2020 Annual Report 2020 Annual

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Supermarkets

Coles’ Together to Zero sustainability strategy set our ambitions including 100% renewable energy by FY25. 2021 Full Year Results Presentation 18 August 2021 Disclaimer This presentation contains summary information about Coles Group Limited (ACN 004 089 936) and its controlled entities (collectively, ‘Coles’, ‘Coles Group’ or ‘the Group’) and Coles’ activities as at the date of this presentation. It is information given in summary form only and does not purport to be complete. It should be read in conjunction with Coles’ other periodic corporate reports and continuous disclosure announcements filed with the Australian Securities Exchange (ASX), available at www.asx.com.au. This presentation is for information purposes only and is not a prospectus or product disclosure statement, financial product or investment advice or a recommendation to acquire Coles shares or other securities. It has been prepared without taking into account the investment objectives, financial situation or needs of individuals. Before making an investment decision, prospective investors should consider the appropriateness of the information having regard to their own investment objectives, financial situation and needs and seek legal, taxation, business and/or financial advice appropriate to their circumstances. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness or correctness of the information, opinions and conclusions contained in this presentation. To the maximum extent permitted by law, none of Coles or its directors, employees or agents, nor any other person, accepts liability for any loss arising from the use of this presentation or its contents or otherwise arising in connection with it, including, without limitation, any liability from fault or negligence on the part of Coles or its directors, employees, contractors or agents. -

COL ASX Release

18 August 2020 The Manager Company Announcements Office Australian Securities Exchange Dear Sir or Madam Coles Group Limited – 2020 Full Year Results Release Please find attached for immediate release to the market the 2020 Full Year Results Release for Coles Group Limited. This announcement is authorised by the Board. Yours faithfully, Daniella Pereira Company Secretary For personal use only Coles Group Limited ABN 11 004 089 936 800 Toorak Road Hawthorn East Victoria 3123 Australia PO Box 2000 Glen Iris Victoria 3146 Australia Telephone +61 3 9829 5111 www.colesgroup.com.au 18 August 2020 2020 Full Year Results Release First year strategy delivered whilst supporting team members, suppliers and community through droughts, bushfires and COVID-19 Performance summary (retail non-IFRS basis)1 ▪ Full year sales revenue increased by 6.9% to $37.4 billion with sales revenue growth across all segments ▪ 51st consecutive quarter of Supermarkets comparable sales growth, increasing by 7.1% in Q4 ▪ Liquor comparable sales growth of 20.2% in Q4 ▪ Express convenience (c-store) comparable sales growth of 8.3% in Q4 ▪ Achieved Smarter Selling cost savings in excess of $250 million ▪ Group EBIT growth achieved for the first time in four years, increasing by 4.7% ▪ Strong earnings per share growth of 7.1% ▪ Cash realisation of 111% and net debt of $0.4 billion, providing significant capacity for future growth ▪ Fully-franked final dividend of 27.5 cents per share declared, a 14.6% uplift on the prior year final dividend ▪ Delivered a total shareholder -

2021 Investor Strategy Day Presentation

ASX Release 17 June 2021 The Manager Company Announcements Office Australian Securities Exchange Dear Manager, Coles Group - 2021 Investor Strategy Day Presentation Please find attached the presentation that will be given today, Thursday 17 June 2021, at the Coles Group 2021 Investor Strategy Day. The briefing will be webcast live and will be accessible via registration on Coles’ website at www.colesgroup.com.au. Yours faithfully, Daniella Pereira Company Secretary For more information: Investors Media Mark Howell Blair Speedy Tel: +613 9829 6408 Tel: +613 9829 4008 Mobile: +61 400 332 640 Mobile: +61 431 960 249 E-mail: [email protected] E-mail: [email protected] Lisa Zimmet Mobile: +61 428 857 242 E-mail: [email protected] This announcement is authorised by the Board. Coles Group Limited ABN 11 004 089 936 800 Toorak Road Hawthorn East Victoria 3123 Australia PO Box 2000 Glen Iris Victoria 3146 Australia Telephone +61 3 9829 5111 www.colesgroup.com.au Winning in our Coles, Collingwood 1914 Second Century Investor Strategy Day June 2021 Coles Local, Fitzroy 2021 Disclaimer This presentation contains summary information about Coles Group Limited (ACN 004 089 936) and its controlled entities (together, ‘Coles’ or ‘the Group’) and Coles’ activities as at the date of this presentation. It is information given in summary form only and does not purport to be complete. It should be read in conjunction with Coles’ other periodic corporate reports and continuous disclosure announcements filed with the Australian Securities Exchange (ASX), available at www.asx.com.au. This presentation is for information purposes only and is not a prospectus or product disclosure statement, financial product or investment advice or a recommendation to acquire Coles shares or other securities. -

