Future Economy Future Jobs

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

LIGHTING WORKSHOP 2018 2018 Brisbane Airportconference Centre Tuesday 22May Brisbane Airportconference Centre Tuesday 22May

LIGHTING WORKSHOP Tuesday 22 May 2018 Brisbane Airport Conference Centre PAVEMENT TECHNOLOGY WORKSHOP Tuesday 22 May 2018 Brisbane Airport Conference Centre PROGRAM www.airports.asn.au THE AUSTRALIAN AIRPORTS ASSOCIATION The AAA facilitates co-operation among all member airports and their many and varied partners in Australian aviation, whilst The Australian Airports Association (AAA) The AAA represents the interests of over contributing to an air transport system that is a non-profit organisation that was 380 members. This includes more than is safe, secure, environmentally responsible 260 airports and aerodromes Australia and efficient for the benefit of all Australians founded in 1982 in recognition of the real wide – from the local country community and visitors. need for one coherent, cohesive, consistent landing strip to major international and vital voice for aerodromes and airports gateway airports. The AAA is the leading advocate for throughout Australia. appropriate national policy relating to The AAA also represents more than airport activities and operates to ensure 120 aviation stakeholders and regular transport passengers, freight, and organisations that provide goods and the community enjoy the full benefits of a services to airports. progressive and sustainable airport industry. CONTACT US P: 02 6230 1110 E: [email protected] w: www.airports.asn.au Welcome to the AAA Pavement Technology Workshop and Lighting Workshop. These are two new events for 2018, and form part of the commitment the AAA has to provide the aviation industry with comprehensive technical training and research updates. We know how important it is to meet your peers and share ideas at these occasions, so we hope you enjoy the opportunity to attend our Networking Drinks, overlooking Brisbane Airport runway, at the Sky Lounge, IBIS. -

Sunshine Coast Airport Expansion

Sunshine Coast Airport Expansion “Field of Dreams” Presentation by ResDev Sunshine Coast Airport Expansion Background • The Sunshine Coast Council has submitted an EIS to the Queensland Coordinator General for the expansion of the Sunshine Coast Airport (SCA) with a new, 2.45km, east west runway. • ResDev, a subgroup of the Mudjimba Residents Association, has examined the EIS for the SCA Expansion and made submissions to the Coordinator General challenging a range of issues in the EIS. • Following an assessment of the 986 submissions from the public (85% opposed to the Project), the Coordinator General sought additional information from the proponent and then public comment on the Additional EIS. • The Coordinator General conditionally approved the EIS and AEIS in its report of May 2016. Sunshine Coast Airport Expansion Some Facts about the existing SCA • Main 18/36 runway -1793m x 30m Minor 12/30 runway - 695m x18m • Fully laden B737 and A320 aircraft can reach destinations on the east coast of Australia. • The runway length can reduce outbound carrying capacity to Auckland and Adelaide (by 17%). • Hence, the existing runway can service flights to 85% of the Australian and 90% of the NZ populations. Sunshine Coast • Since the airport opened in 1961 residential development in Mudjimba and Marcoola has avoided the flight path of 1230 east west Airport Expansion runway (bearing 308 degrees true north). • Through the mid 1980s to the 1998 Airport Master Plan the future east west (13/31) runway had a bearing of 316 degrees true north. • The Maroochy 2000 Plan also indicated the bearing of the future 1331 runway to be 316 degrees true north. -

