Bartek Elected to Lead IBAT Leadership Division Board Of

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Dfa Investment Trust Co

SECURITIES AND EXCHANGE COMMISSION FORM N-Q Quarterly schedule of portfolio holdings of registered management investment company filed on Form N-Q Filing Date: 2004-10-27 | Period of Report: 2004-08-31 SEC Accession No. 0001104659-04-032148 (HTML Version on secdatabase.com) FILER DFA INVESTMENT TRUST CO Business Address 1299 OCEAN AVE CIK:896162| IRS No.: 000000000 | State of Incorp.:DE | Fiscal Year End: 1130 11TH FLOOR Type: N-Q | Act: 40 | File No.: 811-07436 | Film No.: 041100436 SANTA MONICA CA 90401 3103958005 Copyright © 2012 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM N-Q QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED MANAGEMENT INVESTMENT COMPANY Investment Company Act file number 811-7436 THE DFA INVESTMENT TRUST COMPANY (Exact name of registrant as specified in charter) 1299 Ocean Avenue, 11th Floor, Santa Monica, CA 90401 (Address of principal executive offices) (Zip code) Catherine L. Newell, Esquire, Vice President and Secretary The DFA Investment Trust Company, 1299 Ocean Avenue, 11th Floor, Santa Monica, CA 90401 (Name and address of agent for service) Registrant's telephone number, including area code: 310-395-8005 Date of fiscal year end: November 30 Date of reporting period: August 31, 2004 ITEM 1. SCHEDULE OF INVESTMENTS. The DFA Investment Trust Company Form N-Q August 31, 2004 (Unaudited) Table of Contents Schedules of Investments The U.S. Large Company Series The Enhanced U.S. Large Company Series The U.S. Large Cap Value Series The U.S. -

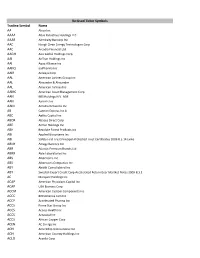

List of Section 13F Securities

List of Section 13F Securities 1st Quarter FY 2004 Copyright (c) 2004 American Bankers Association. CUSIP Numbers and descriptions are used with permission by Standard & Poors CUSIP Service Bureau, a division of The McGraw-Hill Companies, Inc. All rights reserved. No redistribution without permission from Standard & Poors CUSIP Service Bureau. Standard & Poors CUSIP Service Bureau does not guarantee the accuracy or completeness of the CUSIP Numbers and standard descriptions included herein and neither the American Bankers Association nor Standard & Poor's CUSIP Service Bureau shall be responsible for any errors, omissions or damages arising out of the use of such information. U.S. Securities and Exchange Commission OFFICIAL LIST OF SECTION 13(f) SECURITIES USER INFORMATION SHEET General This list of “Section 13(f) securities” as defined by Rule 13f-1(c) [17 CFR 240.13f-1(c)] is made available to the public pursuant to Section13 (f) (3) of the Securities Exchange Act of 1934 [15 USC 78m(f) (3)]. It is made available for use in the preparation of reports filed with the Securities and Exhange Commission pursuant to Rule 13f-1 [17 CFR 240.13f-1] under Section 13(f) of the Securities Exchange Act of 1934. An updated list is published on a quarterly basis. This list is current as of March 15, 2004, and may be relied on by institutional investment managers filing Form 13F reports for the calendar quarter ending March 31, 2004. Institutional investment managers should report holdings--number of shares and fair market value--as of the last day of the calendar quarter as required by Section 13(f)(1) and Rule 13f-1 thereunder. -

