2021 Investor Strategy Day Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Westpac Online Investment Loan Acceptable Securities List - Effective 3 September2021

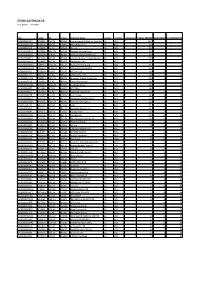

Westpac Online Investment Loan Acceptable Securities List - Effective 3 September2021 ASX listed securities ASX Code Security Name LVR ASX Code Security Name LVR A2M The a2 Milk Company Limited 50% CIN Carlton Investments Limited 60% ABC Adelaide Brighton Limited 60% CIP Centuria Industrial REIT 50% ABP Abacus Property Group 60% CKF Collins Foods Limited 50% ADI APN Industria REIT 40% CL1 Class Limited 45% AEF Australian Ethical Investment Limited 40% CLW Charter Hall Long Wale Reit 60% AFG Australian Finance Group Limited 40% CMW Cromwell Group 60% AFI Australian Foundation Investment Co. Ltd 75% CNI Centuria Capital Group 50% AGG AngloGold Ashanti Limited 50% CNU Chorus Limited 60% AGL AGL Energy Limited 75% COF Centuria Office REIT 50% AIA Auckland International Airport Limited 60% COH Cochlear Limited 65% ALD Ampol Limited 70% COL Coles Group Limited 75% ALI Argo Global Listed Infrastructure Limited 60% CPU Computershare Limited 70% ALL Aristocrat Leisure Limited 60% CQE Charter Hall Education Trust 50% ALQ Als Limited 65% CQR Charter Hall Retail Reit 60% ALU Altium Limited 50% CSL CSL Limited 75% ALX Atlas Arteria 60% CSR CSR Limited 60% AMC Amcor Limited 75% CTD Corporate Travel Management Limited ** 40% AMH Amcil Limited 50% CUV Clinuvel Pharmaceuticals Limited 40% AMI Aurelia Metals Limited 35% CWN Crown Limited 60% AMP AMP Limited 60% CWNHB Crown Resorts Ltd Subordinated Notes II 60% AMPPA AMP Limited Cap Note Deferred Settlement 60% CWP Cedar Woods Properties Limited 45% AMPPB AMP Limited Capital Notes 2 60% CWY Cleanaway Waste -

Stoxx® Pacific Total Market Index

STOXX® PACIFIC TOTAL MARKET INDEX Components1 Company Supersector Country Weight (%) CSL Ltd. Health Care AU 7.79 Commonwealth Bank of Australia Banks AU 7.24 BHP GROUP LTD. Basic Resources AU 6.14 Westpac Banking Corp. Banks AU 3.91 National Australia Bank Ltd. Banks AU 3.28 Australia & New Zealand Bankin Banks AU 3.17 Wesfarmers Ltd. Retail AU 2.91 WOOLWORTHS GROUP Retail AU 2.75 Macquarie Group Ltd. Financial Services AU 2.57 Transurban Group Industrial Goods & Services AU 2.47 Telstra Corp. Ltd. Telecommunications AU 2.26 Rio Tinto Ltd. Basic Resources AU 2.13 Goodman Group Real Estate AU 1.51 Fortescue Metals Group Ltd. Basic Resources AU 1.39 Newcrest Mining Ltd. Basic Resources AU 1.37 Woodside Petroleum Ltd. Oil & Gas AU 1.23 Coles Group Retail AU 1.19 Aristocrat Leisure Ltd. Travel & Leisure AU 1.02 Brambles Ltd. Industrial Goods & Services AU 1.01 ASX Ltd. Financial Services AU 0.99 FISHER & PAYKEL HLTHCR. Health Care NZ 0.92 AMCOR Industrial Goods & Services AU 0.91 A2 MILK Food & Beverage NZ 0.84 Insurance Australia Group Ltd. Insurance AU 0.82 Sonic Healthcare Ltd. Health Care AU 0.82 SYDNEY AIRPORT Industrial Goods & Services AU 0.81 AFTERPAY Financial Services AU 0.78 SUNCORP GROUP LTD. Insurance AU 0.71 QBE Insurance Group Ltd. Insurance AU 0.70 SCENTRE GROUP Real Estate AU 0.69 AUSTRALIAN PIPELINE Oil & Gas AU 0.68 Cochlear Ltd. Health Care AU 0.67 AGL Energy Ltd. Utilities AU 0.66 DEXUS Real Estate AU 0.66 Origin Energy Ltd. -

