ON TRACK for FULL-YEAR TARGETS Q1 2019 Trading Update

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Reckitt Partners with the Cambridge Centre for Risk Studies As It Advances Its Commitments to Carbon Neutrality

Reckitt partners with the Cambridge Centre for Risk Studies as it advances its commitments to carbon neutrality 9 June 2021 – Reckitt today announces its strategic partnership with the Cambridge Centre for Risk Studies (CCRS) as it progresses its sustainability ambitions. The partnership advances Reckitt’s ongoing commitment to deliver on the Paris Accord and its ambition for carbon neutrality by 2040 while delivering growth and long-term shareholder value. Its strategy for managing climate change includes action across the entire footprint of its organisation. The CCRS is working with Reckitt to support its climate change activity with analytics, including: • A detailed assessment of leading climate science to test and inform activity within changing patterns of extreme weather, and different scenarios of transition risks including regulatory change and consumer sentiment trends. • Strengthening Reckitt’s financial quantification of these impacts, by mapping Reckitt’s global business activities and the potential consequences of future changes. • Analysis of potential ways to evolve the business to achieve its goals for the Paris Accord and net-zero ambitions. Reckitt is the official Hygiene Partner for COP26, and is playing its part in tackling climate change by setting science-based targets to reach net zero emissions. In June 2020, Reckitt committed to accelerate the delivery of the Paris Climate Change Agreement and RE100, with the goal of achieving 100% renewable electricity across its operations by 2030 as part of an ambition to be carbon neutral by 2040. David Croft, Global Director of Sustainability, Reckitt, said: “We selected Cambridge because of its experienced, comprehensive and science-based approach to assessing and addressing climate-related risks, opportunities and metrics. -

Rb-Annual-Report-2012.Pdf

Reckitt Benckiser Group plc Reckitt Benckiser Group Healthier Happier Annual Report and Financial Statements 2012 Stronger Reckitt Benckiser Group plc Annual Report and Financial Statements 2012 Contents 1 Chairman’s Statement 2 Chief Executive’s Statement 10 Business Review 2012 18 Board of Directors and Executive Committee 19 Report of the Directors 22 Chairman’s Statement on Corporate Governance 24 Corporate Governance Report 30 Statement of Directors’ Responsibilities 31 Directors’ Remuneration Report 38 Independent Auditors’ Report to the members of Reckitt Benckiser Group plc 39 Group income statement 39 Group statement of comprehensive income 40 Group balance sheet 41 Group statement of changes in equity 42 Group cash flow statement 43 Notes to the financial statements 75 Five-year summary 76 Parent Company – Independent Auditors’ Report to the members of Reckitt Benckiser Group plc 77 Parent Company balance sheet 78 Notes to the Parent Company financial statements 84 Shareholder information Chairman’s Statement largest consumer health care category in The Board conducted its regular reviews the world with the acquisition of Schiff of the Company’s brands, geographic area Nutrition International, Inc. (Schiff) and and functional performance together with its leading US brands in the vitamins, detailed reviews of its human resources. minerals and supplements market. There The Board also completed its annual were also a few disposals of non core assessment of corporate governance assets. Net debt at the end of 2012, after including Board performance, corporate paying for dividends, net acquisitions and responsibility, and reputational and organisation restructuring, stood at business risk. £2,426m (2011: £1,795m). AGM Resolutions Your Board proposes an increase in the final The resolutions, which will be voted dividend of +11%, taking it to 78p per upon at our AGM of 2 May 2013 are share, and bringing the total dividend for fully explained in the Notice of Meeting. -

Hutchison China Meditech ("Chi-Med") (AIM: HCM)

