MCB Bank Limited, Pakistan 75

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

(Winner)MCB Bank Limited Best Bank of the Year 2017 – Mid Size Banks

Banking: Best Bank of the year 2017 – Large Size Banks (Winner)MCB Bank Limited Best Bank of the year 2017 – Mid Size Banks (Winner) Bank Al Habib Limited Best Bank of the year 2017 – Small Size Banks Industrial and Commercial Bank of China (Winner) Limited Best Islamic Window of the year 2017 (Winner) Habib Bank Limited Best Islamic Bank of the year 2017 (Winner) Meezan Bank Limited Corporate Finance: Transaction of the year 2017 (Winner) Habib Bank Limited for Dasu Hydropower Project Best Corporate Finance House of the year (Fixed Income) 2017 United Bank Limited (Winner) Best Corporate Finance House of the year (Fixed Income) 2017Habib Bank Limited (Runner-up) Best Corporate Finance House of the year (Equity & Advisory) - Banks Bank Alfalah Limited 2017 (Winner) Best Corporate Finance House of the year (Equity & Advisory) - Banks United Bank Limited 2017 (Runner-up) Best Corporate Finance House of the year (Equity & Advisory) – Arif Habib Limited Security Firms 2017 (Winner) Best Corporate Finance House of the year (Equity & Advisory) – AKD Securities Limited Security Firms 2017 (Runner-up) Investor Relations: Best Investor Relations – Listed Companies 2017 (Winner) Bank Alfalah Limited Best Investor Relations – Listed Companies 2017 (Runner-up) Engro Fertilizers Limited Women in Finance Initiative: Gender Diversity at Workplace Award 2017 (Winner) Unilever Pakistan Limited Recognizing Gender Diversity Award – Special Recognition: Local National Foods Limited Industry 2017 (Winner) Recognizing Gender Diversity Award – Special Recognition: -

Prospectus, Especially the Risk Factors Given at Para 4.11 of This Prospectus Before Making Any Investment Decision

ADVICE FOR INVESTORS INVESTORS ARE STRONGLY ADVISED IN THEIR OWN INTEREST TO CAREFULLY READ THE CONTENTS OF THIS PROSPECTUS, ESPECIALLY THE RISK FACTORS GIVEN AT PARA 4.11 OF THIS PROSPECTUS BEFORE MAKING ANY INVESTMENT DECISION. SUBMISSION OF FALSE AND FICTITIOUS APPLICATIONS ARE PROHIBITED AND SUCH APPLICATIONS’ MONEY MAY BE FORFEITED UNDER SECTION 87(8) OF THE SECURITIES ACT, 2015. SONERI BANK LIMITED PROSPECTUS THE ISSUE SIZE OF FULLY PAID UP, RATED, LISTED, PERPETUAL, UNSECURED, SUBORDINATED, NON-CUMULATIVE AND CONTINGENT CONVERTIBLE DEBT INSTRUMENTS IN THE NATURE OF TERM FINANCE CERTIFICATES (“TFCS”) IS PKR 4,000 MILLION, OUT OF WHICH TFCS OF PKR 3,600 MILLION (90% OF ISSUE SIZE) ARE ISSUED TO THE PRE-IPO INVESTORS AND PKR 400 MILLION (10% OF ISSUE SIZE) ARE BEING OFFERED TO THE GENERAL PUBLIC BY WAY OF INITIAL PUBLIC OFFER THROUGH THIS PROSPECTUS RATE OF RETURN: PERPETUAL INSTRUMENT @ 6 MONTH KIBOR* (ASK SIDE) PLUS 2.00% P.A INSTRUMENT RATING: A (SINGLE A) BY THE PAKISTAN CREDIT RATING COMPANY LIMITED LONG TERM ENTITY RATING: “AA-” (DOUBLE A MINUS) SHORT TERM ENTITY RATING: “A1+” (A ONE PLUS) BY THE PAKISTAN CREDIT RATING AGENCY LIMITED AS PER PSX’S LISTING OF COMPANIES AND SECURITIES REGULATIONS, THE DRAFT PROSPECTUS WAS PLACED ON PSX’S WEBSITE, FOR SEEKING PUBLIC COMMENTS, FOR SEVEN (7) WORKING DAYS STARTING FROM OCTOBER 18, 2018 TO OCTOBER 26, 2018. NO COMMENTS HAVE BEEN RECEIVED ON THE DRAFT PROSPECTUS. DATE OF PUBLIC SUBSCRIPTION: FROM DECEMBER 5, 2018 TO DECEMBER 6, 2018 (FROM: 9:00 AM TO 5:00 PM) (BOTH DAYS INCLUSIVE) CONSULTANT TO THE ISSUE BANKERS TO THE ISSUE (RETAIL PORTION) Allied Bank Limited Askari Bank Limited Bank Alfalah Limited** Bank Al Habib Limited Faysal Bank Limited Habib Metropolitan Bank Limited JS Bank Limited MCB Bank Limited Silk Bank Limited Soneri Bank Limited United Bank Limited** **In order to facilitate investors, United Bank Limited (“UBL”) and Bank Alfalah Limited (“BAFL”) are providing the facility of electronic submission of application (e‐IPO) to their account holders. -