Submission to the Joint Standing Commission on Treaties Military

Submission to the Joint Standing Commission on Treaties Military Training - Singapore EXECUTIVE SUMMARY Rockhampton Regional Council (RRC) welcomes the opportunity to make a submission to the Joint Standing Commission on Treaties into the ‘Agreement between the Government of Australia and the Government of the Republic of Singapore concerning Military Training and Training Area Development in Australia’ signed on 23 March 2020 (the Agreement). RRC recognises the close and comprehensive bilateral relationship with Singapore as one of Australia's closest and most comprehensive in Southeast Asia. Based on long-standing Commonwealth, defence, education, political, trade and tourism links, as well as on the two countries' similar strategic outlook, the relationship was elevated through the Joint declaration by the Prime Ministers of Australia and Singapore on a Comprehensive Strategic Partnership (CSP), signed on the occasion of the fiftieth anniversary of diplomatic relations between the two countries. The Rockhampton Region is proud and committed to continue its integral role in the defence of the nation through the provision of goods and services in support of Australia’s defence posture and the training activities conducted at the Shoalwater Bay Training Area (SWBTA) for over 50 years. It is equally proud of its role in supporting the annual military exercises undertaken at SWBTA since 1990 by the SAF personnel which has contributed to the comprehensive and longstanding defence and security partnership between the two countries and which has been strengthened by strong patterns of joint exercises and training and close collaboration in operational environments. The unique ties and relationships that have been established between the people and business community of Rockhampton and those in Singapore have deepened over the period of this longstanding relationship, benefitting our two countries and contributing to regional economic growth. -

Sunshine Coast Airport Preliminary Site Investigation March 2019

Airservices Australia Sunshine Coast Airport Preliminary Site Investigation March 2019 Executive summary Airservices Australia (Airservices) engaged GHD Pty Ltd to conduct a Preliminary Site Investigation (PSI) at the Sunshine Coast Airport (SCA) with particular regard to the potential for contamination from per- and poly-fluorinated alkyl substances (PFAS). Based on the review of available site history information, site inspection and site interviews, the following potential sources of PFAS have been identified: Areas in which Aviation Rescue Fire Fighting ARFF operate or have historically operated including: – The Former Fire Station and surrounding area – Fire station wash down areas and runoff – Former performance testing areas in grassed sites Incidents that may have included the discharge of foam including: – An Ansulite spill at the current fire station resulting in foam discharge into the main surface water drain – A small plane incident resulting in an operational release to the north west of the runway Other possible sources: – Irrigation of vegetated areas of the site with the fire trucks – Existing and former surface water drainage channels – Sediment routinely removed from airport drains and relocated on the site – Soil and sediment removed on the site when the drains were relined The desktop review identified the following potential sensitive receptors: Site workers Nearby residents using spear pumps Consumers of potentially impacted seafood from the down gradient surface water receiving environment of the surrounding -

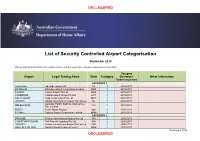

Airport Categorisation List

UNCLASSIFIED List of Security Controlled Airport Categorisation September 2018 *Please note that this table will continue to be updated upon new category approvals and gazettal Category Airport Legal Trading Name State Category Operations Other Information Commencement CATEGORY 1 ADELAIDE Adelaide Airport Ltd SA 1 22/12/2011 BRISBANE Brisbane Airport Corporation Limited QLD 1 22/12/2011 CAIRNS Cairns Airport Pty Ltd QLD 1 22/12/2011 CANBERRA Capital Airport Group Pty Ltd ACT 1 22/12/2011 GOLD COAST Gold Coast Airport Pty Ltd QLD 1 22/12/2011 DARWIN Darwin International Airport Pty Limited NT 1 22/12/2011 Australia Pacific Airports (Melbourne) MELBOURNE VIC 1 22/12/2011 Pty. Limited PERTH Perth Airport Pty Ltd WA 1 22/12/2011 SYDNEY Sydney Airport Corporation Limited NSW 1 22/12/2011 CATEGORY 2 BROOME Broome International Airport Pty Ltd WA 2 22/12/2011 CHRISTMAS ISLAND Toll Remote Logistics Pty Ltd WA 2 22/12/2011 HOBART Hobart International Airport Pty Limited TAS 2 29/02/2012 NORFOLK ISLAND Norfolk Island Regional Council NSW 2 22/12/2011 September 2018 UNCLASSIFIED UNCLASSIFIED PORT HEDLAND PHIA Operating Company Pty Ltd WA 2 22/12/2011 SUNSHINE COAST Sunshine Coast Airport Pty Ltd QLD 2 29/06/2012 TOWNSVILLE AIRPORT Townsville Airport Pty Ltd QLD 2 19/12/2014 CATEGORY 3 ALBURY Albury City Council NSW 3 22/12/2011 ALICE SPRINGS Alice Springs Airport Pty Limited NT 3 11/01/2012 AVALON Avalon Airport Australia Pty Ltd VIC 3 22/12/2011 Voyages Indigenous Tourism Australia NT 3 22/12/2011 AYERS ROCK Pty Ltd BALLINA Ballina Shire Council NSW 3 22/12/2011 BRISBANE WEST Brisbane West Wellcamp Airport Pty QLD 3 17/11/2014 WELLCAMP Ltd BUNDABERG Bundaberg Regional Council QLD 3 18/01/2012 CLONCURRY Cloncurry Shire Council QLD 3 29/02/2012 COCOS ISLAND Toll Remote Logistics Pty Ltd WA 3 22/12/2011 COFFS HARBOUR Coffs Harbour City Council NSW 3 22/12/2011 DEVONPORT Tasmanian Ports Corporation Pty. -

