MVIS United Kingdom Equal Weight Index

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

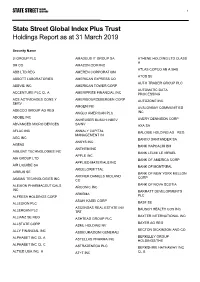

State Street Global Index Plus Trust Holdings Report As at 31 March 2019

1 State Street Global Index Plus Trust Holdings Report as at 31 March 2019 Security Name 3I GROUP PLC AMADEUS IT GROUP SA ATHENE HOLDING LTD CLASS A 3M CO AMAZON.COM INC ATLAS COPCO AB A SHS ABB LTD REG AMEREN CORPORATION ATOS SE ABBOTT LABORATORIES AMERICAN EXPRESS CO AUTO TRADER GROUP PLC ABBVIE INC AMERICAN TOWER CORP AUTOMATIC DATA ACCENTURE PLC CL A AMERIPRISE FINANCIAL INC PROCESSING ACS ACTIVIDADES CONS Y AMERISOURCEBERGEN CORP AUTOZONE INC SERV AMGEN INC AVALONBAY COMMUNITIES ADECCO GROUP AG REG ANGLO AMERICAN PLC INC ADOBE INC ANHEUSER BUSCH INBEV AVERY DENNISON CORP ADVANCED MICRO DEVICES SA/NV AXA SA AFLAC INC ANNALY CAPITAL BALOISE HOLDING AG REG MANAGEMENT IN AGC INC BANCO SANTANDER SA ANSYS INC AGEAS BANK HAPOALIM BM ANTHEM INC AGILENT TECHNOLOGIES INC BANK LEUMI LE ISRAEL APPLE INC AIA GROUP LTD BANK OF AMERICA CORP APPLIED MATERIALS INC AIR LIQUIDE SA BANK OF MONTREAL ARCELORMITTAL AIRBUS SE BANK OF NEW YORK MELLON ARCHER DANIELS MIDLAND CORP AKAMAI TECHNOLOGIES INC CO BANK OF NOVA SCOTIA ALEXION PHARMACEUTICALS ARCONIC INC INC BARRATT DEVELOPMENTS ARKEMA ALFRESA HOLDINGS CORP PLC ASAHI KASEI CORP ALLEGION PLC BASF SE ASCENDAS REAL ESTATE INV BAUSCH HEALTH COS INC ALLERGAN PLC TRT BAXTER INTERNATIONAL INC ALLIANZ SE REG ASHTEAD GROUP PLC BAYER AG REG ALLSTATE CORP ASML HOLDING NV BECTON DICKINSON AND CO ALLY FINANCIAL INC ASSICURAZIONI GENERALI ALPHABET INC CL A BERKELEY GROUP ASTELLAS PHARMA INC HOLDINGS/THE ALPHABET INC CL C ASTRAZENECA PLC BERKSHIRE HATHAWAY INC ALTICE USA INC A AT+T INC CL B 2 BEST BUY CO INC CHUBB -

Annex 1: Parker Review Survey Results As at 2 November 2020

Annex 1: Parker Review survey results as at 2 November 2020 The data included in this table is a representation of the survey results as at 2 November 2020, which were self-declared by the FTSE 100 companies. As at March 2021, a further seven FTSE 100 companies have appointed directors from a minority ethnic group, effective in the early months of this year. These companies have been identified through an * in the table below. 3 3 4 4 2 2 Company Company 1 1 (source: BoardEx) Met Not Met Did Not Submit Data Respond Not Did Met Not Met Did Not Submit Data Respond Not Did 1 Admiral Group PLC a 27 Hargreaves Lansdown PLC a 2 Anglo American PLC a 28 Hikma Pharmaceuticals PLC a 3 Antofagasta PLC a 29 HSBC Holdings PLC a InterContinental Hotels 30 a 4 AstraZeneca PLC a Group PLC 5 Avast PLC a 31 Intermediate Capital Group PLC a 6 Aveva PLC a 32 Intertek Group PLC a 7 B&M European Value Retail S.A. a 33 J Sainsbury PLC a 8 Barclays PLC a 34 Johnson Matthey PLC a 9 Barratt Developments PLC a 35 Kingfisher PLC a 10 Berkeley Group Holdings PLC a 36 Legal & General Group PLC a 11 BHP Group PLC a 37 Lloyds Banking Group PLC a 12 BP PLC a 38 Melrose Industries PLC a 13 British American Tobacco PLC a 39 Mondi PLC a 14 British Land Company PLC a 40 National Grid PLC a 15 BT Group PLC a 41 NatWest Group PLC a 16 Bunzl PLC a 42 Ocado Group PLC a 17 Burberry Group PLC a 43 Pearson PLC a 18 Coca-Cola HBC AG a 44 Pennon Group PLC a 19 Compass Group PLC a 45 Phoenix Group Holdings PLC a 20 Diageo PLC a 46 Polymetal International PLC a 21 Experian PLC a 47 -

