Energy Sector in Gujarat Research Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Addedndum to Petition 1914.Pdf

BEFORE THE GUJARAT ELECTRICITY REGULATORY COMMISSION GANDHINAGAR CASE NO. 1914/2020 Determination of Aggregate Revenue Requirement And Tariff of FY 2021-22 Under GERC (Multi Year Tariff) Regulations, 2016 along with other Guidelines and Directions issued by the GERC from time to time AND under Part VII (Section 61 to Section 64) of the Electricity Act, 2003 read with the relevant Guidelines Filed by:- Paschim Gujarat Vij Company Ltd. Corp. Office: Paschim Gujarat Vij Seva Sadan, Off. Nana Mava Main Road, Laxminagar, Rajkot– 360004. Determination of ARR & Tariff for FY 2021-22 BEFORE THE GUJARAT ELECTRICITY REGULATORY COMMISSION GANDHINAGAR Filing No: Case No: 1914/2020 IN THE MATTER OF Filing of the Petition for determination of ARR & Tariff for FY 2021-22, under GERC (Multi Year Tariff) Regulations, 2016 along with other Guidelines and Directions` issued by the GERC from time to time AND under Part VII (Section 61 to Section 64) of the Electricity Act, 2003 read with the relevant Guidelines AND IN THE MATTER OF Paschim Gujarat Vij Company Limited, Paschim Gujarat Vij Seva Sadan, Off. Nana Mava Main Road, Laxminagar, Rajkot – 360004. PETITIONER Gujarat Urja Vikas Nigam Limited Sardar Patel Vidyut Bhavan, Race Course, Vadodara - 390 007 CO-PETITIONER THE PETITIONER ABOVE NAMED RESPECTFULLY SUBMITS Paschim Gujarat Vij Company Limited 63 Determination of ARR & Tariff for FY 2021-22 TABLE OF CONTENTS SECTION 1. INTRODUCTION .......................................................................................... 68 1.1. PREAMBLE ............................................................................................................ -

GUJARAT STATE PETRONET a I D Nominal COVID-19 Downturn; Quick Revival

s p COMPANY UPDATE a c d i M GUJARAT STATE PETRONET a i d Nominal COVID-19 downturn; quick revival n I India Equity Research| Oil, Gas and Services Gujarat State Petronet (GSPL) is a pure gas pipeline utility, which is EDELWEISS RATINGS relatively less affected by the ongoing COVID-19 downturn. In fact, it is Absolute Rating BUY poised to resume a sustainable 4-5% long-term volume CAGR. It not only Investment Characteristics Growth enjoys a healthy balance sheet, enabling it to weather the current stress, but also robust INR50bn FCF over FY21-23E will help it turn debt free. The stock has fallen ~25% since February on concerns that its largest customer MARKET DATA (R: GSPT.BO, B: GUJS IN) Reliance Industries (RIL) will sharply cut volumes following start-up of its CMP : INR 186 own petcoke gasifier. RIL continues to source 9-10mmscmd of gas despite Target Price : INR 278 full commissioning of its plant during March 2020. Besides, COVID-19- 52-week range (INR) : 264 / 146 related volume hit is also currently limited to 13%, with an ongoing quick Share in issue (mn) : 564.1 recovery. Maintain ‘BUY’ with revised DCF-based TP of INR278 (INR290 M cap (INR bn/USD mn) : 103 / 1,525 earlier) due to cut in volume demand forecast. Avg. Daily Vol. BSE/NSE (‘000) : 584.1 Corona-related volume dip nominal; quick revival underway SHARE HOLDING PATTERN (%) We expect GSPL to report a nominal 3% QoQ volume dip during Q4FY20 and a further Current Q3FY20 Q2FY20 10% dip to 32mmscmd during Q1FY21, followed by a steady revival to normal level. -

