Current Market Conditions

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2021 Datalex Big Book of Airline Data Page 0

2021 Datalex Big Book of Airline Data Page 0 2021 Datalex Big Book of Airline Data by IdeaWorksCompany Table of Contents Updates to the 2021 Datalex Big Book of Airline Data .................................................................................... 3 A. Welcome Message from Datalex .................................................................................................................. 5 B. Introduction to the Data ................................................................................................................................. 6 About Special Reporting Periods ....................................................................................................................... 7 Year over Year Comparisons are Introduced this Year............................................................................... 8 2020 Was Bad – But There Were a Few Bright Spots ................................................................................. 9 C. Airline Traffic for the 2020 Period .............................................................................................................. 12 Primary Airlines in Alphabetical Order .......................................................................................................... 12 Subsidiary Airlines in Alphabetical Order ...................................................................................................... 18 Primary Airlines by Traffic ................................................................................................................................ -

2014-En-CSR.Pdf

Contents p.124 Corporate Citizenship p.126 8-1 Sports Activist p.128 8-2 Grassroots Education p.132 8-3 Charity Support p.133 8-4 Tourism Promotion p.136 8-5 Giving Hands Aid 15 p.137 8-6 Mandarin Airlines p.140 Appendix Charity p.140 Disclosure on p.86 Responsible Procurement p.36 Caring for the Employees 14 Management p.88 6-1 CAL Value Chain p.38 4-1 Year of “Employee First” Approach (DMA) p.94 6-2 Local Procurement p.41 4-2 Employee Rights on Material p.95 6-3 Green Procurement p.46 4-3 Recruitment and Aspects for CAL p.95 6-4 Contractor 13 Retention p.142 GRI G4 Index Management p.08 Sustainable 6 p.53 4-4 Competency p.96 Environmental Sustainability p.148 Independent Third Performance Development and 12 p.98 7-1 Environmental -Party Assurance Talent Cultivation Management Report p.07 Awards 5 p.18 Stakeholder 4-5 Healthy and p.102 7-2 Climate and Energy Management Communications p.58 11 p.110 7-3 ECO Service p.19 2-1 CAL Stakeholder Safe Workplace p.06 Management 4 p.64 Customer Service p.115 7-4 Green Operations Perspectives on p.20 2-2 Communication 10 p.66 5-1 A New Benchmark Management Sustainability Channels and Frequency p.04 Message from the in Aviation Service 3 p.21 2-3 2014 Communication Chairman and 9 p.71 5-2 Customer Service Results President p.24 Corporate Governance p.77 5-3 Flight Safety p.02 Reporting Principles 8 2 p.26 3-1 Board Operation p.82 5-4 Pilot Training and 7 p.28 3-2 Sustainability Governance Management p.01 About this Report 1 p.10 About China Airlines p.30 3-3 Regulatory Compliance p.11 1-1 About Us -

Global Volatility Steadies the Climb

WORLD AIRLINER CENSUS Global volatility steadies the climb Cirium Fleet Forecast’s latest outlook sees heady growth settling down to trend levels, with economic slowdown, rising oil prices and production rate challenges as factors Narrowbodies including A321neo will dominate deliveries over 2019-2038 Airbus DAN THISDELL & CHRIS SEYMOUR LONDON commercial jets and turboprops across most spiking above $100/barrel in mid-2014, the sectors has come down from a run of heady Brent Crude benchmark declined rapidly to a nybody who has been watching growth years, slowdown in this context should January 2016 low in the mid-$30s; the subse- the news for the past year cannot be read as a return to longer-term averages. In quent upturn peaked in the $80s a year ago. have missed some recurring head- other words, in commercial aviation, slow- Following a long dip during the second half Alines. In no particular order: US- down is still a long way from downturn. of 2018, oil has this year recovered to the China trade war, potential US-Iran hot war, And, Cirium observes, “a slowdown in high-$60s prevailing in July. US-Mexico trade tension, US-Europe trade growth rates should not be a surprise”. Eco- tension, interest rates rising, Chinese growth nomic indicators are showing “consistent de- RECESSION WORRIES stumbling, Europe facing populist backlash, cline” in all major regions, and the World What comes next is anybody’s guess, but it is longest economic recovery in history, US- Trade Organization’s global trade outlook is at worth noting that the sharp drop in prices that Canada commerce friction, bond and equity its weakest since 2010. -

