An Overview of the Electronic Communications Market 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Download Europe Pop

EUROPE LEGEND As built: March 2021. Maps are not to scale. Learn more about our network: teliacarrier.com Point of presence (PoP) Multiple PoPs Telia Carrier fiber Leased network OUR PoPs IN EUROPE Amsterdam Copenhagen Helsinki Milan Prague Tallinn Cessnalaan 50, Interxion 3000 Industriparken 20A, Interxion Iso-Roobertinkatu 21–25, Telia Via Caldera 21, Irideos Nad Elektrarnou 411, CECOLO Söle 14, Telia Johan Huizingalaan 759, Global Switch Horskaetten 3, Global Connect Kansakoulukuja 3, Telia 25 Viale Lombardia, Supernap Kuuse 4, Telia J.W Lucasweg 35, Iron Mountain Metrovej 1, Telia Kiviadankatu 2H, Nebula Via Monzoro 101–105, Data4 Riga 12 Koolhovenlaan, EdgeConnex Sydvestvej 100, Telia Parrukatu 2, Equinix Lielvardes Str. 8a, Telia Timisoara Kuiperbergweg 13, Equinix Sahamyllyntie 4b, Equinix Moscow Zakusalas krastmala 1, Riga TV Tower Calea Torontalului 94, Orange Luttenbergweg 4, Equinix Dresden Sinimäentie 12, Equinix Altufevskaya Shosse 33G, IXcellerate Schepenbergweg 42, Equinix Overbeckstr. 41a, Telia Valimotie 3–5, Telia Butlerova Str. 7, MMTS-9 JSC Rome Udomlya Science Park 120a, Digital Realty Oktyabrskaya Str. 1, Telia Via del Tizii, NAMEX CONSYST-Communication Provider Science Park 121, Interxion Dublin Kiev Viamotornaya Str. 69, DataPro Science Park 610, Equinix Kilcarbery Park, Equinix Gaydara Str. 50, New Telco Ukraine Rotterdam Valencia Science Park 105, NIKHEF Citywest Campus, Equinix Leontovicha Str. B. 9/3, Farlep-Invest Munich Van Nelleweg Rotterdam, 1, Smart DC Calle Villa de Madrid 44, Nixval Tupolevlaan 101, Interxion -

Termination Rates at European Level January 2021

BoR (21) 71 Termination rates at European level January 2021 10 June 2021 BoR (21) 71 Table of contents 1. Executive Summary ........................................................................................................ 2 2. Fixed networks – voice interconnection ..................................................................... 6 2.1. Assumptions made for the benchmarking ................................................................ 6 2.2. FTR benchmark .......................................................................................................... 6 2.3. Short term evolution of fixed incumbents’ FTRs (from July 2020 to January 2021) ................................................................................................................................... 9 2.4. FTR regulatory model implemented and symmetry overview ............................... 12 2.5. Number of lines and market shares ........................................................................ 13 3. Mobile networks – voice interconnection ................................................................. 14 3.1. Assumptions made for the benchmarking .............................................................. 14 3.2. Average MTR per country: rates per voice minute (as of January 2021) ............ 15 3.3. Average MTR per operator ...................................................................................... 18 3.4. Average MTR: Time series of simple average and weighted average at European level ................................................................................................................. -

