has been ConduCted to identify and Compare the environmental impacts arising from the Swedish and Irish beef produCtion systems. It is a Cradle to gate study with the funCtional unit of 1 kg of dressed weight. Several proCesses suCh as the slaughterhouse and retail in both Ireland and Sweden have been excluded since they are similar and CanCel each other out. The focus of the study has been on feed, farming and transportation during the beef production. Since this is an attributional LCA, data ColleCtion mainly Consists of average data from different online sources. Smaller differenCes in the Composition of feed were found for the two systems while a major difference between the two production systems is the lifespan of the Cattle. Based on studied literature, the average lifespan for Cattle in Sweden is 45 months while the Irish Cattle lifespan is 18 months. The impaCt Categories that have been assessed are: Climate Change, eutrophiCation, acidifiCation, land oCcupation and land transformation. In all the assessed impact categories, the Swedish beef produCtion system has a higher environmental impact than the Irish beef produCtion system, mainly due to the higher lifespan of the cattle. AcidifiCation, whiCh is the most signifiCant impact Category when analising the normalised results, differs greatly between the two systems. The Swedish beef system emits almost double the amount (1.3 kg) of SO2 Eq for 1 kg of dressed weight Compared to the Irish beef system (0.7 kg SO2 Eq/FU). -

UCC Library and UCC Researchers Have Made This Item Openly Available

UCC Library and UCC researchers have made this item openly available. Please let us know how this has helped you. Thanks! Title The historic record of cold spells in Ireland Author(s) Hickey, Kieran R. Publication date 2011 Original citation HICKEY, K. 2011. The historic record of cold spells in Ireland. Irish Geography, 44, 303-321. Type of publication Article (peer-reviewed) Link to publisher's http://irishgeography.ie/index.php/irishgeography/article/view/48 version http://dx.doi.org/10.2014/igj.v44i2.48 Access to the full text of the published version may require a subscription. Rights © 2011 Geographical Society of Ireland http://creativecommons.org/licenses/by/3.0/ Item downloaded http://hdl.handle.net/10468/2526 from Downloaded on 2021-10-04T01:15:21Z Irish Geography Vol. 44, Nos. 2Á3, JulyÁNovember 2011, 303Á321 The historic record of cold spells in Ireland Kieran Hickey* Department of Geography, National University of Ireland, Galway This paper assesses the long historical climatological record of cold spells in Ireland stretching back to the 1st millennium BC. Over this time period cold spells in Ireland can be linked to solar output variations and volcanic activity both in Iceland and elsewhere. This provides a context for an exploration of the two most recent cold spells which affected Ireland in 2009Á2010 and in late 2010 and were the two worst weather disasters in recent Irish history. These latter events are examined in this context and the role of the Arctic Oscillation (AO) and declining Arctic sea-ice levels are also considered. These recent events with detailed instrumental temperature records also enable a re-evaluation of the historic records of cold spells in Ireland. -

Expmlanatory Memorandum for the Quarterly Report

Irish Communications Market Quarterly Key Data Explanatory Memorandum Document No: 05/92a Date: 20th December 2005 An Coimisiún um Rialáil Cumarsáide Commission for Communications Regulation Abbey Court Irish Life Centre Lower Abbey Street Dublin 1 Ireland Telephone +353 1 804 9600 Fax +353 1 804 9680 Email [email protected] Web www.comreg.ie Contents Contents ..............................................................................................1 1 Executive Summary..........................................................................2 2 Questionnaire Issue ..........................................................................3 3 Primary Data ...................................................................................1 4 Secondary data ................................................................................5 4.1 PRICING DATA..........................................................................................5 4.2 COMPARATIVE DATA ...................................................................................6 5 Glossary..........................................................................................7 6 PPP Conversion Rates data ................................................................0 1 ComReg 05/92a 1 Executive Summary Following the publication of an annual market review in November 1999, ComReg’s predecessor- the ODTR- published its first Quarterly Review on 22nd March 2000. Since that date, ComReg has continued to collect primary statistical data from authorised operators on a quarterly -