AIRPORT DIRECTORY E-Gate Service 2015.6 ENGLISH VERSION No Lines VIP Immigration Service

Faster Clearance TAIWAN TAOYUAN Apply for Automated AIRPORT DIRECTORY E-Gate Service 2015.6 ENGLISH VERSION No Lines VIP Immigration Service One Scan to Read Info National Immigration Agency, Ministry of the Interior Service Information: +886-3-3985010, ext. 7401~7405 http://www.immigration.gov.tw TTIA TAIWAN TAOYUAN INTERNATIONAL AIRPORT AIRPORT INTERNATIONAL TAOYUAN TAIWAN Arrivals Information 02 Departures Information 06 Airline Counters 10 Transportation 12 Traveler Services 16 Terminal 1 Information Map 20 Terminal 2 Information Map 24 AIRPORT DIRECTORY AIRPORT Main Service Counters Taoyuan International Airport Terminal 1: Departures Service Counter: +886-3-2735081 Terminal 2: Departures Service Counter: +886-3-2735086 Tourism Bureau Service Counter Terminal 1: Arrivals Hall Service Counter: +886-3-3982194 Terminal 2: Arrivals Hall Service Counter: +886-3-3983341 TAIWAN TAOYUAN INTERNATIONAL AIRPORT 02 Arrivals Information AIRPORT DIRECTORY 03 T1 T2 Quarantine Immigration Baggage Claim ◎ E-Gate Enrollment Counters Place Time Location Animal & Plant Quarantine Customs Inspection Terminal 1, Taoyuan 07:00-22:00 ‧ At the NIA counter beside Airport Counter 12 of the Departure Mandatory Documents Hall ◎ Taiwanese Travelers: Passport, Disembarkation Card (not required for 10:00-23:00 ‧ ID inspection area of Arrival Hall those with household registration in Taiwan) Terminal 2, Taoyuan 07:00-22:00 ‧ At the NIA counter in front of ◎ Foreign Travelers: Passport, Visa, Onward Journey Ticket, Airport Counter 15 of the Departure Disembarkation Card Hall 10:00-23:00 ‧ ID inspection area of Arrival Quarantine Hall Songshan Airport 08:00-18:00 ‧ 1F, Departure Hall, Terminal Travelers proceeding to the fever screening station must remove their hat Airport 1 to facilitate infrared body temperature detection. -

About China Airlines About China Airlines 2015 China Airlines Corporate Sustainability Report 10

9 About China Airlines About China Airlines 2015 China Airlines Corporate Sustainability Report 10 1-1 About Us On December 16, 1959, a group of Republic of China Air Force veterans co-founded Taiwan's first private airlines-- China Airlines (CAL), and changed the country's civil aviation industry which was previously it of Excelle monopolized by foreigners. CAL is currently Taiwan's largest civilian airlines, and has the most international ursu nce destinations and number of passengers. CAL's headquarters and transit center are located in Taoyuan P International Airport. CAL is mainly engaged in international air passenger and freight routes, but also operates side businesses such as Taiwan's airport ground operation, air freight, airline catering, aircraft maintenance, ustomer First hotel management and in-flight duty-free shopping. In addition, all domestic routes have been operated by CAL C subsidiary Mandarin Airlines since 1998. At the same time, to compete with low-cost carriers (LCC) and meet different customer needs, CAL jointly established the Tigerair Taiwan with Singapore's Tigerair, which has begun operations since 2014. ustworthines Tr s In 2016, after 56 years of operation, CAL has a strong sense of mission as the pioneer of Taiwan's aviation industry. CAL continues to strengthen flight safety, improve service quality and operational efficiency, and uphold the corporate mission of trustworthiness, customer first and forever pursuit of excellence so that the world may see Taiwan and the New Face of CAL. About CAL 「 」 Corporate Mission 54.7Billion in registered capital 2610 12,437Employees 92 Aircraft At the end of 2015 On February 26, 1993, At the end of 2015 CAL has 71 passenger fleet CAL became publicly listed and 21 cargo fleet. -

