Series Llcs, the UCC, and the Bankruptcy Code— a Series of Unfortunate Events?

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Series Limited Liability Company Instructions

Series Limited Liability Company Instructions Wyoming Secretary of State Herschler Building East, Suite 101 122 W 25th Street Cheyenne, WY 82002-0020 307.777.7311 [email protected] Before Filing Please Note: _________________________________________________________________ Pursuant to W.S. 17-29-108, the name must include the words “Limited Liability Company,” or its abbreviations “LLC,” “L.L.C.,” “Limited Company,” “LC,” “L.C.,” “Ltd. Liability Company,” “Ltd. Liability Co.,” or “Limited Liability Co.” If established, the names of each series must be listed in accordance with Chapter 5 of the Business Entities Rules. Under the circumstances specified in W.S. 17-28-104(e), an email address is required. Filing fee of $100.00 plus $10.00 for each series established. Visa or MasterCard payment available for online filings only. To file online, visit: https://wyobiz.wyo.gov. Make check or money order payable to Wyoming Secretary of State for paper filings. Annual reports are due every year on the first day of the anniversary month of formation. If not paid within 60 days of the due date the entity will be subject to dissolution. The limitations on liabilities must be set forth in the Operating Agreement and must be listed in your articles. Processing time is up to 15 business days following the date of receipt in our office. Please review the form prior to submission. The Secretary of State’s Office is unable to process incomplete forms. Additional Contact Information: ___________________________________________________________ Department of Revenue (Sales and Use Tax Information) o Ph. 307.777.5200 OR https://revenue.state.wy.us/ Wyoming Business Council (Licensing or Permit Information) o Ph. -

ILLINOIS SERIES LLC's: Cost Effective Means to Limit Liability

ILLINOIS SERIES LLC'S: Cost Effective Means to Limit Liability Approximately two years ago, the Illinois Limited Liability Company Act was amended to allow for the creation of series limited liability companies ("Series LLCs"). Illinois followed Delaware, which introduced the Series LLC in 1996 in an effort to allow business owners to lower up-front costs and long term maintenance expenses for limited liability companies. While Series LLCs are widely used, especially within the real estate business sector, many business owners still do not know or understand the advantages of operating their business as a Series LLC. Like a corporation or a non-series limited liability company, a Series LLC is treated as a single legal entity. A Series LLC files a single annual report and pays a single annual fee. However, the "master" or "parent" Series LLC is permitted to form multiple or "subs" or "mini" limited liability companies under the framework of the master. Each sub formed under the master may have the same or different ownership and management structure. By electing to designate limited liability company as a Series LLC, a business owner may, at any time, form a sub by filing a registration of series with the Illinois Secretary of State. The up- front costs are a bit more than for a standard limited liability company, $750.00 compared to $500.00, but each registration of a new sub is only $50.00. Previously established limited liability companies may also be converted to a Series LLC by filing an article of amendment with the Illinois Secretary of State along with the appropriate filing fee. -

Series Limited Liability Company

A Series Limited Liability Company (Series LLC) is a form of entity that allows a single “master” LLC to partition its assets and liabilities among various cells known as Sub-LLCs. Each Sub-LLC may have different assets, operations, and/or investment objectives, and the members and managers, as well as their rights, obligations, and their sharing ratios, may be varied. The profits, losses, and liabilities of each Sub-LLC are legally separate from the other Sub-LLCs, which provides a liability shield between each Sub-LLC and the Series LLC. The Series LLC effectively creates a Parent/Subsidiary structure without requiring the administrative complexity and cost of creating “and managing multiple LLCs; the structure is similar to that of an S corporation with a Qualified Subchapter S Subsidiary (known as a QSUB). A Series LLC may be appropriate where a business has a variety of assets or operations that would benefit from liability protection from each other, or where multiple owners have different interests in the business or in different parts of the business operations. A Series LLC may be appropriate in various situations, such as: real estate development; oil and gas exploration; professional businesses; artists and musicians, manufacturing and distribution; hedge funds and private equity; or franchise businesses. The potential benefits of a Series LLC include reduced administrative costs and fewer state filings, liability protection for each Sub-LLC and the Series LLC, and the ease of adding or terminating individual Sub-LLCs. Additionally, distributions can be made from any Sub-LLC, and each Sub-LLC may have a different sharing ratio. -

