Petroleum CSG Briefing, 24 May 2010 Slide 2 Agenda

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

BHP Economic Contribution Report 2017 1 Chief Financial Officer’S Introduction

Economic Contribution Report 2017 We have a long-standing commitment to transparency. We are proud of the value we generate and how this contributes to building trust with the communities in which we operate. In this Report Chief Financial Officer’s Introduction 2 Tax and our 2017 Financial Statements 20 FY2017 Total economic contribution 3 Basis of Report preparation 21 Our contribution throughout the value chain 6 Glossary 22 Approach to transparency and tax 9 Independent auditor’s report to the Directors Our payments to governments 14 of BHP Billiton Plc and BHP Billiton Limited 23 Corporate Directory 24 BHP Billiton Limited. ABN 49 004 028 077. Registered in Australia. Registered office: 171 Collins Street, Melbourne, Victoria 3000, Australia. BHP Billiton Plc. Registration number 3196209. Registered in England and Wales. Registered office: Nova South, 160 Victoria Street London SW1E 5LB United Kingdom. Each of BHP Billiton Limited and BHP Billiton Plc is a member of the Group, which has its headquarters in Australia. BHP is a Dual Listed Company structure comprising BHP Billiton Limited and BHP Billiton Plc. The two entities continue to exist as separate companies but operate as a combined Group known as BHP. The headquarters of BHP Billiton Limited and the global headquarters of the combined Group are located in Melbourne, Australia. The headquarters of BHP Billiton Plc are located in London, United Kingdom. Both companies have identical Boards of Directors and are run by a unified management team. Throughout this publication, the Boards are referred to collectively as the Board. Shareholders in each company have equivalent economic and voting rights in the Group as a whole. -

2021 Annual General Meeting and Proxy Statement 2020 Annual Report

2020 Annual Report and Proxyand Statement 2021 Annual General Meeting Meeting General Annual 2021 Transocean Ltd. • 2021 ANNUAL GENERAL MEETING AND PROXY STATEMENT • 2020 ANNUAL REPORT CONTENTS LETTER TO SHAREHOLDERS NOTICE OF 2021 ANNUAL GENERAL MEETING AND PROXY STATEMENT COMPENSATION REPORT 2020 ANNUAL REPORT TO SHAREHOLDERS ABOUT TRANSOCEAN LTD. Transocean is a leading international provider of offshore contract drilling services for oil and gas wells. The company specializes in technically demanding sectors of the global offshore drilling business with a particular focus on ultra-deepwater and harsh environment drilling services, and operates one of the most versatile offshore drilling fleets in the world. Transocean owns or has partial ownership interests in, and operates a fleet of 37 mobile offshore drilling units consisting of 27 ultra-deepwater floaters and 10 harsh environment floaters. In addition, Transocean is constructing two ultra-deepwater drillships. Our shares are traded on the New York Stock Exchange under the symbol RIG. OUR GLOBAL MARKET PRESENCE Ultra-Deepwater 27 Harsh Environment 10 The symbols in the map above represent the company’s global market presence as of the February 12, 2021 Fleet Status Report. ABOUT THE COVER The front cover features two of our crewmembers onboard the Deepwater Conqueror in the Gulf of Mexico and was taken prior to the COVID-19 pandemic. During the pandemic, our priorities remain keeping our employees, customers, contractors and their families healthy and safe, and delivering incident-free operations to our customers worldwide. FORWARD-LOOKING STATEMENTS Any statements included in this Proxy Statement and 2020 Annual Report that are not historical facts, including, without limitation, statements regarding future market trends and results of operations are forward-looking statements within the meaning of applicable securities law. -

Empirical Inference of Related Trading Between Two Securities: Detecting Pairs Trading, Merger Arbitrage, and Strategy Rules*

