University Microfilms International 300 N

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

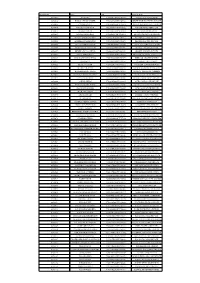

Signatory ID Name CIN Company Name 02700003 RAM TIKA

Signatory ID Name CIN Company Name 02700003 RAM TIKA U55101DL1998PTC094457 RVS HOTELS AND RESORTS 02700032 BANSAL SHYAM SUNDER U70102AP2005PTC047718 SHREEMUKH PROPERTIES PRIVATE 02700065 CHHIBA SAVITA U01100MH2004PTC150274 DEJA VU FARMS PRIVATE LIMITED 02700070 PARATE VIJAYKUMAR U45200MH1993PTC072352 PARATE DEVELOPERS P LTD 02700076 BHARATI GHOSH U85110WB2007PTC118976 ACCURATE MEDICARE & 02700087 JAIN MANISH RAJMAL U45202MH1950PTC008342 LEO ESTATES PRIVATE LIMITED 02700109 NATESAN RAMACHANDRAN U51505TN2002PTC049271 RESHMA ELECTRIC PRIVATE 02700110 JEGADEESAN MAHENDRAN U51505TN2002PTC049271 RESHMA ELECTRIC PRIVATE 02700126 GUPTA JAGDISH PRASAD U74210MP2003PTC015880 GOPAL SEVA PRIVATE LIMITED 02700155 KRISHNAKUMARAN NAIR U45201GJ1994PTC021976 SHARVIL HOUSING PVT LTD 02700157 DHIREN OZA VASANTLAL U45201GJ1994PTC021976 SHARVIL HOUSING PVT LTD 02700183 GUPTA KEDAR NATH U72200AP2004PTC044434 TRAVASH SOFTWARE SOLUTIONS 02700187 KUMARASWAMY KUNIGAL U93090KA2006PLC039899 EMERALD AIRLINES LIMITED 02700216 JAIN MANOJ U15400MP2007PTC020151 CHAMBAL VALLEY AGRO 02700222 BHAIYA SHARAD U45402TN1996PTC036292 NORTHERN TANCHEM PRIVATE 02700226 HENDIN URI ZIPORI U55101HP2008PTC030910 INNER WELLSPRING HOSPITALITY 02700266 KUMARI POLURU VIJAYA U60221PY2001PLC001594 REGENCY TRANSPORT CARRIERS 02700285 DEVADASON NALLATHAMPI U72200TN2006PTC059044 ZENTERE SOLUTIONS PRIVATE 02700322 GOPAL KAKA RAM U01400UP2007PTC033194 KESHRI AGRI GENETICS PRIVATE 02700342 ASHISH OBERAI U74120DL2008PTC184837 ASTHA LAND SCAPE PRIVATE 02700354 MADHUSUDHANA REDDY U70200KA2005PTC036400 -