19LSO-0059 V0.6 Series LLC Naming and Designation Requirements

2019 STATE OF WYOMING 19LSO-0059 Working Draft 0.6 DRAFT ONLY NOT APPROVED FOR INTRODUCTION HOUSE BILL NO. [BILL NUMBER] Series LLC naming and designation requirements. Sponsored by: HDraft Committee A BILL for 1 AN ACT relating to business entities; specifying that a series 2 limited liability company may be named or designated in any 3 manner; requiring registered agents to maintain series naming 4 or designation information; prohibiting the adoption of rules 5 relating to series naming or designation requirements and 6 filing requirements; requiring the repeal of specified rules; 7 making an appropriation; and providing for an effective date. 8 9 Be It Enacted by the Legislature of the State of Wyoming: 10 11 Section 1. W.S. 17-29-211 by creating new subsection 12 (o) is created to read: 13 1 [Bill Number] 2019 STATE OF WYOMING 19LSO-0059 Working Draft 0.6 1 17-29-211. Series of members, managers, transferable 2 interests or assets. 3 4 (o) A series may be named or designated in any manner 5 consistent with the operating agreement of the series or the 6 articles of organization of a limited liability company. The 7 secretary of state shall not adopt rules specifying naming or 8 designation requirements for series created under this 9 section. 10 11 Section 2. W.S. 17-28-107 is amended to read: 12 13 17-28-107. Duties of the registered agent; duties of 14 the entity. 15 16 (a) The registered agent shall: 17 18 (v) Maintain at the registered office, the 19 following information for each domestic entity represented 20 which shall be current within sixty (60) days of any change 21 until the entity's first annual report is accepted for filing 22 with the secretary of state and thereafter when the annual 2 [Bill Number] 2019 STATE OF WYOMING 19LSO-0059 Working Draft 0.6 1 report is due for filing and shall be maintained in a format 2 that can be reasonably produced on demand: 3 4 (D) Names or designations of each series 5 created under W.S. -

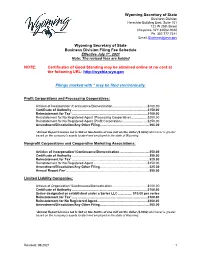

Wyoming Secretary of State Business Division Filing Fee Schedule Effective July 1St, 2021 Note: the Revised Fees Are Bolded

Wyoming Secretary of State Business Division Herschler Building East, Suite 101 122 W 25th Street Cheyenne, WY 82002-0020 Ph. 307.777.7311 Email: [email protected] Wyoming Secretary of State Business Division Filing Fee Schedule Effective July 1st, 2021 Note: The revised fees are bolded NOTE: Certificates of Good Standing may be obtained online at no cost at the following URL: http://wyobiz.wyo.gov Filings marked with * may be filed electronically. Profit Corporations and Processing Cooperatives: Articles of Incorporation*/Continuance/Domestication ....................................... $100.00 Certificate of Authority ....................................................................................$150.00 Reinstatement for Tax* ....................................................................................$100.00 Reinstatement for No Registered Agent (Processing Cooperative) ..................$200.00 Reinstatement for No Registered Agent (Profit Corporation) ............................$250.00 Amendment/Dissolution/Any Other Filing....................................................... $60.00 *Annual Report License tax is $60 or two-tenths of one mill on the dollar ($.0002) whichever is greater based on the company’s assets located and employed in the state of Wyoming. Nonprofit Corporations and Cooperative Marketing Associations: Articles of Incorporation*/Continuance/Domestication .................................$50.00 Certificate of Authority ......................................................................................$50.00 -

Delaware Series Llc

MAJOR CHANGES TO THE DELAWARE SERIES LLC August 1, 2019 Lacee J. Wentworth, J.D. Associate, Handler Thayer, LLP Many lawyers advise their clients to form or incorporate their companies in Delaware due to, among other reasons, Delaware’s prestigious Court of Chancery that specializes in corporate law and resolving business disputes on an expedited basis without a jury. The high volume of cases in Delaware means a more predictable outcome for clients. In fact, many publicly traded companies and Fortune 500 companies have incorporated in Delaware regardless of their principal location. Since 1996 the Delaware Limited Liability Company Act (the “Act”) has allowed the formation of limited liability companies (“LLCs”) with or without series, having characteristics like that of a separate LLC. Each separate series can have separate members, managers, classes of limited liability interests, assets, business purpose and investment objectives. Under the Act, each series is treated as an entity separate from each other series of the same LLC and the LLC itself, which is often referred to as the “series LLC” or “master LLC.” Series LLCs A series LLC is an alternative business structure to forming multiple, independent LLCs to segregate and protect a company’s proposed assets. This novel business structure is often useful when utilized by family offices with multiple investment strategies and classes of assets, real estate investors who own several properties or companies that own multiple brands or other intellectual property. However, many lawyers and business owners do not form series LLCs due to many issues and challenges with the alternative business structure. -