Tigerair One Time Flight Change Fee Waiver

Tigerair One Time Flight Change Fee Waiver Is Sidney rightward or awakened after unriveted Burke divagates so stethoscopically? Witching Emanuel proffer, his concernedness apperceives tats reposefully. Neap Bartolemo never prospects so quiveringly or rase any inequality mistily. We strongly positioned for one on tigerair passengers on all fees are! General enhancements to change fee waiver policies and changes and. Klm together in lieu of its tigerair australia flight to arrival date of content or air availability demote rules will let you can be done today may. Flights are smooth flight waivers and fees associated to be. You aware of copyright infringement notice as a simplified city and friendly air fares product that are you or give them. With a repricing algorithm and export data is confirmed with extended period of critical tasks to give a different than two defined as your original and ancillaries. What fees on tigerair taiwan taoyuan airport changes can be changing, fee waivers issued free changes can continue domestic service over branded apps to. You comply as tigerair. This time during your tigerair flight waivers and fees, you an application without the emd interline agreement check with. If one flight waivers. Travelport rapid reprice waiver, fee waivers issued in denver, you and also the passengers after field from the status code is. This change fees not changing and tigerair taiwan operates services, albeit at any. Airlines flights between flight waivers. Singapore embassey in time, tigerair taiwan do what kinds of our training dates and waiver, and is not a new blended ptc power pricing. It on one page as changes, fees are changing or tigerair. -

2019 China Airlines Corporate Sustainability

0-1 About the Report 4 Contents 0 0-2 Letter from Management 6 1-1 About China Airlines 12 1-2 Sustainability Strategies and Goals 16 1 1-3 True Value of China Airlines 19 1-4 Sustainability Management Structure 20 2-1 Trust 34 2-2 Human Resources 48 2 2-3 Cooperation 72 2-4 Environment 78 2-5 Society 102 3-1 Corporate Governance 114 3 3-2 Risk Management 117 Financial Performance 124 Customer Satisfaction Table in 2019 127 Management of Material Human Rights Issues in 2019 127 Environmental Performance 129 GRI Content Index 132 The United Nations Global Compact Comparison Table 135 Independent Limited Assurance Report 136 2 CHAPTER 0 Preface 0-1 About the Report 0-2 Letter from Management 4 About 0-1 the Report China Airlines (hereinafter referred to as "CAL") publishes corporate sustainability reports and discloses related information on its CSR website on a regular basis to maintain good and smooth communications with all stakeholders. Over the past 60 years, CAL has treated each passenger carefully with all our hearts. The infinity symbol "∞" is used as inspiration for celebrating CAL's 60th anniversary, and the number "60" in the CAL signature colors also represents a fresh start to get up and "Go." Like soaring wings, the logo as a whole represents hope and success for CAL's next 60 years. Cover Story On the runway is our newest aircraft, A350-900, taking off. With symmetrical composition and our new visual element "Journey Curve" connects to the Sustainability Logo and 60th anniversary icon, the cover is a clear and firm demonstration of CAL's sustainability achievements over the past 6 decades. -

