2020 Proxy Season Overview Highlights from the Tsx60

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

THE ROYAL INSTITUTION for the ADVANCEMENT of LEARNING/Mcgill UNIVERSITY

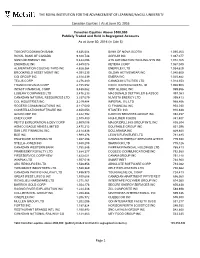

THE ROYAL INSTITUTION FOR THE ADVANCEMENT OF LEARNING/McGILL UNIVERSITY Canadian Equities │ As at June 30, 2016 Canadian Equities Above $500,000 Publicly Traded and Held in Segregated Accounts As at June 30, 2016 (in Cdn $) TORONTO DOMINION BANK 9,836,604 BANK OF NOVA SCOTIA 1,095,263 ROYAL BANK OF CANADA 9,328,748 AGRIUM INC 1,087,077 SUNCOR ENERGY INC 5,444,096 ATS AUTOMATION TOOLING SYS INC 1,072,165 ENBRIDGE INC 4,849,078 KEYERA CORP 1,067,040 ALIMENTATION COUCHE-TARD INC 4,628,364 ENERFLEX LTD 1,054,629 BROOKFIELD ASSET MGMT INC 4,391,535 GILDAN ACTIVEWEAR INC 1,040,600 CGI GROUP INC 4,310,339 EMERA INC 1,025,882 TELUS CORP 4,276,480 CANADIAN UTILITIES LTD 1,014,353 FRANCO-NEVADA CORP 4,155,552 EXCO TECHNOLOGIES LTD 1,008,903 INTACT FINANCIAL CORP 3,488,562 WSP GLOBAL INC 999,856 LOBLAW COMPANIES LTD 3,476,233 MACDONALD DETTWILER & ASSOC 997,083 CANADIAN NATURAL RESOURCES LTD 3,337,079 NUVISTA ENERGY LTD 995,413 CCL INDUSTRIES INC 3,219,484 IMPERIAL OIL LTD 968,856 ROGERS COMMUNICATIONS INC 3,117,080 CI FINANCIAL INC 954,030 CONSTELLATION SOFTWARE INC 2,650,053 STANTEC INC 910,638 GOLDCORP INC 2,622,792 CANYON SERVICES GROUP INC 892,457 ONEX CORP 2,575,400 HIGH LINER FOODS 841,407 PEYTO EXPLORATION & DEV CORP 2,509,098 MAJOR DRILLING GROUP INTL INC 838,304 AGNICO EAGLE MINES LIMITED 2,475,212 EQUITABLE GROUP INC 831,396 SUN LIFE FINANCIAL INC 2,414,836 DOLLARAMA INC 829,840 BCE INC 1,999,278 LEON'S FURNITURE LTD 781,495 ENGHOUSE SYSTEMS LTD 1,867,298 CANADIAN ENERGY SERVICES &TECH 779,690 STELLA-JONES INC 1,840,208 SHAWCOR LTD 775,126 -

Formerly Manulife Asset Management UCITS Series ICAV

Half Yearly Report Manulife Investment Management II ICAV Interim Report and Condensed Unaudited Financial Statements for the six months ended 30 September 2020 An open-ended umbrella Irish Collective Asset-Management Vehicle with segregated liability between its funds registered in Ireland on 15 April 2015 under the Irish Collective Asset-Management Vehicles Act 2015 the “ICAV Act” and authorised and regulated by the Central Bank of Ireland as an Undertaking for Collective Investment in Transferable Securities pursuant to the European Communities (Undertakings for Collective Investment in Transferable Securities Regulations 2011, as amended the “UCITS Regulations”) Manulife Investment Management II ICAV Table of contents 2 A Message to Shareholders 3 General Information 4 Manager’s Report Condensed Interim Financial Statements 11 Statement of Comprehensive Income 15 Statement of Financial Position 19 Statement of Changes in Net Assets Attributable to Holders of Redeemable Participating Shares 21 Statement of Cash Flows 24 Notes to the Condensed Interim Financial Statements 44 Schedule of Investments 112 Supplemental Information 1 A Message to Shareholders Dear shareholder, Despite heightened fears over the coronavirus (COVID-19), which sent markets tumbling just prior to the beginning of the reporting period, global financial markets delivered positive returns for the 6 months ended 30 September 2020. The governments of many nations worked to shore up their economies, equity markets began to rise, and credit spreads rebounded off their highs as liquidity concerns eased. Of course, it would be a mistake to consider this market turnaround a trustworthy signal of assured or swift economic recovery. While there has been economic growth in much of the developed world, the pace has slowed in many areas as interest rates remain low and consumer spending remains far below prepandemic levels. -

