How a Canadian Convenience Store Giant Built Its Empire

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Accessibility of Businesses: Weight and Veterans’ Environments Study GIS Protocol Jones KK, Xiang W, Matthews SA, Zenk SN

Accessibility of businesses: Weight and Veterans’ Environments Study GIS protocol Jones KK, Xiang W, Matthews SA, Zenk SN. Weight and Veterans’ Environments Study Overview This protocol describes the process through which WAVES processed commercial business list data. We include sections on measure definitions, bias assessments, and deduplication. Finally, we include a section describing how we used the processed business list data to create national raster surfaces showing neighborhood environment measures. Acknowledgements This protocol was developed with grant support from the National Cancer Institute (R21CA195543) and the Department of Veterans Affairs (IIR 13-085), co-led by Shannon Zenk and Elizabeth Tarlov. We thank Lisa Powell, Irina Horoi, Sandy Slater for input into this protocol. Haytham Abu Zayd, Shubhayan Ukil and Abby Klemp helped to edit the protocol for dissemination. Suggested Citation Jones K, Xiang W, Matthews SA, Zenk SN. (2018). Accessibility of businesses: Weight and Veterans’ Environments Study GIS protocol, Version 1. Retrieved from Weight and Veterans’ Environments Study website: https://waves.uic.edu/. 2 http://waves.uic.edu/ Version 1, April 2018 Weight and Veterans’ Environments Study Table of Contents Overview ....................................................................................................................................................... 2 Acknowledgements ...................................................................................................................................... -

"St. John Scrip" Spring Scrip-A-Thon March 25

Student Name St. Johns Lutheran School - Wykoff Student Name: www.stjohns-wykoff.org Customer Name: 245 South Line Street Wykoff, MN 55990 Tel: 507-352-4671 Customer Email & Phone#: Email: [email protected] What a great way to support the kids at St. Johns. Thank you so much for your order! Apparel, Shoes, Accessories Dining - On The Go Grocery Product % QTY Total Product % QTY Total Product % QTY Total Aeropostale $25 10% $ Arby's $10 8% $ Sunshine Foods $25 10% $ American Eagle $25 10% $ Brueggers Bagels $10 7% $ Sunshine Foods $50 10% $ Buckle $25 8% $ Burger King $10 4% $ Sunshine Foods $100 10% $ Carter's / OshKosh $25 10% $ Caribou Coffee $10 6% $ Fareway Foods $25 3% $ Children's Place $25 12% $ Chipotle Mexican Grill $10 10% $ Fareway Foods $50 3% $ Claires/Icing $10 9% $ Cold Stone Creamery $10 11% $ Fareway Foods $100 3% $ DSW $25 8% $ Dairy Queen $10 3% $ Preston Foods $25 3% $ Famous Footwear $25 8% $ Domino's $10 8% $ Preston Foods $50 3% $ Foot Locker/Champs $25 8% $ Dunkin' Donuts $10 or $25 3% $ Preston Foods $100 3% $ J. Crew $25 13% $ Fazoli's $25 9% $ Cub Foods $25 4% $ Lands' End $25 15% $ Great Harvest Bread $10 6% $ Cub Foods $100 4% $ Lands' End $100 15% $ Little Caesars $20 8% $ Home Decor Maurices $20 7% $ Noodles & Company $10 8% $ Product % QTY Total Men's Wearhouse $25 8% $ Panera Bread $10 or $25 8% $ Crate & Barrel $25 8% $ Nordstrom $25 or $100 4% $ Papa John's $10 9% $ Pottery Barn Teen $25 8% $ Old Navy $25 14% $ Papa Murphy's Pizza $10 8% $ Online & Catalog Old Navy $100 14% $ Pizza Hut $10 8% $ Product -

Rated Gas Station Brands

GasBuddy reveals America’s 2018 top- rated gas station brands Based on 7 million reviews in the GasBuddy app, they have selected the top 10-rated gas station brands in the U.S. GasBuddy has issued its 2018 Top Gas Station Brands in the U.S. report, revealing which gas station convenience store brands had the best-of-the-best experience based on nearly 7 million reviews in the GasBuddy app. “GasBuddy ratings and reviews data show that customer service, food, and amenities are the top factors in generating positive reviews. All the brands that made our list this year demonstrate how the industry continues to move towards being a destination for fresh food, clean facilities, and excellent customer service,” says Frank Beard, analyst at GasBuddy. Top 10 Gas Station Brands in the U.S. in 2018 1. Kwik Trip Leading the pack is Wisconsin-based Kwik Trip. With more than 560 U.S. locations in Minnesota, Iowa and Wisconsin, Kwik Trip sweeps the rankings by capturing the highest ratings and reviews in four of the six GasBuddy categories: cleanliness, outdoor lighting, restrooms and overall experience. 2. Cenex With more than 1,700 locations across 19 states, Minnesota-based Cenex with also made a strong showing in 2018 by placing second in the overall category and in three individual categories including cleanliness, outdoor lighting and restrooms. Cenex received top marks in customer service. 3. Kum & Go Headquartered in Des Moines, Iowa, Kum & Go placed in five of the six categories, including cleanliness (3), customer service (5), outdoor lighting (4), restrooms (4) and overall experience (3). -

