Council Tax Leaflet 2019-20

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

183 Bus Time Schedule & Line Route

183 bus time schedule & line map 183 Heart Of England School - Meriden Millisons Wood View In Website Mode The 183 bus line (Heart Of England School - Meriden Millisons Wood) has 2 routes. For regular weekdays, their operation hours are: (1) Balsall Common: 8:17 AM (2) Millisons Wood: 3:40 PM Use the Moovit App to ƒnd the closest 183 bus station near you and ƒnd out when is the next 183 bus arriving. Direction: Balsall Common 183 bus Time Schedule 13 stops Balsall Common Route Timetable: VIEW LINE SCHEDULE Sunday Not Operational Monday 8:17 AM Albert Rd, Millisons Wood Tuesday 8:17 AM Showell Lane, Millisons Wood Wednesday 8:17 AM Church Lane, Meriden Thursday 8:17 AM Leys Lane, Meriden Friday 8:17 AM Meriden Green, Meriden Saturday Not Operational 51 Main Road, Meriden Cornets End Lane, Stonebridge Marsh Lane, Hampton In Arden 183 bus Info Direction: Balsall Common Bradnocks Marsh, Barston Stops: 13 Trip Duration: 18 min Park Lane, Berkswell Line Summary: Albert Rd, Millisons Wood, Showell Lane, Millisons Wood, Church Lane, Meriden, Leys Lane, Meriden, Meriden Green, Meriden, Cornets End Chapel Drive, Balsall Common Lane, Stonebridge, Marsh Lane, Hampton In Arden, A452, Balsall Civil Parish Bradnocks Marsh, Barston, Park Lane, Berkswell, Chapel Drive, Balsall Common, Library, Balsall Library, Balsall Common Common, Kenilworth Rd, Balsall Common, Heart Of Kenilworth Road, Balsall Civil Parish England School, Balsall Common Kenilworth Rd, Balsall Common Heart Of England School, Balsall Common Gipsy Lane, Balsall Civil Parish Direction: -

Balsall Common Transport Study Baseline and Constraints Report October 2020 Mott Macdonald 35 Newhall Street Birmingham B3 3PU United Kingdom

Balsall Common Transport Study Baseline and Constraints Report October 2020 Mott MacDonald 35 Newhall Street Birmingham B3 3PU United Kingdom T +44 (0)121 234 1500 mottmac.com Solihull Metropolitan Borough Council Council House Balsall Common Transport Manor Square Solihull Study B91 3QB Baseline & Constraints Report October 2020 Mott MacDonald Limited. Registered in England and Wales no. 1243967. Registered office: Mott MacDonald House, 8-10 Sydenham Road, Croydon CR0 2EE, United Kingdom Mott MacDonald | Balsall Common Transport Study Baseline & Constraints Report Issue and Revision Record Revision Date Originator Checker Approver Description A May 2017 Will Oliver Paresh Draft to Client Hodgson Hague Shingadia Rev A Alex Paul Clewett Ellingham B July 2018 Will Oliver Paresh Draft to Client Hodgson Hague Shingadia Rev B Alex Paul Clewett Ellingham C September 2020 Emily Oliver Tony Draft to Client Callard Hague Sheach Rev C. Weller Updated with Fred Jones local plan allocations D October 2020 Emily Oliver Tony Final to Client Callard – Hague Sheach following Weller client comments Document reference: 415790 | 001 | D 415790-MMD-BCTS-CC-TN-TP-001 Information class: Standard This document is issued for the party which commissioned it and for specific purposes connected with the above- captioned project only. It should not be relied upon by any other party or used for any other purpose. We accept no responsibility for the consequences of this document being relied upon by any other party, or being used for any other purpose, or containing any error or omission which is due to an error or omission in data supplied to us by other parties. -