Press Release Gujarat Gas Limited

Press Release Gujarat Gas Limited October 07, 2019 Ratings Amount Facilities Ratings1 Rating Action (Rs. Crore) CARE AA; Positive/ CARE A1+ Long Term / Short Term 2,000.00 (Double A; Outlook: Positive/ Reaffirmed Bank Facilities A One Plus) 2,000.00 Total Bank Facilities (Rupees Two Thousand Crore Only) Details of facilities in Annexure-1 Detailed Rationale & Key Rating Drivers The ratings for the bank facilities of Gujarat Gas Ltd. (GGL) continue to derive strength from its leading position in the city gas distribution (CGD) business in India, well-established and significantly large scale of operations, established gas sourcing arrangements, moderately diversified customer segment mix, comfortable debt coverage indicators, healthy cash accruals along with strong liquidity and efficient working capital management. The ratings further continue to derive strength from its professional and experienced management and favorable industry outlook for the CGD business. GGL’s long-term rating, however, continues to remain constrained on account of its medium sized capex plans for developing CGD network in various geographical areas (GAs; including in 7 new ones) towards its growth plans, moderate leverage, susceptibility of demand for natural gas from its industrial customers based on price dynamics of competing fuels with its concomitant impact on its profitability and regulatory risk associated with CGD business. GGL’s ability to ensure sustained growth in demand from its industrial segment customers along with sustained improvement in operating profitability and its capital structure, timely execution of projects especially in the new GAs within envisaged cost and time parameters and generating envisaged returns therefrom; along with conduciveness of regulatory environment for CGD sector would be the key rating sensitivities. -

Merchants Where Online Debit Card Transactions Can Be Done Using ATM/Debit Card PIN Amazon IRCTC Makemytrip Vodafone Airtel Tata

Merchants where online Debit Card Transactions can be done using ATM/Debit Card PIN Amazon IRCTC Makemytrip Vodafone Airtel Tata Sky Bookmyshow Flipkart Snapdeal icicipruterm Odisha tax Vodafone Bharat Sanchar Nigam Air India Aircel Akbar online Cleartrip Cox and Kings Ezeego one Flipkart Idea cellular MSEDC Ltd M T N L Reliance Tata Docomo Spicejet Airlines Indigo Airlines Adler Tours And Safaris P twentyfourBySevenBooking Abercrombie n Kent India Adani Gas Ltd Aegon Religare Life Insur Apollo General Insurance Aviva Life Insurance Axis Mutual Fund Bajaj Allianz General Ins Bajaj Allianz Life Insura mobik wik Bangalore electricity sup Bharti axa general insura Bharti axa life insurance Bharti axa mutual fund Big tv realiance Croma Birla sunlife mutual fund BNP paribas mutural fund BSES rajdhani power ltd BSES yamuna power ltd Bharat matrimoni Freecharge Hathway private ltd Relinace Citrus payment services l Sistema shyam teleservice Uninor ltd Virgin mobile Chennai metro GSRTC Club mahindra holidays Jet Airways Reliance Mutual Fund India Transact Canara HSBC OBC Life Insu CIGNA TTK Health Insuranc DLF Pramerica Life Insura Edelweiss Tokio Life Insu HDFC General Insurance IDBI Federal Life Insuran IFFCO Tokio General Insur India first life insuranc ING Vysya Life Insurance Kotak Mahindra Old Mutual L and T General Insurance Max Bupa Health Insurance Max Life Insurance PNB Metlife Life Insuranc Reliance Life Insurance Royal Sundaram General In SBI Life Insurance Star Union Daiichi Life TATA AIG general insuranc Universal Sompo General I -

