Privacy Policy

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SAN MARCOS COMMUNITY FOUNDATION – GRANT FUNDING SUBCOMMITTEE MEETING AGENDA Wednesday, November 13, 2019 – 6:00 PM San Marcos Conference Room

SAN MARCOS COMMUNITY FOUNDATION – GRANT FUNDING SUBCOMMITTEE MEETING AGENDA Wednesday, November 13, 2019 – 6:00 PM San Marcos Conference Room Cell Phones: As a courtesy to others, please silence your cell phone during the meeting and engage in conversations outside the meeting room. Americans with Disabilities Act: If you need special assistance to participate in this meeting, please contact the Board Secretary at (760) 744-1050, ext. 3137. Notification 48 hours in advance will enable the City to make reasonable arrangements to ensure accessibility to this meeting. Assisted listening devices are available for the hearing impaired. Please see the Board Secretary if you wish to use this device. Public Comment: If you wish to address the Board on any agenda item, please complete a “Request to Speak” form. Be sure to indicate which item number you wish to address. Comments are limited to FIVE minutes. The Oral Communication segment of the agenda is for the purpose of allowing the public to address the Board on any matter NOT listed on the agenda. The Board is prohibited by state law from taking action on items NOT listed on the Agenda. However, they may refer the matter to staff for a future report and recommendation. If you wish to speak under “Oral Communications,” please complete a “Request to Speak” form as noted above. Meeting Schedule: Regular San Marcos Community Foundation Grant Funding Subcommittee meetings are generally held on the second Wednesday of each month. The subcommittee does not meet in December. The Agenda’s are posted on the City website at: www.san-marcos.net. -

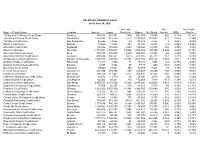

SELECTED FINANCIAL DATA As of June 30, 2020

SELECTED FINANCIAL DATA as of June 30, 2020 Loan Loss Net Net Worth / Name of Credit Union Location Assets Loans Reserves Shares Net Worth Income ROA Assets 1st Northern California Credit Union Martinez 776,407 261,331 1,384 691,588 79,055 420 0.11% 10.18% 1st United Services Credit Union Pleasanton 1,239,993 815,269 2,777 1,110,269 114,002 473 0.08% 9.19% 1st Valley Credit Union San Bernardino 46,256 17,686 80 41,018 4,433 1 0.00% 9.58% allU.S. Credit Union Salinas 47,669 19,919 267 40,420 6,578 (14) -0.06% 13.80% Alta Vista Credit Union Redlands 195,586 121,689 1,429 179,366 14,570 458 0.47% 7.45% Altura Credit Union Riverside 1,751,601 1,189,913 15,092 1,550,154 180,765 5,749 0.66% 10.32% American First Credit Union Brea 830,577 470,639 3,449 639,367 81,307 68 0.02% 9.79% America's Christian Credit Union Glendora 488,846 346,561 3,025 427,012 45,112 567 0.23% 9.23% Arrowhead Central Credit Union Rancho Cucamonga 1,782,036 705,806 13,801 1,506,142 209,832 7,384 0.83% 11.77% Atchison Village Credit Union Richmond 11,311 3,935 71 10,172 1,091 (21) -0.37% 9.65% Barstow Community Credit Union Barstow 7,893 3,304 65 7,177 698 (121) -3.07% 8.84% Bay Cities Credit Union Hayward 79,640 23,541 350 72,159 7,221 77 0.19% 9.07% C.A.H.P. -

2020 Annual Report

Health inside. Welcome in. 2020 ANNUAL REPORT CO VICTORIOUS How we triumphed together. 2020 Senior Leadership Team Our TrueCare Senior Leadership Team, along with our President & CEO, Michelle D. Gonzalez, bring their diverse set of skills and talent to TrueCare each day to fulfill our mission. These leaders consistently and strategically work to position TrueCare as a healthcare leader in all of the MISSION communities we serve. Michelle D. Gonzalez, President and CEO Teresa Therieau, VP of Operations Dr. Marie Russell, Chief Medical Officer and COO Dee Elliot, VP of Finance Kathy Martinez, Chief Financial Officer Amy Ventetuolo, VP of Marketing and Development Our Mission Andrea Lewiston. Chief Human Resources Officer Cathy Sakansky, VP of Quality, Risk and Care Management Tracy Elmer, Chief Innovation Officer Dr. Denise Gomez, Associate Medical Director To improve the health status of our diverse communities by providing quality Briana Cardoza, Chief Business Development Officer Robin Bradley, Compliance Officer healthcare that is comprehensive, affordable, and culturally sensitive. Our Vision 2020 Board of Directors TrueCare will be the premier healthcare provider for diverse communities in Nearly 70% of our Board members are TrueCare patients. This team of passionate men and women San Diego County and the Inland Empire, characterized by an exceptional share their unique perspective as patients and industry leaders to help guide our success, while patient experience, comprehensive and integrated services, and innovative ensuring we continue to provide quality services. approaches to clinical care, patient service and business operations. Donald Stump, Chair Dulce Benetti Carmen Amigon, Vice Chair Karen Pearson Our Values Victor Botello, Secretary Maria Orozco De La Cruz Harriet Carter, Treasurer Mike Michaelson Excellence Adriana Andrés-Paulson, Most Recent Past Chair Russell Riehl Integrity Andrés Martin Walt Steffen Teamwork Craig Jung Quality of Care and Services Innovation Stewardship COLLABORATIVE Passionate, inclusive and engaged. -