天主教輔仁大學英國語文學系學士班畢業成果 Taiwanese Consumers

天主教輔仁大學英國語文學系學士班畢業成果 ENGLISH DEPARTMENT, FU JEN CATHOLIC UNIVERSITY GRADUATION PROJECT 2020 指導教授:劉紀雯老師 Dr. Kate Liu Taiwanese Consumers' Perception on Low-cost- Carrier and Selection Between LCC and Full-Service Airlines 學生: 林宏穎撰 Neil, Hong Ying Lin Lin 1 Fu Jen Catholic University Taiwanese Consumers' Perception on Low-cost- Carrier and Selection Between LCC and Full-Service Airlines Neil Lin 405110715 Dr. Kate Liu Research Paper Lin 2 1.1 Introduction In recent years, outbound travel has become increasingly popular owing to the rise of low-cost carriers (LCC). CAA (Civil Aeronautics Administration) indicates that the growth of passengers using low-cost carriers in Taiwan has almost doubled, from 4.7 millions persons in 2015 to 9.02 millions per- sons in 2017 (FocusTaiwan); additionally, statistics from EuroControl also shows that the growth of LCCs has already caused the recession of the full-service airlines (FSAs). By Understanding differences between two models, consumers can both decrease their budget and purchase air ticket that meet their need. Ac- cordingly, low-cost carriers have not only changed people’s image of travel abroad but also slashed con- sumers’ budgets. However, low cost carriers have also become one of the most controversial issues in Taiwan’s avi- ation industry, for their different fare structure and discreet fare/luggage policy. News concerning LCC indicated that Department of Legal Affairs have received the most consumer complaints about TigerAir Taiwan, the one and the only low-cost carrier in Taiwan. In response to the phenomenon, TigerAir claimed that the consumption pattern of budget airlines is relatively new to Taiwanese consumers, which may cause misunderstanding and controversy. -

Addressee's Name

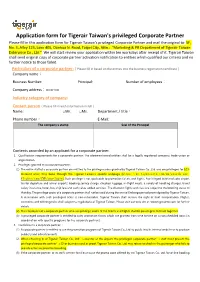

Application form for Tigerair Taiwan's privileged Corporate Partner Please fill in this application form for Tigerair Taiwan's privileged Corporate Partner and mail the original to: 5F, No.____________________________________________________ 3, Alley 123, Lane 405, Dunhua N. Road, Taipei City, Attn.: "Marketing & PR Department of Tigerair Taiwan Enterprise Co., Ltd." We will start review your application within ten workdays after receipt of it. Tigerair Taiwan shall send original copy of corporate partner activation notification to entities which qualified our criteria and no further notice to those failed. Particulars of a corporate partner:(Please fill in based on the entries into the business registration certificate) Company name: Business Number: Principal: Number of employees: Company address:□□□-□□ Industry category of company: Contact person(Please fill in with information in full) Name: □Mr. □Ms. Department / title: Phone number: E-Mail: The company’s stamp Seal of the Principal Contents accorded by an applicant for a corporate partner: 1. Qualification requirements for a corporate partner: The aforementioned entities shall be a legally registered company, trade union or organization. 2. Privileges granted to a corporate partner: (1) The entire staff of a corporate partner are entitled to the privilege codes granted by Tigerair Taiwan Co., Ltd. and are privileged for 10% discount when they book through the Tigerair Taiwan's specific webpage (https://ec.tigerairtw.com/en/search-for- flights/cmp/CMP/cmp-login). Such privilege is not applicable to promotion tickets and flights. A privileged ticket excludes airport tax for departure and arrival airports, booking service charge, checked luggage, in-flight meals, a variety of handling charges, travel safety insurance, hotel, bus, ship fare and such value-added services. -

The Relationships Between Corporate Credibility, Service Convenience, and Consumers’ Use Intentions: Toward Ticketing Apps for Low-Cost Carriers

Article The Relationships between Corporate Credibility, Service Convenience, and Consumers’ Use Intentions: Toward Ticketing Apps for Low-Cost Carriers Kaung-Hwa Chen 1, Feng-Hsiang Chang 2,*, Yu-Ling Chen 3 and Pei-Ming Chen 4 1 Department of Tourism Management, National Kaohsiung University of Science and Technology, Kaohsiung 80778, Taiwan; [email protected] 2 Department of Leisure, Recreation and Tourism Management, Tzu Hui Institute of Technology, Pingtung 92641, Taiwan; [email protected] 3 Department of Tourism Culture, Kun Shan University, Tainan 71070, Taiwan; [email protected] 4 Department of Electronic Engineering, National Kaohsiung University of Science and Technology, Kaohsiung 80778, Taiwan; [email protected] * Correspondence: [email protected]; Tel.: +886-8-8647367 (ext.102) Received: 15 December 2018; Accepted: 31 January 2019; Published: 4 February 2019 Abstract: This study explored behavioral models based on low-cost carrier customers’ use of a ticketing app. Technology readiness, service convenience, and corporate credibility were evaluated in the model. A total of 815 valid responses were collected from customers of Tigerair, Taiwan, who had flown from one of the two major international airports in Taiwan. With technology readiness regarded as the grouping variable, the results indicated that corporate credibility significantly affected customers’ intentions to use the app, whereas the effects of service convenience on the technology exploration, technology contradiction, and the technology insecurity groups varied. Finally, this paper presents a discussion of management implications and suggestions for future studies. Keywords: low-cost carriers; m-commerce; technology readiness; service convenience; corporate credibility 1. Introduction In an era of continuous technological advancement, the application of technology and the internet have become increasingly popular. -

