Editorial by Nicolás Smirnoff

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

TV Channel Distribution in Europe: Table of Contents

TV Channel Distribution in Europe: Table of Contents This report covers 238 international channels/networks across 152 major operators in 34 EMEA countries. From the total, 67 channels (28%) transmit in high definition (HD). The report shows the reader which international channels are carried by which operator – and which tier or package the channel appears on. The report allows for easy comparison between operators, revealing the gaps and showing the different tiers on different operators that a channel appears on. Published in September 2012, this 168-page electronically-delivered report comes in two parts: A 128-page PDF giving an executive summary, comparison tables and country-by-country detail. A 40-page excel workbook allowing you to manipulate the data between countries and by channel. Countries and operators covered: Country Operator Albania Digitalb DTT; Digitalb Satellite; Tring TV DTT; Tring TV Satellite Austria A1/Telekom Austria; Austriasat; Liwest; Salzburg; UPC; Sky Belgium Belgacom; Numericable; Telenet; VOO; Telesat; TV Vlaanderen Bulgaria Blizoo; Bulsatcom; Satellite BG; Vivacom Croatia Bnet Cable; Bnet Satellite Total TV; Digi TV; Max TV/T-HT Czech Rep CS Link; Digi TV; freeSAT (formerly UPC Direct); O2; Skylink; UPC Cable Denmark Boxer; Canal Digital; Stofa; TDC; Viasat; You See Estonia Elion nutitv; Starman; ZUUMtv; Viasat Finland Canal Digital; DNA Welho; Elisa; Plus TV; Sonera; Viasat Satellite France Bouygues Telecom; CanalSat; Numericable; Orange DSL & fiber; SFR; TNT Sat Germany Deutsche Telekom; HD+; Kabel -

A1 Bulgaria Updates Digital Service Strategy with Red Hat Openshift

Case study A1 Bulgaria updates digital service strategy with Red Hat OpenShift A1 Bulgaria is one of the country’s leading telecommunications and digital service providers. The business is transforming its digital channels to increase efficiencies and open new lines of revenue. Together with its trusted technology partner Musala Soft, a Red Hat Advanced Business Partner, the business has created a scalable, integrated, microservices-based environ- ment based on Red Hat OpenShift and Red Hat AMQ. The platform means A1 is faster to market, faster to scale, and more efficient in the way it delivers its digital strategy. Software Telecommunications Red Hat® OpenShift® Container Platform 4,000 employees Red Hat OpenShift Sofia, Bulgaria Container Storage Red Hat AMQ Benefits • Introduced digital Headquarters self-service to improve customer experience “The new self-service features on our digital • Reduced transaction channels put us at the front of Bulgaria’s processing time and improved scalability telecommunications industry.” to support growing Borislav Simeonov customer base Senior IT and Digital Transformation Director A1 Bulgaria • Created foundation for future cloud adoption facebook.com/redhatinc @redhat linkedin.com/company/red-hat redhat.com Adding customer self-service to increase digital adoption “It’s important we create a DevOps A1 Bulgaria (formerly Mobitel), a member of A1 Group, is one of the country’s leading telecommunica- tions and digital services provider. To better serve its more than 4.5 million customers in the digital culture around digital age, A1 Bulgaria sought to update its go-to-market strategy. services, and to be A key focus of this strategic shift was improving its digital service experience for customers to win efficient in doing so. -