2020 Annual Report

24 September 2020 The Manager Company Announcements Office Australian Securities Exchange Dear Manager, 2020 ANNUAL REPORT In accordance with the ASX Listing Rules, attached for release to the market is Coles Group Limited’s 2020 Annual Report. This announcement is authorised by the Board. Yours faithfully, Daniella Pereira Company Secretary For more information: Investor Relations Media Mark Howell Meg Rayner Mobile: +61 400 332 640 Mobile: +61 439 518 456 E-mail: E-mail: [email protected] [email protected] Coles Group Limited ABN 11 004 089 936 800 Toorak Road Hawthorn East Victoria 3123 Australia PO Box 2000 Glen Iris Victoria 3146 Australia Telephone +61 3 9829 5111 www.colesgroup.com.au 2020 Annual Report Sustainably feed all Australians to help them lead healthier, happier lives Coles Group Limited ABN 11 004 089 936 Coles Group Limited 2020 Annual Report Coles acknowledges the Traditional Custodians of Country throughout Australia and pays its respects to elders past and present. We recognise their rich cultures and continuing connection to land and waters. Aboriginal and Torres Strait Islander peoples are advised that this document may contain names and images of people who are deceased. All references to Indigenous people in this document are intended to include Aboriginal and/or Torres Strait Islander people. DRAFT 21 COL1634_An- nualReport_d31a – Rnd 16 Copy September23, 2020 7:52 PM Forward-looking statements This report contains forward-looking statements in relation to Coles Group Limited (‘the Company’) and its controlled entities (together ‘Coles’ or ‘the Group’), including statements regarding the Group’s intent, belief, goals, objectives, initiatives, commitments or current expectations with respect to the Group’s business and operations, market conditions, results of operations and financial conditions, and risk management practices. -

2019 Annual Report. Sustainably Feed All Australians to Help Them Lead Healthier, Happier Lives

2019 Annual Report. Sustainably feed all Australians to help them lead healthier, happier lives. Coles Group Ltd / Annual Report & Financial Statements 2019 Coles Group Limited 2019 Annual Report1 1 Coles acknowledges the Traditional Custodians of Country throughout Australia and pays its respects to elders past and present. We recognise their rich 1914. 1914 cultures and continuing connection to land and waters. The first Coles variety store opens in Aboriginal and Torres Strait Islander peoples are Collingwood, Victoria, advised that this document may contain names and founded by George James Coles and his images of people who are deceased. 1924 brother Jim. Coles’ first city store All references to Indigenous people in this document opens in Bourke Street, Melbourne. are intended to include Aboriginal and/or Torres Strait Islander people. 1939-1945 During World War II, women manage the stores as 90% of male Contents team members enlist 1956 to fight. The first self-service store opens in February. 3 Welcome to Coles 4 2019 performance 1960 5 2019 highlights The first Coles 6 Message from the Chairman supermarket opens 8 Managing Director and in North Balwyn, Victoria. 1980s Chief Executive Ocer’s report Coles acquires a number 12 Our vision, purpose and strategy of liquor businesses, 14 How we create value including the Liquorland and Vintage Cellars 17 Sustainability overview 1985 brands. 18 Sustainability highlights Coles merges with The Myer Emporium 20 Our financial and operating performance Limited to create 29 Looking to the future Coles Myer Limited. 30 How we manage risk 1999 35 Climate change Online shopping is first 38 Corporate governance 2003 trialled by Coles in 23 Melbourne postcodes, 45 Directors’ report Coles enters into an Alliance Agreement paving the way for the 63 Financial report with Shell whereby current Coles Online 104 Shareholder information Coles operates the oering. -

