2020 Management Information Circular

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

THE ROYAL INSTITUTION for the ADVANCEMENT of LEARNING/Mcgill UNIVERSITY

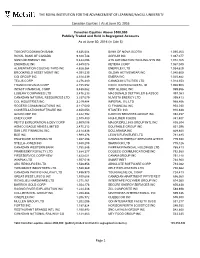

THE ROYAL INSTITUTION FOR THE ADVANCEMENT OF LEARNING/McGILL UNIVERSITY Canadian Equities │ As at June 30, 2016 Canadian Equities Above $500,000 Publicly Traded and Held in Segregated Accounts As at June 30, 2016 (in Cdn $) TORONTO DOMINION BANK 9,836,604 BANK OF NOVA SCOTIA 1,095,263 ROYAL BANK OF CANADA 9,328,748 AGRIUM INC 1,087,077 SUNCOR ENERGY INC 5,444,096 ATS AUTOMATION TOOLING SYS INC 1,072,165 ENBRIDGE INC 4,849,078 KEYERA CORP 1,067,040 ALIMENTATION COUCHE-TARD INC 4,628,364 ENERFLEX LTD 1,054,629 BROOKFIELD ASSET MGMT INC 4,391,535 GILDAN ACTIVEWEAR INC 1,040,600 CGI GROUP INC 4,310,339 EMERA INC 1,025,882 TELUS CORP 4,276,480 CANADIAN UTILITIES LTD 1,014,353 FRANCO-NEVADA CORP 4,155,552 EXCO TECHNOLOGIES LTD 1,008,903 INTACT FINANCIAL CORP 3,488,562 WSP GLOBAL INC 999,856 LOBLAW COMPANIES LTD 3,476,233 MACDONALD DETTWILER & ASSOC 997,083 CANADIAN NATURAL RESOURCES LTD 3,337,079 NUVISTA ENERGY LTD 995,413 CCL INDUSTRIES INC 3,219,484 IMPERIAL OIL LTD 968,856 ROGERS COMMUNICATIONS INC 3,117,080 CI FINANCIAL INC 954,030 CONSTELLATION SOFTWARE INC 2,650,053 STANTEC INC 910,638 GOLDCORP INC 2,622,792 CANYON SERVICES GROUP INC 892,457 ONEX CORP 2,575,400 HIGH LINER FOODS 841,407 PEYTO EXPLORATION & DEV CORP 2,509,098 MAJOR DRILLING GROUP INTL INC 838,304 AGNICO EAGLE MINES LIMITED 2,475,212 EQUITABLE GROUP INC 831,396 SUN LIFE FINANCIAL INC 2,414,836 DOLLARAMA INC 829,840 BCE INC 1,999,278 LEON'S FURNITURE LTD 781,495 ENGHOUSE SYSTEMS LTD 1,867,298 CANADIAN ENERGY SERVICES &TECH 779,690 STELLA-JONES INC 1,840,208 SHAWCOR LTD 775,126 -

Final Terms for Certificates Final Terms

FINAL TERMS FOR CERTIFICATES FINAL TERMS DATED 15 JUNE 2020 BNP Paribas Issuance B.V. (incorporated in The Netherlands) (as Issuer) Legal entity identifier (LEI): 7245009UXRIGIRYOBR48 BNP Paribas (incorporated in France) (as Guarantor) Legal entity identifier (LEI): R0MUWSFPU8MPRO8K5P83 Up to 8,000 EUR “4Y Phoenix Snowball” Certificates relating to Assicurazioni Generali SpA Shares due 8 July 2024 ISIN Code: NL0015034828 under the Note, Warrant and Certificate Programme of BNP Paribas Issuance B.V., BNP Paribas and BNP Paribas Fortis Funding The Base Prospectus received visa no. 20-233 on 2 June 2020 BNP Paribas Arbitrage S.N.C. (as Manager) The Certificates are offered to the public in the Republic of Italy from 15 June 2020 to 26 June 2020 Any person making or intending to make an offer of the Securities may only do so: (i) in those Non-exempt Offer Jurisdictions mentioned in Paragraph 47 of Part A below, provided such person is a Manager or an Authorised Offeror (as such term is defined in the Base Prospectus) and that the offer is made during the Offer Period specified in that paragraph and that any conditions relevant to the use of the Base Prospectus are complied with; or (ii) otherwise in circumstances in which no obligation arises for the Issuer or any Manager to publish a prospectus pursuant to Article 3 of the Prospectus Regulation or to supplement a prospectus pursuant to Article 23 of the Prospectus Regulation, in each case, in relation to such offer. None of the Issuer, the Guarantor or any Manager has authorised, nor do they authorise, the making of any offer of Securities in any other circumstances. -