Lista De Canale Orange Home TV Prin Cablu

Lista de canale Orange Home TV prin cablu Abonamentul Entry Abonamentul Explore Abonamentul Global Interes general Interes general Interes general 111 ProTV 119 PrimaTV 111 ProTV 120 National TV 111 ProTV 120 National TV 113 Antena 1 120 National TV 112 ProTV HD 121 Pro 2 112 ProTV HD 121 Pro 2 114 Kanal D 121 Pro 2 113 Antena 1 HD 122 Pro 2 HD 113 Antena 1 HD 122 Pro 2 HD 116 TVR 1 125 Pro Gold 114 Kanal D 123 Look Plus TV 114 Kanal D 123 Look Plus TV 117 TVR 2 127 TVR 3 115 Kanal D HD 124 Look TV HD 115 Kanal D HD 124 Look TV HD 118 Antena Stars 116 TVR 1 125 Pro Gold 116 TVR 1 125 Pro Gold Știri 117 TVR 2 126 TVR HD 117 TVR 2 126 TVR HD 118 Antena Stars HD 127 TVR 3 118 Antena Stars HD 127 TVR 3 156 Antena 3 161 Nasul TV 119 PrimaTV 128 Neptun TV 119 PrimaTV 128 Neptun TV 157 Romania TV 162 Digi 24 158 Realitatea 167 TV5 Monde Știri Știri 159 B1 155 Orange Info 162 Digi 24 155 Orange Info 165 BBC World News HD Sport 156 Antena 3 HD 165 BBC World News HD 156 Antena 3 HD 166 CNN 157 Romania TV 166 CNN 157 Romania TV 167 TV5 Monde 222 Telekom Sport 5 225 Eurosport 158 Realitatea 167 TV5 Monde 158 Realitatea 168 France 24 223 Telekom Sport 6 227 Eurosport 2 159 B1 168 France 24 159 B1 169 TVE 224 Pro X 160 National 24 Plus 172 Bloomberg 160 National 24 Plus 170 DW (Europe) Filme 161 Nasul TV 161 Nasul TV 171 CC TV News 565 Pro Cinema 573 Paramount Sport 162 Digi 24 172 Bloomberg 567 Diva 574 Comedy Central Extra 222 Telekom Sport 5 HD 225 Eurosport Sport 568 AXN 576 TV 1000 223 Telekom Sport 6 HD 227 Eurosport 2 222 Telekom Sport 5 HD 226 -

TV-Sat Magazyn Maj 2021.Pdf

01_new.qxd 21-04-25 11:50 Page 1 02_Eutelsat.qxd 21-04-25 11:50 Page 2 C M Y B strona 2 03_04_stopka.qxd 21-04-25 12:03 Page 3 NASZE SPRAWY Nowa stacja naziemna w ofercie TVP ANTENA HD (dawniej SILVER TV), nowa stacja naziemna z portfolio MWE Networks, w ofercie Biura Reklamy TVP. Nadawca wybra³ TVP do sprze- da¿y czasu reklamowego, sponsoringu i akcji niestandardowych. Start stacji planowany jest na 1 maja. ANTENA HD jest now¹ stacj¹, powsta³¹ w wyniku konkursu na zagospo- darowanie wygas³ej koncesji stacji ATM Rozrywka. Dziêki otrzymanej koncesji na nadawanie na MUX-1 stacja bêdzie mieæ ogólnopolski zasiêg. ANTENA HD, znana wczeœniej pod robocz¹ nazw¹ SILVER TV, jest od- Najnowocześniejszy powiedzi¹ na rosn¹c¹ si³ê zakupow¹ osób po 50. roku ¿ycia. Jest to stacja filmo- wo-rozrywkowa z licznymi elementami lifestylowymi i edukacyjnymi. wóz transmisyjny Sony „Wybór Biura Reklamy TVP jako brokera dla kana³u ANTENA HD by³ dla nas oczywisty – to jedyne biuro reklamy telewizyjnej w Polsce, które przy w Polsacie ka¿dej kampanii reklamowej bierze pod uwagê widowniê 50+. Jestem bardzo Polsat rozwija nowoczesne technologie produkcyjne i transmisyjne. Dziêki zadowolony ze wspó³pracy z Biurem Reklamy TVP i cieszê siê, ¿e dziêki sta- temu bêdzie mo¿na przygotowaæ jeszcze wiêcej najlepszych i najatrakcyjniej- bilnym przychodom reklamowym mo¿emy rozwijaæ prawdziwie polsk¹ i nieza- szych treœci i programów dla widzów w Polsce, które mo¿na bêdzie ogl¹daæ le¿n¹ grupê medialn¹, która ju¿ nied³ugo bêdzie te¿ nadawa³a ogólnopolski ka- w dowolnie wybrany przez siebie sposób – czy to w telewizji, czy przez Internet. -