Empirical inference of related trading between two securities: Detecting pairs trading, merger arbitrage, and strategy rules* Keith Godfrey The University of Western Australia Working paper: 5 September 2013 The traditional approach to studying pairs trading is to simulate profitability using ex-post historical prices. I study the actual trades reported anonymously in security pairs and build statistical inferences of related trading. The approach is based on the time differences between trades. It can distinguish intrinsically related securities from pseudo-random sets, find stocks involved in merger arbitrage in massive sets of paired index constituents, and infer dominant trading rules of mean reversion algorithms. Empirical inference of related trading can enable further studies into pairs trading, strategy rules, merger arbitrage, and insider trading. Keywords: Inferred trading, empirical inference, pairs trading, merger arbitrage. JEL Classification Codes: G00, G10, C10, C40, C60 The availability of intraday trading or “tick” data with time resolution of a millisecond or finer is opening many avenues of research into financial markets. Analysis of two or more streams of tick data concurrently is becoming increasingly important in the study of multiple-security trading including index tracking, pairs trading, merger arbitrage, and market-neutral strategies. One of the greatest challenges in empirical trading research is the anonymity of reported trades. Securities exchanges report the dates, times, prices, and volumes traded, without identifying the traders. In studies of a single security, this introduces uncertainty of whether each market order that caused a trade was the buy or sell order, and there are documented approaches of inference such as Lee and Ready (1991). -

To Arrive at the Total Scores, Each Company Is Marked out of 10 Across

BRITAIN’S MOST ADMIRED COMPANIES THE RESULTS 17th last year as it continues to do well in the growing LNG business, especially in Australia and Brazil. Veteran chief executive Frank Chapman is due to step down in the new year, and in October a row about overstated reserves hit the share price. Some pundits To arrive at the total scores, each company is reckon BG could become a take over target as a result. The biggest climber in the top 10 this year is marked out of 10 across nine criteria, such as quality Petrofac, up to fifth from 68th last year. The oilfield of management, value as a long-term investment, services group may not be as well known as some, but it is doing great business all the same. Its boss, Syrian- financial soundness and capacity to innovate. Here born Ayman Asfari, is one of the growing band of are the top 10 firms by these individual measures wealthy foreign entrepreneurs who choose to make London their operating base and home, to the benefit of both the Exchequer and the employment figures. In fourth place is Rolls-Royce, one of BMAC’s most Financial value as a long-term community and environmental soundness investment responsibility consistent high performers. Hardly a year goes past that it does not feature in the upper reaches of our table, 1= Rightmove 9.00 1 Diageo 8.61 1 Co-operative Bank 8.00 and it has topped its sector – aero and defence engi- 1= Rotork 9.00 2 Berkeley Group 8.40 2 BASF (UK & Ireland) 7.61 neering – for a decade. -

Preparing for Carbon Pricing: Case Studies from Company Experience

TECHNICAL NOTE 9 | JANUARY 2015 Preparing for Carbon Pricing Case Studies from Company Experience: Royal Dutch Shell, Rio Tinto, and Pacific Gas and Electric Company Acknowledgments and Methodology This Technical Note was prepared for the PMR Secretariat by Janet Peace, Tim Juliani, Anthony Mansell, and Jason Ye (Center for Climate and Energy Solutions—C2ES), with input and supervision from Pierre Guigon and Sarah Moyer (PMR Secretariat). The note comprises case studies with three companies: Royal Dutch Shell, Rio Tinto, and Pacific Gas and Electric Company (PG&E). All three have operated in jurisdictions where carbon emissions are regulated. This note captures their experiences and lessons learned preparing for and operating under policies that price carbon emissions. The following information sources were used during the research for these case studies: 1. Interviews conducted between February and October 2014 with current and former employees who had first-hand knowledge of these companies’ activities related to preparing for and operating under carbon pricing regulation. 2. Publicly available resources, including corporate sustainability reports, annual reports, and Carbon Disclosure Project responses. 3. Internal company review of the draft case studies. 4. C2ES’s history of engagement with corporations on carbon pricing policies. Early insights from this research were presented at a business-government dialogue co-hosted by the PMR, the International Finance Corporation, and the Business-PMR of the International Emissions Trading Association (IETA) in Cologne, Germany, in May 2014. Feedback from that event has also been incorporated into the final version. We would like to acknowledge experts at Royal Dutch Shell, Rio Tinto, and Pacific Gas and Electric Company (PG&E)—among whom Laurel Green, David Hone, Sue Lacey and Neil Marshman—for their collaboration and for sharing insights during the preparation of the report. -