Wilmington Funds Holdings Template DRAFT

Wilmington Global Alpha Equities Fund as of 5/31/2021 (Portfolio composition is subject to change) ISSUER NAME % OF ASSETS USD/CAD FWD 20210616 00050 3.16% DREYFUS GOVT CASH MGMT-I 2.91% MORGAN STANLEY FUTURE USD SECURED - TOTAL EQUITY 2.81% USD/EUR FWD 20210616 00050 1.69% MICROSOFT CORP 1.62% USD/GBP FWD 20210616 49 1.40% USD/JPY FWD 20210616 00050 1.34% APPLE INC 1.25% AMAZON.COM INC 1.20% ALPHABET INC 1.03% CANADIAN NATIONAL RAILWAY CO 0.99% AIA GROUP LTD 0.98% NOVARTIS AG 0.98% TENCENT HOLDINGS LTD 0.91% INTACT FINANCIAL CORP 0.91% CHARLES SCHWAB CORP/THE 0.91% FACEBOOK INC 0.84% FORTIVE CORP 0.81% BRENNTAG SE 0.77% COPART INC 0.75% CONSTELLATION SOFTWARE INC/CANADA 0.70% UNITEDHEALTH GROUP INC 0.70% AXA SA 0.63% FIDELITY NATIONAL INFORMATION SERVICES INC 0.63% BERKSHIRE HATHAWAY INC 0.62% PFIZER INC 0.62% TOTAL SE 0.61% MEDICAL PROPERTIES TRUST INC 0.61% VINCI SA 0.60% COMPASS GROUP PLC 0.60% KDDI CORP 0.60% BAE SYSTEMS PLC 0.57% MOTOROLA SOLUTIONS INC 0.57% NATIONAL GRID PLC 0.56% PUBLIC STORAGE 0.56% NVR INC 0.53% AMERICAN TOWER CORP 0.53% MEDTRONIC PLC 0.51% PROGRESSIVE CORP/THE 0.50% DANAHER CORP 0.50% MARKEL CORP 0.49% JOHNSON & JOHNSON 0.48% BUREAU VERITAS SA 0.48% NESTLE SA 0.47% MARSH & MCLENNAN COS INC 0.46% ALIBABA GROUP HOLDING LTD 0.45% LOCKHEED MARTIN CORP 0.45% ALPHABET INC 0.44% MERCK & CO INC 0.43% CINTAS CORP 0.42% EXPEDITORS INTERNATIONAL OF WASHINGTON INC 0.41% MCDONALD'S CORP 0.41% RIO TINTO PLC 0.41% IDEX CORP 0.40% DIAGEO PLC 0.40% LENNOX INTERNATIONAL INC 0.40% PNC FINANCIAL SERVICES GROUP INC/THE 0.40% ACCENTURE -

Formerly Manulife Asset Management UCITS Series ICAV

Half Yearly Report Manulife Investment Management II ICAV Interim Report and Condensed Unaudited Financial Statements for the six months ended 30 September 2020 An open-ended umbrella Irish Collective Asset-Management Vehicle with segregated liability between its funds registered in Ireland on 15 April 2015 under the Irish Collective Asset-Management Vehicles Act 2015 the “ICAV Act” and authorised and regulated by the Central Bank of Ireland as an Undertaking for Collective Investment in Transferable Securities pursuant to the European Communities (Undertakings for Collective Investment in Transferable Securities Regulations 2011, as amended the “UCITS Regulations”) Manulife Investment Management II ICAV Table of contents 2 A Message to Shareholders 3 General Information 4 Manager’s Report Condensed Interim Financial Statements 11 Statement of Comprehensive Income 15 Statement of Financial Position 19 Statement of Changes in Net Assets Attributable to Holders of Redeemable Participating Shares 21 Statement of Cash Flows 24 Notes to the Condensed Interim Financial Statements 44 Schedule of Investments 112 Supplemental Information 1 A Message to Shareholders Dear shareholder, Despite heightened fears over the coronavirus (COVID-19), which sent markets tumbling just prior to the beginning of the reporting period, global financial markets delivered positive returns for the 6 months ended 30 September 2020. The governments of many nations worked to shore up their economies, equity markets began to rise, and credit spreads rebounded off their highs as liquidity concerns eased. Of course, it would be a mistake to consider this market turnaround a trustworthy signal of assured or swift economic recovery. While there has been economic growth in much of the developed world, the pace has slowed in many areas as interest rates remain low and consumer spending remains far below prepandemic levels. -