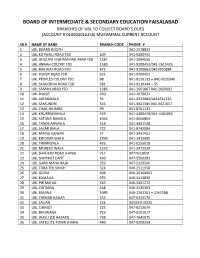

Branches of Ubl to Collect Board's Dues

BOARD OF INTERMEDIATE & SECONDARY EDUCATION FAISALABAD BRANCHES OF UBL TO COLLECT BOARD’S DUES (ACCOUNT # 010901016256) MUKAMMAL CURRENT ACCOUNT SR.# NAME OF BANK BRANCH CODE PHONE. # 1 UBL BOARD BOOTH - 041-2578833 2 UBL KOTWALI ROAD FSD 109 041-9200453 3 UBL GHULAM MUHAMMAD ABAD FSD 1287 041-2694655 4 UBL JINNAH COLONY FSD 1580 041-9200452/041-2615425 5 UBL RAILWAY ROAD FSD 472 041-9200662/0419200884 6 UBL DIJKOT ROAD FSD 531 041-9200451 7 UBL PEOPLES COLONY FSD 98 041-9220133 – 041-9220346 8 UBL SARGODHA ROAD FSD 581 041-9210344 – 35 9 UBL SAMAN ABAD FSD 1286 041-2661867 041-2660092 10 UBL DIJKOT 260 041-2670031 11 UBL JARANWALA 36 041-4312983/0414311126 12 UBL SAMUNDRI 326 041-3421585 041-3421657 13 UBL CHAK JHUMRA 99 041-8761131 14 UBL KHURRIANWALA 429 041-4360429/041-4364050 15 UBL SATANA BANGLA 1066 041-4600804 16 UBL TANDLIANWALA 518 041-3441548 17 UBL SALAR WALA 722 041-8742084 18 UBL MAMU KANJAN 37 041-3431452 19 UBL KHIDDAR WALA 1590 041-3413005 20 UBL THIKRIWALA 433 041-0255018 21 UBL MUREED WALA 1332 041-3472529 22 UBL SHAHEED ROAD JHANG 217 0477613829 23 UBL SHORKOT CANT 430 047-5500281 24 UBL GARH MAHA RAJA 359 047-5320506 25 UBL TOBA TEK SINGH 324 046-2511958 26 UBL GOJRA 404 046-35160062 27 UBL KAMALIA 970 046-3413830 28 UBL PIR MAHAL 545 046-3361272 29 UBL CHITIANA 668 046-2545363 30 UBL RAJANA 1093 046-2262201 – 2261588 31 UBL CHENAB NAGAR 153 047-6334576 32 UBL LALIAN 154 04533-610225 33 UBL CHINIOT 225 047-6213676 34 UBL BHOWANA 726 047-6201017 35 UBL WASU (18 HAZARI) 738 047-7645075 36 UBL SATELLITE TOWN JHANG 440 047-9200254 BOARD OF INTERMEDIATE & SECONDARY EDUCATION FAISALABAD BRANCHES OF MCB TO COLLECT BOARD’S DUES (ACCOUNT # (0485923691000100) PK 365 GOLD SR.# NAME OF BANK BRANCH CODE PHONE. -