Queensland Airports Limited Submission, September 2018

Productivity Commission, Economic Regulation of Airports Queensland Airports Limited submission, September 2018 1 Contents 1.0 Executive Summary ........................................................................................................................... 3 2.0 Introduction ....................................................................................................................................... 4 3.0 Background ........................................................................................................................................ 5 4.0 The current system ............................................................................................................................ 7 4.1 The Queensland market and influence ......................................................................................... 7 South east Queensland and Northern NSW market and Gold Coast Airport .................................. 7 Townsville, Mount Isa and Longreach airports ............................................................................... 7 4.2 General factors .............................................................................................................................. 8 Airport charges ................................................................................................................................ 8 Airport leasing conditions ................................................................................................................ 9 4.3 Airport and airline negotiations.................................................................................................. -

MINUTES AAA QLD Division

MINUTES AAA QLD Division Wednesday 21 March 2018 Brisbane Airport Conference Centre, Brisbane Chair: Rob Porter – General Manager Mackay Airport Attendees: List of Attendees Attached Apologies: Rob MacTaggart (The Airport Group) 1. CONFIRMATION OF MINUTES FROM PREVIOUS MEETING: Noted minutes from last meeting. 2. WELCOME AND INTRODUCTIONS: Rob Porter (General Manager Mackay Airport) opened the meeting, welcomed members and thanked Smiths Detection for sponsoring the meeting. Also thanked our division dinner sponsors Trident Services and Airport Equipment. Noted the excellent presentation from Neil Scales at the dinner, noting that we will invite him back in 12 months’ time to share his experiences. Rob Porter (General Manager Mackay Airport) encouraged members to provide feedback to the AAA team on the recent communications innovations (airport professional, the centre line, social media, etc.) The hot topics section at the end of the agenda was noted and the Chair, encouraged members to share their thoughts. Rob Porter (General Manager Mackay Airport) encouraged members to provide feedback on the number and structure of division meetings. Noted ‘out of the box’ topic suggestions are always welcome. Rob Porter (General Manager Mackay Airport) provided members with an overview of the agenda. Noting the ‘around the tarmacs’ section and encouraged members share their activity. QLD Overview Rob Porter (General Manager Mackay Airport) noted increase pressure across the state in access to aircraft, this has put upwards pressure on regional airfares in particular. 1 3. AAA UPDATE Simon Bourke (Policy Director AAA) noted key topics that the AAA had been working on over the past 6 months. Security Changes Proposed changes to Aviation Security will have an impact on all aviation sectors. -