TARP Capital Purchase Program Recipients

TARP Capital Purchase Program Recipients Date Name of Institution City State Investment Type Investment 2/6/2009 Alaska Pacific Bancshares, Inc. Juneau AK Preferred Stock w/Warrants 4,781,000 Alaska Total: 1 12/19/2008 BancTrust Financial Group, Inc. Mobile AL Preferred Stock w/Warrants $50,000,000 11/14/2008 Regions Financial Corp. Birmingham AL Preferred Stock w/Warrants $3,500,000,000 12/5/2008 Superior Bancorp Inc. Birmingham AL Preferred Stock w/Warrants $69,000,000 12/23/2008 United Bancorporation of Alabama, Inc. Atmore AL Preferred Stock w/ Warrants $10,300,000 Alabama Total: 4 12/12/2008 Bank of the Ozarks, Inc. Little Rock AR Preferred Stock w/Warrants $75,000,000 1/16/2009 Home Bancshares, Inc. Conway AR Preferred Stock w/ Warrants 50,000,000 2/ 1/23/2009 Liberty Bancshares, Inc. Jonesboro AR Preferred Stock w/ Exercised Warrants 57,500,000 2/ 1/30/2009 Rogers Bancshares, Inc. Little Rock AR Preferred Stock w/ Exercised Warrants 25,000,000 3/ 1/16/2009 Southern Bancorp, Inc. Arkadelphia AR Preferred Stock 11,000,000 Arkansas Total: 5 2/ 1/30/2009 Goldwater Bank, N.A. Scottsdale AZ Preferred Stock w/ Exercised Warrants 2,568,000 Arizona Total: 1 11/14/2008 Bank of Commerce Holdings Redding CA Preferred Stock w/Warrants $17,000,000 12/5/2008 Bank of Marin Bancorp Novato CA Preferred Stock w/Warrants $28,000,000 2/ 1/30/2009 Beach Business Bank Manhattan Beach CA Preferred Stock w/ Exercised Warrants 6,000,000 12/23/2008 Bridge Capital Holdings San Jose CA Preferred Stock w/ Warrants $23,864,000 11/14/2008 Broadway Financial Corporation -

DFA INVESTMENT TRUST CO Form N-Q Filed 2007-10-30

SECURITIES AND EXCHANGE COMMISSION FORM N-Q Quarterly schedule of portfolio holdings of registered management investment company filed on Form N-Q Filing Date: 2007-10-30 | Period of Report: 2007-08-31 SEC Accession No. 0001104659-07-078185 (HTML Version on secdatabase.com) FILER DFA INVESTMENT TRUST CO Business Address 1299 OCEAN AVE CIK:896162| IRS No.: 000000000 | State of Incorp.:DE | Fiscal Year End: 1130 11TH FLOOR Type: N-Q | Act: 40 | File No.: 811-07436 | Film No.: 071200596 SANTA MONICA CA 90401 3103958005 Copyright © 2013 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM N-Q QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED MANAGEMENT INVESTMENT COMPANY Investment Company Act file number 811-7436 THE DFA INVESTMENT TRUST COMPANY (Exact name of registrant as specified in charter) 1299 Ocean Avenue, Santa Monica, CA 90401 (Address of principal executive offices) (Zip code) Catherine L. Newell, Esquire, Vice President and Secretary The DFA Investment Trust Company, 1299 Ocean Avenue, Santa Monica, CA 90401 (Name and address of agent for service) Registrants telephone number, including area code: 310-395-8005 Date of fiscal year end: November 30 Date of reporting period: August 31, 2007 ITEM 1. SCHEDULE OF INVESTMENTS. The DFA Investment Trust Company Form N-Q August 31, 2007 (Unaudited) Table of Contents Definitions of Abbreviations and Footnotes Schedules of Investments The U.S. Large Company Series The Enhanced U.S. Large Company Series The U.S. Large Cap Value Series The U.S. -