Lt Gen Tariq Khan, HI (M) (Retd), Is Chief Executive & Managing

Lt Gen Tariq Khan, HI (M) (Retd) Lt Gen Tariq Khan, HI (M) (Retd), is Chief Executive & Managing Director of Fauji Fertilizer Company Limited, FFC Energy Limited and Fauji Fresh n Freeze Limited and also holds directorship on the Boards of following: Fauji Fertilizer Bin Qasim Limited Askari Bank Limited Fauji Foods Limited Philip Morris (Pakistan) Limited Fauji Meat Limited FFBL Foods Limited FFBL Power Company Limited Thar Energy Limited Pakistan Maroc Phosphore S.A. He is Chairman of Sona Welfare Foundation (SWF) and Fertilizer Manufacturers of Pakistan Advisory Council (FMPAC) and member of the Board of Governors of Foundation University, Islamabad. The General was commissioned in Pakistan Army in April1977 with the coveted Sword of Honour. During his illustrious service in the Army, he had been employed on various prestigious command, staff and instructional assignments including command of a Strike Corps. He is a graduate of Command and Staff College Quetta and National Defence University Islamabad. He also holds Master Degree in War Studies. He has served on the faculty of Command and Staff College Quetta and National Defence University Islamabad. Since his retirement, he is on the honorary faculty of renowned institutions including National Defence University as a senior mentor. The General possesses vast experience as adviser to the leading corporate entities. He has been awarded Hilal-e-Imtiaz (Military) and is also the first Pakistan Army General who has been conferred upon the U.S ‘Legion of Merit’ by the U.S Government for his meritorious services as a senior representative at U.S CENTCOM in Tampa, Florida. -

Annual REPORT 2011 SILKBANKT

ANNUAl REPORT 2011 SILKBANKT Notice of AGM & Auditors' Review 35 Auditors' Report 39 Financial Statements 43 Six Years' Rnancial Highlights 44 Statement of Financial Position 50 Profit & Loss Account 51 Statement of Comprehensive Income 52 Vision & Mission 02 Cash Row Statement 53 Message from Chairman 04 Statement of Changes in Equity 54 President & CEO's Review 06 Notes to the Financial Statements 55 Senior Management Committee 09 Statement of Written-off Loans 100 Profiles of Board of Directors 13 Achievements & CSR 103 Corporate Information 17 Additional Shareholders' Information 110 Directors' Report 21 Pattern of Share Holdings CDC & Physical 111 Statement of Compliance with 29 Branch Network 114 the Code of Corporate Governance Foreign Correspondents 116 & Statement of Internal Control Proxy Form 119 To be the leader in premier banking, trusted by customers for accessibility, service and innovation; be an employer of choice creating value for all stakeholders In the aftermath of the economic slowdown since 2008, Non-Performing Loans (NPLs) have dampened the profitability dynamics of commercial banks. I am pleased to advise you that contrary to the banking industry trend, your Bank managed to register a significant reduction in NPLs, in each consecutive year since the takeover by the new management. An NPL reduction by the Special Assets Management team of Rs. 3.398 billion and a Provision Reversal of Rs. 1.829 billion was recorded for the year 2011. The Real Estate Asset Management team (REAM) also supported the Special Assets Management team by successfully selling off various properties held as OREO (Other Real Estate Owned), during the year. -