Before the Gujarat Electricity Regulatory Commission

BEFORE THE GUJARAT ELECTRICITY REGULATORY COMMISSION GANDHINAGAR Petition No 1712 of 2018 In the matter of: Petition under the provision of Electricity Act, 2003 read with GERC (Terms and Conditions of Intra- State Open Access) Regulations, 2011 and in the matter of seeking refund of amount of transmission wheeling charges paid by the Petitioner company Under Protest and in the matter of decision/ order dated 10.05.2017 passed by the Respondent authority rejecting the request/application of refund of amount paid towards Exit Option Charge for Wind Mill No. ADO-36 made by the Petitioner company. Petitioner: Gokul Refoils and Solvent, Gokul House, 43, Shreemali Co-Operative Housing Soc. Ltd., Opp. Shikhar Building, Navrangpura, Ahmedabad. Co-Petitioner: Gokul Agri International Ltd, State Highway No. 41, Near Sujanpur Patia, Sidhpur, District: Patan, Pin Code – 384151 Represented by: Learned Advocate Shri Satyan Thakkar and Shri Nisarg Rawal V/s. Respondent: Gujarat Energy Transmission Corporation Ltd. Sardar Patel Vidyut Bhavan, Race Course, Vadodara- 390 007. Represented by: Learned Sernior Advocate Shri M. G. Ramchandran with Advocate Ms. Ranjitha Ramchandran and Ms. Venu Birappa CORAM: Shri Anand Kumar, Chairman Shri P. J. Thakkar, Member Date: 09/03/2020 ORDER 1 1 The present petition has been filed by M/s Gokul Refoils & Solvent Limited and M/s Gokul Agri International Limited seeking following prayer: “The Commission may be pleased to quash and set aside the impugned decision/order dated 10.05.2017 passed by the Additional Engineer (R&C), Gujarat Energy Transmission Corporation Limited and further be pleased to direct the Gujarat Energy Transmission Corporation Limited i.e. -

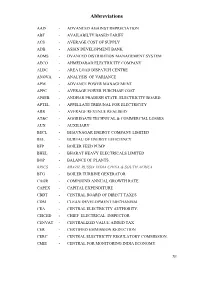

09 List of Abbreviations.Pdf

Abbreviations AAD - ADVANCED AGAINST DEPRECIATION ABT - AVAILABILTY BASED TARIFF ACS - AVERAGE COST OF SUPPLY ADB - ASIAN DEVELOPMENT BANK ADMS - DVANCED DISTRIBITION MANAGEMENT SYSTEM AECO - AHMEDABAD ELECTRICITY COMPANY ALDC - AREA LOAD DISPATCH CENTRE ANOVA - ANALYSIS OF VARIANCE. APM - ADVANCE POWER MANAGEMENT APPC - AVERAGE POWER PURCHASE COST APSEB - ANDHAR PRADESH STATE ELECTRICITY BOARD. APTEL - APPELLATE TRIBUNAL FOR ELECTRICITY ARR - AVERAGE REVENUE REALISED AT&C - AGGREGATE TECHNICAL & COMMERCIAL LOSSES AUX - AUXILIARY BECL - BHAVNAGAR ENERGY COMPANY LIMITED BEE - BUREAU OF ENERGY EFFICIENCY BFP - BOILER FEED PUMP BHEL - BHARAT HEAVY ELECTRICALS LIMITED BOP - BALANCE OF PLANTS. BRICS - BRAZIL RUSSIA INDIA CHINA & SOUTH AFRICA BTG - BOILER TURBINE GENERATOR CAGR - COMPOUND ANNUAL GROWTH RATE CAPEX - CAPITAL EXPENDITURE CBDT - CENTRAL BOARD OF DIRECT TAXES CDM - CLEAN DEVELOPMENT MECHANISM CEA - CENTRAL ELECTRICITY AUTHORITY. CEICED - CHIEF ELECTRICAL INSPECTOR. CENVAT - CENTRALIZED VALUE ADDED TAX CER - CERTIFIED EMMISSION REDUCTION CERC - CENTRAL ELECTRICITY REGULATORY COMMISSION. CMIE - CENTRAL FOR MONITORING INDIA ECONOMY. XI CNG - COMPRESSED NATURAL GAS COC - COST OF CAPITAL COD - COMMERCIAL OPERATION DATE COGS - COST OF GOODS SOLD COP - COST OF PRODUCTION CPCB - CENTRAL POLLUTION BOARD CPL - COASTAL POWER LIMITED CPP - CAPTIVE POWER PLANT CPPs - CAPTIVE POWER PLANTS CRISIL - CREDIT RATING INFORMATION SERVICES OF INDIA LIMITED CSS - CROSS SUBSIDY SURCHARGE CST - CENTRAL SALES TAX CTU - CENTRAL TRANSMISSION UTILITY. CVPF -

Presentation (State Updates)

