Come Dine with Us Bars, Restaurants and Casual Dining Update

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Updates Online

MORSE ROAD Verizon Whole Foods Market Visionworks G2 G1 Blue Star Barbershop Chuy’s Restore Hyper Restore + Wellness Cryotherapy Talbots Elm & Iron Container The Store Solich Piano EASTON GATEWAY DRIVE Lane Bryant PetCo La-Z-Boy WEAVERTON LANE SEWARD STREET SEWARD BJ’s EASTON LOOP Brewhouse Golf Galaxy STELZER ROAD STELZER Zoup! Home Bassett Germain Cadillac CycleBar Massage Elements Float Spa Float European European of Easton G3 REST True Wax Center Wax Pies & Pints Pies Furnishings Mercedes-Benz G6 of Easton Hot Chicken THE GARDEN Takeover Field & Stream smart center Easton J. Alexander’s G5 Fusian Germain Inniti Z Melt Bar Jos A. Bank Spectrum Anthony Nail Spa Vince’ Jaguar and G4 REI COhatch & Grilled Land Rover Easton Nordstrom STREET FENLON LemonShark Beeline RH Columbus, Ivan Kane’s The Gallery 270 ebar Forty Deuce WORTH AVENUE G7 THE at Easton Arhaus DRIVE FARM WOODSIDE TrueGG Café Bistro YARD Town Center SETON STREET Food HHDragon Crimson JJ Kitchen Forbidden Root Donuts II Sleep Ted’s Number by Saks O 5th DRIVE GATEWAY EASTON WORTH AVENUE WORTH AVENUE Select Comfort Dick’s White Barn White Sporting David’s Bridal David’s Montana Grill Midtown Health Carbon Goods Slurping Anthropologie Cooper’s Hawk Winery Pins Oce G11 G8 Grill & Restaurant Turtle Mechanical Building Works & BodyBath LL G9 Gifts College Conrads Cuisine Tumi Boss Gal T soon coming Pho SocialPho Apple KK Aloft Café Zupas Café kate spade Café Istanbul Café EE - LEVELS 3 & 4 LAET DRIVE new york Hotel Tempur-Pedic Mediterranean Mediterranean L.L.Bean Mongolian bd’s Brighton Germain Lexus Madewell Collectibles X Chamberlain MORSE CROSSING V of Easton University MIDTOWN DHL Coach PARKING GARAGE LAET DRIVE BRIGHTON BRIGHTON ROSE WAY Costco Tommy Bahama WORTH PARKING GARAGE Tory Burch Costco Sephora Fuel FENLON STREET FENLON EE 7 For All Mankind W G10 Kendra Scott Louis Vuitton THE STRAND EASTON LOOP EASTON U Michael Kors ALSTON STREET Smith & Tiany & Co. -

