Bank of Montreal Protected Deposit Notes Advantage Minimum Y.I.E.L.D

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

THE ROYAL INSTITUTION for the ADVANCEMENT of LEARNING/Mcgill UNIVERSITY

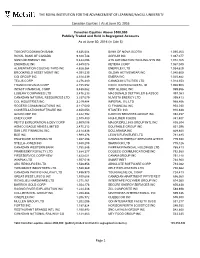

THE ROYAL INSTITUTION FOR THE ADVANCEMENT OF LEARNING/McGILL UNIVERSITY Canadian Equities │ As at June 30, 2016 Canadian Equities Above $500,000 Publicly Traded and Held in Segregated Accounts As at June 30, 2016 (in Cdn $) TORONTO DOMINION BANK 9,836,604 BANK OF NOVA SCOTIA 1,095,263 ROYAL BANK OF CANADA 9,328,748 AGRIUM INC 1,087,077 SUNCOR ENERGY INC 5,444,096 ATS AUTOMATION TOOLING SYS INC 1,072,165 ENBRIDGE INC 4,849,078 KEYERA CORP 1,067,040 ALIMENTATION COUCHE-TARD INC 4,628,364 ENERFLEX LTD 1,054,629 BROOKFIELD ASSET MGMT INC 4,391,535 GILDAN ACTIVEWEAR INC 1,040,600 CGI GROUP INC 4,310,339 EMERA INC 1,025,882 TELUS CORP 4,276,480 CANADIAN UTILITIES LTD 1,014,353 FRANCO-NEVADA CORP 4,155,552 EXCO TECHNOLOGIES LTD 1,008,903 INTACT FINANCIAL CORP 3,488,562 WSP GLOBAL INC 999,856 LOBLAW COMPANIES LTD 3,476,233 MACDONALD DETTWILER & ASSOC 997,083 CANADIAN NATURAL RESOURCES LTD 3,337,079 NUVISTA ENERGY LTD 995,413 CCL INDUSTRIES INC 3,219,484 IMPERIAL OIL LTD 968,856 ROGERS COMMUNICATIONS INC 3,117,080 CI FINANCIAL INC 954,030 CONSTELLATION SOFTWARE INC 2,650,053 STANTEC INC 910,638 GOLDCORP INC 2,622,792 CANYON SERVICES GROUP INC 892,457 ONEX CORP 2,575,400 HIGH LINER FOODS 841,407 PEYTO EXPLORATION & DEV CORP 2,509,098 MAJOR DRILLING GROUP INTL INC 838,304 AGNICO EAGLE MINES LIMITED 2,475,212 EQUITABLE GROUP INC 831,396 SUN LIFE FINANCIAL INC 2,414,836 DOLLARAMA INC 829,840 BCE INC 1,999,278 LEON'S FURNITURE LTD 781,495 ENGHOUSE SYSTEMS LTD 1,867,298 CANADIAN ENERGY SERVICES &TECH 779,690 STELLA-JONES INC 1,840,208 SHAWCOR LTD 775,126 -

Formerly Manulife Asset Management UCITS Series ICAV

Half Yearly Report Manulife Investment Management II ICAV Interim Report and Condensed Unaudited Financial Statements for the six months ended 30 September 2020 An open-ended umbrella Irish Collective Asset-Management Vehicle with segregated liability between its funds registered in Ireland on 15 April 2015 under the Irish Collective Asset-Management Vehicles Act 2015 the “ICAV Act” and authorised and regulated by the Central Bank of Ireland as an Undertaking for Collective Investment in Transferable Securities pursuant to the European Communities (Undertakings for Collective Investment in Transferable Securities Regulations 2011, as amended the “UCITS Regulations”) Manulife Investment Management II ICAV Table of contents 2 A Message to Shareholders 3 General Information 4 Manager’s Report Condensed Interim Financial Statements 11 Statement of Comprehensive Income 15 Statement of Financial Position 19 Statement of Changes in Net Assets Attributable to Holders of Redeemable Participating Shares 21 Statement of Cash Flows 24 Notes to the Condensed Interim Financial Statements 44 Schedule of Investments 112 Supplemental Information 1 A Message to Shareholders Dear shareholder, Despite heightened fears over the coronavirus (COVID-19), which sent markets tumbling just prior to the beginning of the reporting period, global financial markets delivered positive returns for the 6 months ended 30 September 2020. The governments of many nations worked to shore up their economies, equity markets began to rise, and credit spreads rebounded off their highs as liquidity concerns eased. Of course, it would be a mistake to consider this market turnaround a trustworthy signal of assured or swift economic recovery. While there has been economic growth in much of the developed world, the pace has slowed in many areas as interest rates remain low and consumer spending remains far below prepandemic levels. -