Online Banking Registration Disclosure

Online Banking Registration Disclosure ONLINE AGREEMENT AND ELECTRONIC FUNDS TRANSFER DISCLOSURE This Agreement and Disclosure ("Agreement") covers Internet Banking Services offered by Frontwave Credit Union ("Frontwave," "we," "us"). With Frontwave Internet Banking, you can use your personal computer ("PC") with Internet access to access your Frontwave accounts, transfer funds, obtain loan advances and determine the status of deposits. AGREEMENT AND DISCLOSURE STATEMENT INTRODUCTION Electronic Funds Transfers (EFTs) are payments to or withdrawals from your account, which are started electronically. This Agreement applies to transactions initiated by Internet Banking and Telephone Access. By requesting, keeping or using Internet Banking, you consent to the terms of this Agreement. INTERNET BANKING SERVICES Eligibility Internet Banking Services are open to all Frontwave members, subject to credit union approval. If you have a PC with Internet access, keying your Password and the proper commands will enable you to: 1) transfer funds from one of your accounts to another (except IRA or Certificate accounts), 2) obtain an open-end line of credit loan advance (you can apply for a loan online) and have it deposited directly to your Frontwave savings or checking account (Provided you have an active line of credit and are current on all obligations to Frontwave, 3) make payments on Frontwave loans by direct transfer from your account, 4) verify account balances, dividends, last deposit and check clearance status, and 5) review and download account transaction history on Frontwave accounts at any time. TRANSFER LIMITS Government regulation limits certain transfers via Internet Banking from non-transaction accounts, which include money market accounts, to six per month. -

Frontwave-Edocuments.Pdf

Frontwave Credit Union eDocument/eStatement Service Terms and Conditions Please read the following carefully before requesting eDocument/eStatement service. Thank you for your interest in receiving your future account documents and statements through Frontwave Credit Union’s (Frontwave) electronic eDocument/eStatement service available via Frontwave’s Online Banking. We are pleased to make this service available to you at no additional cost. Electronic Documents By affirmatively consenting to this service, you understand that your electronic documents and statements will include account information or notices concerning (but not limited to) your Savings Account(s), Checking Account(s), Loan(s), Tax Reporting Information or forms, other notices or disclosures required under State, Federal or consumer laws, or product and service promotional materials (all inclusively referred hereon as “documents”). By affirmatively consenting, you agree to receive your documents electronically in accordance with the terms and conditions described herein. We reserve the right however, to provide a paper (instead of electronic) copy of any document that you have authorized us to provide electronically. Computer Hardware/Software Requirements You understand in order to access, view and retain electronic documents received from Frontwave, you must have a personal computer with sufficient hard drive or other data unit storage capacity, a printer (if you intend to create a paper copy of a document), and an operating system and connection to the Internet capable of receiving, accessing, displaying, printing or storing documents. You also understand for your security, that documents received from Frontwave will be through an encrypted and password protected site. Document Notification You will receive notice via your email address each time documents are available for you to view. -