2015 Study in Ireland Guide for Indian Students

Contact Us - Ireland: Education In Ireland Enterprise Ireland The Plaza East Point Business Park Study in Dublin 3 Ireland +353 1 7272359/ 7272967 India: Wendy Dsouza India Adviser Education in Ireland Enterprise Ireland Email: [email protected] Follow us on: @EduIreland www.facebook.com/EducationIrelandIndia www.educationinireland.com www.educationinireland.com Welcome To Introduction C O N T E N T S About Ireland 3 An English speaking country within the European Union, Ireland has a reputation for Studying In Ireland 7 natural beauty and friendliness. Ireland is home to more than 1,000 MNCs who run their Preparing For Your Irish Study Journey 11 back office operations out of the country and is just 9 hours by flight from India. Entry Into Ireland 15 Ireland has many similarities with India and Money Matters 17 an important one is that like India, Ireland is a young country with 34% of its population Settling Into Life In Ireland 19 under the age of 25 years. Staying Connected 21 Irish institutions offer a world class educational set up and offer a welcoming Access To Media Culture And Society 23 environment for Indian students. Getting Around 25 Why should you consider studying in Health Matters 29 Ireland? Working In Ireland 33 There are many reasons to consider studying in Ireland. The following are some of them. Safety Matters And The Law 36 World class institutions Returning Home 37 Extensive selection of courses High quality Universities and Technical Useful Links And Information 38 Institutions Friendly and welcoming environment Gateway into Europe Leading Global companies Technology hub Amazing art and culture scene Beautiful and scenic location 1 w w w. -

Irish Business Journal Case Study Edition

business journal 09_30-3-09 31/3/09 12:57 Page 1 Irish Business Journal Case Study Edition Volume 5, Number 1 2009 ISSN: 1649-7120 Supreme Seafoods Dr Thomas Cooney and Prof Roger Mumby-Croft Cartridge World Cork Michael Walsh The Ballymaloe Story Rose Leahy and Nollaig O’Sullivan Flahavan’s – Specialists in Hot Oat Cereals Aileen Cotter Surecom Network Solutions Ltd: In a World of Pots and Pans! Breda Kenny and Prof John Fahy Gleninchaquin Park Dr Breda McCarthy Doolittles Geraldine McGing and Dr Pauline Connolly 1 business journal 09_30-3-09 31/3/09 12:57 Page 2 Irish Business Journal – Case Study Edition ISSN 1649-7120 © The individual contributors, 2009 Editors Rose Leahy, Department of Management and Marketing, CIT Dr Margaret Linehan, School of Business, CIT Editorial Advisory Board Dr Denis Harrington, Waterford Institute of Technology Dr Noel Harvey, Galway Mayo Institute of Technology Dr Michael Morley, University of Limerick Professor Hugh Scullion, National University of Ireland, Galway Professor Stanka Setnikar-Cankar, University of Ljubljana, Slovenia Dr James S. Walsh, National University of Ireland, Cork 2 business journal 09_30-3-09 31/3/09 12:57 Page 3 Editorial Welcome to this special Case Study Edition of Irish Business Journal. As editors we are delighted to provide the opportunity for authors to present Irish case study material. Case studies are a powerful learning tool and are particularly useful for illustrating the applications of academic theories and concepts in “real world” situations. Case studies on Irish companies are relatively scarce and we believe that the cases contained in this edition will provide valuable material for classroom discussions. -

Life in the Fast Lane ONE of the Very First Community Broadband Schemes Is About to Be Switched on in Knockmore, Co Mayo

10 Digital Ireland March 2004 Broadband Ireland: Service providers BROADBAND BRIEFS No knocking Knockmore Life in the fast lane ONE of the very first community broadband schemes is about to be switched on in Knockmore, Co Mayo. The Knockmore initiative has set up a Community Network Society to bring affordable broadband By Leslie Faughnan broadband club had just biggest challenge to take up. access to the community on a non-profit basis. “We should be up 13,000 members. This year The blunt fact is that most and running in a few weeks with the first 30 or so households BROADBAND may be the the take-up speed has begun Irish business people have dominant technology topic of to accelerate at last with Ahern never personally experienced participating,” says chairman Paul Cunnane. Initial backhaul for the the day, but it’s still a fairly pointing out that there has the performance and advant- internet connection is expected to be based on a 2Mbps ADSL exclusive club that only passed been a 33pc weekly increase ages of always-on broadband. connection in Ballina relayed by wireless to the first node in the the 40,000-member mark a since broadband packages of It is confused with the simpler Knockmore region. Unlike broadcast wireless networking, needing at € few weeks ago. According to 40 per month were notions of ‘making internet least one high mast in line of sight, this project is based on a mesh introduced. Prices are contin- performance faster’ and the Minister for Commun- system where each access point is also a repeater linking to the next ications, Marine and Natural uing to inch downwards as perhaps unnecessarily fancy Resources, Dermot Ahern TD, resellers (and re-branders) of stuff such as multimedia and in a line of sight chain — neighbour passes on the signals to Ireland had a grand total of the Eircom service enter the streaming video. -