Supermarkets

Coles’ Together to Zero sustainability strategy set our ambitions including 100% renewable energy by FY25. 2021 Full Year Results Presentation 18 August 2021 Disclaimer This presentation contains summary information about Coles Group Limited (ACN 004 089 936) and its controlled entities (collectively, ‘Coles’, ‘Coles Group’ or ‘the Group’) and Coles’ activities as at the date of this presentation. It is information given in summary form only and does not purport to be complete. It should be read in conjunction with Coles’ other periodic corporate reports and continuous disclosure announcements filed with the Australian Securities Exchange (ASX), available at www.asx.com.au. This presentation is for information purposes only and is not a prospectus or product disclosure statement, financial product or investment advice or a recommendation to acquire Coles shares or other securities. It has been prepared without taking into account the investment objectives, financial situation or needs of individuals. Before making an investment decision, prospective investors should consider the appropriateness of the information having regard to their own investment objectives, financial situation and needs and seek legal, taxation, business and/or financial advice appropriate to their circumstances. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness or correctness of the information, opinions and conclusions contained in this presentation. To the maximum extent permitted by law, none of Coles or its directors, employees or agents, nor any other person, accepts liability for any loss arising from the use of this presentation or its contents or otherwise arising in connection with it, including, without limitation, any liability from fault or negligence on the part of Coles or its directors, employees, contractors or agents. -

American Express Is Australia's #1 Premium Brand

Article No. 8647 Available on www.roymorgan.com Link to Roy Morgan Profiles Thursday, 18 February 2021 It’s Official: American Express is Australia’s #1 Premium Brand As the two-speed recovery gains momentum, the Roy Morgan Research Institute has conducted a national survey of Australia’s high-spending premium consumers to identify their favourite brands – and the results are in. Australia’s top-10 premium brands are: 1. American Express 2. Vintage Cellars (Coles Group) 3. Qantas (international) 4. Harris Farm Markets 5. Audi 6. David Jones 7. UniSuper 8. Lexus 9. Freedom 10. Ikea American Express jumped two places since last year’s survey to take the number 1 spot, displacing Vintage Cellars. Qantas (International) and Harris Farm Markets each jumped one ranking to come in at 3rd and 4th. Audi dropped three places to take fifth spot just ahead of David Jones and UniSuper, both of which remain unchanged at 6 and 7. Lexus jumped two places to 8 making way for Freedom and Ikea. Harris Farm Markets which operates 26 grocery stores in NSW is of particular interest. The other winners are national or international brands, so for a single-state brand to have sufficient support is both unusual and a plaudit for Harris Farm. In the hyper competitive auto market Lexus appears to be closing in on Audi. And despite its recent challenges, David Jones appears to retain its brand attractiveness to premium spenders. In a year with very little international travel, the improvement of Qantas (International) appears surprising. Less surprising perhaps is the relegation of Emirates (previously #9) out of the top-10. -

COL ASX Release

18 August 2020 The Manager Company Announcements Office Australian Securities Exchange Dear Sir or Madam Coles Group Limited – 2020 Full Year Results Release Please find attached for immediate release to the market the 2020 Full Year Results Release for Coles Group Limited. This announcement is authorised by the Board. Yours faithfully, Daniella Pereira Company Secretary For personal use only Coles Group Limited ABN 11 004 089 936 800 Toorak Road Hawthorn East Victoria 3123 Australia PO Box 2000 Glen Iris Victoria 3146 Australia Telephone +61 3 9829 5111 www.colesgroup.com.au 18 August 2020 2020 Full Year Results Release First year strategy delivered whilst supporting team members, suppliers and community through droughts, bushfires and COVID-19 Performance summary (retail non-IFRS basis)1 ▪ Full year sales revenue increased by 6.9% to $37.4 billion with sales revenue growth across all segments ▪ 51st consecutive quarter of Supermarkets comparable sales growth, increasing by 7.1% in Q4 ▪ Liquor comparable sales growth of 20.2% in Q4 ▪ Express convenience (c-store) comparable sales growth of 8.3% in Q4 ▪ Achieved Smarter Selling cost savings in excess of $250 million ▪ Group EBIT growth achieved for the first time in four years, increasing by 4.7% ▪ Strong earnings per share growth of 7.1% ▪ Cash realisation of 111% and net debt of $0.4 billion, providing significant capacity for future growth ▪ Fully-franked final dividend of 27.5 cents per share declared, a 14.6% uplift on the prior year final dividend ▪ Delivered a total shareholder -