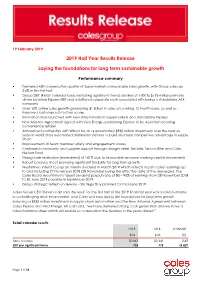

2019 Half Year Results Release Laying the Foundations for Long Term

19 February 2019 2019 Half Year Results Release Laying the foundations for long term sustainable growth Performance summary . Delivered 45th consecutive quarter of Supermarkets comparable sales growth, with Group sales up 2.6% in the first half . Group EBIT (Retail calendar basis excluding significant items) decline of 5.8% to $733 million primarily driven by lower Express EBIT and additional corporate costs associated with being a standalone ASX company . Over 30% online sales growth generating $1 billion in sales on a rolling 12 month basis, as well as improved customer satisfaction scores . Innovation trials launched with new store formats in Supermarkets and standalone Express . New Alliance Agreement signed with Viva Energy, positioning Express to be Australia’s leading convenience retailer . Announced partnership with Witron for an approximately $950 million investment over the next six years in world class automated distribution centres to build structural competitive advantage in supply chain . Improvements in team member safety and engagement scores . Continued community and supplier support through drought relief, Redkite, SecondBite and Coles Nurture Fund . Strong cash realisation (normalised) of 141% due to favourable seasonal working capital movements . Robust balance sheet providing significant flexibility for long term growth . Wesfarmers intend to pay an interim dividend in March 2019 which reflects in part Coles’ earnings up to and including 27 November 2018 (28 November being the effective date of the demerger). The -

Coles Leadership Team

Melbourne 1914 Winning in our Melbourne 2023 Second Century Coles Investor Day June 2019 For personal use only 1 Today’s agenda Topic Time Presenter 1 Growing long-term shareholder value 9:40am – 10:00am Steven Cain 2 Inspire Customers 10:00am – 10:35am Steven Cain 3 Smarter Selling 10:35am – 10:55am Leah Weckert & Matt Swindells Morning tea break 10:55am – 11:25am 4 Win Together 11:25am – 11:40am Steven Cain 5 Coles’ financial framework 11:40am – 12:00pm Leah Weckert Steven Cain, Leah Weckert & Matt 6 Concluding comments & Q&A 12:00pm – 12:40pm Swindells Lunch 12:40pm – 1:20pm Coles’ Own Brand chefs For personal use only Store visits 1:20pm – 4:00pm 1 2 3 4 5 6 7 2 For personal use only Safety briefing For personal use only 1 2 3 4 5 6 7 4 Disclaimer This presentation contains summary information about Coles Group Limited (ACN 004 089 936) (the Group) and its activities current as at the date of this presentation. It is information given in summary form only and does not purport to be complete. It should be read in conjunction with the Group’s other periodic and continuous disclosure announcements filed with the Australian Securities Exchange, available at www.asx.com.au This presentation is for information purposes only and is not a prospectus or product disclosure statement, financial product or investment advice or a recommendation to acquire the Group shares or other securities. It has been prepared without taking into account the investment objectives, financial situation or needs of individuals. -