Dimensional Investment Group

SECURITIES AND EXCHANGE COMMISSION FORM N-Q Quarterly schedule of portfolio holdings of registered management investment company filed on Form N-Q Filing Date: 2008-04-29 | Period of Report: 2008-02-29 SEC Accession No. 0001104659-08-027772 (HTML Version on secdatabase.com) FILER DIMENSIONAL INVESTMENT GROUP INC/ Business Address 1299 OCEAN AVE CIK:861929| IRS No.: 000000000 | State of Incorp.:MD | Fiscal Year End: 1130 11TH FLOOR Type: N-Q | Act: 40 | File No.: 811-06067 | Film No.: 08784216 SANTA MONICA CA 90401 2133958005 Copyright © 2012 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM N-Q QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED MANAGEMENT INVESTMENT COMPANY Investment Company Act file number 811-6067 DIMENSIONAL INVESTMENT GROUP INC. (Exact name of registrant as specified in charter) 1299 Ocean Avenue, Santa Monica, CA 90401 (Address of principal executive offices) (Zip code) Catherine L. Newell, Esquire, Vice President and Secretary Dimensional Investment Group Inc., 1299 Ocean Avenue, Santa Monica, CA 90401 (Name and address of agent for service) Registrant's telephone number, including area code: 310-395-8005 Date of fiscal year end: November 30 Date of reporting period: February 29, 2008 ITEM 1. SCHEDULE OF INVESTMENTS. Dimensional Investment Group Inc. Form N-Q February 29, 2008 (Unaudited) Table of Contents Definitions of Abbreviations and Footnotes Schedules of Investments U.S. Large Cap Value Portfolio II U.S. Large Cap Value Portfolio III LWAS/DFA U.S. High Book to Market Portfolio DFA International Value Portfolio Copyright © 2012 www.secdatabase.com. -

7Alenders Bankname Bankstreet 1ST CAPITAL BANK 5 HARRIS CT

7aLenders BankName BankStreet 1ST CAPITAL BANK 5 HARRIS CT, BLDG N, STE 3 1ST COLONIAL BANCORP, INC 1040 HADDON AVE 1ST CONSTITUTION BANCORP 2650 RTE 130 1ST NATL BK - FOX VALLEY 550 S GREEN BAY RD 1ST NATL BK OF BERLIN 140 W HURON ST 1ST NATL BK OF CARMI 201 E MAIN ST 1ST NATL BK OF COLD SPRING 301 MAIN ST 1ST NATL BK OF ELK RIVER 100 STATE HWY 55 1ST NATL BK OF FAIRFAX 16 SE 1ST ST 1ST NATL BK OF FT SMITH 602 GARRISON AVE 1ST NATL BK OF PLAINVIEW 138 W BROADWAY 1ST SOURCE BANK 100 N MICHIGAN ST 1ST STATE BANK 4805 TOWNE CENTRE RD, STE 100 21ST CENTURY BANK 699 N MEDINA ST 3MV BANCORP, INC. 210 N 78TH ST 473 BROADWAY HOLDING CORPORATI 473 BROADWAY A S I FCU 5508 CITRUS BLVD A. F. GILMORE COMPANY 6301 W 3RD ST ACCESS NATIONAL CORPORATION 1800 ROBERT FULTON DR, STE 300 ACHIEVA CU 1499 GULF TO BAY BLVD ACRU, INC 9860 HWY 92 ADBANC, INC. 202 N SPRUCE ADIRONDACK BANCORP 185 GENESEE ST AGGEORGIA FARM CREDIT, ACA 468 PERRY PARKWAY AGSTAR FINANCIAL SERVICES, ACA 1921 PREMIER DR, P.O. BOX 424 AIM BANCSHARES, INC 110 COLLEGE AVE ALASKA GROWTH CAP. BIDCO INC. 3900 C STREET, SUITE 302 ALASKA PACIFIC BANCSHARES, INC 2094 JORDAN AVE ALASKA USA FCU 4000 CREDIT UNION DR STE 100 ALBANY BANCSHARES NEVADA FINAN ONE E FIRST ST ALDEN STATE BANK 10564 COY ST ALERUS FINANCIAL NATL ASSOC 401 DEMERS AVE ALLEGIANCE BANCSHARES, INC 8727 W SAM HOUSTON PKWY NORTH, S ALLIANCE BANK 101 W MONTGOMERY ST ALLIANCE BANK 105 E LYON AVE ALLIANCE BANK 217 N KINGSHIGHWAY ALLIANCE BANK, N.A. -

