Group Accounts 2014 FINAL

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

EMBARGOED 00.01 2 February 2012 REGIONAL

PRESS RELEASE – EMBARGOED 00.01 2 February 2012 Year-on-Year growth for Smooth Radio UK and Real Radio brand Almost 5.6 million adults tune into a GMG Radio station each week – an extra 376,000 (YonY) Smooth Radio’s digital audience approaches 1 million adults each week GMG Radio’s Smooth Radio and Real Radio brands have recorded impressive year-on- year growth, according to the latest audience research out today (Thursday). 5.6 million adults now tune into one of the group’s stations each week - 376,000 more than a year ago. Smooth Radio UK’s weekly reach now stands at over 3.3 million adult listeners a week, up 231,000 on the same time last year. The audience also likes what they hear, with total hours listened to the station now standing at 25.75 million - almost two million (1.88m) more than a year ago – making it the UK’s second most listened to national commercial radio station. Simon Bates at Breakfast is celebrating his first year on Smooth Radio and has grown the breakfast audience by 69,000 to almost 1.4 million a week (YoY). For the group’s Real Radio brand the audience growth trend is also upwards. The stations, which broadcast on FM in Wales, Scotland, the North East and North West of England and Yorkshire and digitally across the UK, have added a total of 164,000 new adult listeners in the last year to give them a new weekly reach of just over 2.5 million adults. -

GMG Radio Response to the Ofcom Consultation on Review of Procedures for Handling Broadcasting Complaints, Investigations and Sanctions

GMG Radio response to the Ofcom consultation on review of procedures for handling broadcasting complaints, investigations and sanctions Introduction GMG Radio plc is part of The Guardian Media Group and operates fourteen analogue licences within the UK under the separate Real, Smooth and Rock Radio brands. The company was an inaugural partner and is currently a 35% shareholder in the MXR regional multiplex consortium as well as being a long-term service provider on each of its platforms. GMG Radio is also a founding partner and stakeholder in Digital Radio UK, the body charged with helping prepare the UK for digital switchover. GMG Radio considers regulatory compliance to be a hugely important and crucial element to our overall business operation and welcomes proposals which are genuinely designed to assist in improving standards and enhance understanding of regulatory procedures. We note this consultation seeks stakeholder views on proposed changes to procedures as opposed to responses to specific questions. Current understanding Ofcom has no wish to dilute the current process by which it can diligently follow when investigating breaches of broadcast licences, investigating complaints including those on fairness and privacy issues and the consideration of statutory sanctions for proven breaches. As such this consultation is specifically placed within the public arena in order to enlist stakeholder opinions on planned changes which are ultimately designed to ensure an ongoing commitment to the principles of continued fairness to those directly involved and at the same time introduce new procedures which are clearer, simpler and can be implemented as effectively and efficiently as possible. The consultation documents sets out proposals for new procedures covering the handling of broadcasting complaints, investigations and sanctions and it invites written views and comments on each of them prior to the publishing of a finalized version. -

3 Radio and Audio Content 3 3.1 Recent Developments in Scotland

3 Radio and audio content 3 3.1 Recent developments in Scotland Real Radio Scotland has been rebranded as Heart In February 2014 Capital Scotland was sold to the Irish media holding company, Communicorp. It was sold as part of eight stations divested by Global Radio to satisfy the UK regulatory authorities following the acquisition, two years ago, of GMG Radio from Guardian Media Group. Under a brand licensing agreement, Communicorp has rebranded the 'Real' stations under the 'Heart' franchise and plans to relaunch the 'Smooth' stations following the reintroduction of local programming. Therefore, Real Radio Scotland was rebranded as Heart Scotland in May 2014. XFM Scotland was re-launched by its owners, Global Radio, in March 2014. 3.2 Radio station availability Five new community radio stations are available to listeners in Scotland Scotland’s community radio industry has continued to grow. There are now 23 community stations on air, out of the 31 licences that have been awarded in Scotland. New to air in 2013/14 were East Coast FM, Irvine Beat FM, Crystal Radio, and K107 FM. Irvine Beat FM has received funding from the Lottery Awards for All fund to build a training studio. Nevis Radio, which serves Fort William and the surrounding areas, was originally licensed as a commercial radio service, but having chosen to become a community radio service it was awarded this licence instead, on application. The remaining eight of the most recent round of licence awards are preparing to launch. A licensee has two years from the date of the licence award in which to launch a service. -