State Updates – Presentations • Andhra Pradesh • Delhi • Gujarat • Haryana • Karnataka • Maharashtra • Tamil Nadu 1 Andhra Pradesh Power Sector Status and Issues Ahead Presentation by People’s Monitoring Group on Electricity Regulation (PMGER) Hyderabad, Andhra Pradesh 22nd- 23rd March 2007, Mumbai 1 Reform Milestones 2 1 Reform Milestones in AP APSEB Unbundling Financial autonomy Bulk supply & AP Reforms Unbundled into provided to Discoms. trading vested Bill passed into APGenco / Distribution Citizens charter with Discoms in Assembly APTransco Companies introduced as per EA 2003 Apr’98 Feb’99 Apr’00 Apr’02 June 05’ Tripartite agreement with employees on reform program Feb’97 Mar’99 Oct’02 Dec 05’ Employees 7th ARR & Govt. APERC allocated to Tariff filing policy establish all companies made as statement ed through per ACT issued options 2003 Key statistics 4 2 KEY STATISTICS APTRANSCO & DISCOMs APTRANSCO NPDCL Headquarters HYD Headquarters Warangal Consumers 3.47m ADILABAD SRIKAKULAM NIZAMABAD KARIMNAGAR VIJAYNAGARAM WARANGAL MEDAK VISHAKAPATNAM KHAMMAM EAST RANGAREDDY GODAVARI NALGONDA WEST GODAVARI EPDCL CPDCL MAHABOOB NAGAR KRISHNA GUNTUR Headquarters Vizag Headquarters HYD Consumers 3.57m PRAKASAM Consumers 5.61m KURNOOL BAY OF BENGAL ANANTAPUR NELLORE CUDDAPAH SPDCL CHITTOOR Headquarters Tirupati Consumers 5.20m 5 A snapshot of the AP Power Sector Structure Percentage procured from various Key Statistics of Power Sector in sources AP 49% 33% 14% 4% Total Number of 1.73 Cr APGENCO CGS IPPs / JVs NCEs Consumers Per Capita Consumption -

Taurus Infrastructure Fund Factsheet

TAURUS INFRASTRUCTURE FUND - (An Open ended equity scheme investing in Infrastructure sector) SCHEME FEATURES Fund Manager's Comment: Infrastructure remains an important pillar of India growth story. A higher cash Investment Objective allocation was preferred in anticipation of the severing of Covid-19 crises which would impact infra-based companies. However, we continue to align our portfolio with a strong balance sheet coupled with reasonable valuations. Going To provide capital appreciation and income ahead, government thrust in this space, we continue to focus on companies with good financial health and healthy distribution to unitholders by investing pre- ratios, now have improved outlook. dominantly in equity and equity related securities of the companies belonging to infrastructure PORTFOLIO sector and it's related industries. Name of the scrip % to Net Assets Fund Manager Top 10 Holdings Mr. Prasanna Pathak (w.e.f. June 30, 2017) Ultratech Cement Ltd. 7.59 Total work experience: 17 yrs Larsen & Toubro Ltd. 6.72 Date of Allotment Power Grid Corporation of India Ltd. 5.85 March 5, 2007 Bharti Airtel Ltd. 3.84 Benchmark Gujarat Gas Ltd. 3.69 Nifty Infrastructure Index TRI Reliance Industries Ltd. 3.41 Benchmark Index changed w.e.f. 23/03/2018 Jindal Steel & Power Ltd. 3.40 Monthly AUM Graphite India Ltd. 2.94 Monthly Average AUM: ` 4.78 Cr. MOIL Ltd. 2.44 Month End AUM: ` 4.92 Cr. Voltas Ltd. 2.27 Load Structure Top 10 Holdings 42.15 Entry Load - NIL TOTAL - EQUITY 94.32 Exit Load - Upto any amount (Including SIP): CASH & CASH RECEIVABLES 5.68 • 0.5% if exited on or before 7 days. -