Eating-In-Delhi

S No. Premises Name Premises Address District 1 DOMINOS PIZZA INDIA LTD GF, 18/27-E, EAST PATEL NAGAR, ND CENTRAL DISTRICT 2 STANDARD DHABA X-69 WEST PATEL NAGAR NEW DELHI CENTRAL DISTRICT 3 KALA DA TEA & SNACKS 26/140, WEST PATEL NAGAR, NEW DELHI CENTRAL DISTRICT 4 SHARON DI HATTI SHOP NO- 29, MALA MKT. WEST PATEL NAGAR NEW CENTRAL DISTRICT DELHI 5 MAA BHAGWATI RESTAURANT 3504, DARIBA PAN, DBG ROAD, DELHI CENTRAL DISTRICT 6 MITRA DA DHABA X-57, WEST PATEL NAGAR NEW DELHI CENTRAL DISTRICT 7 CHICKEN HUT 3181, SANGTRASHAN STREET PAHAR GANJ, NEW CENTRAL DISTRICT DELHI 8 DIMPLE RESTAURANT 2105,D.B.GUPTA ROAD KAROL BAGH NEW DELHI CENTRAL DISTRICT 9 MIGLANI DHABA 4240 GALI KRISHNA PAHAR GANJ, NEW DELHI CENTRAL DISTRICT 10 DURGA SNACKS 813,G.F. KAMRA BANGASH DARYA GANJ NEW DELHI- CENTRAL DISTRICT 10002 11 M/S SHRI SHYAM CATERERS GF, SHOP NO 74-76A, MARUTI JAGGANATH NEAR CENTRAL DISTRICT KOTWALI, NEAR POLICE STATION, OPPOSITE TRAFFIC SIGNAL, DAR 12 AROMA SPICE 15A/61, WEA KAROL BAGH, NEW DELHI CENTRAL DISTRICT 13 REPUBLIC OF CHICKEN 25/6, SHOP NO-4, GF, EAST PATEL NAGAR,DELHI CENTRAL DISTRICT 14 REHMATULLA DHABA 105/106/107/110 BAZAR MATIYA MAHAL, JAMA CENTRAL DISTRICT MASJID, DELHI 15 M/S LOCHIS CHIC BITES GF, SHOP NO 7724, PLOT NO 1, NEW MARKET KAROL CENTRAL DISTRICT BAGH, NEW DELHI 16 NEW MADHUR RESTAURANT 26/25-26 OLD RAJENDER NAGAR NEW DELHI CENTRAL DISTRICT 17 A B ENTERPRISES( 40 SEATS) 57/13,GF,OLD RAJINDER,NAGAR,DELHI CENTRAL DISTRICT 18 GRAND MADRAS CAFE GF,8301,GALI NO-4,MULTANI DHANDA PAHAR CENTRAL DISTRICT GANJ,DELHI-55 19 STANDARD SWEETS 3510,CHAWRI BAZAR,DELHI CENTRAL DISTRICT 20 M/S CAFE COFFEE DAY 3631, GROUND FLOOR, NETAJI SUBASH MARG, CENTRAL DISTRICT DARYAGANJ, NEW DELHI 21 CHANGEGI EATING HOUSE 3A EAST PARK RD KAROL BAGH ND DELHI 110055 CENTRAL DISTRICT 22 KAKE DA DHABA SHOP NO.47,OLD RAJINDER NAGAR,MARKET,NEW CENTRAL DISTRICT DELHI 23 CHOPRA DHABA 7A/5 WEA CHANNA MKT. -

Differences in Energy and Nutritional Content of Menu Items Served By

RESEARCH ARTICLE Differences in energy and nutritional content of menu items served by popular UK chain restaurants with versus without voluntary menu labelling: A cross-sectional study ☯ ☯ Dolly R. Z. TheisID *, Jean AdamsID Centre for Diet and Activity Research, MRC Epidemiology Unit, University of Cambridge, Cambridge, United a1111111111 Kingdom a1111111111 ☯ These authors contributed equally to this work. a1111111111 * [email protected] a1111111111 a1111111111 Abstract Background OPEN ACCESS Poor diet is a leading driver of obesity and morbidity. One possible contributor is increased Citation: Theis DRZ, Adams J (2019) Differences consumption of foods from out of home establishments, which tend to be high in energy den- in energy and nutritional content of menu items sity and portion size. A number of out of home establishments voluntarily provide consumers served by popular UK chain restaurants with with nutritional information through menu labelling. The aim of this study was to determine versus without voluntary menu labelling: A cross- whether there are differences in the energy and nutritional content of menu items served by sectional study. PLoS ONE 14(10): e0222773. https://doi.org/10.1371/journal.pone.0222773 popular UK restaurants with versus without voluntary menu labelling. Editor: Zhifeng Gao, University of Florida, UNITED STATES Methods and findings Received: February 8, 2019 We identified the 100 most popular UK restaurant chains by sales and searched their web- sites for energy and nutritional information on items served in March-April 2018. We estab- Accepted: September 6, 2019 lished whether or not restaurants provided voluntary menu labelling by telephoning head Published: October 16, 2019 offices, visiting outlets and sourcing up-to-date copies of menus. -