Blythe/Cole/Bourne Catchment Management Plan Final Plan

NRA Severn-Trent 47 BLYTHE/COLE/BOURNE CATCHMENT MANAGEMENT PLAN FINAL PLAN JULY 1994 ' 'Ki. T • t- /*f » • jg , •w* • • * S M i NRA National Rivers Authority Severn-Trent Region En v ir o n m e n t Ag e n cy NATIONAL LIBRARY & INFORMATION SERVICE HEAD OFFICE Rio House, Waterside Drive, Aztec West, Almondsbury, Bristol BS32 4UD If you wish to discuss any matters arising from the Plan please contact: Mr A.G. Stanley, Area Manager, National Rivers Authority, Severn-Trent Region, Upper Trent Area. Sentinel House, Wellington Crescent, Fradley Park, Lichfield, Staffordshire, WS13 8RR. Telephone: (0543) 444141. Fax: (0543) 444161. National Information Centre The Environment Agency Rio House Waterside Drive Aztec West BRISTOL BS12 4UD Due for return Front cover: The Packhorse Bridge over the Blythe above Hampton in Arden. BLYTHE/COLE/BOURNE CATCHMENT MANAGEMENT PLAN FINAL PLAN CONTENTS PAGE 1 CATCHMENT VISION FOR THE BLYTHE/COLE/BOURNE........... 3 2 INTRODUCTION ..................................................................................... 4 3 REVIEW OF THE CONSULTATION PROCESS.....................................5 4 OVERVIEW OF THE CATCHMENT....................................................... 6 4.1 Brief Description of the Catchment ............................................................6 4.2 Summary of Catchment Uses and Activities ............................................. 7 5 ACTION P L A N S .............................................................................................. 11 6 FUTURE REVIEW AND M ONITORING -

Red Barns, Walsal End Lane, Hampton-In-Arden, B92 0Hx Asking Price of £950000

RED BARNS, WALSAL END LANE, HAMPTON-IN-ARDEN, B92 0HX ASKING PRICE OF £950,000 Grade II Listed Country House Three Bathrooms Set Within Approx. 2.5 Acres Set Behind Private Gated Entrance Four Reception Rooms Stunning Countryside Views Five Bedrooms Impressive Siematic Breakfast Kitchen Conservatory PROPERTY OVERVIEW Walsal End is a small rural hamlet dominated by several Grade II listed timber framed buildings which enjoy immense character and a pleasant rural atmosphere. So pleasant is the area that in 1991 Walsal End was designated and approved to be an area of conservation status; 'an area of special architectural/historic interest, the character or appearence of which is desirable to preserve or enhance'. 'Red Barns' is a Grade II listed building residence standing on the edge of the hamlet and enjoys the most superb views over the adjoining fields, countryside and in the distance, West Midlands/Barston golf course. Set behind a private gated entrance the accommodation enjoys a wealth of exposed beams, brickwork and many original features, well preserved and presented throughout. The property has attractive elevations, a detached double width garage with attic/games room above, patios to three sides and delightful gardens and grounds extending to approximately 2.5 acres. Situated within a conservation area this impressive home has been lovingly restored and boasts a bespoke conservatory and oak windows. The fabulous breakfast kitchen benefits from a fitted Siematic kitchen with Aga and under floor heating. The ground floor also comprises a spacious entrance hall, dining room, study, two sitting rooms, two fitted cloak rooms and two stair cases. -

Balsall Common and Hampton-In-Arden HS2 London-West Midlands May 2013

PHASE ONE DRAFT ENVIRONMENTAL STATEMENT Community Forum Area Report 23 | Balsall Common and Hampton-in-Arden HS2 London-West Midlands May 2013 ENGINE FOR GROWTH DRAFT ENVIRONMENTAL STATEMENT Community Forum Area Report ENGINE FOR GROWTH 23 I Balsall Common and Hampton-in-Arden High Speed Two (HS2) Limited, 2nd Floor, Eland House, Bressenden Place, London SW1E 5DU Telephone 020 7944 4908 General email enquiries: [email protected] Website: www.hs2.org.uk © Crown copyright, 2013, except where otherwise stated Copyright in the typographical arrangement rests with the Crown. You may re-use this information (not including logos or third-party material) free of charge in any format or medium, under the terms of the Open Government Licence. To view this licence, visit www.nationalarchives.gov.uk/doc/open-government-licence/ or write to the Information Policy Team, The National Archives, Kew, London TW9 4DU, or e-mail: [email protected]. Where we have identified any third-party copyright information you will need to obtain permission from the copyright holders concerned. To order further copies contact: DfT Publications Tel: 0300 123 1102 Web: www.dft.gov.uk/orderingpublications Product code: ES/13 Printed in Great Britain on paper containing at least 75% recycled fibre. CFA Report – Balsall Common and Hampton-in-Arden/No 23 I Contents Contents Draft Volume 2: Community Forum Area Report – Balsall Common and Hampton-in-Arden/No 23 5 Structure of the HS2 draft Environmental Statement 5 Part A: Introduction 6 1 Introduction 7 -