Uttar Gujarat Vij Company Ltd. Well Comes

Uttar Gujarat Vij Company Ltd. Well Comes Vibrant Gujarat Global Investors Summit-2007 SUPPLY VOLTAGE Contract Supply Demand Voltage Up to At 11 KV/ 22KV 4000 KVA Above At 66 KV 4000 KVA and above Where to apply for Power Connection Name of DISCOM Name of Districts Madhya Gujarat Vij Company Ltd. Vadodara, Anand, Kheda, (MGVCL) Vadodara Panchmahal, Dahod Uttar Gujarat Vij Company Ltd. Ahmedabad (except city), (UGVCL) Mehsana Gandhinagar (except city), Mehsana, Banas Kantha, Patan, Sabar Kantha Paschim Gujarat Vij Company Ltd. Rajkot, Porbandar, Junagadh, (PGVCL) Rajkot Jamnagar, Kutch, Bhavnagar, Amreli, Surendranagar Dakshin Gujarat Vij Company Ltd. Surat except city, Bharuch, (DGVCL) Surat Narmada, Dang,Valsad, Navsari Processing and releasing Authority of HT connection UP TO CIRCLE 275 KVA OFFICE Above CORPORATE 275 KVA OFFICE Procedure for Registration of Application for HT Power Supply Application for supply of power shall be made in the prescribed form. The requisition for supply of electrical energy shall be accompanied by registration charges as under. HT and EHT supply @ Rs.10 per KVA with a ceiling of Rs.25000.00 Checklist- Submission of Documents for Power Supply • Prescribed Application Form in Four (4) Copies • Site plan with key map indicating point of supply in Four (4) Copies. • Land documents – Plot Allotment letter OR 7/12 and 8A Abstract, OR Sale deed in Two (2) Copies. • Memorandum of Articles • Resolution authorizing the person(s) to sign Application and Agreement • Short Description of process • Certificate regarding Industrial use of land from Collector (Before work is taken up on hand.) • NOC of Gujarat Pollution Control Board (Before actual release of power supply.) Estimate [1] • On registration of demand, the DISCOM shall furnish an estimate including Security Deposit and charges for providing electric line/infrastructure as per technical feasibility report. -

Live Billers on Bharat Billpay As on May 15, 2018

LIVE BILLERS ON BHARAT BILLPAY AS ON MAY 15, 2018 National/State Sr. No Category Name Biller Name 1 DTH National Dish TV 2 DTH National Tata Sky Ltd 3 DTH National SUN Direct 4 Electricity Maharashtra Maharashtra State Electricity Distribution Co. Ltd. Southern Power Distribution Company of Andhra Pradesh 5 Electricity Andhra Pradesh Ltd. 6 Electricity Delhi TATA Power North Delhi Power Limited Eastern Power Distribution Company of Andhra Pradesh 7 Electricity Andhra Pradesh Ltd. Madhya Pradesh Paschim Kshetra Vidyut Vitaran Company 8 Electricity Madhya Pradesh Ltd. 9 Electricity Rajasthan Jaipur Vidyut Vitran Nigam Limited 10 Electricity Gujarat Torrent Power 11 Electricity West Bengal Calcutta Electricity Supply Corporation 12 Electricity Maharashtra Reliance Energy Ltd.- Mumbai 13 Electricity Delhi BSES Rajdhani Power Limited 14 Electricity Uttarakhand Uttarakhand Power Corporation Ltd 15 Electricity Delhi BSES Yamuna Power Limited North Eastern Electricity Supply Company of Orissa 16 Electricity Odisha Limited 17 Electricity Odisha Southern Electricity Supply Company Of Orissa Limited 18 Electricity Maharashtra SNDL Nagpur 19 Electricity Meghalaya Meghalaya Electricity Board 20 Electricity Tripura Tripura State Electricity Corporation Ltd 21 Electricity West Bengal India Power Corporation 22 Electricity Bihar Muzzafurpur Vidyut Vitran Ltd. 23 Electricity Uttar Pradesh Noida Power Company Ltd. 24 Electricity Jharkand Jamshedpur Utilities and Services Company 25 Electricity Rajasthan Kota Electricity Distribution Limited 26 Electricity Rajasthan Bharatpur Electricity Service Limited 27 Electricity Uttar Pradesh UttarᅠPradesh Power Corporation-Urban (4) 28 Electricity Daman and Diu Daman and Diu Electricity Department 29 Electricity Rajasthan Bikaner Electricity Supply Ltd 30 Electricity Maharashtra The Tata Power Company Ltd.-Mumbai 31 Electricity Rajasthan Tata Power Ajmer 32 Electricity Bihar North Bihar Power Distribution Company Ltd. -

