Jpmorgan Trust I Form NPORT-P Filed 2021-03-25

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Energy in Wales

House of Commons Welsh Affairs Committee Energy in Wales Third Report of Session 2005–06 Volume I Report, together with formal minutes, Ordered by The House of Commons to be printed 11 July 2006 HC 876-I Published on Thursday 20 July 2006 by authority of the House of Commons London: The Stationery Office Limited £0.00 The Welsh Affairs Committee The Welsh Affairs Committee is appointed by the House of Commons to examine the expenditure, administration, and policy of the Office of the Secretary of State for Wales (including relations with the National Assembly for Wales.) Current membership Dr Hywel Francis MP (Chairman) (Labour, Aberavon) Mr Stephen Crabb MP (Conservative, Preseli Pembrokeshire) David T. C. Davies MP (Conservative, Monmouth) Nia Griffith MP (Labour, Llanelli) Mrs Siân C. James MP (Labour, Swansea East) Mr David Jones MP (Conservative, Clwyd West) Mr Martyn Jones MP (Labour, Clwyd South) Albert Owen MP (Labour, Ynys Môn) Jessica Morden MP (Labour, Newport East) Hywel Williams MP (Plaid Cymru, Caernarfon) Mark Williams MP (Liberal Democrat, Ceredigion) Powers The Committee is one of the departmental select committees, the powers of which are set out in House of Commons Standing Orders, principally in SO No 152. These are available on the Internet via www.parliament.uk. Publications The Reports and evidence of the Committee are published by The Stationery Office by Order of the House. All publications of the Committee (including press notices) are on the Internet at www.parliament.uk/parliamentary_committees/welsh_affairs_committee.cfm. A list of Reports of the Committee in the present Parliament is at the back of this volume. -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

The Definitive Who's Who of the Wind Energy Industry

2014 Top 100 Power People 1 100 TOP 100 POWER PEOPLE 2014 The definitive who’s who of the wind energy industry © A Word About Wind, 2014 2014 Top 100 Power People Contents 2 CONTENTS Editorial: Introducing the Top 100 Power People 3 Compiling the top 100: Advisory panel and methodology 4 Profiles: Numbers 100 to 11 6 Q&A: Rory O’Connor, Managing Director, BlackRock 15 Q&A: David Jones, Managing Director, Allianz Capital Partners 19 Q&A: Torben Möger Pedersen, CEO, PensionDanmark 23 Top ten profiles:The most influential people in global wind 25 Top 100 list: The full Top 100 Power People for 2014 28 Next year: Key dates for A Word About Wind in 2015 30 Networking at A Word About Wind Quarterly Drinks © A Word About Wind, 2014 2014 Top 100 Power People Editorial 3 EDITORIAL elcome to our third annual Top from the six last year, but shows there W100 Power People report. is still plenty that wind can do to attract and retain women in senior roles. When we took on the challenge back in 2012 of identifying and assessing the Wind likes to think of itself as a pro- key people working in wind, it was a gressive industry, and in many ways it timely task. The industry was starting to is. But let’s not be blind to the ways in move out of established pockets in Eu- which it continues to operate like many rope, North America and Asia, and into other sectors, with males continuing to by Richard Heap, emerging markets around the world. -

Attendee List 18/05/2021 14:27 Unmanned Aeriel Systems - Wind and Aviation Webinar 19 May 2021

