2018 Financial Statements

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Appendix a - Ecotrain Survey

Appendix A - EcoTrain Survey Appendix Page 1 Ministère des Transports du Québec, Ontario Ministry of Transportation, and Transport Canada – Updated Feasibility Study of a High Speed Rail Service in the Québec City – Windsor Corridor 145 File No. : 3301-08-AH01 – N/Réf. : P020563-0700--100-EN-00 – November 2010 Appendix Page 2 Ministère des Transports du Québec, Ontario Ministry of Transportation, and Transport Canada – Updated Feasibility Study of a High Speed Rail Service in the Québec City – Windsor Corridor 146 File No. : 3301-08-AH01 – N/Réf. : P020563-0700--100-EN-00 – November 2010 Appendix Page 3 Appendix B - EcoTrain Nesting Structure Appendix Page 4 65 For the NL model estimation, multiple nesting structures were tested including the following: F M il i ni e s N t è o. r e : 3301 Figure 14 : Nesting Structures Tested de s T - 08 r an - A s p H o 01 r t s – du HSR, Automobile, Air, and Slow Mode [Bus, VIA rail] Automobile, Public Fast Mode [Air, HSR], and Public Slow N / R Q é uébe Mode [Bus, VIA rail] f. : P c 020563 , O n t a r - i o 0 M 7 00 i ni -- s 1 t r 00 y o - E f N T r - an 00 s – po N r t o a v t e i on, m b an e r d 2010 T r an s po r t C a n Highway [Automobile, Bus] and Non-Highway [Air, HSR, Existing Mode [Automobile, Bus, Air, VIA rail] and New ada – VIA rail] Mode [HSR] U pda t ed F ea s i b i l i t y S t ud y o f a H i gh S peed R a il S e r v i c e i n t Fast Mode [Air, HSR] and Slow Mode [Automobile, Bus, he Q VIA rail] Air, HSR and Slow Mode [Automobile, Bus, VIA rail] uébe c C i t y – W i nd s o r C o r r i dor Appendix Page 5 Appendix C - SurveyMonkey Questions Appendix Page 6 Quebec-Windsor Intercity Modal Choice Survey Dear Survey Respondent, You have been chosen to participate in a research study conducted by the Department of Civil Engineering at the University of Toronto. -

GACCTO Lease Extension and Rent Abatement Request

Item 3 For Action with Confidential Attachment GACCTO Lease Extension and Rent Abatement Request Date: June 17, 2020 To: Toronto Coach Terminal Inc. – Board of Directors From: Chief Capital Officer Reason for Confidential Information This report is about a proposed or pending land acquisition or disposition of land for municipal or local board purposes. Summary TCTI Board approval is required to authorize a lease extension to Greyhound and Coach Canada Toronto Operations Limited (GACCTO), which currently operates an inter-city bus terminal from the property at 610 Bay Street and 130 Elizabeth Street. The lease extension will provide time for GACCTO to secure an alternate location for its operations. Staff recommend an extension of up to one year, based on the same terms and conditions of the existing lease, with an early termination provision, subject to approval of CreateTO and the City of Toronto in a form acceptable to TTC General Counsel. The report also considers a request for rent abatement from GACCTO. Staff recommendations with respect to this matter are outlined in the Confidential Attachment. Recommendations It is recommended that the TCTI Board: 1. Authorize Staff to extend the 610 Bay Street and 130 Elizabeth Street lease for up to one (1) year on the same terms and conditions as the existing lease, including rent increases applicable at the time of term extension, subject to approval of CreateTO and the City of Toronto in a form acceptable to TTC General Counsel, and including the following additional provision: a) GACCTO and TCTI shall both have the right to terminate the lease, subject to applicable termination provisions in the current lease, at any time after July 7, 2021, with a minimum of six months’ written notice. -

416-393-INFO 3 Faxback Menu 6 Lost & Found Monthly Monthly Fill in the Boxes on Your Metropass in Pen