Constituents & Weights

2 FTSE Russell Publications 19 August 2021 FTSE 100 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.59 UNITED GlaxoSmithKline 3.7 UNITED RELX 1.88 UNITED KINGDOM KINGDOM KINGDOM Admiral Group 0.35 UNITED Glencore 1.97 UNITED Rentokil Initial 0.49 UNITED KINGDOM KINGDOM KINGDOM Anglo American 1.86 UNITED Halma 0.54 UNITED Rightmove 0.29 UNITED KINGDOM KINGDOM KINGDOM Antofagasta 0.26 UNITED Hargreaves Lansdown 0.32 UNITED Rio Tinto 3.41 UNITED KINGDOM KINGDOM KINGDOM Ashtead Group 1.26 UNITED Hikma Pharmaceuticals 0.22 UNITED Rolls-Royce Holdings 0.39 UNITED KINGDOM KINGDOM KINGDOM Associated British Foods 0.41 UNITED HSBC Hldgs 4.5 UNITED Royal Dutch Shell A 3.13 UNITED KINGDOM KINGDOM KINGDOM AstraZeneca 6.02 UNITED Imperial Brands 0.77 UNITED Royal Dutch Shell B 2.74 UNITED KINGDOM KINGDOM KINGDOM Auto Trader Group 0.32 UNITED Informa 0.4 UNITED Royal Mail 0.28 UNITED KINGDOM KINGDOM KINGDOM Avast 0.14 UNITED InterContinental Hotels Group 0.46 UNITED Sage Group 0.39 UNITED KINGDOM KINGDOM KINGDOM Aveva Group 0.23 UNITED Intermediate Capital Group 0.31 UNITED Sainsbury (J) 0.24 UNITED KINGDOM KINGDOM KINGDOM Aviva 0.84 UNITED International Consolidated Airlines 0.34 UNITED Schroders 0.21 UNITED KINGDOM Group KINGDOM KINGDOM B&M European Value Retail 0.27 UNITED Intertek Group 0.47 UNITED Scottish Mortgage Inv Tst 1 UNITED KINGDOM KINGDOM KINGDOM BAE Systems 0.89 UNITED ITV 0.25 UNITED Segro 0.69 UNITED KINGDOM -

Global Equity Fund Description Plan 3S DCP & JRA MICROSOFT CORP

Global Equity Fund June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA MICROSOFT CORP 2.5289% 2.5289% APPLE INC 2.4756% 2.4756% AMAZON COM INC 1.9411% 1.9411% FACEBOOK CLASS A INC 0.9048% 0.9048% ALPHABET INC CLASS A 0.7033% 0.7033% ALPHABET INC CLASS C 0.6978% 0.6978% ALIBABA GROUP HOLDING ADR REPRESEN 0.6724% 0.6724% JOHNSON & JOHNSON 0.6151% 0.6151% TENCENT HOLDINGS LTD 0.6124% 0.6124% BERKSHIRE HATHAWAY INC CLASS B 0.5765% 0.5765% NESTLE SA 0.5428% 0.5428% VISA INC CLASS A 0.5408% 0.5408% PROCTER & GAMBLE 0.4838% 0.4838% JPMORGAN CHASE & CO 0.4730% 0.4730% UNITEDHEALTH GROUP INC 0.4619% 0.4619% ISHARES RUSSELL 3000 ETF 0.4525% 0.4525% HOME DEPOT INC 0.4463% 0.4463% TAIWAN SEMICONDUCTOR MANUFACTURING 0.4337% 0.4337% MASTERCARD INC CLASS A 0.4325% 0.4325% INTEL CORPORATION CORP 0.4207% 0.4207% SHORT-TERM INVESTMENT FUND 0.4158% 0.4158% ROCHE HOLDING PAR AG 0.4017% 0.4017% VERIZON COMMUNICATIONS INC 0.3792% 0.3792% NVIDIA CORP 0.3721% 0.3721% AT&T INC 0.3583% 0.3583% SAMSUNG ELECTRONICS LTD 0.3483% 0.3483% ADOBE INC 0.3473% 0.3473% PAYPAL HOLDINGS INC 0.3395% 0.3395% WALT DISNEY 0.3342% 0.3342% CISCO SYSTEMS INC 0.3283% 0.3283% MERCK & CO INC 0.3242% 0.3242% NETFLIX INC 0.3213% 0.3213% EXXON MOBIL CORP 0.3138% 0.3138% NOVARTIS AG 0.3084% 0.3084% BANK OF AMERICA CORP 0.3046% 0.3046% PEPSICO INC 0.3036% 0.3036% PFIZER INC 0.3020% 0.3020% COMCAST CORP CLASS A 0.2929% 0.2929% COCA-COLA 0.2872% 0.2872% ABBVIE INC 0.2870% 0.2870% CHEVRON CORP 0.2767% 0.2767% WALMART INC 0.2767% -