1 Minutes of the Annual Parish Meeting Held on Wednesday 14Th April 2010 in the Village Hall at 7.30Pm

Minutes of the Annual Parish Meeting held on Wednesday 14th April 2010 in the Village Hall at 7.30pm. Present Rosie Weaver, Bob Kipling, Graeme Goodsir, Shirley Goodsir, Melanie Lee. Apologies Sarah and Will Markham. Marilyn Hamilton on holiday. Minutes of the last Annual Parish Meeting RESOLVED That the minutes of the last Annual Parish Meeting were read and signed as a correct record of that meeting. Matters Arising from the Minutes None. Information Since 1 st April 2009 the attendance of the Parish Councillors at the Parish Council Meetings has been as follows. Attendance is shown after the name. Parish Council Meeting Attendance Ms Weaver (93%), Mr Goodsir (93%), Mrs Goodsir (100%), Mrs Lee (93%), Mrs Hamilton (79%), Mr Kipling (71%), Mr Markham (21%), Mrs Markham (36%). Planning Matters 57 planning matters have been dealt with over the year 1 st April 2009 to 31 st March 2010, of which 39 planning applications have been approved by Solihull MBC, 6 decisions are outstanding, 8 applications were refused and 4 withdrawn. Allotments 15 of the 16 allotments were let. Plot 1 being kept vacant as parking space and a log pile. Chair’s report It is with great pleasure that I present this year’s report which shows that the range of activities and events within the Parish have increased this year. There are many local people getting involved in the range of issues and activities within the Parish. Things are changing in a positive way within our local community. I have to report obviously about the initiative that the Parish Council resolved to undertake two years ago. -

Buyers' Guide BARK and BARK BASED PRODUCTS D

Buyers' Guide BARK AND BARK BASED PRODUCTS D. 0. Hunt Ltd., Watkins Nayler & Co. Ltd., SEAWEED FERTILISERS Camland Products Ltd., Orchard Nurseries, Forders Lane, Friar Street, Hereford, Seamac Agricultural Ltd., 36, Regent Street, Bishopsteignton, Devon, TQM 9RZ Tel: Hereford (0432) 274361 Telex: 3502 Foundry Lane, Chippenham, . Cambridge, CB2 1DB Tel: 062 67 2427 W. Nayler or contact your dealer. Wilts, Distributors for May & Baker, Synchemicals, Tel: (0249) 652811. Tel: (0223) 68780 Telex: 81254. IRRIGATION EQUIPMENT Mommersteeg, Proctors, & Supaturf Fertilisers. BOWLING GREEN, GOLF GREEN/ British Overhead Irrigation Ltd., SEMI-MATURE TREES Manufacturers of top dressings. TEE CONSTRUCTION The Green, Upper Halliford, Eastcote Nurseries (Solihull) Ltd., Wener & Longstaffe Ltd., GOLF COURSE ACCESSORIES Shepperton, Middlesex, TW1 7 8RY Wood Lane, Barston, Solihull, 5, Lovelace Road, Bridges Pennants Tel: 09327 88301 Telex: 928767 West Midlands, B92 OJL East Barnet, Herts, 68, Southchurch Avenue, Southend-on-Sea, Contact: Sales Department. Tel: 06755 2033/4 Tel: 01 3684845. Essex, SS1 2RR Sports Ground Irrigation, Contact: Stephen or Michael Fisher. BRITISH ASSOCIATION GOLF Tel: 0702 61 2344 'Hereward Lodge', Paget Road, SEMI-MATURE TREE PLANTING COURSE ARCHITECTS Contact: Mr. E/vin. Lubenham, Market Harborough, Leics. Eastcote Nurseries (Solihull) Ltd., Cotton (CK), Pennink, Lawrie & H. Pattison & Co. Ltd., Tel: (0858) 63153. Wood Lane, Barston, Solihull, Partners Ltd., Stanmore Hill Works, Stanmore, Toro Irrigation Ltd., West Midlands, B92 OJL Marlow Place, Station Road, Unit 7, Millstream Trading Estate, Middlesex, HA7 3HD Tel: 06755 2033/4 Marlow, Bucks, SL7 1NB Ringwood, Hampshire, BH24 3SD Tel: 01-954 4171. Contact: Stephen or Michael Fisher. Tel: Ringwood (042 54) 6261. Tel: Marlow 72555 Telex: 311210. -