Bank Alfalah Limited SHELF PROSPECTUS for THE

ADVICE FOR INVESTORS INVESTORS ARE STRONGLY ADVISED IN THEIR OWN INTEREST TO CAREFULLY READ THE CONTENTS OF THIS PROSPECTUS ESPECIALLY THE RISK FACTORS GIVEN AT PART 6 OF THIS PROSPECTUS BEFORE MAKING ANY INVESTMENT DECISION. SUBMISSION OF FALSE AND FICTITIOUS APPLICATIONS IS PROHIBITED AND SUCH APPLICANT’S MONEY MAY BE FORFEITED UNDER SECTION 87(8) OF THE SECURITIES ACT, 2015 Bank Alfalah Limited SHELF PROSPECTUS FOR THE ISSUANCE OF RATED, SECURED, LISTED, REDEEMABLE TERM FINANCE CERTIFICATES OF PKR 50,000 MILLION (Under shelf registration over a period of 3-years) Date and Place of Incorporation: Karachi, June 21st, 1992, Incorporation Number: 0027580, Registered and Corporate Office: B.A. Building, I.I Chundrigar Road, Karachi, Contact Person: Muhammad Zeeshan, Contact Number: +92 21 3312 2126, Website: https://www.bankalfalah.com/, Email: [email protected] Type of Issue and Total Approved Issue Size: The Issue consists of Rated, Secured, Listed, Redeemable Term Finance Certificates (TFCs) having a Total Approved Issue Size of up to PKR 50,000 million. Time Period of Shelf Registration: The TFCs shall be issued in multiple tranches over a period of three (3) years from the date of publication of this prospectus. Size of Current Tranche Series A: Issue Size of Current Tranche Series A is PKR 11,000 million (inclusive of Green Shoe Option of PKR 1,000 million), out of which TFCs of PKR 9,000 million (82% of Issue Size) have been issued to and subscribed by Pre-IPO investors and TFCs of PKR 2,000 million (18% of Issue Size), inclusive of a Green Shoe Option of PKR 1,000 million, are being offered to the general public by way of an Initial Public Offering through this Shelf Prospectus. -

3Rd Quarterly Report 2018

In the name Of Allah, most Gracious, most Merciful. This is by the Grace Of Allah. Contents Company Information 2 Directors’ Report 3 Condensed Interim Statement of Financial Information 4 Condensed Interim Profit and Loss Account (Un-audited) 5 Condensed Interim Statement of Comprehensive Income (Un-audited) 6 Condensed Interim Cash Flow Statement (Un-audited) 7 Condensed Interim Statement of Changes in Equity (Un-audited) 8 Notes to the Condensed Interim Financial Information (Un-audited) 9 International Steels Limited Company Information As at 31 March 2018 Chairman (Independent) Registered Office Mr. Kemal Shoaib 101, Beaumont Plaza, 10 Beaumont Road, Karachi – 75530 Independent Directors Telephone Nos.: +9221-35680045-54, UAN: 021-111-019-019 Mr. Tariq Iqbal Khan Fax: +9221-35680373, Mr. Kamran Y. Mirza e-mail: [email protected] Syed Salim Raza Lahore Office Non-Executive Directors Chinoy House, 6 Bank Square, Lahore - 54000 Mr. Towfiq H. Chinoy Telephone Nos:+9242-37229752-55, UAN:+9242-111-019-019 Mr. Kamal A. Chinoy Fax: +9242-37249755 Syed Hyder Ali e-mail: [email protected] Mr. Riyaz T. Chinoy Mr. Kazuteru Mihara Islamabad Office Office # 2, First Floor, Ahmed Centre, Executive Directors I-8 Markaz, Islamabad. Mr. Yousuf H. Mirza (Chief Executive Officer) Telephone Nos: +9251-2524650, +9251-4864601-2 Mr. Samir M. Chinoy Multan Office Chief Financial Officer Office No. 708-A, “The United Mall”, Mr. Mujtaba Hussain Plot No. 74, Abdali Road, Multan Company Secretary Factory Ms. Uzma Amjad Ali 399 - 404, Rehri Road, Landhi, Karachi. Telephone Nos: +9221-35013104-5 Chief Internal Auditor Fax: +9221-35013108 Mrs. -