Auto Trader Group

Auto Trader Group plc Annual Report and Financial Statements 2017 Driving trust and transparency Auto Trader Group plc is a 100% digital business having successfully completed the transition from a print title in 2013. Auto Trader sits at the heart of the UK’s vehicle buying and selling processes and operates the UK’s largest digital automotive marketplace. Strategic report 02 Business at a glance 04 Market overview 10 Our business model 12 Chief Executive Officer’s statement 16 Delivering on our priorities 22 Key performance indicators 26 Financial review 30 Risk management 33 Principal risks and uncertainties 36 Corporate social responsibility Governance 44 Governance overview 46 Board of Directors 48 Corporate governance statement 54 Report of the Nomination Committee 56 Report of the Audit Committee 60 Directors’ remuneration report 73 Directors’ report Financial statements 76 Independent auditors’ report to the members of Auto Trader Group plc only 79 Consolidated income statement 80 Consolidated statement of comprehensive income 81 Consolidated balance sheet 82 Consolidated statement of changes in equity 83 Consolidated statement of cash flows 84 Notes to the consolidated financial statements 116 Company balance sheet 117 Company statement of changes in equity 118 Notes to the Company financial statements 123 Shareholder information Follow us: twitter.com/ATInsight To view and download this report online: ar2017.autotrader.co.uk There’s nothing more important than trust and transparency in today’s automotive marketplace. A transparent market makes car buying fair, inherently generating trust and building better relationships. Auto Trader creates this trust and transparency throughout the market, allowing car buyers and sellers to focus on the things that really matter. -

The UK Private Equity IPO Report

THE UK PRIVATE EQUITY IPO REPORT Private equity-backed IPOs: 1 January 2009 – 31 December 2017 IN ASSOCIATION WITH 2 | THE UK PRIVATE EQUITY IPO REPORT CONTENTS FOREWORD 03 HISTORIC ANALYSIS OF PRIVATE EQUITY-BACKED IPOS IN THE UK 04 BETWEEN 1 JANUARY 2009 AND 31 DECEMBER 2017 VOLUME AND VALUE OF PRIVATE EQUITY-BACKED IPOS LISTING IN THE UK 05 TOP 10 PRIVATE EQUITY-BACKED IPOS 06 INDUSTRIES 07 FREE FLOAT 12 USE OF PROCEEDS 13 PRICING 14 PERFORMANCE 15 ANALYSIS OF ACTIVE PRIVATE EQUITY HOUSES BY SIZE 17 LOCK-UP PERIODS 18 HOLDING PERIODS 20 PRIVATE EQUITY-BACKED IPO ACTIVITY IN 2017 21 APPENDIX 23 PRIVATE EQUITY-BACKED IPOS 1 JANUARY 2009 - 31 DECEMBER 2017 23 METHODOLOGY 31 CONTACTS 32 3 | THE UK PRIVATE EQUITY IPO REPORT FOREWORD Public markets have long been an important exit route for private equity houses selling their stakes into the companies they have backed, yet little research has been conducted into how these businesses perform after they have floated. This report, published by the BVCA and PwC, provides an historic analysis of private equity-backed IPOs in the UK between 1 January 2009 and 31 December 2017. It looks at a number of metrics including the use of proceeds, pricing and performance to build a picture of the IPO market and the key trends with the market. The performance numbers are particularly revealing as they show that private equity-backed IPOs are trading on average 43.9% higher than their offer price for the period from IPO to 31 December 2017 compared to the non-private equity-backed IPOs of the same period which are trading at an average of 26.6% higher. -