TC Energy 2021 Management Information Circular

Management information circular March 4, 2021 Notice of annual meeting of shareholders to be held May 7, 2021 24668 TC_ENGLISH Circular cover spread.pdf - p1 (March 6, 2021 00:22:29) DT Letter to shareholders ........................................... 1 Notice of 2021 annual meeting ................................ 2 About Management information circular ............................3 TC Energy Summary ....................................................................4 About the shareholder meeting ...............................6 Delivering the energy people need, every day. Safely. Delivery of meeting materials ........................................7 Responsibly. Collaboratively. With integrity. Attending and participating in the meeting .....................8 We are a vital part of everyday life — delivering the energy millions of people rely on to power their lives in a Voting ...................................................................... 10 sustainable way. Thanks to a safe, reliable network of natural gas and crude oil pipelines, along with power generation Business of the meeting .............................................. 14 and storage facilities, wherever life happens — we’re there. Guided by our core values of safety, responsibility, Governance ........................................................33 collaboration and integrity, our 7,500 people make a positive difference in the communities where we operate across About our governance practices ...................................33 Canada, the U.S. and Mexico. -

ZGD) (The “ETF”) for the Six-Month Period Ended June 30, 2017 (The “Period”) Manager: BMO Asset Management Inc

SEMI-ANNUAL MANAGEMENT REPORT OF FUND PERFORMANCE BMO S&P/TSX Equal Weight Global Gold Index ETF (ZGD) (the “ETF”) For the six-month period ended June 30, 2017 (the “Period”) Manager: BMO Asset Management Inc. (the “Manager” and “portfolio manager”) Management Discussion Significant individual contributors to performance were of Fund Performance Kirkland Lake Gold Ltd., IAMGOLD Corporation, Kinross Gold Corporation. and Osisko Gold Royalties Ltd. Results of Operations Individual detractors to performance included Asanko The ETF outperformed the broad-based S&P/TSX Capped Gold Inc., SEMAFO Inc., Klondex Mines Ltd. and Eldorado Composite Index by 0.23%. However, the more appropriate Gold Corporation. comparison is to the S&P/TSX Equal Weight Global Gold Index (the “Index”), due to the concentration of the Recent Developments portfolio in global gold mining companies. The ETF The portfolio manager believes oil prices should continue returned 0.97% versus the Index return of 1.22%. The to stabilize from oil production cuts out of OPEC. While U.S. change in total net asset value during the Period from oil production increases, it poses a risk to oil prices. The approximately $30 million to approximately $27 million rebound in economic growth should increase demand for had no impact to the performance of the ETF. other commodities and could raise their prices. Gold could also fair well with increased geopolitical uncertainty. The difference in the performance of the ETF relative to the Index during the Period (-0.25%) resulted from the payment Subsequent Events of management fees (-0.31%), and the impact of sampling Underlying Index Change and certain other factors (0.06%), which may have included Effective on or about September 15, 2017, the underlying timing differences versus the Index, and market volatility. -