CRA Evaluation Charter 21017

O INTERMEDIATE SMALL BANK Comptroller of the Currency Administrator of National Banks Washington, DC 20219 PUBLIC DISCLOSURE January 17, 2012 COMMUNITY REINVESTMENT ACT PERFORMANCE EVALUATION MetroBank, National Association Charter Number: 21017 9600 Bellaire Boulevard, Suite 252 Houston, Texas 77036 Office of the Comptroller of the Currency Houston Field Office 1301 McKinney Street, Suite 1410 Houston, Texas 77010-3031 NOTE: This document is an evaluation of this institution’s record of meeting the credit needs of its entire community, including low- and moderate-income neighborhoods consistent with safe and sound operation of the institution. This evaluation is not, nor should it be construed as, an assessment of the financial condition of this institution. The rating assigned to this institution does not represent an analysis, conclusion, or opinion of the federal financial supervisory agency concerning the safety and soundness of this financial institution. Charter Number: 21017 INSTITUTION'S CRA RATING: This institution is rated Satisfactory. The Lending Test is rated: Satisfactory. The Community Development Test is rated: Outstanding. MetroBank, National Association (Metro) has a Satisfactory record of meeting community credit needs based on the following: The level of community development (CD) lending and investments shows excellent responsiveness. Metro originated a significant level of qualified loans and made two large qualified investments during the evaluation period. The geographic distribution of loans to businesses reflects excellent dispersion for low- and moderate-income tracts in the assessment area (AA). Lending to businesses of different sizes in the AAs reflects reasonable penetration and meets the standards for Satisfactory performance. A substantial majority of lending is inside Metro’s AAs. -

Name of Institution City State Investment Description Investment

U.S. Treasury Department Office of Financial Stability Troubled Asset Relief Program Transactions Report For Period Ending May 20, 2009 CAPITAL PURCHASE PROGRAM Treasury Investment Remaining Seller Purchase Details Capital Repayment Details After Capital Repayment Final Disposition Remaining Investment Final Disposition Final Disposition Purchase 6 Footnote Date Name of Institution City State Investment Description Investment Amount Pricing Mechanism Capital Repayment Date Capital Repayment Amount Remaining Capital Amount Description Date Disposition Investment Description Proceeds 10/28/2008 Bank of America Corporation Charlotte NC Preferred Stock w/ Warrants $ 15,000,000,000 Par 10/28/2008 Bank of New York Mellon Corporation New York NY Preferred Stock w/ Warrants $ 3,000,000,000 Par 10/28/2008 Citigroup Inc. New York NY Preferred Stock w/ Warrants $ 25,000,000,000 Par 10/28/2008 The Goldman Sachs Group, Inc. New York NY Preferred Stock w/ Warrants $ 10,000,000,000 Par 10/28/2008 JPMorgan Chase & Co. New York NY Preferred Stock w/ Warrants $ 25,000,000,000 Par 10/28/2008 Morgan Stanley New York NY Preferred Stock w/ Warrants $ 10,000,000,000 Par 10/28/2008 State Street Corporation Boston MA Preferred Stock w/ Warrants $ 2,000,000,000 Par 10/28/2008 Wells Fargo & Company San Francisco CA Preferred Stock w/ Warrants $ 25,000,000,000 Par 11/14/2008 Bank of Commerce Holdings Redding CA Preferred Stock w/ Warrants $ 17,000,000 Par 11/14/2008 1st FS Corporation Hendersonville NC Preferred Stock w/ Warrants $ 16,369,000 Par 11/14/2008 UCBH Holdings, Inc. San Francisco CA Preferred Stock w/ Warrants $ 298,737,000 Par 11/14/2008 Northern Trust Corporation Chicago IL Preferred Stock w/ Warrants $ 1,576,000,000 Par 11/14/2008 SunTrust Banks, Inc. -