Press Cutting Publication: FT.com Date: 13 February 2013 Reckitt gets taste for Chinese remedy By Adam Jones Reckitt Benckiser has bought a manufacturer of traditional Chinese sore-throat remedies as part of a drive to add more holistic treatments to its stable of western healthcare brands. The UK-headquartered maker of Nurofen painkillers, Strepsils lozenges and Durex condoms on Wednesday said it had acquired Oriental Medicine Company for an undisclosed sum. Reckitt said the cost was modest as it announced the deal in annual results, featuring a 2 per cent increase in pre-tax profits compared with 2011 and a 7 per cent rise in the dividend. However, it still represents an eye-catching diversification for a western consumer goods group and comes in the wake of Reckitt’s purchase of Schiff Nutrition International, a US vitamin company, for $1.4bn late last year. Rakesh Kapoor, chief executive, said Reckitt had to keep up with changing consumer behaviour: “People think about their health in much more holistic terms. It is about how do you lead a more balanced life.” Oriental Medicine’s main remedy was a sore-throat powder, he said. The company makes all its sales in China, the group added. Western companies have been showing growing interest in China’s traditional medicine sector. In November Nestlé agreed a tie-up with a traditional Chinese medicine company controlled by Hong Kong billionaire Li Ka-shing. Although Reckitt one day hopes to use Oriental Medicine as a sales platform for its western healthcare products in China, Mr Kapoor said it was too early to say if Reckitt would seek to sell traditional Chinese remedies outside China. -

Rb Announces Changes to Executive Team

RB ANNOUNCES CHANGES TO EXECUTIVE TEAM 17 January, 2020 – Reckitt Benckiser Group plc, (“RB”) today announces a series of management changes which will focus on delivering performance and the next phase of transformation for the company. After 27 years with the company, Gurveen Singh, Chief Human Resources Officer, has decided to retire. Ranjay Radhakrishnan will join RB as Chief Human Resources Officer and a member of the company’s executive committee with effect from 1st March 2020. Ranjay is currently Chief Human Resources Officer at InterContinental Hotels Group (IHG plc). Prior to IHG, Ranjay spent 23 years at Unilever, in a range of senior leadership roles at global, regional and country levels. Mike Duijser, Chief Supply Officer, has decided to leave RB to return to the US for personal reasons. A successor will be appointed in due course and Frederick Dutrenit, SVP Manufacturing Health, will be covering this role in the interim. Group CEO Laxman Narasimhan said about the changes: “Gurveen has made a significant contribution to RB during her long and distinguished career with the company and I wish her all the very best for the future. Under her leadership, the HR function has flourished and delivers sustained positive impact to the business. I would also like to thank Mike for his contribution to RB and wish him success for his future endeavours.” Laxman added: “I am delighted to announce the appointment of Ranjay as Gurveen’s successor. This announcement follows the appointment of Jeff Carr, Harold van den Broek and Kris Licht to the executive team and I look forward to working with this exceptional group of leaders as we continue to drive performance to transform the business.” Reckitt Benckiser Group plc’s LEI code is 5493003JFSMOJG48V108 About RB RB is the global leading consumer health, hygiene and home company. -

RB Enhances Consumer Health Position with the Completion of Its Acquisition of the Mead Johnson Nutrition Company

Contacts: Lynn Kenney – Communications Director, RB North America P: +1 201-953-5348 [email protected] UK +44 (0)1753 217 800 Richard Joyce – SVP, Investor Relations Patty O’Hayer - Director, External Relations and Government Affairs RB enhances consumer health position with the completion of its acquisition of the Mead Johnson Nutrition Company Parsippany, NJ – June 15, 2017 – RB is pleased to announce the completion of the acquisition of the Mead Johnson Nutrition Company (“Mead Johnson”). The transaction takes RB into a global market leadership position in consumer health and hygiene. Mead Johnson brings the addition of two infant and child nutrition Powerbrands Enfa and Nutramigen, and is a natural extension of RB’s existing health portfolio which is trusted around the globe by millions of consumers. Rakesh Kapoor, RB chief executive, said: “The closure of the acquisition marks an inflection point in RB’s evolution to become a leader in consumer health care. By combining the best of RB’s global scale with MJN’s science-based innovation, RB is well positioned to deliver further value for all stakeholders. We continue to execute on our strategy of providing innovative health solutions for healthier lives and happier homes to millions of people around the world.” Mead Johnson will initially operate as a separate division within RB and be led by Aditya Sehgal, who joins RB’s Executive Committee. Aditya’s previous roles included responsibility for RB’s operations in China and North Asia, RB’s global health care division and RB’s North American business. The Mead Johnson division will continue its mission to nourish the world’s children for the best start in life. -