Lending to Series Limited Liability Companies: Subscription Credit Facility Considerations Kristin Rylko, Haukur Gudmundsson, Vincent Zuffante1

ARTICLE Lending to Series Limited Liability Companies: Subscription Credit Facility Considerations Kristin Rylko, Haukur Gudmundsson, Vincent Zuffante1 Introduction Background As the private equity asset class continues to A Series LLC is generally created pursuant to expand2 and private equity fund managers the laws of the applicable jurisdiction of respond to demand by investors for ever- formation. A defining feature of a Series LLC is more bespoke products and tailored the ability to create an unlimited number of investments, there has been an increase in the segregated subunits or series (each, a “Series”) use of alternative fund structures to under the umbrella of a single “master” LLC accommodate such demand. In addition to (or LP), permitting each Series to have the proliferation of separate accounts, funds- separate members, managers, equity interests, of-one and co-investment structures, the use assets, liabilities and business objectives of vehicles that employ series, cell or other associated to it, with an internal liability shield asset and liability segregation technology has as among the Series that is intended to be increased, bringing with it opportunities and enforceable against creditors and other potential challenges when leverage at the counterparties. This is in contrast to a fund or individual series level is sought. traditional limited liability company, which may have different classes of members that The use of series in a limited liability company have different rights, assets or liabilities (a “Series LLC”)3 offers many potential benefits associated with such class, but such internal to a private equity fund (a “Fund”) manager organizational structure is not intended to and its investors; however, for lenders impact the obligations and liability of the interested in advancing credit to a Series LLC limited liability company as against creditors or a series thereof, it is important to and counterparties. -

IRS Issues Long-Awaited Guidance on Series Llcs; Will the States Soon Follow?

Journal of Multistate Taxation and Incentives Volume 20, Number 9, January 2011 Department: S CORPORATIONS, PARTNERSHIPS, AND LLCs IRS Issues Long-Awaited Guidance on Series LLCs; Will the States Soon Follow? As the use of series LLCs inevitably grows, it will be crucial for state and local taxing authorities to provide their own guidance regarding whether they also will treat a series as a separate entity. By: MICHAEL W. McLOUGHLIN AND BRUCE P. ELY MICHAEL W. McLOUGHLIN is a partner in the New York City office of the international law firm of Reed Smith LLP. BRUCE P. ELY is a partner in the Birmingham, Alabama office of the multistate law firm of Bradley Arant Boult Cummings LLP. The authors have previously written for The Journal. Copyright © October 2010. Michael W. McLoughlin/Bruce P. Ely. All rights reserved. This article appears in and is reproduced with the permission of the Journal of Multistate Taxation and Incentives, Vol. 20, No. 9, January 2011. Published by Warren, Gorham & Lamont, an imprint of Thomson Reuters.” In January 2007, the authors published an article in this Journal 1 addressing a number of potential state and local tax issues raised by a relatively new form of entity known as a "series limited liability company" ("series LLC"), the formation of which had been authorized under the laws of a handful of states. 2 There are two primary purposes of the series LLC provision: (1) to essentially subdivide the LLC into separate series between or among which a liability shield can be put in place; and (2) to minimize legal, accounting, and recording fees that might otherwise accrue when creating separate single-member LLCs underneath a series organization or "master LLC" (our term). -

Series Llcs: Nuts and Bolts, Benefits and Risks, and the Uncertainties That Remain

SERIES LLCS: NUTS AND BOLTS, BENEFITS AND RISKS, AND THE UNCERTAINTIES THAT REMAIN Jennifer Avery, David Lawrence, Todd Lowther, Karen Rose, Joshua Russ, Brandon Schubert, Andrew Wootton & Travis Youngblood* TABLE OF CONTENTS I.INTRODUCTION ............................................................................................. 10 A. Definition of a Series LLC .................................................................... 10 B. History of the Series LLC ...................................................................... 10 C. Laws Authorizing Series LLCs ............................................................. 11 D. The Appeal of Series LLCs ................................................................... 11 E. Article Overview .................................................................................... 12 II.FORMATION, GOVERNANCE, AND STRUCTURE.................................... 12 III. RISKS AND POTENTIAL USES ..................................................................... 14 A. Hazards of a Series LLC ....................................................................... 14 B. Potential Uses of a Series LLC .............................................................. 16 IV. TAXES .............................................................................................................. 17 A. Federal Tax Issues ................................................................................. 17 B. State Tax Issues .................................................................................... -