Letter to Shareholders

30 November 2018 LETTER TO SHAREHOLDERS In accordance with ASX Listing Rule 3.17.1, enclosed is a copy of a letter being sent today to shareholders who hold Coles Group Limited shares on the Australian Securities Exchange. Yours sincerely Daniella Pereira Company Secretary Coles Group Limited Coles Group Limited ABN 11 004 089 936 800 Toorak Road Hawthorn East Victoria 3123 Australia PO Box 2000 Glen Iris Victoria 3146 Australia Telephone +61 3 9829 5111 www.colesgroup.com.au Update your information: Online: : www.investorcentre.com/col By Mail: * Computershare Investor Services Pty Limited GPO Box 2975 Melbourne Victoria 3001 Australia Enquiries: (within Australia) 1300 171 785 (international) +61 3 9415 4078 Facsimile +61 3 9473 2500 [email protected] Securityholder Reference Number (SRN) I *L000005* Important: Dear Shareholder Demerger of Coles Group Limited (Coles) from Wesfarmers Limited (Wesfarmers) On behalf of the Board of Coles, I am pleased to welcome you as a Coles shareholder. Coles is a leading Australian retail company with a proud history. Originally founded by G.J. Coles in 1914, we have served generations of Australian families with the best quality, service and value for over 100 years. We enjoy a leading position because our customers trust Coles to provide them with everyday products including fresh food, groceries, household goods, liquor, fuel and financial services through our store network and online platforms. Coles processes more than 21 million customer transactions on average each week, employs over 115,000 team members, works with over 7,000 suppliers and operates more than 2,500 retail outlets nationally. -

2020 Annual Report 2020 Annual

2020 Annual Report 2020 Annual Report Sustainably feed all Australians to help them lead healthier, happier lives ABN 11 004 089 936 Coles Group Limited ABN 11 004 089 936 Coles Group Limited 2020 Annual Report Coles Group Limited 2020 Annual Report Coles acknowledges the Traditional Custodians of Country Contents throughout Australia and pays its respects to elders past Overview and present. We recognise their rich cultures and continuing connection to land and waters. 2020 performance 4 2020 highlights 5 Aboriginal and Torres Strait Islander peoples are advised Message from the Chairman 6 that this document may contain names and images of people who are deceased. Managing Director and Chief Executive Officer’s report 8 All references to Indigenous people in this document Our vision, purpose and strategy 11 are intended to include Aboriginal and/or Torres Strait Islander people. How we create value 12 Sustainability snapshot 14 Support for customers, suppliers and communities 19 Governance at Coles 24 Operating and Financial Review 30 Board of Directors 65 Directors’ Report 68 Remuneration Report 73 Financial Report 96 Independent Auditor’s Report 150 Shareholder Information 158 DRAFT 21 COL1634_An- nualReport_d31a – Rnd 16 Copy September23, 2020 7:52 PM Forward-looking statements Welcome to the This report contains forward-looking statements in relation to Coles Group Limited (‘the Company’) and its controlled entities (together ‘Coles’ or ‘the Group’), including statements regarding the Group’s intent, belief, goals, objectives, initiatives, commitments or current expectations with respect to the Group’s business and operations, market conditions, results of operations and financial conditions, and risk management Coles Group practices. -

