Monthly Factsheet

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Impatto COVID-19 Sui Primi Nove Mesi 2020 (Mnes Mondiali E FTSE MIB)

BRIEFING NOTE: IMPACTS OF COVID-19 PANDEMIC ON 9 MONTHS 2020 (MNES AND FTSE MIB) Area Studi Mediobanca Milan, 19 November 2020 1 ASM SHEDS LIGHT ON THE IMPACT OF PANDEMIC FOR 9M 2020 The survey analyses trends on results for 9M 2020 of: 1) Large industrial companies that have disclosed the results for the period January- September by November 16, 2020, sector by sector 2) 26 industrial and service companies listed on the FTSE MIB*: A2A, Amplifon, Atlantia, Buzzi Unicem, CNH Industrial, Davide Campari-Milano, DiaSorin, ENEL, ENI, FCA, Ferrari, Hera, Interpump Group, Inwit, Italgas, Leonardo, Moncler, Pirelli & C., Prysmian, Recordati, Saipem, Snam, STM, Telecom Italia, Tenaris, Terna That are 15 privately held and 11 state-owned companies, 16 manufacturing industry, 6 energy/utilities, 3 service companies and 1 oil and gas At the end of September 2020 the FTSE MIB companies analyzed were worth 318 €billion on the stock market and represented 76% of the total capitalization (excluding finance and insurance) 2 * Escluding Exor because does not publish quarterly reports SUMMARY 1. Impact on results for 9M 2020: Large industrial companies 2. Impact on results for 9M 2020: FTSE MIB (industry and services) 3. Overall look 3 IMPACT ON RESULTS FOR 9M 2020: LARGE INDUSTRIAL COMPANIES Section 1 4 REVENUES GROWTH IN 9M 2020/2019 Net sales 9M 2020/2019, percentage change – Multinational companies by sectors 18.4 8.8 5.7 3.7 3.1 0.3 -1.8 -5.4 -9.4 -17.4 -21.3 -30.6 -32.3 The world multinational companies average is equal to: -4.3% 5 REVENUES GROWTH IN DIFFERENT QUARTERS 2020 Net sales 9M 2020/2019, percentage change - Multinational companies by sectors 1Q 2020/2019 2Q 2020/2019 3Q 2020/2019 20.4 17.3 17.5 10.5 7.3 8.5 6.5 5.9 6.3 5.5 4.5 3.8 5.0 4.6 4.3 2.4 2.2 -0.2 -1.6 -0.8 -2.3 -2.5 -3.2 -3.0 -5.7 -9.2 -8.7 -9.8 -12.5 -13.1 -14.8 -21.7 -21.9 -28.0 -31.6 -40.5 -41.6 -42.1 -51.5 WebSoft, large-scale distribution, electronics and food are the only sectors to grow the net sales in all the different quarters of 2020. -

Euro Stoxx® Total Market Index

EURO STOXX® TOTAL MARKET INDEX Components1 Company Supersector Country Weight (%) ASML HLDG Technology Netherlands 3.45 LVMH MOET HENNESSY Consumer Products & Services France 2.76 LINDE Chemicals Germany 2.40 SAP Technology Germany 2.38 TOTAL Energy France 1.99 SANOFI Health Care France 1.88 SIEMENS Industrial Goods & Services Germany 1.84 ALLIANZ Insurance Germany 1.74 L'OREAL Consumer Products & Services France 1.55 IBERDROLA Utilities Spain 1.38 SCHNEIDER ELECTRIC Industrial Goods & Services France 1.35 AIR LIQUIDE Chemicals France 1.33 ENEL Utilities Italy 1.32 BASF Chemicals Germany 1.23 ADYEN Industrial Goods & Services Netherlands 1.13 ADIDAS Consumer Products & Services Germany 1.13 AIRBUS Industrial Goods & Services France 1.08 BNP PARIBAS Banks France 1.05 DAIMLER Automobiles & Parts Germany 1.03 ANHEUSER-BUSCH INBEV Food, Beverage & Tobacco Belgium 1.02 DEUTSCHE TELEKOM Telecommunications Germany 1.02 BAYER Health Care Germany 1.00 VINCI Construction & Materials France 0.98 BCO SANTANDER Banks Spain 0.93 Kering Retail France 0.87 AXA Insurance France 0.86 PHILIPS Health Care Netherlands 0.85 SAFRAN Industrial Goods & Services France 0.85 DEUTSCHE POST Industrial Goods & Services Germany 0.84 INFINEON TECHNOLOGIES Technology Germany 0.84 Prosus Technology Netherlands 0.83 ESSILORLUXOTTICA Health Care France 0.80 DANONE Food, Beverage & Tobacco France 0.73 INTESA SANPAOLO Banks Italy 0.73 MUENCHENER RUECK Insurance Germany 0.72 PERNOD RICARD Food, Beverage & Tobacco France 0.66 ING GRP Banks Netherlands 0.64 HERMES INTERNATIONAL -