The Manager, Announcements ASX Market Announcements Office 4Th Floor, 20 Bridge Street SYDNEY NSW 2000 by E-Lodgement

The Manager, Announcements ASX Market Announcements Office 4th Floor, 20 Bridge Street SYDNEY NSW 2000 By E-lodgement 31 August 2016 Dear Manager Please refer to the following pages for details of the K2 Global Equities Fund portfolio as at 30 June 2016. Yours sincerely Hollie Wight Company Secretary K2 Asset Management Ltd as responsible entity for K2 Global Equities Fund AbbVie Inc 1.7% Hyundai Elevator Co Ltd 0.6% Aconex Ltd 0.5% IMF Bentham Ltd 0.6% Activision Blizzard Inc 0.4% Ingenia Communities Group 0.8% Adairs Ltd 1.0% Iron Mountain Inc 1.5% Aena SA 0.4% JPMorgan Chase & Co 0.6% Alibaba Group Holding Ltd 1.3% Kina Securities Ltd 1.6% Alphabet Inc Class A 1.5% Kingspan Group PLC 0.6% AMA Group Ltd 0.2% Koninklijke Ahold Delhaize NV 0.7% Amorepacific Corp 0.3% Korea Aerospace Industries Ltd 0.1% Anadarko Petroleum Corp 0.7% Kyoritsu Maintenance Co Ltd 0.3% Apiam Animal Health Ltd 1.1% LatAm Autos Ltd 0.3% Apple Inc 1.0% Lear Corp 0.9% Arvida Group Ltd 0.3% Legal & General Group PLC 0.4% Atos SE 0.9% LG Display Co Ltd 0.5% Auto Trader Group PLC 0.6% Lloyds Banking Group PLC 0.5% Baby Bunting Group Ltd 0.4% MaxLinear Inc 0.2% Beijing Capital International Airport Co 0.9% Medical Developments International Ltd 2.7% LtdBerkeley Group Holdings PLC 1.2% Microsoft Corp 0.7% BHP Billiton Limited 0.7% Morgan Stanley 1.1% Blackmores Ltd 0.2% National Storage REIT 3.1% Bloomage BioTechnology Corp Ltd 0.3% NCSoft Corp 0.7% Broadcom Ltd 0.6% Nutribiotech Co Ltd 0.7% Byucksan Corp 0.1% Oneview Healthcare PLC 0.7% Cedar Woods Properties Ltd 1.3% -

Auto Trader Annual Report 2020

Leaders in our market AUTO TRADER GROUP PLC Annual Report and Financial Statements 2020 WHO WE ARE Auto Trader Group plc is the UK’s largest digital automotive marketplace. WHAT WE DO There are 10 million transactions in the automotive market each year and we are driving change in how consumers are shopping for these cars online. We aim to drive further efficiencies in the market, benefitting consumers, retailers and manufacturers alike. 2 60 94 STRATEGIC REPORT GOVERNANCE FINANCIAL STATEMENTS 2 Business at a glance 60 Governance overview 94 Independent auditor’s report to the 4 Assessing the impact of COVID-19 62 Board of Directors members of Auto Trader Group plc 8 Chairman’s statement 64 Corporate governance statement 100 Consolidated income statement 12 Chief Executive Officer’s statement 70 Report of the Nomination Committee 101 Consolidated statement of 14 How we create value 73 Report of the Audit Committee comprehensive income 16 Market overview 77 Directors’ remuneration report 102 Consolidated balance sheet 20 Our strategy 90 Directors’ report 103 Consolidated statement of changes 22 Our strategy in action in equity 28 How we engage with our stakeholders 104 Consolidated statement of cash flows 30 Key performance indicators 105 Notes to the consolidated financial 34 Operational review statements 36 Financial review 143 Company balance sheet 40 Making a difference 144 Company statement of changes 52 How we manage risk in equity 54 Principal risks and uncertainties 145 Notes to the Company financial statements 150 Unaudited five-year record 151 Shareholder information plc.autotrader.co.uk Auto Trader Insight @ATInsight What does it mean to be a leader? To us, leading the way is all about improving tomorrow’s car market to ensure it’s a fair and transparent one. -