Coles Group Results Release 1H20

18 February 2020 2020 Half Year Results Release Successful strategy execution inspires customers and drives Supermarkets growth, interim dividend of 30 cents per share declared Performance summary (retail non-IFRS basis) ▪ First half sales revenue (excluding Fuel sales1 and Hotels) increased by 3.3% with growth in all segments ▪ 49th consecutive quarter of Supermarkets comparable sales growth, increasing to 3.6% in Q2 ▪ Express comparable fuel volume growth of 4.2%, first consecutive quarters of positive growth in six years ▪ Earnings before interest and tax (EBIT)2 increased by 0.4%, partially due to strong property disposal demand ▪ Interim fully-franked dividend of 30 cents per share declared, in line with demerger guidance Strategic highlights Inspire Customers ▪ Delivered trusted value for customers through the “Good things. Great value.” campaign which focused on lowering the cost of breakfast, lunch, dinner and Christmas entertaining ▪ Most significant range change period in recent years with more than 3,000 new products introduced ▪ Healthier options including an expanded vegetarian range delivered through the convenience roll-out to 114 supermarkets ▪ Own Brand achieved sales in excess of $1 billion in December and grew by 6% in the first half ▪ ‘Delivery Plus’ subscription service introduced in Coles Online ▪ Tailored range change initiated in Liquor providing a more relevant customer offer Smarter Sellling ▪ $95 million in cost-out due to Smarter Selling initiatives ▪ More than 1,000 stores now connected to high-speed broadband -

Preliminary Final Report

Call 18 August 2021 The Manager Company Announcements Office Australian Securities Exchange Dear Sir or Madam Coles Group Limited (Coles) – Appendix 4E and Annual Results for the period ended 27 June 2021 In accordance with ASX Listing Rule 4.3A and the Corporations Act 2001(Cth), I enclose the following for immediate release to the market: 1. Appendix 4E; 2. Operating and Financial Review, which accompanies the Directors’ Report; 3. Directors’ Report (including the Remuneration Report); 4. Financial Report; and 5. Independent Auditor’s Report, for the full year ended 27 June 2021. Coles will conduct an analyst briefing on the annual results from 10.00am AEST. This briefing will be audio webcast and is accessible via the Company’s website at www.colesgroup.com.au. This announcement is authorised by the Board. Yours faithfully, Daniella Pereira Company Secretary Coles Group Limited ABN 11 004 089 936 800 Toorak Road Hawthorn East Victoria 3123 Australia PO Box 2000 Glen Iris Victoria 3146 Australia Telephone +61 3 9829 5111 www.colesgroup.com.au Appendix 4E Preliminary Final Report For the year ended 27 June 2021 APPENDIX 4E Under ASX Listing Rule 4.3A PRELIMINARY FINAL REPORT Current reporting period (‘FY21’) 29 June 2020 to 27 June 2021 Previous corresponding period (‘FY20’) 1 July 2019 to 28 June 2020 This Preliminary Final Report presents the results of Coles Group Limited (‘the Company’) and the entities it controlled at the reporting date or during the year ended 27 June 2021 (collectively, ‘Coles’, ‘Coles Group, or ‘the Group’). -

Coles Group Appendix 4E

18 August 2020 The Manager Company Announcements Office Australian Securities Exchange Dear Sir or Madam Coles Group Limited (Coles) – Appendix 4E and Annual Results for the period ended 28 June 2020 In accordance with ASX Listing Rule 4.3A and the Corporations Act 2001 (Cth), I enclose the following for immediate release to the market: 1. Appendix 4E; 2. Operating and Financial Review, which accompanies the Directors’ Report; 3. Directors’ Report (including the Remuneration Report); 4. Financial Report; and 5. Independent Auditor’s Report, for the full year ended 28 June 2020. Coles will conduct an analyst briefing on the annual results from 10.00am AEST. This briefing will be audio webcast and is accessible via the Company’s website at www.colesgroup.com.au. This announcement is authorised by the Board. Yours faithfully, Daniella Pereira Company Secretary For personal use only Coles Group Limited ABN 11 004 089 936 800 Toorak Road Hawthorn East Victoria 3123 Australia PO Box 2000 Glen Iris Victoria 3146 Australia Telephone +61 3 9829 5111 www.colesgroup.com.au Appendix 4E Preliminary Final Report For the year ended 28 June 2020 For personal use only APPENDIX 4E Under ASX Listing Rule 4.3A PRELIMINARY FINAL REPORT Current reporting period (‘FY20’) 1 July 2019 to 28 June 2020 (52 weeks) Previous corresponding period (‘FY19’) 1 July 2018 to 30 June 2019 (52 weeks + 1 day) RESULTS FOR ANNOUNCEMENT TO THE MARKET This Preliminary Final Report presents the results of Coles Group Limited (‘the Company’) and the entities it controlled at the reporting date or during the year ended 28 June 2020 (collectively, ‘Coles’ or ‘the Group’). -