Caloundra Aerodrome Att 3 Business Strategy

Caloundra Aerodrome Att 3 Business Strategy Caloundra Aerodrome Business Strategy Caloundra Aerodrome Att 3 Business Strategy August 2012 Table of Contents Table of Contents ............................................................................................................ 2 1 Executive Summary........................................................................................ 5 1.1 Purpose of Business Strategy 5 1.2 Site 5 1.3 Business Objectives 8 1.4 Business Outcomes 9 2 Introduction................................................................................................... 10 2.1 Purpose of Business Strategy 10 2.2 Context – the General Aviation History 10 2.2.1 Aviation Support Industries 11 2.2.2 GA Industry Drivers 11 3 Situational Analysis...................................................................................... 12 3.1 Background 12 3.2 Site Characteristics 13 3.3 Current Utilisation 14 3.4 Surrounding Uses 15 3.5 Strategic Risks 16 3.6 Operational Risks 17 4 Business Objective....................................................................................... 18 4.1 Regional Outcomes 18 4.2 Financial Objectives 18 4.3 Aerodrome Management 19 4.4 Operational Objectives – Aerodrome Regulatory System 20 4.5 Revenue Growth Objectives 20 4.6 Cost Management Objectives 21 4.7 Tenant Commercial Relationship and Customer Service Objective 21 5 Demand Analysis.......................................................................................... 22 2 of 45 Caloundra Aerodrome Att 3 Business Strategy -

AAA Queensland Division Meeting

MINUTES (Aide Memoire) AAA Queensland Division Meeting 08/09 March 2017 Amsterdam Room, Brisbane Airport Corporation Chair: Rob Porter 1. Welcome and Apologies (Rob Porter – Divisional Chair) Rob Porter, the AAA Queensland division chair, welcomed members and new members to the meeting and advised apologies had been received from: Peter Dunlop (Brisbane Airport) Peter Pallot (Sunshine Coast) Robert Pugsley (OTS) Duncan Bird (Archerfield) Rob thanked the sponsors of the event, Queensland Airport Lighting (Meeting) and Smiths Detection (Dinner), and called on members present to introduce themselves advising which airport or business they were representing. Rob encouraged all members to continue to read the regular AAA e-news alerts and AAA papers that are available on the website. Attendees to the meeting were noted as listed on the final page. 2. AAA Update & 3. AAA Policy Update (Caroline Wilkie - CEO, AAA) The most significant issues covered were: The Pavement & Lighting Forum - May 2017 AAA National Conference Adelaide – 13-17 November 2017 Airfield Lighting and Pavement Practice Notes Launch of Webinar Program Launch of online education program CASA MOS 139 Review Review of Services 4. AAA Education Launch (Andrew Goodlace - Education Manager, AAA) Andrew outlined some new online training that has been made available to members and encouraged them to visit the education website: www.airporteducation.asn.au ASO/WSO course now available Wildlife Hazard Management Essentials Course 1 Additionally there are several courses still in development: 1. Airside Safety Essentials 2. Airfield Lighting Essentials 3. WSO – Time Limited Works The AAA also facilitates a broad range of working groups for stakeholders and members to participate in and attend. -