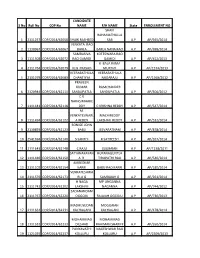

S No Roll No COP No CANDIDATE NAME F/H NAME State

CANDIDATE S No Roll No COP No NAME F/H NAME State ENROLLMENT NO SHAIK RAHAMATHULLA 1 2111257 COP/2014/62058 SHAIK RASHEED SAB A.P AP/945/2014 VENKATA RAO 2 1130967 COP/2014/62067 BARLA BARLA NANA RAO A.P AP/698/2014 SAMBASIVA KOTESWARA RAO 3 1111308 COP/2014/62072 RAO GAMIDI GAMIDI A.P AP/452/2013 K BALA RAMA 4 2111764 COP/2014/62079 KLN PRASAD MURTHY A.P AP/1574/2013 VEERABATHULA VEERABATHULA 5 2131079 COP/2014/62083 CHANTIYYA NAGARAJU A.P AP/1568/2012 PRAVEEN KUMAR RAMCHANDER 6 2120944 COP/2014/62111 SANDUPATLA SANDUPATLA A.P AP/306/2012 C V NARASIMHARE 7 1111441 COP/2014/62118 DDY C KRISHNA REDDY A.P AP/547/2014 M. VENKATESWARL MACHIREDDY 8 1111494 COP/2014/62122 A REDDY LAKSHMI REDDY A.P AP/532/2014 BONIGE JOHN 9 2130893 COP/2014/62123 BABU JEEVARATNAM A.P AP/878/2014 10 2541694 COP/2014/62140 S SANTHI R SATHEESH A.P AP/267/2014 11 2111643 COP/2014/62148 C RAJU SUGRAIAH A.P AP/1238/2011 SATYANARAYAN RUPANAGUNTLA 12 1111480 COP/2014/62150 A R. TIRUPATHI RAO A.P AP/540/2014 AMBEDKAR 13 2131102 COP/2014/62154 KARRI BABU RAO KARRI A.P AP/180/2014 VENKATESHWA 14 2111570 COP/2014/62173 RLU G SAMBAIAH G A.P AP/261/2014 H NAGA MP LINGANNA 15 2111742 COP/2014/62202 LAKSHMI NAGANNA A.P AP/744/2012 SADANANDAM 16 2111767 COP/2014/62220 OGGOJU RAJAIAH OGGOJU A.P AP/736/2013 MADHUSUDAN MOGILAIAH 17 2111661 COP/2014/62231 KACHAGANI KACHAGANI A.P AP/478/2014 MOHAMMAD MOHAMMAD 18 1111532 COP/2014/62233 DILSHAD RAHIMAN SHARIFF A.P AP/550/2014 PUNYAVATHI NAGESHWAR RAO 19 1121035 COP/2014/62237 KOLLURU KOLLURU A.P AP/2309/2013 G SATHAKOTI GEESALA 20 2131021 COP/2014/62257 SRINIVAS NAGABHUSHANAM A.P AP/1734/2011 GANTLA GANTLA SADHU 21 1131067 COP/2014/62258 SANYASI RAO RAO A.P AP/1802/2013 KOLICHALAM NAVEEN KOLICHALAM 22 1111688 COP/2014/62265 KUMAR BRAHMAIAH A.P AP/1908/2010 SRINIVASA RAO SANKARA RAO 23 2131012 COP/2014/62269 KOKKILIGADDA KOKKILIGADDA A.P AP/793/2013 24 2120971 COP/2014/62275 MADHU PILLI MAISAIAH PILLI A.P AP/108/2012 SWARUPARANI 25 2131014 COP/2014/62295 GANJI GANJIABRAHAM A.P AP/137/2014 26 2111507 COP/2014/62298 M RAVI KUMAR M LAXMAIAH A.P AP/177/2012 K. -

Castes and Caste Relationships

Chapter 4 Castes and Caste Relationships Introduction In order to understand the agrarian system in any Indian local community it is necessary to understand the workings of the caste system, since caste patterns much social and economic behaviour. The major responses to the uncertain environment of western Rajasthan involve utilising a wide variety of resources, either by spreading risks within the agro-pastoral economy, by moving into other physical regions (through nomadism) or by tapping in to the national economy, through civil service, military service or other employment. In this chapter I aim to show how tapping in to diverse resource levels can be facilitated by some aspects of caste organisation. To a certain extent members of different castes have different strategies consonant with their economic status and with organisational features of their caste. One aspect of this is that the higher castes, which constitute an upper class at the village level, are able to utilise alternative resources more easily than the lower castes, because the options are more restricted for those castes which own little land. This aspect will be raised in this chapter and developed later. I wish to emphasise that the use of the term 'class' in this context refers to a local level class structure defined in terms of economic criteria (essentially land ownership). All of the people in Hinganiya, and most of the people throughout the village cluster, would rank very low in a class system defined nationally or even on a district basis. While the differences loom large on a local level, they are relatively minor in the wider context. -

