1 Press Release Update on the On-Going

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Technicolor 2015 Consolidated Financial Statements

TECHNICOLOR 2015 CONSOLIDATED FINANCIAL STATEMENTS Consolidated statement of operations 2 Consolidated statement of comprehensive income 3 Consolidated statement of financial position 4 Consolidated statement of cash flows 6 Consolidated statement of changes in equity 7 Notes to the consolidated financial statements 1. General information .................................................................................................................................................. 8 2. Accounting policies ................................................................................................................................................... 9 3. Group critical accounting estimates and judgments ............................................................................................... 11 4. Scope of consolidation ........................................................................................................................................... 13 5. Information by operating segments and by geographic areas ............................................................................... 22 6. Selling and administrative expenses and other income (expense) ........................................................................ 27 7. Research and development expenses ................................................................................................................... 27 8. Net impairment losses on non-current operating assets ....................................................................................... -

Notice of Meeting Annual General Shareholders’ Meeting of Technicolor to Be Held on Thursday, June 17, 2010 at 5:00 P.M

Notice of meeting Annual General Shareholders’ Meeting of Technicolor To be held on Thursday, June 17, 2010 at 5:00 p.m. At the Palais des Congrès de Paris 2, place de la Porte-Maillot - 75017 Paris On first notice* Contents page AgendA 2 HOw tO pArticipAte in tHe meeting 3 tecHnicOlOr in 2009 5 Organization 5 Reviewofactivities 5 Consolidatedresults 7 Balancesheetrestructuring 10 Strategyandoutlook 11 Parentcompanyresults 12 Keyfinancialdata 13 explAnAtOry cOmments On tHe resOlutiOns 14 infOrmAtiOn AbOut tHe directOrs wHOse rAtificAtiOn Of tHe cO-OptAtiOn, tHe renewAl Of tHe term Of Office, Or tHe AppOintement Are submitted fOr ApprOvAl tO tHe sHAreHOlders’ meeting 16 prOpOsed resOlutiOns 19 finAnciAl results Of tHe pArent cOmpAny fOr tHe lAst five fiscAl yeArs 21 request fOr dOcuments And infOrmAtiOn 23 * In case of a lack of quorum, the Meeting will be convened on second notice by June 30, 2010. AgendA To be considered by The ordinary shareholders’ MeeTing n Board of Directors’ report and statutory auditors’ report on the annual and consolidated accounts for the fiscal year ended December 31, 2009 and special report of the statutory auditors on regulated agreements; n Report of the Chairman of the Board of Directors on the preparation and organization of the Board’s activities and on internal control procedures and risk management, and the statutory auditors’ report relating to the report of the Chairman of the Board of Directors; n Resolution n°1: Approval of the parent company unconsolidated financial statements for the fiscal year -

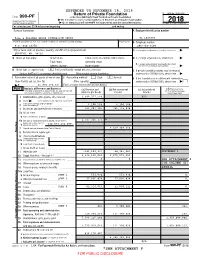

990-PF Or Section 4947(A)(1) Trust Treated As Private Foundation | Do Not Enter Social Security Numbers on This Form As It May Be Made Public

EXTENDED TO NOVEMBER 15, 2019 Return of Private Foundation OMB No. 1545-0052 Form 990-PF or Section 4947(a)(1) Trust Treated as Private Foundation | Do not enter social security numbers on this form as it may be made public. Department of the Treasury 2018 Internal Revenue Service | Go to www.irs.gov/Form990PF for instructions and the latest information. Open to Public Inspection For calendar year 2018 or tax year beginning , and ending Name of foundation A Employer identification number BILL & MELINDA GATES FOUNDATION TRUST 91-1663695 Number and street (or P.O. box number if mail is not delivered to street address) Room/suite B Telephone number P.O. BOX 23350 206-709-3100 City or town, state or province, country, and ZIP or foreign postal code C If exemption application is pending, check here ~ | SEATTLE, WA 98102 G Check all that apply: Initial return Initial return of a former public charity D 1. Foreign organizations, check here ~~ | Final return Amended return 2. Foreign organizations meeting the 85% test, Address change Name change check here and attach computation ~~~~ | X H Check type of organization: Section 501(c)(3) exempt private foundation E If private foundation status was terminated Section 4947(a)(1) nonexempt charitable trust Other taxable private foundation under section 507(b)(1)(A), check here ~ | X I Fair market value of all assets at end of yearJ Accounting method: Cash Accrual F If the foundation is in a 60-month termination (from Part II, col. (c), line 16) Other (specify) under section 507(b)(1)(B), check here ~ | | $ 46,894,654,661. -

