A Social Divide in the City Mining for Impact

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

City Investment Watch

UK Commercial – January 2021 MARKET IN City Investment MINUTES Savills Research Watch December records highest monthly volume of 2020 bringing the annual total to £4.48Bn. December is historically the busiest month of the year as and retail complex totals approximately 192,700 sq. ft. The investors look to close deals prior to year-end. Any concerns total rent passing is approximately £7.3 million per annum the typical flurry of activity would be impacted by the with approximately 40% of the income expiring in 2021. omnipresent political and economic disruption, principally December saw £1.18Bn focused around lengthy Brexit trade negotiations and the No new assets were marketed in December given the transact over 16 deals ever-evolving Covid-19 pandemic, were allayed swiftly. disruption associated with the November Lockdown and the The largest deal of the year exchanged early in the month Christmas / New Year break. Accordingly, with the rise in contributing to a monthly volume of £1.18Bn, a significant investment turnover there has been an expected fall in the increase on November (£404M) and the 2020 monthly average volume of stock under offer, which currently stands at £1.50Bn of £301.60M, but 31% below December 2019 (£1.69Bn). across 14 transactions. A comparatively strong December contributed to a total Q4 Unsurprisingly given the disruption across both investment volume of £2.14Bn, 34% down on Q4 2019 and 39% down on and occupational markets, investors were principally the Q4 10-year average. Total 2020 transactional volume seeking Core (54% of annual transactional volume over reached £4.48Bn, which is approximately 42.5% down on that 13 transactions) and Core Plus (29% over 29 transactions) achieved in 2019 (£8.18Bn) and 53% below the 10-year average. -

Smurfit Kappa Annual Report 2009

SMURFIT KAPPA GROUP PLC ANNUAL REPORT 2009 ANNUAL REPORT 2009 Raw materials The raw material for paper-based packaging comes from renewable sources and the end product is recycled many times making all forms of SKG’s paper-based packaging the most environmentally friendly available. SKG recovers almost 5 million tonnes of recycled paper each year in Europe where it is the European leader in recycling and 0.8 million tonnes in Latin America where it also holds a leading position. Almost all of this is sourced through our own recovery systems. Modern mills The Group produces well over 6 million tonnes of paper, primarily in the containerboard, solidboard and sackpaper grades, at its 38 mills across the world. The Group is the leading producer of containerboard in Europe and one of the largest in Latin America using wood and recovered paper to manufacture kraftliner and recycled paper grades respectively. Our containerboard production is integrated into our corrugated operations. Operating excellence The product range of our containerboard mills covers the complete spectrum of paper and board including features such as weight, colour and printability. On the packaging side, our extensive presence in 21 European and 9 Latin American countries allows us to offer customers a “one stop shop” for all their packaging needs and a differentiated quality of service. With a strong focus on innovative packaging solutions, our operations are supported by outstanding research and development facilities with a view to enhancing the customer offering. Design expertise/Innobook In SKG we have created “Innobook”, a library with over 3,000 proven design solutions, which is available to the more than 500 designers within our worldwide group and to both our sales and customer support people. -

Investor Presentation

Investor Presentation HY 2020 Our Investment Case 1 2 3 4 Our distinctive The scale and A well-positioned Our operational business model & quality of our development expertise & clear strategy portfolio pipeline customer insight Increasing our focus 22.5m sq ft of Development pipeline Expertise in on mixed use places high quality assets aligned to strategy managing and leasing our assets based on our customer insight Growing London Underpinned by our Provides visibility campuses and resilient balance sheet on future earnings Residential and refining and financial strength Drives incremental Retail value for stakeholders 1 British Land at a glance 1FA, Broadgate £15.4bn Assets under management £11.7bn Of which we own £521m Annualised rent 22.5m sq ft Floor space 97% Occupancy Canada Water Plymouth As at September 2019 2 A diverse, high quality portfolio £11.7bn (BL share) Multi-let Retail (26%) London Campuses (45%) 72% London & South East Solus Retail (5%) Standalone offices (10%) Retail – London & SE (10%) Residential & Canada Water (4%) 3 Our unique London campuses £8.6bn Assets under management £6.4bn Of which we own 78% £205m Annualised rent 6.6m sq ft Floor space 97% Occupancy As at September 2019 4 Canada Water 53 acre mixed use opportunity in Central London 5 Why mixed use? Occupiers Employees want space which is… want space which is… Attractive to skilled Flexible Affordable Well connected Located in vibrant Well connected Safe and promotes Sustainable and employees neighbourhoods wellbeing eco friendly Tech Close to Aligned to -