Italy Strengthens Foreign Direct Investment Regime

CORONAVIRUS: ITALY STRENGTHENS FOREIGN DIRECT INVESTMENT REGIME To tackle the impact of Coronavirus (Covid-19) and its aftermath, the Italian Government has become more protective over Italian strategic sectors and, accordingly, has strengthened the Italian foreign direct investment regime. This move is part of a broader European strategy towards stricter tests and requirements over foreign hostile buyouts. INTRODUCTION On 8 April 2020, the Italian Government ("Government") has adopted the Law Decree n. 23 ("Decree") which broadens its screening powers over foreign direct investments ("FDI"). Firstly, these new provisions extend the scope of the strategic sectors subject to the Government's screening powers. Secondly, even acquisitions of Italian strategic companies from EU subjects must be notified to the Government. Thirdly, the Government enlarges its powers to detect critical acquisitions. It must be pointed out that this new regime is immediately applicable to any acquisitions which are in a pre-closing phase (although the signing has already occurred). In the same vein, the obligations to disclose significant shareholdings into Italian listed companies have been strenghtened. THE EXTENSION OF THE STRATEGIC SECTORS Since 2012 onwards, the Italian FDI regime requires notification to the Government of acquisitions of stakes in companies owning assets in strategic sectors (i.e., defence, public security, energy, transports and communications), if certain thresholds are met. In 2019, the list of sensitive sectors was enlarged including also the broadband electronic communication based on 5G technology (which is subjects to a FDI special regime) and sectors listed in letters a) and b) (as illustrated here below) of the Regulation (EU) 452/20191 ("EU Regulation"). -

7 P.M. Ore 17:30

17/08/2021 7 P.M. ORE 17:30 Chiusura borse europee Macroeconomia FTSE MIB Future – Ultime sedute EuroStoxx 50 – Ultime sedute L’Agenda Macro di oggi ha visto arrivare, dopo il dato sulla disoccupazione in Price Price EUR EUR Gran Bretagna, il Pil del secondo trimestre per l’Eurozona. La stima flash 26.600 4.230 26.550 Eurostat del PIL dell'area euro evidenzia un +2% per il secondo trimestre del 26.500 4.220 26.450 2021, con occupazione in aumento dello 0,5% nell'area dell'euro. IL dato è in 26.400 4.210 26.350 4.200 linea con le stime di consensus. Nel primo trimestre del 2021 il PIL era 26.300 4.197,42 26.250 4.190 diminuito dello 0,3% nell'area dell'euro. 26.215 26.200 12:30 16:30 08:30 12:30 16:30 08:30 12:30 16:30 08:30 17:30 13:30 17:30 13:30 17:30 13:30 17:30 Da oltreoceano, invece, sono stati resi noti i dati sulle vendite al dettaglio e 13 ago 21 16 ago 21 17 ago 21 13 ago 21 16 ago 21 17 ago 21 sulla produzione industriale. Negli Stati Uniti le vendite al dettaglio a luglio INDICE VALORE VAR. % VAR. 2021 sono calate dell'1,1% rispetto al mese precedente da +0,7% di giugno e contro MILANO (Ftse Mib Future) 26.227 -0,85% 17,96% il -0,3% atteso dagli analisti. Le vendite al dettaglio escluse le auto sono EUROSTOXX50 4.199 -0,14% 18,20% diminuite a sorpresa dello 0,4% contro il +0,1% del consensus. -