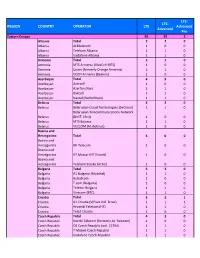

SVOD Platforms Carried by Pay TV Operators

SVOD platforms carried by pay TV operators Source: Digital TV Research Note: Excludes SVOD platforms owned by pay TV operator Country Pay TV Operator SVOD Platform Argentina Telecentro Netflix Argentina Telecom Argentina Netflix Australia iiNet Netflix Australia Optus Netflix Austria UPC Netflix Azerbaijan Aile TV Megogo Bahrain Batelco Netflix Bahrain Viva Icflix Bahrain Viva Istikana Bahrain Viva Shahid Bahrain Viva Starz Play Bahrain Viva Telly Bahrain Zain Icflix Belgium Belgacom/Proximus Netflix Belgium Telenet Netflix Belgium Voo Canal Play Bolivia Tigo Netflix Bosnia M:tel Pickbox Brazil TIM Netflix Bulgaria Fusion TV Voyo Bulgaria Vivacom Voyo Canada Bell Netflix Canada Cogeco Netflix Canada MTS Netflix Canada Rogers Netflix Canada Telus Optik Netflix Chile VTR Netflix Colombia UNE Netflix Costa Rica Tigo Netflix Croatia T-HT Oyo Croatia T-HT Pickbox Croatia Vipnet Oyo Czech Rep T-Mobile Voyo Czech Rep UPC Netflix Denmark TDC HBO Denmark Telia HBO Denmark Waoo Netflix Denmark Waoo Viaplay Denmark YouSee HBO Egypt Telecom Egypt Icflix Egypt Vodafone Starz Play El Salvador Tigo Netflix Estonia Elion Netflix SVOD platforms carried by pay TV operators Source: Digital TV Research Note: Excludes SVOD platforms owned by pay TV operator Finland DNA C More Finland Elisa HBO Finland Elisa Netflix Finland Telia C More Finland Telia HBO Finland Telia Netflix France Bouygues Telecom Netflix France Free Canal Play France Free Filmo France Numericable Filmo France Orange Filmo France Orange Netflix France SFR Netflix Germany Deutsche Telekom -

Repaircms SMS Credit Price List

SMS-Pricing Country Credits Abkhazia (7940) A-Mobile 0.8 Albania (355) AMC 0.8 Eagle Mobile (ALBtelecom) 0.8 Plus Communication (Mobile 4AL) 0.8 Vodafone 0.8 Andorra (376) Mobiland (STA) 0.8 Austria (43) A1 Telekom (Mobilkom, Tele2 Mobil) 1.5 Orange (One) 1.5 T-Mobile (Tele.Ring) 0.8 TRE (Hutchinson 3G) 1.5 Belarus (375) life (BTN,Best) 0.8 MTS (Mobile TeleSystems) 0.8 Velcom (MDC) 0.8 Belgium (32) Base (KPN, Orange) 0.5 LycaMobile (MVNO Mobistar) 0.8 Mobistar 0.8 Proximus (Belgacom) 2 Telenet 0.8 Bosnia-Herzegovina (387) BH Mobile (Joint Stock Company) 0.8 HT-ERONET (PECT, Mostar) 0.8 m:tel (RS Telecomms, Mobis, Telek.Srbija) 0.8 Bulgaria (359) Globul (Cosmo,OTE,Telenor) 1.5 M-Tel (MobilTel) 0.8 Vivacom (BTC, Vivatel) 0.8 Croatia (385) T-Mobile (HTMobile,Cronet,T-Hrvatski,CroatiaTele.) 0.8 Tele2 0.8 Vip (VipNET, Telekom Austria) 0.8 Cyprus (357) Cytamobile-Vodafone (CYTA) 0.7 MTN (Areeba,Scancom) 0.3 PrimeTel 0.6 Czech Republic (420) O2 (Telefonica, EuroTel) 0.8 T-Mobile (Radiomobil) 0.8 U:fon (MobilKom) 0.8 Vodafone (Oskar) 0.8 Denmark (45) Lebara Mobile (MVNO Telenor) 0.6 LycaMobile (MVNO TDC) 0.4 TDC 0.4 Telenor (Sonofon, Dansk Mobil) 0.6 Telia (Sonera) 0.5 Three (3, Hutchison) 0.8 Estonia (372) Elisa (Radiolinja) 0.8 EMT (TeliaSonera) 1.5 Tele2 (Eesti) 0.8 Faroe Islands (298) FaroeseTelecom 0.8 Vodafone (Kall Telecom) 0.8 Finland (358) Alands (AMT) 0.8 DNA 0.8 Elisa 1.5 Finnet (MVNO) 0.8 Saunalahti (Jippii) 1.5 TeliaSonera 1.5 Vectone Mobile 0.8 France (33) Bouygues 1.5 Free Mobile 1.5 Keyyo 1.5 Lycamobile 1.5 Orange (France Telecom) -