Consultation Statement Submission Version

Consultation Statement (Submission) November 2019 2 Consultation Statement (Submission) November 2019 Table of contents 1 Introduction ............................................................................................................................... 4 2 Regulation 19 consultation process ........................................................................................... 6 2.1 Notification ................................................................................................................................ 6 Website .................................................................................................................................... 6 Emails ...................................................................................................................................... 6 Social media ............................................................................................................................ 6 Hard copies ............................................................................................................................. 7 2.2 Coverage .................................................................................................................................. 7 Media coverage ....................................................................................................................... 7 Scrutiny Committee ................................................................................................................ 8 Petitions.................................................................................................................................. -

October 31St, 2019

Quarter ended October 31, 2019 The New Ireland Fund Performance Data and Portfolio Composition QTR END NAV (unaudited) & MARKET PRICE PERFORMANCE as of 10/31/2019 NAV per share $11.09 10% Market Price $9.06 Discount to NAV -18.30% 5% 12 MONTH RANGE OF PRICES NAV high, 4/22/19 $11.52 0% NAV low, 12/27/18 $9.56 Market Price high, 4/18/19 $9.59 -5% 3 6 1 3 5 10 Incpt mths mths Year Year Year Year Market Price low,12/20/18 $7.76 NAV 8.53% 0.53% 5.38% 2.45% 4.88% 8.60% 7.11% Market Price 5.96% -1.71% 3.81% -0.56% 3.70% 7.99% 5.93% Benchmark^^ 6.15% 1.23% 6.40% 7.73% 7.01% 9.35% 7.06% Source: Fund’s Accounting Agent as of 10/31/19. Past performance is no guarantee of future results. Investment DISTRIBUTIONS returns and principal value will fluctuate and shares when sold, may be worth more or less than original cost. Current performance may be lower or higher than the performance data Most recent* September 27, 2019 quoted. NAV return data includes investment management fees, custodial charges and administrative fees (such as Distribution, most recent $0.1115 Director and legal fees) and assumes the reinvestment of all distributions. The Fund is subject to investment risk, including the possible loss of principal. Returns for less than one year are Cumulative, 12 months $0.444 not annualized. Managed distribution rate 4.0% of Oct 31 NAV ^^The Benchmark is the MSCI All Ireland Capped Index. -

Retail Is Not Dead and Regionally Dominant Shopping Centres Offer an Attractive Value Play

REAL ASSETS Research & Strategy For professional clients only January 2019 Retail is not dead and regionally dominant shopping centres offer anattractive value play Executive summary: ■ The consumer has taken control of the retail relationship which is putting pressure on retailers’ margins, as they face increased competition and a need to invest in a full reconfiguration of their supply chain to offer an “Omni-channel” distribution model ■ This pressure on retailers’ margins is likely to limit rental value growth Justin Curlow prospects over the short-term, as traditional bricks and mortar retailers’ Global Head of Research & Strategy space consolidations leave more voids than online pure play retailers establishing a physical presence absorb ■ In our view, regionally dominant shopping centres and second-tier tourist- oriented city high streets represent an attractive “value play” for investors, as we feel the entire sector is being tainted by the same doomsday brush despite the fact that the operational performance of these schemes remains strong ■ The sector is not without risks, as highlighted by the continued raft of Vanessa Moleiro retailer failures and bankruptcies which could be exacerbated if an economic Research Analyst downturn materialised over the short term. In addition, for those schemes that remain viable and in demand, the retailer-landlord relationship has to respond to a shorter retail life cycle and increased ambiguity across ultimate sales channels ■ Ultimately, we do not think the developed world will stop consuming -

Annex 1: Parker Review Survey Results As at 2 November 2020

Annex 1: Parker Review survey results as at 2 November 2020 The data included in this table is a representation of the survey results as at 2 November 2020, which were self-declared by the FTSE 100 companies. As at March 2021, a further seven FTSE 100 companies have appointed directors from a minority ethnic group, effective in the early months of this year. These companies have been identified through an * in the table below. 3 3 4 4 2 2 Company Company 1 1 (source: BoardEx) Met Not Met Did Not Submit Data Respond Not Did Met Not Met Did Not Submit Data Respond Not Did 1 Admiral Group PLC a 27 Hargreaves Lansdown PLC a 2 Anglo American PLC a 28 Hikma Pharmaceuticals PLC a 3 Antofagasta PLC a 29 HSBC Holdings PLC a InterContinental Hotels 30 a 4 AstraZeneca PLC a Group PLC 5 Avast PLC a 31 Intermediate Capital Group PLC a 6 Aveva PLC a 32 Intertek Group PLC a 7 B&M European Value Retail S.A. a 33 J Sainsbury PLC a 8 Barclays PLC a 34 Johnson Matthey PLC a 9 Barratt Developments PLC a 35 Kingfisher PLC a 10 Berkeley Group Holdings PLC a 36 Legal & General Group PLC a 11 BHP Group PLC a 37 Lloyds Banking Group PLC a 12 BP PLC a 38 Melrose Industries PLC a 13 British American Tobacco PLC a 39 Mondi PLC a 14 British Land Company PLC a 40 National Grid PLC a 15 BT Group PLC a 41 NatWest Group PLC a 16 Bunzl PLC a 42 Ocado Group PLC a 17 Burberry Group PLC a 43 Pearson PLC a 18 Coca-Cola HBC AG a 44 Pennon Group PLC a 19 Compass Group PLC a 45 Phoenix Group Holdings PLC a 20 Diageo PLC a 46 Polymetal International PLC a 21 Experian PLC a 47 -