The Cottage, Barston Lane, Barston, B92 0Ju Guide Price £650,000

THE COTTAGE, BARSTON LANE, BARSTON, B92 0JU GUIDE PRICE £650,000 Grade II Listed Detached House Completely Refurbished Modern Open Plan Kitchen Three Bedrooms Plus Guest Annexe Many Original Features Some Underfloor Heating Located In The Heart Of Barston Three Reception Rooms Garden & Private Courtyard PROPERTY OVERVIEW This absolutely stunning three bedroom 17th century Grade II listed property resides in the heart of Barston village and benefits from having been internally remodelled and completely refurbished throughout. Retaining many of the features associated with a property of the period, the present owners have sympathetically updated the property to include underfloor heating to some of the ground floor and a modern open plan kitchen with a range of fitted appliances, integrated log burners to both the living and dining room and complete redecoration throughout. The ground floor accommodation comprises of three reception rooms including living room, dining room and play room, kitchen, boot room, guest cloakroom and utility. To the first floor are three excellent bedrooms and a large family bathroom. The property also includes a detached guest annexe with shower facilities and bedroom above which has exposed oak trusses. Outside the property benefits from a gravelled driveway which leads to a private landscaped garden and courtyard which provides private access into the guest annexe. PROPERTY LOCATION Barston is a delightful and charming village, conveniently situated near to Knowle and Dorridge villages and also Solihull town centre and having main rail links into Birmingham Snow Hill and London Marylebone. Hampton-In-Arden station is approximately two miles away which has free parking, and Birmingham International station is well within reach and has links to London Euston and Birmingham New Street. -

Solihull Council's Magazine for Residents Winter 2018

Solihull Council’s magazine for residents Winter 2018 Your Solihull | Winter 2018 1 Recycling and rubbish Christmas collection arrangements Over Christmas and New Year some There will be no collections on recycling and rubbish collections will Tuesday 25 December, Wednesday be affected. 26 December or Tuesday 1 January. Residents whose collection day is a Normal collections will resume from Thursday or Friday will not Wednesday 2 January. be affected. Details of alternative collection For those who have collections on a arrangements for these days are Tuesday or a Wednesday, the shown below. collections will be affected. Affected collection day – Tuesday Alternative collection arrangements Tuesday 25 December – recycling and rubbish Friday 21 December – recycling Saturday 29 December – rubbish Tuesday 25 December – rubbish Saturday 29 December – rubbish Tuesday 1 January – recycling and rubbish Saturday 29 December – recycling and rubbish Tuesday 1 January – rubbish Saturday 29 December– rubbish Affected collection day – Wednesday Alternative collection arrangements Wednesday 26 December – recycling and rubbish Wednesday 2 January – rubbish (extra will be taken) Wednesday 9 January − recycling and rubbish (extra recycling will be taken) Wednesday 26 December – rubbish Wednesday 2 January – rubbish (extra will be taken) Please make sure that all extra tree suppliers offer take-back For more information including what rubbish is bagged. There is no limit schemes for used Christmas trees can be recycled, extra rubbish on the amount of recycling that so please check with the supplier collections, opening hours for is collected. when purchasing. People can also Bickenhill Household Waste take used trees to Bickenhill Recycling Centre and how to Please ensure that rubbish and Household Waste Recycling Centre. -