IBFT Guideline

MCB Bank Limited IBFT- Guidelines 1. Al Baraka Bank (Pakistan) Limited Please enter Bank Al-Baraka total digits of account Number: Total Digits of Account Number: 13 Digits Format Example: AAAAAAAAAAAAA Note: A = Account Number 2. Allied Bank Limited Please enter Allied Bank Account Number by following the layout below: Total Digits of Account Number: 13 or 20 Digits Format Example: BBBBAAAAAAAAA or BBBBAAAAAAAAAAAAAAAA Note: B = Branch Code, A = Account Number 3. APNA Microfinance Bank Please enter APNA Microfinance Bank Account Number by following the layout below: Total Digits of Account Number: 16 Digits Format Example: BBBBAAAAAAAAAAAA Note: B = Branch Code, A = Account Number 4. Askari Bank Limited Please enter Askari Bank Account Number by following the layout below: For Branch Banking: Total Digits of Bank Account Number: 14 Digits Format Example: BBBBAAAAAAAAAA Note: B = Branch Code, A = Account Number For Branchless Banking: Total Digits of Bank Account Number: 11 Digits Format Example: 03XXXXXXXXX 5. Bank Al-Habib Limited Please enter Bank Al-Habib Account Number by following the layout below: Total Digits of Account Number: 17 Digits Format Example: BBBBTTTTBBBBBBRRC Note: B = Branch Code, A = Account Number, T = Account Type, BBBB= Base Number, RR = Digit Running Number, C = Check Digit 111 000 622 mcb.com.pk /MCBBankPk Over 1350 Branches & ATMs 6. Bank Al-Falah Limited Please enter Bank Al-Falah Account Number by following the layout below: For Conventional Banking: Total Digits of Account Number: 14 Digits Format Example: BBBBAAAAAAAAAA Note: B = Branch Code, A = Account Number For Islamic Banking: Total Digits of Account Number: 18 Digits Format Example: BBBBAAAAAAAAAAAAAA Note: B = Branch Code, A = Account Number For Branchless Banking: Total Digits of Account Number: 11 Digits Format Example: 03XXXXXXXXX 7. -

The Relative Efficiency of Commercial Banks in Pakistan with Respect to Size and Ownership Structure During and After Global Financial Crisis

Journal of Accounting and Finance in Emerging Economies Vol 4, No 2, December 2018 Volume and Issues Obtainable at Center for Sustainability Research and Consultancy Journal of Accounting and Finance in Emerging Economies ISSN: 2519-0318ISSN (E) 2518-8488 Volume 4: Issue 2 December 2018 Journal homepage: publishing.globalcsrc.org/jafee The Relative Efficiency of Commercial Banks in Pakistan with Respect to Size and Ownership Structure During and After Global Financial Crisis 1Allah Bakhsh khan, 2Syed Zulfiqar Ali Shah, 3Muhammad Abbas, 4Qaiser Maqbool khan 1 Asst Professor (Commerce) Bahauddin Zakariya University, Multan, and PhD Scholar at International Islamic University, Islamabad. Pakistan. Email: [email protected] 2 Associate Professor, Faculty of Management Sciences, International Islamic University, Islamabad. Pakistan. 3 Assistant Professor, Air University, Multan Campus. Email: [email protected] 4 PhD Scholar at Department of Commerce, Bahauddin Zakariya University, Multan. Pakistan. Email:[email protected] ARTICLE DETAILS ABSTRACT History Purpose: This study has been carried out to find out the relative efficiency Revised format: Nov2018 of the commercial banks in Pakistan over a five- year period from 2006 to Available Online: Dec 2018 year 2010 using Frontier Approach of efficiency. The commercial banks included in this research paper are public sector banks, privatized banks, Keywords domestic private banks, and foreign banks. In addition to overall efficiency Efficiency, Banks, comparison of the commercial banks, this study has also tested the effect of Financial Intermediation, size and ownership structure of the commercial banks in Pakistan on their Moral Hazard, Data efficiency. Data/Design/Methodology/Approach: Out of 44 banks, 21 commercial JEL Classification: banks have been chosen, which, in terms of deposits, account for about 94 D61,E58,E44,Y10 percent of total deposits of the banking sector (Rs.5,124,308 million) as on December, 2010. -

MCB Bank Annual Report 2012

MCB enjoys the unique position of being the Bank for Life because of its commitment to excellence and its constant endeavour to make banking convenient for everybody. MCB shares the element of convenience with water because not only is water the basis of life but also takes on the form and shape of the vessel it is kept in. MCB too quenches the thirst for convenience by taking on different forms according to the needs and requirements of the consumer. 2 Content 05 Vision Standalone Financial Statements 07 Mission 102 Auditors’ Report to the Members 09 Strategic Objectives 103 Statement of Financial Position 23 Core Values 104 Profit and Loss Account 25 Awards 105 Statement of Comprehensive Income 27 Products and Services 106 Cash Flow Statement 31 Corporate Information 107 Statement of Changes in Equity 32 Board of Directors 108 Notes to the Financial Statements 34 Profile of the Board of Directors 170 Annexure 39 Board Committees 42 Organizational Structure Consolidated Financial Statements 44 Management Committees 200 Directors’ Report on Consolidated Financial 47 Other Senior Management Statements 48 Entity Credit Rating 201 Auditors’ Report to the Members 49 Corporate Profile of the Bank 202 Consolidated Statement of Financial Position 50 Chairman’s Message 203 Consolidated Profit and Loss Account 51 President’s Review 204 Consolidated Statement of Comprehensive Income Stakeholder’s Information 205 Consolidated Cash Flow Statement 53 Annual Trend 2002 – 2012 206 Consolidated Statement of Changes in Equity 54 Highlights 2012 207 Notes -