Unmanned Aeriel Systems - Wind and Aviation Webinar 19 May 2021 First Name Last Name Job title Organisation Sue Allen Market Analyst 4C Offshore Jim Gilhooly Partner Achieving the Difference LLP Rafal Libera Group Integration Manager Acteon Group Robert Hoermann CEO Aero Enterprise GmbH Andy Evans Director Aerossurance Limited Steve Robertson Director Air & Sea Analytics Athena Scaperdas Consultant Engineer Air Ops Safety Antonio Martinez Customer Solution Competitiveness Airbus Helicopters Arnaud Roux Operational Marketing Manager Airbus Helicopters Ralph Setz Senior Manager Operational Marketing Offshore Wind Airbus Helicopters Thierry Mauvais Key Segment Manager - Offshore Wind and Energy Airbus Helicopters Tim Williams Advisor Maritime Helicopters & UAV Airbus Helicopters Ashish Rughooa Trainee Engineer Airmate Ltd Mislav Spajic Data scientist/UAV operator Airspect d.o.o. Stuart Dawson Development Manager Aker Offshore Wind Andrew Lang Marine Hose Specialist Allied Marine Logistics Ltd. David Wilson Business Development Manager Allspeeds Limited Vanessa Cutler Strategic Account Manager Anixter Limited Andrew Reay group head of commercial Offshore wind Associated British Ports Jay Medina Commercial Manager Associated British Ports Binh Le Graduate Engineer Atkins Sebastian Bourne Project Director Atkins Anette Soderberg Named Accounts Sales Executive EMEA Autodesk Mark Marien US Director offshore HSE Avangrid Renewables Peter Gay Accountable Manager Aviation company Bobby Osahan Technical Director Aviation Consult Kari Soltvedt Safety Manager Avinor AS Simge Cakirli Student Özyeğin University Ronan McMahon Flight Operations Manager Babcock Mission Critical Services Ireland Ltd Ian Millhouse Senior Structures Specialist BAE Systems Spencer Tsao General Manager Bank of Taiwan London Branch Amy Townsend Senior Development Planner Banks Group Frazer Harrison Development Engineer Banks Renewables Ltd Joe Brown Programme Manager Barnsley Council Ian Simms Senior Development Manager BayWa r.e. -

Financial Report at 31 December 2014 Financial Report 31 December at 2014

FINANCIAL REPORT AT 31 DECEMBER 2014 FINANCIAL REPORT 31 DECEMBER AT 2014 Falck Renewables S.p.A. Falck Renewables S.p.A. Via Alberto Falck 4-16, 20099 Sesto San Giovanni (MI) - Italy Via Alberto Falck 4-16, 20099 Sesto San Giovanni (MI) phone +39.02.24332360 phone +39.02.24331 www.falckrenewables.eu - [email protected] www.falckrenewables.eu - [email protected] Annual report for the year ended 31 December 2014 Chairman’s letter to the shareholders and stakeholders pag. 4 Chief Executive Officer’s letter to the shareholders and stakeholders pag. 6 1 Notice of annual general meeting pag. 9 2 Company officers pag. 12 3 Group structure pag. 13 4 Consolidated financial highlights pag. 14 5 Directors’ report 5.1 Economic framework pag. 17 5.2 Falck Renewables group operating and financial review 5.2.1 Falck Renewables group profile pag. 26 5.2.2 Regulatory framework pag. 27 5.2.3 Performance pag. 38 5.2.4 Non-financial performance indicators pag. 45 5.2.5 Share price performance pag. 46 5.2.6 Performance of business sectors pag. 47 5.2.7 Review of business in 2014 pag. 51 5.2.8 Employees pag. 56 5.2.9 Environment, health and safety pag. 56 5.2.10 Research and development activities pag. 58 5.2.11 Risks and uncertainties pag. 58 5.2.12 Significant events after the balance sheet date pag. 76 5.2.13 Management outlook and going concern pag. 77 5.3 Operating and financial review of Falck Renewables SpA . 5.3.1 Financial highlights pag. -

JESG Actions

JESG Actions – Update 12 September 2012 This document contains details for some of the outstanding actions from the August JESG, and has been circulated to JESG members for information. Action Action Lead Status Update No Party 5 Determine the priority issues within the Barbara Ongoing issues log Vest & All 20 Chair of JESG to write to ENTSO-E to: Barbara Open • request that meetings are not held Vest on Mondays and Fridays, or very near Christmas as it will discourage attendance. • request that a sufficient length of time is provided for consideration of papers prior to meetings (suggested at least 10 days) Peter Bolitho to provide BV with some Peter words on the ENTSOG process Bolitho 42 For each Network Code a comparison NGET Ongoing document between the Network Code and existing GB Codes will be produced. 46 Provide a steer to the Stakeholder Ofgem Open community on how implementation of the Network Codes, such as CACM, is to be timed (i.e. work required in advance of Comitology completing) 49 Ofgem to consider if a GB Stakeholders Ofgem Open meeting on the Transparency Guidelines is required, and what the best process is for arranging such a meeting. 57 Chair and NGET to discuss feedback on BV/CH Closed Feedback on the RFG will be discussed on the September Agenda the JESG in advance of September Meeting Page 1 Action Action Lead Status Update No Party 58 Chair and NGET to discuss and agree BV/PW Closed New Dates circulated dates for JESG meetings in 2013 59 Feedback/Queries to ENTSO-E: NGET Closed 1. -