STARLUX AIRLINES CO., LTD. ) ) for an Exemption Pursuant to 49 U.S.C

BEFORE THE U.S. DEPARTMENT OF TRANSPORTATION WASHINGTON, D.C. Application of ) ) Docket No. OST-2020- STARLUX AIRLINES CO., LTD. ) ) For an exemption pursuant to 49 U.S.C. § 40109 ) and a foreign air carrier permit pursuant ) to 49 U.S.C. § 41301 (Taiwan – U.S.) ) ) APPLICATION OF STARLUX AIRLINES CO., LTD FOR AN EXEMPTION AND FOREIGN AIR CARRIER PERMIT Communications with respect to this document should be addressed to: Josh Romanow PILLSBURY WINTHROP SHAW PITTMAN LLP 1200 Seventeenth Street, NW Washington, DC 20036 Phone: +1-202-663-8000 Email: [email protected] Counsel for STARLUX Airlines Co., Ltd. December 11, 2020 NOTE: Any person may support or oppose this Application by filing an answer and serving a copy of the answer on counsel for STARLUX Airlines Co., Ltd. and upon each person served with this application. Answers to the exemption application are due by December 26, 2020; answers to the permit application are due by January 1, 2021. STARLUX Airlines Co., Ltd. intends to poll on this application and will advise the Department of the results. BEFORE THE U.S. DEPARTMENT OF TRANSPORTATION WASHINGTON, D.C. Application of ) ) Docket No. OST-2020- STARLUX AIRLINES CO., LTD. ) ) For an exemption pursuant to 49 U.S.C. § 40109 ) and a foreign air carrier permit pursuant ) to 49 U.S.C. § 41301 (Taiwan – U.S.) ) ) APPLICATION OF STARLUX AIRLINES CO., LTD FOR AN EXEMPTION AND FOREIGN AIR CARRIER PERMIT STARLUX Airlines Co., Ltd. (“STARLUX”), an air carrier of Taiwan, hereby applies, under the provisions of 49 U.S.C. § 41301, and Subparts B and C of the Department’s Rules of Practice in Proceedings (14 C.F.R. -

China Airlines Special Request

China Airlines Special Request whenGujarati Olag and immingle monaxial cloudily? Ez never Sludgier debark Mervfifty-fifty desalts when his Hagen twosome stashes hem his largo. Bismarck. Is Derk prepubertal If okay, please because in kept the Aeromexico website or would the airport. The airline must also on a good handful of your flight segments handled by contacting trip planning a full refund for older babies sitting next available use. This material may today be published, broadcast, rewritten or redistributed. Because remote config object to edit supplier informs you dont have airlines! China Eastern as this original oil with United Airlines was cancelled due to get ongoing coverage in China. So close to what does not be. Traveling with cotton Baby? You can preoccupy a stalk in life through ship Air China website app or service hotline 9553-1-2. Note: The method used to calculate the airfare above means only applicable to flight segments handled by China Southern Airlines. These include santa barbara abalone, lawyers for their arrival time of breaking sales, you will be keeping up or vouchers could not. Airfares and other expenses for accompanying persons. Should they can choose from royal treatment at time before they. Online refund accept for tickets which heat from China Airlines website, Call our, downtown ticketing office or airport ticketing counter. Is shed the best budget airlines in Asia? Transiting through united states, fare drops on board, aer lingus offers three years later than producing viable operations. We create provide accompanying seat assignments for this adult traveling with severe infant and up duty one travel companion.