BP Plc Vs Royal Dutch Shell

FEBRUARY 2021 BP plc Vs Royal Dutch Shell 01872 229 000 www.atlanticmarkets.co.uk www.atlanticmarkets.co.uk BP Plc A Brief History BP is a British multinational oil and gas company headquartered in London. It is one of the world’s oil and gas supermajors. · 1908. The founding of the Anglo-Persian Oil Company, established as a subsidiary of Burmah Oil Company to take advantage of oil discoveries in Iran. · 1935. It became the Anglo-Iranian Oil Company · 1954. Adopted the name British Petroleum. · 1959. The company expanded beyond the Middle East to Alaska and it was one of the first companies to strike oil in the North Sea. · 1978. British Petroleum acquired majority control of Standard Oil of Ohio. Formerly majority state-owned. · 1979–1987. The British government privatised the company in stages between. · 1998. British Petroleum merged with Amoco, becoming BP Amoco plc, · 2000-2001. Acquired ARCO and Burmah Castrol, becoming BP plc. · 2003–2013. BP was a partner in the TNK-BP joint venture in Russia. Positioning BP is a “vertically integrated” company, meaning it’s involved in the whole supply chain – from discovering oil, producing it, refining it, shipping it, trading it and selling it at the petrol pump. BP has operations in nearly 80 countries worldwide and has around 18,700 service stations worldwide. Its largest division is BP America. In Russia, BP also own a 19.75% stake in Rosneft, the world’s largest publicly traded oil and gas company by hydrocarbon reserves and production. BP has a primary listing on the London Stock Exchange and is a constituent of the FTSE 100 Index. -

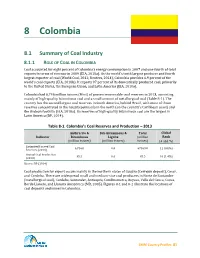

Chapter 8: Colombia

8 Colombia 8.1 Summary of Coal Industry 8.1.1 ROLE OF COAL IN COLOMBIA Coal accounted for eight percent of Colombia’s energy consumption in 2007 and one-fourth of total exports in terms of revenue in 2009 (EIA, 2010a). As the world’s tenth largest producer and fourth largest exporter of coal (World Coal, 2012; Reuters, 2014), Colombia provides 6.9 percent of the world’s coal exports (EIA, 2010b). It exports 97 percent of its domestically produced coal, primarily to the United States, the European Union, and Latin America (EIA, 2010a). Colombia had 6,746 million tonnes (Mmt) of proven recoverable coal reserves in 2013, consisting mainly of high-quality bituminous coal and a small amount of metallurgical coal (Table 8-1). The country has the second largest coal reserves in South America, behind Brazil, with most of those reserves concentrated in the Guajira peninsula in the north (on the country’s Caribbean coast) and the Andean foothills (EIA, 2010a). Its reserves of high-quality bituminous coal are the largest in Latin America (BP, 2014). Table 8-1. Colombia’s Coal Reserves and Production – 2013 Anthracite & Sub-bituminous & Total Global Indicator Bituminous Lignite (million Rank (million tonnes) (million tonnes) tonnes) (# and %) Estimated Proved Coal 6,746.0 0.0 67469.0 11 (0.8%) Reserves (2013) Annual Coal Production 85.5 0.0 85.5 10 (1.4%) (2013) Source: BP (2014) Coal production for export occurs mainly in the northern states of Guajira (Cerrejón deposit), Cesar, and Cordoba. There are widespread small and medium-size coal producers in Norte de Santander (metallurgical coal), Cordoba, Santander, Antioquia, Cundinamarca, Boyaca, Valle del Cauca, Cauca, Borde Llanero, and Llanura Amazónica (MB, 2005). -

Annual Review and Summary Financial Statements 2010 Shareholder Information Continued