Foot Traffic Report Q4 2017

FOOT TRAFFIC REPORT & DRIVING TRENDS for the fuel & convenience store industry 2017 YEAR IN REVIEW & 2018 FORECAST 2017 YEAR IN REVIEW & 2018 FORECAST GasBuddy and Cuebiq examined 121 million consumer trips to convenience and fuel retailers in 2017—with 35 million visits taking place between October 1 and December 31. This data provides insights into consumer behavior that will continue to be relevant throughout 2018. Highlights: Ricker’s Captures the Top Spot in 2017 The Indiana-based retailer edges out the competition for the highest ratio of footfall per station in 2017—nearly five times the industry average. Costco claims second place after capturing the top spot in Q4, and Meijer comes in a close third. Good Forecourt Lighting is Good for Business Throughout 2017, there was a strong correlation between overnight foot traffic and the quality of forecourt lighting. Stations near interstates with above-average outdoor lighting ratings on GasBuddy saw a 50% increase in foot traffic, during the hours of 9:00pm to 5:00am, when compared to those with below-average ratings. Visits were up in Q4 From Q3 to Q4 2017, visits to gas stations and convenience stores saw an uplift of 5.15%. Busiest Time of the Day An analysis of location data reveals that Friday at 12:00pm saw the highest average levels of foot traffic in 2017. Lunch hours were the busiest during the work week, and the morning commute was comparatively slower. GasBuddies Go Beyond the Pump McDonald’s narrowly edged out Subway to become GasBuddies' favorite quick-service restaurant of 2017, and Starbucks took the title over Dunkin' Donuts in the coffee shop category. -

Agreement to Acquire Holiday Stationstores, Inc

ALIMENTATION COUCHE-TARD INC. AGREEMENT TO ACQUIRE HOLIDAY STATIONSTORES, INC. July 10, 2017 FORWARD-LOOKING INFORMATION AND CAUTIONARY LANGUAGE This presentation and the accompanying oral presentation contain forward-looking statements within the meaning of applicable securities legislation. Forward- looking statements are typically identified by words such as “projected”, “estimate”, “may”, “anticipate”, “believe”, “expect”, “plan”, “intend” or similar words suggesting future outcomes or statements regarding an outlook. All statements other than statements of historical fact contained in these slides are forward- looking statements. Forward-looking statements involve numerous assumptions, risks and uncertainties. A variety of factors, many of which are beyond Alimentation Couche-Tard Inc.’s (“Couche-Tard”) control, may cause actual results to differ materially from the expectations expressed in its forward-looking statements. These factors include, but are not limited to, the effects of the integration of acquired businesses and the ability to achieve projected synergies, fluctuations in margins on motor fuel sales, competition in the convenience store and retail motor fuel industries, foreign exchange rate fluctuations, and such other risks as described in detail from time to time in documents filed by Couche-Tard with securities regulatory authorities in Canada, including those risks described in Couche-Tard’s management’s discussion and analysis (MD&A) for the year ended April 24, 2016. Couche-Tard’s MD&A and other publicly filed documents are available on SEDAR at www.sedar.com. Unless otherwise required by law, Couche-Tard does not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by it or on its behalf. -

Wikipedia List of Convenience Stores

List of convenience stores From Wikipedia, the free encyclopedia The following is a list of convenience stores organized by geographical location. Stores are grouped by the lowest heading that contains all locales in which the brands have significant presence. NOTE: These are not ALL the stores that exist, but a good list for potential investors to research which ones are publicly traded and can research stock charts back to 10 years on Nasdaq.com or other related websites. [edit ] Multinational • 7-Eleven • Circle K [edit ] North America Grouping is by country or united States Census Bureau regional division . [edit ] Canada • Alimentation Couche-Tard • Beckers Milk • Circle K • Couch-Tard • Max • Provi-Soir • Needs Convenience • Hasty Market , operates in Ontario, Canada • 7-Eleven • Quickie ( [1] ) [edit ] Mexico • Oxxo • 7-Eleven • Super City (store) • Extra • 7/24 • Farmacias Guadalajara [edit ] United States • 1st Stop at Phillips 66 gas stations • 7-Eleven • Acme Express gas stations/convenience stores • ampm at ARCO gas stations • Albertsons Express gas stations/convenience stores • Allsup's • AmeriStop Food Mart • A-Plus at Sunoco gas stations • A-Z Mart • Bill's Superette • BreakTime former oneer conoco]] gas stations • Cenex /NuWay • Circle K • CoGo's • Convenient Food Marts • Corner Store at Valero and Diamond Shamrock gas stations • Crunch Time • Cumberland Farms • Dari Mart , based in the Willamette Valley, Oregon Dion's Quik Marts (South Florida and the Florida Keys) • Express Mart • Exxon • Express Lane • ExtraMile at -

Ready to Rock $100,000?