Ftse4good UK 50

2 FTSE Russell Publications 19 August 2021 FTSE4Good UK 50 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.81 UNITED GlaxoSmithKline 5.08 UNITED Rentokil Initial 0.67 UNITED KINGDOM KINGDOM KINGDOM Anglo American 2.56 UNITED Halma 0.74 UNITED Rio Tinto 4.68 UNITED KINGDOM KINGDOM KINGDOM Antofagasta 0.36 UNITED HSBC Hldgs 6.17 UNITED Royal Dutch Shell A 4.3 UNITED KINGDOM KINGDOM KINGDOM Associated British Foods 0.56 UNITED InterContinental Hotels Group 0.64 UNITED Royal Dutch Shell B 3.75 UNITED KINGDOM KINGDOM KINGDOM AstraZeneca 8.25 UNITED International Consolidated Airlines 0.47 UNITED Schroders 0.28 UNITED KINGDOM Group KINGDOM KINGDOM Aviva 1.15 UNITED Intertek Group 0.65 UNITED Segro 0.95 UNITED KINGDOM KINGDOM KINGDOM Barclays 2.1 UNITED Legal & General Group 1.1 UNITED Smith & Nephew 0.99 UNITED KINGDOM KINGDOM KINGDOM BHP Group Plc 3.2 UNITED Lloyds Banking Group 2.39 UNITED Smurfit Kappa Group 0.74 UNITED KINGDOM KINGDOM KINGDOM BT Group 1.23 UNITED London Stock Exchange Group 2.09 UNITED Spirax-Sarco Engineering 0.72 UNITED KINGDOM KINGDOM KINGDOM Burberry Group 0.6 UNITED Mondi 0.67 UNITED SSE 1.13 UNITED KINGDOM KINGDOM KINGDOM Coca-Cola HBC AG 0.37 UNITED National Grid 2.37 UNITED Standard Chartered 0.85 UNITED KINGDOM KINGDOM KINGDOM Compass Group 1.96 UNITED Natwest Group 0.77 UNITED Tesco 1.23 UNITED KINGDOM KINGDOM KINGDOM CRH 2.08 UNITED Next 0.72 UNITED Unilever 7.99 UNITED KINGDOM KINGDOM -

Constituents & Weights

2 FTSE Russell Publications 19 August 2021 FTSE 100 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.59 UNITED GlaxoSmithKline 3.7 UNITED RELX 1.88 UNITED KINGDOM KINGDOM KINGDOM Admiral Group 0.35 UNITED Glencore 1.97 UNITED Rentokil Initial 0.49 UNITED KINGDOM KINGDOM KINGDOM Anglo American 1.86 UNITED Halma 0.54 UNITED Rightmove 0.29 UNITED KINGDOM KINGDOM KINGDOM Antofagasta 0.26 UNITED Hargreaves Lansdown 0.32 UNITED Rio Tinto 3.41 UNITED KINGDOM KINGDOM KINGDOM Ashtead Group 1.26 UNITED Hikma Pharmaceuticals 0.22 UNITED Rolls-Royce Holdings 0.39 UNITED KINGDOM KINGDOM KINGDOM Associated British Foods 0.41 UNITED HSBC Hldgs 4.5 UNITED Royal Dutch Shell A 3.13 UNITED KINGDOM KINGDOM KINGDOM AstraZeneca 6.02 UNITED Imperial Brands 0.77 UNITED Royal Dutch Shell B 2.74 UNITED KINGDOM KINGDOM KINGDOM Auto Trader Group 0.32 UNITED Informa 0.4 UNITED Royal Mail 0.28 UNITED KINGDOM KINGDOM KINGDOM Avast 0.14 UNITED InterContinental Hotels Group 0.46 UNITED Sage Group 0.39 UNITED KINGDOM KINGDOM KINGDOM Aveva Group 0.23 UNITED Intermediate Capital Group 0.31 UNITED Sainsbury (J) 0.24 UNITED KINGDOM KINGDOM KINGDOM Aviva 0.84 UNITED International Consolidated Airlines 0.34 UNITED Schroders 0.21 UNITED KINGDOM Group KINGDOM KINGDOM B&M European Value Retail 0.27 UNITED Intertek Group 0.47 UNITED Scottish Mortgage Inv Tst 1 UNITED KINGDOM KINGDOM KINGDOM BAE Systems 0.89 UNITED ITV 0.25 UNITED Segro 0.69 UNITED KINGDOM -