B I O G R a P

Biography William E. Birnie President/CEO Frontwave Credit Union Bill Birnie holds a BBA degree with an emphasis in Finance and Banking as well as an MBA with an emphasis in International Business from National University. Bill has more than 25 years of experience within the Credit Union movement which began when volunteered for service on the Supervisory Committee at Pacific Marine Credit Union in 1988. He served eight years on the Committee, six of those years as Chairman. In addition, Bill served one year on the Board of Directors but had to resign due to military commitments. Upon his retirement from the U.S. Marine Corps as a Sergeant Major in 1997, Bill accepted the position of Internal Auditor at Pacific Marine CU. In 2004 he was promoted to Vice President Finance and Risk Management responsible for the full spectrum of financial matters as well as the leadership of the Accounting, Risk Management, Facilities and Item Processing Departments. In 2007 he was selected as the President/CEO for Eagle Community CU, and led that Credit Union until his selection as the President/ CEO of Frontwave CU in August 2015. He is a “Highest Honors” graduate of Western CUNA Management School and recipient of the Charles Clark Memorial award as well as the SCCUA’s inaugural Collaborator of the Year Award. His previous industry involvement includes service as Chairman of the CUES Council Board for Southern California and Nevada, Chairman of the CU4K Advisory Board for the Children’s Hospital of Orange County, Steering Committee Member of the Southern California Credit Union Alliance, and served on the Board of Directors for the California Credit Union League. -

Frontwave Credit Card Agreement

Frontwave Credit Union VISA CREDIT CARD AGREEMENT 1278 Rocky Point Drive Oceanside, CA 92056-5867 Toll Free (800) 736-4500 Fax (877) 789-7628 IN THIS AGREEMENT, "YOU" AND "YOUR" MEAN ANY PERSON WHO ACCEPTS THIS AGREEMENT OR USES THE CARD. THE "CARD" MEANS ANY CREDIT CARD ISSUED TO YOU OR THOSE DESIGNATED BY YOU UNDER THE TERMS OF THIS AGREEMENT. "WE", "US", "OUR" AND THE "CREDIT UNION" MEANS FRONTWAVE CREDIT UNION OR ITS SUCCESSORS. BY USING YOUR CARD, YOU AGREE TO ALL OF THE TERMS AND CONDITIONS SET FORTH HEREIN. Others Using Your Account. If you allow anyone else to use your account, THE GRANTING OF THIS SECURITY INTEREST IS A CONDITION FOR you will be liable for all credit extended to such persons. You promise to pay THE ISSUANCE OF CREDIT UNDER THIS AGREEMENT. for all purchases and advances made by anyone you authorize to use your YOU SPECIFICALLY GRANT US A CONSENSUAL SECURITY account, whether or not you notify us that he or she will be using it. If INTEREST IN ALL INDIVIDUAL AND JOINT ACCOUNTS YOU HAVE someone else is authorized to use your account and you want to end that WITH US NOW AND IN THE FUTURE TO SECURE REPAYMENT OF person's privilege, you must notify us in writing, and if he or she has a Card, CREDIT EXTENDED UNDER THIS AGREEMENT. YOU ALSO AGREE you must return that Card with your written notice for it to be effective. THAT WE HAVE SIMILAR STATUTORY LIEN RIGHTS UNDER STATE AND/OR FEDERAL LAW. IF YOU ARE IN DEFAULT, WE CAN APPLY Ownership of Card. -

Institutions Exempt from the Debit Card Interchange Standards

Institutions Exempt from the Debit Card Interchange Standards Status FRB_ID Legal_Name Short_Name City State TYPE FDIC_ID OCC_ID NCUA_ID Exempt 725291 1199 SEIU FEDERAL CREDIT UNION 1199 SEIU FCU NEW YORK NY Federal Chartered Natural Persons Credit Union 0 0 24670 Exempt 916398 121 FINANCIAL CREDIT UNION 121 FNCL CU JACKSONVILLE FL State Chartered Natural Persons Credit Union 0 0 61605 Exempt 720689 167TH TFR FEDERAL CREDIT UNION 167TH TFR FCU MARTINSBURG WV Federal Chartered Natural Persons Credit Union 0 0 13028 Exempt 3317192 1ST ADVANTAGE BANK 1ST ADVAN BK SAINT PETERS MO State Nonmember Commercial Bank 57899 0 0 Exempt 497383 1ST ADVANTAGE FEDERAL CREDIT UNION 1ST ADVANTAGE FCU YORKTOWN VA Federal Chartered Natural Persons Credit Union 0 0 7448 Exempt 564856 1ST BANK 1ST BK BROADUS MT State Member Commercial Bank 22039 0 0 Exempt 350657 1ST BANK IN HOMINY 1ST BK IN HOMINY HOMINY OK State Member Commercial Bank 4122 0 0 Exempt 148470 1ST BANK OF SEA ISLE CITY 1ST BK OF SEA ISLE CITY SEA ISLE CITY NJ State Nonmember Savings Bank 30367 0 0 Exempt 3048487 1ST BANK YUMA 1ST BK YUMA YUMA AZ State Nonmember Commercial Bank 57298 0 0 Exempt 3945737 1ST BERGEN FEDERAL CREDIT UNION 1ST BERGEN FCU HACKENSACK NJ Federal Chartered Natural Persons Credit Union 0 0 24810 Exempt 941653 1ST CAMERON STATE BANK 1ST CAMERON ST BK CAMERON MO State Nonmember Commercial Bank 32487 0 0 Exempt 3594797 1ST CAPITAL BANK 1ST CAP BK SALINAS CA State Nonmember Commercial Bank 58485 0 0 Exempt 166595 1ST CHOICE CREDIT UNION 1ST CHOICE CU ATLANTA GA State Chartered -