Solihull Drinker Issue No 87 Free Spring 2019 Please Take One

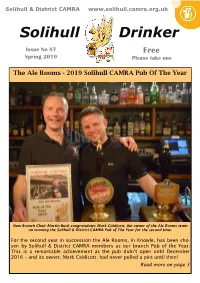

Solihull & District CAMRA www.solihull.camra.org.uk Solihull Drinker Issue No 87 Free Spring 2019 Please take one The Ale Rooms - 2019 Solihull CAMRA Pub Of The Year New Branch Chair Martin Buck congratulates Mark Caldicott, the owner of the Ale Rooms team on winning the Solihull & District CAMRA Pub of The Year for the second time. For the second year in succession the Ale Rooms, in Knowle, has been cho- sen by Solihull & District CAMRA members as our branch Pub of the Year. This is a remarkable achievement as the pub didn’t open until December 2016 – and its owner, Mark Caldicott, had never pulled a pint until then! Read more on page 3 THE BULLS HEAD Barston Lane, Barston B92 0JU Tel: 01675 442830 Brad and Joy, celebrating 31 years of award winning hospitality, welcome you to their 15th century village inn Opening hours: Mon—Thurs: 11am—2.30pm & 5.00pm—11pm Friday, Saturday and Sunday: 11.00am—11.00pm. Listed in the CAMRA Good Beer Guide for over 20 years & 7 times Solihull CAMRA Pub of the Year Cask Marque accredited—4 real ales on at all times Home-cooked meals available lunchtimes and evenings Tuesdays to Saturdays in the comfortable pub bars or separate intimate restaurant (Sundays, Mondays: Lunch only: available from 12 noon to 3pm) “A quart of ale is a dish for a king.” ― Winter’s Tale Act IV Scene 3 William Shakespeare www.TheBullsHeadBarston.co.uk 2 Continued from page 1. team put in a lot of work to ensure Testimony to what Mark, Callum, the pub runs smoothly. -

Arbour Farm Barston Lane Barston

Arbour Farm Barston Lane Barston Internal Page 4 Pic Inset LifestyleFamily home benefit with pull annex, out statementland and planning can go to two orpermission three lines. Property Infomation List FirstBarston paragraph, is an attractive editorial village style, situated short, consideredin rolling countryside headline with Property Infomation List benefitsexcellent ofaccess living tohere. the MidlandsOne or two road, sentences rail and that air link.convey The whatvillage Property Infomation List youhas wouldtwo public say in houses person. and a fine parish church. There are local Property Infomation List shops and amenities in Balsall Common, Hampton-in-Arden and Second paragraph, additional details of note about the Property Infomation List Knowle with more extensive shopping and recreational facilities in property. Wording to add value and support image selection. nearby Solihull including the Touchwood shopping centre. There Property Infomation List Tem volum is solor si aliquation rempore puditiunto qui utatis adit,are primary animporepro schools experit at Knowle, et dolupta Hampton-in-Arden ssuntio mos apieturere and Balsall ommostiCommon andsquiati in thebusdaecus area there cus are dolorporum other state, volutem. private and grammar schools to meet most requirements including Solihull Thirdand Warwick paragraph, public additional schools. details of note about the property. Wording to add value and support image selection. Tem volumThe M42 is solor (J5) is si about aliquation 3 miles rempore away giving puditiunto access qui to utatis the M40, adit,Birmingham animporepro International experit et Airport dolupta and ssuntio Birmingham mos apieturere rail station. ommostiHampton-in-Arden, squiati busdaecus about 2 milescus dolorporum away, has a volutem. railway station with a commuter service to Birmingham. -

Kimberley House, Barston Lane, Barston B92 0Ju Offers Over £700,000

KIMBERLEY HOUSE, BARSTON LANE, BARSTON B92 0JU OFFERS OVER £700,000 Immaculate Traditional Detached Modern Open Plan Breakfast Kitchen South Facing Rear Garden Five Double Bedrooms Separate Family Room Master With En-Suite Refurbished & Updated Living Room Large Games Room PROPERTY OVERVIEW This completely updated and improved traditional five bedroom detached property resides within the popular village of Barston and benefits from a large southerly facing rear garden. The property has been significantly improved by its present owners to include a new modern open plan breakfast kitchen / dining area with three sets of bi-fold doors opening onto the rear patio, living room, dining room, family room, large entrance hallway, five double bedrooms (master with en-suite, dressing room and Juliet style balcony), family bathroom, large play room / loft conversion and garage. The property also benefits from a large southerly and private rear garden with patio area to the side and full width patio with further seating area located to the rear of the garden affording open views. PROPERTY LOCATION Barston is a delightful and charming village, conveniently situated near to Knowle and Dorridge villages and also Solihull town centre and having main rail links into Birmingham New Street and London Euston. In addition, the property is located a short drive from Junction 5 and 6 of the M42 providing main road links to both North and South of the country via the M42 / M6 and M42 / M40. The excellent shopping facilities of Solihull are located close by containing many exclusive shops, boutiques and household names such as John Lewis and House of Fraser.