(2003) Paper Abstracts

Note: Abstracts exceeding the 150-word limit were abbreviated at approximately 175 words and marked with an ellipsis. Abraham, Shinu, University of Pennsylvania Modeling Social Complexity in Late Iron Age/Early Historic Tamilakam This paper evaluates social complexity of the South Indian region known as Tamilakam, comprising the states of Kerala and Tamil Nadu during the late Iron Age/Early Historic period. Tamilakam does not appear to conform to traditionally conceived forms of social organization, making it necessary to consider alternative models within which social complexity can be addressed through an analysis of material remains and their patterning. New mortuary, settlement, and ceramic data from a regional survey of the Palghat Gap in Kerala, South India, is considered and evaluated in the context of prevailing text-based reconstructions of the period. This approach for understanding early Tamil material culture does not ignore the historical record, but instead seeks to integrate the historical and archaeological records more tightly and explicitly. This study has been structured around the analysis of two bodies of material data--megaliths and ceramics--in conjunction with the analysis of historical documents, and concludes that the archaeological data from Iron Age/Early Historic Tamilakam can be better understand with the application of heterarchical principles to early Tamil society. Adamjee, Qamar, New York University Uniting Modernity and Tradition: The Art of Shahzia Sikander The scale, styles, superb draftsmanship and overall rich appearance of Shahzia Sikander’s paintings immediately recall some of the most memorable examples of Persian and Indian painting traditions from the sixteenth through the eighteenth centuries. Yet a closer look at the images reveals a far more complex dynamic, one deeply-rooted in contemporary issues and not simply a revival of traditional styles. -

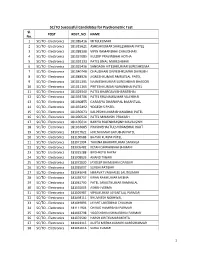

SC/TO Successful Candidates for Psychometric Test Sl

SC/TO Successful Candidates for Psychometric Test Sl. POST REGT_NO NAME No. -

List of Officers Who Attended Courses at NCRB

List of officers who attened courses at NCRB Sr.No State/Organisation Name Rank YEAR 2000 SQL & RDBMS (INGRES) From 03/04/2000 to 20/04/2000 1 Andhra Pradesh Shri P. GOPALAKRISHNAMURTHY SI 2 Andhra Pradesh Shri P. MURALI KRISHNA INSPECTOR 3 Assam Shri AMULYA KUMAR DEKA SI 4 Delhi Shri SANDEEP KUMAR ASI 5 Gujarat Shri KALPESH DHIRAJLAL BHATT PWSI 6 Gujarat Shri SHRIDHAR NATVARRAO THAKARE PWSI 7 Jammu & Kashmir Shri TAHIR AHMED SI 8 Jammu & Kashmir Shri VIJAY KUMAR SI 9 Maharashtra Shri ABHIMAN SARKAR HEAD CONSTABLE 10 Maharashtra Shri MODAK YASHWANT MOHANIRAJ INSPECTOR 11 Mizoram Shri C. LALCHHUANKIMA ASI 12 Mizoram Shri F. RAMNGHAKLIANA ASI 13 Mizoram Shri MS. LALNUNTHARI HMAR ASI 14 Mizoram Shri R. ROTLUANGA ASI 15 Punjab Shri GURDEV SINGH INSPECTOR 16 Punjab Shri SUKHCHAIN SINGH SI 17 Tamil Nadu Shri JERALD ALEXANDER SI 18 Tamil Nadu Shri S. CHARLES SI 19 Tamil Nadu Shri SMT. C. KALAVATHEY INSPECTOR 20 Uttar Pradesh Shri INDU BHUSHAN NAUTIYAL SI 21 Uttar Pradesh Shri OM PRAKASH ARYA INSPECTOR 22 West Bengal Shri PARTHA PRATIM GUHA ASI 23 West Bengal Shri PURNA CHANDRA DUTTA ASI PC OPERATION & OFFICE AUTOMATION From 01/05/2000 to 12/05/2000 1 Andhra Pradesh Shri LALSAHEB BANDANAPUDI DY.SP 2 Andhra Pradesh Shri V. RUDRA KUMAR DY.SP 3 Border Security Force Shri ASHOK ARJUN PATIL DY.COMDT. 4 Border Security Force Shri DANIEL ADHIKARI DY.COMDT. 5 Border Security Force Shri DR. VINAYA BHARATI CMO 6 CISF Shri JISHNU PRASANNA MUKHERJEE ASST.COMDT. 7 CISF Shri K.K. SHARMA ASST.COMDT. -