ANNUAL REPORT 2012 ANNUAL REPORT Including Theannual Financial Report 2012 50/317:29 115/04/13 5 / 0 4 / 1 3

2012 ANNUAL REPORT REPORT ANNUAL Corporate Headquarters: 1-5, rue Jeanne d’Arc 92130 Issy-les-Moulineaux – France E-mail: [email protected] Tel.: +33 (0)1 41 86 50 00 – Fax: +33 (0)1 41 86 58 59 Technicolor Inc. 6040 Sunset Blvd Hollywood, CA 90 028 USA Tel.: +1 (323) 817 6600 www.technicolor.com ANNUAL REPORT 2012 Technicolor S.A. with a share capital of €335,543,841 – 333 773 174 R.C.S. Nanterre including the Annual Financial Report TTEN2012EN2012_D DRFRF_E ENN_C COUVOUV_P PLANCHE.inddLANCHE.indd I 115/04/135/04/13 1 17:297:29 PRESENTATION OF THE GROUP AND TECHNICOLOR ITS ACTIVITIES ................................................................................................................................................................................................... 5 AND ITS SHAREHOLDERS ...........................................................................................................................93 1 1.1 financial data ..................................................................................................................................................................... 6 5 5.1 Share capital ............................................................................................................................................................................................................. 94 1.2 History and strategy of the Company .................................................................................................. 8 5.2 Listing information ................................................................................................................................................................................100 -

Audited Consolidated Financial Statements As of December 31, 2019

TECHNICOLOR 2019 CONSOLIDATED FINANCIAL STATEMENTS Audited consolidated financial statements as of December 31, 2019 1 TECHNICOLOR 2019 CONSOLIDATED FINANCIAL STATEMENTS CONSOLIDATED STATEMENT OF OPERATIONS 3 CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME 4 CONSOLIDATED STATEMENT OF FINANCIAL POSITION 5 CONSOLIDATED STATEMENT OF CASH FLOWS 7 CONSOLIDATED STATEMENT OF CHANGES IN EQUITY 8 NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS 1. GENERAL INFORMATION ............................................................................................................................... 9 1.1. MAIN EVENTS OF THE YEAR ............................................................................................................................................ 9 1.2. ACCOUNTING POLICIES .................................................................................................................................................. 9 2. SCOPE OF CONSOLIDATION ....................................................................................................................... 17 2.1. SCOPE AND CONSOLIDATION METHOD ........................................................................................................................... 17 2.2. CHANGE IN THE SCOPE OF CONSOLIDATION OF 2019 ..................................................................................................... 18 2.3. CHANGE IN THE SCOPE OF CONSOLIDATION 2018 .......................................................................................................... 18 -

Annual Report 2013.Pdf

PRESENTATION OF THE GROUP AND ITS SOCIAL INFORMATION AND 1 ACTIVITIES ................................................................................................................................................................................................................................ 5 6 SUSTAINABILITY ....................................................................................................................................................................................... 111 1.1 Selected financial information ........................................................................................................................ 6 6.1 Employees and workforce ...................................................................................................................................... 112 1.2 History and strategy of the Company .................................................................................... 8 6.2 Environmental matters .................................................................................................................................................. 126 1.3 Business overview ................................................................................................................................................................................. 15 6.3 Stakeholder relations and local impacts of the Company’s activities ........................................................................................................................................................... -

In the United States District Court for the Eastern District of Texas Marshall Division