Prepared for Upload GCD Wls Networks

LTE‐ LTE‐ Region Country Operator LTE Advanced 5G Advanced Pro Eastern Europe 92 57 4 3 Albania Total 32 0 0 Albania ALBtelecom 10 0 0 Albania Telekom Albania 11 0 0 Albania Vodafone Albania 11 0 0 Armenia Total 31 0 0 Armenia MTS Armenia (VivaCell‐MTS) 10 0 0 Armenia Ucom (formerly Orange Armenia) 11 0 0 Armenia VEON Armenia (Beeline) 10 0 0 Azerbaijan Total 43 0 0 Azerbaijan Azercell 10 0 0 Azerbaijan Azerfon (Nar) 11 0 0 Azerbaijan Bakcell 11 0 0 Azerbaijan Naxtel (Nakhchivan) 11 0 0 Belarus Total 42 0 0 Belarus A1 Belarus (formerly VELCOM) 10 0 0 Belarus Belarusian Cloud Technologies (beCloud) 11 0 0 Belarus Belarusian Telecommunications Network (BeST, life:)) 10 0 0 Belarus MTS Belarus 11 0 0 Bosnia and Total Herzegovina 31 0 0 Bosnia and Herzegovina BH Telecom 11 0 0 Bosnia and Herzegovina HT Mostar (HT Eronet) 10 0 0 Bosnia and Herzegovina Telekom Srpske (m:tel) 10 0 0 Bulgaria Total 53 0 0 Bulgaria A1 Bulgaria (Mobiltel) 11 0 0 Bulgaria Bulsatcom 10 0 0 Bulgaria T.com (Bulgaria) 10 0 0 Bulgaria Telenor Bulgaria 11 0 0 Bulgaria Vivacom (BTC) 11 0 0 Croatia Total 33 1 0 Croatia A1 Hrvatska (formerly VIPnet/B.net) 11 1 0 Croatia Hrvatski Telekom (HT) 11 0 0 Croatia Tele2 Croatia 11 0 0 Czechia Total 43 0 0 Czechia Nordic Telecom (formerly Air Telecom) 10 0 0 Czechia O2 Czech Republic (incl. CETIN) 11 0 0 Czechia T‐Mobile Czech Republic 11 0 0 Czechia Vodafone Czech Republic 11 0 0 Estonia Total 33 2 0 Estonia Elisa Eesti (incl. -