Irish Climate Futures: Data for Decision-Making Report No

EPA Research Report 277 Irish Climate Futures: Data for Decision-making Report No. 277 Authors: Conor Murphy, Claran Broderick, Tom K.R. Matthews, Simon Noone and Ciara Ryan Irish Climate Futures: Data for Decision-making Identified Pressures Authors: Conor Murphy, Ciaran Broderick, Tom K.R. Matthews, The realisation of a climate-resilient Ireland over the coming decades depends on decisions taken at all scales to adapt to climate change. Good decisions depend on the type and quality of information used Simon Noone and Ciara Ryan to inform planning. Building resilience requires the diversification of the types of information used to understand past and future climate variability and change, and improved insight into the plausible range of changing conditions that will need to be addressed. Informed Policy The need to adapt to climate change means that there is a demand from a variety of different users and sectors for actionable climate information. For instance, in the Irish context, guidance is provided for sectors and local authorities in developing and implementing adaptation plans. In particular, climate information is required to (1) assess the current adaptation baseline, which involves identifying extremes in the historical record and examining the vulnerabilities and impacts of these; (2) assess future climate risks; and (3) identify, assess and prioritise adaptation options. A key challenge to undertaking these tasks is identifying the kinds of climate data that are required for the development and implementation of adaptation planning. This challenge is explored and aspects are addressed as part of this research. Outputs from this work have been used to inform the Citizen’s Assembly deliberations on climate change, the National Adaptation Framework and the Oireachtas Joint Committee on Climate Action. -

Consultation: 12/117

Internal Use Only ` Market Review Retail Access to the Public Telephone Network at a Fixed Location for Residential and Non Residential Customers All responses to this consultation should be clearly marked:- ―Reference: Submission re Market Review – Retail Access to the Public Telephone Network at a Fixed Location for Residential and Non Residential Customers, ComReg 12/117‖ and sent by post, facsimile, or e-mail, to arrive on or before 17:00 on 21 December 2012, to: Claire Kelly Commission for Communications Regulation Irish Life Centre Abbey Street Freepost Dublin 1 Ireland Ph: +353-1-8049600 Fax: +353-1-804 9680 Email: [email protected] Please note ComReg will publish all respondents‘ submissions with the Response to this Consultation, subject to the provisions of ComReg‘s guidelines on the treatment of confidential information – ComReg 05/24. Consultation and Draft Decision Reference: ComReg 12/117 Date: 26/10/2012 An Coimisiún um Rialáil Cumarsáide Commission for Communications Regulation Abbey Court Irish Life Centre Lower Abbey Street Dublin 1 Ireland Telephone +353 1 804 9600 Fax +353 1 804 9680 Email [email protected] Web www.comreg.ie Legal Disclaimer This Consultation Paper is not a binding legal document and also does not contain legal, commercial, financial, technical or other advice. The Commission for Communications Regulation (―ComReg‖) is not bound by it, nor does it necessarily set out ComReg‘s final or definitive position on particular matters. To the extent that there might be any inconsistency between the contents of this document and the due exercise by ComReg of its functions and powers, and the carrying out by it of its duties and the achievement of relevant objectives under law, such contents are without prejudice to the legal position of ComReg. -

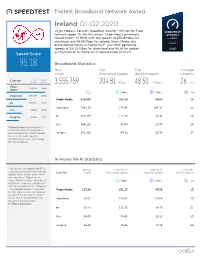

2020 Ireland Virginmedia Fixed.Pdf

Fastest Broadband Network Award Ireland Q1-Q2 2020 Virgin Media is Ireland’s Speedtest Awards™ Winner for fixed network speed. To win this award, Virgin Media achieved a Speed Score™ of 95.18, with top speeds of 255.18 Mbps for download and 46.86 Mbps for upload. Virgin Media also achieved the fastest In-Home Wi-Fi with 90th percentile speeds of 251.23 Mbps for download and 45.36 for upload giving them an In-Home Wi-Fi Speed Score of 117.20. Speed Score 95.18 Broadband Statistics Test Top Top Average Count Download Speed: Upload Speed: Latency: Carrier User Speed Count Score 3,555,759 204.81 Mbps 48.50 Mbps 26 ms Virgin 174,762 95.18 Media Mbps Mbps ms Vodafone 138,085 48.82 Virgin Media 819,475 255.18 46.86 16 eir 163,255 39.59 Vodafone 768,153 175.95 135.14 22 Sky 43,985 36.53 eir 766,777 112.28 41.34 24 Imagine 28,895 29.78 Sky 194,226 95.33 29.73 25 Speed Score incorporates a measure of each provider’s download and upload speed Imagine 242,213 84.22 13.37 53 to rank network speed performance. See next page for more detail. In-Home Wi-Fi Statistics The fastest In-Home Wi-Fi is Speed Top Wi-Fi Top Wi-Fi Average calculated from the results of Carrier Score Download Speed Upload Speed Wi-Fi Latency speed tests taken over Wi-Fi connections. These tests come from various speedtest Mbps Mbps ms platforms and are combined into an overall Wi-Fi category. -