Overview of Business Valuation Parameters in the Energy Industry Edition N.2 - 2015 Contents

Overview of business valuation parameters in the energy industry Edition n.2 - 2015 Contents Preface 3 Section I - Methodology 4 Section II - Identification of panels 6 Section III - Simulation for calculation of WACC 10 - Sector comparison Section IV - The multiples 18 Section V - Multiples by geographic area and by segment 22 This edition of the publication aims to provide some of the basic parameters used when valuing companies and/or groups of companies operating in the Energy industry. The Deloitte Financial Advisory Valuation Team performed an analysis of the cost of capital (WACC) and the main Asset Side market multiples estimated on an Italian, European and worldwide level. The purpose is to make a contribution towards the typical work of decision makers in the sector i.e. initial valuation analysis performed for potential M&A transactions and general business valuations in the Energy industry. 2 Preface by Marco Vulpiani In light of our extensive experience in the valuation of companies and groups operating in the Energy industry and considering the positive interest gathered from the first issue of this study, we are pleased to present this second edition that represents the natural continuation of our analysis focused on this important industry. The objectives of this periodic publication remain: firstly, to provide insight into the trends in certain value indicators (multiples) and drivers (cost of capital); secondly, to provide average benchmark parameters for the industry to those who have to perform preliminary valuations. This publication is primarily addressed at those In particular, as highlighted in the various sections operating in the Energy industry. -

Harnessing Value for Scotland from Offshore Wind Development Harnessing Value for Scotland from Offshore Wind Development Introduction

HARNESSING VALUE FOR SCOTLAND FROM OFFSHORE WIND DEVELOPMENT HARNESSING VALUE FOR SCOTLAND FROM OFFSHORE WIND DEVELOPMENT INTRODUCTION he Scottish Council for Development i. explore the barriers / opportunities for and Industry (SCDI) supports the offshore wind development in Scotland development of offshore wind farms in Scotland. With the ScotWind ii. examine the opportunities for the supply offshore leasing round due to be chain in Scotland and Tdetermined in 2021, SCDI held a webinar with the aim of exploring how best to harness value iii. consider how best to engage and support from offshore wind in Scotland. communities in the context of offshore wind development. Falck Renewables and BlueFloat Energy (partners in the ScotWind process) sponsored the event which aimed to: HARNESSING VALUE FOR SCOTLAND FROM OFFSHORE WIND DEVELOPMENT This event was held online with an audience of approx. 135 people. Presentations by speakers were followed by discussions amongst participants who were divided into random groups and asked to discuss a number of pre-set questions relating to issues facing the offshore wind industry and how future developments can benefit Scotland. Each breakout group was moderated by a member of SCDI staff and notes taken. This document is a summary of the presentations from speakers and the subsequent debate amongst participants. 1 HARNESSING VALUE FOR SCOTLAND FROM OFFSHORE WIND DEVELOPMENT THE EVENT 1. Opening remarks: Paul Wheelhouse MSP, Minister for Energy, Connectivity & the Islands, Scottish Government he minister set the scene for requirement for bidders in the ScotWind process the discussion. The Scottish to include statements setting out their planned Government’s ambitions and local spend which will encourage compliance commitment to offshore wind are by companies and provide certainty on the set out in the Sectoral Marine Plan forward pipeline for suppliers. -