Pocketbook for You, in Any Print Style: Including Updated and Filtered Data, However You Want It

Hello Since 1994, Media UK - www.mediauk.com - has contained a full media directory. We now contain media news from over 50 sources, RAJAR and playlist information, the industry's widest selection of radio jobs, and much more - and it's all free. From our directory, we're proud to be able to produce a new edition of the Radio Pocket Book. We've based this on the Radio Authority version that was available when we launched 17 years ago. We hope you find it useful. Enjoy this return of an old favourite: and set mediauk.com on your browser favourites list. James Cridland Managing Director Media UK First published in Great Britain in September 2011 Copyright © 1994-2011 Not At All Bad Ltd. All Rights Reserved. mediauk.com/terms This edition produced October 18, 2011 Set in Book Antiqua Printed on dead trees Published by Not At All Bad Ltd (t/a Media UK) Registered in England, No 6312072 Registered Office (not for correspondence): 96a Curtain Road, London EC2A 3AA 020 7100 1811 [email protected] @mediauk www.mediauk.com Foreword In 1975, when I was 13, I wrote to the IBA to ask for a copy of their latest publication grandly titled Transmitting stations: a Pocket Guide. The year before I had listened with excitement to the launch of our local commercial station, Liverpool's Radio City, and wanted to find out what other stations I might be able to pick up. In those days the Guide covered TV as well as radio, which could only manage to fill two pages – but then there were only 19 “ILR” stations. -

QUARTERLY SUMMARY of RADIO LISTENING Survey Period Ending 22Nd June 2008

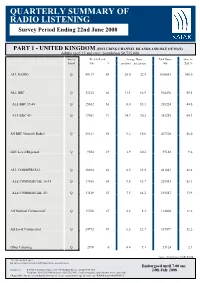

QUARTERLY SUMMARY OF RADIO LISTENING Survey Period Ending 22nd June 2008 PART 1 - UNITED KINGDOM (INCLUDING CHANNEL ISLANDS AND ISLE OF MAN) Adults aged 15 and over: population 50,735,000 Survey Weekly Reach Average Hours Total Hours Share in Period '000 % per head per listener '000 TSA % ALL RADIO Q 45117 89 20.0 22.5 1016681 100.0 ALL BBC Q 33323 66 11.1 16.9 564476 55.5 ALL BBC 15-44 Q 15362 61 8.0 13.1 201224 44.6 ALL BBC 45+ Q 17961 71 14.3 20.2 363252 64.3 All BBC Network Radio¹ Q 29611 58 9.2 15.8 467328 46.0 BBC Local/Regional Q 9504 19 1.9 10.2 97148 9.6 ALL COMMERCIAL Q 30984 61 8.5 13.9 431081 42.4 ALL COMMERCIAL 15-44 Q 17465 69 9.5 13.7 239533 53.1 ALL COMMERCIAL 45+ Q 13519 53 7.5 14.2 191547 33.9 All National Commercial¹ Q 13760 27 2.2 8.3 114002 11.2 All Local Commercial Q 24992 49 6.2 12.7 317079 31.2 Other Listening Q 2978 6 0.4 7.1 21124 2.1 Source: RAJAR/Ipsos MORI/RSMB ¹ See note on back cover. For survey periods and other definitions please see back cover. Embargoed until 7.00 am Enquires to: RAJAR, Paramount House, 162-170 Wardour Street, London W1F 8ZX 24th July 2008 Telephone: 020 7292 9040 Facsimile: 020 7292 9041 e mail: [email protected] Internet: www.rajar.co.uk ©Rajar 2008. -