A Copy of the Sunshine Coast Airport Briefing Presentation by CEO

INFRASTRUCTURE ASSOCIATION OF QUEENSLAND PROJECT & INVESTMENT FACILITATION TASKFORCE New runway, new horizons MARCH 2020 Sunshine Coast Airport History Transition to private operator (Palisade Investment Partners) under 99 year lease Terminal agreement with SCC Officially redevelopment 2007 Terminal opened as detailed 2004 Masterplan redevelopment2012 Preliminary work Maroochy adopted by construction 1983 designJetstar phase begins Air New Zealand begins on new runway Airport Sunshine Coast starts Control tower built Early 2021servicesto begins services mid 2021 Council (SCC) End 2021 19612020 2017 2009 2016 1962 1997 2002 Renamed EIS approved First hangar built Current terminal Virgin Blue constructed and Qantas Sunshine Coast begin services Airport New runway, new horizons MARCH 2020 Why More than One of the Game-changing Sunshine Coast Queensland’s expand our 1.3m fastest projects worth expected population fastest growing passengers growingairports $12.5b 580K airport? annually inAustralia beingdelivered by 2041 visitor region New runway, new horizons MARCH 2020 Catchment area Sunshine Coast region Includes Sunshine Coast, Wide Bay SUNSHINE 800k and Moreton Bay North COAST BRISBANE Sunshine Coast greaterregion TOOWOOMBA Includes South East Queensland up to 3.6m Bundaberg and west to Toowoomba New runway, new horizons MARCH 2020 New runway Terminal New runway, new horizons MARCH 2020 redevelopment project Terminal New runway, new horizons MARCH 2020 Timeline & Milestones Terminal Terminal redevelopment Terminal redevelopment detailed -

Sunshine Coast Economic Development Strategy 2013-2033: Sunshine Coast – the Natural Advantage

1 DISCLAIMER This document has been produced as supporting information for the Draft Sunshine Coast Economic Development Strategy 2013-2033: Sunshine Coast – The Natural Advantage. It represents an overview and analysis of some of the research, data and reports that have informed the development of the draft Strategy. All major research documents and sources are identified in Appendix 1. Nothing in this document should be regarded as an endorsement (either expressly or implied) of the primary and secondary research sources referenced in the document. i TABLE OF CONTENTS 1. Introduction 1 Purpose of the Draft Research Compendium 1 Frequently Used Terms 1 About the Draft Strategy 1 Summary conclusions based on key research findings that have informed the draft Strategy 2 2. Regional Overview – where are we now as a region? 5 Place 5 People 5 The Economy 7 3. Economic Challenges – what is the evidence suggesting we should change in the region’s economy? 11 Business and Industry Base 11 Profile of the Region’s Business Sector 13 Workforce 15 Demographics 19 4. Competitive Analysis – what are the emerging opportunities and where are the region’s competitive strengths? 20 Global, National and Regional Trends and Regional Opportunities 20 Major Infrastructure 21 Growth Industries 21 Education, Research and Development 22 Retail 23 Land Use 23 Tourism and Lifestyle 23 Proximity 23 5. The New Economy – how will we transition to a new economy? 24 Key Sectoral Growth Opportunities 24 Anticipated Growth for Traditional Industries 29 Capital Investment 30 Local-to-Global Connections 31 Talent and Skills 32 Appendix 1: Primary and Secondary Research Sources 34 ii 1. -

Transformingseq the SEQ City Deal Proposition February 2019 Working Together for an SEQ City Deal

TransformingSEQ The SEQ City Deal Proposition February 2019 Working together for an SEQ City Deal South East Queensland (SEQ) is a region of And it’s why the Queensland Government and the Council unmatched potential, with the ability to combine its of Mayors (SEQ) have been working together for several natural assets, people, economic opportunity and years to develop the concept of a City Deal for SEQ. liveability to deliver a significant contribution to the Our long-standing partnership to develop an SEQ state and national economy. City Deal is focused on securing the future prosperity It is the idyllic lifestyle, geographic advantage and and liveability of our region, and means we are more economic diversity that attracts both talent and prepared than any other region in Australia to deliver investment to our region, which is expected to grow a strategic and transformational agreement that will by almost two million people in the next 25 years. deliver an enduring benefit for our communities and the nation. While this growth is an opportunity for SEQ, it cannot come at the cost of liveability and lifestyle. Our idea to develop a City Deal was the first of its kind in Australia, and contributed to the Australian Government In short, we need to make sure growth means SEQ including the concept in their Smart Cities Plan in 2016. gets better, not just bigger. State and local governments have long recognised this – it’s why we have a long history developing and implementing the South East Queensland Regional Plan. TransformingSEQ, the SEQ City Deal Proposition, is the Our aspiration for an SEQ City Deal comes at a time next step in our journey towards a City Deal.