Climate Change 2020

Emera Inc. - Climate Change 2020 C0. Introduction C0.1 (C0.1) Give a general description and introduction to your organization. Emera Inc. is a geographically diverse energy and services company headquartered in Halifax, Nova Scotia, Canada with approximately $32 billion in assets and 2019 revenues of $6.1 billion. From our origins as a single electric utility in Nova Scotia, Emera has grown into an energy leader serving 2.5 million customers in Canada, the US, and the Caribbean. Emera’s strategy has been focused on safely delivering cleaner, affordable and reliable energy to customers for more than 15 years. Our company has investments throughout North America, and in four Caribbean countries. A description of the Emera affiliates that report to CDP is as follows: Tampa Electric (TEC) is a vertically integrated regulated electric utility servicing 780,000 customers in West Central Florida. Peoples Gas (PGS) is a natural gas utility serving 406,000 customers in Florida. New Mexico Gas Company (NMGC) is a natural gas utility serving 534,000 customers in New Mexico. Nova Scotia Power Inc. (NSPI) is a vertically integrated electric utility serving 523,000 customers in Nova Scotia. Emera Caribbean includes vertically integrated electric utilities serving 184,000 customers on the islands of Barbados, Grand Bahama, St. Lucia and Dominica. Emera Maine is a transmission and distribution electric utility serving 159,000 customers in northern and eastern Maine. The sale of Emera Maine to ENMAX Corporation closed in March 2020. Emera New Brunswick owns and operates the Brunswick Pipeline, a 145 km pipeline natural gas pipeline in New Brunswick and Emera Newfoundland and Labrador owns and operates the Maritime Link and manages investments in associated projects. -

BMO Equal Weight Global Gold Index ETF (ZGD) Summary of Investment Portfolio • As at September 30, 2019

QUARTERLY PORTFOLIO DISCLOSURE BMO Equal Weight Global Gold Index ETF (ZGD) Summary of Investment Portfolio • As at September 30, 2019 % of Net Asset % of Net Asset Portfolio Allocation Value Top 25 Holdings Value Canada ........................................................................................................ 60.1 Centerra Gold Inc. .............................................................. 3.6 United States .............................................................................................. 16.5 Gold Fields Limited, ADR ...................................................... 3.5 South Africa .................................................................................................. 9.7 OceanaGold Corporation ....................................................... 3.5 Australia ........................................................................................................ 3.5 Alacer Gold Corporation ....................................................... 3.5 Nicaragua ...................................................................................................... 3.4 Coeur Mining, Inc. ............................................................. 3.4 Cote D’Ivoire ................................................................................................. 3.3 Kirkland Lake Gold Ltd. ........................................................ 3.4 Brazil ............................................................................................................. 3.2 IAMGOLD Corporation -

Preparing for Growth: Capitalizing on a Period of Progress and Stability

Preparing for growth: Capitalizing on a period of progress and stability www.pwc.com/ca/canadianmine A year of stability Contents 2 A year of stability 3 Highlights and analysis 7 Agnico Eagle: Perfecting a successful 60 year-old strategy 9 Osisko Gold Royalties: Disrupting the cycle An interview with John Matheson, Partner, PwC Canada 11 Savvy investments in stable times Call it breathing room. Over the last year, into Eastern and Central Europe with its Canada’s major mining companies have Belt and Road Initiative (formerly One Belt entered a period of relative stability after and One Road) is increasing demand for weathering a frenzied period of boom, industrial products. bust and recovery. Globally, the geopolitical situation will About this report The sector has been paying down debt, likely remain volatile through 2018 and Preparing for growth is one of improving balance sheets and judiciously beyond. While bullion largely shrugged four publications in our annual investing in capital projects, on trend with off 2017’s world events, international Canadian mine series looking at the wider global mining industry in 2017. uncertainties could yet become an the realities and priorities of public Maintaining flexibility and increasing upward force on gold prices. The success mining companies headquartered efficiency are key goals for many executive of stock markets around the globe last in Canada. It offers a summary of financial analysis of the top 25 teams as they try to position themselves to year dampened general investor interest listings by market capitalization on capitalize on the next stages of the cycle. in gold equities, with the precious metal the TSX and complements our Junior Some companies have sought to enhance traditionally serving as a hedge against mine 2017 report, which analyzes the operations through acquisitions, but on market downturns, said David Smith, top 100 listings on the TSX Venture the whole, 2017 saw few eye-popping Senior Vice President of Finance and Chief Exchange (TSX-V). -