Hygiene Home Our Purpose Is to Make a Difference by Giving People

Our purpose is to make a difference RB 2.0 reorganising by giving people innovative solutions for long-term growth for healthier lives and happier homes and outperformance Now we are starting a new chapter of sustainable outperformance with the creation of two focused, fully accountable and more agile business units – Health and Two companies, both rich in history Hygiene Home. and expertise, joined forces. Thomas and Reckitt & Sons Mead Johnson Gaviscon Ecolab Lehn & Fink Reckitt and Adams Schiff Nutrition Hypermarcas We are driven by: Isaac Reckitt founded in Hull founded Acquisition Acquisition Acquisition Benckiser Respiratory Acquisition Condom and MJN brings to RB: build the Maud 1840 1905 1970 1987 1994 Merged Therapeutics 2012 Lubricant Front line obsession Foster mill 1999 Acquisition Acquisition Excellence in infant and child nutrition 1819 2008 2016 Category focus and expertise Deep understanding of new parents Ownership & Entrepreneurship Benckiser Reckitt Reckitt & Sons Air Wick Boyle Midway Sold Colman's Boots SSL K-Y Brand Mead Johnson Respected relationships with healthcare founded in launched on merges with J Acquisition Acquisition Food Business Healthcare International Acquisition / Nutrition professionals Ready to disrupt Germany London Stock & J Colman to 1985 1990 1995 Acquisition Acquisition Spin off Indivior Acquisition/ Radical simplification 1823 Exchange become Reckitt 2006 2010 – (RB Pharma) Sold Food Scale and infrastructure in new markets 1888 & Colman 2014 Business 1938 2017 Together we will find new and exciting The future of RB is exciting. The changes ways to promote health and wellbeing, we are making will reignite the potential of from infancy to adulthood around the world our people and our brands and create value for years to come. -

Cleaning Materials & Supplies *

CLEANING MATERIALS & SUPPLIES * CLEANING MATERIALS & SUPPLIES P 018001 DISHWASHING TABS FINISH POWER BALL 18'S PK P 018001- DISHWASHING TABS FINISH TUTTO PK P 018001Y DISHWASHING TABS FINISH LEMON @ 15'S PC P 018002 FLOOR CLEANER AJAX 1LT PC P 018002- BATH CLEANER MR.CLEAN 1LT PC P 018003 HAND WASHING POWDER LANZA E2 380GR PC P 018004 DISHWASHING TABLETS FINISH POWER BALL 3I PC P 018005 DISHWASHING POWERGEL LIQUID FINISH 1LT PC P 018005- DISHWASHING GEL LIQUID FINISH 1LT LEMON PC 1 CLEANING MATERIALS & SUPPLIES * P 018006 AIR FRESHNER AIR WICK SPRAY @ 12X250ML PC P 018006- AIR FRESHNER AIR WICK SPRAY ANT-AGR-BLUE PC P 018007 AIR FRESHNER GLADE SPRAY @ 300ML PC P 018008 SWIFFER WET 10'S PK P 018009 BAR SOAP PALMOLIVE 125GR PC P 018010 SPONTEX CLASSIC SPONGE PAD @ 4'S PK P 018011 ANTILIMESTONE VIAKAL CASA 500ML BT P 018012 SPONGE PAD YELLOW MULTIPURPOSE 3PCS/PKT PK P 018014 SPONGE SCRUB HEAVY DUTY DOUBLE FACE CSOT PK P 018015 LAUNDRY DETERGENT LIQUID DASH @ 3LT/BTL BT P 018016 LAUNDRY DETERGENT LIQUID ARIEL @ 3LT BT P 018017 TOILET DUCK ULTRA GEL 750ML BT P 018018 KITCHEN PAPER ROLL SCOTTEX MAXI @ 3'S RL P 018018- KITCHEN PAPER ROLL SCOTTEX JUMBO 3'S PC P 018020 KITCHEN PAPER ROLLS SCOTTEX MAXI 4'S RL P 018021 FINISH DISHWASHER SALT @ 20X1KG KG P 018022 FABRIC SOFTNER MINI CONC. VERNEL 500ML PC P 018023 FLOOR CLEANER (WOOD)"PRONTO" LEGNO PULIT PC 2 CLEANING MATERIALS & SUPPLIES * Y 018019 LAUNDRY DETERGENT LIQUID ARIEL @ 2,92LT BT Y 018041 ZIPLOC BAGS LARGE @ 8'S 33X38CM PK Y 018042 ZIPLOC BAGS MEDIUM @ 15'S 27X28CM BX Y 018043 SOUPLINE -