U.S. Department of the Treasury

6/4/2020 Treasury Provides TARP Funds to Local Banks U.S. DEPARTMENT OF THE TREASURY Press Center Treasury Provides TARP Funds to Local Banks 1/22/2009 To view or print the PDF content on this page, download the free Adobe® Acrobat® Reader®. ts-01 Washington- The U.S. Treasury Department announced details this week of a $1.5 billion investment in 39 banks made through its Capital Purchase Program. Treasury created the Capital Purchase Program, a part of the Troubled Asset Relief Program, to help to stabilize and strengthen the U.S. financial system. Treasury allocated $250 billion under TARP's Capital Purchase Program to invest in U.S. financial institutions. To date, the Department has made $193.8 billion of investments, receiving preferred stock and warrants from participating institutions. Investments have ranged from as small as $1 million to as large as $25 billion, financing community banking and Community Development Financial Institutions in 43 states and Puerto Rico. Institutions that sell shares to the government must comply with restrictions on executive compensation during the period that Treasury holds equity issued through this program and agree to limitations on dividends and stock repurchases. Information about Treasury's Troubled Asset Relief Program can be found at http://www.treas.gov/initiatives/eesa/. Following are the transaction details: Seller Name of Institution City State Price Paid Home Bancshares, Inc. Conway AR $50,000,000 Washington Banking Company/Whidbey Island Oak Harbor WA $26,380,000 Bank New Hampshire Thrift Newport NH $10,000,000 Bancshares, Inc. Bar Harbor Bankshares/Bar Harbor Bar Harbor ME $18,751,000 Bank & Trust Somerset Hills Bancorp Bernardsville NJ $7,414,000 SCBT Financial Columbia SC $64,779,000 Corporation S&T Bancorp Indiana PA $108,676,000 https://www.treasury.gov/press-center/press-releases/Pages/ts01.aspx 1/3 6/4/2020 Treasury Provides TARP Funds to Local Banks ECB Bancorp, Inc./East Engelhard NC $17,949,000 Carolina Bank First BanCorp San Juan PR $400,000,000 Texas Capital Dallas TX $75,000,000 Bancshares, Inc. -

August 28, 2012 Jennifer J. Johnson, Secretary Board Of

August 28, 2012 Jennifer J. Johnson, Secretary Office of the Comptroller of the Board of Governors of the Federal Currency Reserve System 250 E Street, SW 20th Street and Constitution Avenue, Mail Stop 2-3 N.W. Washington, D.C. 20551 Washington, DC 20219 E-mail: [email protected] E-mail: [email protected] Subject: Comment on Basel III Docket No. 1442 Subject: Comment on Basel III OCC Docket ID OCC-2012-0008, 0009, and 0010 Robert E. Feldman Executive Secretary Attention: Comments/Legal ESS Federal Deposit Insurance Corporation, 550 17th Street, N.W. Washington, D.C. 20429 E-mail: [email protected] Subject: Comment on Basel III FDIC RIN 3064- AD95, RIN 3064-AD96, and RIN 3064-D97 Ladies and Gentlemen: Firstbank Corporation is pleased to have the opportunity to comment on the Basel III proposals1 that were recently approved by the Federal Reserve Board, the Office of the Comptroller of the Currency, and the Federal Deposit Insurance Corporation (collectively the “banking agencies”). We offer the following comments in the spirit of achieving the best possible rule making for our industry as a matter of public policy. Firstbank Corporation is a $1.5 billion asset community banking company with five banks in the outstate areas of Michigan’s Lower Peninsula. We primarily 1 The proposals are titled: Regulatory Capital Rules: Regulatory Capital, Implementation of Basel III, Minimum Regulatory Capital Ratios, Capital Adequacy, and Transition Provisions; Regulatory Capital Rules: Standardized Approach for Risk-weighted Assets; Market Discipline and Disclosure Requirements; and Regulatory Capital Rules: Advanced Approaches Risk-based Capital Rules; Market Risk Capital Rule. -