2020 Management Information Circular

2020 Management information circular Manulife Financial Corporation Annual Meeting May 7, 2020 Notice of annual meeting of shareholders Your participation is important. Please read this document and vote. Notice of annual meeting of common shareholders You’re invited to attend our 2020 annual meeting of common shareholders When Four items of business May 7, 2020 • Receiving the consolidated financial statements and 11 a.m. (Eastern time) auditors’ reports for the year ended December 31, 2019 • Electing directors Where • Appointing the auditors Manulife Head Office • Having a say on executive pay 200 Bloor Street East We’ll consider any other matters that are properly Toronto, Canada brought before the meeting, but we are not aware of any at this time. The annual meeting for The Manufacturers Life Insurance Company will be held at the same time and place. We are actively monitoring the coronavirus (COVID-19) situation and are sensitive to the public health and travel concerns our shareholders may have as well as the protocols public health authorities may recommend. We remind shareholders that a live webcast of the meeting will be available at manulife.com and this year, more than ever, we encourage you to vote your shares prior to the meeting. Please read the voting section starting on page 10 for information on how to vote. In the event it is not possible or advisable to hold our annual meeting in person, we will announce alternative arrangements for the meeting via press release as promptly as practicable, which may include holding the meeting solely by means of remote communication. -

Notice of Annual Meeting of Shareholders of Kirkland Lake Gold Ltd

PMS: 662 C PMS: Cool Gray 7 C PMS: 7407 C PMS: 135 C C:100 M:87 Y:0 K:20 C:20 M:14 Y:12 K:40 C:6 M:36 Y:79 K:12 C:0 M:21 Y:76 K:0 R:24 G:54 B:131 R:135 G:138 B:143 R:210 G:152 B:71 R:255 G:203 B:88 HEX: #163683 HEX: #878a8f HEX: #d29847 HEX: #ffcb58 2021 Notice of Annual Meeting of Shareholders of Kirkland Lake Gold Ltd. TO BE HELD ON MAY 6, 2021 MANAGEMENT INFORMATION CIRCULAR DATED APRIL 9, 2021 MANAGEMENT INFORMATION CIRCULAR | DATED APRIL 9, 2021 KIRKLAND LAKE GOLD LTD. NOTICE OF ANNUAL MEETING OF SHAREHOLDERS NOTICE IS HEREBY GIVEN that an annual meeting (the “Meeting”) of the shareholders (the “Shareholders”) of Kirkland Lake Gold Ltd. (the “Company”) will be held in a virtual-only format, which will be conducted via live audio webcast available online at https://virtual-meetings.tsxtrust.com/1086 on Thursday, May 6, 2021 at 4:30 p.m. (Toronto time) for the following purposes: 1. to receive and consider the audited consolidated financial statements of the Company as at and for the years ended December 31, 2020 and 2019, together with the report of the auditors thereon; 2. to appoint KPMG LLP, Chartered Professional Accountants as auditor of the Company and authorize the board of directors to fix their remuneration; 3. to elect the directors of the Company for the ensuing year; 4. to consider and, if deemed appropriate, pass, with or without variation, a non-binding advisory resolution on the Company’s approach to executive compensation; and 5. -

Our Members Our Members

SUBSCRIBE TO MAC NEWS Home > Members & Partners > Our Members Our Members Members and associate members of the Mining Association of Canada play a vital role in ensuring the continued strength and sustainability of Canada’s mining industry. Our members account for most of Canada’s production of base and precious metals, uranium, diamonds, metallurgical coal and mined oil sands, and are actively engaged in mineral exploration, mining, smelting, rening and semi-fabrication. Full Members AGNICO EAGLE MINES LIMITED ALEXCO RESOURCE CORP. ARCELORMITTAL MINES CANADA B2GOLD CORP. BAFFINLAND BARRICK BHP CAMECO CORPORATION CANADIAN NATURAL RESOURCES LIMITED COPPER MOUNTAIN MINING CORPORATION DE BEERS CANADA INC. ELDORADO GOLD EQUINOX GOLD CORPORATION EXCELLON RESOURCES INC. FIRST QUANTUM MINERALS LTD. FORT HILLS LIMITED PARTNERSHIP GLENCORE CANADA CORPORATION HD MINING INTERNATIONAL LTD. HECLA QUÉBEC INC. HUDBAY MINERALS INC. IAMGOLD CORPORATION IMPALA CANADA LIMITED IRON ORE COMPANY OF CANADA KINROSS GOLD CORPORATION KIRKLAND LAKE GOLD LUNDIN FOUNDATION LUNDIN MINING CORPORATION MCEWEN MINING NEW GOLD INC. NEWMONT NEXGEN ENERGY LTD. NORONT RESOURCES LTD. NORZINC LTD. (FORMERLY CANADIAN ZINC CORPORATION) NYRSTAR CANADA (HOLDINGS) LTD. PAN AMERICAN SILVER CORP. RIO TINTO CANADA RIVERSDALE RESOURCES LIMITED ROYAL CANADIAN MINT SHERRITT INTERNATIONAL STAR DIAMOND CORPORATION SUNCOR ENERGY INC. SYNCRUDE CANADA LTD. TECK RESOURCES LIMITED TREVALI VALE WESTERN COPPER AND GOLD YAMANA GOLD INC. Associates AUSENCO LIMITED AVALON ADVANCED MATERIALS INC. BARR ENGINEERING AND ENVIRONMENTAL SCIENCE CANADA LTD. BBA INC. BENNETT JONES LLP BGC ENGINEERING INC. BUREAU VERITAS LABORATORIES CANADA NORTH ENVIRONMENTAL SERVICES LTD. CEMENTATION CANADA INC. CEMI - CENTRE FOR EXCELLENCE IN MINING INNOVATION CHAMBER OF MARINE COMMERCE CHARLES TENNANT & COMPANY (CANADA) LTD. -