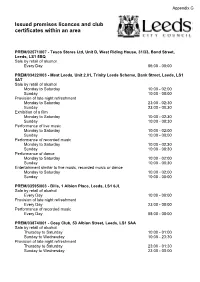

Issued Premises Licences and Club Certificates Within an Area

Issued premises licences and club certificates within an area PREM/02571/007 - Tesco Stores Ltd, Unit D, West Riding House, 31/33, Bond Street, Leeds, LS1 5BQ Sale by retail of alcohol Every Day 06:00 - 00:00 PREM/03422/003 - Meat Leeds, Unit 2.01, Trinity Leeds Scheme, Bank Street, Leeds, LS1 5AT Sale by retail of alcohol Monday to Saturday 10:00 - 02:00 Sunday 10:00 - 00:00 Provision of late night refreshment Monday to Saturday 23:00 - 02:30 Sunday 23:00 - 00:30 Exhibition of a film Monday to Saturday 10:00 - 02:30 Sunday 10:00 - 00:30 Performance of live music Monday to Saturday 10:00 - 02:00 Sunday 10:00 - 00:00 Performance of recorded music Monday to Saturday 10:00 - 02:30 Sunday 10:00 - 00:30 Performance of dance Monday to Saturday 10:00 - 02:00 Sunday 10:00 - 00:30 Entertainment similar to live music, recorded music or dance Monday to Saturday 10:00 - 02:00 Sunday 10:00 - 00:00 PREM/03595/003 - Bills, 1 Albion Place, Leeds, LS1 6JL Sale by retail of alcohol Every Day 10:00 - 00:00 Provision of late night refreshment Every Day 23:00 - 00:00 Performance of recorded music Every Day 08:00 - 00:00 PREM/03874/001 - Cosy Club, 53 Albion Street, Leeds, LS1 5AA Sale by retail of alcohol Thursday to Saturday 10:00 - 01:00 Sunday to Wednesday 10:00 - 23:30 Provision of late night refreshment Thursday to Saturday 23:00 - 01:30 Sunday to Wednesday 23:00 - 00:00 PREM/03406/005 - Byron, 9A Lands Lane, Leeds, LS1 6AW Sale by retail of alcohol Every Day 11:00 - 00:00 Provision of late night refreshment Every Day 23:00 - 00:30 Performance of recorded -

Venue Id Venue Name Address 1 City Postcode Venue Type

Venue_id Venue_name Address_1 City Postcode Venue_type 2012292 Plough 1 Lewis Street Aberaman CF44 6PY Retail - Pub 2011877 Conway Inn 52 Cardiff Street Aberdare CF44 7DG Retail - Pub 2006783 McDonald's - 902 Aberdare Gadlys Link Road ABERDARE CF44 7NT Retail - Fast Food 2009437 Rhoswenallt Inn Werfa Aberdare CF44 0YP Retail - Pub 2011896 Wetherspoons 6 High Street Aberdare CF44 7AA Retail - Pub 2009691 Archibald Simpson 5 Castle Street Aberdeen AB11 5BQ Retail - Pub 2003453 BAA - Aberdeen Aberdeen Airport Aberdeen AB21 7DU Transport - Small Airport 2009128 Britannia Hotel Malcolm Road Aberdeen AB21 9LN Retail - Pub 2014519 First Scot Rail - Aberdeen Guild St Aberdeen AB11 6LX Transport - Local rail station 2009345 Grays Inn Greenfern Road Aberdeen AB16 5PY Retail - Pub 2011456 Liquid Bridge Place Aberdeen AB11 6HZ Retail - Pub 2012139 Lloyds No.1 (Justice Mill) Justice Mill Aberdeen AB11 6DA Retail - Pub 2007205 McDonald's - 1341 Asda Aberdeen Garthdee Road Aberdeen AB10 7BA Retail - Fast Food 2006333 McDonald's - 398 Aberdeen 1 117 Union Street ABERDEEN AB11 6BH Retail - Fast Food 2006524 McDonald's - 618 Bucksburn Inverurie Road ABERDEEN AB21 9LZ Retail - Fast Food 2006561 McDonald's - 663 Bridge Of Don Broadfold Road ABERDEEN AB23 8EE Retail - Fast Food 2010111 Menzies Farburn Terrace Aberdeen AB21 7DW Retail - Pub 2007684 Triplekirks Schoolhill Aberdeen AB12 4RR Retail - Pub 2002538 Swallow Thainstone House Hotel Inverurie Aberdeenshire AB51 5NT Hotels - 4/5 Star Hotel with full coverage 2002546 Swallow Waterside Hotel Fraserburgh -