Sale of Food Business to Mccormick

Sale of Food Business to McCormick 19 July, 2017 – Slough, UK – Reckitt Benckiser Group plc (“RB”) is pleased to announce that it has entered into an agreement to sell its Food business (“RB Food” or “French’s Food”), including the French’s, Frank’s RedHot and Cattlemen’s brands, to McCormick & Company Inc. (“McCormick”) for $4.2 billion on a cash-free, debt-free basis. Today’s announcement follows a comprehensive strategic review of French’s Food. The valuation achieved reflects the quality of this highly profitable, growth business. McCormick will retain the leading brand names of French’s, Frank’s RedHot and Cattlemen’s. RB Food’s focus on creating high quality products with simple ingredients makes it a strong match with McCormick. Rakesh Kapoor, Chief Executive Officer of RB, said: “Our French’s Food business is a true reflection of RB’s strengths – a portfolio of great brands driven through a culture of innovation by passionate people to deliver consistent outperformance. We are pleased to be selling to owners who can provide the necessary resources, market expertise and global platform, whilst being a good home for our people. French’s Food is well positioned to continue on its successful growth trajectory under the food-focused ownership of McCormick. “Following the acquisition of Mead Johnson Nutrition, this transaction marks another step towards transforming RB into a global leader in consumer health and hygiene, ensuring we continue to deliver for shareholders and give people innovative solutions for healthier lives and happier homes.” The consideration is subject to customary working capital adjustments at completion. -

Hygiene Home Creating a Cleaner World

Operating Review Hygiene Home Creating a cleaner world Our Hygiene Home business unit is bringing innovative solutions into 1 billion homes around the world by eliminating dirt, germs, pests and odours that impact health and happiness. We are also accelerating hygiene foundations across the world. Hygiene Home Net Revenue 2017 2018 LFL growth: +4% Actual growth: -1% £4,887m £4,835m Reckitt Benckiser Group plc (RB) 30 Annual Report and Financial Statements 2018 Strategic ReportStrategic Key Hygiene Home brands Geographic profile Developing markets 25% Developed markets 75% Governance Category profile Other brands 20% Key brands 80% StatementsFinancial Our priorities and aspirations Identify powerful social Focus on low-penetration, Expand e-business causes and develop purpose- higher-growth categories opportunities rapidly by led innovations with superior while delivering better product investing disproportionately product solutions solutions in premium category in this fast-growing channel segments to a growing base of middle-class consumers Unlock emerging markets Increase the contribution Continue investing in capabilities by exploiting digital platforms that innovation makes to our and innovation while sustaining for consumer communications growth rates by leveraging the our best-in-class operating margins and transactions that open combination of our global leading up new opportunities for brands and local innovation hubs market penetration We are back to competitive LFL growth of 4%. Our strong purpose-led brands that fight social causes with innovative solutions, give us great penetration potential in high-margin categories. Rob de Groot President, Hygiene Home Reckitt Benckiser Group plc (RB) Annual Report and Financial Statements 2018 31 Operating Review: Hygiene Home continued We see huge opportunities in both mature and emerging markets. -

Consumer Products Tested for Endocrine Disruptors and Asthma-Associated Chemicals

www.silentspring.org/product-test Silent Spring Institute conducted a study testing comsumer products for 66 endocrine disruptors and asthma-related chemicals. The methods and results, published in Environmental Health Perspectives, can be found here: http://dx.doi.org/10.1289/ehp.1104052. Below is a table of the products tested in this study. This study represents only a small fraction of consumer products and a small number of the chemicals used in products. In addition, since manufacturers are constantly reformulating their products and products may vary in different regions of the U.S, results from these tests may not apply to current products on the shelves. The study combined the conventional products into composite samples for testing, so results for conventional products cannot be linked to a specific product. Alternative products were tested individually. Consumer products tested for endocrine disruptors and asthma-associated chemicals Product Type Product Name Product Manufacturer Conventional cat litter Fresh Step Scoopable Clumping Cat Litter Clorox Pet Products Company Stop & Shop Companion Scoopable Cat Litter Foodhold USA Purina Tidy Cats Clay Cat Litter for Multiple Cats Nestle Purina pillow protector Clean Sleep Vinyl Pillow Protectors Extra Heavy 6 Gauge w/ Ultra Fresh Protection Priva diapers Huggies Supreme Natural Fit Diapers Kimberly-Clark Pampers Baby Dry Diapers Procter & Gamble Target Jumbo Baby Diapers Stretchable Grip Tabs Ultra Absorbent Target Corporation Luvs Guaranteed Ultra Leak Guards Jumbo Diapers Viacom -