DEF MNO Adult Student*** /Senior Child *** Adult Student*** /Senior 416-393-INFO 3 FaxBack Menu 6 Lost & Found Monthly Monthly Fill in the boxes on your Metropass in pen. Your Metropass is valid only with: GHI PRS Cash Metropass $93.50 $80.00 ADULTS require a TTC Metropass Photo I.D. OR a Driver’s Licence Photo I.D. 1 4 7 Cash $1.50 Cash Cash SENIORS require a TTC Senior’s Metropass Photo I.D. OR a Driver’s Licence Photo I.D. Single Fare Purchase $2.25 50¢ MDP by mail. Best value! Annual Annual Routes, Schedules & Maps Service Updates Multi-language Line 12 month subscription per month $85.75 per month $73.25 STUDENTSmust show a valid TTC Student Discount Card Photo I.D. ABC JKL Tickets or Tokens Tickets only 2 5 Tickets only Family Group Single ONLY Family/Group or Single Fares, Subway & GTA Info Escalators/Elevators Tokens/ 5- $9.00 5- $6.00 EXACT 24hr Transit Info 10 - FARE Day Pass SUNDAY & HOLIDAY - Good for up to6 persons, maximum 2 adults, Unlimited one-day travel on all regular TTC routes, good for Tickets $4.00 $7.50 with up to 4 children/youths*. (*Youths = 19 years of age or under.) ONE person. MONDAY to FRIDAY after 9:30am. SATURDAYS, 10 - $18.00 10 - $12.00 Unlimited one-day travel on regular TTC routes Sundays & Holidays . SUNDAYS, or STATUTORY HOLIDAYS from the start of service. Lost & Found: Located at Bay subway station, Monday - Accessible Buses: TTC accessible buses now serve many * TTC STUDENT DISCOUNT CARD must be shown or adult fare required. -

Yongetomorrow: Public Event #1 – Display Boards

Welcome Public Event #1 Thursday, May 9, 2019 Municipal Class Environmental Assessment Yonge Street from Queen Street to College Street The information displayed today is available online at: toronto.ca/yongeTOmorrow Study area 2 Study Area Area for which data collection and analysis is being completed N Roxborough St W YongeTOmorrow EA Focus Area Davenport Rd (Phase 1) Area for which alternative St onge solutions are currently being Y developed and evaluated To ronto Public Library Bloor St W Bloor St E Future Focus Area (Phase 2) An EA to develop and evaluate design solutions for Yonge from College to Davenport is planned to Queens Park start upon completion of University Wellesley St E YongeTOmorrow Phase 1 of To ronto Wider Neighbourhood Impacts St onge College St Y Carlton St YongeTOmorrow will consider e the existing conditions and Av impacts of the alternatives vis St on the north-south and Ryerson Jar University east-west streets within the University study area before making Dundas St W Dundas St E a final recommendation Eaton Centre for the focus area. To ronto City Hall Massey Hall Queen St W Old City Hall Queen St E onge St onge Y King St W King St E St ry Union Station Cher CN Tower GARDINER XPY What is an EA? 3 Phase 1 Problem & The Municipal Class Environmental Winter 2018 Opportunity Assessment (EA) is a planning Statement process required under the Ontario Environmental Assessment Act. Phase 2 It provides the framework for Spring 2018 municipalities to plan, design and construct infrastructure projects. Background Data YongeTOmorrow is following the Collection & Analysis process for a Schedule ‘C’ Class EA. -

Canadian National Exhibition, Toronto, Friday, August 23Rd to Saturday

IOCUE 4 PR ldudincj SPORTS Activitie* T c £<fAUG.23toSEPT 7, 1935 t JfcO^V*57 INCLUSIVE »">'jnIW l'17' '.vir^diii IBITION TORONTO The EDITH and LORNE PIERCE COLLECTION o/CANADIANA TORONTO MONTREAL REGIXA HALIFAX PLAN OF GROUNDS AND BUILDINGS CANADIAN NATIONAL EXHIBITION "Be Foot Happy" World's Famous Hot Pavements Athletes Use Long Walks Hard Floors are unkind to Your Feet OLYMPEME Not an the Antiseptic Lihimekt Olympene is kind Ordinary Liniment An Antiseptic Liniment Recommended Especia lly OSCAR ROETTGER, Player Manager, Montreal Royal Baseball. for Athlete's Foot. The Athlete's Liniment. JIM WEAVER, Pitcher, Newark Bears Baseball. For Soreness, Stiffness of Muscles and Joints- . ' W. J " Bill ' O'BRIEN, Montreal Maroons, Montreal. Strains and Sprains- RUTH DOWNING, Toronto. Abscesses, Boils, Pimples and Sores. "Torchy" Vancouver, Six Day Bicycle Cuts and Bruises. PEDEN, Rider. Nervousness and Sleeplessness. BERNARD STUBECKE, Germany, Six Day Bicycle Head Colds, Catarrh and Hay Fever- Rider. RUTH DOWNING Corns, Bunions, Sore or Swollen Feet- FRED BULLIVENT, Head Trainer, Six Day Bicycle Toronto's Sweetheart of the Swim Riders. Sunburn, Poison Ivy, Insect Bites Says Use JIM McMILLEN, Wrestler, Vice-President, Chicago Dandruff. Bears. GEORGE "Todger" ANDERSON, Hamilton, Manufactured by OLYMPENE Assoc. -Coach, Hamilton Olympic Club. NORTHROP & LYMAN CO., LIMITED OLYMPEME Trainer, Bert Pearson, Sprinter. TORONTO ONTARIO the Antiseptic Liniment Established 1854 the Antiseptic Lininent Canadian "National Exhibition :@#^: Fifty-Seventh Annual -