1 King's Cross Bridge, London N1 Outstanding New Restaurant / Retail Opportunity Triple Frontage Prime King's Cross Location 13 11

1 King's Cross Bridge, London N1 Outstanding New Restaurant / Retail Opportunity Triple Frontage Prime King's Cross Location 13 11 12 COAL DROPS 10 GRANARY YARD King’s Cross Bridge occupies a unique setting on an SQUARE island site diagonally opposite the entrance to King’s Cross Station with triple frontage onto Pentonville Road, Gray’s Inn Road and Kings Cross Bridge. 15 k al W 14 te Evidence of the excellent location can be seen in the u in lk M a 16 W 5 te oradjacent and surrounding occupiers; Camino, Five u in M 3 Guys, McDonalds, Starbucks, Pret, Nandos, and ST PANCRAS 1 8 Honest Burger. 2 6 7 KING’S CROSS 9 4 1 King’s Cross Bridge is a brand new, modern and eye 5 3 catching mixed-use development in the heart of one of London’s most connected locations. An established office, residential, tourist and leisure area, there is an abundance of footfall for a restaurant, retail, gym or bar occupier to benefit from, not to mention being a destination location in its own right. Set above the restaurant will be striking Grade A office accommodation which the incoming restaurant or bar operator will benefit from. 1. German Gymnasium 9. Five Guys 2. Mildreds 10. Granary Brasserie 3. The Standard Hotel 11. Dishoom 4. Pret A Manger 12. Barrafina 5. The Gilbert Scott 13. Kerb Kings Cross 6. Starbucks 14. Granger and Co 7. Camino 15. Notes 8. Nando’s 16. Franco Manca The Property benefits from an excellent location in the centre of the King’s Cross regeneration area which has seen the development of Coal Drops Yard and Granary Square into a vast office and amenity offering. -

Prospect Exhibitor Information Bounce Back Stronger

Hotel, Restaurant & Catering 2021 The business event for hospitality and foodservice professionals Prospect Exhibitor Information Bounce Back Stronger Preparing your Business for 2021 Success With more than 86 years of expertise in serving the hospitality and foodservice community, HRC is recognised globally as the annual event for industry professionals to source, taste and test the products and services available in the market today. We are market leading because we consistently deliver an unrivalled audience of senior decision makers, all hungry to find the latest innovation and business solutions to help their business improve. For the first time, HRC will take place alongside the International Food & Drink Event, IFE Manufacturing Solutions, London Produce Show and Festival of Enterprise to serve an audience of more than 40,000 food, drink & hospitality professionals. There really is no better opportunity to showcase your products or services to a curated community committed to finding new suppliers and keeping up-to-date with the latest industry trends. We look forward to welcoming you. Kind regards Ronda Annesley Event Manager - HRC What to expect from HRC HRC 2020 visitors were: 43% Hospitality Foodservice 17% Click to view video on Vimeo > 9% Wholesaler/Distributor 15k 5% Retail (in-store catering) visitors 2% Import/Export 10% Manufacturer 14% Other Purchasing Power Per Annum 7% £5,000,000+ 10% £1,000,000 - £5,000,000 9% £500,000 - £999,999 20% £100,000 - £499,999 73% of attendees have direct £50,000 - £99,999 15% purchasing power 19% £10,000 - £49,999 9% £5,000 - £9,999 11% Less than £5,000 Recognised as the UK’s largest and most A one-stop-shop prestigious chef competition. -