Celebrating 40 Years of Commercial Radio With

01 Cover_v3_.27/06/1317:08Page1 CELEBRATING 40 YEARS OF COMMERCIAL RADIOWITHRADIOCENTRE OFCOMMERCIAL 40 YEARS CELEBRATING 01 9 776669 776136 03 Contents_v12_. 27/06/13 16:23 Page 1 40 YEARS OF MUSIC AND MIRTH CONTENTS 05. TIMELINE: t would be almost impossible to imagine A HISTORY OF Ia history of modern COMMERCIAL RADIO music without commercial radio - and FROM PRE-1973 TO vice-versa, of course. The impact of TODAY’S VERY privately-funded stations on pop, jazz, classical, soul, dance MODERN BUSINESS and many more genres has been nothing short of revolutionary, ever since the genome of commercial radio - the pirate 14. INTERVIEW: stations - moved in on the BBC’s territory in the 1960s, spurring Auntie to launch RADIOCENTRE’S Radio 1 and Radio 2 in hasty response. ANDREW HARRISON From that moment to this, independent radio in the UK has consistently supported ON THE ARQIVAS and exposed recording artists to the masses, despite a changing landscape for AND THE FUTURE broadcasters’ own businesses. “I’m delighted that Music Week 16. MUSIC: can be involved in celebrating the WHY COMMERCIAL RadioCentre’s Roll Of Honour” RADIO MATTERS Some say that the days of true ‘local-ness’ on the UK’s airwaves - regional radio for regional people, pioneered by 18. CHART: the likes of Les Ross and Alan Robson - are being superseded by all-powerful 40 UK NO.1 SINGLES national brands. If that’s true, support for the record industry remains reassuringly OVER 40 YEARS robust in both corners of the sector. I’m delighted that Music Week can be involved in celebrating the RadioCentre’s 22. -

By Global Radio

Annexes to the report on the Global Radio/GMG Radio public interest test Report on public interest test on the acquisition of Guardian Media Group’s radio stations (Real and Smooth) by Global Radio ANNEXES 0 Annexes to the report on the Global Radio/GMG Radio public interest test Contents 1 Annex 1: Glossary Annex 2: Summary of stakeholder representations 2 Annex 3: Information received from OFT Annex 4: Area by area analysis 1 Annexes to the report on the Global Radio/GMG Radio public interest test Annex 1 3 Glossary BARB Broadcasters Audience Research Board. The pan-industry body that measures television viewing. Broadband A service or connection generally defined as being ‘always on’ and providing a bandwidth greater than narrowband. Communications Act Communications Act 2003, which came into force in July 2003. ‘Connected’ TV A television that is broadband-enabled to allow viewers to access internet content. DAB Digital audio broadcasting. A set of internationally-accepted standards for the technology by which terrestrial digital radio multiplex services are broadcast in the UK. DCMS Department for Culture, Media and Sport Digital switchover The process of switching over the analogue television or radio broadcasting system to digital. DTT Digital terrestrial television. The television technology that carries the Freeview service. First-run acquisitions A ready-made programme bought by a broadcaster from another rights holder and broadcast for the first time in the UK during the reference year. First-run originations Programmes commissioned by or for a licensed public service channel with a view to their first showing on television in the United Kingdom in the reference year. -