D Donate to ACO Jo Oin ACO Visit Our Website

From: Architectural Conservancy Ontario [mailto:[email protected]] On Behalf Of Architectural Conservancy Ontario Sent: February-05-18 2:33 PM To: Erica Cole Subject: Acorn in a Nutshell: Heritaga e Month Happenings ACORN in a Nutshell: The Newsletter of View thhis email in your browser ARCHITECTURAL CONSERVANCY ONTARIO The past. Our present. Your future. Donate to ACO Join ACO Visit our Website Dear readers, This month's issue of Nutshell is a big one. We hope you enjoy the addition of event listings; they represent the work of so many peoplle across Ontario to preserve, share and discuss our heritage. If you have events to contribute for future issues, or wish to submit articles about projects in your community, please don't hesitate to send them in! The place to send your submissions is [email protected] Just one more thing before we jump in: Although our advocacyy at ACO is focused on the Ontario and our local governments, our sister organization, the National Trust for Canada, has produced a Webinar and Advocacy Toolkit that deals with many of the same concepts. The first webinar is Tuesday February 6 from 2-3 pm. You are asked to register in advance. Here are the links: National Trust for Canada Webinar Registration: http://bit.ly/2E4UlSj Advocacy Toolkit: https://nationaltrustcanada.ca/what-you-can-doo/advocacy-action/the- advocacy-tool-kit Upcoming Public Heritage Events Heritage Day was created in 1973 by the Heritage Canada Foundation to preserve and promote Canada’s natural, architectural, and historical heritage. -

Download the Toronto PATH Map

Whatever your destination... ...PATH signs lead the way. On the PATH Map Squares represent buildings. M The Green Line represents links between and through buildings. Colours represent the four points of the compass – Toronto’s north (blue), south (red), east (yellow), and west (orange). Downtown Walkway H represents hotel. C represents cultural building. S represents sports venue. represents tourist attraction Adelaide Place F-9, G-9 MetLife Place M-11 11 Adelaide St. West L-10 MetroCentre B-12 1 Adelaide St. East N-10 Metro Hall B-12 PATH Marker Welcome to PATH – 105 Adelaide St. West I-10 Metro Toronto Convention Centre B-16, C-18 Signs ranging from 130 Adelaide St. West H-9 Munich Re Centre (390 Bay Street) J-7 Toronto’s Downtown Walkway Air Canada Centre J-17 free-standing outdoor pylons linking 27 kilometres of under- Allen Lambert Galleria One Dundas West M-3 to door decals identify entrances (Brookfield Place) L-15 One Queen Street East N-7 ground shopping, services and Atrium on Bay K-2 Osgoode Subway Station E-6 to the walkway. entertainment Bank of Nova Scotia K-11 Parking, City Hall I-6 220 Bay J-13 Parking, University Avenue F-15 In many elevators there is 390 Bay (Munich Re Centre) J-7 Plaza at Sheraton Centre, The H-7 Bay Adelaide Centre L-8 a small PATH logo mounted Bay East Teamway K-16 1 Queen Street East N-7 beside the button for the floor Bay Wellington Tower K-14 2 Queen Street East N-6 Bay West Teamway J-16 Queen Subway Station N-6 leading to the walkway. -