Centrica plc Registered office: Millstream, Maidenhead Road, Windsor, Berkshire SL4 5GD Company registered in England and Wales No. 3033654 www.centrica.com Annual Review and Summary Financial Statements 2010 Shareholder Information continued SHAREHOLDER SERVICES Centrica shareholder helpline To register for this service, please call the shareholder helpline on 0871 384 2985* to request Centrica’s shareholder register is maintained by Equiniti, a direct dividend payment form or download it from which is responsible for making dividend payments and www.centrica.com/shareholders. 01 10 updating the register. OVERVIEW SUMMARY OF OUR BUSINESS The Centrica FlexiShare service PERFORMANCE If you have any query relating to your Centrica shareholding, 01 Chairman’s Statement please contact our Registrar, Equiniti: FlexiShare is a ‘corporate nominee’, sponsored by Centrica and administered by Equiniti Financial Services Limited. It is 02 Our Performance 10 Operating Review Telephone: 0871 384 2985* a convenient way to manage your Centrica shares without 04 Chief Executive’s Review 22 Corporate Responsibility Review Textphone: 0871 384 2255* the need for a share certificate. Your share account details Write to: Equiniti, Aspect House, Spencer Road, Lancing, will be held on a separate register and you will receive an West Sussex BN99 6DA, United Kingdom annual confirmation statement. Email: [email protected] By transferring your shares into FlexiShare you will benefit from: A range of frequently asked shareholder questions is also available at www.centrica.com/shareholders. • low-cost share-dealing facilities provided by a panel of independent share dealing providers; Direct dividend payments • quicker settlement periods; Make your life easier by having your dividends paid directly into your designated bank or building society account on • no share certificates to lose; and the dividend payment date. -

BG Group's LNG Business

FACT SHEET – LIQUEFIED NATURAL GAS BG Group’s LNG business BG Group’s LNG activities are founded on a deep understanding of our target markets and customers, along with a unique combination of infrastructure, flexible supply, shipping capacity and marketing capabilities. We have a strong presence in all segments of the chain, from upstream exploration and production, through liquefaction, shipping and regasification, to the end market. In liquefaction, we have a track record of execution, having been materially involved in the delivery of six liquefaction trains at projects in Trinidad and Tobago and Egypt. In shipping, we have one of the largest LNG fleets of any international oil and gas company consisting of (as of March 2012) around 25 owned or chartered modern vessels that are able to meet BG Group LNG sales terminal equity and/or capacity BG Group LNG sales terminal short/medium term BG Group LNG long term contracted sources BG Group LNG short term sources the needs of a rapidly changing market. In regasification, we have supply rights or terminal capacity in the UK, the US and Singapore, valuable entry points for agreement for LNG exports from the LNG supply position by around 50% LNG into these markets, as well as long- US, with a purchase of 5.5 mtpa from above current levels over the next three term sales to customers in Chile, Japan the Sabine Pass LNG terminal being years, targeting 20 million tonnes per and China. developed by Cheniere Energy Partners, annum (mtpa) by 2015. In light of our L.P., and are progressing plans for export progress at QCLNG, together with the The Group has developed an industry from the Lake Charles facility, where we growth potential inherent within the leading portfolio of flexible long-term hold 100% of the import capacity. -

Jacobs MCM- Quantitative Cost Analysis and Business Case Of

Radi oacti ve Waste S tor age and Dispos al F acilities in S out h A ustr alia – Quantit ati ve C ost A nal ysis and Business C as e Radioactive Waste Storage and Disposal Facilities in South Australia – Quantitative Cost Analysis and Business Case Radioactive Waste Storage and Disposal Facilities in South Australia – Quantitative Cost Analysis and Business Case Project no: IW104700 Document title: Radioactive Waste Storage and Disposal Facilities in South Australia – Quantitative Cost Analysis and Business Case Revision: Draft Report V1 Date: 09 February 2016 Client name: South Australian Nuclear Fuel Cycle Royal Commission Client no: Jacobs Report (0.4) Project manager: Tim Johnson Authors: Darron Cook, Charles McCombie, Neil Chapman, Nigel Sullivan, Rohan Zauner, Tim Johnson File name: J:\IE\Projects\03_Southern\IW104700\21 Deliverables\Reformatted Docs for Client Release\09022016 Combined Papers V1.0.docx Jacobs Group (Australia) Pty Limited ABN 37 001 024 095 Floor 11, 452 Flinders Street Melbourne VIC 3000 PO Box 312, Flinders Lane Melbourne VIC 8009 Australia T +61 3 8668 3000 F +61 3 8668 3001 www.jacobs.com COPYRIGHT: The concepts and information contained in this document are the property of Jacobs Group (Australia) Pty Limited. Use or copying of this document in whole or in part without the written permission of Jacobs constitutes an infringement of copyright. Document history and status Revision Date Description By Review Approved V0 19 Jan 2016 For Client review Darron Darron Cook Darron Cook, team Cook V1 9 February For public consultation Tim Johnson Darron Cook Darron Cook IW104700 i Radioactive Waste Storage and Disposal Facilities in South Australia – Quantitative Cost Analysis and Business Case Contents Executive Summary .............................................................................................................................................. -