Global Radio Holdings Limited of Juice Holdco Limited

Anticipated acquisition by Global Radio Holdings Limited of Juice Holdco Limited Please note that [] indicates figures or text which have been deleted or replaced in ranges at the request of the parties for reasons of commercial confidentiality. The CMA’s decision on reference under section 33(1) of the Enterprise Act 2002 given on 5 October 2015. Full text of the decision published on 22 October 2015. ME/6546/15 SUMMARY 1. Global Radio Holdings Limited (Global) has agreed to acquire Juice Holdco Limited (Juice) (the Merger). Global and Juice are together referred to as the Parties. 2. The Competition and Markets Authority (CMA) considers that the Parties will cease to be distinct as a result of the Merger, that the share of supply test is met and that accordingly arrangements are in progress or in contemplation which, if carried into effect, will result in the creation of a relevant merger situation. 3. The Parties overlap in the supply of commercial radio services, a two-sided market in which radio stations compete both for advertisers and consumers (in this case, radio listeners). In this case, the CMA has focussed on the effect of this Merger on the advertisers’ side of the market as the CMA considers that the interests of listeners are largely protected through Ofcom’s licencing requirements and the presence of the BBC. In terms of geographic scope, the CMA assessed the effect of the Merger in those areas where the Parties currently operate (ie the Total Survey Area (TSA))1 and where there is some overlap either at a regional or local level. -

PRS Radio Dec 2018.Xlsx

No of Days in Total Per Amount from Amount from Domain StationId Station UDC Performance Date Period Minute Rate Broadcast Public Reception RADIO BR ONE BBC RADIO 1 B0001 31/12/2099 92 £12.2471 £7.3036 £4.9435 RADIO BR TWO BBC RADIO 2 B0002 31/12/2099 92 £25.4860 £25.3998 £0.0862 RADIO BR1EXT BBC 1XTRA CENSUS B0106 31/12/2099 92 £2.8113 £2.7199 £0.0914 RADIO BRASIA BBC ASIAN NETWORK (CENSUS) B0064 31/12/2099 92 £3.6951 £3.3058 £0.3892 RADIO BRBEDS BBC THREE COUNTIES RADIO (CENSUS) B0065 31/12/2099 92 £0.2445 £0.2442 £0.0003 RADIO BRBERK BBC RADIO BERKSHIRE (CENSUS) B0103 31/12/2099 92 £0.1436 £0.1435 £0.0002 RADIO BRBRIS BBC RADIO BRISTOL (CENSUS) B0066 31/12/2099 92 £0.1532 £0.1531 £0.0002 RADIO BRCAMB BBC RADIO CAMBRIDGESHIRE (CENSUS) B0067 31/12/2099 92 £0.1494 £0.1493 £0.0002 RADIO BRCLEV BBC RADIO TEES (CENSUS) B0068 31/12/2099 92 £0.1478 £0.1477 £0.0002 RADIO BRCMRU BBC RADIO CYMRU B0011 31/12/2099 92 £0.5707 £0.5690 £0.0017 RADIO BRCORN BBC RADIO CORNWALL (CENSUS) B0069 31/12/2099 92 £0.1535 £0.1534 £0.0002 RADIO BRCOVN BBC RADIO COVENTRY AND WATWICKSHIRE(CENSUS) B0070 31/12/2099 92 £0.1023 £0.1022 £0.0001 RADIO BRCUMB BBC RADIO CUMBRIA (CENSUS) B0071 31/12/2099 92 £0.1085 £0.1084 £0.0001 RADIO BRCYMM BBC RADIO CYMRU 2 B0114 31/12/2099 92 £0.5707 £0.5690 £0.0017 RADIO BRDEVN BBC RADIO DEVON (CENSUS) B0072 31/12/2099 92 £0.2421 £0.2419 £0.0003 RADIO BRDRBY BBC RADIO DERBY (CENSUS) B0073 31/12/2099 92 £0.1535 £0.1534 £0.0002 RADIO BRESSX BBC ESSEX (CENSUS) B0074 31/12/2099 92 £0.2091 £0.2089 £0.0002 RADIO BRFIVE BBC FIVE LIVE B0005 -