TC Energy 2021 Management Information Circular

Management information circular March 4, 2021 Notice of annual meeting of shareholders to be held May 7, 2021 24668 TC_ENGLISH Circular cover spread.pdf - p1 (March 6, 2021 00:22:29) DT Letter to shareholders ........................................... 1 Notice of 2021 annual meeting ................................ 2 About Management information circular ............................3 TC Energy Summary ....................................................................4 About the shareholder meeting ...............................6 Delivering the energy people need, every day. Safely. Delivery of meeting materials ........................................7 Responsibly. Collaboratively. With integrity. Attending and participating in the meeting .....................8 We are a vital part of everyday life — delivering the energy millions of people rely on to power their lives in a Voting ...................................................................... 10 sustainable way. Thanks to a safe, reliable network of natural gas and crude oil pipelines, along with power generation Business of the meeting .............................................. 14 and storage facilities, wherever life happens — we’re there. Guided by our core values of safety, responsibility, Governance ........................................................33 collaboration and integrity, our 7,500 people make a positive difference in the communities where we operate across About our governance practices ...................................33 Canada, the U.S. and Mexico. -

Climate Change 2020

Emera Inc. - Climate Change 2020 C0. Introduction C0.1 (C0.1) Give a general description and introduction to your organization. Emera Inc. is a geographically diverse energy and services company headquartered in Halifax, Nova Scotia, Canada with approximately $32 billion in assets and 2019 revenues of $6.1 billion. From our origins as a single electric utility in Nova Scotia, Emera has grown into an energy leader serving 2.5 million customers in Canada, the US, and the Caribbean. Emera’s strategy has been focused on safely delivering cleaner, affordable and reliable energy to customers for more than 15 years. Our company has investments throughout North America, and in four Caribbean countries. A description of the Emera affiliates that report to CDP is as follows: Tampa Electric (TEC) is a vertically integrated regulated electric utility servicing 780,000 customers in West Central Florida. Peoples Gas (PGS) is a natural gas utility serving 406,000 customers in Florida. New Mexico Gas Company (NMGC) is a natural gas utility serving 534,000 customers in New Mexico. Nova Scotia Power Inc. (NSPI) is a vertically integrated electric utility serving 523,000 customers in Nova Scotia. Emera Caribbean includes vertically integrated electric utilities serving 184,000 customers on the islands of Barbados, Grand Bahama, St. Lucia and Dominica. Emera Maine is a transmission and distribution electric utility serving 159,000 customers in northern and eastern Maine. The sale of Emera Maine to ENMAX Corporation closed in March 2020. Emera New Brunswick owns and operates the Brunswick Pipeline, a 145 km pipeline natural gas pipeline in New Brunswick and Emera Newfoundland and Labrador owns and operates the Maritime Link and manages investments in associated projects. -

2020 Management Information Circular

2020 Management information circular Manulife Financial Corporation Annual Meeting May 7, 2020 Notice of annual meeting of shareholders Your participation is important. Please read this document and vote. Notice of annual meeting of common shareholders You’re invited to attend our 2020 annual meeting of common shareholders When Four items of business May 7, 2020 • Receiving the consolidated financial statements and 11 a.m. (Eastern time) auditors’ reports for the year ended December 31, 2019 • Electing directors Where • Appointing the auditors Manulife Head Office • Having a say on executive pay 200 Bloor Street East We’ll consider any other matters that are properly Toronto, Canada brought before the meeting, but we are not aware of any at this time. The annual meeting for The Manufacturers Life Insurance Company will be held at the same time and place. We are actively monitoring the coronavirus (COVID-19) situation and are sensitive to the public health and travel concerns our shareholders may have as well as the protocols public health authorities may recommend. We remind shareholders that a live webcast of the meeting will be available at manulife.com and this year, more than ever, we encourage you to vote your shares prior to the meeting. Please read the voting section starting on page 10 for information on how to vote. In the event it is not possible or advisable to hold our annual meeting in person, we will announce alternative arrangements for the meeting via press release as promptly as practicable, which may include holding the meeting solely by means of remote communication. -