TC Energy 2021 Management Information Circular

Management information circular March 4, 2021 Notice of annual meeting of shareholders to be held May 7, 2021 24668 TC_ENGLISH Circular cover spread.pdf - p1 (March 6, 2021 00:22:29) DT Letter to shareholders ........................................... 1 Notice of 2021 annual meeting ................................ 2 About Management information circular ............................3 TC Energy Summary ....................................................................4 About the shareholder meeting ...............................6 Delivering the energy people need, every day. Safely. Delivery of meeting materials ........................................7 Responsibly. Collaboratively. With integrity. Attending and participating in the meeting .....................8 We are a vital part of everyday life — delivering the energy millions of people rely on to power their lives in a Voting ...................................................................... 10 sustainable way. Thanks to a safe, reliable network of natural gas and crude oil pipelines, along with power generation Business of the meeting .............................................. 14 and storage facilities, wherever life happens — we’re there. Guided by our core values of safety, responsibility, Governance ........................................................33 collaboration and integrity, our 7,500 people make a positive difference in the communities where we operate across About our governance practices ...................................33 Canada, the U.S. and Mexico. -

Q1 2020 Building Sustainable Shareholder Value Business Overview

Q1 2020 Building Sustainable Shareholder Value Business overview Update in light of COVID-19 Business group results & highlights Capital management Asset portfolio Sustainability 2 A $26.51 billion leading global financial services organization Offices in 40,600 Employees 125,900 advisors 27 markets 2 2 2 Operating through a balanced and diversified model and focused on creating shareholder value now and in the future SUN LIFE • Q1 2020 1 Market capitalization in C$ as at March 31, 2020 3 2 As at December 31, 2019. Includes Asia joint ventures The Sun Life story • A diversified business model, with four strong pillars that can each compete, win and grow in their respective sectors and which leverage each other • Bound together by a strong balance sheet and risk culture, including no U.S. Variable Annuity or U.S. Long-Term Care • Digital transformation that is deeply embedded throughout the organization • Building on momentum created by past organic investments and acquisitions that will help drive earnings growth SUN LIFE • Q1 2020 4 Executing on our ambition to be one of the best insurance and asset management companies globally A Leader in Insurance and A Leader in U.S. Wealth Solutions in our CAN US Group Benefits Canadian Home Market A Leader in Asia A Leader in Global AM ASIA through Distribution Asset Management Excellence in Higher Growth Markets Each pillar Top quartile Disproportionate Top quartile total viewed as a Client share of top shareholder leader experience talent return SUN LIFE • Q1 2020 5 Consistently delivering value to shareholders 5-year total shareholder return1 Progress on medium-term objectives March 31, 2020 Sun Life 6.9% Medium-term objective Q1 2020 TSX 0.9% Underlying ROE2 12-14% 14.2% Canadian lifecos 0.0% Underlying EPS growth2 9% Global lifecos (1.2)% 8-10% Dividend payout ratio2 U.S. -

Climate Change 2020

Emera Inc. - Climate Change 2020 C0. Introduction C0.1 (C0.1) Give a general description and introduction to your organization. Emera Inc. is a geographically diverse energy and services company headquartered in Halifax, Nova Scotia, Canada with approximately $32 billion in assets and 2019 revenues of $6.1 billion. From our origins as a single electric utility in Nova Scotia, Emera has grown into an energy leader serving 2.5 million customers in Canada, the US, and the Caribbean. Emera’s strategy has been focused on safely delivering cleaner, affordable and reliable energy to customers for more than 15 years. Our company has investments throughout North America, and in four Caribbean countries. A description of the Emera affiliates that report to CDP is as follows: Tampa Electric (TEC) is a vertically integrated regulated electric utility servicing 780,000 customers in West Central Florida. Peoples Gas (PGS) is a natural gas utility serving 406,000 customers in Florida. New Mexico Gas Company (NMGC) is a natural gas utility serving 534,000 customers in New Mexico. Nova Scotia Power Inc. (NSPI) is a vertically integrated electric utility serving 523,000 customers in Nova Scotia. Emera Caribbean includes vertically integrated electric utilities serving 184,000 customers on the islands of Barbados, Grand Bahama, St. Lucia and Dominica. Emera Maine is a transmission and distribution electric utility serving 159,000 customers in northern and eastern Maine. The sale of Emera Maine to ENMAX Corporation closed in March 2020. Emera New Brunswick owns and operates the Brunswick Pipeline, a 145 km pipeline natural gas pipeline in New Brunswick and Emera Newfoundland and Labrador owns and operates the Maritime Link and manages investments in associated projects. -