Case 2:16-cv-00322-JRG-RSP Document 55 Filed 04/25/16 Page 1 of 118 PageID #: 773 IN THE UNITED STATES DISTRICT COURT FOR THE EASTERN DISTRICT OF TEXAS MARSHALL DIVISION ROVI GUIDES, INC., Case No. 2:16-cv-00322 Plaintiff, DEMAND FOR JURY TRIAL v. FIRST AMENDED COMPLAINT FOR PATENT INFRINGEMENT COMCAST CORPORATION; COMCAST CABLE COMMUNICATIONS, LLC; COMCAST CABLE COMMUNICATIONS MANAGEMENT, LLC; COMCAST OF HOUSTON, LLC; COMCAST BUSINESS COMMUNICATIONS, LLC; COMCAST HOLDINGS CORPORATION; COMCAST SHARED SERVICES, LLC; ARRIS INTERNATIONAL PLC; ARRIS GROUP INC.; ARRIS TECHNOLOGY, INC.; ARRIS ENTERPRISES LLC.; ARRIS SOLUTIONS, INC.; PACE LTD.; PACE AMERICAS HOLDINGS, INC.; PACE AMERICAS INVESTMENTS, LLC; PACE AMERICAS, LLC; TECHNICOLOR SA; TECHNICOLOR USA, INC.; and TECHNICOLOR CONNECTED HOME USA LLC, Defendants. Plaintiff Rovi Guides, Inc. (“Rovi Guides”) (“Rovi Guides,” “Rovi,” or “Plaintiff”) hereby brings this First Amended Complaint for patent infringement (“Complaint”) against Comcast Corporation; Comcast Cable Communications, LLC; Comcast Cable Communications Management, LLC; Comcast of Houston, LLC; Comcast Business Communications, LLC; Comcast Holdings Corporation; Comcast Shared Services, LLC (all Comcast entities, collectively, “Comcast” or “Comcast Defendants”); Arris International plc; Arris Group Inc.; Case 2:16-cv-00322-JRG-RSP Document 55 Filed 04/25/16 Page 2 of 118 PageID #: 774 Arris Technology, Inc.; Arris Enterprises LLC; Arris Solutions, Inc.; Pace Ltd.; Pace Americas Holdings, Inc.; Pace Americas Investments, LLC; Pace Americas, LLC (all Arris and Pace entities, collectively, “Arris” or “Arris Defendants”); Technicolor SA; Technicolor USA, Inc.; Technicolor Connected Home USA LLC (all Technicolor entities, collectively, “Technicolor” or “Technicolor Defendants”); (Arris and Technicolor, collectively, “Manufacturer Defendants”) (all defendant entities, collectively, “Defendants”) for infringement of U.S. -

Technicolor Notice of Meeting June 30, 2020 Message from the Chairperson and the Chief Executive Officer 1

NOTICE OF MEETING COMBINED GENERAL SHAREHOLDERS’ MEETING OF TECHNICOLOR June 30, 2020 at 10 am TECHNICOLOR 8-10, rue du Renard 75004 Paris NOTICE OF MEETING COMBINED GENERAL SHAREHOLDERS’ MEETING June 30, 2020, at 10 am TECHNICOLOR 8-10, rue du Renard 75004 Paris C o n t e n t s 1. MESSAGE FROM THE CHAIRPERSON AND THE CHIEF EXECUTIVE OFFICER 3 2. OVERVIEW OF TECHNICOLOR IN 2019 4 3. TECHNICOLOR IN 2019 6 4. TECHNICOLOR’S GOVERNANCE 14 5. AGENDA 28 6. EXPLANATORY COMMENTS AND TEXT OF THE RESOLUTIONS 30 7. SUMMARY OF THE FINANCIAL AUTHORIZATIONS AND DELEGATIONS IN PLACE 58 8. PARTICIPATE IN THE GENERAL MEETING 60 9. DOCUMENTATION REQUEST 63 This document is a free translation into English of the French "Brochure de convocation". In the event of conflict in interpretation, reference should be made to the French version. TECHNICOLOR NOTICE OF MEETING JUNE 30, 2020 MESSAGE FROM THE CHAIRPERSON AND THE CHIEF EXECUTIVE OFFICER 1 Dear Shareholders, We are pleased to invite you to support the decisions proposed at the Shareholders’ Meeting which will be held on Tuesday June 30, 2020, at 10 am. We were hoping to hold a physical meeting but considering OUR GOAL IS TO BRING BOTH the sanitary crisis, this meeting will be held behind closed doors. STABILITY AND GROWTH TO 2019 was a year of transition affected by numerous headwinds. TECHNICOLOR AND TO UNLOCK Technicolor nevertheless achieved revenues of €3.8 billion, ITS FULL POTENTIAL. adjusted EBITDA of €324 million and adjusted EBITA of €42 million. Since the beginning of the year and in common with many businesses, Technicolor is facing an unprecedented We have the opportunity to take advantage of the strong increase crisis due to Covid-19, but the impact during the first quarter was in digital media consumption, the significant growth in residential limited, with resilience in both our Connected Home and Advertising broadband access and increased demand for original content. -

The Battle for 5G Sovereignty - a Qualitative Patent Portfolio Analysis Executive Summary

5G-Study – qualitative patent portfolio analysis (ARIAD IP-Rating) April 2020 The battle for 5G sovereignty - a qualitative patent portfolio analysis Executive Summary In the discussion about European sovereignty in the area of system-critical 5G infrastructure, the thesis of China's 5G technology leadership and of European companies being left behind is often spread. The present analyses were able to show that despite the high number of 5G patent applications filed by Chinese companies (here: Huawei and ZTE), the quality of these, evaluated using the proven ARIAD Patent Rating Methodology, lags significantly behind the other top global applicants. Furthermore, the possibility of a European "IT- AIRBUS" with Nokia and Ericsson, as well as in an additional analysis with InterDigital, was considered as the merging companies. Based on the 5G patent portfolios, it was possible to show that such a group could compete qualitatively, as well as quantitatively, with the international 5G technology leaders (Qualcomm and LG). According to the patent data-based analyses, Europe thus has the potential to build the future-oriented 5G infrastructure on its own while maintaining sovereignty and security. Introduction The fifth generation of mobile communications technologies (5G) represents an enormous step in the development towards a completely connected world: the technology enables wireless data transmission at speeds previously unavailable to the public. They form the basis for future concepts, which are often described as "smart": Smart City, Smart Mobility, Smart Home, Smart Factory, Smart Everything. 5G technology offers the possibility of taking digital communication between humans, humans and machines, but also between machines, into a new age, and represents the backbone for autonomously operating vehicles, robots and household appliances, i.e. -