RBC Principal Protected Guaranteed Return Enhanced Yield LEOS® Series 247

EQUITY LINKED NOTE | RBC GLOBAL INVESTMENT SOLUTIONS RBC Principal Protected Guaranteed Return Enhanced Yield LEOS® Series 247 7 year Term 100% Principal 0.40% - 6.00% Protection at Maturity Coupon in Years 1-7 This Note is a 7 year investment designed to provide annual income based on exposure to an equally Offering Closes weighted Canadian Equity Portfolio. Investors will receive a minimum coupon of 0.40%, to a maximum of 6.00% in years 1-7 based on the price performance of a portfolio of 10 Canadian companies. The May 21, 2021 principal amount is guaranteed by RBC at maturity. The maturity date is May 30, 2028. FundSERV INVESTMENT HIGHLIGHTS RBC4247 Income Potential: Minimum Coupon of 0.40%, to a maximum of 6.00% in Years 1-7, based on the price performance of the Shares in the Equity Portfolio where performance per Share is measured from inception to each annual coupon valuation date, subject to a maximum of 6.00% and a minimum of Issue Date -10%. Notes do not represent an interest in the securities of the companies that comprise the Equity Portfolio, and holders will have no right or entitlement to such securities including the dividends and May 26, 2021 other distributions paid on these securities. The indicative dividend yield on the Equity Portfolio as of April 30, 2021 was 4.96%, representing an aggregate dividend yield of approximately 40.34% annually compounded over the seven year term, on the assumption that the dividend yield remains constant. Principal Protection: Royal Bank of Canada guarantees the principal amount at maturity. -

Stoxx® Canada Total Market Mid Index

STOXX® CANADA TOTAL MARKET MID INDEX Components1 Company Supersector Country Weight (%) EMERA Utilities Canada 3.01 BAUSCH HEALTH Health Care Canada 2.71 WSP GLOBAL Construction & Materials Canada 2.59 Teck Resources Ltd. Cl B Basic Resources Canada 2.48 Canadian Tire Corp. Ltd. Cl A Retail Canada 2.36 ALGONQUIN POWER & UTILITIES Utilities Canada 2.34 CAE Industrial Goods & Services Canada 2.27 CCL INDS.'B' Industrial Goods & Services Canada 2.12 CANADIAN APARTMENT PROP REIT Real Estate Canada 2.11 Kinross Gold Corp. Basic Resources Canada 2.11 TFI INTERNATIONAL Industrial Goods & Services Canada 2.04 LIGHTSPEED POS Technology Canada 1.97 AIR CANADA Travel & Leisure Canada 1.95 Cameco Corp. Energy Canada 1.93 INTER PIPELINE Energy Canada 1.83 TOROMONT INDUSTRIES Industrial Goods & Services Canada 1.81 TOURMALINE OIL Energy Canada 1.81 GILDAN ACTIVEWEAR Consumer Products & Services Canada 1.77 Blackberry Ltd Technology Canada 1.72 RITCHIE BROS.AUCTIONEERS (NYS) Consumer Products & Services Canada 1.68 WEST FRASER TIMBER Basic Resources Canada 1.62 FIRSTSERVICE Real Estate Canada 1.62 NORTHLAND POWER Utilities Canada 1.56 PAN AMER.SILV. (NAS) Basic Resources Canada 1.55 LUNDIN MINING Basic Resources Canada 1.53 ALTAGAS Utilities Canada 1.51 KEYERA CORP Energy Canada 1.51 IA FINANCIAL CORP Insurance Canada 1.51 EMPIRE 'A' Personal Care, Drug & Grocery Stores Canada 1.49 DESCARTES SYSTEMS GROUP Technology Canada 1.44 RIOCAN REIT.TST. Real Estate Canada 1.44 ONEX Financial Services Canada 1.44 TMX GROUP Financial Services Canada 1.41 ARC RESOURCES LTD Energy Canada 1.29 Element Fleet Management Corp. -