FTSE Publications

2 FTSE Russell Publications 19 August 2021 FTSE Italia PIR All Cap Indicative Index Weight Data as at Closing on 30 June 2021 Constituent Index weight (%) Country Constituent Index weight (%) Country Constituent Index weight (%) Country A2A 0.5 ITALY El En 0.2 ITALY Prysmian 1.49 ITALY Acea 0.37 ITALY Enav 0.43 ITALY Rai Way 0.21 ITALY Alerion Cleanpower 0.04 ITALY Enel 10.01 ITALY Recordati 0.87 ITALY Amplifon 1 ITALY Eni 4.82 ITALY Reno de Medici 0.32 ITALY Anima Holding 0.5 ITALY Erg 0.63 ITALY Reply 1.42 ITALY Aquafil 0.39 ITALY Esprinet 0.24 ITALY Retelit 0.44 ITALY Ascopiave 0.12 ITALY Eurotech 0.18 ITALY Sabaf 0.3 ITALY Astaldi 0.1 ITALY Exor NV 1.3 ITALY Safilo Group 0.27 ITALY Atlantia 1.4 ITALY Falck Renewables 0.29 ITALY Saipem 0.21 ITALY Autogrill 0.53 ITALY Ferrari NV 3.95 ITALY Salcef Group 0.07 ITALY Avio 0.33 ITALY Fiera Milano 0.11 ITALY Salvatore Ferragamo 0.55 ITALY Azimut Holding 0.47 ITALY Fila 0.14 ITALY Sanlorenzo 0.13 ITALY B.F. 0.08 ITALY Fincantieri 0.17 ITALY Saras 0.18 ITALY Banca Generali 0.38 ITALY Finecobank 1.67 ITALY Seri Industrial 0.17 ITALY Banca Ifis 0.16 ITALY Garofalo Health Care 0.26 ITALY Sesa 0.41 ITALY Banca Mediolanum 0.44 ITALY Generali 4.06 ITALY SICIT Group 0.27 ITALY Banca Monte Paschi Siena 0.14 ITALY GVS 0.44 ITALY Snam 2.03 ITALY Banca Popolare Sondrio 0.75 ITALY Hera 0.51 ITALY Sol 0.28 ITALY Banca Sistema 0.13 ITALY Igd - Immobiliare Grande Distribuzione 0.12 ITALY Stellantis NV 6.25 ITALY Banco BPM 0.76 ITALY Illimity Bank 0.34 ITALY STMicroelectronics 3.71 ITALY BFF Bank 0.7 ITALY -

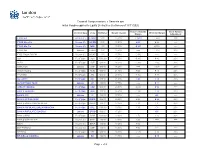

Cassa Di Compensazione E Garanzia Spa Initial Margin Applied to Share Section GEM, MTA/MIV - 16/8/2021 Min

Cassa di Compensazione e Garanzia spa Initial Margin applied to Share Section GEM, MTA/MIV - 16/8/2021 Min. Code Contract Type Mar. Interval Mar. Azioni A. S. ROMA ASR Stocks 49.00% --- Azioni Abitare IN ABT Stocks 22.00% --- Azioni Acea ACE Stocks 13.25% €0.122 Azioni Acotel ACO Stocks 41.25% --- Azioni Aedes AED Stocks 51.25% --- Azioni Aeroporto Guglielmo Marconi di Bologna ADB Stocks 18.25% --- Azioni Alerion Cleanpower ARN Stocks 25.00% --- Azioni Algowatt ALW Stocks 30.75% --- Azioni Alkemy ALK Stocks 25.00% --- Azioni Ambienthesis ATH Stocks 26.75% --- Azioni Amplifon AMP Stocks 13.00% €0.260 Azioni Anima Holding ANIM Stocks 19.25% €0.038 Azioni Antares Vision AV Stocks 9.25% --- Azioni Aquafil ECNL Stocks 26.25% --- Azioni Ascopiave ASC Stocks 13.00% --- Azioni Atlantia ATL Stocks 23.75% €0.146 Azioni Autogrill AGL Stocks 33.50% €0.082 Azioni Autostrade Meridionali AUTME Stocks 26.50% --- Azioni Avio AVIO Stocks 22.50% --- Azioni Azimut Holding AZM Stocks 17.50% €0.182 Azioni ACSM AGAM ACS Stocks 19.00% --- Azioni A2A A2A Stocks 14.75% €0.012 Azioni B.F. BFG Stocks 13.50% --- Azioni B&C Speakers BEC Stocks 13.00% --- New or changed instruments are indicated in boldface Page 1 of 16 Cassa di Compensazione e Garanzia spa Initial Margin applied to Share Section GEM, MTA/MIV - 16/8/2021 Min. Code Contract Type Mar. Interval Mar. Azioni Banca Carige CRG Stocks 97.50% --- Azioni Banca Carige Rnc CRGR Stocks 96.50% --- Azioni Banca Farmafactoring BFF Stocks 17.25% --- Azioni Banca Finnat BFE Stocks 16.75% --- Azioni Banca Generali BGN -