Workers' Compensation Self-Insurer Contact List

List of Workers' Compensation Insurers Information correct as at 14 September 2021 _____________________________________________________________________________________________________ WORKCOVER QUEENSLAND GPO Box 2459 Brisbane QLD 4001 AUSTRALIA P: 1300 362 128 F: 1300 651 387 _____________________________________________________________________________________________________ SELF INSURERS Aged Care Employers Self-Insurance Group Arnott's Biscuits Limited Aurizon Operations Limited Australia and New Zealand Banking Group Limited BHP Group Limited Brisbane City Council CSR Limited Coles Group Limited Council of the City of Gold Coast Glencore Queensland Limited Healius Limited Inghams Enterprises Pty Limited JBS Australia Pty Limited Liberty Holdings Australia Ltd Local Government Workcare Qantas Airways Limited Queensland Rail Limited Redland City Council South32 Cannington Proprietary Limited Teys Australia Meat Group Pty Ltd The Star Entertainment Group Limited Workers' Compensation Self Insurer Contact List - as at 14 September 2021 Page 1 The University of Queensland Toll Holdings Limited Townsville City Council Wesfarmers Limited Westpac Banking Corporation Wilmar Sugar Pty Ltd Woolworths Group Limited Workers' Compensation Self Insurer Contact List - as at 14 September 2021 Page 2 _____________________________________________________________________________________________________ SELF-INSURANCE LICENCE: Aged Care Employers Self-Insurance Group COMMENCEMENT DATE: 1 January 2005 ADDRESS: TriCare Ltd 250 Newnham Road PO Box 439 MT -

26 June 2020 ASX Limited ASX Market Announcements Office

26 June 2020 ASX Limited ASX Market Announcements Office Exchange Centre Level 6, 20 Bridge Street SYDNEY NSW 2000 EINVEST INCOME GENERATOR FUND (MANAGED FUND) (ASX: EIGA) Monthly portfolio disclosure notification 31 May 2020 We advise that the portfolio for the Fund as at 31 May 2020 comprised the following securities: Stock Ticker % Total Portfolio BHP Group Ltd BHP 9.39 Cash CASH 7.24 National Australia Bank Ltd NAB 5.55 Macquarie Group Ltd MQG 5.42 Wesfarmers Ltd WES 5.29 Commonwealth Bank of Australia CBA 5.24 Telstra Corp Ltd TLS 4.72 Fortescue Metals Group Ltd FMG 4.42 Westpac Banking Corp WBC 4.14 Woodside Petroleum Ltd WPL 3.84 Rio Tinto Ltd RIO 3.73 Woolworths Group Ltd WOW 3.39 Suncorp Group Ltd SUN 2.91 Aust And Nz Banking Group ANZ 2.59 Platinum Asset Management PTM 2.48 Qantas Airways Ltd QAN 2.44 Orora Ltd ORA 2.42 Insurance Australia Group IAG 2.37 Allied Gold Min Plc ALD 2.24 Downer Edi Ltd DOW 2.18 Tabcorp Holdings Ltd TAH 2.00 Perpetual Ltd PPT 1.73 Event Hospitality and Entertainment EVT 1.71 Coles Group Ltd COL 1.59 Crown Resorts Ltd CWN 1.55 Seven Group Holdings Ltd SVW 1.51 Amcor Limited AMC 1.29 Janus Henderson Group-Cdi JHG 1.00 Aurizon Holdings Ltd AZJ 0.97 Medibank Private Ltd MPL 0.94 Monadelphous Group Ltd MND 0.86 Perennial Investment Management Limited. ABN 13 108 747 637 AFS Licence No. 275101 www.perennial.com.au Level 27, 88 Phillip Street, Sydney NSW 2000, Australia. -

Dow Jones Sustainability Australia Index

Effective as of 23 September 2019 Dow Jones Sustainability Australia Index Company Country Industry Group Comment Australia & New Zealand Banking Group Ltd Australia Banks National Australia Bank Ltd Australia Banks Westpac Banking Corp Australia Banks CIMIC Group Ltd Australia Capital Goods Brambles Ltd Australia Commercial & Professional Services Downer EDI Ltd Australia Commercial & Professional Services Addition Star Entertainment Grp Ltd Australia Consumer Services Tabcorp Holdings Ltd Australia Consumer Services Janus Henderson Group PLC United Kingdom Diversified Financials Macquarie Group Ltd Australia Diversified Financials Oil Search Ltd Australia Energy Woodside Petroleum Ltd Australia Energy Coles Group Ltd Australia Food & Staples Retailing Fisher & Paykel Healthcare Corp Ltd New Zealand Health Care Equipment & Services Asaleo Care Ltd Australia Household & Personal Products Insurance Australia Group Ltd Australia Insurance QBE Insurance Group Ltd Australia Insurance BHP Group Ltd Australia Materials Boral Ltd Australia Materials Addition Evolution Mining Ltd Australia Materials Addition Fletcher Building Ltd New Zealand Materials Addition Fortescue Metals Group Ltd Australia Materials Iluka Resources Ltd Australia Materials Incitec Pivot Ltd Australia Materials Independence Group NL Australia Materials Addition Newcrest Mining Ltd Australia Materials Orica Ltd Australia Materials Orocobre Ltd Australia Materials Rio Tinto Ltd Australia Materials Sims Metal Management Ltd Australia Materials South32 Ltd Australia Materials -