Local Energy

House of Commons Energy and Climate Change Committee Local Energy Sixth Report of Session 2013–14 Volume II Additional written evidence Ordered by the House of Commons to be published 9 May and 16 July 2013 Published on 6 August 2013 by authority of the House of Commons London: The Stationery Office Limited The Energy and Climate Change Committee The Energy and Climate Change Committee is appointed by the House of Commons to examine the expenditure, administration, and policy of the Department of Energy and Climate Change and associated public bodies. Current membership Mr Tim Yeo MP (Conservative, South Suffolk) (Chair) Dan Byles MP (Conservative, North Warwickshire) Barry Gardiner MP (Labour, Brent North) Ian Lavery MP (Labour, Wansbeck) Dr Phillip Lee MP (Conservative, Bracknell) Rt Hon Peter Lilley MP (Conservative, Hitchin & Harpenden) Albert Owen MP (Labour, Ynys Môn) Christopher Pincher MP (Conservative, Tamworth) John Robertson MP (Labour, Glasgow North West) Sir Robert Smith MP (Liberal Democrat, West Aberdeenshire and Kincardine) Dr Alan Whitehead MP (Labour, Southampton Test) The following members were also members of the committee during the Parliament: Gemma Doyle MP (Labour/Co-operative, West Dunbartonshire) Tom Greatrex MP (Labour, Rutherglen and Hamilton West) Laura Sandys MP (Conservative, South Thanet) Powers The Committee is one of the departmental select committees, the powers of which are set out in House of Commons Standing Orders, principally in SO No 152. These are available via www.parliament.uk. Publication The Reports and evidence of the Committee are published by The Stationery Office by Order of the House. All publications of the Committee (including press notices) are on the internet at www.parliament.uk/parliament.uk/ecc. -

Spotlight on Northern Ireland Regional Focus

COMMUNICATION HUB FOR THE WIND ENERGY INDUSTRY ‘TITANIC’ SPOTLIGHT ON NORTHERN IRELAND REGIONAL FOCUS GLOBAL WIND ALLIANCE COMPETEncY BasED TRaininG FEBRUARY/MARCH 2012 | £5.25 www.windenergynetwork.co.uk INTRODUCTION COMMUNICATING YOUR THOUGHTS AND OPINIONS WIND ENERGY NETWORK TV CHANNEL AND ONLINE LIBRARY These invaluable industry resources continue to build and we are very YOU WILL FIND WITHIN THIS We hope you enjoy the content and pleased with the interest and support EDITION CONTRIBUTIONS WHICH please feel free to contact us to make of our proposed sponsors. Please give COULD BE DESCRIBED AS OPINION your feelings known – it’s good to talk. the team a call and find out how to get PIECES. THEY ARE THERE TO FOCUS involved in both. ATTENTION ON VERY IMPORTANT ‘SpoTLIGHT ON’ regIONAL FOCUS SUBJECT AREAS WITH A VIEW Our regional focus in this edition features Remember they are free to TO GALVANISING OPINION AND Northern Ireland. Your editor visited contribute and free to access. BRINGING THE INDUSTRY TOGETHER the area in late November 2011 when TO ENSURE EFFECTIVE PROGRESS reporting on the Quo Vadis conference Please also feel free to contact us AND THEREFORE SUCCESS. and spent a very enjoyable week soaking if you wish to highlight any specific up the atmosphere, local beverages as area within the industry and we will Ray Sams from Spencer Coatings well the Irish hospitality (the craic). endeavour to encourage debate and features corrosion in marine steel feature the issue within our publication. structures, Warren Fothergill from As you will see it is a very substantial Group Safety Services on safety feature and the overall theme is one of passports and Michael Wilder from excitement and forward thinking which Petans on competency based training will ensure Northern Ireland is at the standardisation. -

Memorandum Submitted by the Department of Energy and Climate Change (WIND 01)