ANNUAL REPORT 2011 Including the Annual Financial Report ANNUAL REPORT 2011

ANNUAL REPORT 2011 including the Annual Financial Report ANNUAL REPORT 2011 .............................................................. 1 TECHNICOLOR AND ITS SHAREHOLDERS .................... 87 5 5.1 Share capital .........................................................................................................88 PRESENTATION OF THE GROUP 5.2 Listing information .............................................................................................95 1 AND ITS ACTIVITIES .................................................................. 5 1.1 Selected Financial Data ......................................................................................... 6 SOCIAL INFORMATION AND SUSTAINABILITY ............ 97 1.2 History and Strategy of the Company ............................................................ 9 6.1 Employees and workforce ...............................................................................98 1.3 Business Overview ..................................................................................................13 6 6.2 Environmental matters ...................................................................................107 6.3 Technicolor Foundation for Cinema Heritage ......................................117 OPERATING AND FINANCIAL REVIEW AND PROSPECTS ..................................................................... 21 2 ADDITIONAL INFORMATION ........................................... 119 2.1 Overview ...................................................................................................................22 -

Financial Statements

TECHNICOLOR 2016 CONSOLIDATED FINANCIAL STATEMENTS CONSOLIDATED STATEMENT OF OPERATIONS 2 CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME 3 CONSOLIDATED STATEMENT OF FINANCIAL POSITION 4 CONSOLIDATED STATEMENT OF CASH FLOWS 6 CONSOLIDATED STATEMENT OF CHANGES IN EQUITY 7 NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS 1. GENERAL INFORMATION ...................................................................................................................................... 8 1.1. MAIN EVENTS OF THE YEAR ................................................................................................................................................... 8 1.2. ACCOUNTING POLICIES ......................................................................................................................................................... 8 2. SCOPE OF CONSOLIDATION .............................................................................................................................. 12 2.1. SCOPE AND CONSOLIDATION METHOD .................................................................................................................................. 12 2.2. CHANGE IN THE SCOPE OF CONSOLIDATION OF 2016 ............................................................................................................ 14 2.3. CHANGE IN THE SCOPE OF CONSOLIDATION OF 2015 ............................................................................................................ 15 2.4. INVESTMENTS IN ASSOCIATES & JOINT-VENTURES ............................................................................................................... -

Press Release

PRESS RELEASE RECEPTION OF INDICATIVE NEW FINANCING OFFERS NEGOTIATIONS WITH INVESTORS AND CREDITORS TO IMPLEMENT SUCH NEW FINANCING SOLICITATION OF THE RELEVANT CREDITORS TO PETITION FOR THE APPOINTMENT OF A CONCILIATOR Richard Moat, Chief Executive Officer of Technicolor, stated: “On February 13th, we announced our 2020-2022 strategic plan and a c. €300m rights issue. Since then the world and our industries have faced an unprecedented crisis due to the Covid-19 pandemic. We have been working tirelessly to guarantee safety for our employees, whilst ensuring the smooth continuity of our activities. Nevertheless, the current situation has limited our capacity to launch the envisaged rights issue, and so we have recently entered into discussions with some of our creditors and with third party investors to obtain a new €400 million financing more adapted to the Group’s current situation. To facilitate the implementation of this financing, we are now soliciting consents from our creditors to have the option to open a Conciliation proceeding. This additional financing, together with a restructuring of our balance sheet, should reinforce the Group and its ability to serve its clients and trade with its suppliers in the long term. Whilst this is in progress, the business will continue as usual, with no impact on our operations and the quality of service we deliver to our clients, and we intend to maintain our workforce of talented people to enable the delivery of all our services and products.” Paris (France), 26 May 2020 – Technicolor (Euronext Paris: TCH; OTCQX: TCLRY) (the “Company”) announces today that the prolonged uncertainty in global market conditions, as well as the impact of the Covid 19 crisis on its business in the short term, have limited the ability of the Company to launch the previously announced €300 million Rights Issue.