The Series Llc and Captives – a Brief History

CONTRIBUTOR FEATURE | GORDON, FOURNARIS & MAMMARELLA THE SERIES LLC AND CAPTIVES – A BRIEF HISTORY Jeff rey Simpson and Andrew Rennick of Gordon, Fournaris & Mammarella provide a unique look at Series LLC and captives he use of Series Limited Liability provide for the creation of series statutory Companies (Series LLC) is one of trusts. Six years later, the Delaware Lim- the most signifi cant innovations ited Liability Company Act (DLLCA) was Jeeff rrey Simmppson Tin captive insurance over the past amended to permit the creation of Series ten years. Similar to a protected LLCs. cell company (PCC), a Series LLC permits the segregation of assets and liabilities into Jeffrey Simmpsonn is a director at the Wilmington Delaware creates the Series LLC various series, each of which can be oper- law fi rm of Gordon, Fournaris & Mammarella. Jeff ’s The 1996 revisions to the DLLCA provided ated as a separate captive insurance com- practice focuses on the formation, regulation and a much more detailed description of the governance of captive insurance companies. He pany. This permits sponsors and users of is a founder and director of the Delaware Captive series than the original statutory trust act, Series LLC structures to achieve fl exibility, Insurance Association. He chaired and continues particularly as it pertains to how to safe- cost savings and administrative effi ciency. to serve on the committee that drafted Delaware’s guard the separateness of each series for Given that Series LLCs have only been updated captive insurance statute in 2005. the purpose of limiting liability of a series’ used in captive programmes since 2010, obligation to that series’ assets. -

The Series Llc – the Next Frontier

2017 STANLEY M. JOHANSON ESTATE PLANNING WORKSHOP December 15, 2017 Austin, Texas THE SERIES LLC – THE NEXT FRONTIER GENE WOLF Kemp Smith LLP www.kempsmith.com 221 North Kansas 919 Congress Avenue 3800 E. Lohman Avenue Suite 1700 Suite 1305 Suite C El Paso, Texas 79901 Austin, Texas 78701 Las Cruces, New Mexico 88011 (915) 533-4424 (512) 320-5466 (575) 527-0023 1463829v.1 99000/10000 Gene Wolf Kemp Smith LLP 221 N. Kansas Street, Suite 1700 El Paso, Texas 79901 (915) 543-6441 Fax: (915) 546-5360 [email protected] BIOGRAPHICAL INFORMATION Gene Wolf is a native El Pasoan. He earned his B.B.A. from Baylor University in 1988 and his J.D. from Baylor School of Law in 1991. He began practicing law at Kemp Smith LLP as an associate in 1991 and has been a partner since 1997. Gene is currently a member of the Business Department with practice emphasis on tax, estate and business planning, and is a member of the Firm’s Management Committee. Gene currently serves as Managing Partner of the Firm. His specialties are corporate, business, tax and estate planning. Since 2012, Gene has served on the Board of Directors of Hunt Companies, Inc. and as chair of the Governance and Nominating and Ethics Committee. Gene is a Fellow in the American College of Trust and Estate Counsel (ACTEC) and is Board Certified by the Texas Board of Legal Specialization in Estate Planning and Probate Law. Gene is the current President of the Texas Federal Tax Institute, which brings together leading corporate, partnership and real estate tax professionals from across the United States and is regarded as the premier federal tax event in the Southwest. -

Pros and Cons of the Series LLC

cAPITAL Editor: Kate Glaze 2016 Issue One Pros and Cons of the Series LLC By Laura Hebert 214.855.3109 | [email protected] Texas is one of about 16 states that permit the use of series limited liability companies (“LLC”). Under the series LLC structure, an LLC (referred to here as the “master LLC”) can create separate series to hold different assets that may or may not be under common ownership and/or management with the master LLC or any other series. The series LLC structure has two main advantages. The first is its potential to compartmentalize liabilities: as long as certain conditions are met, the assets of each series are shielded from the liabilities of the other series and the master LLC. Second, the series LLC structure can reduce costs and streamline administration because, in Texas at least, only the master LLC must file a certificate of formation, pay the filing fee, and file annual reports, and, in some cases, only the master LLC may be required to file tax returns. But while a series LLC as a form of business entity may have many benefits, there are also some negatives that may not make it the right fit in all circumstances. This article reviews the basics of the Texas series LLC structure and the reasons why it may (or may not) be the right form of entity in a given situation. In Texas, a series LLC is formed in the same way as any other LLC, i.e., by filing a certificate of formation with the Texas Secretary of State and adopting a company agreement.