7 P.M. Ore 17:30

25/06/2021 7 P.M. ORE 17:30 Chiusura borse europee Macroeconomia FTSE MIB Future – Ultime sedute EuroStoxx 50 – Ultime sedute L’Agenda finanziaria di oggi ha visto arrivare dall’Italia il dato sulla fiducia dei 25.380Price Price EUR EUR consumatori e delle imprese. Secondo quanto riportato dall'Istat, a giugno 4.120 25.300 4.118,48 2021 si stima un marcato aumento sia dell'indice del clima di fiducia dei 25.250 4.110 consumatori, da 110,6 a 115,1, sia dell'indice composito del clima di fiducia 25.200 4.100 delle imprese, da 107,3 a 112,8. Tutte le componenti dell'indice di fiducia dei 25.150 25.100 4.090 consumatori sono in crescita seppur con intensità diverse: il clima economico e 25.050 quello corrente registrano gli incrementi più decisi; più contenuta la dinamica 4.080 25.000 del clima personale e di quello futuro. Per quel che riguarda le imprese, si 12:30 16:30 12:30 16:30 12:30 16:30 17:30 13:30 17:30 13:30 17:30 13:30 17:30 23 giu 21 24 giu 21 25 giu 21 23 giu 21 24 giu 21 25 giu 21 stima un miglioramento della fiducia nella manifattura e, soprattutto, nei servizi. Si segnala una netta crescita della fiducia nel settore dei beni intermedi. INDICE VALORE VAR. % VAR. 2021 Nel commercio al dettaglio, la risalita dell'indice è trainata dal miglioramento MILANO (Ftse Mib Future) 25.487 0,35% 14,64% dei giudizi sia sulle vendite sia sulle scorte; le attese sulle vendite EUROSTOXX50 4.121 -0,04% 15,99% diminuiscono. -

Cassa Di Compensazione E Garanzia Spa Initial Margin Applied to Share Section GEM, MTA/MIV - 28/6/2021 Min

Cassa di Compensazione e Garanzia spa Initial Margin applied to Share Section GEM, MTA/MIV - 28/6/2021 Min. Code Contract Type Mar. Interval Mar. Azioni A. S. ROMA ASR Stocks 49.00% --- Azioni Abitare IN ABT Stocks 22.00% --- Azioni Acea ACE Stocks 13.25% €0.106 Azioni Acotel ACO Stocks 41.25% --- Azioni Aedes AED Stocks 51.25% --- Azioni Aeffe AEF Stocks 20.50% --- Azioni Aeroporto Guglielmo Marconi di Bologna ADB Stocks 18.25% --- Azioni Alerion Cleanpower ARN Stocks 41.75% --- Azioni Algowatt ALW Stocks 30.75% --- Azioni Alkemy ALK Stocks 25.00% --- Azioni Ambienthesis ATH Stocks 29.75% --- Azioni Amplifon AMP Stocks 13.00% €0.186 Azioni Anima Holding ANIM Stocks 19.25% €0.038 Azioni Antares Vision AV Stocks 9.25% --- Azioni Aquafil ECNL Stocks 26.25% --- Azioni Ascopiave ASC Stocks 13.00% --- Azioni Astaldi AST Stocks 41.75% --- Azioni Atlantia ATL Stocks 23.75% €0.146 Azioni Autogrill AGL Stocks 33.50% €0.094 Azioni Autostrade Meridionali AUTME Stocks 26.50% --- Azioni Avio AVIO Stocks 22.50% --- Azioni Azimut Holding AZM Stocks 17.50% €0.164 Azioni ACSM AGAM ACS Stocks 19.00% --- Azioni A2A A2A Stocks 14.75% €0.012 New or changed instruments are indicated in boldface Page 1 of 16 Cassa di Compensazione e Garanzia spa Initial Margin applied to Share Section GEM, MTA/MIV - 28/6/2021 Min. Code Contract Type Mar. Interval Mar. Azioni B.F. BFG Stocks 13.50% --- Azioni B&C Speakers BEC Stocks 13.00% --- Azioni Banca Carige CRG Stocks 97.50% --- Azioni Banca Carige Rnc CRGR Stocks 96.50% --- Azioni Banca Farmafactoring BFF Stocks 17.25% -