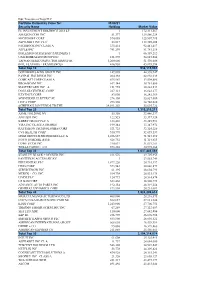

F&C Investment Trust PLC Portfolio Ranked by Value

F&C Investment Trust PLC Portfolio Ranked by Value for: 31/08/21 Security Name Holding Market Value PE INVESTMENT HOLDINGS 2018 LP 1 172,311,567 AMAZON.COM INC 51,377 129,566,324 MICROSOFT CORP 574,005 125,907,785 ALPHABET INC CL C 53,817 113,769,405 FACEBOOK INC CLASS A 335,414 92,441,417 APPLE INC 741,299 81,781,218 INFLEXION STRATEGIC PARTNERS 1 1 66,169,212 UNITEDHEALTH GROUP INC 181,378 54,845,004 TAIWAN SEMICONDUCTOR MANUFAC 3,200,000 51,430,606 INTL FLAVORS + FRAGRANCES 416,958 45,893,394 Total Top 10 934,115,931 GOLDMAN SACHS GROUP INC 147,805 44,398,947 PAYPAL HOLDINGS INC 204,338 42,858,633 COMCAST CORP CLASS A 895,989 39,504,886 BROADCOM INC 107,344 38,781,886 MASTERCARD INC A 151,955 38,222,539 DOLLAR GENERAL CORP 227,321 36,822,277 KEYENCE CORP 83,000 36,242,369 SCHNEIDER ELECTRIC SE 276,108 35,827,000 HOYA CORP 295,500 34,740,020 SCHIEHALLION FUND LTD/THE 38,011,269 33,695,722 Total Top 20 1,315,210,211 ASML HOLDING NV 55,350 33,446,337 ANTHEM INC 122,525 33,397,124 KERRY GROUP PLC A 313,436 33,349,981 VISA INC CLASS A SHARES 199,144 33,147,972 RAYTHEON TECHNOLOGIES CORP 521,725 32,124,226 CVS HEALTH CORP 510,778 32,055,139 MGM GROWTH PROPERTIES LLC A 1,046,687 31,524,190 NOVO NORDISK A/S B 428,752 31,114,815 LOWE S COS INC 210,032 31,097,701 WELLS FARGO + CO 933,228 30,975,364 Total Top 30 1,637,443,061 STANLEY BLACK + DECKER INC 211,576 29,705,955 PANTHEON ACCESS SICAV 1 29,063,743 PRUDENTIAL PLC 1,897,220 28,733,397 HESS CORP 573,542 28,646,879 SERVICENOW INC 61,195 28,604,793 MERCK + CO. -

Smurfit Kappa Annual Report 2014

Annual Report 2014 OPEN OPPORTUNITIES From the production line through to the consumer, packaging can make a difference: through new ideas it has the potential to shape the way you do business. The images in this report are from video case studies on our company microsite. For more information visit openthefuture.info OPEN POTENTIAL The Smurfit Kappa Group strives to be a customer-orientated, market-led company where the satisfaction of customers, the personal development of employees, and respect for local communities and the environment are seen as being inseparable from the aim of creating value for the shareholders. CONTENTS 2 Group Profile 62 Statement of Directors’ 3 2014 Financial Responsibilities Performance Overview 63 Independent Auditors’ Report 4 Group Operations 68 Consolidated Income Statement 6 Chairman’s Statement 69 Consolidated Statement of 10 Chief Executive’s Review Comprehensive Income 12 Business Model 70 Consolidated Balance Sheet 13 Strategy 71 Company Balance Sheet 16 Operations Review 72 Consolidated Statement of Changes in Equity 22 Finance Review 73 Company Statement of 32 Sustainability Changes in Equity 34 Board of Directors 74 Consolidated Statement 38 Corporate Governance of Cash Flows Statement 75 Company Statement 43 Directors’ Report of Cash Flows 45 Audit Committee Report 76 Notes to the Consolidated 48 Remuneration Report Financial Statements 61 Nomination Committee Report 131 Shareholder Information Group Profile Group Profile Smurfit Kappa Group plc (‘SKG plc’ or ‘the Given the high degree of integration Company’) and its subsidiaries (together between the mills and its conversion plants, 42,000 ‘SKG’ or ‘the Group’) is one of the world’s particularly in terms of containerboard, the people employed worldwide largest integrated manufacturers of Group’s end customers are primarily in the paper-based packaging products, with corrugated packaging market, which uses operations in Europe, Latin America, the the packaging for product protection and We operate in United States and Canada.