(A1 Telekom Austria AG) Belgium Telenet

Земји Оператори Albania Telekom Albania Australia Optus Australia Austria T-Mobile AUT Austria Mobilkom (A1 Telekom Austria AG) Belgium Telenet (KPN Group Belgium NV/SA) - BASE Belgium Belgacom Mobile (Proximus ) Bosnia & Hercegovina BH TELECOM Bosnia & Hercegovina M:TEL Bosnia & Hercegovina ERONET Bulgaria Vivacom Bulgaria Telenor (Globul) Canada Bell Canada Telus Croatia Hrvatski Telekom Croatia Tele 2 Group Czech Republic T-Mobile Czech Republic Czech Republic Telefonica O2 Czech Rep.,a.s. Denmark Telenor France Orange France France SFR France Germany Telekom Deutschland Germany E-Plus Germany Germany Telefonica O2 Germany Greece Cosmote Greece Greece WIND HELLAS Hungary Magyar Telekom Plc Hungary Telenor Ireland Meteor Israel Partner Communication Israel Italy Telecom Italia Italy Wind Tre Italia ITAWI Japan SoftBank Mobile Corp. Latvia Tele 2 Group Lithuania Tele 2 Group Liechtenstein Telekom Luxembourg Tango Luxemburg Luxembourg Post Malta Go Mobile Malta Montenegro Pro Monte Montenegro Montenegro MTEL Montenegro (RB) Montenegro Crnogorski Telekom Netherlands T-Mobile Netherlands BV Netherlands KPN B.V. Norway Telenor Poland ERA GSM Poland (T-Mobile Poland) Portugal NOS (Sonaecom ) Qatar Q-TEL Qatar Romania Telekom Romania Mobile S.A. Russia KB Impuls (Vimpelkom ) Russia Megafone SAD T-Mobile USA Serbia Telenor Serbia Serbia Telekom Srbija Serbia Vip Mobile Singapore Starhub Slovakia T-Mobile Slovakia Slovenia Tusmobil d.o.o. Slovenia Si.Mobil Slovenia Kosovo IPKO Spain Orange Spain Telefonica Moviles Spain (Movistar) Sweden Telenor Sweden Tele 2 Group Switzerland Orange Communications SA Switzerland Sunrise Communications AG Switzerland Swisscom Switzerland Ltd. Turkey Turkcell Turkey AVEA Iletisim Hizmetleri A.S. UK JV EE Ltd. (ex T-Mobile GBR) UK Telefonica O2 UK Limited Ukraina Kyivstar Monaco, Kosovo Monaco Telekom /IPKO Belarus Mobile TeleSystems (RB) Bulgaria MOBILTEL EAD China China Unicom Israel Pelephone Communications Italy Vodafone Omnitel N.V. -

TELEKOM SRBIJA Akcionarsko Društvo, Beograd

PREDUZEĆE ZA TELEKOMUNIKACIJE TELEKOM SRBIJA akcionarsko društvo, Beograd STANDARDNA PONUDA ZA USLUGE MEĐUPOVEZIVANJA SA JAVNOM FIKSNOM KOMUNIKACIONOM MREŽOM PREDUZEĆA ZA TELEKOMUNIKACIJE TELEKOM SRBIJA akcionarsko društvo, Beograd Beograd, jun 2017. godine Telekom Srbija a.d., Beograd Standardna ponuda za međupovezivanje STANDARDNA PONUDA ZA USLUGE MEĐUPOVEZIVANJA SA JAVNOM FIKSNOM KOMUNIKACIONOM MREŽOM PREDUZEĆA ZA TELEKOMUNIKACIJE TELEKOM SRBIJA akcionarsko društvo, Beograd 5 1. Opšte odredbe .................................................................................................................................... 5 1.1. Predmet Standardne ponude ..................................................................................................... 5 1.2. Opis i vrste usluga ....................................................................................................................... 6 1.3. Datum objavljivanja, primena, izmene i dopune Standardne ponude ..................................... 6 1.4. Uslovi pod kojima važi ponuda ................................................................................................... 6 1.5. Definicije ...................................................................................................................................... 7 1.6. Podnošenje zahteva za međupovezivanje, postupak pregovaranja ........................................ 9 1.6.1. Osnovni uslov .......................................................................................................................... -