131 West Nile Street Glasgow G1

house everything at your doorstep empire 131 WEST NILE STREET GLASGOW G1 2RX empirehouse 131 WEST NILE STREET GLASGOW G1 2RX leisure specification Glasgow Royal Concert Hall, Cineworld and Situated at the corner of West Nile Street Street Bus Station and numerous bus the Theatre Royal and Sauchiehall Street, Empire House is links, all just a stone’s throw away. There offer an abundance of • Modern open plan offices entertainmant choice one of the most “staff friendly” locations are on street and multi storey parking throughtout the year, in Glasgow city centre with fantastic facilities coveniently nearby. and all lie within close • New contemporary entrance hall shops, restaurants and leisure amenities proximity. on its doorstep. After work, the surrounding restaurants, • Office suites refurbished prior to entry bars, hotels, multi screen cinema, Furthermore, getting here could not concert hall and theatres provide eat + drink • Full time commissionaire be easier with Queen Street Station, staff with a vast choice of leisure and Buchanan Street Subway and Buchanan entertainment opportunities. From fast food to fine dining, • DDA compliant from coffee to cocktails, it’s all literally on the doorstep with Starbucks, Pret A Manger, • On site secure car parking KFC, La Bonne Auberge, Walkabout and many more • Cycle storage, showering and lockers nearby. • Security Door Entry System shopping • 24 Hour access Everyday essentials to little to let • Gas Central Heating luxuries, Empire House is Superb modern perfectly situated to take full advantge of Glasgow’s • Perimeter Trunking office suites excellent shopping provision available in a with Buchanan Galleries, • Comfort Cooled Suites Available Buchanan Quarter and variety of sizes. -

LONDON Cushman & Wakefield Global Cities Retail Guide

LONDON Cushman & Wakefield Global Cities Retail Guide Cushman & Wakefield | London | 2019 0 For decades London has led the way in terms of innovation, fashion and retail trends. It is the focal location for new retailers seeking representation in the United Kingdom. London plays a key role on the regional, national and international stage. It is a top target destination for international retailers, and has attracted a greater number of international brands than any other city globally. Demand among international retailers remains strong with high profile deals by the likes of Microsoft, Samsung, Peloton, Gentle Monster and Free People. For those adopting a flagship store only strategy, London gives access to the UK market and is also seen as the springboard for store expansion to the rest of Europe. One of the trends to have emerged is the number of retailers upsizing flagship stores in London; these have included Adidas, Asics, Alexander McQueen, Hermès and Next. Another developing trend is the growing number of food markets. Openings planned include Eataly in City of London, Kerb in Seven Dials and Market Halls on Oxford Street. London is the home to 8.85 million people and hosting over 26 million visitors annually, contributing more than £11.2 billion to the local economy. In central London there is limited retail supply LONDON and retailers are showing strong trading performances. OVERVIEW Cushman & Wakefield | London | 2019 1 LONDON KEY RETAIL STREETS & AREAS CENTRAL LONDON MAYFAIR Central London is undoubtedly one of the forefront Mount Street is located in Mayfair about a ten minute walk destinations for international brands, particularly those from Bond Street, and has become a luxury destination for with larger format store requirements. -

No.4 Upper St Martin's Lane London

No.4 Upper St Martin’s Lane London WC2 The shop is situated on Upper St Martin’s Lane in the heart of London’s theatre district. Seven Dials Village sits immediately to the north, home to a mix of independent boutiques, global brands, theatres and luxury hotels. Leicester Square, St Martin’s Courtyard, Tottenham Court and the world-renowned Covent Garden Piazza are all within a 10 minute walk, attracting tourists year round. As well as an abundance of fashion retailers including Barbour and & Other Stories, Upper St Martin’s Lane and the surrounding area is an established food destination that boasts a vibrant and eclectic mix of operators including Timberyard, Ole & Steen, Chick ‘n’ Sours, Pizza Pilgrims, Bills, Five Guys and Dishoom, who will shortly be extending their existing restaurant. PRIME A1 SHOP TO LET KEY FIGURES AREAS The shop is arranged Rent over ground floor providing Subject to contract rental offers are invited in the region of £135,000 per annum exclusive of the following approximate rates, (VAT if applicable) and all other outgoings. net internal floor area: Ground Floor: Rateable Value (2017) 1,073 ft² / 99.68 m² £100,000 Rates Payable (2019/20) TENURE £52,400 per annum The shop is available by way of a new effective FRI lease for a Service Charge & Insurance term to be agreed. The lease The service charge and insurance for the current year are estimated at £7,700 and £800 will be contracted outside respectively. of the security of tenure and compensation provisions of Planning the landlord and tenant act The shop benefits from A1 planning consent. -