Assicurazioni Generali

Assicurazioni Generali REPORTS AND PROPOSALS ON THE ITEMS OF THE AGENDA Ordinary shareholders’ meeting 26-28-30 April 2011 th year9 2010 REPORTS AND PROPOSALS ON THE ITEMS OF THE AGENDA Ordinary shareholders’ meeting 26-28-30 April 2011 2010 ECPI Ethical Index Euro ECPI Ethical Index Global FTSE ECPI Italia SRI: Leaders Index; Benchmarck Index Registered Office and Central Head Office in Trieste Head Office for Italian Operations in Mogliano Veneto Capital (fully paid in) Euro 1,556,873,283.00 Fiscal code and Trieste Companies Register 00079760328 Company entered in the Register of Italian Insurance and Reinsurance Companies under no. 100003 Parent Company of Generali Group, entered in the Register of Insurance Groups under no. 026 CHAIRMAN Cesare Geronzi VICE - CHAIRMEN Vincent Bolloré, Francesco Gaetano Caltagirone, Alberto Nicola Nagel MANAGING DIRECTOR AND GROUP CEO Giovanni Perissinotto (*) (*) He acts also as General Manager MANAGING DIRECTOR Sergio Balbinot (*) DIRECTORS Ana Patricia Botin / Cesare Calari / Carlo Carraro (**) Directors who, together with the Chairman, Diego Della Valle / Petr Kellner / Angelo Miglietta (**) Vice-Chairmen and Managing Directors, form the Executive Committee Alessandro Pedersoli / Lorenzo Pellicioli (**) / Reinfried Pohl Paola Sapienza / Paolo Scaroni / Francesco Saverio Vinci GENERAL COUNCIL Giorgio Davide Adler / José Ramón Álvarez Rendueles José Maria Amusátegui de la Cierva / Francesco Maria Attaguile Claude Bébéar / Kenneth J. Bialkin / Gerardo Broggini Giacomo Costa / Maurizio De Tilla / Enrico -

2011 Annual Report

2011 Annual Report The Lazard model is simple and powerful. Our model is built on Financial In Asset Management, we are Advisory and Asset Management— a world-class firm with strong what we consider the two most performance and growth. We are attractive businesses in financial leaders in emerging markets and services. global equities. We provide clients with global and local investment We compete on equal footing with solutions that we export and import firms many times our size, without around the world. the inherent risks and conflicts that come with the use of capital. We aim to drive shareholder returns through quality revenue growth, In Financial Advisory, we are investing smartly in hiring and long-standing leaders in M&A and expansion, focusing on realizing strategic advice. We offer clients operating leverage, and returning extraordinary depth and experience cash to shareholders. in our understanding of capital structure and capital markets. We are leaders in restructuring and in advising governments around the world. And our Capital Structure Advisory business is a powerful complement to our strategic advice. Financial Highlights ($mm, except per share data) 2011 2010 2009 Net Revenue $1,830 $1,905 $1,531 Operating Revenue1,3 1,884 1,979 1,618 Adjusted Net Income2,3 179 281 11 Adjusted Net Income Per Share—Diluted2,3 $1.31 $2.06 $0.09 OPERATING REVENUE1,3 ($mm) 2011 NET REVENUE BY BUSINESS4 2,500 Financial Asset Advisory Management $2,015 $1,979 2,000 $1,884 $1,675 $1,618 53% 47% 1,500 2011 NET REVENUE BY GEOGRAPHY 1,000 59% 33% United Europe States 500 8% Rest of World 0 2007 2008 2009 2010 2011 STOCK PERFORMANCE5 Lazard Ltd S&P Financial Index S&P 500 Index $200 150 100 50 0 30 Dec 2005 29 Dec 2006 31 Dec 2007 31 Dec 2008 31 Dec 2009 31 Dec 2010 30 Dec 2011 1 Excludes revenues related to non-controlling interests, interest expense 3 A non-U.S. -