APSCC Monthly E-Newsletter OCTOBER 2017

APSCC Monthly e-Newsletter OCTOBER 2017 The Asia-Pacific Satellite Communications Council (APSCC) e-Newsletter is produced on a monthly basis as part of APSCC’s information services for members and professionals in the satellite industry. Subscribe to the APSCC monthly newsletter and be updated with the latest satellite industry news as well as APSCC activities! To renew your subscription, please visit www.apscc.or.kr/sub4_5.asp. To unsubscribe, send an email to [email protected] with a title “Unsubscribe.” News in this issue has been collected from September 1 to September 30. INSIDE APSCC APSCC 2017 Satellite Conference & Exhibition, 10-12 October, Tokyo, Japan The APSCC Satellite Conference and Exhibition is Asia’s must-attend executive conference for the satellite and space industry, where business leaders come together to gain market insight, strike partnerships and conclude major deals. Celebrating its 20th annual event APSCC 2017 #SATECHexplorer will incorporate industry veterans and new players through the 3-day of in-depth conference program to reach out to a broader audience. Join APSCC 2017 and expand your business network while hearing from a broad range of thought-provoking panels and speakers representing visionary ideas and years of business experience in the industry. For more information, please visit www.apscc2017.com SATELLITE BUSINESS Bluesky Cook Islands to Launch 4G+ Service via SES Networks September 4, 2017 - Bluesky Cook Islands, the sole provider of fixed phone, mobile and broadband services to the Cook Islands, has increased the amount of satellite capacity it is using from SES Networks, in order to launch 4G+ service to Rarotonga and Aitutaki, the two key cities of the island nation. -

Termination Rates at European Level January 2021

BoR (21) 71 Termination rates at European level January 2021 10 June 2021 BoR (21) 71 Table of contents 1. Executive Summary ........................................................................................................ 2 2. Fixed networks – voice interconnection ..................................................................... 6 2.1. Assumptions made for the benchmarking ................................................................ 6 2.2. FTR benchmark .......................................................................................................... 6 2.3. Short term evolution of fixed incumbents’ FTRs (from July 2020 to January 2021) ................................................................................................................................... 9 2.4. FTR regulatory model implemented and symmetry overview ............................... 12 2.5. Number of lines and market shares ........................................................................ 13 3. Mobile networks – voice interconnection ................................................................. 14 3.1. Assumptions made for the benchmarking .............................................................. 14 3.2. Average MTR per country: rates per voice minute (as of January 2021) ............ 15 3.3. Average MTR per operator ...................................................................................... 18 3.4. Average MTR: Time series of simple average and weighted average at European level ................................................................................................................. -

Organization Country

19 Organization Country 3DD ENTERTAINMENT United Kingdom 7A MEDIA, CORP United States 9 STORY DISTRIBUTION INTERNATIONAL Ireland A+E NETWORKS United States ABOUT PREMIUM CONTENT France ALFRED HABER DISTRIBUTION United States ALL3MEDIA INTERNATIONAL United States ANIMIKI SEE DISTRIBUTION Canada ARCANA STUDIO INC Canada ARTE FRANCE France ARTICO DISTRIBUTION INTL, S.L. Spain ARTWORKS ENTERTAINMENT S. DE R.L DE C.V. Mexico ATRESMEDIA TELEVISION Spain ATV Turkey AUSTRAL FILMS Argentina AZTECA Mexico BALANGA France BANIJAY RIGHTS United Kingdom BBC STUDIOS Mexico BBC STUDIOS United States BETA FILM GMBH Chile BEYOND DISTRIBUTION LTD Ireland BIG MEDIA United States BLUE ANT MEDIA Canada BOAT ROCKER STUDIOS Canada BOOMERANG TV / LAGARDERE STUDIOS DISTRIBUTION Spain BORSALINO France C MAJOR ENTERTAINMENT Germany CAKE United Kingdom CALINOS ENTERTAINMENT Turkey CANAL 13 S.P.A. Chile CARACOL TELEVISION United States CBS STUDIOS INTERNATIONAL United States CDC UNITED NETWORK Belgium CHINA FANTAWILD ANIMATION INC. China 19 CHINA INTERCONTINENTAL COMMUNICATION CENTER (CICC) China CINEFLIX RIGHTS United Kingdom CINEMEX PRESENTA Mexico CINEPOLIS DISTRIBUCION Mexico CJ ENM CO., LTD. Korea (South) COMAREX SA DE CV Mexico COMEDIHA! DISTRIBUTION Canada COPENHAGEN BOMBAY SALES Denmark CROWN MEDIA INTERNATIONAL DISTRIBUTION United States CYBER GROUP STUDIOS France D3 TELEFILM United States DANDELOOO France DEUTSCHE WELLE / TRANSTEL Germany DEVISED TV Spain DHX MEDIA LTD Canada DICK CLARK PRODUCTIONS United States DISCOVERY COMMUNICATIONS LLC United States -