Ready for Upload GCD Wls Networks

LTE‐ LTE‐ REGION COUNTRY OPERATOR LTE Advanced Advanced Pro Eastern Europe 92 55 2 Albania Total 320 Albania ALBtelecom 100 Albania Telekom Albania 110 Albania Vodafone Albania 110 Armenia Total 310 Armenia MTS Armenia (VivaCell‐MTS) 100 Armenia Ucom (formerly Orange Armenia) 110 Armenia VEON Armenia (Beeline) 100 Azerbaijan Total 430 Azerbaijan Azercell 100 Azerbaijan Azerfon (Nar) 110 Azerbaijan Bakcell 110 Azerbaijan Naxtel (Nakhchivan) 110 Belarus Total 420 Belarus Belarusian Cloud Technologies (beCloud) 110 Belarusian Telecommunications Network Belarus (BeST, life:)) 100 Belarus MTS Belarus 110 Belarus VELCOM (A1 Belarus) 100 Bosnia and Herzegovina Total 300 Bosnia and Herzegovina BH Telecom 100 Bosnia and Herzegovina HT Mostar (HT Eronet) 100 Bosnia and Herzegovina Telekom Srpske (m:tel) 100 Bulgaria Total 530 Bulgaria A1 Bulgaria (Mobiltel) 110 Bulgaria Bulsatcom 100 Bulgaria T.com (Bulgaria) 100 Bulgaria Telenor Bulgaria 110 Bulgaria Vivacom (BTC) 110 Croatia Total 321 Croatia A1 Croatia (VIPnet incl. B.net) 111 Croatia Hrvatski Telekom (HT) 110 Croatia Tele2 Croatia 100 Czech Republic Total 430 Czech Republic Nordic Telecom (formerly Air Telecom) 100 Czech Republic O2 Czech Republic (incl. CETIN) 110 Czech Republic T‐Mobile Czech Republic 110 Czech Republic Vodafone Czech Republic 110 Estonia Total 330 Estonia Elisa Eesti (incl. Starman) 110 Estonia Tele2 Eesti 110 Telia Eesti (formerly Eesti Telekom, EMT, Estonia Elion) 110 Georgia Total 630 Georgia A‐Mobile (Abkhazia) 100 Georgia Aquafon GSM (Abkhazia) 110 Georgia MagtiCom -

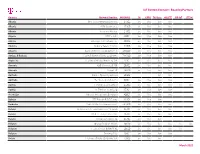

Iot Custom Connect - Roaming Partners

IoT Custom Connect - Roaming Partners Country Column1 Network Provider Column2MCCMNCColumn10 Column32G Column4GPRS Column53G Data Column64G/LTE Column7NB-IoT LTE-M Albania One Telecommunications sh.a 27601 live live live live Albania ALBtelecom sh.a. 27603 live live live live Albania Vodafone Albania 27602 live live live live Algeria ATM Mobilis 60301 live live live live Algeria Wataniya Telecom Algerie 60303 live live live live Andorra Andorra Telecom S.A.U. 21303 live live live live Anguilla Cable and Wireless (Anguilla) Ltd 365840 live live live live Antigua & Barbuda Cable & Wireless (Antigua) Limited 344920 live live live live Argentina Telefónica Móviles Argentina S.A. 72207 live live live live Armenia VEON Armenia CJSC 28301 live live live live Armenia Ucom LLC 28310 live live live live Australia SingTel Optus Pty Limited 50502 live live Australia Telstra Corporation Ltd 50501 live live live live Austria T-Mobile Austria GmbH 23203 live live live live live live Austria A1 Telekom Austria AG 23201 live live live live Azerbaijan Bakcell Limited Liable Company 40002 live live live live Bahrain STC Bahrain B.S.C Closed 42604 live live live Barbados Cable & Wireless Barbados Ltd. 342600 live live live live Belarus Belarusian Telecommunications Network 25704 live live live live Belarus Mobile TeleSystems JLLC 25702 live live live live Belarus Unitary Enterprise A1 25701 live live live Belgium Orange Belgium NV/SA 20610 live live live live live live Belgium Telenet Group BVBA/SPRL 20620 live live live live live Belgium Proximus PLC 20601 live live live live Bolivia Telefonica Celular De Bolivia S.A. 73603 live live live March 2021 IoT Custom Connect - Roaming Partners Country Column1 Network Provider Column2MCCMNCColumn10 Column32G Column4GPRS Column53G Data Column64G/LTE Column7NB-IoT LTE-M Bosnia and Herzegovina PUBLIC ENTERPRISE CROATIAN TELECOM Ltd. -