RBC Principal Protected Guaranteed Return Enhanced Yield LEOS® Series 247

EQUITY LINKED NOTE | RBC GLOBAL INVESTMENT SOLUTIONS RBC Principal Protected Guaranteed Return Enhanced Yield LEOS® Series 247 7 year Term 100% Principal 0.40% - 6.00% Protection at Maturity Coupon in Years 1-7 This Note is a 7 year investment designed to provide annual income based on exposure to an equally Offering Closes weighted Canadian Equity Portfolio. Investors will receive a minimum coupon of 0.40%, to a maximum of 6.00% in years 1-7 based on the price performance of a portfolio of 10 Canadian companies. The May 21, 2021 principal amount is guaranteed by RBC at maturity. The maturity date is May 30, 2028. FundSERV INVESTMENT HIGHLIGHTS RBC4247 Income Potential: Minimum Coupon of 0.40%, to a maximum of 6.00% in Years 1-7, based on the price performance of the Shares in the Equity Portfolio where performance per Share is measured from inception to each annual coupon valuation date, subject to a maximum of 6.00% and a minimum of Issue Date -10%. Notes do not represent an interest in the securities of the companies that comprise the Equity Portfolio, and holders will have no right or entitlement to such securities including the dividends and May 26, 2021 other distributions paid on these securities. The indicative dividend yield on the Equity Portfolio as of April 30, 2021 was 4.96%, representing an aggregate dividend yield of approximately 40.34% annually compounded over the seven year term, on the assumption that the dividend yield remains constant. Principal Protection: Royal Bank of Canada guarantees the principal amount at maturity. -

Assicurazioni Generali

Assicurazioni Generali MANAGEMENT REPORT AND PARENT COMPANY STATEMENTS th year 2009 MANAGEMENT REPORT AND PARENT COMPANY STATEMENTS 2009 APPROVED BY THE SHAREHoLDERS’ MEETING OF 24 APRIL 2010 Registered Office and Central Head Office in Trieste Head Office for Italian Operations in Mogliano Veneto Capital (fully paid in) Euro 1,556,864,483.00 Fiscal code and Trieste Companies Register 00079760328 Company entered in the Register of Italian Insurance and Reinsurance Companies under no. 100003 Parent Company of Generali Group, entered in the Register of Insurance Groups under no. 026 CHAIRMAN Cesare Geronzi VICE-CHAIRMEN Vincent Bolloré, Francesco Gaetano Caltagirone, Alberto Nicola Nagel MANAGING DIRECTORS AND GROUP CEO Giovanni Perissinotto (*) (*) He acts also as General Manager MANAGING DIRECTOR Sergio Balbinot (*) (*) He acts also as General Manager DIRECTORS Ana Patricia Botìn / Cesare Calari / Carlo Carraro (**) Directors who, together with the Chairman, Diego Della Valle / Leonardo Del Vecchio (**) / Petr Kellner Vice-Chairmen and Managing Directors, form the Executive Committee Angelo Miglietta / Alessandro Pedersoli / Lorenzo Pellicioli (**) Reinfried Pohl / Paola Sapienza / Paolo Scaroni / Francesco Saverio Vinci GENERAL COUNCIL Giorgio Davide Adler / José Ramón Álvarez Rendueles Comprising, besides the below listed elective José Maria Amusátegui de la Cierva / Francesco Maria Attaguile Members, the Members of the Board of Directors and the General Managers Claude Bébéar / Kenneth J. Bialkin / Gerardo Broggini Giacomo Costa / Maurizio -

Bank of Montreal Protected Deposit Notes Advantage Minimum Y.I.E.L.D

Bank of Montreal Protected Deposit Notes Advantage Minimum Y.I.E.L.D. Class TM, Series 1 > Key Features • 5 year term to maturity • Minimum annual interest payment of 0.70% • Annual interest payment ranging from 0.70% to 7.0% based on the price performance of a portfolio of ten (10) Canadian issuers* • 100% principal guaranteed by BMO as issuer if held to maturity *The amount of annual interest paid is unlikely to mirror the price performance of the securities in the Benchmark Portfolio since the return cannot exceed 7.0% of the Deposit Amount and could be zero provided no extraordinary event has occurred under the terms of the Information Statement. > Hypothetical Return Examples On an Interest Payment Date a Holder will be entitled to receive Interest on a Deposit Note equal to: (i) the maximum amount of Interest of 7.0% of the Deposit Amount, if the Closing Price of each Security has increased from the Closing Date to the applicable Valuation Date; (ii) 0.70% of the Deposit Amount, if the simple average of the effective returns is zero or negative; or (iii) a percentage of the Deposit Amount greater than 0.70% and less than 7.0%, if the simple average of the effective returns is greater than 0% and less than 6.3%. The following examples are included for illustration purposes only. The values of the Deposit Notes used to illustrate two different scenarios are hypothetical and are not estimates or forecasts of expected returns from the Closing Date to and including the Final Valuation Date.