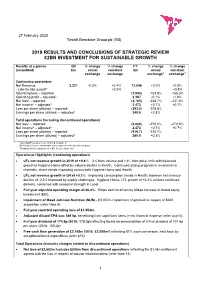

2019 Results and Conclusions of Strategic Review £2Bn Investment for Sustainable Growth

27 February 2020 Reckitt Benckiser Group plc (RB) 2019 RESULTS AND CONCLUSIONS OF STRATEGIC REVIEW £2BN INVESTMENT FOR SUSTAINABLE GROWTH Results at a glance Q4 % change % change FY % change % change (unaudited) £m actual constant £m actual constant exchange exchange exchange3 exchange3 Continuing operations Net Revenue 3,321 -0.5% +0.4% 12,846 +2.0% +0.8% - Like-for-like growth1 +0.3% +0.8% Operating loss – reported (1,954) -163.9% -166.0% Operating profit – adjusted1 3,367 -0.1% -1.9% Net loss2 – reported (2,785) -228.7% -231.0% Net income2 – adjusted1 2,473 +2.7% +0.7% Loss per share (diluted) – reported (393.0) -228.8% Earnings per share (diluted) – adjusted1 349.0 +2.8% Total operations (including discontinued operations) Net loss2 – reported (3,683) -270.6% -272.9% Net income2 – adjusted1 2,473 +2.7% +0.7% Loss per share (diluted) – reported (519.7) -270.7% Earnings per share (diluted) – adjusted1 349.0 +2.8% 1 Non-GAAP measures are defined on page 6 2 Net (loss)/ income attributable to the owners of the parent company 3 Restated for the adoption of IFRS 16 (see Note 14). Operational Highlights (continuing operations) LFL net revenue growth in 2019 of +0.8%. -2% from volume and +3% from price / mix with balanced growth in Hygiene Home offset by volume decline in Health. Continued strong progress in e-commerce channels, share trends improving across both Hygiene Home and Health. LFL net revenue growth in Q4 of +0.3%. Improving consumption trends in Health, however net revenue decline of -2.2% impacted by supply challenges. -

Reckitt Benckiser Group Plc

A Progressive Digital Media business COMPANY PROFILE Reckitt Benckiser Group plc REFERENCE CODE: C62A3104-054F-4A32-AA68-7311274905BE PUBLICATION DATE: 28 Sep 2017 www.marketline.com COPYRIGHT MARKETLINE. THIS CONTENT IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED OR DISTRIBUTED Reckitt Benckiser Group plc TABLE OF CONTENTS TABLE OF CONTENTS Company Overview ........................................................................................................3 Key Facts.........................................................................................................................3 SWOT Analysis ...............................................................................................................4 Reckitt Benckiser Group plc Page 2 © MarketLine Reckitt Benckiser Group plc Company Overview Company Overview COMPANY OVERVIEW Reckitt Benckiser Group plc (RB or 'the group') is engaged in the production and distribution of household cleaning, and health and personal care products. The company’s major brands include Nurofen, Strepsils, Mucinex, Dettol, Lysol, Veet, Harpic, Mortein, Finish and Vanish. It also sells food products, over-the- counter products and pest control products. The group operates in Europe, North America, Latin America, Asia Pacific, and the Middle East and Africa. It is headquartered in Slough, Berkshire, the UK. The company reported revenues of (British Pounds) GBP9,891 million for the fiscal year ended December 2016 (FY2016), an increase of 11.5% over FY2015. In FY2016, the company’s operating margin was 24.4%, compared to an operating margin of 25.3% in FY2015. In FY2016, the company recorded a net margin of 18.5%, compared to a net margin of 19.6% in FY2015. Key Facts KEY FACTS Head Office Reckitt Benckiser Group plc Turner House 103-105 Bath Road Slough Berkshire Slough Berkshire GBR Phone 44 1753 217800 Fax 44 1753 217899 Web Address www.rb.com Revenue / turnover (GBP Mn) 9,891.0 Revenue (USD Mn) 13,363.1 Financial Year End December Employees 34,700 London Stock Exchange (LON) RB.