Toronto Transit Commission

ARNNUAL EPORT 2003 2003 ANNUAL REPORT Toronto Transit Commission As at December 31, 2003 Chair Vice-Chair Howard Moscoe Joe Mihevc Commissioners Mayor Brian Ashton Bas Balkissoon Sandra Bussin Adam Giambrone Peter Li Preti David Miller David Shiner Letter from the Chair DATE: June, 2004 TO: MAYOR DAVID MILLER AND COUNCILLORS OF THE CITY OF TORONTO It is with pride that I submit the 2003 Annual Report for the Toronto Transit Commission (the “TTC”). 2003 was yet another year filled with challenges for the City’s public transit authority. The year began with a Commission-approved, standard 10-cent fare increase and proportionate increases to all other fare media. The roller coaster ride took off from there. The City of Toronto faced some difficulties in 2003, and the TTC felt them every step of the way – Severe Acute Respiratory Syndrome (SARS) hurt tourism, West Nile Virus kept people indoors, and the blackout in August stopped everything in sight, including the economy. Throughout it all, the TTC workforce did their best to keep us on the move – proof positive that the Commission’s greatest asset is its employees. They stepped up and turned each negative story into a positive one. In March, the SARS crisis caused a significant dip in ridership. The Commission estimated a loss of about 3.5 million riders as a result of the outbreak, which lasted several months. A further 1 million rides were lost due to the extended economic slowdown. However, the excellent TTC service proved to be a big hit with many of the 400,000 Rolling Stones fans attending a special SARS benefit concert at Downsview Park on July 30. -

Draft Consolidated Financial Statements of Toronto Transit Commission for the Year Ended December 31, 2019

Item 6 AU6.9g For Action Draft Consolidated Financial Statements of Toronto Transit Commission for the Year Ended December 31, 2019 Date: June 17, 2020 To: TTC Board Summary This item was considered by the TTC Audit & Risk Management Committee on June 3, 2020 and was adopted without amendments. Contact Alex Cassar – Director – Budgets, Costing and Financial Reporting (416) 393-3647 [email protected] Draft Consolidated Financial Statements of Toronto Transit Commission for the Year Ended December 31, 2019 Page 1 of 1 For Action Draft Consolidated Financial Statements of Toronto Transit Commission for the Year Ended December 31, 2019 Date: June 3, 2020 To: TTC Audit & Risk Management Committee From: Interim Chief Financial Officer Summary The TTC is required to prepare audited annual financial statements under Public Sector Accounting Standards and to forward them to the City. The 2019 accounting surplus is $485.6 million and is comprised mainly of the value of capital asset additions, partially offset by depreciation of assets in use and the loss recorded on the Provincial Expansion Project upload. Operating activities do not generally contribute to the accounting surplus or shortfall as the operating expenses are funded in full by operating revenues and subsidies received. Recommendations It is recommended that the TTC Audit and Risk Management Committee: 1. Approve this report; and 2. Forward a copy of this report to the TTC Board and to the City Clerk for submission to the next City Audit Committee meeting. Implementation Points This report requires approval at the June 3, 2020 TTC Audit & Risk Management Committee Meeting to ensure timely submission to the June 17, 2020 TTC Board Meeting and then to the City Audit Committee Meeting of the City of Toronto. -

Commission Report Macro

Form Revised: February 2005 TORONTO TRANSIT COMMISSION REPORT NO. MEETING DATE: February 2, 2015 SUBJECT: 2015 TTC and Wheel-Trans Operating Budgets ACTION ITEM RECOMMENDATION It is recommended that the Commission: 1) approve the 2015 TTC Operating Budget as detailed in this report and as summarized in Appendix A; 2) approve the 2015 Wheel-Trans Operating Budget as detailed later in this report and as summarized in Appendix B; 3) approve, effective March 1, 2015: • a 10 cent increase in the price of a single adult token and a proportionate increase in all other fares (except for cash and children’s fares); • a one-trip increase in the price of the Adult Metropass; and • children aged 12 and under will ride for free as detailed in this report and set out in Appendix C 4) forward this report to the City of Toronto for submission into the City Budget process and for confirmation of the 2015 operating subsidy levels; 5) forward this report to the Metrolinx Board; and 6) forward this report to the Ontario Minister of Transportation. COMPANION REPORT This report should be considered in concert with the companion report “2015 – 2024 TTC Capital Budget”. 2015 TTC and Wheel-Trans Operating Budgets Page 2 FUNDING The City Manager has advised that the City of Toronto will provide $478.9 million in subsidy to support the TTC’s 2015 Operating Budget and $108.8 million for the Wheel- Trans Operating Budget. These funding levels represent increases of $38.8 million and $2 million, over the 2014 budgeted levels for TTC and Wheel-Trans, respectively. -