Nebraska Department of Motor Vehicles Participating Lender ID's

Nebraska Department of Motor Vehicles Participating Lender ID's Lender ID Financial Institution Address City St Zip 40508547 1ST ADVANTAGE FEDERAL CREDIT UNION 110 CYBERNETICS WAY YORKTOWN VA 23693 12469773 1ST FINANCIAL FEDERAL CREDIT UNION 1232 WENTZVILLE PKWY WENTZVILLE MO 63385 26802365 1ST MIDAMERICA CREDIT UNION PO BOX 210 BETHALTO IL 62010 42389658 1ST UNITED SERVICES CU 5901 GIBRALTAR DR PLEASANTON CA 94588 11035268 360 EQUIPMENT FINANCE LLC 300 BEARDSLEY LN BLDG D-201 AUSTIN TX 78746 94305284 360 FEDERAL CREDIT UNION PO BOX 273 WINDSOR LOCKS CT 06096 20148596 4FRONT CREDIT UNION PO BOX 795 TRAVERSE CITY MI 49685 20907485 5 STAR COMMUNITY CREDIT UNION 1005 CHERRY ST MT PLEASANT IA 52641 21347780 510 NOVA LLC PO BOX 164843 FORT WORTH TX 76161 11685478 A+ FEDERAL CREDIT UNION PO BOX 14867 AUSTIN TX 78761 4867 33185965 AAA FEDERAL CREDIT UNION PO BOX 3788 SOUTH BEND IN 46619 22214719 AAC CREDIT UNION 215 EAST 25TH ST HOLLAND MI 49423 20125256 ABBOTT LABORATORIES EMPL CU (ALEC) 325 TRI-STATE PKWY GURNEE IL 60031 44714700 ABC BUS LEASING INC 1506 30TH ST NW FARIBAULT MN 55021 98366901 ABERDEEN FEDERAL CU PO BOX 1495 ABERDEEN SD 57402 1495 18667854 ABERDEEN PROVING GROUND FEDERAL CU PO BOX 1176 ABERDEEN MD 21001 26378954 ABLE INC PO BOX 1907 AUSTIN TX 78767 44769856 ACA DBA AUTO FINANCE PO BOX 4419 WILMINGTON OH 45177 4419 94219879 ACADEMY BANK NA 1111 MAIN ST STE 200 KANSAS CITY MO 64105 21702589 ACCENTRA CREDIT UNION 400 4TH AVE NE PO BOX 657 AUSTIN MN 55912 22258417 ACCEPTANCE LOAN COMPANY INC PO BOX 9219 MOBILE AL 36691 170442 ACCESS BANK 8712 W DODGE RD OMAHA NE 68114 21598741 ACCESS COMMERCIAL CAPITAL LLC 3000 MARCUS AVE STE 3E01 LAKE SUCCESS NY 11042 41294875 ACCLAIM FEDERAL CREDIT UNION 1823 BANKING ST GREENSBORO NC 27408 20366875 ACE MOTOR ACCEPTANCE CORP. -

SELECTED FINANCIAL DATA As of March 31, 2021

SELECTED FINANCIAL DATA as of March 31, 2021 Loan Loss Net Net Worth / Name of Credit Union Location Assets Loans Reserves Shares Net Worth Income ROA Assets 1st Northern California Credit Union Martinez 854,430 285,945 1,610 767,063 81,722 361 0.17% 9.56% 1st United Credit Union Pleasanton 1,291,786 785,293 1,895 1,171,636 115,455 735 0.23% 8.94% 1st Valley Credit Union San Bernardino 50,417 16,508 106 46,071 4,499 9 0.07% 8.92% allU.S. Credit Union Salinas 51,871 18,861 228 44,535 6,691 32 0.25% 12.90% Alta Vista Credit Union Redlands 220,396 98,498 879 201,826 15,554 398 0.72% 7.06% Altura Credit Union Riverside 2,127,465 1,275,350 14,287 1,915,692 194,322 5,368 1.01% 9.13% American First Credit Union Brea 813,947 537,818 3,502 666,272 86,599 1,786 0.88% 10.64% America's Christian Credit Union Glendora 603,139 392,530 4,012 541,866 47,614 1,504 1.00% 7.89% Arrowhead Central Credit Union Rancho Cucamonga 2,118,357 673,545 13,199 1,833,597 216,446 4,578 0.86% 10.22% Atchison Village Credit Union Richmond 12,578 3,742 68 11,488 1,051 (17) -0.54% 8.36% Barstow Community Credit Union Barstow 7,448 2,895 59 6,864 563 (50) -2.69% 7.56% Bay Cities Credit Union Hayward 86,425 21,311 157 78,997 7,192 (127) -0.59% 8.32% C.A.H.P. -