Bank of Montreal Diversified Bull & Bear Callable Principal Protected Deposit Notes, Series 5

BMO Global Structured Products Principal Protected Solutions Bank of Montreal Diversified Bull & Bear Callable Principal Protected Deposit Notes, Series 5 100% of the positive price Or 15% of the negative price 100% Principal Protected 7 Year Term performance of the Reference performance of the Reference if held to Maturity Portfolio at maturity Portfolio at maturity Investment Highlights Reference Basket Callable Feature: The Reference Portfolio will consist of common shares or units of 10 TSX-listed Canadian large cap issuers. While the securities in Callable at the option of Bank of Montreal at any time prior to the Reference Portfolio had an average dividend or distribution Maturity with interest at annual compounded rate of return of 15% yield of 4.90% and an average market capitalization of $18.14 calculated from the Closing Date to the Call Date. billion as of September 8, 2017, investors in the Deposit Notes must be prepared to waive the aggregate dividend yield provided If not called for redemption, a holder will receive a return at by the securities of the issuers, representing approximately Maturity equal to 100% of any percentage increase or 15% of any 39.76% over the 7-year term of the Deposit Notes, assuming the percentage decrease in the Reference Portfolio Value from the average dividend yield on such securities remains constant at Closing Date to the Final Valuation Date. No Variable Return will 4.90% each year and assuming dividends are reinvested in such be paid if the Reference Portfolio Value has not changed from the securities. The value of the Reference Portfolio will not include Closing Date to the Final Valuation Date. -

Enbridge's Energy Infrastructure Assets

Enbridge’s Energy Infrastructure Assets Last Updated: Aug. 4, 2021 Energy Infrastructure Assets Table of Contents Crude Oil and Liquids Pipelines .................................................................................................... 3 Natural Gas Transmission Pipelines ........................................................................................... 64 Natural Gas Gathering Pipelines ................................................................................................ 86 Gas Processing Plants ................................................................................................................ 91 Natural Gas Distribution .............................................................................................................. 93 Crude Oil Tank Terminals ........................................................................................................... 96 Natural Gas Liquids Pipelines ................................................................................................... 110 NGL Fractionation ..................................................................................................................... 111 Natural Gas Storage ................................................................................................................. 112 NGL Storage ............................................................................................................................. 119 LNG Storage ............................................................................................................................ -

Canadian Preferred Shares Report

Canadian Preferred Shares Report July 21, 2021 Fixed Income Group The evaporating Preferred market For the first half of 2021, there were only a handful of new issues in the Canadian Performance preferred market and redemptions galore; it was like a kettle filled to the top that keeps boiling over. The S&P/TSX Preferred Share Index continued its upward trend for the 2nd quarter of 2021, through a robust appetite from individual yield seekers, Inside this Report managed products and the continued redemption of outstanding issues. This forced Market Performance ..................... 2 investors to buy less attractive issues and invest more money into ETFs and mutual fund preferred issues. Several factors contributed to this including but not limited Redemptions announced in Q3 2021 ............................................ 2 to: Fund Flows .................................. 2 Negative supply – There has been approx. $5 billion in net redemptions (book value) in 2021. Most issuers redeemed preferred shares (prefs) when it was Market Updates ............................ 2 advantageous to do so. Issuers have not been issuing new paper in exchange, but New Issues in Q2 2021 ................. 3 have been using different venues for financing. The first and second quarters saw Credit Rating Changes ................. 3 very few new issues; so there was a dwindling supply of prefs for a second quarter in a row. Canadian Yield Curve Portfolio Positioning and Where to Look for Opportunities .................. 3 ETF and Fund inflows – With issues being called away and no alternative new issues Highlighted: Preferred Shares…....4 in sight, investors have been pouring money into preferred share ETFs and mutual funds. Approximately $743 million of new money has gone into these two Most Actively Traded………………6 instruments since the beginning of the year. -