HBO and Mercado Libre Seal Strategic Alliance to Provide Benefits in Content

HBO and Mercado Libre seal strategic alliance to provide benefits in content The benefit will allow Mercado Libre and Mercado Pago users to subscribe to HBO GO with discounts and without needing a credit or debit card. HBO GO will offer millions of Mercado Libre and Mercado Pago users’ access to its complete catalog of productions, featuring thousands of premium titles. Miami, July 20, 2020 - Mercado Libre and HBO Latin America announced today a strategic and innovative alliance that, for the first time, will provide premium content benefits to millions of Mercado Libre users in Mexico, Argentina and Brazil. Users of the e-commerce platform in these territories will have two great benefits with this new offer: the ability to subscribe to the HBO GO streaming platform with special discounts, as well as the possibility to do so without a credit or debit card. As a result of this agreement, Mercado Libre users in Mexico, Argentina and Brazil will be able to access thousands of exclusive HBO titles including the most recent releases, such as drama series PERRY MASON and the acclaimed VERONICA MARS, as well as the most awarded productions of HBO, including GAME OF THRONES, WESTWORLD, CHERNOBYL, SUCCESSION, BIG LITTLE LIES and iconic series like THE SOPRANOS and SEX AND THE CITY, plus successful local original productions from Latin America like JOINT VENTURE, THE BRONZE GARDEN, SR. AVILA, THE BUSINESS, EPITAFIOS and CAPADOCIA. Users will also count on the latest HBO releases including new Hollywood blockbusters and upcoming content such as the new drama series LOVECRAFT COUNTRY, premiering in August. -

Global Pay TV Fragments

Global pay TV fragments The top 503 pay TV operators will reach 853 million subscribers from the 1.02 billion global total by 2026. The top 50 operators accounted for 64% of the world’s pay TV subscribers by end-2020, with this proportion dropping to 62% by 2026. Pay TV subscribers by operator ranking (million) 1200 1000 143 165 38 45 800 74 80 102 102 600 224 215 400 200 423 412 0 2020 2026 Top 10 11-50 51-100 101-200 201+ Excluded from report The top 50 will lose 20 million subscribers over the next five years. However, operators beyond the top 100 will gain subscribers over the same period. Simon Murray, Principal Analyst at Digital TV Research, said: “Most industries consolidate as they mature. The pay TV sector is doing the opposite – fragmenting. Most of the subscriber growth will take place in developing countries where operators are not controlled by larger corporations.” By end-2020, 13 operators had more than 10 million pay TV subscribers. China and India will continue to dominate the top pay TV operator rankings, partly as their subscriber bases climb but also due to the US operators losing subscribers. Between 2020 and 2026, 307 of the 503 operators (61%) will gain subscribers, with 13 showing no change and 183 losing subscribers (36%). In 2020, 28 pay TV operators earned more than $1 billion in revenues, but this will drop to 24 operators by 2026. The Global Pay TV Operator Forecasts report covers 503 operators with 726 platforms [132 digital cable, 116 analog cable, 279 satellite, 142 IPTV and 57 DTT] across 135 countries. -

40% More Gigabytes in Spite of the Pandemic

Industry analysis #3 2020 Mobile data – first half 2020 40% more gigabytes in spite of the pandemic But revenue negatively affected: -0.5% 140% Average +51% Average +54% th 120% Tefficient’s 28 public analysis on the 100% development and drivers of mobile data ranks 116 80% operators based on average data usage per 60% SIM, total data traffic and revenue per gigabyte in 40% the first half of 2020. y growth in mobile data usage data mobile in y growth - o - 20% Y The data usage per SIM grew for basically every 0% Q1 2020 Q2 2020 operator. 42% could turn -20% that data usage growth into ARPU growth. It’s a bit lower than in our previous reports and COVID-19 is to blame; many operators did report negative revenue development in Q2 2020 when travelling stopped and many prepaid subscriptions expired. Mobile data traffic continued to grow, though: +40%. Although operators in certain markets were giving mobile data away to mitigate the negative consequences of lockdowns, most of the global traffic growth is true, underlying, growth. Data usage actually grew faster in Q2 2020 than in Q1 2020 even though lockdowns mainly affected Q2. Our industry demonstrated resilience, but now needs to fill the data monetisation toolbox with more or sharper tools. tefficient AB www.tefficient.com 3 September 2020 1 27 operators above 10 GB per SIM per month in 1H 2020 Figure 1 shows the average mobile data usage for 116 reporting or reported1 mobile operators globally with values for the first half of 2020 or the full year of 2019. -