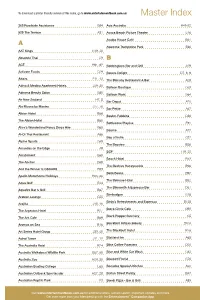

Master Index

To download a printer friendly version of this index, go to www.entertainmentbook.com.au Master Index 365 Roadside Assistance G84 Avis Australia H49-52 529 The Terrace A31 Avoca Beach Picture Theatre E46 Awaba House Café B61 A Awezone Trampoline Park E66 AAT Kings H19, 20 Absolute Thai C9 B ACE H61, 62 Babbingtons Bar and Grill A29 Activate Foods G29 Bakers Delight D7, 8, 9 Adairs F11, 12 The Balcony Restaurant & Bar A28 Adina & Medina Apartment Hotels J29, 30 Balloon Boutique G63 Adnama Beauty Salon G50 Balloon Worx G64 Air New Zealand H7, 8 Bar Depot A20 Ala Moana by Mantra J77, 78 Bar Petite A67 Albion Hotel B66 Baskin-Robbins D36 The Albion Hotel B60 Battlezone Playlive E91 Alice’s Wonderland Fancy Dress Hire G65 Baume A77 Al-Oi Thai Restaurant A66 Bay of India C37 Alpine Sports G69 The Bayview B56 Amandas on the Edge A9 BCF F19, 20 Amazement E69 Beach Hotel B13 The Anchor B68 The Beehive Honeysuckle B96 And the Winner Is OSCARS B53 Bella Beans B97 Apollo Motorhome Holidays H65, 66 The Belmore Hotel B52 Aqua Golf E24 The Bikesmith & Espresso Bar D61 Aqua re Bar & Grill B67 Bimbadgen G18 Arabian Lounge C25 Birdy’s Refreshments and Espresso B125 Arajilla J15, 16 Black Circle Cafe B95 The Argenton Hotel B27 Black Pepper Butchery G5 The Ark Cafe B69 Aromas on Sea B16 Blackbird Artisan Bakery B104 Art Series Hotel Group J39, 40 The Blackbutt Hotel B76 Astral Tower J11, 12 Blaxland Inn A65 The Australia Hotel B24 Bliss Coffee Roasters D66 Australia Walkabout Wildlife Park E87, 88 Blue and White Car Wash G82 Australia Zoo H29, 30 Bluebird Florist G76 Australian Boating College E65 Bocados Spanish Kitchen A50 Australian Outback Spectacular H27, 28 Bolton Street Pantry B47 Australian Reptile Park E3 Bondi Pizza - Bar & Grill A85 Visit www.entertainmentbook.com.au for additional offers, suburb search, important updates and more. -

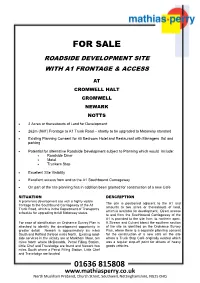

Roadside Development Site with A1 Frontage & Access

FOR SALE ROADSIDE DEVELOPMENT SITE WITH A1 FRONTAGE & ACCESS AT CROMWELL HALT CROMWELL NEWARK NOTTS • 2 Acres or thereabouts of Land for Development • 262m (860’) Frontage to A1 Trunk Road – shortly to be upgraded to Motorway standard • Existing Planning Consent for 40 Bedroom Hotel and Restaurant with Managers flat and parking • Potential for alternative Roadside Development subject to Planning which would include: • Roadside Diner • Motel • Truckers Stop • Excellent Site Visibility • Excellent access from and to the A1 Southbound Carriageway • On part of the site planning has in addition been granted for construction of a new Cafe SITUATION DESCRIPTION A prominent development site with a highly visible The site is positioned adjacent to the A1 and frontage to the Southbound Carriageway of the A1 amounts to two acres or thereabouts of land, Trunk Road, which is in the Department of Transport’s which is available for development. Direct access schedule for upgrading to full Motorway status. to and from the Southbound Carriageway of the A1 is provided to the site from its northern apex. For ease of identification an Ordnance Survey Plan is A Stream and Culvert bisect the southern section attached to identify the development opportunity in of the site as identified on the Ordnance Survey greater detail. Newark is approximately six miles Plan, where there is a separate planning consent South and Retford thirteen miles North. Existing road- for the construction of a new café on the site side services in the vicinity are at Markham Moor, ten where a Truck Stop Café originally existed which miles North where McDonalds, Petrol Filling Station, was a regular stop-off point for drivers of heavy Little Chef and Travelodge are found and Newark two goods vehicles.