2020 Proxy Season Overview Highlights from the Tsx60

2020 PROXY SEASON OVERVIEW HIGHLIGHTS FROM THE TSX60 AND COMMENTARY ON THE IMPACTS OF COVID19 In Summary 2019 was a stellar year for the TSX overall, but circumstances drastically changed in February/March 2020. The unprecedented impacts of COVID-19 halted businesses and resulted in one of the fastest share price declines in history. Adding to these difficulties, firms in the Energy sector had to overcome tumbling oil prices and a lack of storage due to the demand shock and OPEC / Russia market share battle. At the other end, the Materials sector excelled as the S&P/TSX Materials Capped Index saw 2020 YTD to May 31, 2020 performance of +10% (vs. -11% for the S&P/TSX Composite Index). During this time, compensation has been an important topic to all stakeholders, and we have seen numerous firms implement reductions or deferrals in executive and director compensation. As in the recent past, executive compensation trends in 2019 regarding the design of incentive plans and the use of the performance metrics remain relatively stable. Greater emphasis continues on items related to environment, social and governance topics, with notable emphasis on the “social” component as boards grapple with employee safety, diversity and inclusion. S&P/TSX Indices Equity Market Price Changes - FY2019 and 2020 YTD Top 3 TSX60 Performers End of 2019 Shopify Inc. 453.5% 60% Capped Materials Wheaton Precious Metals Corp. 122.6% 40% 38.13% 20% 11.77% TSX60 Kinross Gold Corporation 103.4% 0% 5.89% -2.16% Composite Bottom 3 TSX60 Performers -20% Bombardier Inc. -78.1% -40% -41.17% Capped Financials Ovintiv Inc. -

Canada's Only University Accredited Corporate

CANADA’S ONLY UNIVERSITY ACCREDITED CORPORATE DIRECTOR DEVELOPMENT PROGRAM CONGRATULATIONS TO OUR LATEST GRADUATES Our Valued Sponsors Chartered Directors* Scott Stewart Blakey, Fay Booker, C. Dir. Alex Bystrin, C. Dir. Timothy Carter, C. Dir. William Cheuk, C. Dir. John Cieslak, C. Dir. David Clark, C. Dir. Adam Cooper, C. Dir. Kathryn Craig, C. Dir. Dennis Cusson, C. Dir. Don Dalicandro, C. Dir. C. Dir. Booker & Oakville Hydro T. D. Bank Canadian Wheat National Bank Veridian OTG Financial Inc. Fundy Linen NAV CANADA APEXSI-APEXWare Toronto Transit Associates Inc. Corporation Financial Group Board of Canada Corporation Service Inc. Mobile Applications Commission Anton Davies, C. Dir. Robert Doyle, C. Dir. Gale Evans, C. Dir. David M. Fitzpatrick, Rod Flaman, C. Dir. Richard Fox, C. Dir. Catherine Gardiner, C. Dir. Peter Goring, C. Dir. William Greenhalgh, C. Dir. David J. Horsley, C. Dir. Timo Hytonen, C. Dir. RWDI Group Inc. Medoro Resources CMA Canada C. Dir. Canadian Wheat Deutsche Bank The Conference Board Human Resources Sino-Forest The Empire Life Kivacorp Petroleum Ltd. Board Canada of Canada Professionals Association Corporation Insurance Company of Ontario Virendra Jha, C. Dir. Brock Junkin, C. Dir. Diane Kalina, C. Dir. Fergus V. Keyes, C. Dir. John G. Khattar, C. Dir. Alanna Koch, C. Dir. Richard Koroscil, C. Dir. Norm Lavallee, C. Dir. Selma M. Lussenburg, Dean McCann, C. Dir. Steven McCartney, C. Dir. Canadian Space Sakku BioCatalyst Panamsec.com Inc. Nova Scotia Gaming Saskatchewan Ministry Hamilton International Northern Centre C. Dir. Canadian Tire Atria Networks LP Agency Investments Corp. Yorkton Ltd. Corporation of Agriculture Airport for Advanced Financial Services Technology Inc.