Pwc IPO Track Record Since 2010

PwC IPO Track record since 2010 March 2021 27 >20 23 Companies supported on the years of experience Companies supported on the AIM segment since 2010 in IPO and Capital Markets MTA segment since 2010 Financial and Strategic Capital Markets and Advisory Accounting Advisory Environmental, Social Consulting Tax & Legal Services and Corporate Governance Advisory 2 MTA Mercato Telematico Azionario MTA Mercato Telematico Azionario | AIM Alternative Investment Market 2020 2019 2019 GVS NEXI NEWLAT FOOD IPO IPO IPO 19/06/2020 16/04/2019 29/10/2019 Mkt cap: € 1.426,3 M Mkt cap: € 5.650,0 M Mkt cap: € 236,5 M Raised: € 570,5 M Raised: € 2.055,9 M Raised: € 79,9 M 2019 2017 2017 ITALIAN EXHIBITION GROUP GAMENET AQUAFIL IPO IPO Business combination 19/06/2019 06/12/2017 (SPAC) Mkt cap: € 115,1 M Mkt cap: € 225,0 M 04/12/2017 Raised: € 20,1 M Raised: € 78,2 M Mkt cap: € 536,1 M PwC IPO | Track record since 2010 4 MTA Mercato Telematico Azionario | AIM Alternative Investment Market 2017 2017 2017 PIRELLI DOBANK INDEL B IPO IPO IPO 04/10/2017 14/07/2017 19/05/2017 Mkt cap: € 6.500,0 M Mkt cap: € 720,0 M Mkt cap: € 128,4 M Raised: € 2.397, 9 M Raised: € 343,5 M Raised: € 36,8 M 2017 2016 2016 BANCA FARMAFACTORING TECHNOGYM FERRARI IPO IPO IPO 07/04/2017 03/05/2016 04/01/2016 Mkt cap: € 799,4 M Mkt cap: 650,0 M Mkt cap: € 8.405,1 M Raised: € 249,1 M Raised: € 186,9 M PwC IPO | Track record since 2010 5 MTA Mercato Telematico Azionario | AIM Alternative Investment Market 2015 2015 2015 POSTE ITALIANE INWIT MASSIMO ZANETTI BEVERAGE GROUP IPO IPO 27/10/2015 -

Effects of Covid-19 on 9M 2020 Results

EFFECTS OF COVID -19 ON 9M 2020 RESULTS FOR MULTINATIONALS A ND FTSE MIB COMPANIES MULTINAT IONAL S: SOFTWARE /INTERNET , LARGE -SCALE DISTRIBUTION A ND ELECTRONICS CONTINUE TO GROW ; OIL /GAS , FASHION AND A UTOMOTIVE STRUGGLING FTSE MIB COMPANIES : €46 BN IN MARKET CAP WIPED OFF THE STOCK MARKET IN 9M, SOME OF WHICH HAS BEEN RECOVERED ALREADY ; POSITIVE RESPONSE FR OM MANUFACTURING INDUST RY IN 3Q Milan, 19 November 2020 The Mediobanca Research Area has analysed the impact of the Covid-19 pandemic on the 9M 2020 financial statements of over 160 global industrial multinationals with annual turnover of more than €3bn, and the 26 industrial and services companies included in the FTSE MIB index. 1 The presentation is available for download from the company’s website at www.mbres.it. ****** Industrial multinationals in 9M 2020: comparison between sectors In the first nine months of 2020, the turnover posted by the industrial multinationals analysed shrank by 4.3% Y.o.Y., with the reductions by certain sectors offset in part by the growth in others. Software/internet, large-scale distribution, electronics and food are the only sectors that saw total sales increase in all the first three quarters of 2020. In particular, top-line growth was reported by the software/internet companies (total sales up 18.4% Y.o.Y.), followed by large-scale distribution (up 8.8%) and electronics (up 5.7%). Other good performances were reported by the food multinationals (total sales up 3.7%), the pharmaceutical companies (up 3.1%) and the firms operating in the pay tech industry (up 0.3%). -

Cassa Di Compensazione E Garanzia Spa Initial Margin Applied to Share Section GEM, MTA/MIV - 22/4/2021 Min