FY21 Results Presentation

18 August 2021 The Manager Company Announcements Office Australian Securities Exchange Dear Sir or Madam Coles Group Limited – 2021 Full Year Results Presentation Please find attached for immediate release to the market the 2021 Full Year Results Presentation for Coles Group Limited. This announcement is authorised by the Board. Yours faithfully, Daniella Pereira Company Secretary Coles Group Limited ABN 11 004 089 936 800 Toorak Road Hawthorn East Victoria 3123 Australia PO Box 2000 Glen Iris Victoria 3146 Australia Telephone +61 3 9829 5111 www.colesgroup.com.au Coles’ Together to Zero sustainability strategy set our ambitions including 100% renewable energy by FY25. 2021 Full Year Results Presentation 18 August 2021 Disclaimer This presentation contains summary information about Coles Group Limited (ACN 004 089 936) and its controlled entities (collectively, ‘Coles’, ‘Coles Group’ or ‘the Group’) and Coles’ activities as at the date of this presentation. It is information given in summary form only and does not purport to be complete. It should be read in conjunction with Coles’ other periodic corporate reports and continuous disclosure announcements filed with the Australian Securities Exchange (ASX), available at www.asx.com.au. This presentation is for information purposes only and is not a prospectus or product disclosure statement, financial product or investment advice or a recommendation to acquire Coles shares or other securities. It has been prepared without taking into account the investment objectives, financial situation or needs of individuals. Before making an investment decision, prospective investors should consider the appropriateness of the information having regard to their own investment objectives, financial situation and needs and seek legal, taxation, business and/or financial advice appropriate to their circumstances. -

Supermarkets Growth, Interim Dividend of 30 Cents Per Share Declared

18 February 2020 The Manager Company Announcements Office Australian Securities Exchange Dear Sir or Madam Coles Group Limited – 2020 Half Year Results Presentation Please find attached for immediate release to the market the 2020 Half Year Results Presentation for Coles Group Limited. Yours faithfully, Daniella Pereira Company Secretary For personal use only Coles Group Limited ABN 11 004 089 936 800 Toorak Road Hawthorn East Victoria 3123 Australia PO Box 2000 Glen Iris Victoria 3146 Australia Telephone +61 3 9829 5111 www.colesgroup.com.au 2019 Full Year Results Presentation 22 August 2019 Coles team members delivering supplies to bushfire Emergency Services Control Centre in Yeppoon, Queensland. For personal use only 2020 Half Year Results Presentation 18 February 2020 Disclaimer This presentation contains summary information about Coles Group Limited (ACN 004 089 936) and its related bodies corporate (together, Coles) and Coles’ activities as at the date of this presentation. It is information given in summary form only and does not purport to be complete. It should be read in conjunction with Coles’ other periodic corporate reports and continuous disclosure announcements filed with the Australian Securities Exchange (ASX), available at www.asx.com.au This presentation is for information purposes only and is not a prospectus or product disclosure statement, financial product or investment advice or a recommendation to acquire Coles shares or other securities. It has been prepared without taking into account the investment objectives, financial situation or needs of individuals. Before making an investment decision, prospective investors should consider the appropriateness of the information having regard to their own investment objectives, financial situation and needs and seek legal, taxation, business and/or financial advice appropriate to their circumstances.