The Musalman Races Found in Sindh

A SHORT SKETCH, HISTORICAL AND TRADITIONAL, OF THE MUSALMAN RACES FOUND IN SINDH, BALUCHISTAN AND AFGHANISTAN, THEIR GENEALOGICAL SUB-DIVISIONS AND SEPTS, TOGETHER WITH AN ETHNOLOGICAL AND ETHNOGRAPHICAL ACCOUNT, BY SHEIKH SADIK ALÍ SHER ALÍ, ANSÀRI, DEPUTY COLLECTOR IN SINDH. PRINTED AT THE COMMISSIONER’S PRESS. 1901. Reproduced By SANI HUSSAIN PANHWAR September 2010; The Musalman Races; Copyright © www.panhwar.com 1 DEDICATION. To ROBERT GILES, Esquire, MA., OLE., Commissioner in Sindh, This Volume is dedicated, As a humble token of the most sincere feelings of esteem for his private worth and public services, And his most kind and liberal treatment OF THE MUSALMAN LANDHOLDERS IN THE PROVINCE OF SINDH, ВY HIS OLD SUBORDINATE, THE COMPILER. The Musalman Races; Copyright © www.panhwar.com 2 PREFACE. In 1889, while I was Deputy Collector in the Frontier District of Upper Sindh, I was desired by B. Giles, Esquire, then Deputy Commissioner of that district, to prepare a Note on the Baloch and Birahoi tribes, showing their tribal connections and the feuds existing between their various branches, and other details. Accordingly, I prepared a Note on these two tribes and submitted it to him in May 1890. The Note was revised by me at the direction of C. E. S. Steele, Esquire, when he became Deputy Commissioner of the above district, and a copy of it was furnished to him. It was revised a third time in August 1895, and a copy was submitted to H. C. Mules, Esquire, after he took charge of the district, and at my request the revised Note was printed at the Commissioner-in-Sindh’s Press in 1896, and copies of it were supplied to all the District and Divisional officers. -

FACULTY DIRECTORY SP MEDICAL COLLEGE, BIKANER Anaesthesia

FACULTY DIRECTORY SP MEDICAL COLLEGE, BIKANER Anaesthesia: S.No. Designation Name Qualification Permanent Address Mobile No. Email-id 1. Senior Dr. Madhu MBBS(1979) Dainik Yugpaksha, +91- -------- Professor & Saxena MD(1983) Phar Bazaar, 7742845533 Head Bikaner(Raj) 2. Senior Dr. H. MBBS(1979) Naseeb Manzil, +91- [email protected] Professor Rehman MD(1984) Mohalla Pajavgiran, 9828034655 Bikaner(Raj) 3. Senior Dr. MBBS(1977- Paras Dhan, +91- [email protected] Professor Sadhana 78) Gangashehar Road, 9829550517 Jain MD(1982) Bikaner(Raj) 4. Professor Dr. Anita MBBS(1988) 4-e-188, Behind Youth +91- [email protected] Pareek MD(1992) Fashion, J.N.Vyas 9828101281 Colony, Bikaner(Raj) 5. Associate Dr.Kanta MBBS(1991) Near Hanumangarh +91- [email protected] Professor Bhati MD(1996) Mandir, Subhashpura, 9413466688 Lalgarh, Bikaner(Raj) 6. Associate "Dr. MBBS(1996) Shri Hari,250, +91- [email protected] Professor Sonali MD(2002) Marudhara Colony, 9414137866 Dhawan Bikaner(Raj) 7. Assistant Dr. Kiwi MBBS(2004) A-22, Shastri Nagar, +91- [email protected] Professor Mantan MD(2010) Bikaner (Raj) 9929092702 8. Assistant Dr. Mohd. MBBS(2007) 58, PG Hostel, PBM +91- [email protected] Professor Yunus MD(2013) Hospital 8587858715 Khilji Campus, Bikaner(Raj) 9. Assistant Dr. MBBS(2006) II- E -244, J.N. Vyas +91- [email protected] Professor Pramila MD(2013) Colony, Bikaner (Raj) 9468940551 Soni 10. Senior Dr. Gauri MBBS 27 Nagrechi 9530002433 [email protected] resident Arora DA scheme,Pawanpuri bikaner (Raj) 11. Senior Dr. Savita MBBS c/o R.N Rathi 7023455500 [email protected] resident Rathi MD ramrajya chowk bikaner 12. -