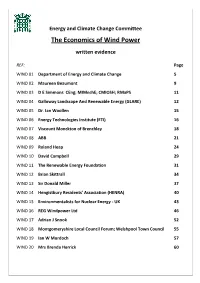

Energy and Climate Change Committee The Economics of Wind Power written evidence REF: Page WIND 01 Department of Energy and Climate Change 5 WIND 02 Maureen Beaumont 9 WIND 03 D E Simmons CEng; MIMechE; CMIOSH; RMaPS 11 WIND 04 Galloway Landscape And Renewable Energy (GLARE) 12 WIND 05 Dr. Ian Woollen 15 WIND 06 Energy Technologies Institute (ETI) 16 WIND 07 Viscount Monckton of Brenchley 18 WIND 08 ABB 21 WIND 09 Roland Heap 24 WIND 10 David Campbell 29 WIND 11 The Renewable Energy Foundation 31 WIND 12 Brian Skittrall 34 WIND 13 Sir Donald Miller 37 WIND 14 Hengistbury Residents' Association (HENRA) 40 WIND 15 Environmentalists for Nuclear Energy ‐ UK 43 WIND 16 REG Windpower Ltd 46 WIND 17 Adrian J Snook 52 WIND 18 Montgomeryshire Local Council Forum; Welshpool Town Council 55 WIND 19 Ian W Murdoch 57 WIND 20 Mrs Brenda Herrick 60 WIND 21 Mr N W Woolmington 62 WIND 22 Professor Jack W Ponton FREng 63 WIND 23 Mrs Anne Rogers 65 WIND 24 Global Warming Policy Foundation (GWPF) 67 WIND 25 Derek Partington 70 WIND 26 Professor Michael Jefferson 76 WIND 27 Robert Beith CEng FIMechE, FIMarE, FEI and Michael Knowles CEng 78 WIND 28 Barry Smith FCCA 81 WIND 29 The Wildlife Trusts (TWT) 83 WIND 30 Wyck Gerson Lohman 87 WIND 31 Brett Kibble 90 WIND 32 W P Rees BSc. CEng MIET 92 WIND 33 Chartered Institution of Water and Environmental Management 95 WIND 34 Councillor Ann Cowan 98 WIND 35 Ian M Thompson 99 WIND 36 E.ON UK plc 102 WIND 37 Brian D Crosby 105 WIND 38 Peter Ashcroft 106 WIND 39 Campaign to Protect Rural England (CPRE) 109 WIND 40 Scottish Renewables 110 WIND 41 Greenpeace UK; World Wildlife Fund; Friends of the Earth 114 WIND 42 Wales and Borders Alliance 119 WIND 43 National Opposition to Windfarms 121 WIND 44 David Milborrow 124 WIND 45 SSE 126 WIND 46 Dr Howard Ferguson 129 WIND 47 Grantham Research Institute 132 WIND 48 George F Wood 135 WIND 49 Greenersky. -

Members' Directory 2019-2020

Directory Sponsor MEMBERS’ DIRECTORY RenewableUK 2019-2020 Members’ Directory 2019-2020 Members’ Directory Micro Grid Renewables Generation Solar Electricity Trading Transmission Distribution Demand-Side Centralised Power Response Generation Smart Storage Cities Wind Smart Homes User Demand EVs 25 EUR million Sales in more than Established 6 manufacturing State of the art average annual investments facilities (last 3 years) 50 countries 1950 plants in 3 countries Who we are Tracing its industrial roots back to 1950, Cablel® Hellenic Cables has evolved into a leading European provider of reliable and competitive cable solutions. With 6 manufacturing plants across 3 countries, Cablel® Hellenic Cables covers a wide range of cable products and solutions, from Land and Submarine Power cables to Fiber Optics, Telecommunication cables and Magnet Wires. Cablel® Hellenic Cables offers a wide range of integrated solutions, including design, manufacturing, planning, project management and installation. In-house R&D and testing facilities guarantee continuous product development and innovation. As the world’s need for sustainable and reliable flow of energy and information continues to increase, we remain focused on our mission to provide top-quality products and services meeting the highest technical and sustainability standards set by our customers. HEAD OFFICE: 33, Amaroussiou - Halandriou Str., 151 25 Maroussi, Athens, GREECE Tel.: +30 210 6787 416, +30 210 6787 900, Fax: +30 210 6787 406 [email protected] www.cablel.com 09-13-2019_KX_CABLEL_168x240mm_FINAL.indd