Morningstar Report

Report as of 01 Oct 2021 BlackRock UK Absolute Alpha Fund S Inc Morningstar® Category Morningstar® Benchmark Fund Benchmark Morningstar Rating™ Category_EUCA001005 Not Categorized ICE LIBOR 3 Month GBP Not Rated Used throughout report Investment Objective Performance The Fund aims to achieve positive absolute returns for 110 investors through a combination of capital growth and 105 income on your investment and, as such, the Fund will not be managed against any United Kingdom (UK) equity index. 100 The Fund will be managed with the aim of delivering 95 absolute (more than zero) returns on a 12 month basis in 90 any market conditions. However, an absolute return is not guaranteed over a 12 month or any period and the Fund 2016 2017 2018 2019 2020 2021-08 may experience periods of negative return. The Fund’s 2.31 1.50 -5.03 9.39 -0.62 0.80 Fund capital is at risk. The Fund primarily aims to gain investment exposure to equity securities (e.g.... Risk Measures Trailing Returns % Fund Quarterly Returns % Q1 Q2 Q3 Q4 3Y Alpha - 3Y Sharpe Ratio 0.39 3 Months 1.17 2021 0.54 -1.07 - - 3Y Beta - 3Y Std Dev 4.35 6 Months 0.09 2020 -3.02 2.93 -2.75 2.38 3Y R-Squared - 3Y Risk - 1 Year 3.02 2019 4.07 2.51 0.72 1.81 3Y Info Ratio - 5Y Risk - 3 Years Annualised 2.19 2018 -2.39 1.79 -2.00 -2.46 3Y Tracking Error - 10Y Risk - 5 Years Annualised 1.58 2017 0.37 0.65 -0.17 0.65 10 Years Annualised - Data as of 30/09/2021 Portfolio 31 Aug 2021 Asset Allocation % Net America Europe Asia Stocks 22.19 Bonds 0.03 Cash 77.78 Other 0.00 <25 25-50 50-75 >75 Top Holdings World Regions % Fund Holding Name Sector % Americas 3.74 BlackRock ICS Sterling Liq.. -

International Fund Portfolio Holdings

PORTFOLIO HOLDINGS Harbor International Fund As of 06/30/2021 Subadviser: Marathon Asset Management LLP - Since 08/22/2018 Portfolio Managers: Neil M. Ostrer, Charles Carter, Nick Longhurst, William J. Arah, Simon Somerville, Michael Nickson, CFA, Justin Hill, Alex Duffy Shares/Par/ Current Base Base Market Value % of Total Net SEDOL Asset Description Contracts Price $ $ Assets 7110388 Roche Holding Ltd 224,553 377.08 84,673,489 1.75 0798059 BP p.l.c. 18,053,623 4.35 78,561,563 1.63 6429104 Hitachi,Ltd. 1,362,000 57.31 78,058,228 1.62 BN4MYF5 Vestas Wind Systems A/S 1,746,074 39.04 68,166,104 1.41 BHC8X90 Novo Nordisk A/S Class B 763,711 83.79 63,990,207 1.32 BYWH8S0 HelloFresh SE 613,546 97.22 59,648,997 1.23 3134865 Barclays PLC 22,968,245 2.36 54,295,493 1.12 BWXC0Z1 Flutter Entertainment Plc 276,702 181.59 50,246,759 1.04 6900643 Toyota Motor Corp. 570,800 87.49 49,936,649 1.03 3163836 Intertek Group plc 645,142 76.39 49,285,101 1.02 7309681 BNP Paribas SA Class A 775,881 62.70 48,646,603 1.01 B8FMRX8 Coloplast A/S Class B 290,847 164.10 47,728,124 0.99 BGDT3G2 Rightmove plc 5,057,785 8.97 45,374,082 0.94 0870612 Lloyds Banking Group plc 69,120,045 0.64 44,582,360 0.92 BYPC1T4 ASSA ABLOY AB Class B 1,438,489 30.14 43,362,483 0.90 B5VQMV6 Entain PLC 1,718,679 24.11 41,442,868 0.86 B1WGG93 Geberit AG 55,065 750.80 41,342,681 0.86 B11ZRK9 Legrand SA 380,942 105.85 40,324,025 0.83 BD6K457 Compass Group PLC 1,902,312 21.03 39,997,386 0.83 0718875 Rio Tinto plc 482,627 82.18 39,663,477 0.82 BDSV2V0 CNH Industrial NV 2,375,980 16.51 39,236,124 -