Details Length Natural Gas Pipelines Network in India

Natural Gas Pipelines Network in India - As on 30.06.2020 Details Length Total length of Authorized Natural Gas Pipelines 32,559 Km Total length of Operational Natural Gas Pipelines 17,016 Km Total length of Under Construction Natural Gas Pipelines 15,543 Km Note: Pipelines authorized under Regulation 19 (Dedicated Pipeline) and 21 (Tie-in connectivity) of the NGPL Authorization Regulations are not included in the above length. Disclaimer: While every care has been taken to upload the accurate data; PNGRB shall not be held responsible for any loss, damage etc. due to action taken by any one based on this information. This information may not be quoted in any court as an evidence. Operational Natural Gas Pipelines – As on 30.06.2020 Authorized S. Name of Natural Gas Name of Date of States from which Pipeline Length (KM) Capacity No. Pipelines Authorized Entity Authorization passes (MMSCMD) 1 Assam Regional Network GAIL 04.11.2009 7.8 2.50 Assam 2 Cauvery Basin Network GAIL 04.11.2009 240.3 4.33 Puducherry, Tamil Nadu Hazira-Vijaipur-Jagdishpur - GREP (Gas Rehabilitation and Uttar Pradesh, Madhya 3 GAIL 19.04.2010 4222.0 57.30 Expansion Project)-Dahej- Pradesh, Rajasthan, Gujarat Vijaipur HVJ/VDPL Kakinada-Hyderabad-Uran- Andhra Pradesh, Gujarat, 4 Ahmedabad (East West PIL 19.04.2010 1460.0 85.00 Maharashtra, Telangana Pipeline) 5 Dahej-Uran-Panvel-Dhabhol GAIL 10.05.2010 815.0 19.90 Gujarat, Maharashtra 6 KG Basin Network GAIL 12.05.2010 877.9 16.00 Andhra Pradesh, Puducherry 7 Gujarat Regional Network GAIL 03.12.2010 608.8 8.31 Gujarat 8 Agartala Regional Network GAIL 13.12.2010 55.4 2.00 Tripura Haryana, Punjab, Uttar 9 Dadri-Panipat IOCL 05.01.2011 132.0 20.00 Pradesh Dahej-Vijaipur (DVPL)-Vijaipur- Gujarat, Madhya Pradesh, 10 Dadri (GREP) Upgradation GAIL 14.02.2011 1280.0 54.00 Rajasthan, Uttar Pradesh DVPL 2 & VDPL Cont. -

COMPANY REPORT an ISO 9001:2008 Certified Company BUY

1 INVESTMENT INTERRMEDIATES LTD. COMPANY REPORT An ISO 9001:2008 Certified Company BUY 28 Mar, 2011 Indraprastha Gas Limited Key Data (`) Indraprastha Gas Ltd (IGL) is in the City Gas Distribution (CGD) business supplying CMP 299 compressed natural gas (CNG) to the transport Sector and piped natural gas (PNG) to domestic and commercial sectors in the National Capital Territory (NCT) region Target Price 357 of Delhi. It has a CNG compression capacity of 3.52mn Kg per day and fuels more Key Data than 400,000 vehicles daily. In the PNG segment, IGL provides natural gas to over Bloomberg Code IGL IN 210,000 domestic and 300 commercial customers. It also supplies re-gasified liquid Reuters Code IGAS.BO natural gas (R-LNG) to 58 industrial consumers. We initiate our coverage on IGL ` BSE Code 532514 with a “Buy” recommendation and a price target of 357. NSE Code IGL Investment Rationale Face Value (`) 10 Robust demand for CNG in Delhi and NCR, a major boost for IGL: Market Cap. (` Bn) 41.9 Delhi Government introduced 2,000 new buses & ~20,000 new radio taxis during 52 Week High (`) 374 the Common Wealth games. In addition, introduction of CNG models by car 52 Week Low (`) 209 manufacturers along with conversion to CNG by private car owners provides Avg. Daily Volume (6m) 336945 significant opportunity for the company. In line IGL has consistently increased the Beta (Sensex) 0.7 number of CNG stations from 181 in FY09 to 241 stations by the end of FY10 and it plans to further strengthen its CNG stations count to 281 by the end of FY11.