An Open Letter to Chairman Hagman and the Board of Supervisors - News - Vvdailypress.Com - Victorville, CA

6/24/2019 An open letter to Chairman Hagman and the Board of Supervisors - News - vvdailypress.com - Victorville, CA An open letter to Chairman Hagman and the Board of Supervisors By Joseph W. Brady Posted Jun 23, 2019 at 6:37 AM Dear Chairman Hagman and Members of the Board: With negotiations currently underway between San Bernardino County and the Sheriff’s Employee Benefits Association, it is imperative that I once again call your attention to the need for more law enforcement personnel to be deployed to the High Desert portion of the County, as well as the importance of offering competitive compensation to the County’s law enforcement officers. After going without pay increases for five years during the Great Recession, SEBA negotiated a nine percent pay increase (three percent annually from 2016- 19) in an effort to close the gap between compensation offered by our county and law enforcement salaries in neighboring jurisdictions. With these recent increases, the salaries paid to our sheriff’s deputies are now more competitive; it is essential that this progress be maintained in the current round of negotiations. Of even greater importance is the need to increase Sheriff’s Department staffing, particularly in the High Desert. In a recent conversation I had with Sheriff John McMahon, he indicated that 52 additional deputies were needed in the High Desert in order to reach appropriate staffing levels. It is, therefore, not sufficient to merely maintain salaries at a competitive level; the number of deputies must be significantly increased as well. Over the past several years on the pages of the Daily Press, I have written extensively about the crime problems we face in the High Desert and the negative effects that high crime and the public’s perception of our region as a high crime area have had on housing sales and commercial and economic development. -

E-Title Certified Lienholders* Lienholder Idlienholder Name Address Line 1 Address Line 2 City State Zip Code 540623618001St Advantage FCU P.O

Texas Department of Motor Vehicle Registration and Title System e-Title Certified Lienholders* Lienholder IDLienholder Name Address Line 1 Address Line 2 City State Zip Code 540623618001st Advantage FCU P.O. Box 2116 Newport News VA 23609 750873880001ST Community FCU 3505 Wildewood Drive San Angelo TX 76904 460133740001st Financial Bank USA 47 Sherman Hill Rd Woodbury TX 06798 370580723001st MidAmerica Credit Union 731 E Bethalto Dr Bethalto IL 62010 9522491920020th Century Fox FCU PO Box 641849 Los Angeles CA 90064 27250498200360 Equipment Finance, LLC 300 Beardsley Lane Building D Suite 201 Austin Tx 78745 06067454100360 Federal Credit Union 191 Ella Grasso Turnpike Windsor Locks CT 06096 381524350004Front Credit Union PO Box 795 Traverse City MI 49685 82531214500777 Equipment Finance LLC 600 Brickell Ave 19th Floor Miami FL 33131 81376585600A Plus Finance PO Box 4136 McAllen TX 78502 74117864800A+ Federal Credit Union PO Box 14867 Austin TX 78761 82374905500AAB-CADI LLC 12001 SW 128th Ct Ste 106 Miami FL 33186 38029964300AAC Credit Union 177 Wilson Ave NW Grand Rapids MI 49534 11601490300AAFCU PO Box 619001 MD#2100 DFW Airport TX 752619001 75605437700AAFES Federal Credit Union PO Box 210708 Dallas TX 75211 52063737400Aberdeen Proving Ground Fed CU PO Box 1176 Aberdeen MD 21001 75088886000Abilene Teachers FCU PO Box 5706 Abilene TX 796085706 61054906800Abound Federal Credit Union PO Box 900 Radcliff KY 40159 83228040400ABT Keystone Auto Lending LLC 140 Intracoastal Pointe Dr Ste 212 Jupiter FL 33477 84056779600Academy Bank, N.A. 1111 Main St., Ste 202 Kansas City MO 64105 63113138100Acceptance Loan Company Inc PO Box 9219 Mobile AL 36691 26137562200Access Bank 210 N.