National Commission for Denotified, Nomadic and Semi-Nomadic Tribes

NATIONAL COMMISSION FOR DENOTIFIED, NOMADIC AND SEMI-NOMADIC TRIBES Voices of the DNT/NT Communities in India Visit of Chairman and Member to the State of Rajasthan and receiving representations/grievanc0es from local DNT/NT people CONTENTS Page No. 1. Foreword from Chairman 1 2. A note from Member Secretary – 3 ‘Voices of DNT/NT Communities in India’ 3. Summary of grievances received (State wise) 9 4. Analysis of Grievances/Policy implications 24 ANNEXURES Annexure-1 : List of States/Communities visited/met 31 Annexure-2 : State wise grievance statement 33 Annexure-3 : List of Communities seeking inclusion 118 Foreword Government of India has constituted a National Commission for Denotified, Nomadic & Semi-Nomadic Tribes with a mandate to identify and prepare a state-wise list of DNT/NT, apart from assessing the status of their inclusion in SC/ST/OBC, identification of areas where they are densely populated, reviewing the progress of development and suggesting appropriate measures for their upliftment. Commission came into existence from 9th January, 2015. 2. The Commission led by me made extensive visits, visited 20 states, held meetings with 15 State Governments, met nearly 123 communities in their locations and saw their living conditions and received nearly 834 grievances/representations from the community people, leaders and associations. 3. These visits and the grievances have given a new vision to us and views of the people, especially the down-trodden people who are yet to see the ray of hope. The publication of the document “Voices of the Denotified, Nomadic & Semi-Nomadic Tribes” is a very big effort towards achieving the objectives of the Commission. -

Non Teaching Staff

GCS Medical College, Hospital and Research Centre - Ahmedabad - 380025 Details of Para-Medical Staff Sr. No. Name of Employee Designation 1 Minakshi Vimal Jogiya Jr. Techinician 2 Mr.Bhailal F. Patel Chief Laboratory Technician 3 Mr.Suresh Kantilal Rana Sr. Technician 4 Ms.Usha Jayminkumar Patel Sr. Laboratory Technician 5 Mr.Mahesh Baldevbhai Patel Sr. Laboratory Technician 6 Ms.Nimisha Vivek Makwana Laboratory Technician 7 Mr.Rajeshkumar Mangaru Maurya Jr. Laboratory Technician 8 Mr.Dushyant Mahendrabhai Parmar Technician 9 Mr.Kanaiyalal Premchandbhai Solanki Jr. Assistant 10 Ms. Vaishali Sagar Bhavsar Sr. Laboratory Technician 11 Ms.Nayna Parsottambhai Prajapati Sr. Assistant 12 Ms.Sharmila Hiteshkumar Kadam Sr. Laboratory Technician 13 Mr.Himmat Jayantibhai Rawat Sr. Assistant 14 Mr.Vaibhav Ajaykumar Nanshah O. T. Co-ordinator 15 Mr.Nareshkumar Hiralal Parmar Sr. Laboratory Technician 16 Mr.Pradipkumar Lavjibhai Solanki Assistant Officer 17 Ms.Hina Kaushik kumar Oza Sr. Laboratory Technician 18 Ms.Namrata Ajitsinh Masani Sr. Laboratory Technician 19 Mr.Ashok Manilal Solanki Sr. Assistant 20 Ms.Ramila Pravinbhai Parmar Jr. Assistant 21 Mr.Pravinbhai Harjivanbhai Vaghela Jr. Assistant 22 Ms.Rizwana Sarfaraj Mansuri Medical Social Worker 23 Mr.Jignesh Ramanbhai Shrimali Technical Assistant 24 Mr.Manharsinh Padamsinh Bhati Sr. X-Ray Technician 25 Mr.Ashok Hirabhai Parmar Assistant 26 Mr.Kamlesh Kantilal Makwana Phlebotomist 27 Mr.Tarunkumar Babubhai Rana Phlebotomist 28 Ms.Heena Hemal Rathod Sr. Pharmacist 29 Ms.Parul Dixit Patel Laboratory Technician 30 Mr.Kanubhai Panabhai Solanki Phlebotomist 31 Ms.Shambhavi Subhash Chaoudhary Pharmacist 32 Mr.Rajnikant Chimanlal Solanki Phlebotomist 33 Ms. Parul Harishbhai Vasaikar Laboratory Technician 34 Mr.Mahipalsinh Arjunsinh Chavda Jr. -