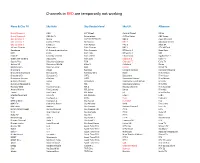

Channels in RED Are Temporarily Not Working

Channels in RED are temporarily not working Nova & Ote TV Sky Italy Sky Deutschland Sky UK Albanian Nova Cinema 1 AXN 13th Street Animal Planet 3 Plus Nova Cinema 2 AXN SciFi Boomerang At The Races ABC News Ote Cinema 1 Boing Cartoon Network BBC 1 Agon Channel Ote Cinema 2 Caccia e Pesca Discovery BBC 2 Albanian screen Ote Cinema 3 Canale 5 Film Action BBC 3 Alsat M Village Cinema Cartoonito Film Cinema BBC 4 ATV HDTurk Sundance CI Crime Investigation Film Comedy BT Sports 1 Bang Bang FOX Cielo Film Hits BT Sports 2 BBF FOXlife Comedy Central Film Select CBS Drama Big Brother 1 Greek VIP Cinema Discovery Film Star Channel 5 Club TV Sports Plus Discovery Science FOX Chelsea FC Cufo TV Action 24 Discovery World Kabel 1 Clubland Doma Motorvision Disney Junior Kika Colors Elrodi TV Discovery Dmax Nat Geo Comedy Central Explorer Shkence Discovery Showcase Eurosport 1 Nat Geo Wild Dave Film Aktion Discovery ID Eurosport 2 ORF1 Discovery Film Autor Discovery Science eXplora ORF2 Discovery History Film Drame History Channel Focus ProSieben Discovery Investigation Film Dy National Geographic Fox RTL Discovery Science Film Hits NatGeo Wild Fox Animation RTL 2 Disney Channel Film Komedi Animal Planet Fox Comedy RTL Crime Dmax Film Nje Travel Fox Crime RTL Nitro E4 Film Thriller E! Entertainment Fox Life RTL Passion Film 4 Folk+ TLC Fox Sport 1 SAT 1 Five Folklorit MTV Greece Fox Sport 2 Sky Action Five USA Fox MAD TV Gambero Rosso Sky Atlantic Gold Fox Crime MAD Hits History Sky Cinema History Channel Fox Life NOVA MAD Greekz Horror Channel Sky -

Claves Sobre La Marginalidad Económica Y La Movilidad Social

BIBLOS (Buenos Aires). Claves sobre la marginalidad económica y la movilidad social. Segregación urbana y cambios macroeconómicos. Agustín Salvia y EDUARDO CHAVEZ MOLINA. Cita: Agustín Salvia y EDUARDO CHAVEZ MOLINA (2016). Claves sobre la marginalidad económica y la movilidad social. Segregación urbana y cambios macroeconómicos. Buenos Aires: BIBLOS. Dirección estable: https://www.aacademica.org/agustin.salvia/276 Acta Académica es un proyecto académico sin fines de lucro enmarcado en la iniciativa de acceso abierto. Acta Académica fue creado para facilitar a investigadores de todo el mundo el compartir su producción académica. Para crear un perfil gratuitamente o acceder a otros trabajos visite: http://www.aacademica.org. Claves sobre la marginalidad económica y la movilidad social Segregación urbana y cambios macroeconómicos Agustín Salvia y Eduardo Chávez Molina (coordinadores) Claves sobre la marginalidad económica y la movilidad social Segregación urbana y cambios macroeconómicos Juan Ignacio Boniglio Guillermina Comas Eduardo Chávez Molina Pablo Molina Derteano Fernando Flores Hein Bianca Musante Federico Petriella Jésica Lorena Pla María Laura Raffo Agustín Salvia Edith Vallejos Vanina van Raap Victoria Ventura Editorial Biblos SOCIEDAD Claves sobre la marginalidad económica y la movilidad social: segregación urbana y cambios macroeconómicos / Agustín Salvia ... [et.al.]; coordinado por Agustín Salvia y Eduardo Chávez Molina.- 1a ed.- Ciudad Autónoma de Buenos Aires: Biblos, 2016. 280 p.; 16x23 cm. ISBN 978-987-691-382-9 1. Economía. 2. Invetigación Sociológica. I. Salvia, Agustín II. Salvia, Agustín, coord. III. Chávez Molina, Eduardo, coord. CDD 303.6 Esta publicación fue realizada con fondos de los proyectos “Reproducción social de la nueva marginalidad urbana. Articulación entre prácticas de subsistencia y prácticas de acumulación en un sistema social dual y fragmentado”, Foncyt PICT 2005 (2007-2009), y “Heterogeneidad estructural y desigualdad social.