Bauer Radio Ltd / TIML Golden Square

Anticipated acquisition by Bauer Radio Limited of TIML Golden Square Limited (Absolute Radio) The OFT’s decision on reference under section 33(1) given on 20 December 2013. Full text of decision published 10 January 2014. Please note that the square brackets indicate figures or text which have been deleted or replaced in ranges at the request of the parties or third parties for reasons of commercial confidentiality. PARTIES 1. Bauer Radio Limited ('Bauer') is a UK-based division of Bauer Media Group, a multi-national media group covering print, online, radio and TV. In 2012, Bauer's total UK radio turnover was approximately £[ ]million with advertising revenues accounting for approximately £[ ]million. Bauer currently holds 41 local and eight national commercial radio licences which Bauer transmits on AM, FM, digital audio broadcasting ('DAB'), Digital Terrestrial Television ('DTT'), satellite, cable and the internet across the UK. Bauer's key brands include Kiss and Magic in addition to multiple local radio stations. 2. Absolute Radio ('Absolute') is owned by TIML Golden Square Limited ('TIML'), which is in turn owned by TIML Global Limited, a subsidiary of The Times of India Group. Absolute's 2012 UK turnover is £[ ]. Absolute Radio broadcasts across its national AM licence, a London FM licence and national DAB services, all under the Absolute brand. 1 TRANSACTION 3. On 26 July 2013, Bauer signed a Share Purchase Agreement to acquire the entire issued share capital of TIML, the owner of Absolute Radio (the 'Merger'). Completion of the Merger is subject clearance by the UK competition authorities. 4. On 25 October 2013, the OFT received an informal submission from the parties concerning the Merger. -

Performing Right Society Limited Distribution Rules

PERFORMING RIGHT SOCIETY LIMITED DISTRIBUTION RULES PRS distribution policy rules Contents INTRODUCTION...................................................................................... 12 Scope of the PRS Distribution Policy ................................................................................ 12 General distribution policy principles ............................................................................. 12 Policy review and decision-making processes ............................................................. 13 DISTRIBUTION CYCLES AND CONCEPTS ................................................. 15 Standard distribution cycles and frequency .................................................................. 15 Distribution basis ..................................................................................................................... 15 Distribution sections ............................................................................................................... 16 Non-licence revenue ............................................................................................................... 16 Administration recovery rates ............................................................................................ 16 Donation to the PRS Foundation and Members Benevolent Fund ........................ 17 Weightings .................................................................................................................................. 17 Points and point values ......................................................................................................... -

Determination of Merger Notification M/07/006 – Gmg/Saga

DETERMINATION OF MERGER NOTIFICATION M/07/006 – GMG/SAGA Section 21 of the Competition Act 2002 Proposed acquisition by GMG Radio Holdings Limited of Saga Radio Limited, Saga Radio (North East) Limited, Saga Radio (Scotland) Limited and Saga Regional Digital Radio Limited Dated 14/02/07 Introduction 1. On 17 January 2007 the Competition Authority (“the Authority”), in accordance with Section 18 (1)(b) of the Competition Act, 2002 (“the Act”) was notified, on a mandatory basis, of the proposed acquisition by GMG Radio Holdings Limited, a wholly owned subsidiary of Guardian Media Group plc (“GMG”), of the entire issued share capital of Saga Radio Limited, Saga Radio (North East) Limited, Saga Radio (Scotland) Limited and Saga Regional Digital Radio Limited (collectively, “the target”). 2. The Authority advised the undertakings involved and the Minister that it considered the proposed transaction to be a “media merger” within the meaning of Section 23 of the Act. The Undertakings Involved 3. GMG, the acquirer, is a UK based multi-media organisation with interests in national newspapers, regional newspapers, magazines, radio and internet businesses. The company is wholly-owned by the Scott-Trust, which was created in 1936 to secure the financial and editorial independence of the Guardian in perpetuity. In the financial year ended 2 April 2006 GMG had a worldwide turnover of €1.036 billion. 4. GMG’s activities in the State are mainly conducted through its Trader Media Group (TMG) division. TMG publishes Autotrader, a weekly advertising-only publication dedicated to motor vehicles. TMG also operates two websites advertising motor vehicles for sale (autotrader.ie and carzone.ie) and a website design service for motor dealers.