RBC Principal Protected Guaranteed Return Enhanced Yield LEOS® Series 247

EQUITY LINKED NOTE | RBC GLOBAL INVESTMENT SOLUTIONS RBC Principal Protected Guaranteed Return Enhanced Yield LEOS® Series 247 7 year Term 100% Principal 0.40% - 6.00% Protection at Maturity Coupon in Years 1-7 This Note is a 7 year investment designed to provide annual income based on exposure to an equally Offering Closes weighted Canadian Equity Portfolio. Investors will receive a minimum coupon of 0.40%, to a maximum of 6.00% in years 1-7 based on the price performance of a portfolio of 10 Canadian companies. The May 21, 2021 principal amount is guaranteed by RBC at maturity. The maturity date is May 30, 2028. FundSERV INVESTMENT HIGHLIGHTS RBC4247 Income Potential: Minimum Coupon of 0.40%, to a maximum of 6.00% in Years 1-7, based on the price performance of the Shares in the Equity Portfolio where performance per Share is measured from inception to each annual coupon valuation date, subject to a maximum of 6.00% and a minimum of Issue Date -10%. Notes do not represent an interest in the securities of the companies that comprise the Equity Portfolio, and holders will have no right or entitlement to such securities including the dividends and May 26, 2021 other distributions paid on these securities. The indicative dividend yield on the Equity Portfolio as of April 30, 2021 was 4.96%, representing an aggregate dividend yield of approximately 40.34% annually compounded over the seven year term, on the assumption that the dividend yield remains constant. Principal Protection: Royal Bank of Canada guarantees the principal amount at maturity. -

Bank of Montreal Protected Deposit Notes Advantage Minimum Y.I.E.L.D

Bank of Montreal Protected Deposit Notes Advantage Minimum Y.I.E.L.D. Class TM, Series 1 > Key Features • 5 year term to maturity • Minimum annual interest payment of 0.70% • Annual interest payment ranging from 0.70% to 7.0% based on the price performance of a portfolio of ten (10) Canadian issuers* • 100% principal guaranteed by BMO as issuer if held to maturity *The amount of annual interest paid is unlikely to mirror the price performance of the securities in the Benchmark Portfolio since the return cannot exceed 7.0% of the Deposit Amount and could be zero provided no extraordinary event has occurred under the terms of the Information Statement. > Hypothetical Return Examples On an Interest Payment Date a Holder will be entitled to receive Interest on a Deposit Note equal to: (i) the maximum amount of Interest of 7.0% of the Deposit Amount, if the Closing Price of each Security has increased from the Closing Date to the applicable Valuation Date; (ii) 0.70% of the Deposit Amount, if the simple average of the effective returns is zero or negative; or (iii) a percentage of the Deposit Amount greater than 0.70% and less than 7.0%, if the simple average of the effective returns is greater than 0% and less than 6.3%. The following examples are included for illustration purposes only. The values of the Deposit Notes used to illustrate two different scenarios are hypothetical and are not estimates or forecasts of expected returns from the Closing Date to and including the Final Valuation Date.