Places to Visit in Jaisalmer

! FORT & HAVELIS Gadsisar Lake 2.0 kilometres from Jaisalmer Marriott Resort & Spa is a man-made lake in the heart of city which was constructed in year 1367 By Maharawal Gadsisar to fulDil the drinking water requirement of the locals By storing the rain water. It is currently a major tourist huB & is famous for Boating & cat Dishes in the lake. Golden Jaisalmer Fort with Jain Temples & Palace Museum 1.5 kilometres from Jaisalmer Marriott Resort & Spa is the only Living fort in the world. The fort's massive yellow sandstone walls are a tawny lion colour during the day, fading to honey-gold as the sun sets, thereBy camouDlaging the fort in the yellow desert. It is also known as the Sonar Quila or Golden Fort. Its perhaps one of the more striking monuments in the area, its dominant hilltop location making the sprawling towers of its fortiDications visiBle for many miles around Patwon Ki Haveli The Patwon Ji ki Haveli is an interesting piece of Architecture and is the most important among the havelis in Jaisalmer. The Dirst among these havelis was commissioned and constructed in the year 1805 By Guman Chand Patwa. The havelis are also known as the 'mansion of Brocade merchants'. This name has Been given proBaBly Because the family dealt in threads of gold and silver used in embroidering dresses. This is the largest Haveli in Jaisalmer and stands in a narrow lane. Nathmal Ji ki Haveli This Nathmal Ji ki haveli was commissioned to serve as the residence of Diwan Mohata Nathmal, the then Prime Minister of Jaisalmer. -

Village Survey Monographs, 3 Bujawar, Part VI-C, Vol-XIV

PReM. 171 C 3 (N) 1,000 CENSUS OF INDIA 1961 VOLUME XIV RAJAS'fHAN PART VI - C VILLAGE SURVEY MONOGRAPHS 3. B U JAW A R Field Investigation and First Draft by SHAMSHER SINGH Supervision and Final Draft by G. R. GUPTA Editor C. S. GUPTA OF THE INDIAN ADMINISTRATIVE SERVICE Superintendent of Census Operations. Rajasthan. 1966 FOREWORD Apart from laying the foundation of to find out how much of a village was static and demograpby in this sub-continent, a bundred yet changing and how fast the winds of change years of the Indian Census has also produced were blowing and from where. 'elaborate and scholarly accounts of the variegated phenomena of Indian lire, sometimes with no Randomness of selection was, therefore, statistics attached but usually with just enough eschewed. There was no intention to build up a statisticJ, (0 give empirical underpinning to their picture for the whole State in quantitative terms conclusiom.'. In a country, largely illiterate, where on the ba~is of "illages selected statistically at statistical or numerical comprehension of even random. The selection was avowedly purposive: such a simple thing as age was liable to be the object being as much to find out what was inaccurate, an understanding of the social struc happening and how fast to those villages which ture was essential. It was morc necessary to had fewer leaSODS to choose cbange and more attain a broad understanding of what was happen to remain lodged in the past as to discover how ing around oneself than to wrap oneself up in tbe more 'normal' types of villages were changing.