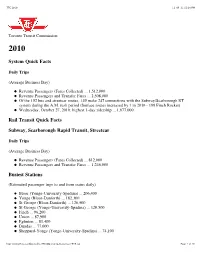

2010 Operating Statistics

TTC 2010 11-06-21 12:18 PM Toronto Transit Commission 2010 System Quick Facts Daily Trips (Average Business Day) Revenue Passengers (Fares Collected) ... 1,512,000 Revenue Passengers and Transfer Fares ... 2,508,000 Of the 152 bus and streetcar routes, 149 make 247 connections with the Subway/Scarborough RT system during the A.M. rush period (Surface routes increased by 1 in 2010 - 199 Finch Rocket). Wednesday, October 27, 2010: highest 1-day ridership ... 1,677,000 Rail Transit Quick Facts Subway, Scarborough Rapid Transit, Streetcar Daily Trips (Average Business Day) Revenue Passengers (Fares Collected) ... 812,000 Revenue Passengers and Transfer Fares ... 1,246,000 Busiest Stations (Estimated passenger trips to and from trains daily) Bloor (Yonge-University-Spadina) ... 206,400 Yonge (Bloor-Danforth) ... 182,300 St George (Bloor-Danforth) ... 126,500 St George (Yonge-University-Spadina) ... 120,500 Finch ... 96,200 Union ... 87,900 Eglinton ... 81,400 Dundas ... 77,000 Sheppard-Yonge (Yonge-University-Spadina) ... 74,100 http://www3.ttc.ca/About_the_TTC/Operating_Statistics/2010.jsp Page 1 of 16 TTC 2010 11-06-21 12:18 PM Kennedy (Bloor-Danforth) ... 69,800 Number of Stations ... 69 (subway interchanges counted once). Number of Escalators ... 294 Number of Elevators ... 78 (In service at: Bathurst, Bayview, Bessarion, Bloor-Yonge, Broadview, Davisville, Don Mills, Downsview, Dundas West, Eglinton, Eglinton West, Finch, Jane, Kennedy, Kipling, Leslie, Main Street, North York Centre, Queen, Scarborough Centre, Sheppard-Yonge, Spadina, St Clair, St Clair West (serves mezzanine level only), St George, Osgoode, Queen’s Park, Queens Quay, Union, York Mills.) Number of Commuter Parking Lots - 30 (13,977 spaces). -

2015 Annual Report Toronto Transit Commission This Page Has Been Left Blank Intentionally

2015 Annual Report Toronto Transit Commission This page has been left blank intentionally. 2015 Annual Report Toronto Transit Commission The 2015 Operating Budget added $95-million worth of new and enhanced service priorities to meet ridership demand across the city. 4 | Toronto Transit Commission – Annual Report 2015 2015: In Review January 19: Toronto Mayor John Tory and TTC Chair Josh Colle announced a $95-million Jan investment to significantly expand and enhance transit service, reduce wait times and crowding, and reverse the service cuts that were imposed on the TTC in 2011. The Mayor and Chair also announced that children 12 and under will ride the TTC for free starting on March 1. February 2: The TTC Board approved the 2015 Operating Budget with $95-million worth of Feb new and enhanced service priorities to meet ridership demand across the city, such as: more bus and streetcar service at off-peak periods to reduce crowding, benefitting 55 million customer trips and adding 1.8 million new customer trips; a city-wide network of 10-minute or better service frequency to benefit 48 million customer trips and add 1.8 million new customer trips; phased-in restoration of all-day, every day service on the vast majority of bus and streetcar routes; and expand the overnight Blue Night Network with 12 additional bus and streetcar routes, adding 300,000 new customer trips. March 1: New fare rates in line with the rate of inflation took effect. The pricing change saw a Mar 10-cent increase in the price of a single Adult token ($2.80 from $2.70) and a proportionate increase to all other fares, plus a one-trip increase in the price of the Adult Metropass.