Reused Ticker List.Xlsx

Re-Used Ticker Symbols Trading Symbol Name AA Alcoa Inc AAAA Atlas Industries Holdings LLC AAAB Admiralty Bancorp Inc AAC Hongli Clean Energy Technologies Corp AAC Arcadia Financial Ltd AAGH Asia Global Holdings Corp AAI AirTran Holdings Inc AAI Aqua Alliance Inc AAIIQ aaiPharma Inc AAIR Airways Corp AAL American Airlines Group Inc AAL Alexander & Alexander AAL American Airlines Inc AAMC American Asset Management Corp AAN RBS Holdings N.V. ADR AAN Aaron's Inc AANI Amedia Networks Inc AB Cannon Express Inc A ABD Agility Capital Inc ABDR Abacus Direct Corp ABE Armor Holdings Inc ABH Resolute Forest Products Inc ABI Applied Biosystems Inc ABI Safety First Trust Principal-Protected Trust Certificates 2009-8.5.14 Linke ABNK Amegy Bancorp Inc ABR Atlantic Premium Brands Ltd ABRX Able Laboratories Inc ABS Albertson's Inc ABS Albertsons Companies Inc ABY Abitibi-Consolidated Inc ABY Swedish Export Credit Corp Accelerated Return Bear Martket Notes 2009-8.3.1 AC Marquee Holdings Inc ACAP American Physicians Capital Inc ACAP USA Biomass Corp ACCM American Custom Components Inc ACCO 800 America.com Inc ACCP Accelerated Pharma Inc ACCS Prime Star Group Inc ACCS Access Health Inc ACCS Accesstel Inc ACCS African Copper Corp ACEN AC Energy Inc ACHI AmeriChip International Inc ACHI American Country Holdings Inc ACLO Accelio Corp ACMI American Consolidated Management Group Inc ACMI Accumed International Inc ACMR A C Moore Arts & Crafts Inc ACOM Agency.com Ltd ACOM A+ Network Inc ACOM Ancestry.com Inc ACPI Anthracite Capital Inc ACRE Americold Realty Trust -

Supplementary Appendix: Bank CEO Optimism and the Financial Crisis

Supplementary Appendix: Bank CEO Optimism and the Financial Crisis Yueran Ma∗ I Additional Tables Table A1: CEO Optimism and Pre-Crisis Growth of Real Estate Loans (Matching Estimates) CEOs in sample are divided into the \more optimistic" group (CEO equity holding change above median) and the \less optimistic" group (CEO equity holding change below median). The constant term is the matching estimate of the difference in real estate loan growth between these two subsamples. The matching covariates used in a given specification are labeled with \Yes", and the set of covariates are the same as the control variables in Table 4 in the paper. I use matching with replacement and three matched observations per target observation (with bias adjustment). Log Change in Loans backed by RE (2002|2005) (1) (2) (3) (4) (5) Constant 0.158*** 0.114** 0.178*** 0.110** 0.178*** (0.0511) (0.0444) (0.0610) (0.0429) (0.0560) Matching Covariates FHFA Index Change Yes Yes Yes Dividend Yield as of 2002 Yes Yes Yes Yes Volatility as of 2002 Yes Yes Yes Yes RE Loans/Assets by 2002 Yes Yes Yes Yes Size (log assets) by 2002 Yes Yes Yes Yes Log Holding Change (98{01) Yes Yes RE Loan Growth (98{01) Yes Yes Observations 142 136 76 136 76 Standard errors in parentheses *** p<0.01, ** p<0.05, * p<0.1 ∗Harvard University (email: [email protected]). 1 Table A2: CEO Optimism and Loans Sold for Securitization This table performs the same set of tests as Table 5 of the paper using HMDA data, but focus on originated-and-sold loans rather than originated-and-held loans: The dependent variable is the bank fixed effect bi estimated from log(loan0205ij) − log(loan9801ij) = bi + cj + ij, where loan0205ij is the total originated-and-sold HMDA loans made in 2002|2005 by bank i in county j, loan9801ij is the total originated-and-sold HMDA loans made in 1998|2001 by bank i in county j, and cj is the county fixed effect.