Frequently Asked Questions

Frequently Asked Questions 1. If I already have an account with MCB Bank, can I open MCB Asaan Account too? No 2. Who can open MCB Asaan Account? Only Individuals can open this account as single or joint account. 3. Can MCB Asaan Account be opened in Saving category? No. Nature of MCB Asaan Account can only be Current. 4. Can MCB Asaan Account be opened in Foreign Currency? No. MCB Asaan Accounts can only be opened in PKR. 5. Can MCB Asaan Account be opened with more than Rs. 100 as initial deposit? MCB Asaan Accounts should be opened with minimum of initial deposit i.e. Rs. 100. However; the customer would have discretion to request the bank to deposit any amount over and above Rs.100 as initial deposit. 6. Which Instruments will be issued with the account? This is preferably a card based account. However, customers may be issued cheque books on their request. 7. What are the documents required for opening MCB Asaan Account? Any one of the following documents* may be used as a proof of identity for opening of MCB Asaan Account: (i) Computerized/Smart National Identity Card (CNIC/SNIC) (ii) National Identity Card for Overseas Pakistanis (NICOP) (iii) Pakistan Origin Card (POC) (iv) Alien Registration Card (ARC) issued by National Aliens Registration Authority (v) Passport (vi) Pension Book * The original identification document should be produced by the customer for “Original Seen” 8. What are the documents required for opening MCB Asaan Account in case of Minor? In case of minor accounts, the staff shall obtain photocopy of Form-B, Birth Certificate or Student ID card (as appropriate) from the minor. -

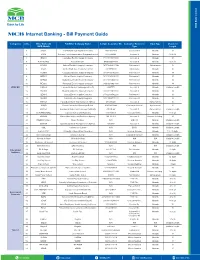

Internet Banking - Bill Payment Guide

MCB Bank Limited Internet Banking - Bill Payment Guide Categories S.No. Biller Name On Full Biller Company Name Sample Consumer No. Consumer Reference Input Type Character MCB Mobile Type Length 1 SNGPL Sui Northern Gas Pipelines Limited 17647668748 Consumer # Numeric 11 2 PTCL Pakistan Telecommunication Company Limited 2105788644 Account ID Numeric 10 to 14 3 IESCO Islamabad Electric Supply Company 15141111610800 Account # Numeric 14 4 K-ELECTRIC Karachi Electric 0400000664365 Account # Numeric 10 to 15 5 LESCO Lahore Electricity Supply Company 10111440863100u Reference # Alphanumeric 15 6 SSGC Sui Southern Gas Company Limited 2827970000 Customer # Numeric 10 7 FESCO Faisalabad Electric Supply Company 08134130792600 Reference # Numeric 14 8 MEPCO Multan Electric Supply Company 16151121444300 Reference # Numeric 14 9 GEPCO Gujranwala Electric Power Company 01121330008100 Reference # Numeric 14 10 PESCO Peshawar Electric Supply Company 04261210027191 Reference # Numeric 14 Utility Bill 11 LWASA Lahore Water And Sewerage Authority 40097772 Account # Numeric Variable Length 12 HESCO Hyderabad Electric Supply Company 01373110013800 Account # Numeric 14 13 QESCO Quetta Electric Supply Company 07482430592200 Reference # Numeric 14 14 SEPCO Sukkur Electric Supply Company 02321548795135 Reference # Numeric 14 15 FWASA Faisalabad Water And Sanitation Agency w11200287 Account # Alpha numeric 10 16 KWSB Karachi Water And Sewerage Board N0073050000 Consumer Number Alphanumeric 11 17 RWASA Rawalpindi Water And Sewerage Authority A0100762 Account #