March 2020 Volume 2 Issue 3 GET READY TO ROCK SALES The Lottery is celebrating the 50th anniversary of ■ Encourage your players to follow the lottery Minnesota’s iconic First Avenue music venue with on social media to see how they can sign up the First $50 scratch game — a $5 ticket that offers a for the chance to win a pair of tickets to an $100,000 top prize. upcoming show at First Avenue. The First $50 scratch game is loaded with $50 prizes! Remember, your business receives a 1 percent cashing bonus on all prizes paid out at your location, so it pays to cash your players winning tickets! With the influx in $50 prize winners, the more you pay out, the more extra cash customers will have to spend at your business! Here are some tips to help your sales rock on this spring: ■ Display the point-of-purchase materials that you received in the March new game kits in high-traffic areas. The First $50 sticker will make a starry- eyed impression on the front of your counter. Place the double- READY TO ROCK sided tower topper on top of the ticket dispenser, or near your $100,000? register to grab your customer’s attention. ■ Point out to your players that the overall odds of winning a prize by playing the First $50 ticket are 1 in 3.63! ■ Tell your players that the party continues at mnlottery.com where they can enter non-winning tickets for the chance to win $1,000 cash, First Avenue merchandise, or concert tickets. -

Catalog of Data

Catalog of Data Volume 5, Issue 10 October 2013 AggData LLC - 1 1570 Wilmington Dr, Suite 240, Dupont, WA 98327 253-617-1400 Table of Contents Table of Contents ................................................................................................... 2 I. Explanation and Information ............................................................................ 3 II. New AggData September 2013 ........................................................................ 4 III. AggData by Category ........................................................................................ 5 Arts & Entertainment .......................................................................................... 5 Automotive ......................................................................................................... 5 Business & Professional Services ......................................................................... 8 Clothing & Accessories ........................................................................................ 9 Community & Government ............................................................................... 13 Computers & Electronics ................................................................................... 13 Food & Dining ................................................................................................... 14 Health & Medicine ............................................................................................ 23 Home & Garden ............................................................................................... -

Investors Presentation

ALIMENTATION COUCHE-TARD INC. INVESTORS PRESENTATION September 2017 FORWARD-LOOKING INFORMATION AND CAUTIONARY LANGUAGE This presentation and the accompanying oral presentation contain forward-looking statements within the meaning of applicable securities legislation. Forward-looking statements are typically identified by words such as “projected”, “estimate”, “may”, “anticipate”, “believe”, “expect”, “plan”, “intend” or similar words suggesting future outcomes or statements regarding an outlook. All statements other than statements of historical fact contained in these slides are forward-looking statements. Forward-looking statements involve numerous assumptions, risks and uncertainties. A variety of factors, many of which are beyond Alimentation Couche-Tard Inc.’s (“Couche-Tard”) control, may cause actual results to differ materially from the expectations expressed in its forward-looking statements. These factors include, but are not limited to, the effects of the integration of acquired businesses and the ability to achieve projected synergies, fluctuations in margins on motor fuel sales, competition in the convenience store and retail motor fuel industries, foreign exchange rate fluctuations, and such other risks as described in detail from time to time in documents filed by Couche-Tard with securities regulatory authoritiesin Canada, including those risks described in Couche-Tard’s management’s discussion and analysis (MD&A) for the year ended April 30, 2017. Couche-Tard’s MD&A and other publicly filed documents are available on SEDAR at www.sedar.com. Unless otherwise required by law, Couche-Tard does not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by it or on its behalf. -

The Annual Report on the Most Valuable and Strongest Retail Brands March 2019 About Brand Finance