Cassa di Compensazione e Garanzia spa Initial Margin applied to Share Section GEM, MTA/MIV - 22/4/2021 Min. Code Contract Type Mar. Interval Mar. Azioni A. S. ROMA ASR Stocks 62.00% --- Azioni Abitare IN ABT Stocks 22.00% --- Azioni Acea ACE Stocks 13.25% €0.106 Azioni Acotel ACO Stocks 41.25% --- Azioni Aedes AED Stocks 51.25% --- Azioni Aeffe AEF Stocks 23.50% --- Azioni Aeroporto Guglielmo Marconi di Bologna ADB Stocks 18.25% --- Azioni Alerion Cleanpower ARN Stocks 41.75% --- Azioni Algowatt ALW Stocks 30.75% --- Azioni Alkemy ALK Stocks 25.00% --- Azioni Ambienthesis ATH Stocks 29.75% --- Azioni Amplifon AMP Stocks 13.00% €0.166 Azioni Anima Holding ANIM Stocks 19.25% €0.038 Azioni Aquafil ECNL Stocks 26.25% --- Azioni Ascopiave ASC Stocks 13.00% --- Azioni Astaldi AST Stocks 41.75% --- Azioni Atlantia ATL Stocks 23.75% €0.146 Azioni Autogrill AGL Stocks 41.50% €0.118 Azioni Autostrada TO-MI AT Stocks 30.50% €0.310 Azioni Autostrade Meridionali AUTME Stocks 26.50% --- Azioni Avio AVIO Stocks 21.00% --- Azioni Azimut Holding AZM Stocks 17.50% €0.164 Azioni ACSM AGAM ACS Stocks 19.00% --- Azioni A2A A2A Stocks 14.75% €0.011 Azioni B.F. BFG Stocks 13.50% --- New or changed instruments are indicated in boldface Page 1 of 15 Cassa di Compensazione e Garanzia spa Initial Margin applied to Share Section GEM, MTA/MIV - 22/4/2021 Min. Code Contract Type Mar. Interval Mar. Azioni B&C Speakers BEC Stocks 13.00% --- Azioni Banca Carige CRG Stocks 97.50% --- Azioni Banca Carige Rnc CRGR Stocks 96.50% --- Azioni Banca Farmafactoring BFF Stocks -

Cassa Di Compensazione E Garanzia Spa Initial Margins Applied to Equity Derivatives Section As of 13/11/2020

Cassa di Compensazione e Garanzia spa Initial Margins applied to Equity Derivatives Section as of 13/11/2020 Futures Straddle Short Options Contract type Code Multiplier Margin Interval Minimum Margin Margin Adjustment FTMIB Fut Futures (C) FTMIB 5.00 15.50% € 1500 € 650 === FTMIB Micro Fut Futures (C) MICRO 0.20 15.50% € 60 € 26 === FTMIB Mini Fut Futures (C) MINI 1.00 15.50% € 300 € 130 === FTMIB Opt Options FTMIB 2.50 15.50% === € 325 20% FTSE ITALIA PIR PMI Futures (C) MCAP 1.00 15.75% € 470 === === A2A Fut (F)/Opt A2A 5000.00 17.25% € 380 € 42 20% ACEA Fut (F)/Opt ACE 500.00 16.50% € 300 € 60 20% AMPLIFON Options AMP 500.00 16.25% === € 101 20% ANIMA Holding Fut (F)/Opt ANIM 500.00 21.75% € 60 € 15 20% ATLANTIA Fut (F)/Opt ATL 500.00 27.50% € 160 € 78 20% AUTOGRILL Fut (F)/Opt AGL 500.00 21.50% € 60 € 14 20% AUTOSTRADA TO-MI Options AT 100.00 17.75% === € 11 === AZIMUT HOLDING Fut (F)/Opt AZM 500.00 20.50% € 210 € 59 === BANCA GENERALI Fut (F)/Opt BGN 100.00 16.50% € 180 € 16 20% BANCA IFIS Options IF 100.00 17.00% === € 5 === BANCA MEDIOLANUM Fut (F)/Opt BMED 500.00 20.25% € 90 € 24 20% BANCA MONTE PASCHI SIENA Fut (F)/Opt BMPS 100.00 27.25% € 10 € 1 20% BANCA POPOLARE EMILIA ROMAGNA Fut (F)/Opt BPE 1000.00 19.75% € 80 € 8 20% BANCA POPOLARE SONDRIO Options BPSO 500.00 17.25% === € 5 20% BANCO BPM Fut (F)/Opt BAMI 1000.00 22.00% € 70 € 15 20% BANCO SANTANDER Futures (C) SANT 100.00 17.00% € 30 === === BBVA Futures (C) BBVA 100.00 17.25% € 30 === === BNP PARIBAS Futures (C) BNP 100.00 18.50% € 80 === === BREMBO Fut (F)/Opt BRE 500.00