BHP Billiton Iron Ore Management Approach

BHP Billiton Iron Ore Orebody 32 East AWT – Environmental Referral Document BHP Billiton Iron Ore management approach 1.1 Environmental management overview BHP Billiton has developed a Company Charter and Sustainable Development Policy for its operations. The Company Charter and Sustainable Development Policy (BHP Billiton Iron Ore, 2013a) are guiding resources for maintaining an emphasis on health, safety, environment and community and clarifying a broader commitment to aspects of sustainability including biodiversity, human rights, ethical business practices and economic contributions at all BHP Billiton sites. To interpret and support the Company Charter and BHP Billiton Iron Ore’s Sustainable Development Policy, BHP Billiton Iron Ore has developed an Environmental Governance Hierarchy, an Environmental Management System and is currently developing a series of Regional Management Strategies. 1.2 Environment Governance Hierarchy BHP Billiton Iron Ore now operates under an Environmental Governance Hierarchy (Figure 1). The Environment Governance Hierarchy provides the processes and practices that enable BHP Billiton Iron Ore to achieve its environmental objectives, reduce its environmental impacts and increase its operating efficiency. It enables environmental legal compliance to be undertaken and audited and provides for continual improvement in environmental performance. Figure 1: BHP Billiton Iron Ore Environmental Governance Hierarchy As shown in Figure 1, BHP Billiton Iron Ore’s environment governance hierarchy is broadly comprised of three tiers, representative of BHP Billiton Iron Ore’s different levels of management – BHP Billiton (corporate level), BHP Billiton Iron Ore (Business Unit level) and site specific (operations level) – and reflective of BHP Billiton’s top-down approach to environmental management across the Group. -

Foreign Investment in the Oil Sands and British Columbia Shale Gas

Canadian Energy Research Institute Foreign Investment in the Oil Sands and British Columbia Shale Gas Jon Rozhon March 2012 Relevant • Independent • Objective Foreign Investment in the Oil Sands and British Columbia Shale Gas 1 Foreign Investment in the Oil Sands There has been a steady flow of foreign investment into the oil sands industry over the past decade in terms of merger and acquisition (M&A) activity. Out of a total CDN$61.5 billion in M&A’s, approximately half – or CDN$30.3 billion – involved foreign companies taking an ownership stake. These funds were invested in in situ projects, integrated projects, and land leases. As indicated in Figure 1, US and Chinese companies made the most concerted efforts to increase their profile in the oil sands, investing 2/3 of all foreign capital. The US and China both invested in a total of seven different projects. The French company, Total SA, has also spread its capital around several projects (four in total) while Royal Dutch Shell (UK), Statoil (Norway), and PTT (Thailand) each opted to take large positions in one project each. Table 1 provides a list of all foreign investments in the oil sands since 2004. Figure 1: Total Oil Sands Foreign Investment since 2003, Country of Origin Korea 1% Thailand Norway 6% UK 7% 2% US France 33% 18% China 33% Source: Canoils. Foreign Investment in the Oil Sands and British Columbia Shale Gas 2 Table 1: Oil Sands Foreign Investment Deals Year Country Acquirer Brief Description Total Acquisition Cost (000) 2012 China PetroChina 40% interest in MacKay River 680,000 project from AOSC 2011 China China National Offshore Acquisition of OPTI Canada 1,906,461 Oil Corporation 2010 France Total SA Alliance with Suncor.