Retail 50 2019The annual report on the most valuable and strongest retail brands March 2019 About Brand Finance. Contents. Brand Finance is the world’s leading independent About Brand Finance 2 brand valuation and strategy consultancy. Get in Touch 2 Brand Finance was set up in 1996 with the aim of ‘bridging Request Your Brand Value Report 4 the gap between marketing and finance’. For more than 20 years, we have helped companies and organisations of Brand Valuation Methodology 5 all types to connect their brands to the bottom line. Foreword 6 We pride ourselves on four key strengths: Brand Finance Retail 50 (USD m) 12 + Independence + Transparency + Technical Credibility + Expertise Regional Analysis 14 We put thousands of the world’s biggest brands to the Sector Reputation Analysis 16 test every year, evaluating which are the strongest and most valuable. Brand Strength Analysis 18 Brand Finance helped craft the internationally Definitions 20 recognised standard on Brand Valuation – ISO 10668, and the recently approved standard on Brand Evaluation Consulting Services 22 – ISO 20671. Brand Evaluation Services 23 Communications Services 24 Get in Touch. Brand Finance Network 26 For business enquiries, please contact: Richard Haigh Managing Director [email protected] For media enquiries, please contact: Sehr Sarwar Global Forum 2019 Senior Communications Manager [email protected] For all other enquiries, please contact: Understanding the Value of [email protected] Geographic Branding +44 (0)207 389 9400 2 April 2019 For more information, please visit our website: www.brandfinance.com Join us at the Brand Finance Global Forum, an action-packed day-long event at the Royal Automobile Club in London, as we explore how linkedin.com/company/brand-finance geographic branding can impact brand value, attract customers, and influence key stakeholders. -

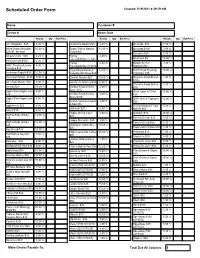

Scheduled Order Form Created: 5/19/2021 8:29:59 AM

Scheduled Order Form Created: 5/19/2021 8:29:59 AM Name Customer # Check # Order Date Rebate Qty Ext Price Rebate Qty Ext Price Rebate Qty Ext Price Ace Hardware $25 4.00 % Dunham's Sports $25 8.00 % Menards $25 3.00 % Allied Waste/Republic 10.00 % Edson Farms Natural 11.00 % Menards $100 3.00 % $20 (W. MI only) Foods $25 Michaels $25 4.00 % Amazon.com $25 2.25 % Family 2.00 % Fare/D&W/Glen's $25 Moomers $5 10.00 % Amazon.com $100 2.25 % Family 2.00 % Mutual Service 3.00 % AMC Theatres/Loews 8.00 % Fare/D&W/Glen's $100 Stations $20 Cineplex $25 Gap/Athleta/Banana 14.00 % North Peak Brewing 10.00 % American Eagle® $25 10.00 % Republic/Old Navy $25 Company $25 American Waste $100 5.00 % Garden Goods $25 10.00 % Oleson's Food Stores 4.00 % $100 American Waste $20 5.00 % Gauthier's Archery $25 6.00 % Oleson's Food Stores 4.00 % Amical $25 10.00 % Gordon Food Service 4.00 % $25 Store $25 Apple Store/Apple.com 5.00 % Once Upon A Child 10.00 % $15 Gordon Food Service 4.00 % $25 Store $100 Apple Store/Apple.com 5.00 % OPA! Grill & Taproom 10.00 % $25 Grand Traverse Resort 5.00 % $25 & Spa $50 Applebee's $25 8.00 % Oryana Natural Food 5.00 % Hallmark $25 4.00 % Market $50 Arby's $10 8.00 % Happy Dining Card 8.00 % Outback $25 10.00 % Bath & Body Works 12.00 % $25 $10 Panera Bread $10 8.00 % Happy Moments $25 8.00 % Bath & Body Works 12.00 % Panera Bread $25 8.00 % $25 Harrington's/Sorellina 10.00 % $25 Papa John's Pizza $10 8.00 % Bay Bread $10 10.00 % Higher Grounds Coffee 25.00 % PetSmart $25 7.00 % Bed Bath & Beyond 7.00 % $20 $25 Pizza Hut -

Fleet Cards – Reporting of Alternative Fuels

i Fleet Cards – Reporting of Alternative Fuels Annandale, VA September 2007 This report satisfies the requirements of Battelle Energy Alliance, LLC Contract Number 0050214. Battelle Energy Alliance, LLC manages the Department of Energy’s Idaho National Laboratory under U.S. Government Contract Number De-AC07-05ID14517. The findings and recommendations contained in this report are those of Vista Consultants, LLC. The findings and recommendations are advisory only and do not represent the position of Battelle Energy Alliance, LLC, the management of the Idaho National Laboratory, the Department of Energy or the Federal Government. FLEET CARDS – REPORTING OF ALTERNATIVE FUELS Report Prepared By: Vista Consultants, LLC 5157 Linette Lane Annandale, VA 22003-4122 202-256-0552 www.vistaconsultants.net FLEET CARDS – REPORTING OF ALTERNATIVE FUELS i CONTENTS Executive Summary ........................................................................................................................................................ 1 FLEET CARDS – REPORTING OF ALTERNATIVE FUELS ................................................................................. 3 Summary of Issue ............................................................................................................................................................ 3 Background Information ......................................................................................................................................... 3 Legal and Administrative Requirements .........................................................................................................