Telekom Srbija

CONTENTS OTE GROUP AT A GLANCE OTE Group at a glance................................................................................................................6 Shareholder structure and share information.................................................................................................8 OTE Group key financial and operational highlights...................................................................10 OTE Group operations..............................................................................12 OTE Group key developments...............................................................................................................14 Message from the Chairman ...................................................................................................................16 OTE SA: THE PARENT COMPANY OF THE GROUP Corporate governance..................................................................................................................................20 Corporate responsibility...........................................................................................................................30 Investments in infrastructure...........................................................................................................................34 Human resources...............................................................................................................39 OTE GROUP OPERATIONS FIXED-LINE ΟΤΕ SA Broadband services....................................................................................................................................48 -

Telekom Srbija

Customer Success Story Project and Portfolio Management, Software Services Telekom Srbija IT efficiency with Micro Focus® Project and Portfolio Management enables Telekom Srbija to be faster to market. Overview “Corporate customers expect it,” says Biljana Telekom Srbija Group provides a wide range Mladić, head of section for business request of telecommunications services to over management, Telekom Srbija. “It is a necessary 11 million subscribers on three regional mar- part of the tender process, but, naturally, qual- kets in Serbia, Bosnia and Herzegovina and ity also has a positive impact on productivity.” Montenegro. IT governance is central to this. Telekom Srbija Challenge wanted to ensure its IT was correctly aligned At a Glance Telekom Srbija is a telecommunications busi- with the requirements of the business. That ness based in Belgrade, Serbia. It was founded the right resources were being spent on the Industry in 1997, following the privatization of the state- right projects, particularly on projects critical Telecommunications owned supplier. Today the business operates to new services. “We wanted to improve our Location in Serbia, Bosnia and Montenegro under the time-to-market by at least 10 percent,” says Belgrade, Serbia MTS and mtel brands. It aims for market lead- Mladić. “To do that we wanted transparency of every request coming into the IT department.” ership wherever it operates, in terms of market Challenge share and service innovation. At this stage, continues Mladi , IT manage- Establish end-to-end visibility of project ć management. The business places a high value on compli- ment consisted of multiple Excel spread- ance and process efficiency. -

KNOWLEDGE Roaming Networks Is One of the Leading System Integration Companies in the ICT Field in Serbia and the Balkan Region

THE POWER OF KNOWLEDGE Roaming Networks is one of the leading system integration companies in the ICT field in Serbia and the Balkan region. We provide professional consulting, design, implementation, integration and maintenance services in the fields of of radio communications, passive optical networks and access systems, ICT infrastructure and data centers and life safety, security, automation and building management systems and e-Mobility. In recent years we have built a strong presence in the markets of Serbia, Montenegro, Bosnia and Herzegovina, Austria and Germany. As our business has grown, so has our team: at the end of 2013 the Roaming Networks Group employed 67 staff; in2015 this increased to 243 and today we number more than 700 employees. Our revenues have increased more than tenfold over the past three years. We have partnership with over 15 global firms. By steadily developing and growing we strive to strength our presence in Balkan region and expand in new markets in Europe and USA. OUR GROWTH! ANNUAL INCOME EMPLOYEES 71.000.000 70.000.000 700 650 60.000.000 600 500 50.000.000 500 42.000.000 400 40.000.000 37.000.000 400 350 32.000.000 30.000.000 300 260 20.000.000 20.000.000 200 11.000.000 200 10.000.000 100 70 3.600.000 2013 2014 2015 2016 2017 2018 2019 2013 2014 2015 2016 2017 2018 2019 3 SERVICES Radio Communications Passive Optical Networks and Access Systems ICT Infrastructure and Data Center Life Safety, Security, Automation and Building Management Systems e-Mobility General scope of works: Design Building, Installation and Implementation Technical Support and Managed Services 4 QUALITY OVER QUANTITY In parallel with constantly expanding our company’s business, we have succeeded in maintaining high quality of service and preserving the satisfaction of all stakeholders, from staff to clients.