Sabatino-Etal-NH2016-Modelling

Nat Hazards DOI 10.1007/s11069-016-2506-7 ORIGINAL PAPER Modelling sea level surges in the Firth of Clyde, a fjordic embayment in south-west Scotland 1 2 Alessandro D. Sabatino • Rory B. O’Hara Murray • 3 1 1 Alan Hills • Douglas C. Speirs • Michael R. Heath Received: 14 January 2016 / Accepted: 24 July 2016 Ó The Author(s) 2016. This article is published with open access at Springerlink.com Abstract Storm surges are an abnormal enhancement of the water level in response to weather perturbations. They have the capacity to cause damaging flooding of coastal regions, especially when they coincide with astronomical high spring tides. Some areas of the UK have suffered particularly damaging surge events, and the Firth of Clyde is a region with high risk due to its location and morphology. Here, we use a three-dimensional high spatial resolution hydrodynamic model to simulate the local bathymetric and morpho- logical enhancement of surge in the Clyde, and disaggregate the effects of far-field atmospheric pressure distribution and local scale wind forcing of surges. A climatological analysis, based on 30 years of data from Millport tide gauges, is also discussed. The results suggest that floods are not only caused by extreme surge events, but also by the coupling of spring high tides with moderate surges. Water level is also enhanced by a funnelling effect due to the bathymetry and the morphology of fjordic sealochs and the River Clyde Estuary. In a world of rising sea level, studying the propagation and the climatology of surges and high water events is fundamental. -

Climate Change in Ireland

Climate change in Ireland- recent trends in temperature and precipitation Laura McElwain and John Sweeney Department of Geography, National University of Ireland, Maynooth ABSTRACT This paper presents an assessment of indicators of climate change in Ireland over the past century. Trends are examined in order to determine the magnitude and direction of ongoing climate change. Although detection of a trend is difficult due to the influence of the North Atlantic Ocean, it is concluded that Irish cli- mate is following similar trajectories to those predicted by global climate mod- els. Climatic variables investigated included the key temperature and precipita- tion data series from the Irish synoptic station network. Analysis of the Irish mean temperature records indicates an increase similar to global trends, particu- larly with reference to early-twentieth century wanning and, more importantly, rapid warming in the 1990s. Similarly, analysis of precipitation change support the findings of the United Kingdom Climate Impacts Programme (UKCIPS) with evidence of a trend towards winter increases in the north-west of the coun- try and summer decreases in the south-east. Secondary climate indicators such as frequency of 'hot' and 'cold' days were found to reveal more variable trends. Key index words: climate change, trends, precipitation, trajectories. Introduction An increase in global surface temperature of 0.6 + 0.2°C has occurred since the late- nineteenth century (IPCC, 2001). Most of this warming has occurred during two main periods: 1910-1945 and 1976 to the present. During the present episode of rapid wanning, temperatures have increased at a rate of 0.15°C per decade (Jones et al., 2001). -

Lot 1 Box of Irish Railway Interest Photographs Etc. Estimate

Purcell Auctioneers - Specialist Auction Of Irish Interest Books with dedicated section for Irish Railwayana Literature & Ephemera - Starts 13 Mar 2019 Lot 1 Box of Irish Railway Interest Photographs etc. Estimate: 40 - 60 Fees: 20% inc VAT for absentee bids, telephone bids and bidding in person 23.69% inc VAT for Live Bidding and Autobids Lot 2 Box of Irish Railway Interest Ephemera Estimate: 40 - 60 Fees: 20% inc VAT for absentee bids, telephone bids and bidding in person 23.69% inc VAT for Live Bidding and Autobids Lot 3 Box of Irish Railway Interest Ephemera Estimate: 30 - 50 Fees: 20% inc VAT for absentee bids, telephone bids and bidding in person 23.69% inc VAT for Live Bidding and Autobids Lot 4 Large Box of Mostly Non-Irish Railway Interest Books etc. Estimate: 20 - 40 Fees: 20% inc VAT for absentee bids, telephone bids and bidding in person 23.69% inc VAT for Live Bidding and Autobids Lot 5 Two Boxes of CIE Interest Ephemera, Ledgers etc. Estimate: 60 - 100 Fees: 20% inc VAT for absentee bids, telephone bids and bidding in person 23.69% inc VAT for Live Bidding and Autobids Lot 6 Irish Railwayana Scrap Book, tickets, correspondence, notices etc. Estimate: 50 - 100 Fees: 20% inc VAT for absentee bids, telephone bids and bidding in person 23.69% inc VAT for Live Bidding and Autobids Lot 7 Irish Railwayana Scrap Book, tickets, correspondence, notices etc. Estimate: 50 - 100 Fees: 20% inc VAT for absentee bids, telephone bids and bidding in person 23.69% inc VAT for Live Bidding and Autobids Lot 8 Irish Railwayana Scrap Book, County Donegal Railways, Northern Ireland Railways, Great Northern Railway Co.