Information About Coles Group

6 Information about Coles Group 6.1 Background Information Coles Group (ASX:CGJ) is one of Australia’s largest retailers with approximately 3,000 stores, revenue of $34.7 billion (FY2007) and market capitalisation of approximately $18.0 billion as at 25 September 2007. Coles Group is headquartered in Melbourne, Australia and employs approximately 170,000 people nationally. A brief history of Coles Group is set out below. • The fi rst Coles Group variety store was opened in Melbourne, Victoria in 1914 and the fi rst Coles Group supermarket was opened in 1960. At the end of the 2007 fi nancial year, 674 Coles and 71 Bi-Lo supermarkets were open. • The fi rst Kmart opened in Melbourne, Victoria in 1969, and as at the end of the 2007 fi nancial year, there were 182 Kmart stores in Australia and New Zealand, making it Australia’s largest discount department store operator. • In 1985, Coles Group merged with The Myer Emporium Limited to create Coles Myer Limited. • The merger with the Myer Emporium brought Target into the brand portfolio which, as at the end of the 2007 fi nancial year, had 268 locations in metropolitan and country areas offering on-trend apparel and soft home-wares. • Through the 1980s and 1990s Coles Group acquired a number of liquor businesses and over the past six years it has continued to expand its liquor business by acquiring hotels and rolling out superstores. • In 1994 the fi rst Offi ceworks store opened, with the chain having grown to 107 stores and nine Harris Technology Business Centres as at the end of the 2007 fi nancial year. -

STOXX AUSTRALIA 50 Selection List

STOXX AUSTRALIA 50 Last Updated: 20210702 ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) Rank (FINAL)Rank (PREVIOUS) AU000000CBA7 6215035 CBA.AX 621503 Commonwealth Bank of Australia AU AUD Y 112.2 1 1 AU000000BHP4 6144690 BHP.AX 614469 BHP GROUP LTD. AU AUD Y 90.6 2 2 AU000000CSL8 6185495 CSL.AX 618549 CSL Ltd. AU AUD Y 82.2 3 3 AU000000WBC1 6076146 WBC.AX 607614 Westpac Banking Corp. AU AUD Y 59.9 4 4 AU000000NAB4 6624608 NAB.AX 662460 National Australia Bank Ltd. AU AUD Y 54.8 5 5 AU000000ANZ3 6065586 ANZ.AX 606558 Australia & New Zealand Bankin AU AUD Y 50.7 6 6 AU000000WES1 6948836 WES.AX 694883 Wesfarmers Ltd. AU AUD Y 42.4 7 7 AU000000MQG1 B28YTC2 MQG.AX 655135 Macquarie Group Ltd. AU AUD Y 32.5 8 9 AU000000WOW2 6981239 WOW.AX 698123 WOOLWORTHS GROUP AU AUD Y 30.6 9 8 AU000000RIO1 6220103 RIO.AX 622010 Rio Tinto Ltd. AU AUD Y 29.8 10 10 AU000000TLS2 6087289 TLS.AX 608545 Telstra Corp. Ltd. AU AUD Y 28.3 11 11 AU000000FMG4 6086253 FMG.AX 608625 Fortescue Metals Group Ltd. AU AUD Y 25.5 12 12 AU000000TCL6 6200882 TCL.AX 689933 Transurban Group AU AUD Y 24.7 13 13 AU000000GMG2 B03FYZ4 GMG.AX 690433 Goodman Group AU AUD Y 22.5 14 14 AU000000APT1 BF5L8B9 APT.AX AU802E AFTERPAY AU AUD 18.7 15 17 AU000000ALL7 6253983 ALL.AX 605156 Aristocrat Leisure Ltd. AU AUD Y 17.4 16 15 AU0000030678 BYWR0T5 COL.AX AU80Q2 Coles Group AU AUD Y 14.4 17 18 AU000000WPL2 6979728 WPL.AX 697972 Woodside Petroleum Ltd.