M Funds Quarterly Holdings 3.31.2020*

M International Equity Fund 31-Mar-20 CUSIP SECURITY NAME SHARES MARKET VALUE % OF TOTAL ASSETS 233203421 DFA Emerging Markets Core Equity P 2,263,150 35,237,238.84 24.59% 712387901 Nestle SA, Registered 22,264 2,294,710.93 1.60% 711038901 Roche Holding AG 4,932 1,603,462.36 1.12% 690064001 Toyota Motor Corp. 22,300 1,342,499.45 0.94% 710306903 Novartis AG, Registered 13,215 1,092,154.20 0.76% 079805909 BP Plc 202,870 863,043.67 0.60% 780087953 Royal Bank of Canada 12,100 749,489.80 0.52% ACI07GG13 Novo Nordisk A/S, Class B 12,082 728,803.67 0.51% B15C55900 Total SA 18,666 723,857.50 0.51% 098952906 AstraZeneca Plc 7,627 681,305.26 0.48% 406141903 LVMH Moet Hennessy Louis Vuitton S 1,684 625,092.87 0.44% 682150008 Sony Corp. 10,500 624,153.63 0.44% B03MLX903 Royal Dutch Shell Plc, Class A 35,072 613,753.12 0.43% 618549901 CSL, Ltd. 3,152 571,782.15 0.40% ACI02GTQ9 ASML Holding NV 2,066 549,061.02 0.38% B4TX8S909 AIA Group, Ltd. 60,200 541,577.35 0.38% 677062903 SoftBank Group Corp. 15,400 539,261.93 0.38% 621503002 Commonwealth Bank of Australia 13,861 523,563.51 0.37% 092528900 GlaxoSmithKline Plc 26,092 489,416.83 0.34% 891160954 Toronto-Dominion Bank (The) 11,126 473,011.14 0.33% B1527V903 Unilever NV 9,584 472,203.46 0.33% 624899902 KDDI Corp. -

Beleggingen Ultimo 4E Kwartaal 2020

Beleggingen ultimo 4e kwartaal 2020 Onderstaande lijst betreft de directe beleggingen van Bpf Zoetwaren per 31 december 2020. Aandelen 3i Group Plc AMERISAFE, Inc. Banco de Sabadell SA 3M Co. AmerisourceBergen Corp. Banco Santander SA A.P. Møller-Mærsk A/S Amgen, Inc. Bank of Montreal Aarons, Inc. Analog Devices, Inc. Bank of Nova Scotia ABB Ltd. Andritz AG Barclays Plc Abbott Laboratories Anglo American Plc Barnes Group Inc AbbVie, Inc. Anheuser-Busch InBev SA Barrick Gold Corp. ABN AMRO Group NV ANSYS, Inc. BAWAG Group AG Acadia Healthcare Co., Inc. Anthem, Inc. Baxter International, Inc. Accenture Plc Apple, Inc. Bayerische Motoren Werke AG ACI Worldwide, Inc. Applied Industrial Technologies, BCE, Inc. ACS Actividades de Construccion y Inc. Bechtle AG Servicios SA Applied Materials, Inc. Bed Bath & Beyond, Inc. Activision Blizzard, Inc. Applus Services SA Benchmark Electronics, Inc. Adecco SA Arrow Electronics, Inc. Berkeley Group Holdings Plc Admiral Group Plc Asahi Glass Co., Ltd. Berkshire Hathaway, Inc. Adobe Systems, Inc. ASM International NV Best Buy Co., Inc. Advance Auto Parts, Inc. ASML Holding NV BHP Billiton Ltd. Adyen NV Assicurazioni Generali SpA BHP Billiton Plc AEGON NV Assurant, Inc. Biogen, Inc. Aflac, Inc. Assured Guaranty Ltd. Bio-Rad Laboratories, Inc. ageas SA/NV Astellas Pharma, Inc. BioTelemetry, Inc. Agilent Technologies, Inc. AstraZeneca Plc Blackbaud, Inc. AGL Energy Ltd. ASX Ltd. BNP Paribas SA Akamai Technologies, Inc. AT&T, Inc. Boise Cascade Co. Akzo Nobel NV Atlas Copco AB Boliden AB Alcoa, Inc. ATOS SE Booz Allen Hamilton Holding Corp. Alexion Pharmaceuticals, Inc. Aurizon Holdings Ltd. BorgWarner, Inc. Alika SRL AusNet Services Ltd.